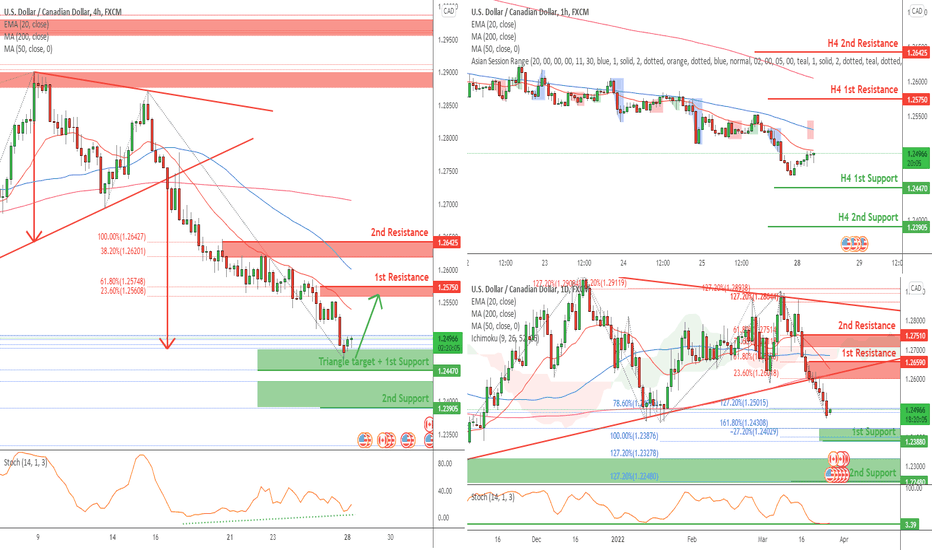

USDCAD- 28Mar2022USDCAD- 28Mar2022

On the daily/weekly, USDCAD broke below the triangle convincingly. However daily Stochastic and Fib confluence is at Support, we could expect a short-term bounce this week.

On the H4, price went lower continuously w/o a bounce after breaking below the triangle pattern. It has now achieved its triangle downside target at around 1.2480. With Fib confluence support + H4 Stochastic is indicating negative bullish divergence + DXY strengthening today, we could expect a short-term bounce to 1st Resistance at 1.25750.

This is for personal record purposes only, not financial advise or solicitation of trade.

28mar22

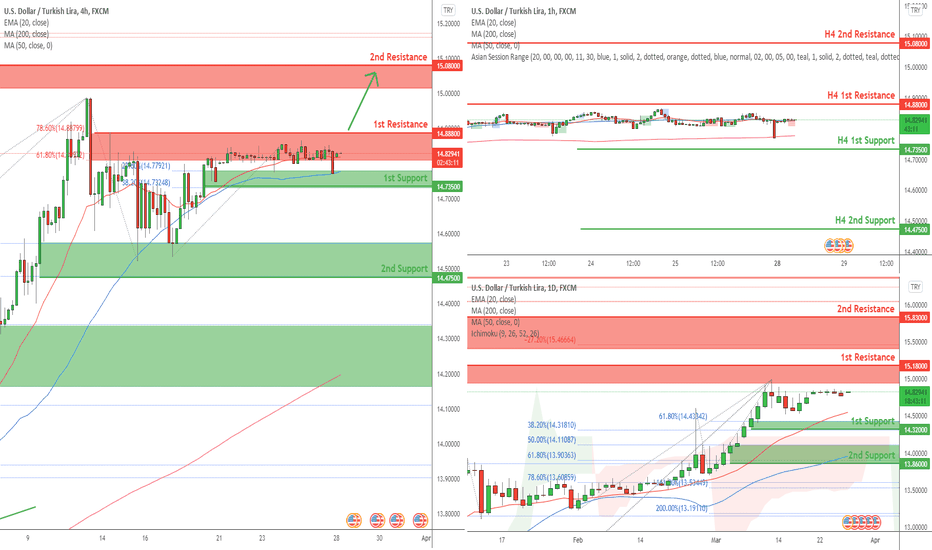

USDTRY- 28Mar2022USDTRY- 28Mar2022

Price action for USDTRY last week was pretty much just sideway consolidation.

On the H4, price is retesting the 61.8% Fib resistance at 14.80. With the overall strength in USD, we could expect price to bounce higher to 78.6% Fib at 14.88. If it can close above, the next resistance will be at 15.08, in-line with daily resistance.

This is for personal record purposes only, not financial advise or solicitation of trade.

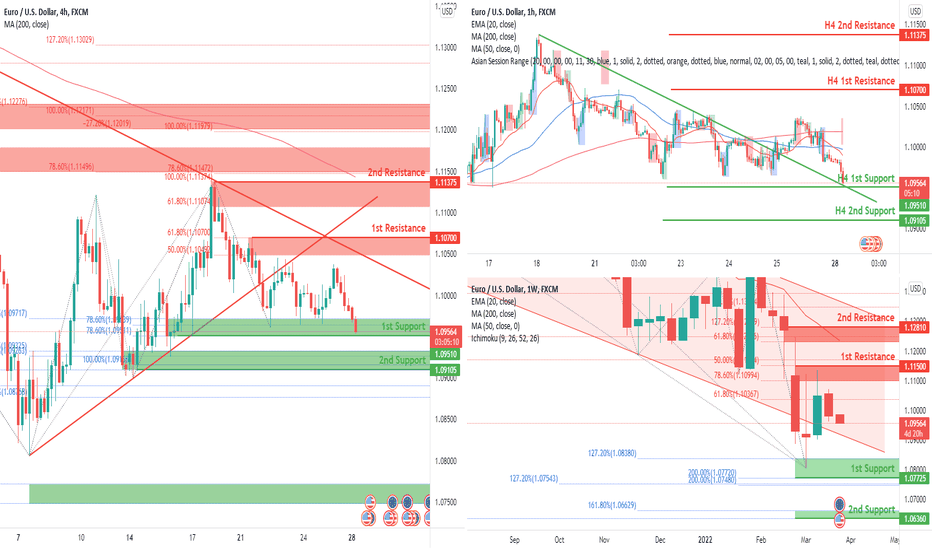

EURUSD- 28Mar2022EURUSD- 28Mar2022

On the weekly, last week bearish candle negated most of previous week's bounce indicating a weakness in the EUR. Price action is weak and could potentially pulled back lower this week.

On the H4, price has started to form micro lower highs and lower lows after facing bearish pressure from 1.11375 level. However, it is still making higher highs and higher lows after finding bottom around 07Mar22. For today, we need to monitor whether EURUSD breaks previous higher lows at 1.09105, if it does we could expect it to retest previous lows at around 1.0800.

This is for personal record purposes only, not financial advise or solicitation of trade.

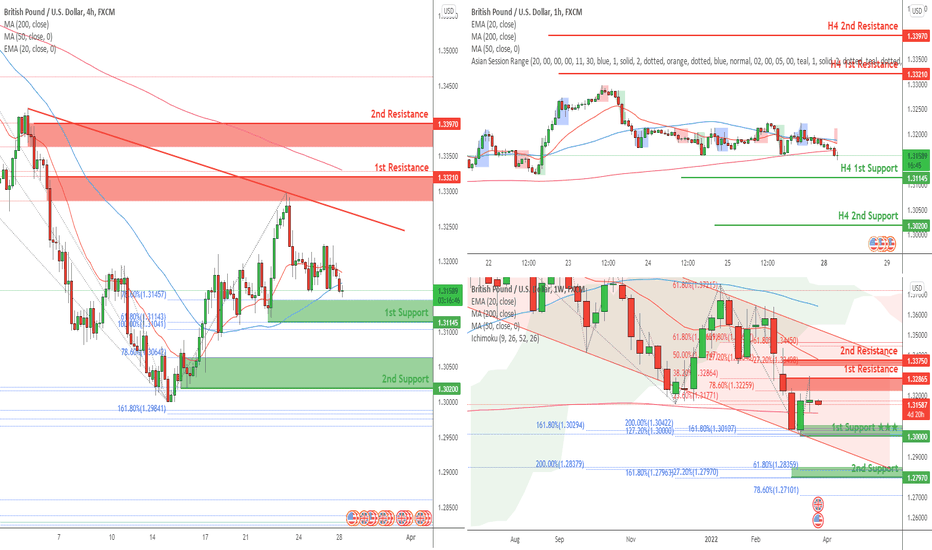

GBPUSD- 28Mar2022GBPUSD- 28Mar2022

On the weekly, GBPUSD did not follow through on the bounce last week. Price action is mixed for now as GBPUSD remains in the lower end of the channel.

On the H4, price also invalidated the uptrend channel by closing below the channel last Friday. If price confirms below 20 & 50MAs today, we could expect GBPUSD to drop lower to 1st Support at 1.31145. If not GBPUSD can bounce higher to test the descending trendline, closing above the trendline could potentially trigger an inverse h&s.

This is for personal record purposes only, not financial advise or solicitation of trade.

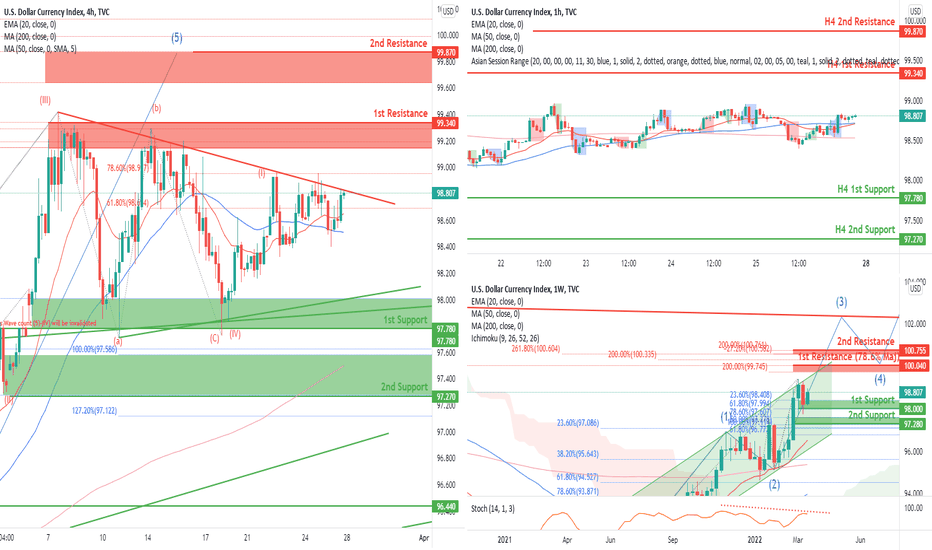

DXY - 28Mar2022DXY - 28Mar2022

On the weekly, DXY bounced back to 61.8% Fib last week after bearish candle from the previous week. Price action is indicating that it is forming Wave 3. However, we remain cautious for further upside as weekly Stochastic have started to form negative bearish divergence.

On the H4, price remain resilient and bounce back near the descending trendline. Price action indicates Wave 5-(V)-(II) is still forming and we will need to wait patiently for price to break above the descending trendline with confirmation.

This is for personal record purposes only, not financial advise or solicitation of trade.