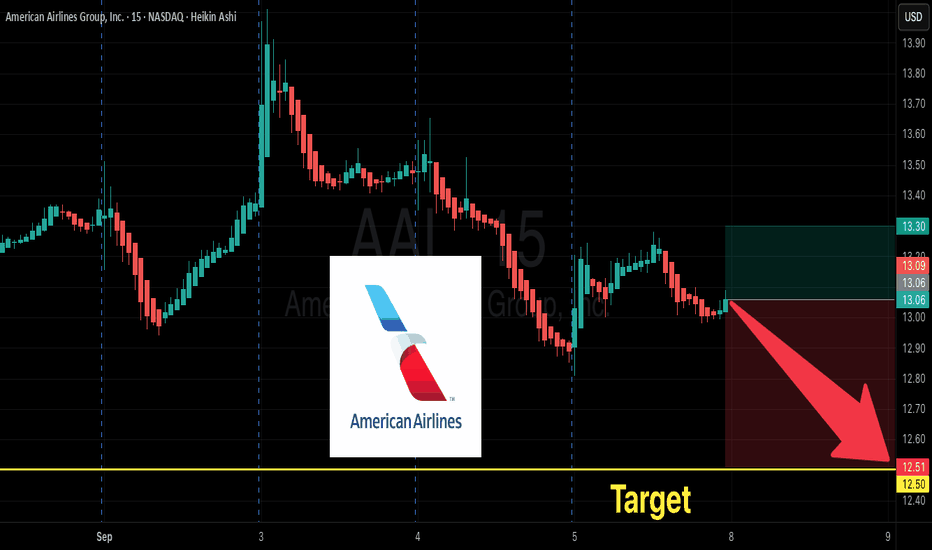

AAL Breakdown Setup — $12.50 PUT Trade Idea!

# 🐻 AAL Weekly Bearish Setup — \$12.50 PUT 🎯 (Sep 12 Expiry)

📊 **Summary**

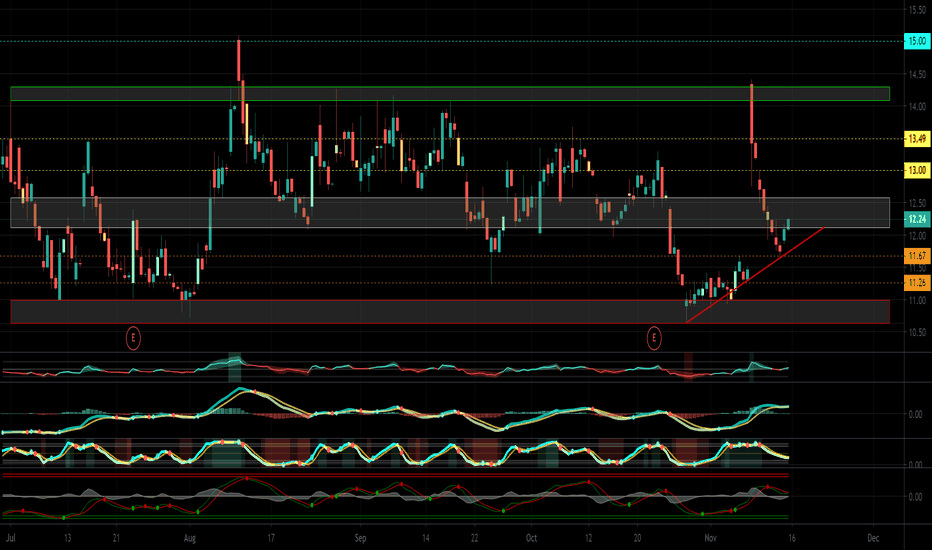

* **Momentum:** Daily RSI 53.4 falling, Weekly RSI 64.4 falling → downside tilt.

* **Volume:** +30% on a red week → institutional distribution.

* **Options Flow:** Call/Put ratio 1.65 (bullish flow) but likely **retail/covered calls**, not confirmation.

* **Volatility/Gamma:** Favorable for weekly directionals.

---

🎯 **Trade Plan**

* Instrument: **AAL**

* Direction: **PUT (short)**

* Strike: **\$12.50**

* Expiry: **2025-09-12**

* Entry Price: **\$0.20**

* Profit Target: **\$0.40** (100%)

* Stop Loss: **\$0.10**

* Size: **1 contract**

* Confidence: **70%**

---

⚠️ **Risks**

* Heavy call flow could cause short-term squeezes.

* Low-priced weekly options = high theta decay.

* Exit by Thursday to avoid Friday gamma ramp.

---

📉 **Overall Bias:** Bearish tilt — price action + distribution outweigh bullish options flow.

🕒 **Signal Time:** 2025-09-06 09:15 EDT

---

### 🔑 Tags :

\#AAL #OptionsTrading #PutOptions #WeeklyOptions #StockMarket #Bearish #TradingSetup #MomentumTrading #OptionsFlow #TradingView

Aalanalysis

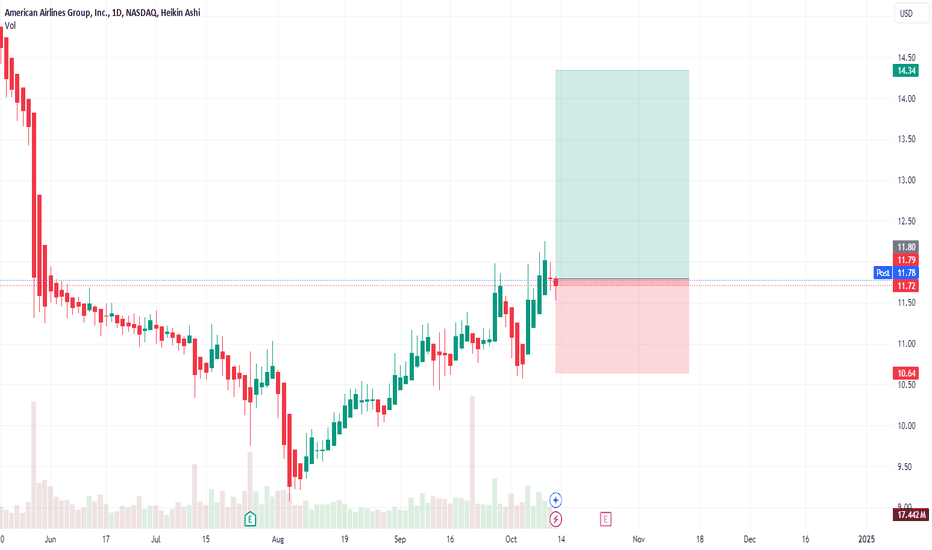

AAL ( American Airlines Group Inc. ) BUY TF H4 TP = 14.34On the H4 chart the trend started on Aug. 13. (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 14.34

This level, which I have outlined above, is certainly not a “finish” level. But it is the level that has the “highest percentage of hits on target.”

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading