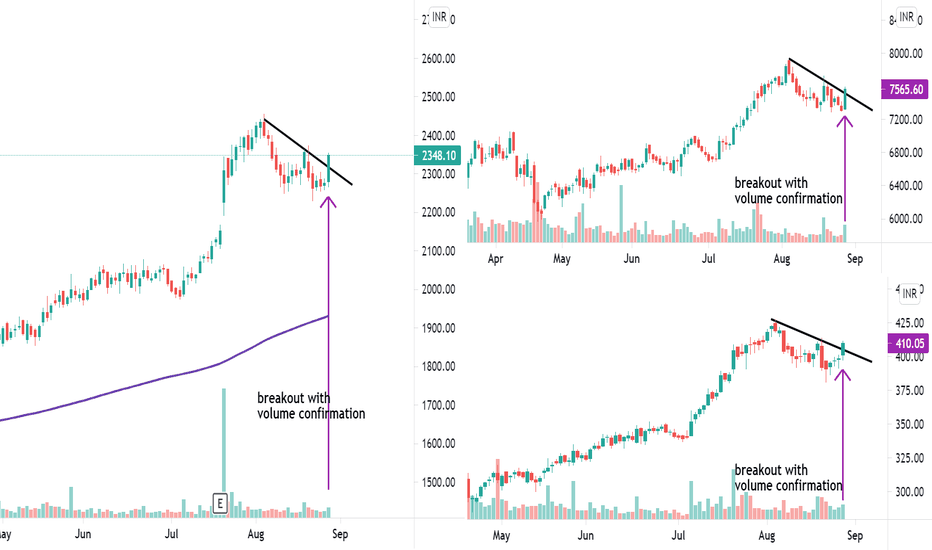

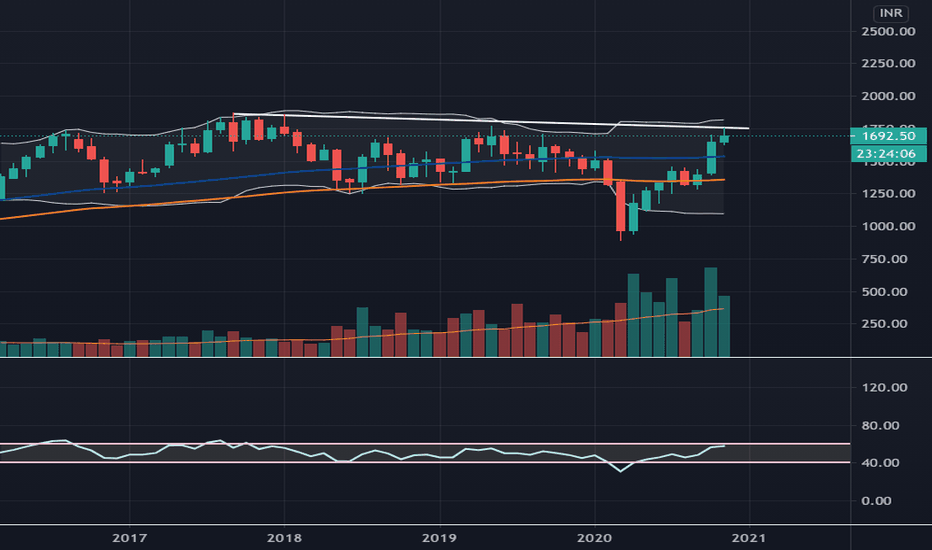

Cement Stocks -ACC, ULTRACEMCO, AMBUJACEM -Similar opportunitiesThere seems to be something cooking up in all major cement stocks. Similar opportunities can also be found in related stocks.

One should keep a close watch and can capture short term opportunities.

Do let me know on my social media platforms shared below, which one of them is your favorite.

The above analysis is purely for educational purpose. Traders must do their own study & follow risk management before entering into any trade.

Checkout my other ideas to understand how one can earn from stock markets with simple trade setups.

Feel Free to connect with me for any query or suggestion regarding this stock or Price Action Analysis.

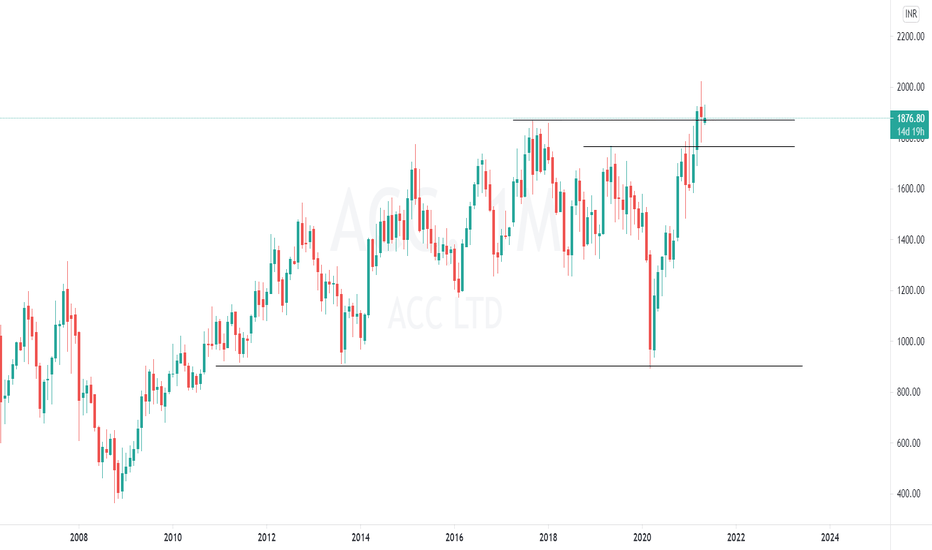

ACC

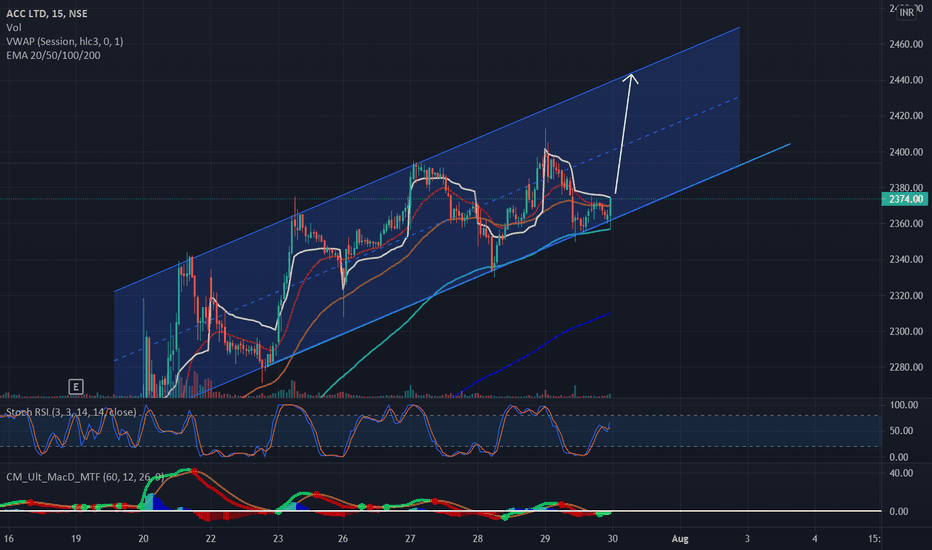

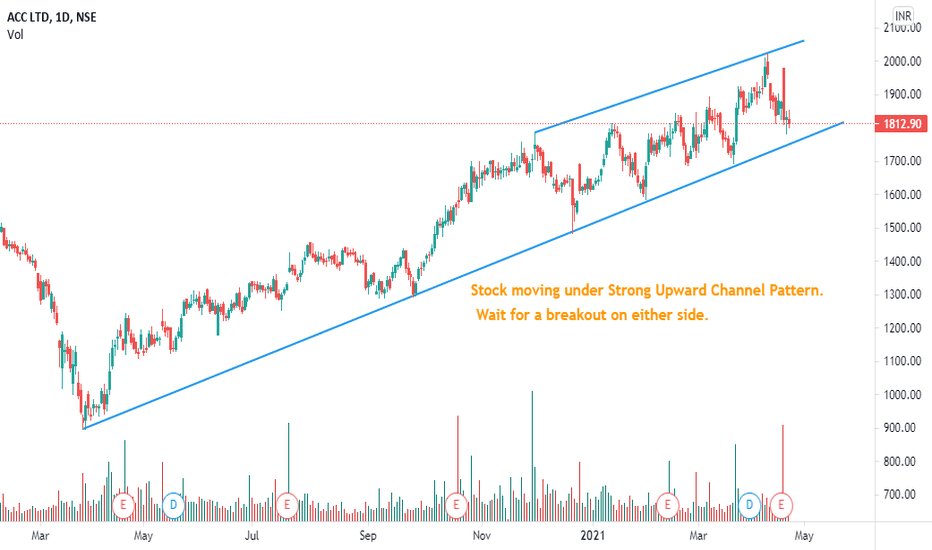

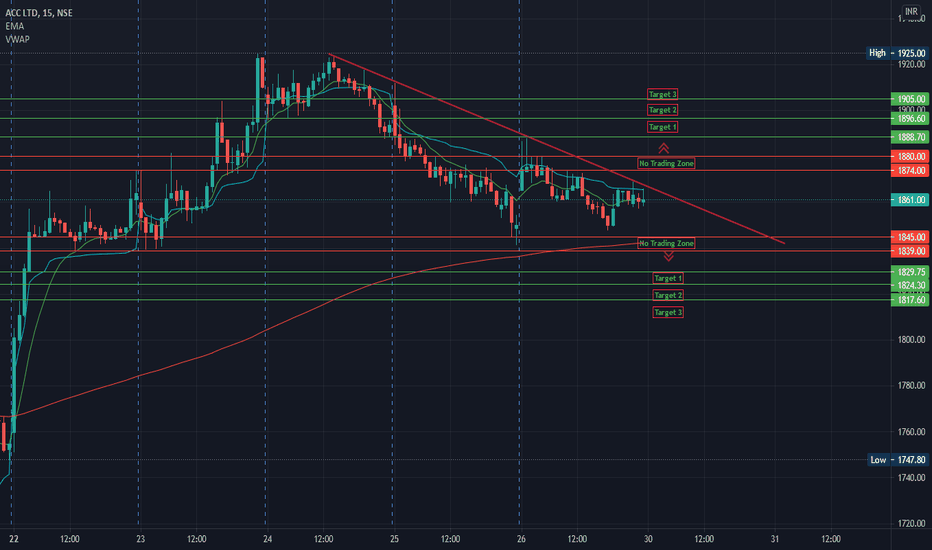

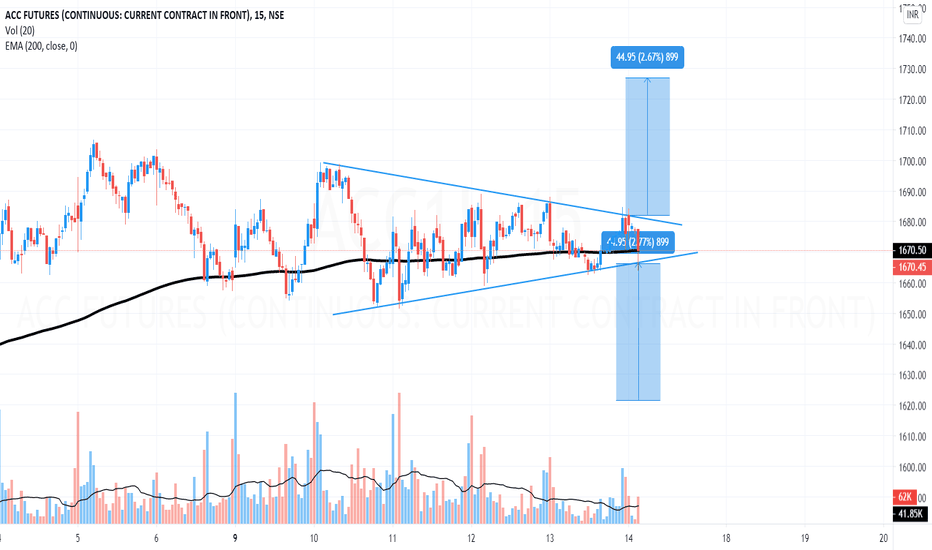

ACC 15 Mins Chart Showing Positive MoveACC is moving in a upward channel. Yes it just hit the lowest point of the channel and bounced back. Today most probably it will be moving up. Even when the market was falling this week, ACC was one of the strong stocks which was giving Green after Green Candle. Wait and watch for first 15 min candle and take your call on Long / Short according to the movement.

ACC following trendlinesACC following trendlines strictly. Long position. Hoping to get the target of 2044 and 2091. What you guys feel?

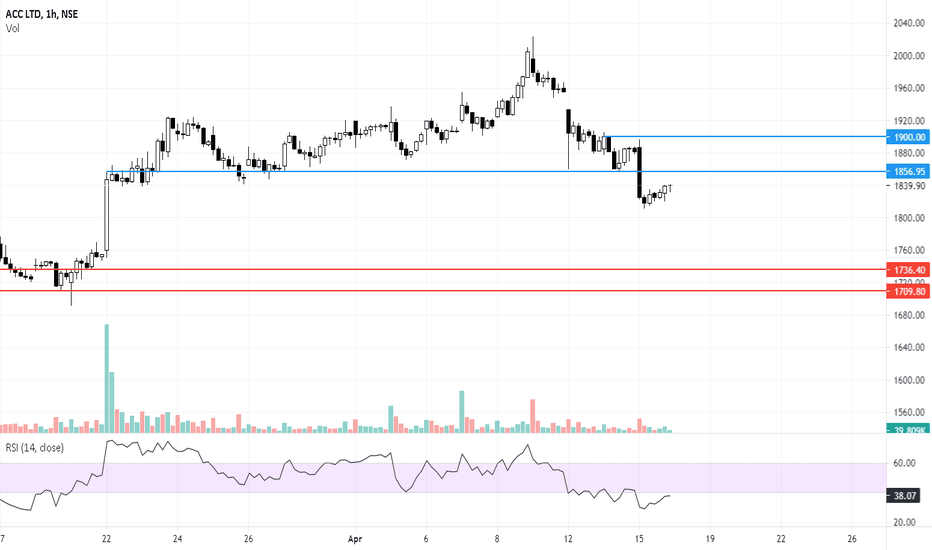

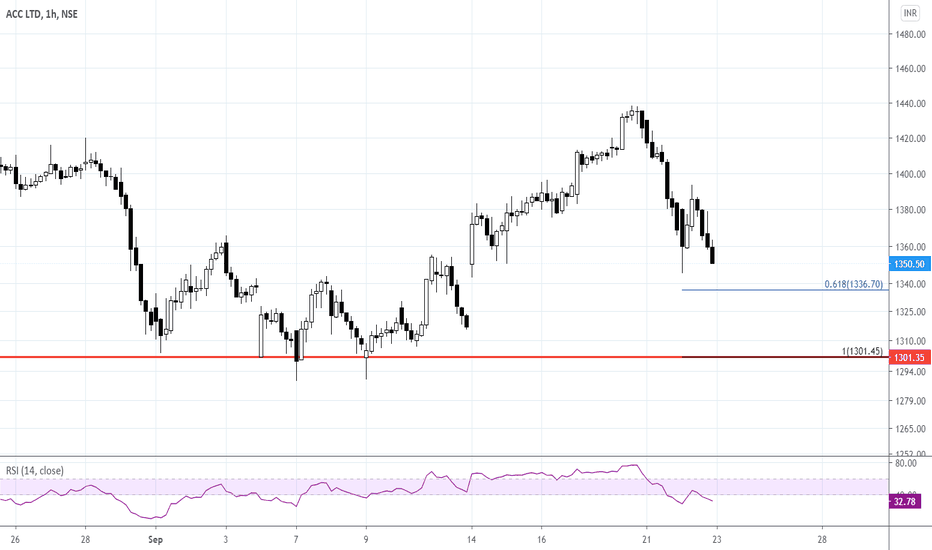

ACC LTD: Cement sector stock-2Sl-1755

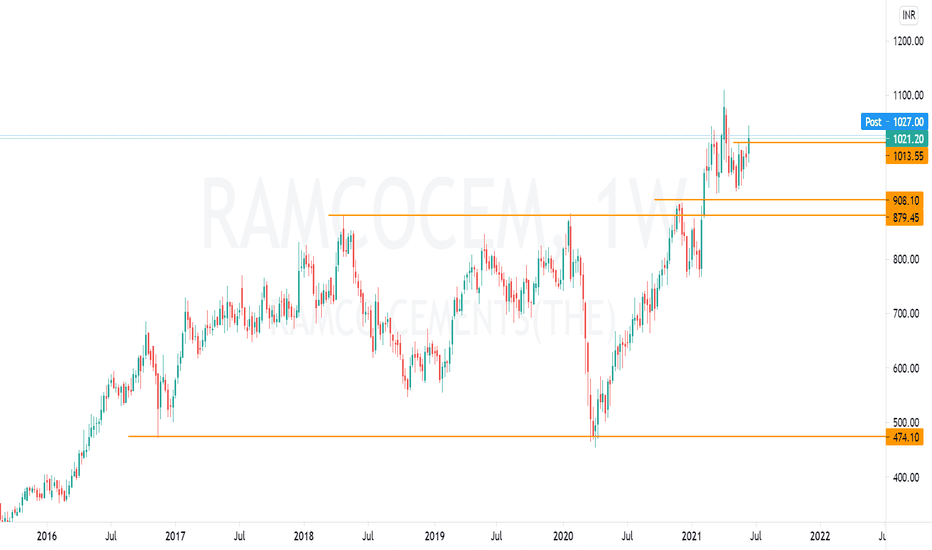

Stocks for the week-4

Hello everyone, this week we are going to invest in many different sectors.

One of which is CEMENT SECTOR(from infrastructure sector).

I will be posting best stocks of cement sector and the % allocation that stock should take in your portfolio.

STOCKS ALLOCATIONS

Stock 1: AMBUJA CEMENTS LTD 25%

Stock 2: ACC LTD 15%

Stock 3: INDIA CEMENTS 15%

Stock 4: JK LAKSHMI CEMENT 15%

Stock 5: SANGHI INDUSTRIES 10%

Stock 6: GUJARAT SIDHEE CEM 15%

Stock 7: BURNPUR CEMENT LTD 5% (penny stock)

So folks feel free to DM or comment.

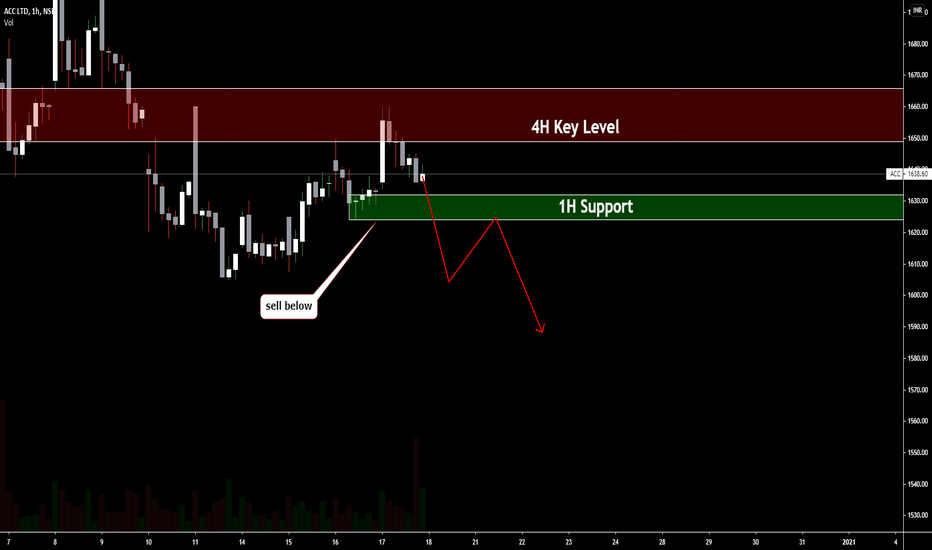

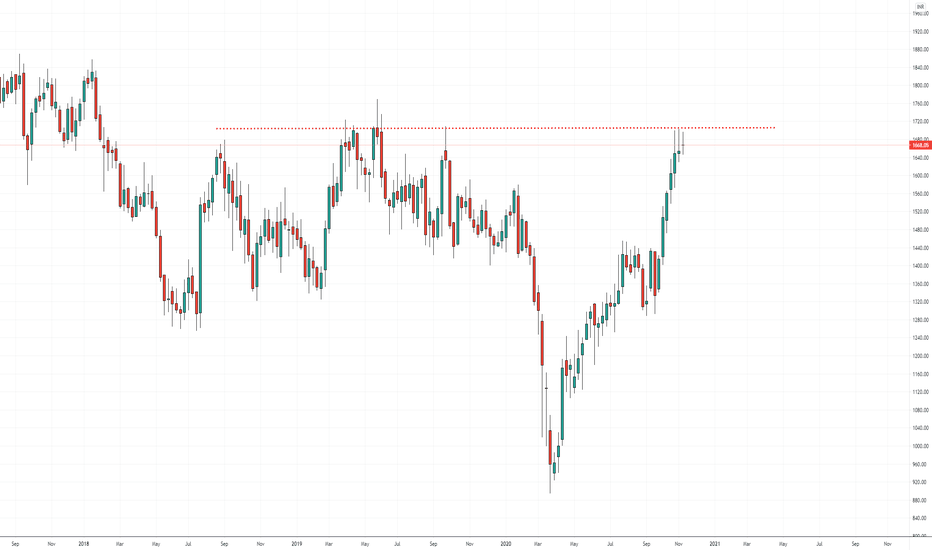

ACC - Weak Price ActionThe price structure looks weak and there is a probability that the stock can fall further towards 1730- 1710 levels.

To continue weakness, should sustain below 1900 levels.

Immediate resistance is around 1860

The trend change level is 1900.

In conclusion, as long as it trading below 1900, any rally if comes in the stock, might be used to create fresh shorts in the stock.

Disclaimer: These posts are for educational purposes, if you are trading this, Trade at your own risk.

ACC Short Swing Trade ACC has completed its targets in the monthly charts. Resistance on the trendline. Formed a bearish engulfing candle two days back and then a bear sashe yesterday. Sell on bounce is the strategy in this.

Entry @ 1690-1710

SL @ 1770

Target 1522,1468

Great Risk: Reward ratio

The view basically holds till the 52 weeks high is intact.

Disclaimer: The analysis is only for educational purposes.

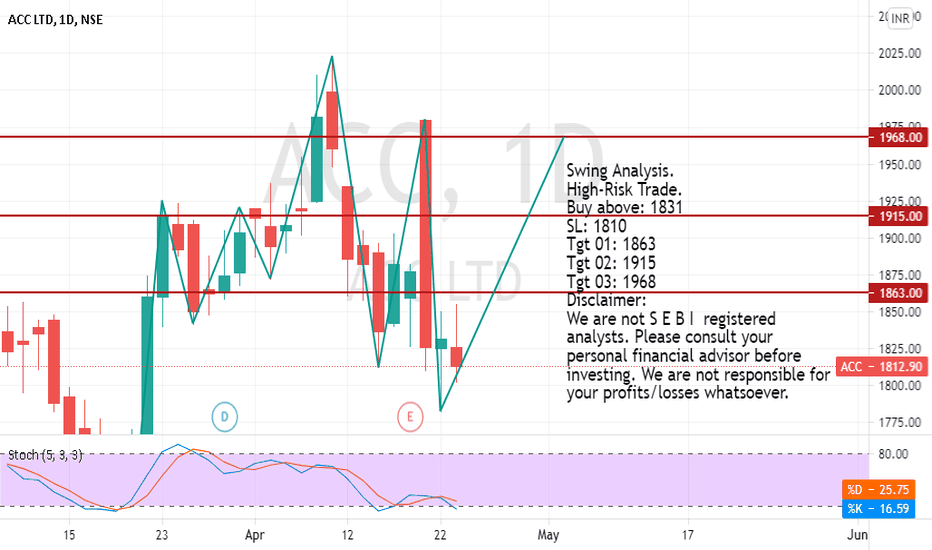

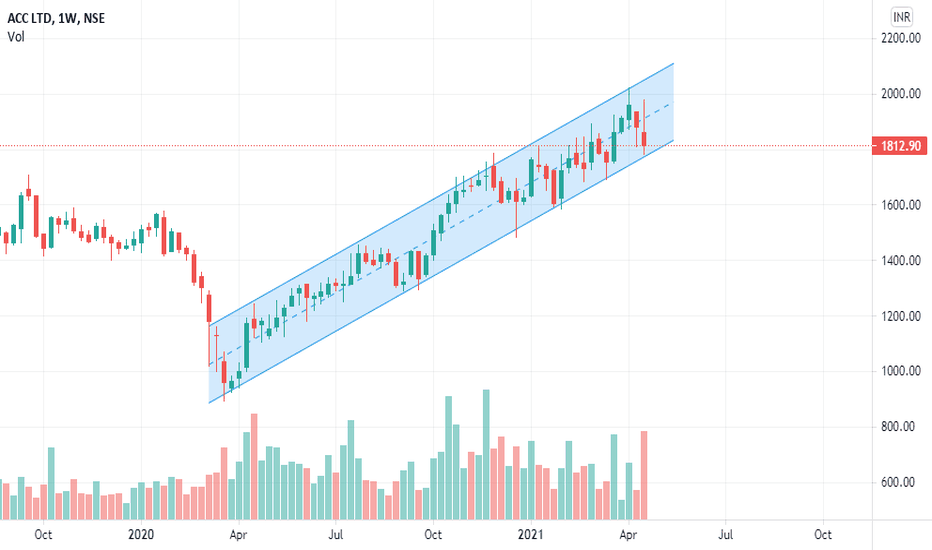

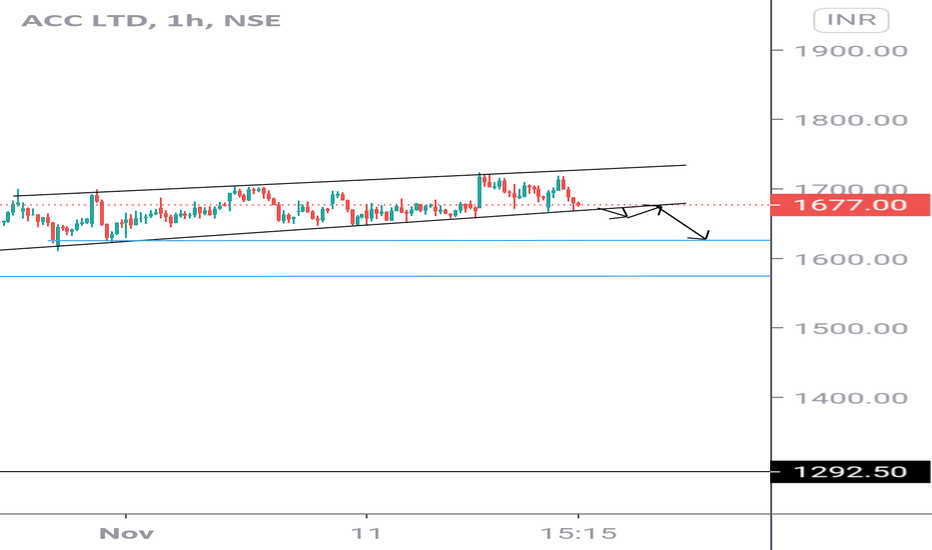

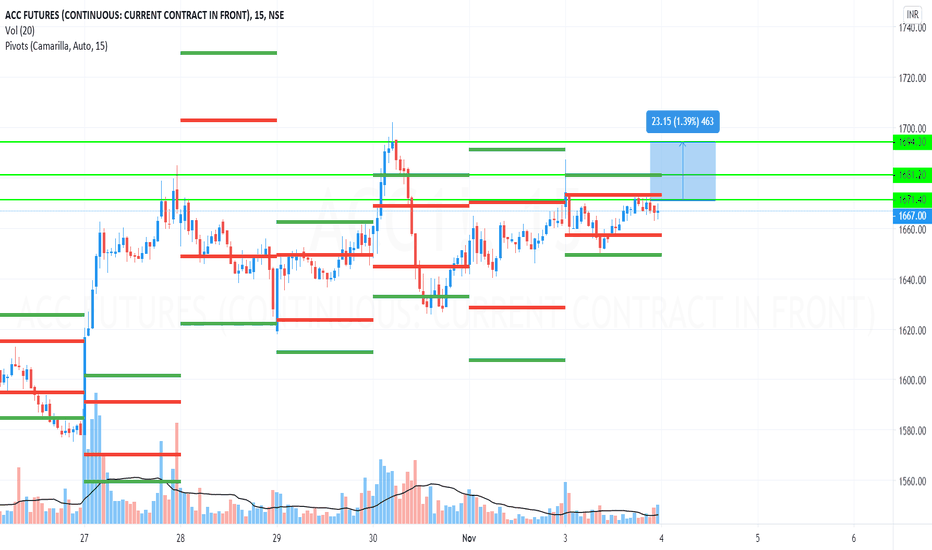

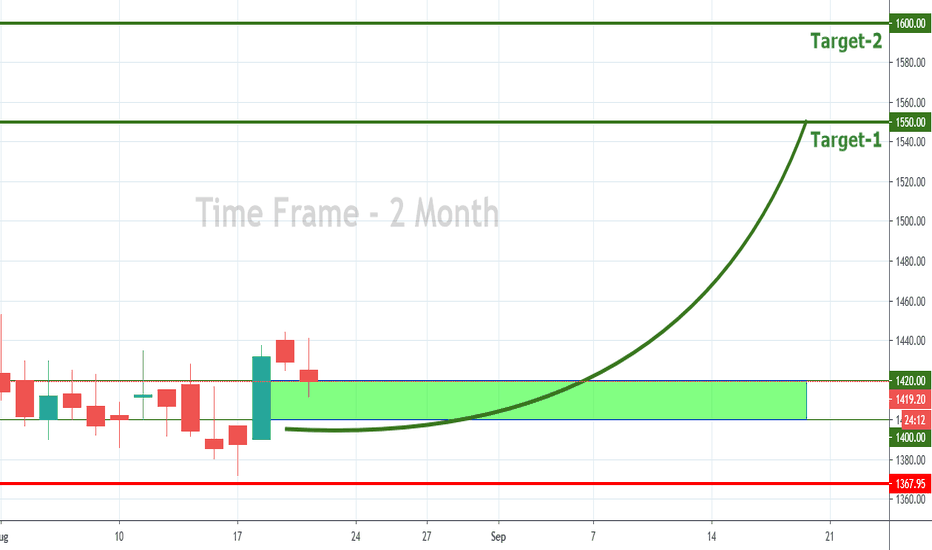

Swing Trade Idea for ACC in December Month

Hello everyone,

ACC is Trading in a range for the last 3 weeks this is a consolidation fedge and this range will decide what will the next move. Create alerts at 1590 and 1725 and wait for breaks. A huge run will be accepted either downside or upside depending on where it breaks. Perfect for swings and RR is good here.

Long above: 1725

SL:1590

Target: Open

Short: 1590

SL: 1625

Target: Open

ACC SETUPACC SETUPACC SETUPACC SETUPACC SETUPACC SETUPACC SETUPACC SETUPACC SETUPACC SETUPACC SETUPACC SETUPACC SETUPACC SETUPACC SETUPACC SETUP

Buying Setup for 4th November in ACC Cement 2020Buying Setup for 4th November in ACC Cement 2020

Buying Setup for 4th November in ACC Cement 2020