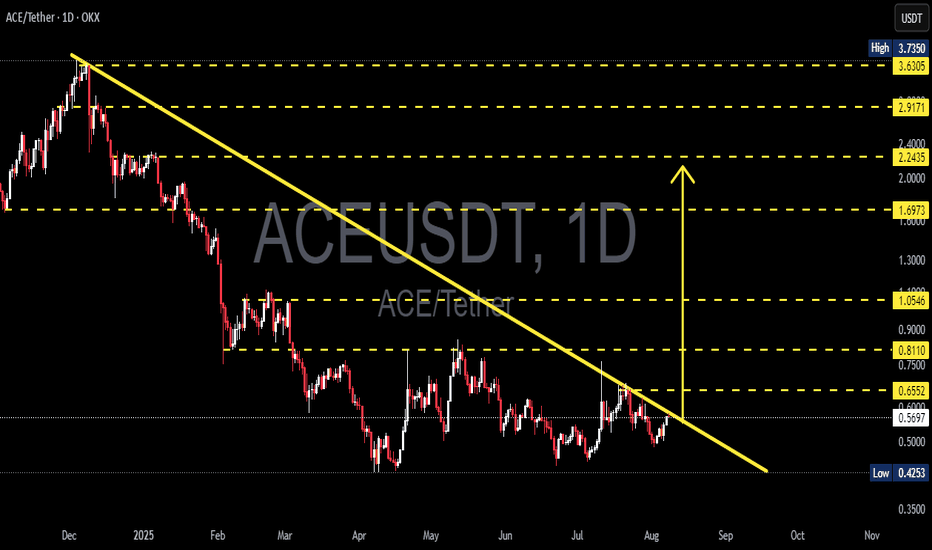

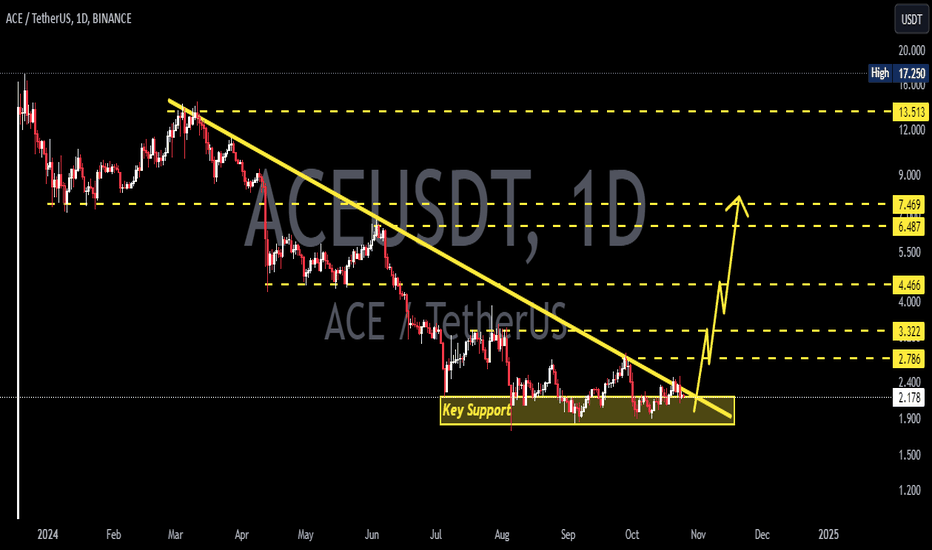

ACE/USDT Testing Long-Term Downtrend – Will It Break Out?Chart Overview:

The ACE/USDT pair on the 1D (Daily) timeframe is currently in a prolonged downtrend that has persisted since early 2025. The price has consistently formed lower highs, and it's been contained under a well-respected descending trendline (yellow line).

Currently, ACE is approaching a key decision point near the trendline resistance zone ($0.57–$0.60). What happens at this level will likely determine the next major move.

---

🟢 Bullish Scenario: Breakout Ahead?

If the price successfully breaks above the descending trendline and confirms with a daily close above $0.6552, we could see a trend reversal from bearish to bullish. Key resistance levels to watch for potential upside targets are:

1. $0.8110 – psychological and structural resistance

2. $1.0546 – strong previous resistance

3. $1.6973 – mid-term bullish target

4. $2.2435 and $2.9171 – extended bullish targets if momentum continues

Confirmation should be supported by increasing volume and RSI breaking above 50.

---

🔴 Bearish Scenario: Another Rejection?

If the price fails to break the trendline and gets rejected, ACE/USDT may resume its downward trajectory and test the following support levels:

1. $0.5691 – immediate support

2. $0.5000 – psychological support

3. $0.4253 – historical low and potential demand zone

This scenario would reaffirm continued bearish dominance and prolong the current downtrend.

---

📊 Pattern Analysis: Descending Trendline

The dominant pattern here is a descending resistance trendline, showing clear selling pressure and bearish market structure.

A breakout would signal the first major higher high in months – a potential trend reversal signal.

---

🎯 Conclusion & Strategy:

ACE is at a crucial inflection point.

Traders should wait for confirmation before entering a breakout trade.

If a breakout occurs, consider a buy-the-breakout strategy with a stop-loss below the trendline.

If rejected, a short/rejection play toward lower support zones could be viable.

#ACEUSDT #CryptoAnalysis #Altcoins #TechnicalAnalysis #BreakoutTrade #BearishScenario #BullishScenario #DescendingTrendline

Aceusdtbuy

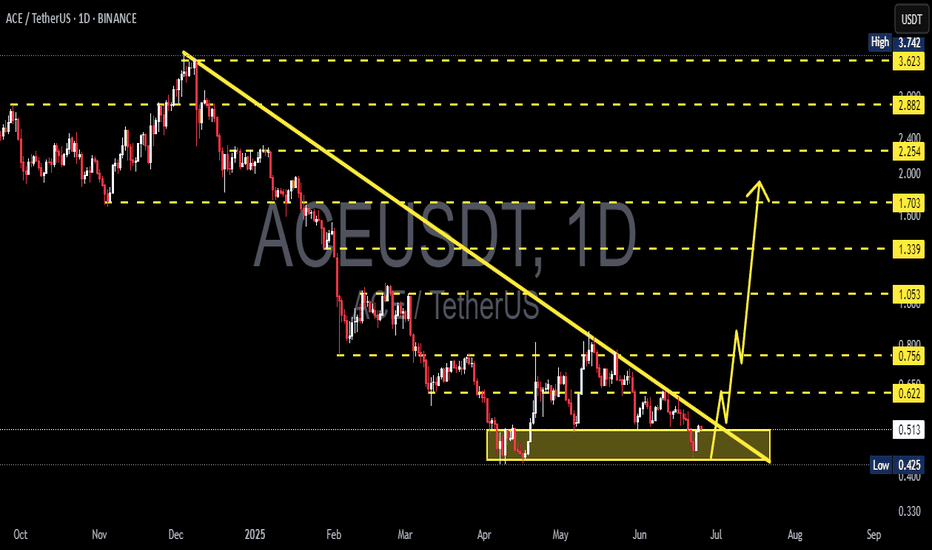

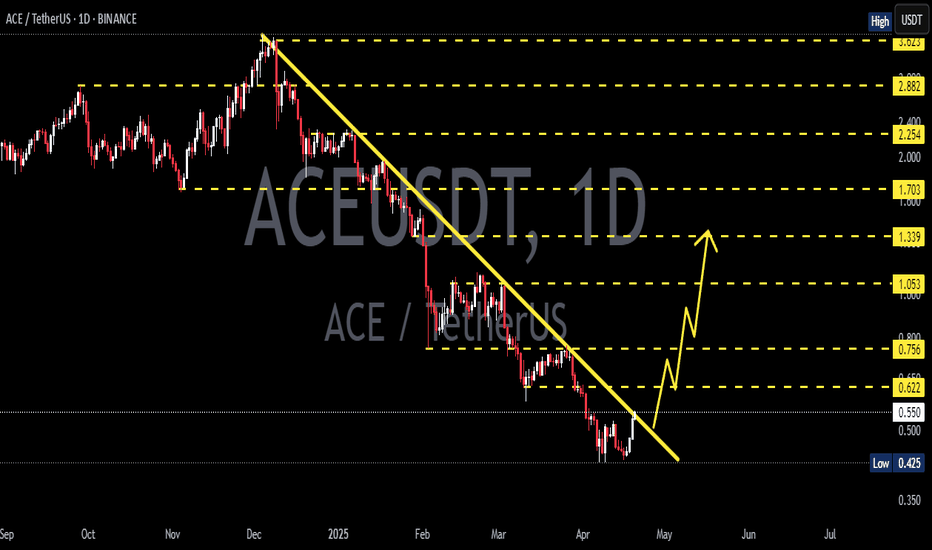

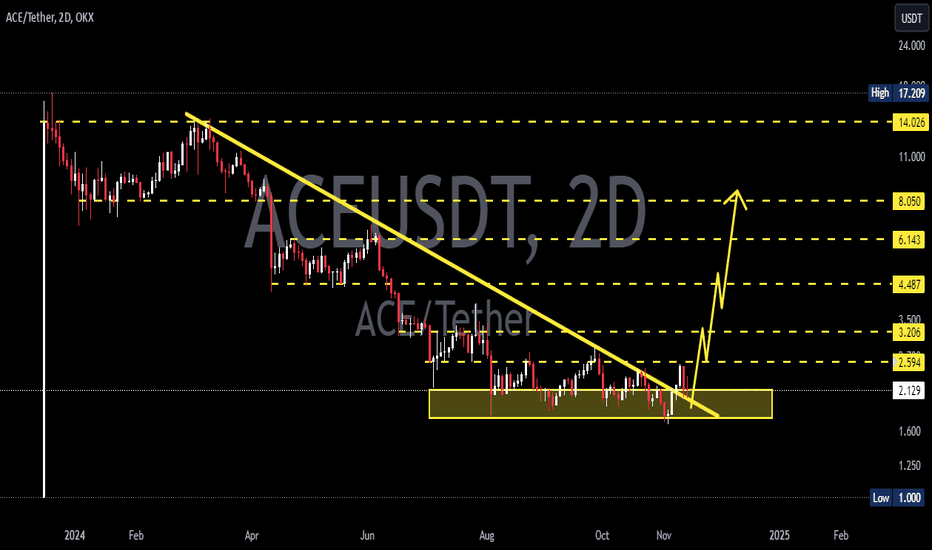

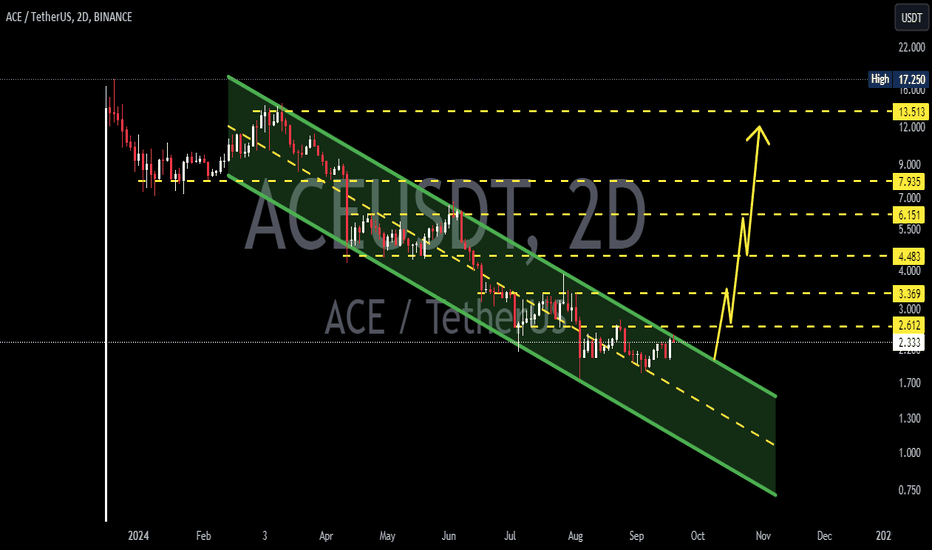

ACE/USDT – Breaking Out of the Falling Wedge? Potential Reversal📝 Technical Analysis Overview:

The ACE/USDT pair on the daily timeframe (1D – Binance) is showing signs of a potential breakout from a long-standing falling wedge pattern, suggesting a possible trend reversal to the upside.

🔍 Key Technical Highlights:

1. Falling Wedge Pattern:

A clearly defined falling wedge has formed from the December 2024 peak near $3.742, down to the current consolidation zone between $0.425–$0.514.

This yellow support box represents a strong demand zone, with repeated price reactions since April 2025.

2. Major Support and Resistance Levels:

Strong Support: $0.425 – $0.514 (accumulation zone)

Potential Resistance / Upside Targets:

$0.622

$0.756

$1.053

$1.339

$1.703

$2.254

$2.882

$3.623 (just below the previous high at $3.742)

3. Bullish Breakout Scenario:

A confirmed breakout above the descending trendline and resistance at $0.622 could trigger a bullish move toward higher targets.

The first key breakout confirmation would be a daily close above $0.756 with increasing volume.

4. Early Signals & Validation:

A breakout with strong momentum followed by a successful retest of the trendline would validate the bullish setup.

Watch for high volume and candle structure during the breakout phase to avoid fakeouts.

📌 Summary:

ACE is currently testing the final stage of a bullish falling wedge. A successful breakout could lead to a strong trend reversal with targets beyond $1.0 and higher. This setup offers a good risk/reward opportunity for bullish traders—confirmation is key.