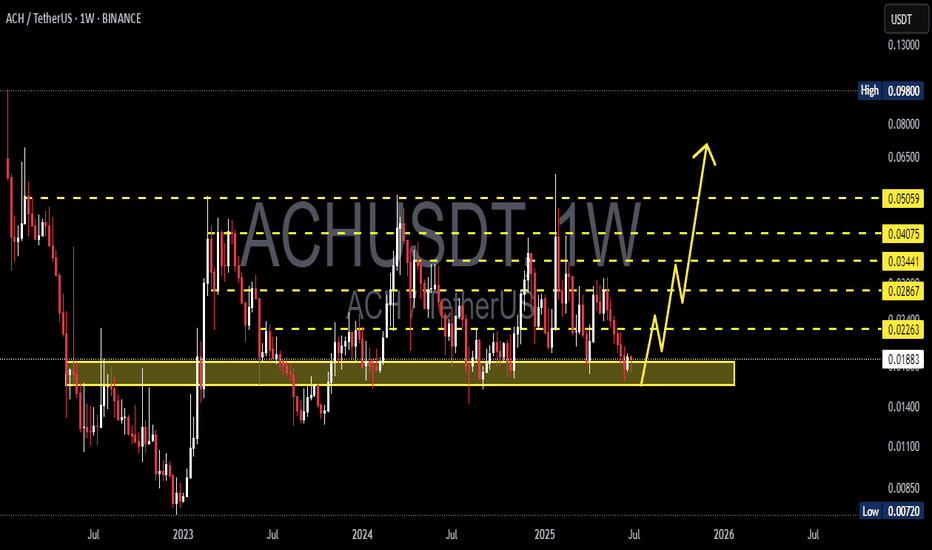

ACH/USDT at a Historical Pivot Zone — Is a Major Reversal🔍 In-Depth Weekly Chart Analysis of ACH/USDT

ACH/USDT is currently retesting a critical historical demand zone between $0.01876 – $0.02263, which has consistently acted as a major accumulation area since late 2022. This zone has served as the launchpad for multiple bullish moves in the past and is now being tested once again.

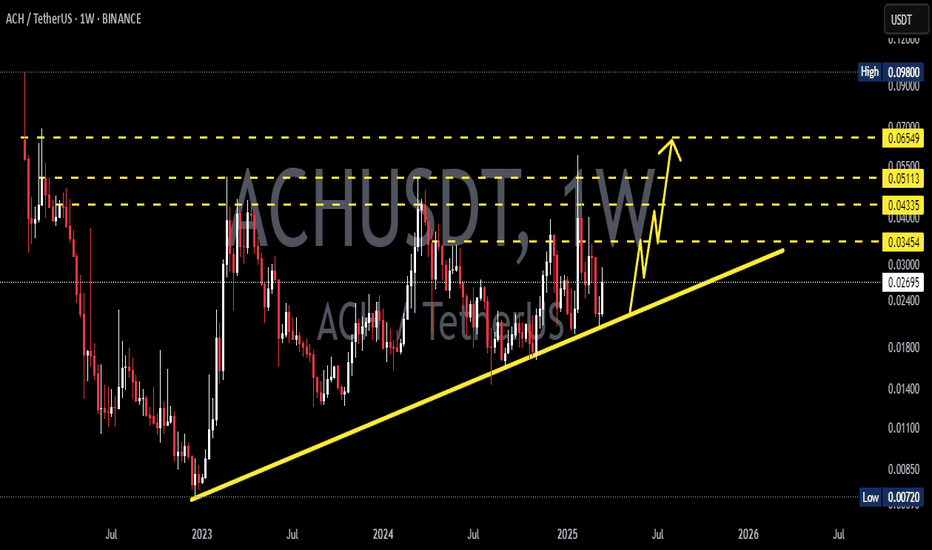

Interestingly, price action appears to be forming a long-term consolidation base, potentially a triple bottom pattern or a classic accumulation phase, which often precedes significant impulsive rallies.

✅ Bullish Scenario (High-Probability Reversal)

If price successfully:

1. Holds above $0.01876, and

2. Breaks above minor resistances at $0.02263 and $0.02867

Then a bullish reversal is likely, with price targeting the following resistance levels:

🔸 $0.02867 — structural resistance

🔸 $0.03441 — neckline zone of the accumulation pattern

🔸 $0.04075 — key psychological level

🔸 $0.05059 — full measured move target from the base pattern

Should momentum and market sentiment align, ACH could even test the $0.065–$0.098 range, especially if volume supports a breakout continuation.

Key confirmation: A weekly close above $0.02867 with strong volume would signal a clear breakout from accumulation.

❌ Bearish Scenario (Breakdown from Critical Support)

On the flip side, if price fails to hold:

A weekly breakdown and close below $0.01876 will invalidate the bullish structure.

This could lead to a decline toward:

$0.01400 — minor support

$0.01000 – $0.00720 — historical bottom zone

This would likely reflect a capitulation phase, particularly if accompanied by negative macro sentiment across the broader crypto market.

📈 Technical Pattern Structure

📌 Triple Bottom + Long-Term Accumulation = Early Reversal Signal

📌 Multiple rejections off the support zone = Buyer defense still strong

📌 Increasing volume near lows = Signs of smart money accumulation

📌 Formation of higher lows in the coming weeks will reinforce bullish momentum

💬 Market Psychology Insight

After prolonged sideways action, many retail traders tend to exit

This creates ideal conditions for smart money to accumulate quietly

A breakout from this zone could trigger mass FOMO, accelerating price action

🧠 Conclusion

ACH/USDT currently offers a highly attractive risk-to-reward setup, especially for swing traders and medium-term investors. The zone being tested is a make-or-break level that could dictate the next major trend. A confirmed breakout could mark the beginning of a powerful expansion phase.

#ACHUSDT #CryptoAnalysis #AltcoinReversal #BullishSetup #TechnicalAnalysis #TripleBottom #BreakoutTrade #SwingTradeOpportunity #CryptoOpportunities