Li Auto (LI) – Gaining Speed as China’s EV PowerhouseCompany Snapshot:

Li Auto NASDAQ:LI is scaling rapidly in the Chinese EV market, combining expanding distribution, premium product strategy, and smart technology integration to capture high-value demand.

Key Catalysts:

Aggressive Expansion 🏙️

Now in 140+ cities, with strategic moves into lower-tier regions, Li Auto is boosting brand visibility and tapping into untapped demographics.

Premium Product Pipeline 🚙

New models like the MEGA MPV and upgraded L-Series SUVs are driving strong demand, lifting margins above 22%—a signal of its move upmarket.

Smart Tech Differentiation 🤖

Proprietary AI cockpits, voice command systems, and ADAS platforms elevate the customer experience, creating a clear competitive edge.

Execution at Scale 📈

With YTD deliveries surpassing 180,000, Li Auto is proving it can deliver both volume and quality—earning analyst upgrades and institutional backing.

Investment Outlook:

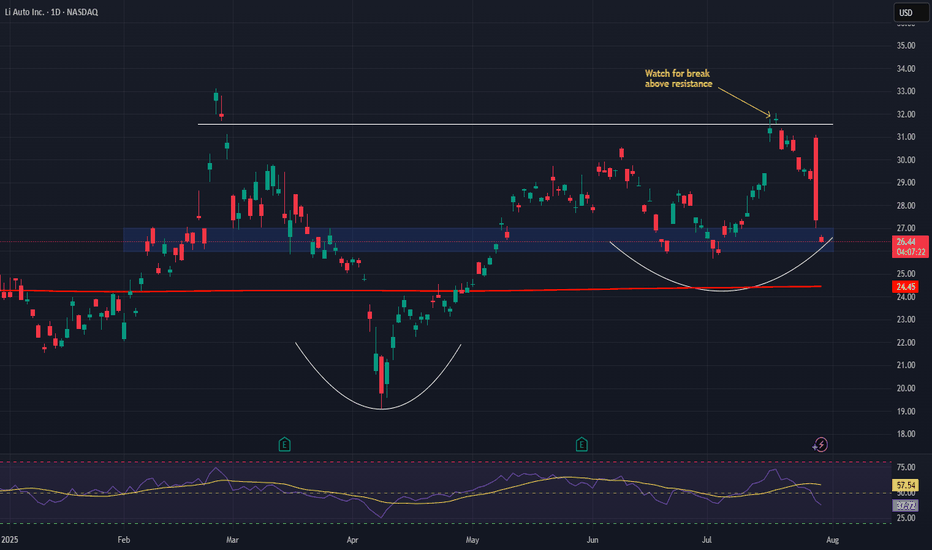

Bullish Entry Zone: Above $26.00–$27.00

Upside Target: $46.00–$47.00, fueled by premium positioning, tech innovation, and delivery momentum.

🔋 Li Auto is not just riding the EV wave—it’s leading it in China’s premium smart vehicle segment.

#LiAuto #EV #ChinaAutos #SmartCars #ADAS #AI #ElectricVehicles #TechStocks #PremiumEV #Mobility #InstitutionalInterest #GrowthStocks #LI

Adas

ADA Cardano Bearish Short Cardano face the SEC’s scrutinyDAILY TF short

4H Short

2H Short

34min Short

Strategy Trend Bearish Only technical rules.I ignore all fundamentals

Risk and money management; Trend continuation,trailing stop(Only if buy sell pressure and trendomat confirmation follows)

Position sizing

Solana and Cardano get listed as tradable digital assets in Indonesia.

SOL and ADA experienced price recoveries despite lingering bearish trends.

Solana and Cardano have found themselves entangled in the scrutiny of the US Securities and Exchange Commission. Yet, a glimmer of hope emerged from the recent developments in Asia, potentially offering respite to the assets and their holders. While the regulatory situation in the US remains uncertain and unclear, the news from Asia brings a fresh breeze of optimism.

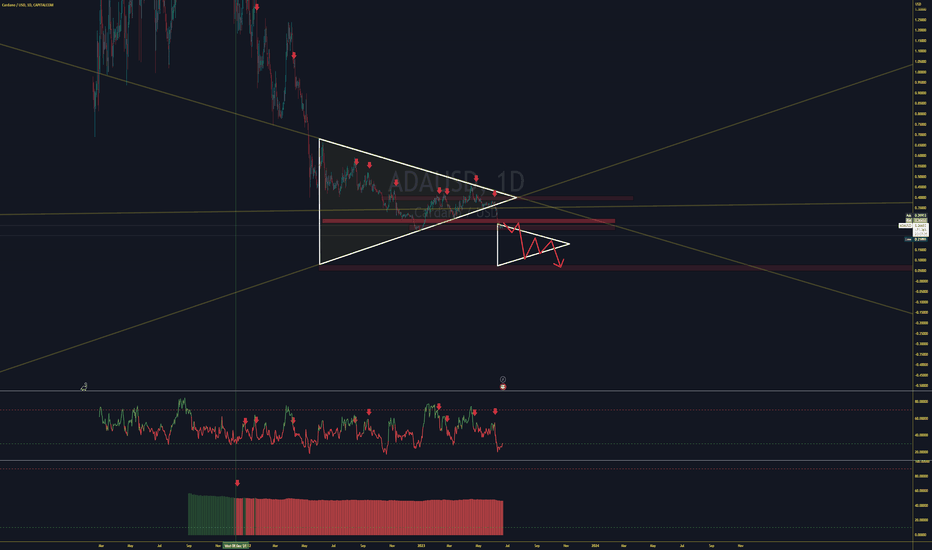

Cardano could enter an extended price consolidation below $0.3 as buyer and seller indecision persists.

ADA’s lower and higher timeframe charts were bearish.

Long positions were wrecked; funding rates were negative.

The resilience seen within the Cardano ecosystem is yet to boost ADA’s price outlook. It registered an impressive adoption and network growth rate as transactions hit 69 million. But the token’s price remained below $0.3. In fact, it even surrendered gains made between 10-13 June.

The strong rebound from $0.220 on 10 June saw bulls extend gains up to 13 June but didn’t cross the $0.3 price level. Interestingly, the $0.3 level aligns with the 50% Fib level, making it a more crucial roadblock if bulls were to gain an edge and reverse Q2 losses.

In the meantime, the RSI (Relative Strength Index) retreated from the oversold zone but was still within lower ranges, signalling weak buying pressure. But the Accumulation/Distribution metric moved sideways after a slight uptick – pointing to indecision between buyers and sellers.

So, a range formation between $0.247 – $0.3 could be on the cards, given the indecision among buyers and sellers.

But a bearish breakout from the range could ease at $0.220 or $0.182, especially if BTC retests the $24k.

A pullback can be used to sell more ada, as trendomat is bearish