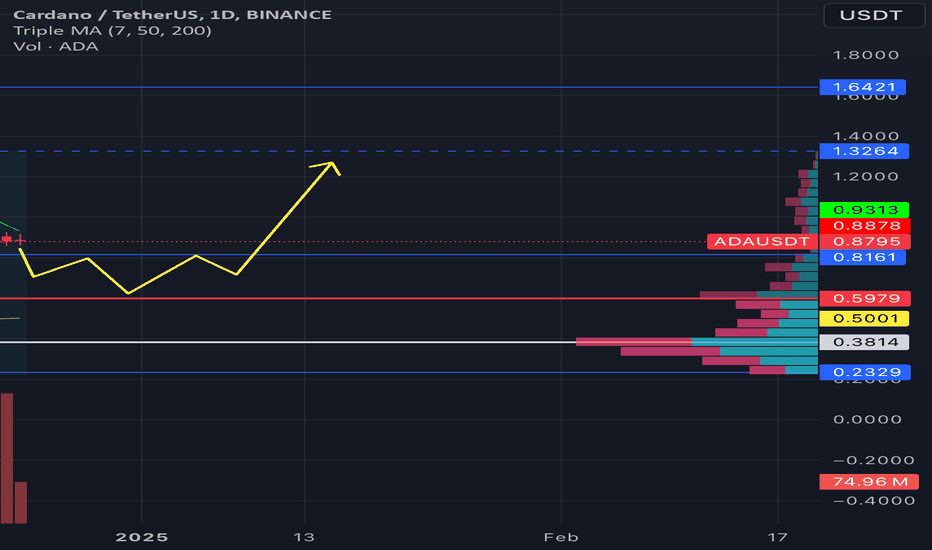

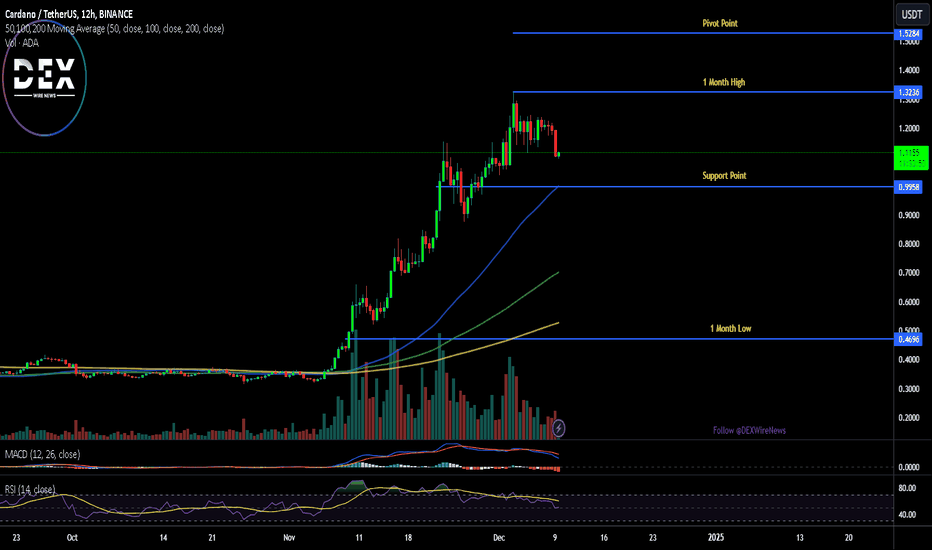

ADA/USDT Trading Scenario UpdateThe asset has shown a strong upward trend, rising from $0.3190 to $1.3264, indicating increased market interest. This growth was accompanied by higher trading volumes, which confirms its strength. Currently, ADA is in a correction phase, which has already retraced over 40% from its peak.

The key POC (Point of Control) level of the current local uptrend cycle is at $0.5979. This volume-based level could serve as support and potentially mark the beginning of a reversal. For investors, this represents a good entry point to purchase the asset at a more favorable price before a potential altseason.

It’s important to monitor the price action near this level, as its reaction could determine the further direction of movement.

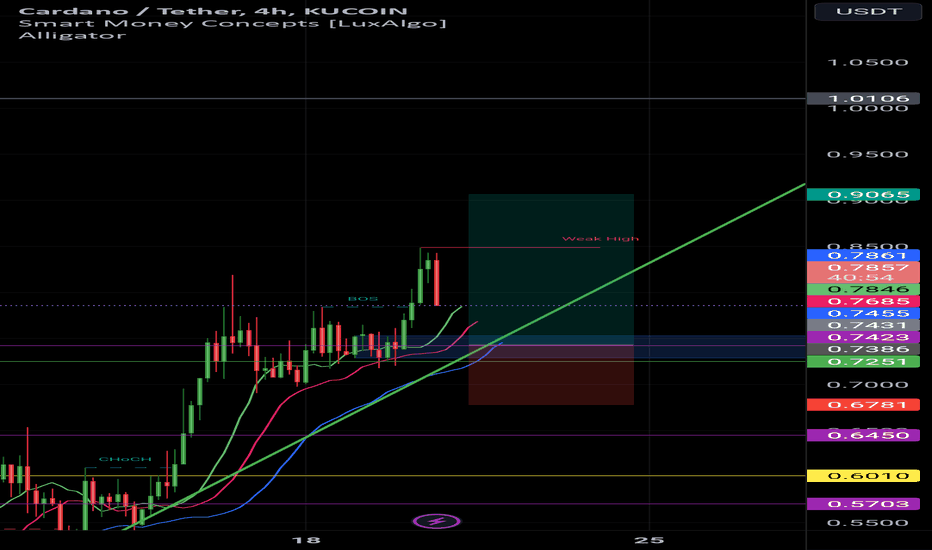

Adausdlong

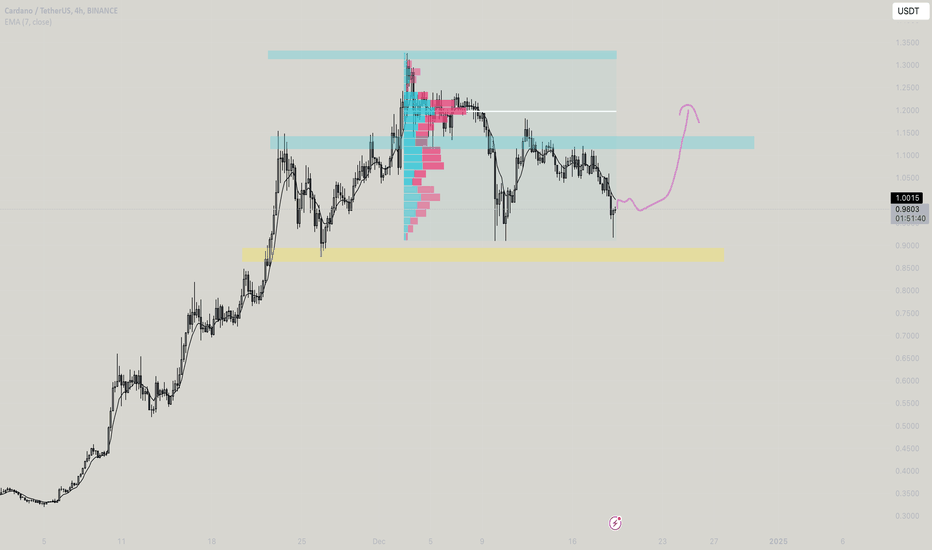

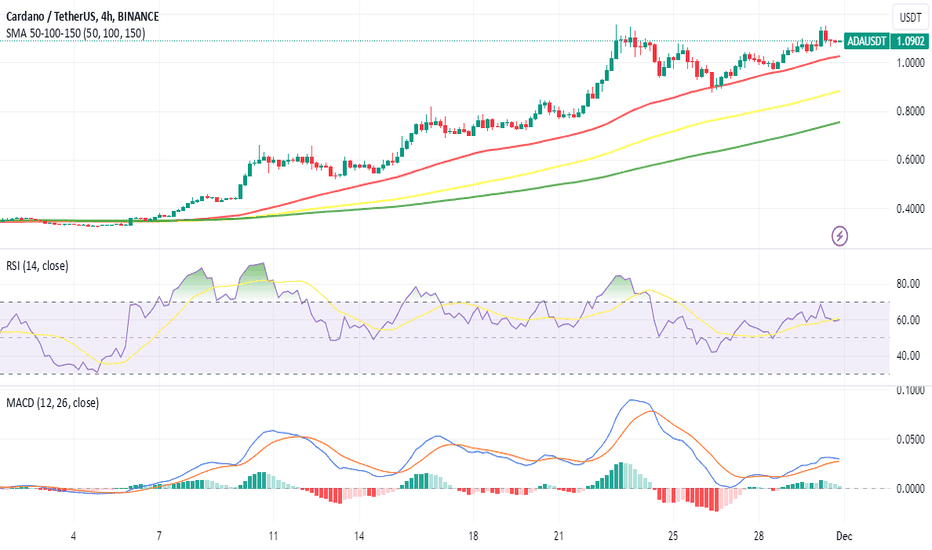

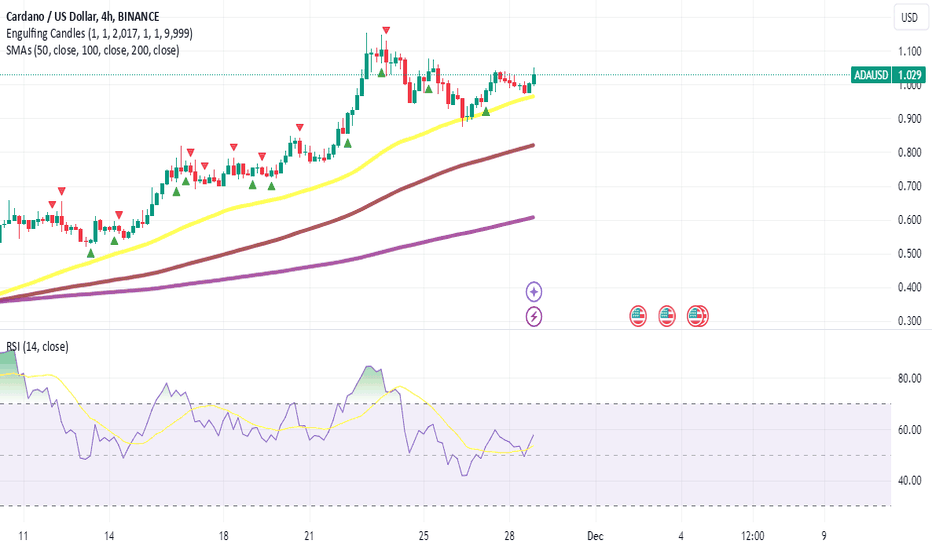

ADA/USDT – Key Demand Zone Around $1The blue box on BINANCE:ADAUSDT.P represents a strong demand zone that could attract buyers, making it a pivotal area to watch. Its proximity to the psychological level of $1 enhances its significance, as this level could act as both a technical and psychological support.

Key Observations:

Demand Zone: The blue box aligns with a high-probability buying area where buyers are likely to step in.

Psychological Level: The $1 mark serves as a key round number, potentially reinforcing support in this zone.

Buyer Activity: Increased interest from buyers at this level could signal a trend reversal or continuation.

Strategy:

Monitor price action within the blue box for confirmation signals such as bullish candlestick patterns, strong wicks, or increased volume.

A break and hold above $1 could confirm the zone as a new support level.

Place stops below the demand zone to manage risk effectively.

If the zone holds, CRYPTOCAP:ADA has the potential to stage a significant bounce from this key level.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

ADAUSDT | The Blueprint for a Potential ReboundIn the current market structure, the blue boxes on the chart may serve as potential demand zones.

These areas are key levels where buying interest could emerge, providing support for ADA's price.

If the price revisits these zones, they could act as strong entry points for a potential bounce. However, it’s essential to monitor how price reacts upon reaching these levels and wait for confirmation signals to ensure the zones hold as valid support.

I keep my charts clean and simple because I believe clarity leads to better decisions. Trading doesn’t have to be overly complicated, and I enjoy sharing setups that have worked well for me.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups. It’s all about learning and growing together as traders, and I’m here to share what I see.

The markets can confirm what the charts whisper if we’re paying attention. I hope these levels help you as much as they’ve helped me in the past. Let’s see how this plays out!

My Previous Hits

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

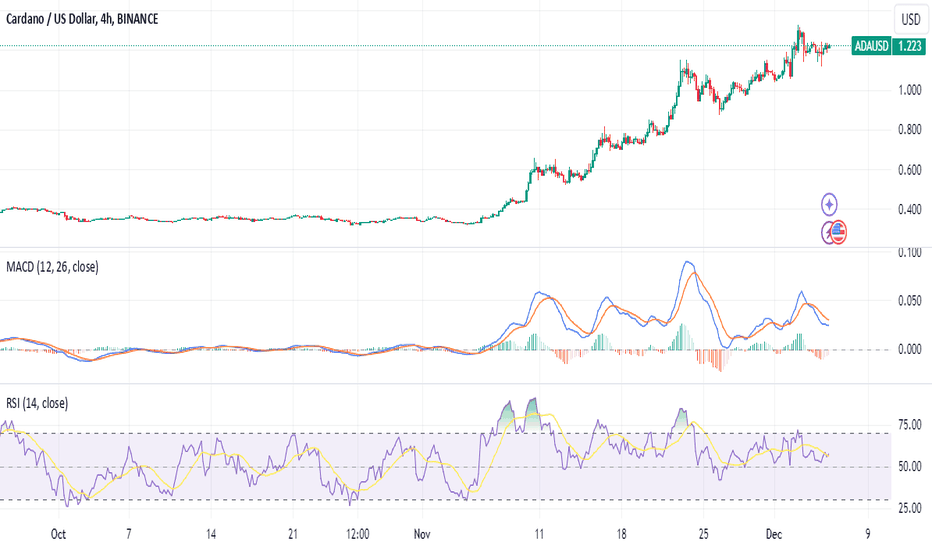

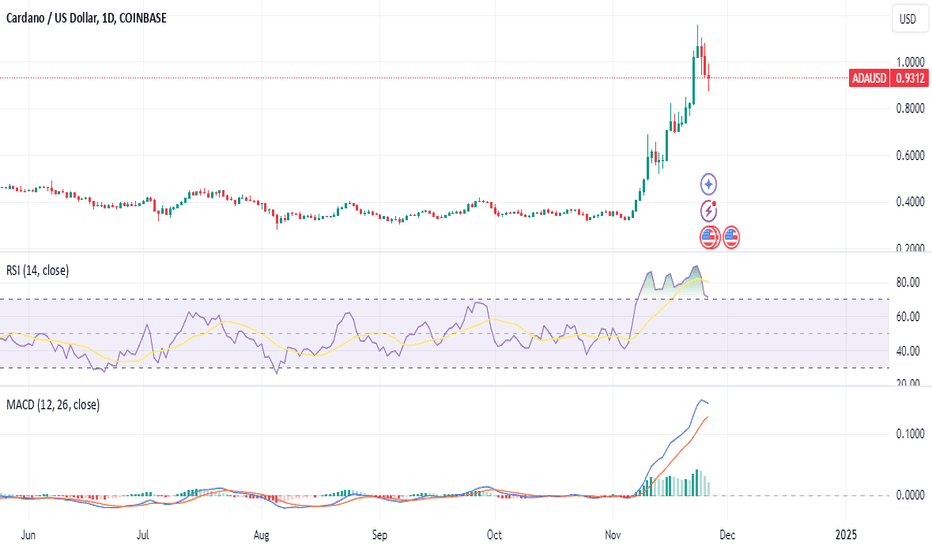

Cardano ($ADA) Dips 8% After Foundation’s X Account HackCardano ( CRYPTOCAP:ADA ), one of the largest cryptocurrencies by market cap, faced significant turbulence after the Cardano Foundation’s X account (@Cardano_CF) was compromised on Sunday. This breach resulted in false promotions and market concerns, triggering an 8% drop in ADA’s price. Here’s a comprehensive analysis of the incident and the technical and fundamental outlook for the coin.

The Hack and Market Sentiment

The compromised X account propagated false information, including:

- Promotion of a fake token, ADAsol: Claimed as a partnership between Cardano and Solana.

- False claims of ADA withdrawal halts: Allegedly tied to SEC actions, further amplifying market fears.

The Cardano Foundation promptly addressed the issue, urging users to disregard any posts from the hacked account. Despite this, the damage to market sentiment was palpable, as fear and uncertainty gripped traders.

Broader Implications

This incident underscores the vulnerability of social media platforms to cyberattacks, even for established blockchain entities. It also raises critical questions about the need for enhanced cybersecurity in the crypto ecosystem.

However, amidst the chaos, optimism persists. Whale activity has shown signs of accumulation, suggesting that large investors still hold faith in ADA’s long-term prospects. Additionally, Cardano’s strong monthly performance—166% gains—indicates the potential for recovery.

Technical Analysis

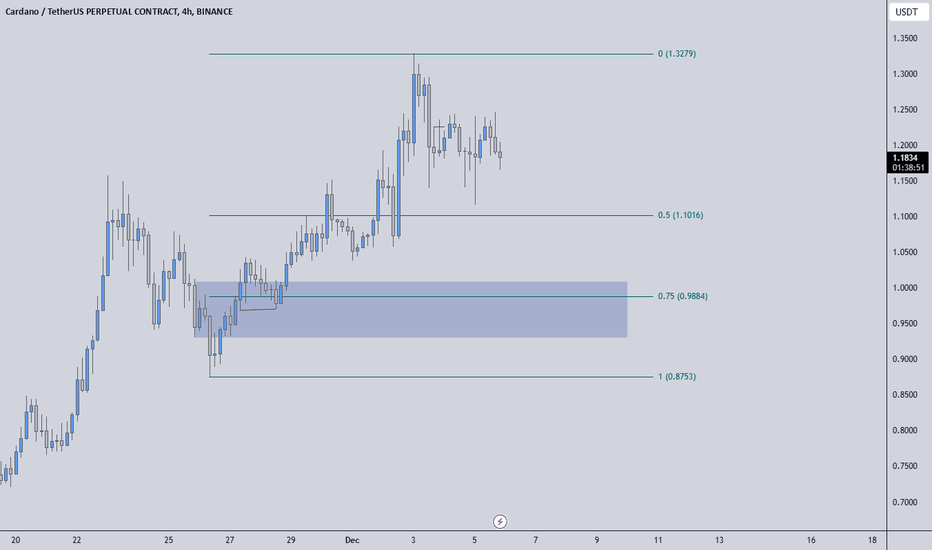

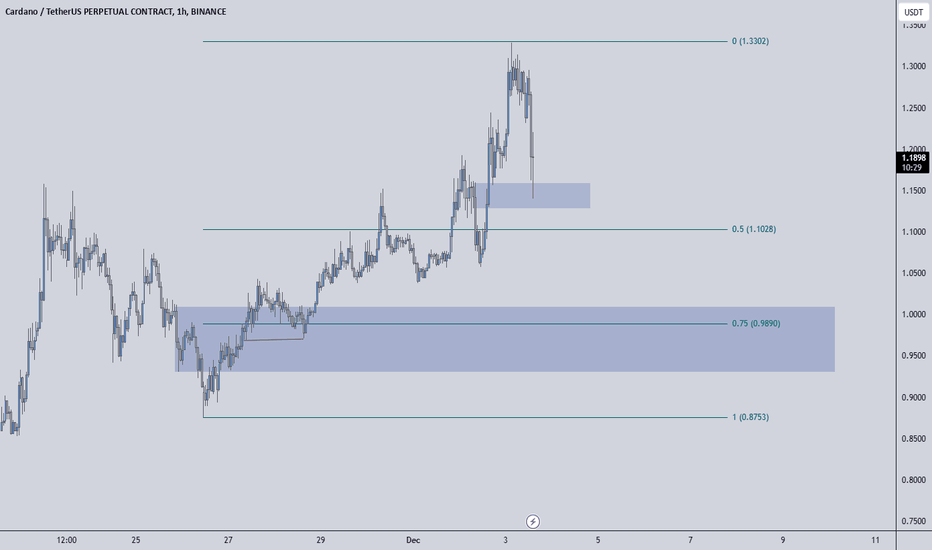

At the time of writing, CRYPTOCAP:ADA trades at $1.115, reflecting a 6.79% drop intraday. The coin’s immediate range shows:

- Intraday low/high: $1.15–$1.22

- RSI (Relative Strength Index): 49, indicating weak momentum but a potential buy zone for opportunistic traders.

Market Outlook

While the hack triggered bearish sentiment, ADA’s price action aligns with broader market trends. Bulls will need to reclaim $1.22 to resume the upward trajectory seen earlier in Q4. Meanwhile, sellers may dominate if ADA fails to hold above the 38.2% Fib retracement level.

The Road Ahead

The X account hack could continue to weigh on ADA’s price in the short term. Negative sentiment might lead to increased selling pressure, especially if there are delays in restoring the compromised account.

Long-Term Prospects

Despite this setback, ADA’s bullish fundamentals remain intact:

- Whale Accumulation: Signals strong institutional confidence.

- Q4 Market Optimism: Renewed interest in cryptocurrencies positions ADA for potential gains.

Conclusion

The Cardano Foundation’s X account hack has undeniably shaken market confidence, resulting in an 8% dip in ADA’s price. However, with strong fundamentals and signs of whale accumulation, the coin still holds promise for recovery.

Traders should closely monitor technical levels and broader market trends to navigate this volatile period. For long-term holders, ADA remains a compelling investment, backed by its ecosystem and community support.

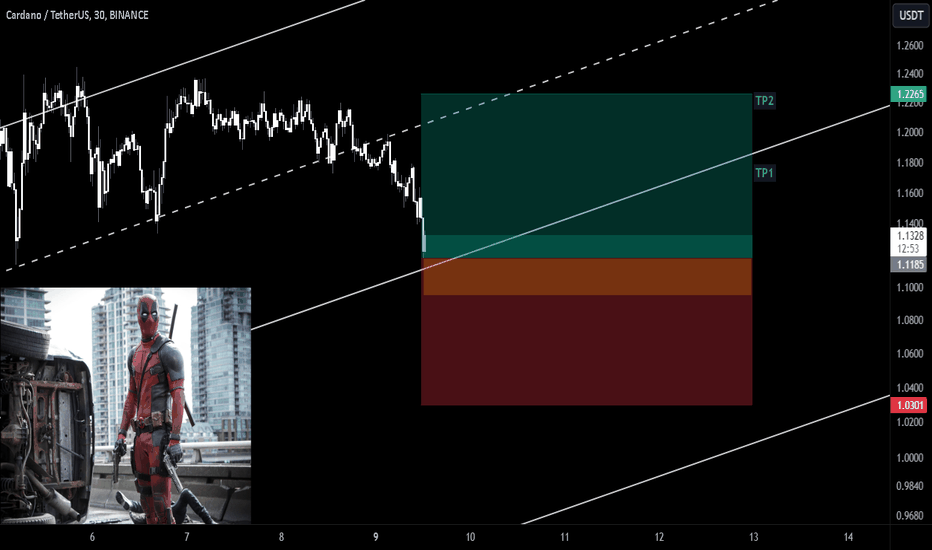

ADAUSDT Long Setup Setting / Futures TradeBINANCE:ADAUSDT

COINBASE:ADAUSD

📈Which side you pick?

Bull or Bear

Low-risk status: 3x-4x Leverage

Mid-risk status: 5x-8x Leverage

(For beginners, I suggest low risk status)

👾Note: The setup is active but expect the uncertain phase as well. also movement lines drawn to predict future price reactions are relative and approximate.

➡️Entry Area:

Yellow zone

⚡️TP:

1.1726

1.2265

🔴SL:

1.0301

🧐The Alternate scenario:

If the price stabilizes against the direction of the position, below or above the trigger zone, the setup will be canceled.

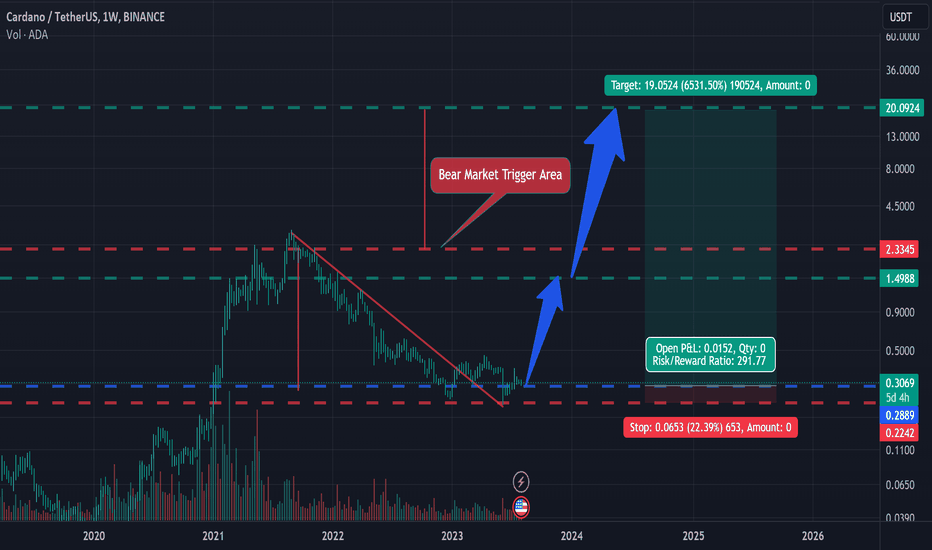

Exploring the Factors Driving Cardano's Bullish TrajectoryCardano (ADA), a blockchain platform known for its robust security and energy efficiency, has been steadily gaining traction in the cryptocurrency market. Analysts are increasingly bullish on ADA's future price movements, with some predicting that the token could reach as high as $9+ in the coming months. This optimistic outlook is fueled by a combination of strong fundamentals, positive market sentiment, and historical price patterns.

Strong Fundamentals Powering ADA's Rise

Cardano's underlying technology, Ouroboros, is a proof-of-stake (PoS) consensus mechanism that offers several advantages over traditional proof-of-work (PoW) systems, including lower energy consumption and improved scalability. Additionally, Cardano's layered architecture enables the platform to handle complex smart contracts and decentralized applications (dApps).

The Cardano community is actively developing a diverse range of projects, including decentralized finance (DeFi) protocols, non-fungible token (NFT) marketplaces, and supply chain solutions. As the ecosystem continues to grow and mature, the demand for ADA is likely to increase.

Positive Market Sentiment Boosts ADA's Prospects

The broader cryptocurrency market is currently experiencing a bullish phase, with Bitcoin and Ethereum leading the charge. This positive market sentiment has spilled over into altcoins like Cardano, driving increased investor interest and capital inflows.

Moreover, the recent surge in interest in blockchain technology and decentralized applications has further fueled the bullish sentiment surrounding ADA. As more and more people become aware of the potential benefits of blockchain, the demand for ADA is likely to rise.

Technical Analysis: A Bullish Outlook

A technical analysis of ADA's price chart suggests that the token may be on the cusp of a significant breakout. Historical price patterns indicate that ADA tends to form support and resistance levels. By breaking through these levels, ADA can enter a new uptrend and potentially reach higher price targets.

Key technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), are also signaling bullish momentum. The RSI, which measures the speed and change of price movements, is currently in the overbought territory, suggesting strong buying pressure. The MACD, which compares two moving averages, is also trending upwards, indicating a bullish crossover.

Potential Challenges and Risks

While the outlook for ADA is positive, it's important to acknowledge potential challenges and risks. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. Regulatory uncertainty, economic downturns, and negative market sentiment can all impact ADA's price.

Additionally, Cardano's network performance and scalability will be crucial factors in determining its future success. As the number of users and transactions on the network increases, it will be essential for Cardano to maintain its performance and avoid congestion.

Conclusion

Cardano's strong fundamentals, positive market sentiment, and bullish technical indicators suggest that the token has the potential to reach new heights. However, investors should approach ADA with a long-term perspective and be prepared for short-term volatility. By carefully considering the risks and rewards, investors can make informed decisions about their ADA investments.

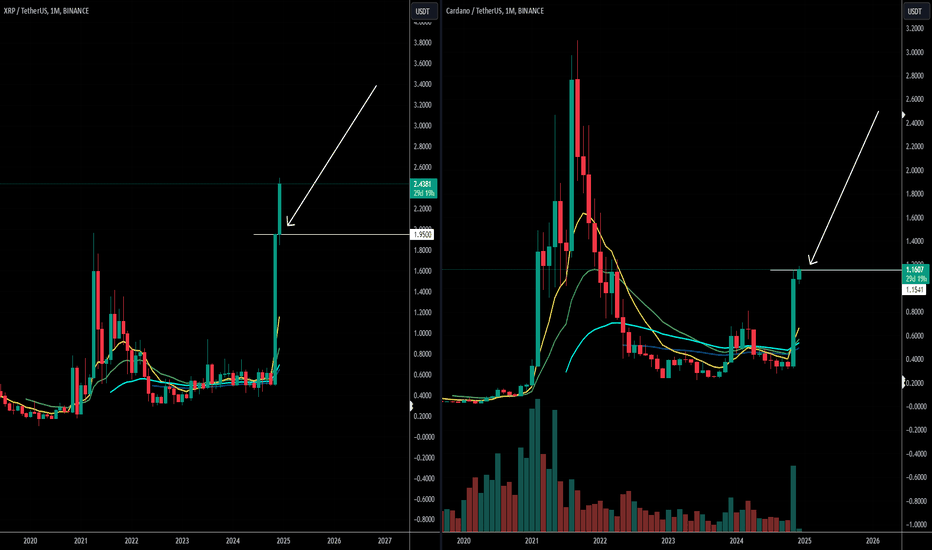

ADA Can Moon Just Like XRP MartyBoots here , I have been trading for 17 years and sharing my thoughts on ADA here.

ADA is looking beautiful , very strong chart for more upside

Very similar to XRP which is up nearly 30% increase from the new monthly level

Do not miss out on ADA as this is a great opportunity

Watch video for more details

Can Cardano's (ADA) Rally Reach $2? A Deep Dive

Cardano (ADA) has undeniably been one of the standout performers in November 2023, surging over 140% and reaching a multi-year high of $0.80. This impressive rally has sparked renewed optimism among investors, with many wondering if ADA can maintain its momentum and even reach the coveted $2 price point.

The Drivers Behind Cardano's Rally

Several factors have contributed to Cardano's recent price surge:

1. Network Upgrades and Developments: Cardano has consistently focused on technological advancements, with key developments like the Vasil hard fork enhancing its scalability and efficiency. These upgrades have positioned Cardano as a strong contender in the smart contract platform space.

2. Growing Ecosystem: The Cardano ecosystem has seen significant growth, with a growing number of decentralized applications (dApps) being built on the platform. This increased adoption has bolstered Cardano's utility and potential for future growth.

3. Positive Market Sentiment: The broader cryptocurrency market has experienced a resurgence in recent months, driven by factors such as declining inflation rates and potential regulatory clarity. This positive sentiment has spilled over into altcoins like Cardano.

4. Institutional Interest: Institutional investors have shown increasing interest in Cardano, recognizing its potential as a long-term investment. This institutional adoption can provide stable support to ADA's price.

The Road to $2: Challenges and Opportunities

While Cardano's rally has been impressive, several factors could impact its ability to reach the $2 price target:

1. Market Volatility: The cryptocurrency market is inherently volatile, and sudden price swings can occur due to various factors, including macroeconomic events, regulatory changes, and market sentiment shifts.

2. Technical Resistance Levels: As Cardano's price rises, it may encounter significant technical resistance levels. Overcoming these levels will be crucial for sustaining the uptrend.

3. Competition from Other Blockchains: Cardano faces competition from other established and emerging blockchains like Ethereum, Solana, and Polygon. These competitors offer unique advantages and could attract investor interest away from Cardano.

4. Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain, and any negative regulatory developments could impact the price of ADA.

Technical Analysis: A Glimpse into the Future

Technical analysis provides valuable insights into potential price movements. Key technical indicators to watch for Cardano include:

• Moving Averages: The 50-day and 200-day moving averages can provide support or resistance levels. A bullish crossover, where the 50-day MA crosses above the 200-day MA, could signal a strong uptrend.

• Relative Strength Index (RSI): The RSI measures the speed and change of price movements. An RSI above 70 indicates overbought conditions, while an RSI below 30 suggests oversold conditions.

• MACD: The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator. A bullish crossover, where the MACD line crosses above the signal line, can signal a potential uptrend.

Conclusion

Cardano's recent rally has been fueled by strong fundamentals and positive market sentiment. While reaching the $2 price target is not impossible, it will require sustained momentum, overcoming technical hurdles, and navigating potential market challenges. Investors should conduct thorough research and consider consulting with financial advisors before making any investment decisions.

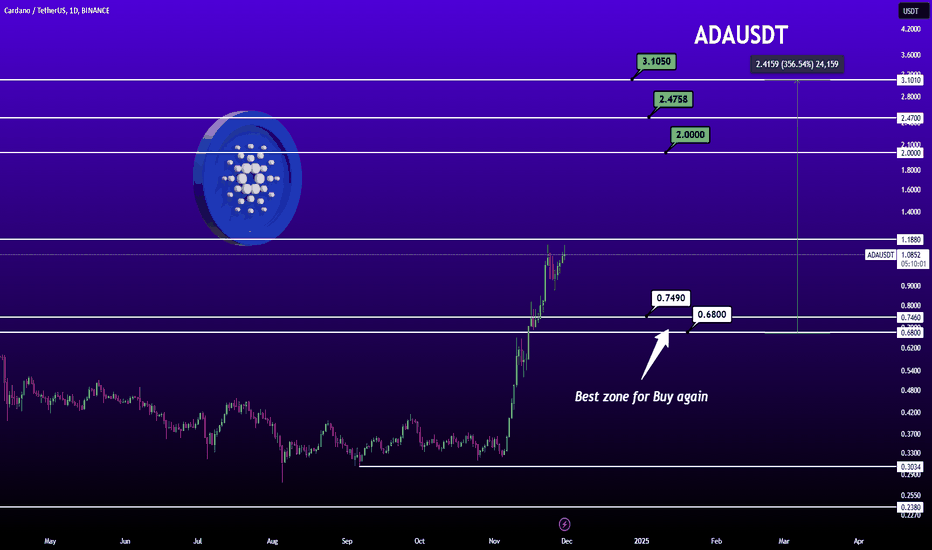

356% ADA Profit🚀 ADA/USDT Price Analysis

The Cardano (ADA) chart shows strong bullish momentum, with prices climbing steadily. Here's a breakdown of key levels:

🔼 Resistance Zones to Watch:

$2.00 🛑: First major resistance. Breaking this could signal a rally.

$2.4758 🛑: A critical level for medium-term targets.

$3.1050 🛑: Long-term price target if the bullish trend holds.

🔽 Support Zones for Buying:

$0.7490 ✅: A solid support zone where buyers previously stepped in.

$0.6800 ✅: Highlighted as the "Best Zone for Buy Again" – ideal for re-entry during corrections.

📈 Upside Potential:

If the bullish trend continues, ADA has a 356% growth potential, aiming for $2.4159 and beyond!

💡 Takeaway:

The current trend favors bulls, but a pullback to support zones could provide better entry opportunities. Keep an eye on trading volumes and breakout confirmations at resistance levels!

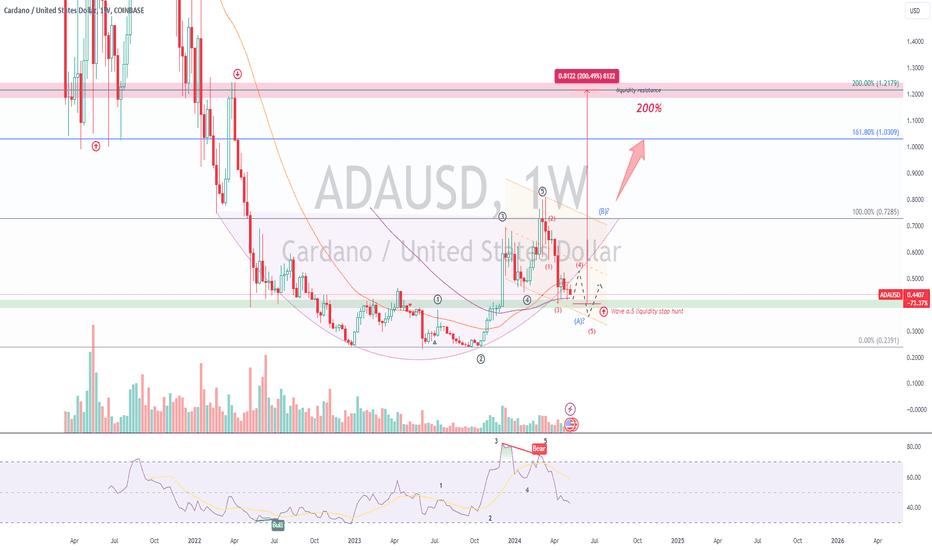

ADAUSD | Wave Analysis CUP&HANDLE Formation +200% TargetA potential ABC correction - cup with bull flag / flat handle ABC formation which currently retraced 61.8% of the A/1 wave with a possible a.4-a.5 stop hunt ending diagonal for a second false breakdown.

Entry Position: Once price successfully recovered from the false breakdown support zone which could be a few attempts since wave 4 often a complex triangle.

Indicator support: RSI bullish divergence in TFD confirmation of the a.5 wave.

Target Position: TP1 @ 161.8% and TP2 @ 200% Fibonacci extension +200%!

Invalidation: Below the lowest price position.

Always trade with affordable risk and respect your stop,

Good Luck

Understanding the Cardano (ADA) Surge: Comprehensive Analysis

Cardano (ADA), the native cryptocurrency of the Cardano blockchain, has recently exhibited a notable uptrend, breaking above the crucial $0.8800 support level. The price has since rallied to trade above the $0.9500 mark, surpassing the 100-hourly Simple Moving Average (SMA).

Technical Analysis: A Bullish Outlook

A closer look at the hourly chart of the ADA/USD pair reveals a key bearish trend line forming resistance near the $1.0200 level. However, a decisive breakout above this trend line could trigger a significant upward move, potentially propelling the price towards the $1.0500 resistance zone.

Key Technical Indicators:

• Relative Strength Index (RSI): The RSI is currently hovering above the 50 level, indicating bullish momentum. A sustained increase in the RSI could signal further price appreciation.

• Moving Averages: The 100-hourly SMA has been acting as a strong support level, and a break above it has confirmed the bullish bias.

• Momentum Indicators: Momentum indicators like the Moving Average Convergence Divergence (MACD) and the Stochastic Oscillator are also showing bullish signals, suggesting that the upward trend may continue.

Fundamental Factors Driving ADA's Price Increase

While technical analysis provides insights into short-term price movements, it's essential to consider the underlying fundamental factors driving ADA's price increase:

• Network Upgrades: Cardano's ongoing network upgrades, such as the Vasil hard fork, have significantly improved the network's scalability and efficiency. These upgrades have attracted more developers and investors to the Cardano ecosystem.

• Growing DeFi Ecosystem: The Cardano blockchain is rapidly emerging as a hub for decentralized finance (DeFi) applications. The increasing number of DeFi projects and protocols built on Cardano can boost demand for ADA.

• Institutional Adoption: Institutional investors and corporations are increasingly recognizing the potential of blockchain technology and cryptocurrencies. As more institutions allocate capital to Cardano, it can further fuel price appreciation.

• Positive Market Sentiment: The overall positive sentiment in the cryptocurrency market, driven by factors such as increasing institutional adoption and regulatory clarity, can also contribute to ADA's price increase.

Potential Risks and Challenges

While the technical and fundamental outlook for ADA appears bullish, it's important to acknowledge potential risks and challenges:

• Market Volatility: The cryptocurrency market is highly volatile, and prices can fluctuate rapidly due to various factors, including macroeconomic events, regulatory changes, and market sentiment.

• Competition from Other Blockchains: Cardano faces competition from other blockchain platforms like Ethereum and Solana. These competing platforms may offer advantages in terms of scalability, transaction fees, and developer ecosystem.

• Regulatory Uncertainty: Regulatory uncertainty remains a significant risk for the cryptocurrency industry. Strict regulations or unfavorable policies could negatively impact the price of ADA.

Conclusion

Cardano's recent price surge and positive technical indicators suggest that the bullish trend may continue in the short term. However, it's crucial to approach investments in cryptocurrencies with caution and consider diversifying your portfolio. As with any investment, conducting thorough research and consulting with financial advisors can help you make informed decisions.

Cardano (ADA) Reclaims $1, Eyes Crucial Resistance Zone

Cardano (ADA), the popular layer-1 blockchain platform, has once again surged above the significant $1 price level. In the past 24 hours, the altcoin has witnessed a remarkable seven percent increase, fueling optimism among investors. As ADA approaches a crucial resistance zone, analysts closely monitor its price action to gauge its potential future trajectory.

A Closer Look at the Technical Analysis

A technical analysis of ADA's price chart reveals a bullish sentiment. The recent surge has pushed the altcoin above several key resistance levels, including the 200-day moving average. This positive price action indicates a potential shift in market sentiment, with investors becoming more optimistic about ADA's prospects.

However, ADA still faces a significant challenge in the form of a strong resistance zone between $1.10 and $1.15. This zone has historically proven to be a formidable obstacle for the altcoin. If ADA can successfully break through this resistance, it could pave the way for further upside potential.

On the other hand, a failure to overcome this resistance zone could lead to a potential price correction. In such a scenario, ADA might retest the $1 support level. Therefore, it is crucial to monitor the price action around this critical resistance zone in the coming hours.

Factors Driving ADA's Recent Surge

Several factors have contributed to ADA's recent price surge:

1. Network Upgrades: Cardano has been actively working on various network upgrades and improvements, including the Vasil hard fork. These upgrades have enhanced the network's scalability and performance, making it more attractive to developers and users.

2. Growing Developer Community: The Cardano ecosystem has witnessed a significant increase in developer activity. More and more projects are being built on the Cardano blockchain, which could drive demand for ADA.

3. Positive Market Sentiment: The broader cryptocurrency market has been experiencing a period of relative stability and growth. This positive market sentiment has benefited ADA and other altcoins.

4. Institutional Interest: Institutional investors are increasingly showing interest in Cardano. This growing institutional adoption could provide long-term support for ADA's price.

What's Next for ADA?

The short-term outlook for ADA is cautiously optimistic. If the altcoin can successfully break through the $1.10 to $1.15 resistance zone, it could potentially rally towards the next major resistance level at $1.25. However, a failure to overcome this resistance could lead to a price correction.

Long-term, ADA's success will depend on its ability to attract and retain developers, as well as its ability to deliver on its technological promises. If Cardano can continue to innovate and grow its ecosystem, it has the potential to become a major player in the cryptocurrency market.

Conclusion

Cardano's recent price surge and the potential for further upside have generated excitement among investors. However, it is essential to approach this development with caution and conduct thorough research before making any investment decisions.

As always, it is crucial to diversify your portfolio and manage risk effectively. By staying informed about the latest market trends and developments, investors can make informed decisions and maximize their returns.

Cardano's Resurgence: A $1 Reclaim and a Bullish OutlookCardano (ADA), the blockchain platform known for its scientific approach and focus on sustainability, has recently made significant strides.1 The cryptocurrency has not only reclaimed the crucial $1 price level but has also witnessed a surge in network growth, sparking optimism among investors and analysts alike.2

Reclaiming the $1 Mark

After a period of consolidation, ADA successfully broke through the psychologically significant $1 resistance level.3 This achievement marks a significant milestone for the cryptocurrency, which has been steadily gaining momentum in recent months.4 The price surge can be attributed to several factors, including increased network activity, positive market sentiment, and growing institutional interest.5

Network Growth and Adoption

One of the key drivers behind Cardano's recent price appreciation is the substantial growth in its network activity.6 The number of daily active addresses on the Cardano blockchain has surged, indicating increased user engagement and adoption.7 This uptick in user activity is a strong indicator of the network's health and potential for future growth.8

Furthermore, Cardano's Total Value Locked (TVL) has also experienced significant growth, reflecting the increasing popularity of decentralized applications (dApps) and other projects built on the platform. As more projects and users choose Cardano, the network's value proposition strengthens, attracting further investment and attention.9

Technical Analysis: A Bullish Outlook

From a technical perspective, Cardano's price action appears to be forming a bullish pattern. The recent breakout above the $1 resistance level has provided strong confirmation of the uptrend. Additionally, key technical indicators such as the Relative Strength Index (RSI) and Moving Averages (MAs) are signaling bullish momentum.

However, it is important to note that the cryptocurrency market is highly volatile, and prices can fluctuate rapidly.10 While the technical indicators suggest a potential for further upside, conducting thorough research and considering risk management strategies is crucial before making any investment decisions.

Future Potential and Challenges

As Cardano continues to mature and evolve, it has the potential to become a leading player in the blockchain industry. The platform's focus on sustainability, scalability, and security positions it well to address the challenges faced by other blockchains.11

However, Cardano still faces several challenges, including competition from other established and emerging platforms.12 Additionally, the regulatory environment for cryptocurrencies remains uncertain, which could impact the adoption and growth of the industry.13

Conclusion

Cardano's recent price surge and increased network activity are positive signs for the future of the platform. The cryptocurrency's strong fundamentals, coupled with a growing community and a dedicated development team, position it well for long-term growth.14

While the short-term price movements may be subject to market volatility, the long-term outlook for Cardano remains bullish.15 As the network continues to mature and attract more users and developers, ADA has the potential to reach new heights and solidify its position as a leading blockchain platform.16

Cardano's Resurgence: A $1 Reclaim and a Bullish OutlookCardano (ADA), the blockchain platform known for its scientific approach and focus on sustainability, has recently made significant strides.1 The cryptocurrency has not only reclaimed the crucial $1 price level but has also witnessed a surge in network growth, sparking optimism among investors and analysts alike.2

Reclaiming the $1 Mark

After consolidation, ADA successfully broke through the psychologically significant $1 resistance level.3 This achievement marks a significant milestone for the cryptocurrency, steadily gaining momentum in recent months.4 The price surge can be attributed to several factors, including increased network activity, positive market sentiment, and growing institutional interest.5

Network Growth and Adoption

One of the key drivers behind Cardano's recent price appreciation is the substantial growth in its network activity.6 The number of daily active addresses on the Cardano blockchain has surged, indicating increased user engagement and adoption.7 This uptick in user activity strongly indicates the network's health and potential for future growth.8

Furthermore, Cardano's Total Value Locked (TVL) has also experienced significant growth, reflecting the increasing popularity of decentralized applications (dApps) and other projects built on the platform. As more projects and users choose Cardano, the network's value proposition strengthens, attracting further investment and attention.9

Technical Analysis: A Bullish Outlook

From a technical perspective, Cardano's price action appears to be forming a bullish pattern. The recent breakout above the $1 resistance level has provided strong confirmation of the uptrend. Additionally, key technical indicators such as the Relative Strength Index (RSI) and Moving Averages (MAs) are signaling bullish momentum.

However, it is important to note that the cryptocurrency market is highly volatile, and prices can fluctuate rapidly.10 While the technical indicators suggest a potential for further upside, conducting thorough research and considering risk management strategies is crucial before making any investment decisions.

Future Potential and Challenges

As Cardano continues to mature and evolve, it has the potential to become a leading player in the blockchain industry. The platform's focus on sustainability, scalability, and security positions it well to address the challenges faced by other blockchains.11

However, Cardano still faces several challenges, including competition from other established and emerging platforms.12 Additionally, the regulatory environment for cryptocurrencies remains uncertain, which could impact the adoption and growth of the industry.13

Conclusion

Cardano's recent price surge and increased network activity are positive signs for the future of the platform. The cryptocurrency's strong fundamentals, coupled with a growing community and a dedicated development team, position it well for long-term growth.14

While the short-term price movements may be subject to market volatility, the long-term outlook for Cardano remains bullish.15 As the network continues to mature and attract more users and developers, ADA has the potential to reach new heights and solidify its position as a leading blockchain platform.16

Is Cardano Heading Towards $6? Expert Analysis and Bullish SignsCardano (ADA), the blockchain platform known for its scientific approach to blockchain development, has recently shown significant bullish signs. The cryptocurrency has experienced a surge in price, breaking key resistance levels and attracting increased investor attention.

Cardano Price Rumbles On, Breaks $1 For The First Time Since 2022

One of the most notable developments is Cardano's recent price surge, which has pushed the token above the $1 mark for the first time since 2022. This significant milestone has ignited optimism among investors and analysts alike.

Key Factors Driving Cardano's Bullish Momentum

Several factors are contributing to Cardano's bullish momentum:

1. Network Upgrades and Developments:

o Vasil Hard Fork: The successful implementation of the Vasil hard fork brought significant performance and scalability improvements to the Cardano network. This upgrade enhanced the network's capacity to handle increased transaction volume and smart contract activity.

o Djed Stablecoin: The launch of Djed, a decentralized stablecoin, has added a new dimension to Cardano's ecosystem. Djed aims to provide stability and facilitate financial transactions within the Cardano network.

2. Growing Developer Activity:

o The number of developers building on the Cardano platform has been steadily increasing. This growing developer community is a strong indicator of the network's potential and future growth.

o The development of dApps (decentralized applications) on Cardano is gaining momentum, expanding the platform's utility and attracting new users.

3. Positive Market Sentiment:

o The broader cryptocurrency market has been experiencing a positive trend, with many cryptocurrencies showing significant price gains. This positive sentiment has spilled over to Cardano, driving its upward momentum.

o Increased institutional interest in the cryptocurrency market has also contributed to the positive sentiment surrounding Cardano.

Expert Forecast: $6 Price Target

In light of these positive developments, experts have issued bullish forecasts for Cardano's future price. Some analysts believe that Cardano could reach a price target of $6 in the coming months or years.

Potential Challenges and Risks

While the outlook for Cardano appears promising, it's important to acknowledge potential challenges and risks:

• Market Volatility: The cryptocurrency market is inherently volatile, and sudden price swings can occur.

• Regulatory Uncertainty: Changes in regulatory policies can impact the cryptocurrency market, including Cardano.

• Competition from Other Blockchains: Cardano faces competition from other blockchain platforms, such as Ethereum and Solana, which could impact its growth and adoption.

Conclusion

Cardano's recent price surge and positive developments suggest a bullish outlook for the cryptocurrency. However, it's crucial to approach investments with caution and conduct thorough research before making any decisions. As with any investment, there are risks involved, and past performance is not indicative of future results.

By staying informed about the latest developments in the Cardano ecosystem and the broader cryptocurrency market, investors can make informed decisions and potentially benefit from Cardano's future growth.

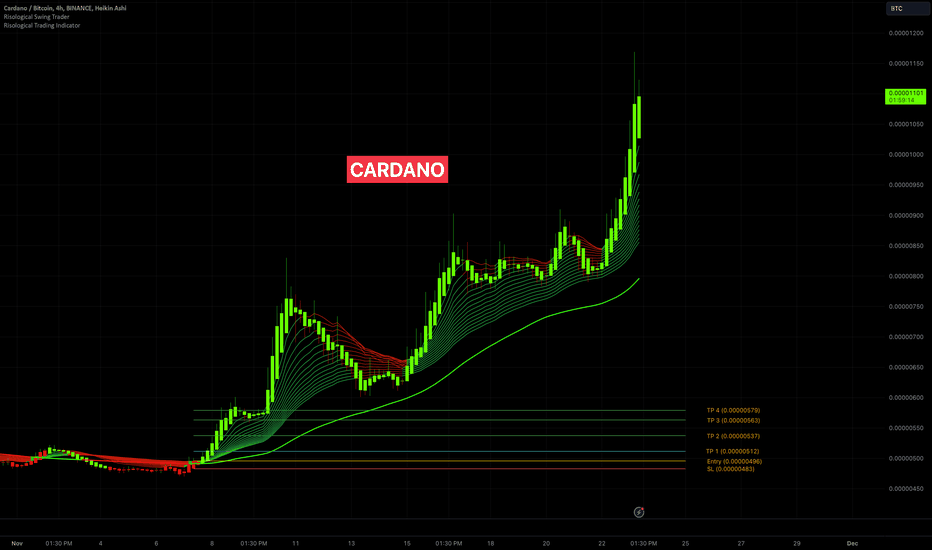

Cardano (ADA) Rockets 1300% Gains at 10x Leverage!Trade Overview:

CARDANO (ADA) on the 4-hour timeframe showcased a phenomenal long trade setup using the Risological Green Lines and the Risological Swing Trader. The trade captured an impressive 1300% gain at 10x leverage, demonstrating the strength of the tools in identifying market momentum.

Key Levels:

TP1: $0.00000512 ✅

TP2: $0.00000537 ✅

TP3: $0.00000563 ✅

TP4: $0.00000579 ✅

Technical Analysis:

The trade began with a clear breakout above the Risological Green Lines , confirming strong bullish momentum. The entry point at $0.00000496 was precisely timed, with a tight stop-loss placed at $0.00000483, ensuring minimal downside risk. Each profit target was sequentially hit as the price displayed consistent strength, powered by solid market sentiment.

The combination of clear Risological trend alignment and disciplined risk management allowed traders to capitalize fully on the upward move. This trade is another testament to the accuracy and reliability of the Risological system in achieving consistent profits while mitigating risks effectively.

How Will the Record-High Value of Cardano's ADA Impact CryptoCardano's native cryptocurrency, ADA, has recently experienced a significant price surge, reaching a 2.5-year high of 90 cents. Factors, including increased institutional interest, growing on-chain activity, and positive developments within the Cardano ecosystem have fueled this impressive rally.

Whale Accumulation and Institutional Interest

One of the key drivers of ADA's price surge has been the accumulation of large amounts of ADA by whales and institutional investors. On-chain data reveals that whale holdings have surpassed $12 billion, indicating significant institutional interest in the project.

These large-scale investors are often attracted to Cardano's unique features, such as its proof-of-stake consensus mechanism, which is more energy-efficient than proof-of-work. Additionally, Cardano's focus on sustainability and its commitment to scientific research and peer-reviewed development have further enhanced its appeal to institutional investors.

Growing On-Chain Activity

Alongside whale accumulation, increased on-chain activity has also contributed to ADA's price rally. The number of active addresses on the Cardano network has been steadily rising, indicating growing adoption and usage of the platform.

This surge in on-chain activity can be attributed to several factors, including the launch of new decentralized applications (dApps) on the Cardano network, the increasing number of projects utilizing Cardano's smart contract functionality, and the growing popularity of Cardano-based non-fungible tokens (NFTs).

Positive Developments Within the Cardano Ecosystem

Several positive developments within the Cardano ecosystem have also contributed to the recent price surge. These include:

• Vasil Hard Fork: The successful implementation of the Vasil hard fork, which introduced significant performance and scalability improvements to the Cardano network, has boosted investor confidence and attracted new developers to the ecosystem.

• DApp Development: The growing number of dApps being built on Cardano, ranging from decentralized exchanges to gaming platforms, has increased the utility of the ADA token and attracted new users to the network.

• NFT Market: The thriving NFT market on Cardano, with projects like CNFTs, has generated significant interest and driven demand for ADA.

Future Outlook

Given the positive developments within the Cardano ecosystem, the strong institutional interest, and the increasing on-chain activity, many analysts are bullish on the future of ADA. Some experts predict that ADA could reach $1.25 shortly, provided that the current positive momentum continues.

However, it is important to note that the cryptocurrency market is highly volatile, and ADA's price could fluctuate significantly in the short term. Investors should conduct thorough research and consider consulting with a financial advisor before making any investment decisions.1

Despite the inherent risks associated with cryptocurrency investments, Cardano's strong fundamentals, growing ecosystem, and increasing institutional interest position it as a promising long-term investment. As the Cardano network continues to evolve and mature, ADA's price could experience further significant growth in the years to come.

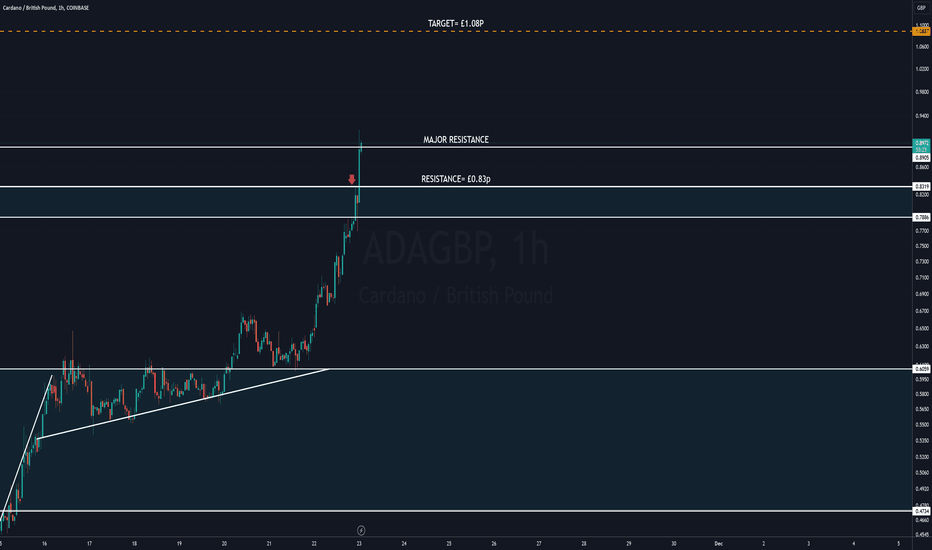

Cardano (ADA) - Key Levels to Next Leg UpThe bulls are trying to push the price past to the psychological level of £0.83, which is expected to act as a strong resistance. If the price turns down from £0.80p but does not fall below £0.80, it will indicate that the bulls have flipped the level into support. That increases the possibility of a break above £0.89. The ADA/GBP pair may then ascend to £1.37.

Major Resistance has been broken, so the next target for bulls to break will be roughly= £1.08p

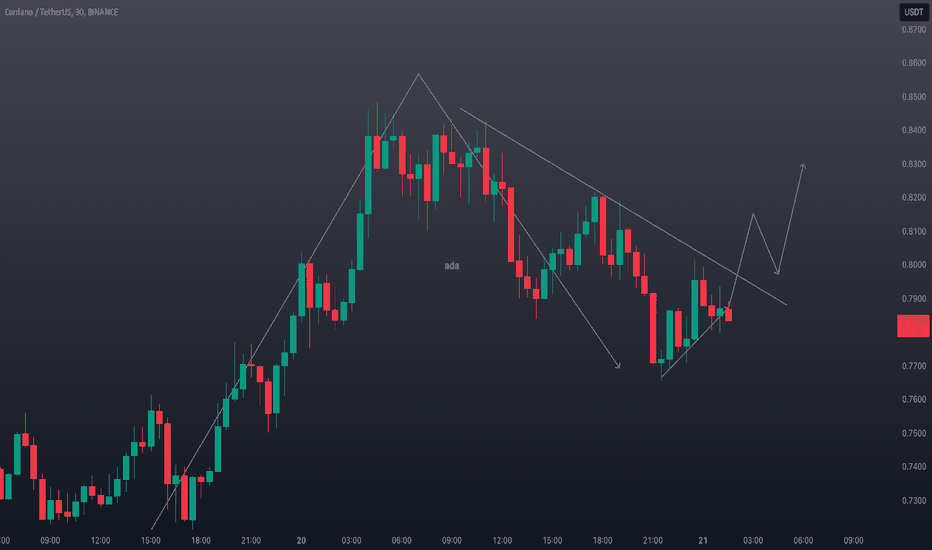

ADA CARDANO 4H Retrace - Is It Time To BUY?👀👉 ADA CARDANO has recently experienced a pullback, leaving traders wondering: what’s next? I’m leaning toward looking for a buy opportunity, but this depends on a bullish structural break—specifically, a break above the current previous high on the 30m timeframe. 📊 Disclaimer: This is for educational purposes only and should not be considered financial advice. Always do your own research and trade responsibly.

Analyzing Cardano's Resurgence Due To Whale ActivityCardano (ADA), the proof-of-stake blockchain platform, has been making significant strides in the cryptocurrency market, defying the broader market downturn and attracting the attention of large-scale investors. The recent surge in whale activity, characterized by transactions involving substantial amounts of ADA, has ignited optimism among the Cardano community.

A Beacon of Stability in a Turbulent Market

While many cryptocurrencies have struggled to maintain their value amidst market volatility, Cardano has emerged as a beacon of stability. This resilience can be attributed to several factors:

• Strong Fundamental Value Proposition: Cardano's focus on sustainability, scalability, and security has solidified its position as a leading blockchain platform. Its unique proof-of-stake consensus mechanism, Ouroboros, offers energy-efficient and environmentally friendly transaction processing.

• Active Development and Innovation: The Cardano team continues to actively develop and innovate on the platform. Recent advancements, such as the implementation of smart contract functionality through the Alonzo hard fork, have expanded Cardano's capabilities and attracted a growing developer community.

• Strong Community Support: A dedicated and passionate community of supporters has been instrumental in driving Cardano's growth. This community actively participates in the network's development, governance, and promotion.

Whale Activity: A Bullish Indicator

The recent surge in whale activity on the Cardano network is a significant bullish indicator. Large-scale investors, often referred to as whales, are typically sophisticated market participants who make informed investment decisions. Their increased interest in Cardano suggests a strong belief in the platform's long-term potential.

Whale activity can influence market sentiment and price trends in several ways:

• Accumulation: Whales may be accumulating ADA in anticipation of future price appreciation. This increased demand can drive the price higher.

• Market Manipulation: While less likely in a decentralized market like Cardano, large-scale transactions can potentially impact short-term price movements.

• Signaling Confidence: Whale activity can signal confidence in the project's future, encouraging other investors to follow suit.

The Road Ahead for Cardano

As Cardano continues to evolve and mature, its potential for future growth remains significant. The platform's focus on sustainability, scalability, and security positions it well to address the challenges facing the broader blockchain industry. Additionally, the growing interest from institutional investors and the active development of the Cardano ecosystem further bolster its prospects.

However, it's important to approach any investment with caution and conduct thorough research before making any decisions. The cryptocurrency market is highly volatile, and past performance is not indicative of future results.

Key Takeaways:

• Cardano's strong fundamentals, active development, and supportive community have contributed to its resilience in a turbulent market.

• The recent surge in whale activity is a positive indicator of investor confidence in Cardano's long-term potential.

• While the future of Cardano is promising, it's essential to approach investments with caution and consider the inherent risks associated with the cryptocurrency market.

By staying informed about Cardano's progress and market trends, investors can make informed decisions and potentially benefit from the platform's future growth.