GBP/USD slides after Fitch's downgradeGBP/USD is down sharply today. In the North American session, GBP/USD is trading at 1.1150 down a massive 1.58%. The pound continues to exhibit sharp volatility, with swings of over 1% every day this week.

The fallout surrounding Chancellor Kwarteng's ill-fated mini-budget just won't go away. After immense pressure, Kwarteng abolished the tax breaks for the top 1% earners in a humiliating U-turn that has badly damaged the credibility of the new government. The fiasco sent the pound to a record low and forced the Bank of England to step in after the bond market was close to crashing. On Wednesday, the Fitch ratings agency lowered its outlook for UK debt from "stable" to "negative", following a similar move by Standard & Poor's after the mini-budget. Fitch did maintain the UK's credit rating of AA-, but the lower outlook will not help Prime Minister Truss' beleaguered government.

The pound was pummelled in September, losing 3.9%. The outlook for the pound does not look good, with soaring inflation and the new government's serious missteps after only a few weeks in office. Manufacturing PMI remained below 50, which indicates contraction. Today's Construction PMI rose to 52.3, up from 49.2, but much of the improvement was due to an easing in supply shortages, and new orders fell to their lowest level since May 2020.

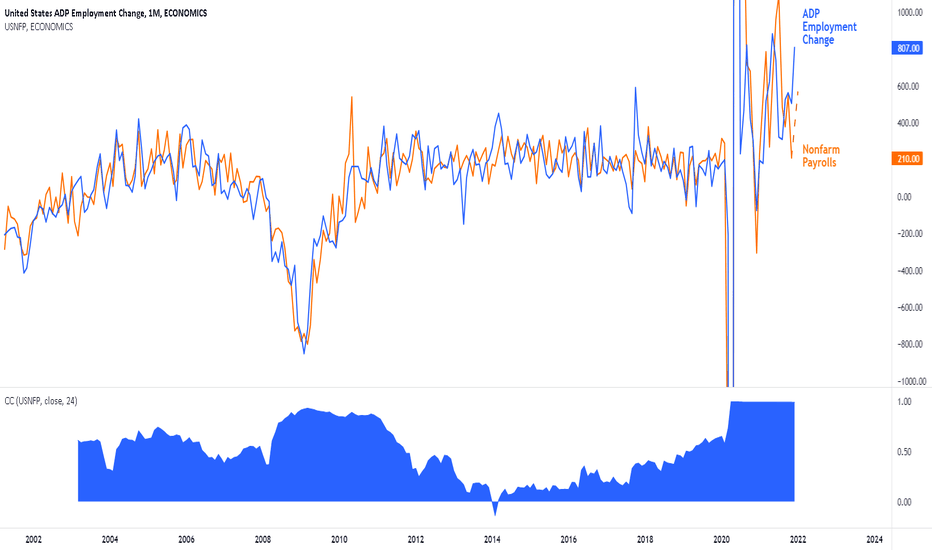

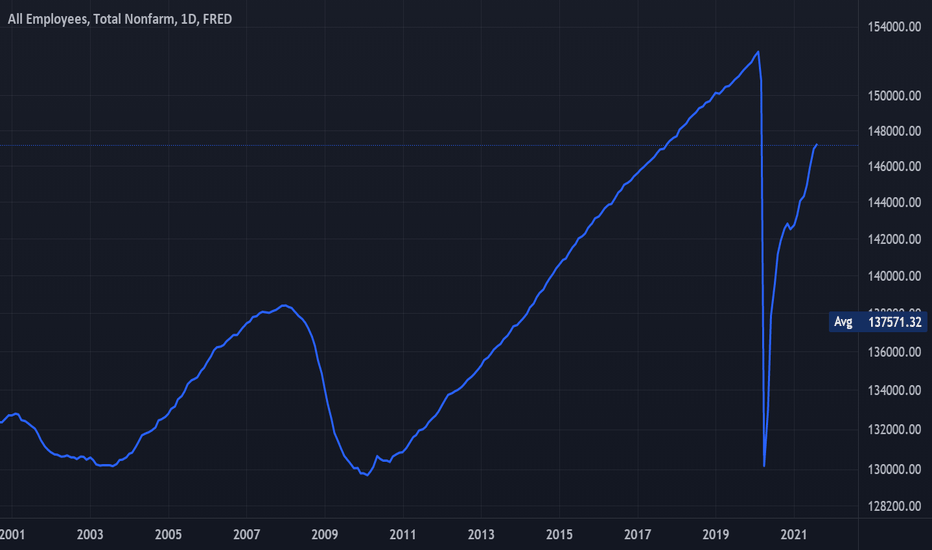

In the US, the spotlight will be on Friday's nonfarm payroll report. The reading is an important bellwether of the health of the US economy and can provide insights into the Federal Reserve's future rate policy. On Wednesday, the ADP employment report showed a slight improvement at 208,000, up from 185,000 (200,000 est.) The ADP release is not a reliable forecaster of the official NFP release, but ADP is now using a new methodology, which hopefully will improve its reliability. Non-farm payrolls are expected to decline to 250,000 in September, down from 315,000 in August. A reading that is well off the estimate could trigger volatility from the US dollar - a strong reading will raise expectations that the Fed will stay very aggressive, while a soft release could mean the Fed has to pivot earlier than it expected.

GBP/USD is testing support at 1.1206. The next support line is at 1.1085

There is resistance at 1.1350 and 1.1486

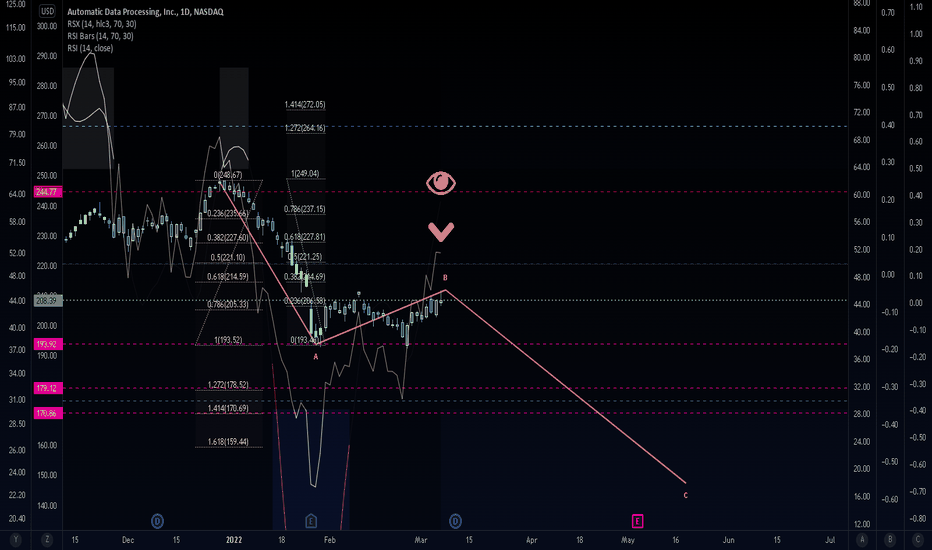

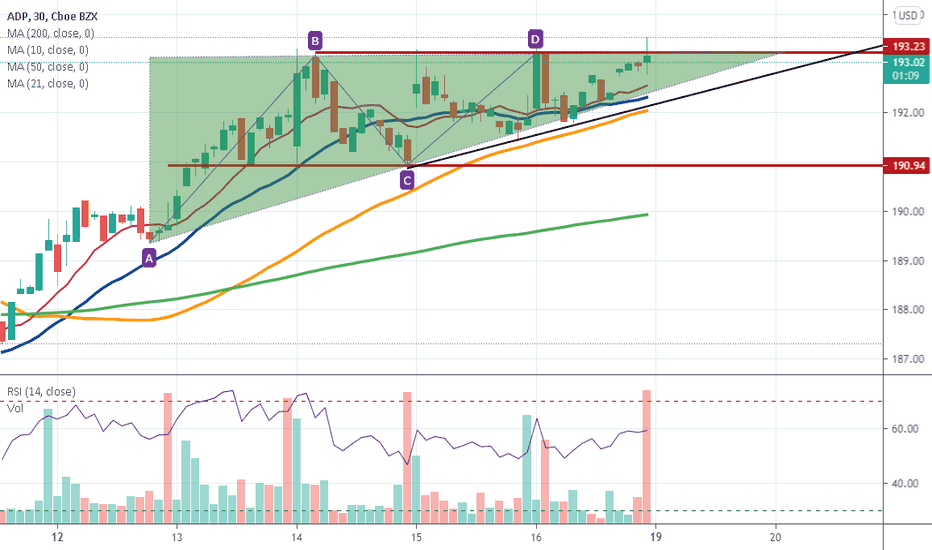

ADP

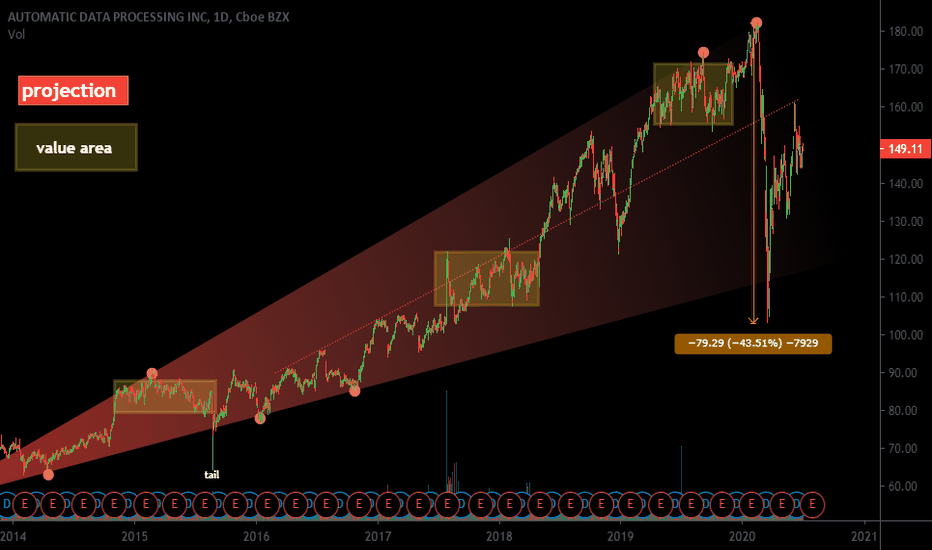

Automatically down on ADP.Goals 193, 179, 170. Invalidation at 244.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

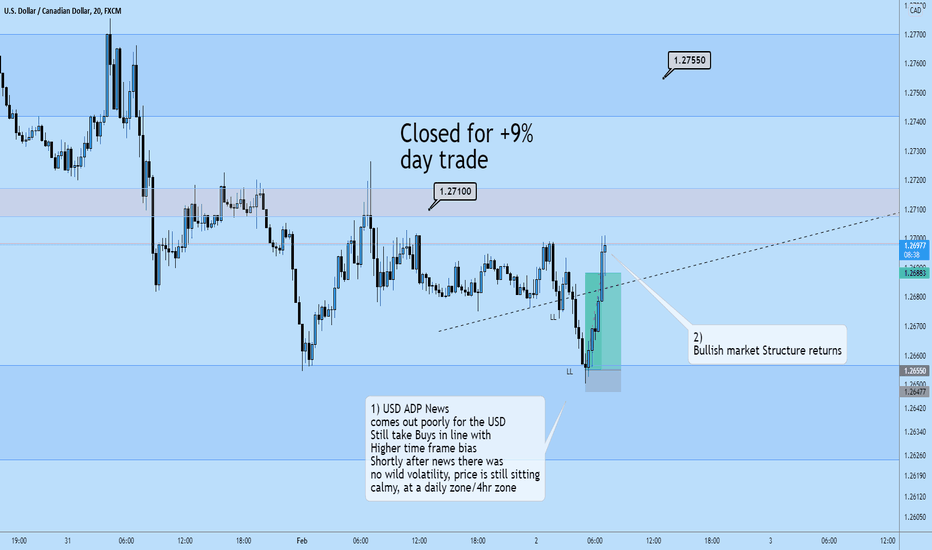

+9% Despite Poor USD ; ADP NewsBias remains the same for this pair

Despite DXY going wild

Crude oil is also in quite a volatile range for CAD

ASP news this morning was very poor for the USD

However we have only see DXY appreciate since the news

This is because USD is a safe haven despite the worlds largest economy having

bad employment numbers. We would like to see a continuation of bull market structure as we move into london close

for our bias to remain strong. NFP in 2 days

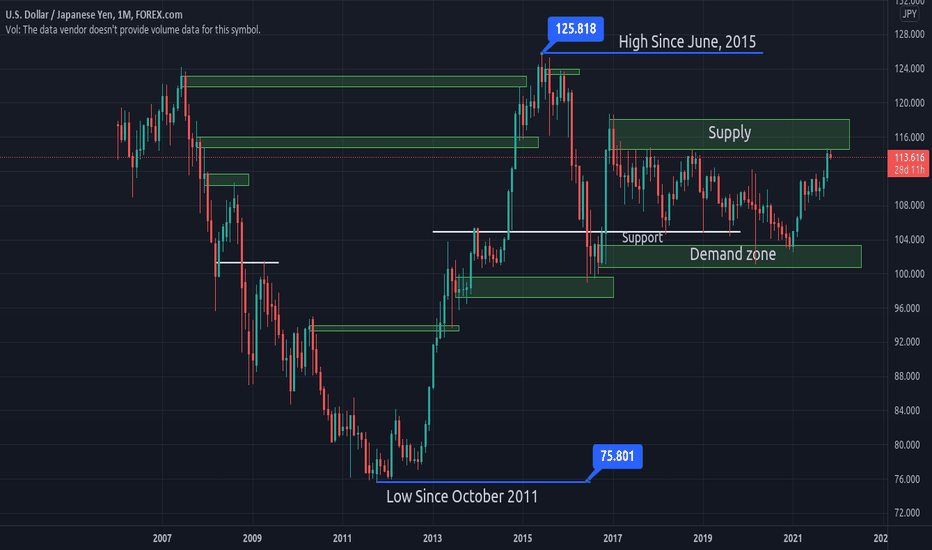

Yen edges below 116, inflation nextThe Japanese yen has edged higher and is back below the 116 level. Still, the yen remains vulnerable, especially with US treasury yields moving higher. Earlier in the week, USD/JPY broke above116 line for the first time since January 2017.

The dollar has managed to push the yen to 5-year lows on the back of rising US Treasury yields. The 10-year yield, which finished 2021 above the 1.50% level, hasn’t missed a beat in the first week of 2022 and has pushed above 1.70%. The widening US/Japan rate differential has been weighing on the yen, which is extremely sensitive to the rate differential. If US yields remain high, I would not be surprised to see USD/JPY break past the 118 mark over the coming weeks.

Inflation has become a hot topic for the Federal Reserve and the BoE, as policymakers must deal with inflation levels that are double or triple the banks’ inflation target of 2%. In Japan, inflation has been at low levels for years, with deflation a constant problem. However, Japan hasn’t been immune to surging energy costs and rising prices of raw materials, and inflation is now getting some attention from the Bank of Japan. We’ll get a look at Tokyo Core CPI for December later in the day, which is expected to rise to 0.5% y/y, up from 0.3% in November.

With the FOMC minutes behind us, the markets are anxiously awaiting Friday’s nonfarm payroll report. The ADP employment report surprised to the upside, with a massive 807 thousand new jobs, double the consensus of 400 thousand. The huge gain led Goldman Sachs to upwardly revise its forecast by 50 thousand to 500 thousand and some analysts are projecting a print north of the 1-million mark. Still, it should be remembered that the ADP report has not been a reliable indicator for nonfarm payrolls. The consensus for the NFP stands at 424 thousand, and if the reading comes in below expectations, we could see the US dollar falter as a weak NFP could delay the timeframe for the first rate hike of 2022.

USD/JPY is putting pressure on resistance at 115.78. Above, there is resistance at 116.38

There is support at 114.54 and 113.98

Euro recaptures 1.13, German PMI declinesThe euro started the New Year with sharp losses, but the currency has rebounded on Wednesday, posting gains of 0.44% and punching above the 1.13 level.

Germany's service sector showed contraction in December, falling below the 50-level for the first time in eight months. The PMI fell from 52.7 to 48.7 points. The German recovery stalled in December, as the country was hit by a fourth wave of Covid and tighter health restrictions dampened business activity, especially exports. The silver lining is that despite the current difficult conditions, German service providers remain optimistic that business conditions will rebound during the year. The German PMI was significantly lower than the all-eurozone PMI, which came in at 53.1 points.

In the US, the ADP employment report surprised to the upside, with a December reading of 807 thousand new jobs, double the consensus of 400 thousand. The estimate for the nonfarm payroll report on Friday is 424 thousand, but the ease in which the ADP crushed the estimate could mean that the NFP forecast is too low. Still, it is worth noting that the ADP report only covered the first two weeks of December, before the massive spike in Omicron cases.

Later today, we'll get a look at the FOMC minutes from the December policy meeting. The Fed recently abandoned its 'transitory inflation' label, as inflation, which is running at a 40-year high, shows no signs of easing anytime soon. The Fed has shifted to a hawkish stance and plans to double the size of its tapers from USD 15 billion to USD 30 billion. This will be followed by the first rate hike in three years. Lift-off could come as early as March - Fed Watch has priced in a March hike at over 60%. The markets expect the Fed to be more hawkish and have priced in three rate hikes in 2022.

EUR/USD has support at 1.1303. Below, there is support at 1.1232

There is resistance at 1.1456 and 1.1415

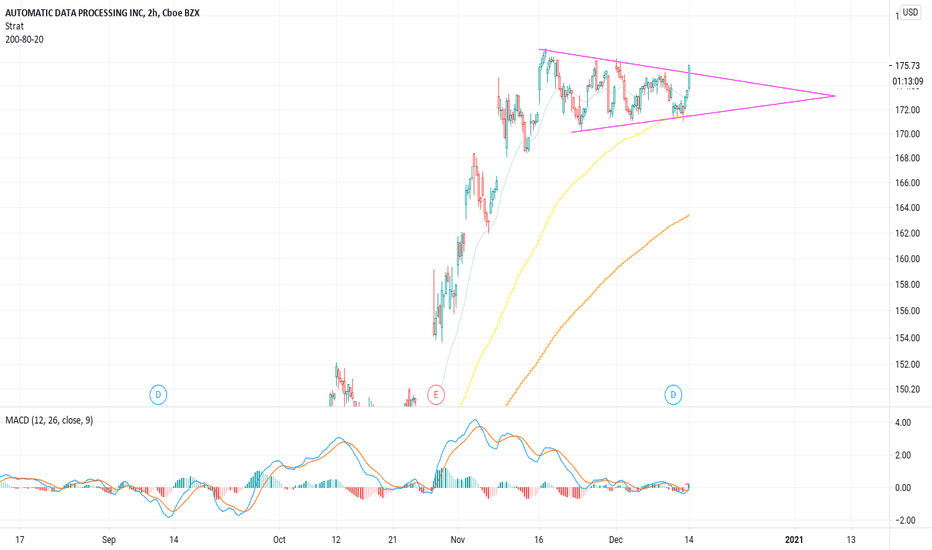

ADP Jobs Report Strong for Continued EmploymentStrong ADP jobs report showing 807K jobs vs 400K expectations.

The main jobs report is on Friday (1/7//22), and I expect us to beat the 400K expectations and report ~570K jobs.

Hopefully Omicron doesn't make the return of employment drag out more.

Rolling 2Y correlation between the two around 70% after normalizing for COVID volatility in 2020.

USDJPY Monthly OutlookThe recent weakness of the Japanese Yen made all pair Bullish against the Yen, the US Dollar is not exempted.

After USDJPY broke the support it mitigated with the Monthly Demand zone, breaking all highs and now it is currently at the supply zone.

Will price still remain bullish?

Anticipating a decline in price during the Major Economic events holding in the first week of November, 2021.

Trade with caution

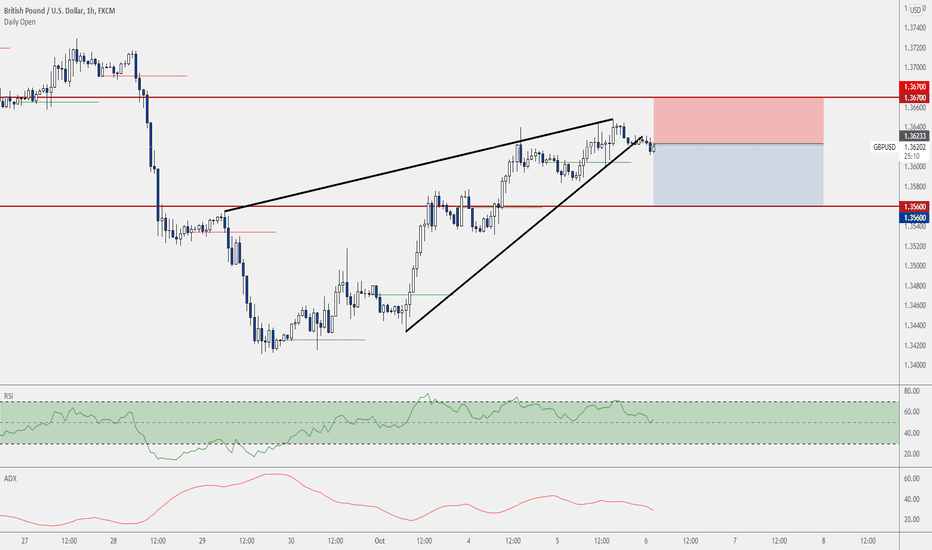

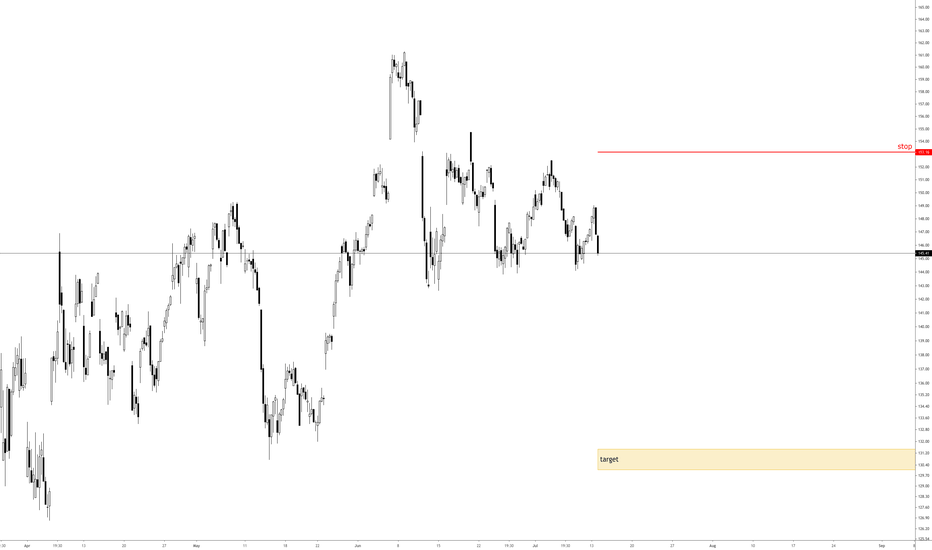

GBP/USD Signal - USD ADP Employment Change - 6 Oct 2021GBPUSD has bounced out of the ascending wedge pattern prior to the USD ADP employment change data, which predicts NFP. Technically the pair has broken the ascending wedge, which is a bearish price pattern, and the pair is looking to further downside.

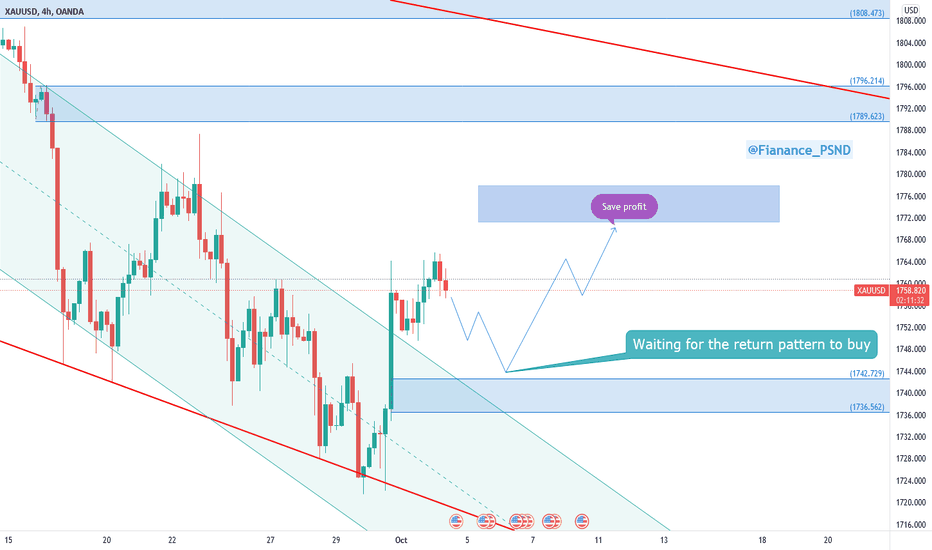

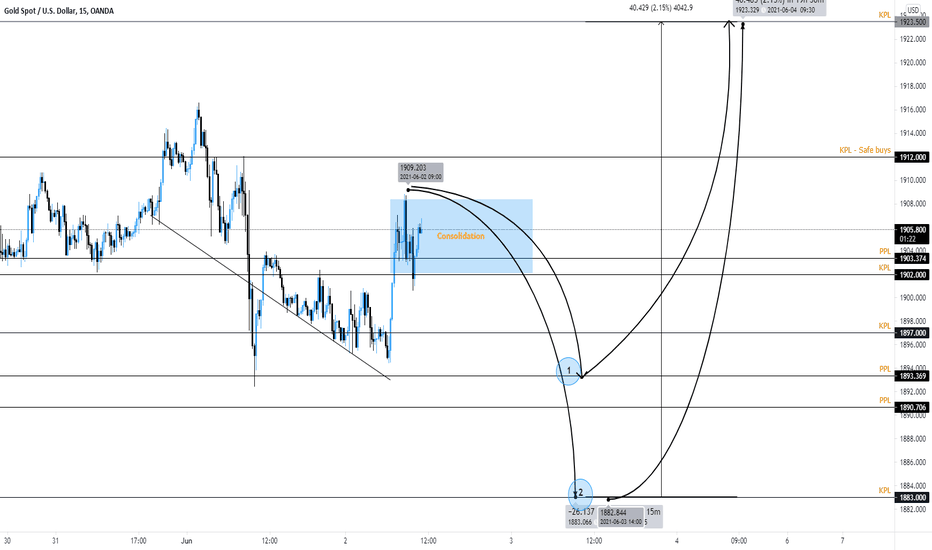

Gold Analysis - June 3-4th 2021Hello,

We are approaching a fundamental rally between tomorrow and Friday with the following economic events:

ADP (Automatic Data Processing) Non-Farm Employment - Expecting bad numbers

Unemployment Claims - Expecting bad numbers

PMI - Expecting good numbers

Average Hourly Earnings - Expecting bad numbers

NFP - Expecting good numbers

Unemployment Rate - Expecting good rate

Taking all this information and analyzing it, there is a 50/50 expectation towards the market. There is a very high possibility that Gold will drop into recent demand areas where Buys for me make a lot more sense at the moment continuing the strong bullish momentum it has had. I will be analyzing the following areas for High Risk High Reward Buys:

Zone 1 - 1893 (HRHR Buys)

Zone 2 - 1883 (HRHR Buys)

1st TP - 1912

2nd TP - 1923

From here to tomorrow I can easily see there will be consolidation preparing for the news on Thursday and Friday. If you see price taking a specific direction then consolidating it is preparing to do the complete opposite. In my experience Gold sets and prepares itself at a certain area which becomes a high demand zone, order block and then once news is released the orders will release as well.

Safe trading!

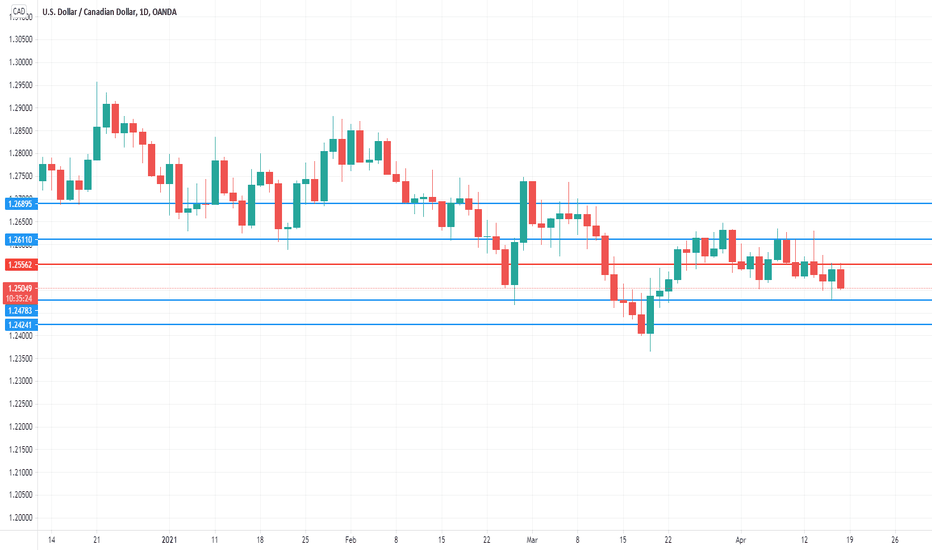

CAD edges higher, US confidence data nextThe Canadian dollar is slightly higher on Friday. Currently, USD/CAD is trading at 1.2513, down 0.25% on the day. On the fundamental front, Canada will release tier-2 data, including Housing Starts. In the US, today's highlight is UoM Consumer Sentiment, which is expected to accelerate to 88.9 points.

Canada's ADP job report has been bleak in recent months, with triple-digit declines in the past two months. However, the indicator roared back in March, with an impressive gain of 634.8 thousand new jobs. ADP attributed the strong rebound in the labour market, which was based in all sectors, to relaxed health restrictions in some provinces.

However, the picture could be significantly worse in the April data, as Ontario, the most populous province, imposed a 4-week lockdown at the end of March. Canada's Covid rate per capita is now outpacing the US, and this is likely to take a toll on the economy.

The news was far less positive in the manufacturing sector. Manufacturing Sales suffered a decline of 1.6%, worse than the forecast of -1.1%, and its weakest showing in six months.

In the US, retail sales surged in March, as consumers loosened their purse strings. Headline retail sales sparkled at 9.8%, while Core Retail Sales rose 8.4%. Both releases easily beat their estimates of 5.8% and 5.1%, respectively. The catalyst for the surge in consumer spending was the latest batch of government stimulus, with US households receiving stimulus cheques of 1400 dollars, as well as many states relaxing health restrictions. US consumers were only too happy to hit the stores and purchase big-ticket items, including cars, electronics and furniture.

Somewhat surprisingly, the explosive retail sales release failed to push the US dollar higher, as the currency markets appeared more focused on other matters, such as the vaccine rollout in Germany and France.

There is weak support at 1.2478. Below, there is support at 1.2423. Below, there is a pivot point at 1.2556. On the upside, we have resistance at 1.2611 and 1.2689

Pound continues to driftThe British pound is almost unchanged for a third straight day. Currently, GDP/USD is trading at 1.3964, up 0.07% on the day.

Pound stabilizes below 1.40

The British pound is in tranquil waters this week, after the currency slid 1.5% late last week. The catalyst for the steep drop was the sharp jump in US Treasury bonds, which boosted the US dollar. However, with US Treasuries retreating, the dollar's rally has run out of steam, and GBP/USD has been trading slightly below the 1.40 level for most of the week.

The UK services sector has been hard-hit by the Covid-19 pandemic, and health restrictions and the national lockdown have resulted in contraction in Services PMI for the past four months. Still, the PMI showed strong improvement in February, rising from 39.5 to 49.5 index points. This shows a degree of stability has returned to the services sector, which is just a tad below the 50-level, which separates contraction from expansion. The lockdown has resulted in pent-up consumer demand, and with the government slowly opening up the UK economy, we can expect the services sector to rise into expansion territory later in the year.

Over in the US, the ADP Employment report was surprisingly weak, with a weak gain of 117 thousand. This was much lower than the previous release of 174 thousand and nowhere near the forecast of 203 thousand. The big question for investors is whether the weak ADP reading will be followed on Friday, when the official nonfarm payrolls report is released. The forecast stands at 185 thousand, and a significantly lower release could weigh on the US dollar.

There is resistance just above the 1.40 level, at 1.4005. The next resistance line is at 1.4050

The first level of support is at 1.3954. Below, we find support at 1.3814. This is followed by the rising wedge at 1.3785

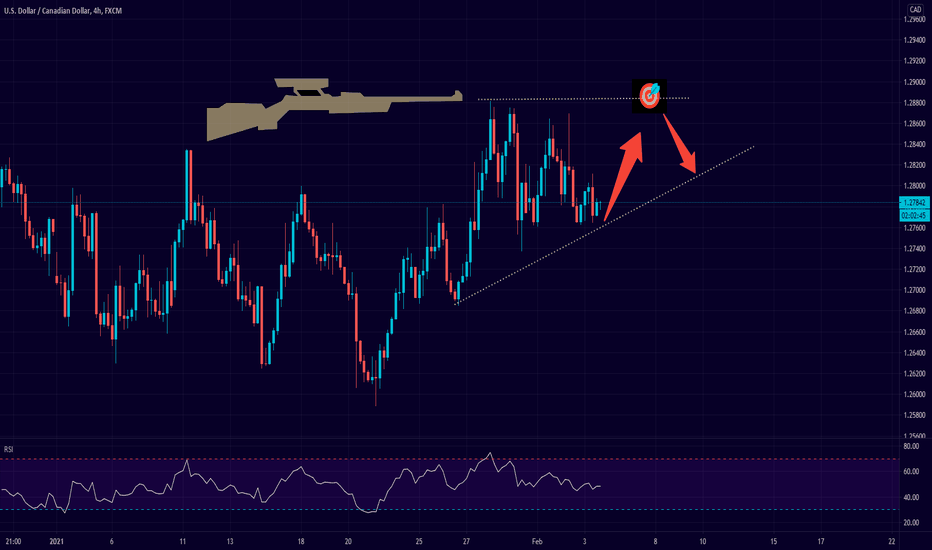

Potential Sniper Shot off the 1.29 Handle - USDCADCurrently I'm bullish but I'll be bearish off the 1.29 handle.

This morning we had fairly decent ADP figures from the US in at +174k.

Typically on a monthly basis the ADP provides a leading clue as to what we might expect with the following NFP figures. My guess is that Non-Farm on Friday will come in hot and could add some strength to the greenback. I don't think the dollar will remain strong for too long though if we do in fact get some strength following the report. For that reason, I'm placing pending sell limit orders off the 1.29 area in an attempt to snipe the intra-day top.

-------------------------

Please don't forget to FOLLOW, LIKE, and COMMENT ...

If you like my analysis:)

Trade Safe - Trade Well

Regards,

Michael Harding 😎 Chief Technical Strategist @ LEFTURN Inc.

RISK DISCLAIMER

Information and opinions contained with this post are for educational purposes and do not constitute trading recommendations. Trading Forex on margin carries a high level of risk and may not be suitable for all investors. Before deciding to invest in Forex you should consider your knowledge, investment objectives, and your risk appetite. Only trade/invest with funds you can afford to lose.

The NFP and the OPEC data & few reasons for pessimismFriday promises to be an extremely eventful and interesting day. On the one hand, statistics on the US labor market will not let you get bored in the currency and stock markets, and on the other hand, the results of the OPEC meeting will determine the dynamics in the oil market. We will talk about this and much more in today's review.

But let's start traditionally with news about the coronavirus. As the number of cases in the world grows, measures to contain the epidemic are tightened. Italy closes schools and restricts public gatherings. Companies continue to revise their forecasts for financial results. Quite frightening figures were noted by the International Air Transport Association. According to their experts, the industry’s losses from coronavirus may amount to $ 113 billion.

And there are already the first victims of this. Chinese Tourism and Financial Conglomerate HNA Group Co. was taken under state control. That is, in fact, the company ceased to exist as an independent entity. Indicative in this case is the fact that one of the main reasons for the fall of the company was its high debt cut (about 85 billion). The evidence is that this is generally very typical of Chinese companies (overblown debts). HNA Group Co. clearly demonstrated how quickly one of the fastest-growing companies can go bankrupt. In general, there are enough reasons for pessimism.

Realizing the impasse of monetary incentives, more and more countries are using fiscal instruments (mainly increased government spending) as a measure to combat the effects of coronavirus. Asian countries are so far ready to pour in up to $ 40 billion, and the United States - about $ 8.

They are also trying to fight the consequences of coronavirus in OPEC. Today there is an attempt to carry out the following agreement: to withdraw from the market another 1.5 million b/d with a minimum of the end of the second quarter. So far, Russia remains a stumbling block. If she can be persuaded, a very serious reason for price increases will appear in the oil market. So today we will buy oil in the hope that everyone will agree. The deal seems to be quite good, if only because the stops are relatively small (places below 44 or closes on the fact of negative news), but the profits are very ambitious (an increase of up to 57 or even higher for the WTI brand).

The key event of the day for other financial markets will be the publication of statistics on the US labor market. Since the data will be for February, there is a risk of failure in the numbers of NFPs in connection with the coronavirus epidemic. However, the dollar has already lost quite a lot in the foreign exchange market, and the data from ADP came out unexpectedly good, so today we will buy the dollar.

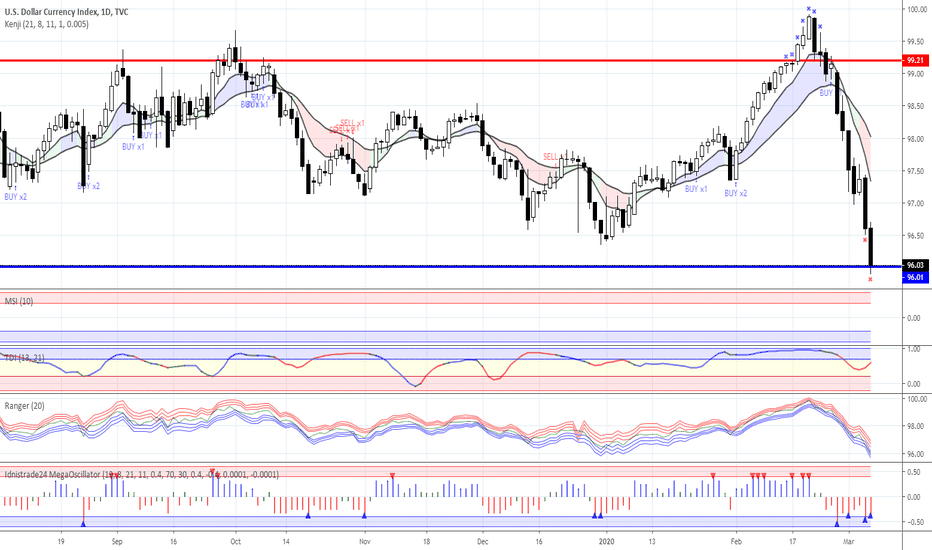

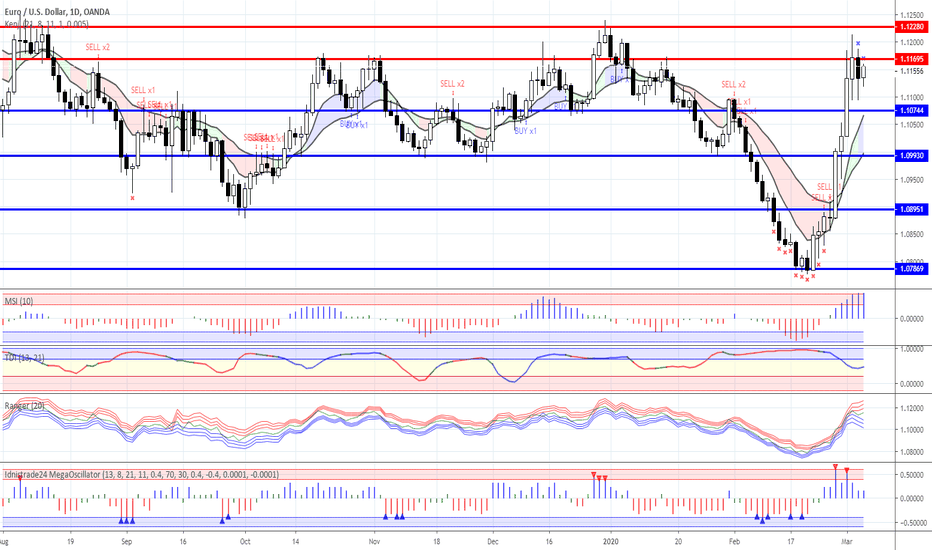

What does a market reaction to the Fed's decision say?Since yesterday, by and large, was the first full day of working out the Fed’s emergency decision to lower the rate by 0.5%, today some results can be summed up. And they are generally disappointing for optimists. In theory, stock markets should have perked up and provoked a sharp increase in stock indices. But this did not happen, that is, there was growth, but not at the scale that could be expected. In theory, the pressure on the dollar should have intensified. But yesterday, the Dollar Index rose. In theory, the Fear Index was to drop significantly. But according to the results of yesterday, the decrease was insignificant.

What are all these signals talking about? The magic of Central banks no longer works the way it used to. Lower rates no longer automatically resolve existing problems. And this is a very alarming signal for stock market buyers, gold sellers, and other optimists. It seems that the bubble is nevertheless broken and the air, despite all the efforts of its creators, is gradually coming out. In general, monetary policy has exhausted itself and this is an extremely alarming signal: if the situation worsens, it will not be possible to resolve the situation with the usual methods.

The consequences of the coronavirus have not even begun to appear, and Nasdaq is quoted 10% below the maximum and, it seems, can no longer grow with the certainty with which it was literally a couple of weeks ago.

So in everything that happens, we see the strongest confirmation of our basic investment ideas: sales on world stock markets, and especially on the US stock market; gold purchases and sales of risky assets (such as the Russian ruble).

But back to the events of yesterday, which was very full of news. The Bank of Canada lowered the rate immediately by 0.5%. The Canadian dollar obediently worked this out, losing about 100 points paired with the dollar. But in general, the reaction was relatively calm at such a massive reduction in rates.

US employment data from ADP turned out to be quite good: +183K with a forecast of +170K. What sets in a positive mood against the dollar ahead of Friday's official statistics. The ISM Index in the non-productive sphere also pleasantly surprised: 57.3 points with a forecast of 54.8 points. But the Eurozone indices traditionally fell short of expectations and for the most part, came out worse than forecasts.

Well, the results of super-Tuesday played into the hands of the dollar, on which Biden won quite unexpectedly, who is considered a more adequate option from the Democrats as opposed to the “left” Sanders.

In general, our desire to sell a pair of EURUSD intensified up to the recommendation to sell the pair from the current ones with the addition of any attempt to grow.

Oil stocks in the United States have grown quite slightly, but all the attention of oil market participants has been riveted to the OPEC meeting and OPEC+ decisions. It is very likely that today some specific information will appear that could provoke strong movements in the oil market. If OPEC+ decides on additional reductions (ideally about 1 million b/d), oil has a chance of growth. The main stumbling block is Russia and its unwillingness to scale up the reduction.