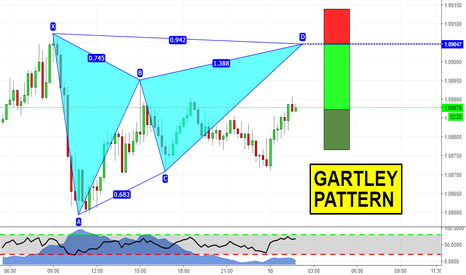

Short term Gartley formation!Hi guys,

for those of you who day-trade advanced pattern formations there's a Gartley pattern completing at 1,0904s on 15m AUDNZD chart. I'm already involved with this pair (see attachment) so i'm not taking this one, but i wanted to share with you anyway,

Stops above X, targets as usual for pattern (better risk/reward ratio with such a deep Gartley).

If you want to ask questions feel free to type them in below.

Otherwise, see you in the next chart!

Advancedpatterns

EURUSD 60minMy Friend

Gartley pattern has emerged on the FX:EURUSD on the 60min chart. Stick to your trading system and use this a to highlight your strengthens. Also; make sure you have proper stop loss or risk management system implementation in.

Remember friends no revenue leakage!

Cheers and Happy Trading

EDub

Bullish Cypher on EURUSD Heading Into NFP!There is a potential bullish cypher on the EURUSD that will complete at 1.05780. Now this probably wont get filled until the jobs number comes out, but if you trade during the NFP you might have a potential opportunity here. Minimum stops as always must be under X at 1.05668 with target 1 around the 38.2 fib retrace at 1.05935 and target 2 at the 61.8 at 1.06032.

If you want to see some more ideas such as this one, tune into the live trading room today.

Here is the link: youtu.be

Good luck and good trading

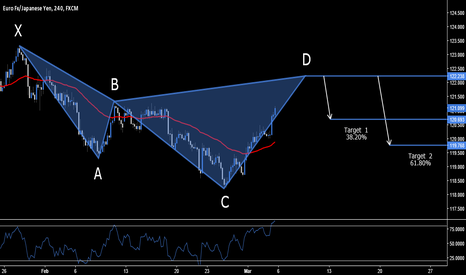

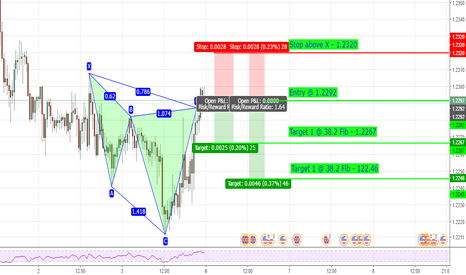

EUR.JPY - BEARISH CYPHER SETUP - 122.238On the EUR.JPY 4hr chart we have a potential short opportunity at the D leg completion of bearish Cypher setup.

The price reversal zone on this pair is between 122.238 & 123.322

The PRZ zone is only a guideline of where we will be paying attention for trade setups and opportunity's.

Potential targets for the Cypher setup placed at the .382% and .618% retracement of the C to D move.

There is also opportunity to look for extended targets at around 123.00

Stop loss would be placed above X leg structure resistance .

Target 1 - 120.693

Target 2 - 119.768

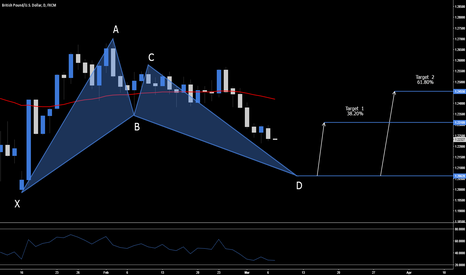

GBP.USD - Bullish Bat Setup - 1.2062On the GBP.USD Daily chart we have a potential long opportunity's at the D leg completion of bullish Bat setup.

The price reversal zone on this pair is between 1.2062 & 1.1986

The PRZ zone is only a guideline of where we will be paying attention for trade setups and opportunity's.

Potential targets for the Bat setup placed at the .382% and .618% retracement of the A to D move.

There is also an opportunity to look for extended targets at 1.2550

Stop loss would be placed below X leg structure support.

Target 1 - 1.2310

Target 2 - 1.2455

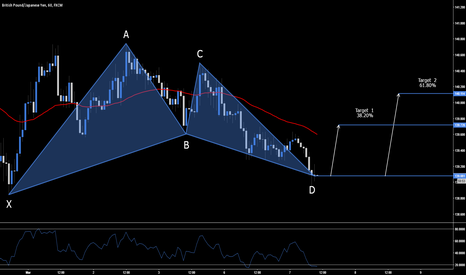

GBP.JPY - Bullish Bat Setup @ MarketOn the GBP.JPY 1hr chart we have a potential long opportunity's at the D leg completion of bullish Bat setup.

The price reversal zone on this pair is between 139.081 & 138.844

The PRZ zone is only a guideline of where we will be paying attention for trade setups and opportunity's.

Potential targets for the Bat setup placed at the .382% and .618% retracement of the A to D move.

There is also an opportunity to look for extended targets at 140.40

Stop loss would be placed below X leg structure support .

Target 1 - 139.720

Target 2 - 140.114

Deep Gartley on 15m AUDNZDHi guys,

for those of you who day-trade advanced pattern formations there's a Gartley pattern completing at 1,0904s on 15m AUDNZD chart. I'm already involved with this pair (see attachment) so i'm not taking this one, but i wanted to share with you anyway,

Stops above X, targets as usual for pattern (better risk/reward ratio with such a deep Gartley).

If you want to ask questions feel free to type them in below.

Otherwise, see you in the next chart!

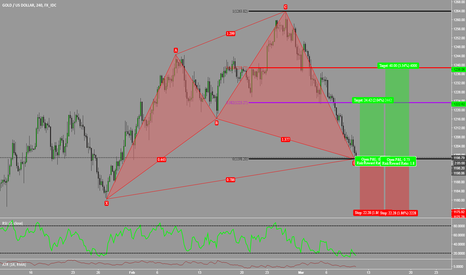

Bullish Cypher on GOLDYou have a bullish Cypher pattern that is just about ready to fill on XAUUSD. This pattern will complete at 1198.20. Now depending on where you put your stops, you will have around a 1:1 R/R Ratio. Min. stops need to be below X @ 1180.12 with Target 1 at the 38.2 Fibonacci Retracement at 1223.27 and Target 2 at the 61.8 Fibonacci Retracement at 1238.75.

Now we have NFP tomorrow, so this could get blown out or hit targets in a very short time. Either way, trade your plan and follow your rules.

Good luck and good trading.

EUR.CHF - BULLISH CYPHER SETUP - 1.0656On the EUR.CHF 1hr chart we have a potential long opportunity's at the D leg completion of bullish Cypher setup.

The price reversal zone on this pair is between 1.0656 & 1.0632

The PRZ zone is only a guideline of where we will be paying attention for trade setups and opportunity's.

Potential targets for the Cypher setup placed at the .382% and .618% retracement of the C to D move.

There is also opportunity to look for extended targets back into 1.0730

Stop loss would be placed below X leg structure support.

Target 1 - 1.0690

Target 2 - 1.0712

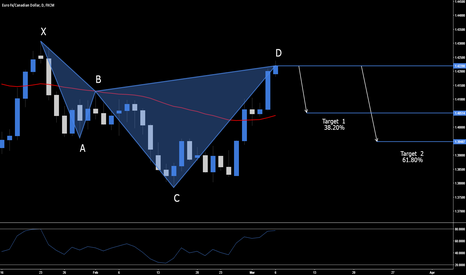

EUR.CAD - Bearish Cypher Setup @ MarketOn the EUR.CAD Daily chart we have a potential short opportunity at the D leg completion of bearish Cypher setup.

The price reversal zone on this pair is between 1.4220 & 1.4308

The PRZ zone is only a guideline of where we will be paying attention for trade setups and opportunity's.

Potential targets for the Cypher setup placed at the .382% and .618% retracement of the C to D move.

There is also opportunity to look for extended targets at around 1.3850

Stop loss would be placed above X leg structure resistance.

Target 1 - 1.4051

Target 2 - 1.3948

2618 & Gartley on EURAUDHi guys,

two different setups on this pair, there's a Gartley formation already completed and a 2618 that could be completed on the next hours.

As you can see in both cases we can earn some profits, keep in mind that this particular time i'm going to use 1 single target for the pattern (at the 2618 completion) with stops above the X.

Good trading!

If you want to share your standpoint, feel free to write below.

Otherwise, see you in the next chart!

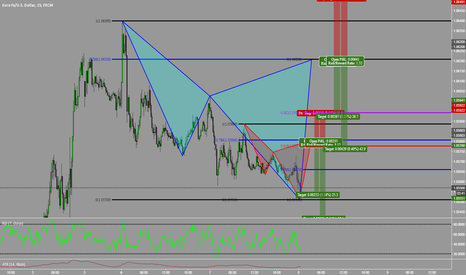

Two Potential Cyphers On EURUSDThere are two potential Cypher patterns setting up on EURUSD. There is a shorter term Bearish Cypher (Red) that will potentially complete @ 1.05806. Now this one can be used as an alternate entry for a trend continuation trade.

Now the Longer term Cypher (Blue) will potentially complete @ 1.06208. This one can be traded normally, (taking targets 1 and 2 at the 38.2 & 61.8 Fibonacci Retracements) or you can use this as an alternate entry as well.

Either way, make sure to follow your plan.

If you would like to see more analysis like this, come by and join us in the live trading room. Here is the link: youtu.be

Good luck and Good Trading.

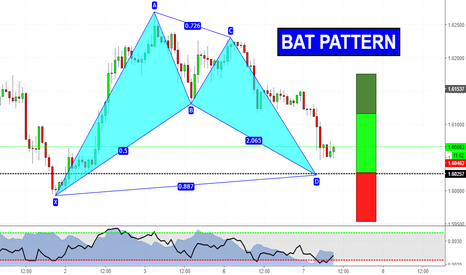

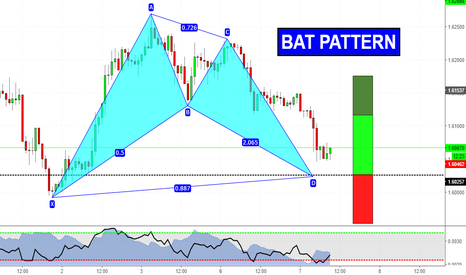

Bat formation near the D point!Hi guys,

here you can see a bat formation near to the completion D point. However, my analysis started from higher timeframe, where i've indentified the strong daily support sitting at 1,60 even handle number. The harmonic formation ends up right there and therefore i think it could be a nice opportunity to go long.

Stops below X, targets at the .382 and .618 retracement of AD leg.

Good trading!

If you want to share your standpoint or ask questions, feel free to comment below.

Otherwise, see you in the next chart!

Bat formation near completion!Hi guys,

here you can see a bat formation near to the completion D point. However, my analysis started from higher timeframe, where i've indentified the strong daily support sitting at 1,60 even handle number. The harmonic formation ends up right there and therefore i think it could be a nice opportunity to go long.

Stops below X, targets at the .382 and .618 retracement of AD leg.

Good trading!

If you want to share your standpoint or ask questions, feel free to comment below.

Otherwise, see you in the next chart!

Advanced Pattern FormationsHey Traders,

Bat Pattern completion at 0.76989, Targets at the 38.2 Fib Retracement of the A-D leg with stops being at the 1.272 Fib Extension of the A-D leg.

I'm a little late posting this, however, if you enter now (currently price is 138.950) this will work out to your advantage as you will ultimately get a better entry and a better risk to reward than if you had entered at the pattern completion :)

Trade Your Plan!

GBP.JPY - BEARISH BAT SETUP - 141.362On the GBP.JPY 1hr chart we have a potential short opportunity at the D leg completion of bearish Bat setup.

The price reversal zone on this pair is between 141.362 & 142.040

The PRZ zone is only a guideline of where we will be paying attention for trade setups and opportunity's.

Potential targets for the Bat setup placed at the .382% and .618% retracement of the C to D move.

There is also an opportunity to look for extended targets at around 139.200

Stop loss would be placed above X leg structure resistance.

Target 1 - 140.391

Target 2 - 139.798

GBP.AUD - x2 Bearish Cypher Setups - 1.6583 & 1.6378On the GBP.AUD 4hr chart we 2 potential trade opportunity's at the D leg completion of Bearish Cypher setups.

Bearish Cypher Setup ( Blue ) - D leg completion 1.6583

Target 1 - 1.6357

Target 2 - 1.6216

Bearish Cypher Setup ( White ) - D leg completion 1.6378

Target 1 - 1.6231

Target 2 - 1.6140

Bearish Cypher Setup: Stop loss would be placed above X leg structure resistance.