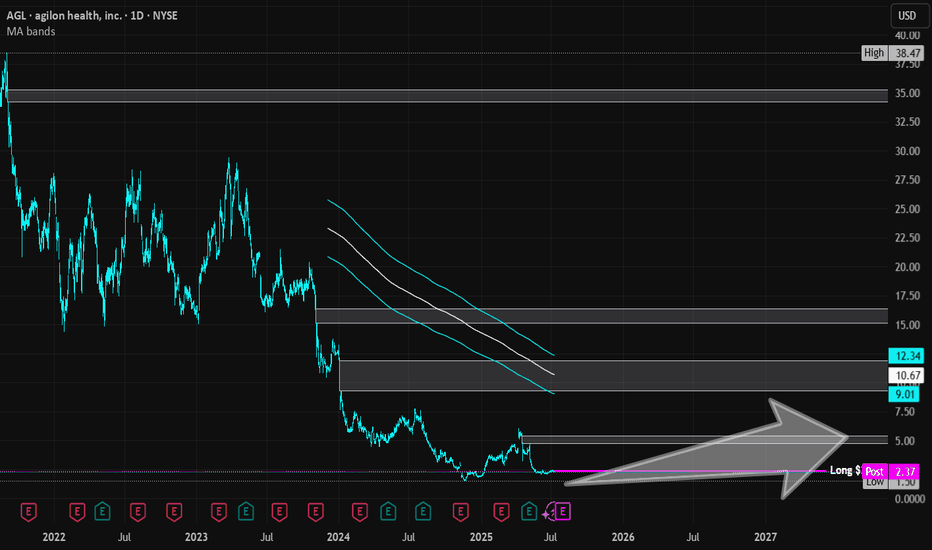

Agilon Health (Revised) | AGL | Long at $0.76This is a revised analysis of Agilon Health NYSE:AGL as seen here:

-------

Full disclosure: I am a holder of shares at $2.36, $0.76, and $0.79. Last entry planned near $0.50 if it reaches that level. Current cost average is near $1.11.

Let me be clear: This is a ***highly risky*** trade given the recent news regarding the CEO, securities fraud investigation, suspension of FY guidance. Do your own due diligence.

-------

The link above/previous writeup details some of the basic fundamentals of Agilon Health NYSE:AGL . As predicted, the price fell below $1 after the most recent earnings call. This was due to:

Revenue down 6% to $1.4B, Medicare Advantage membership at 498,000.

CEO Steve Sell resigning, Ron Williams appointed Executive Chairman.

2025 guidance suspended due to market challenges.

New securities fraud investigations.

I think the challenges NYSE:AGL is going through will extend through 2025 in into early 2026. If you look at the healthcare sector, it has taken a beating mostly due to Medicare and Medicaid cuts / rising healthcare costs. NYSE:AGL is not profitable and wasn't expected to become profitable until 2028 - but that may get revised....

However, the company focuses on senior patients, primarily through Medicare Advantage and ACO REACH programs, targeting value-based care for older adults across 31+ communities in 12 states. The need for services targeting the Baby Boom population is going to rapidly increase in the next few years. NYSE:AGL may become a leader in this area, but the company needs to regroup and focus on a model that returns money to investors - a dirty game. So, while the near-term is doom and gloom, the future could be very, very bright with NYSE:AGL if they are able to turn things around with this new leadership shakeup. Time will tell. It's a gamble. One I am, personally, willing to take.

Revised Targets into 2028:

$1.60 (+110.5%)

$3.00 (+294.7%)

Agilonhealth

Agilon Health | AGL | Long at $2.36Reentering this trade (original: )

Agilon Health NYSE:AGL

Pros:

Revenue consistently grew from 2019 ($794 million) to 2024 ($6.06 billion). Expected to reach $9.16 billion by 2028.

Current debt-to-equity ratio 0.07 (very low)

Sufficient cash reserves to fund operations and strategic initiatives

Strong membership growth (659,000 in 2024, a 38% year-over-year increase)

Recent insider buying ($2 - $3) and awarding of options

Cons:

Rising medical costs - currently unprofitable and not forecast to become profitable over the next 3 years

Medicare Advantage Membership issues with the new political administration

No dividend

It's a gamble and I think it's a possibility this could drop near $1 in the near-term due to the Medicaid changes/fear... regardless, long-term, personal buy-zone at $2.36.

Targets in 2027

$3.70 (+56.8%)

$5.25 (+122.5%)

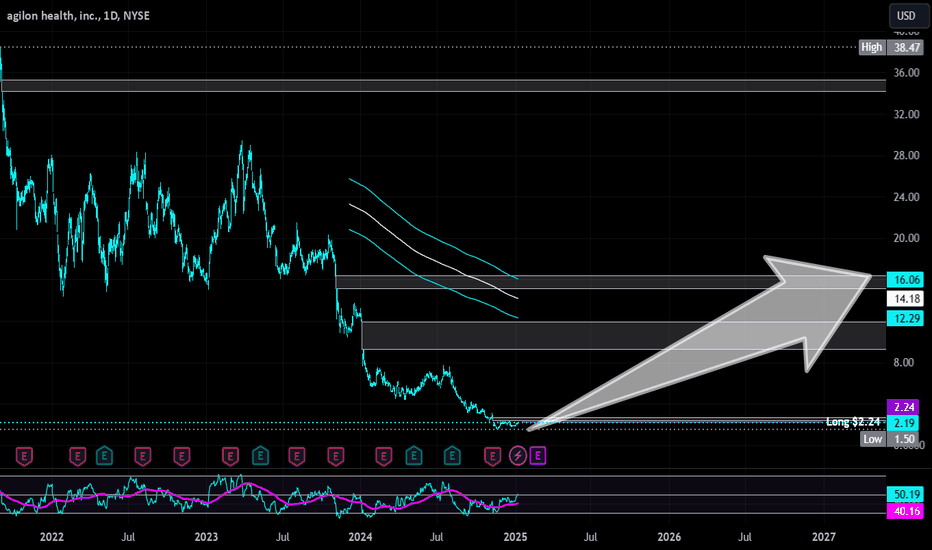

Agilon Health | AGL | Long at $2.24Agilon Health NYSE:AGL

Pros:

Revenue consistently grew from 2019 ($794 million) to 2023 ($4.3 billion) and through three quarters of 2024 ($5.6 billion). Expected to reach $8.7 billion by 2027.

Current debt-to-equity ratio 0.06 (very low)

Sufficient cash reserves to fund operations and strategic initiatives

Strong membership growth (525,000 as of Q3 2024, a 37% year-over-year increase)

Recent insider buying ($2 - $3) and awarding of options

Cons:

Rising medical costs - currently unprofitable and not forecast to become profitable over the next 3 years

No dividend

Targets (into 2027):

$2.72

$4.00

$5.00

$7.00

$11.50

$16.00