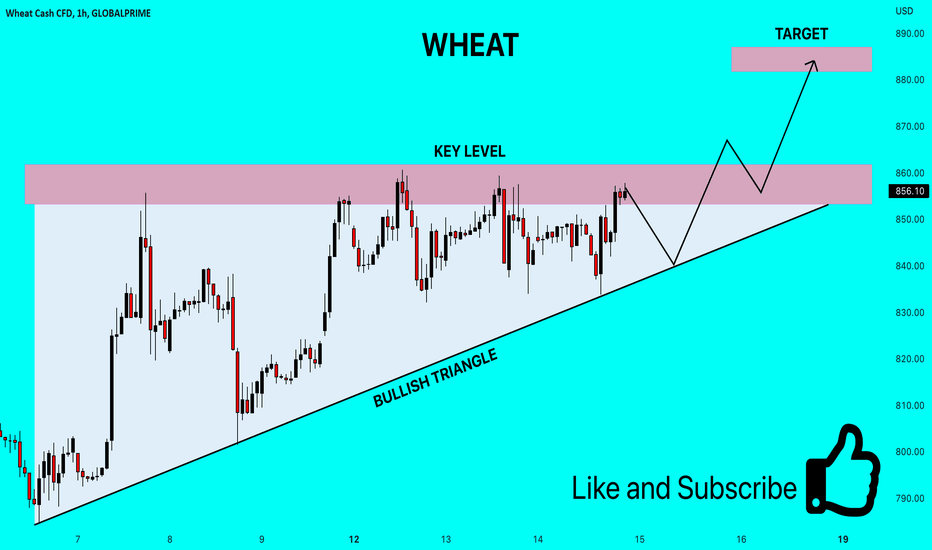

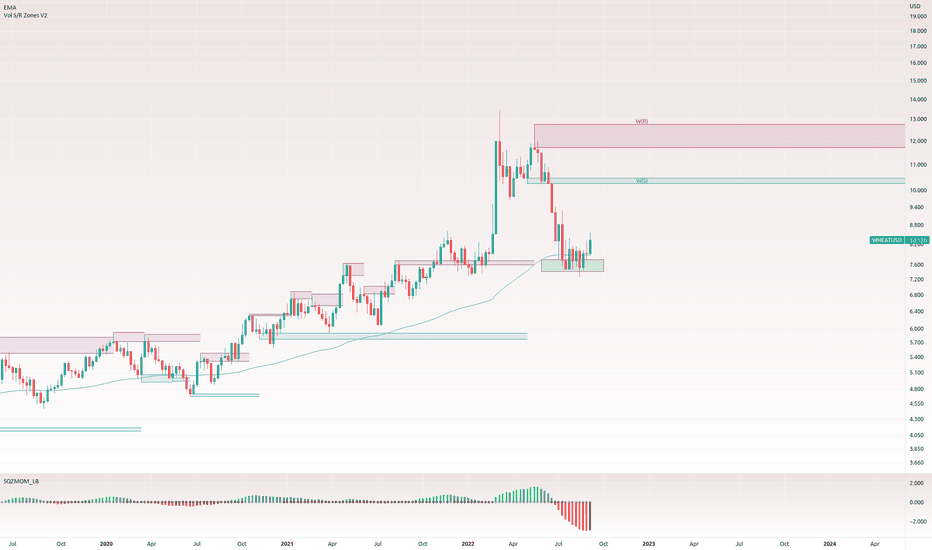

✅WHEAT WAIT FOR BREAKOUT|LONG🚀

✅WHEAT is trading in a local uptrend

And the pair has formed a local

Bullish triangle pattern

So IF we see a breakout

Then the price will go further up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Agricultural Commodities

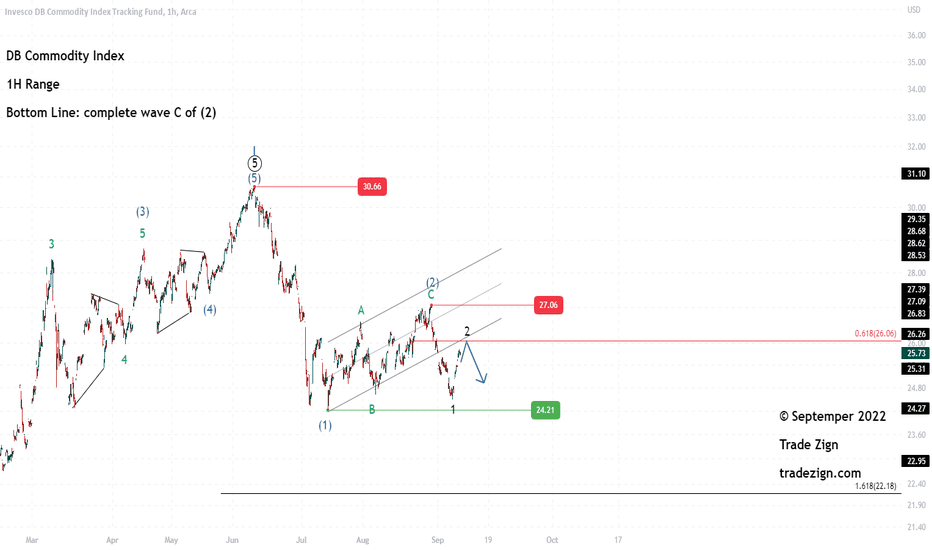

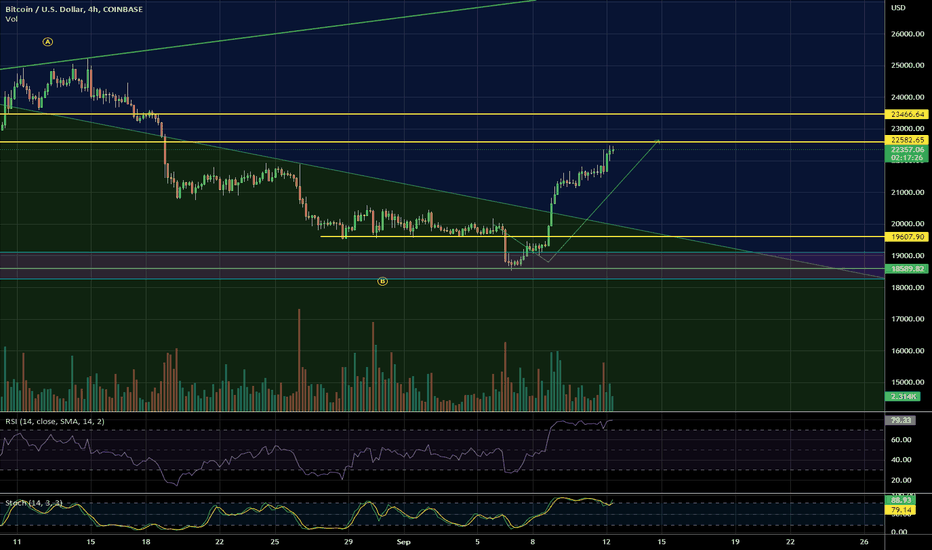

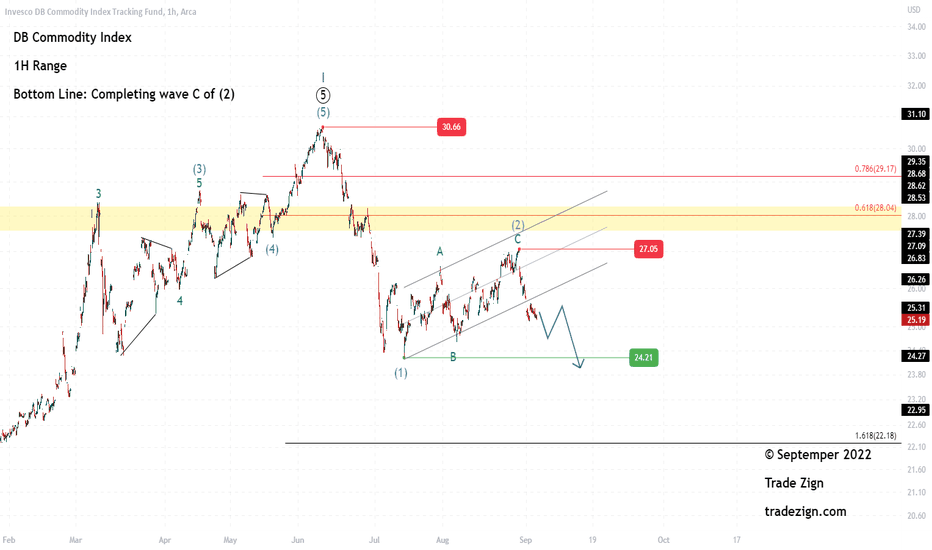

DB. commodity index idea (13/09/2022)DB. commodity index

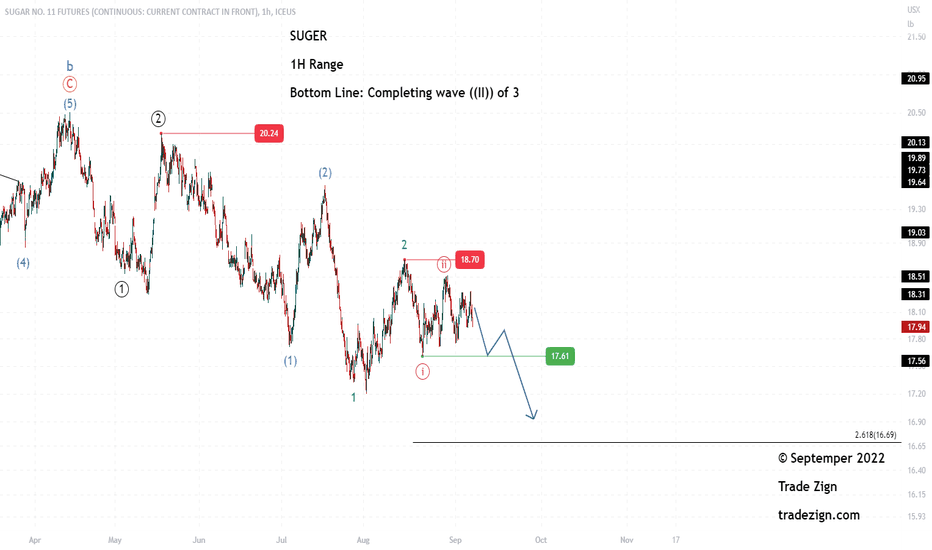

We expect the index to continue declining because prices are below the 27.05 resistance point, and wave (2) has already ended and started falling in waves (3). We expect prices to drop to 1.618% at 22.18, but currently, we expect the correction to continue to 61% at 26.06 to end wave 2 before descending again.

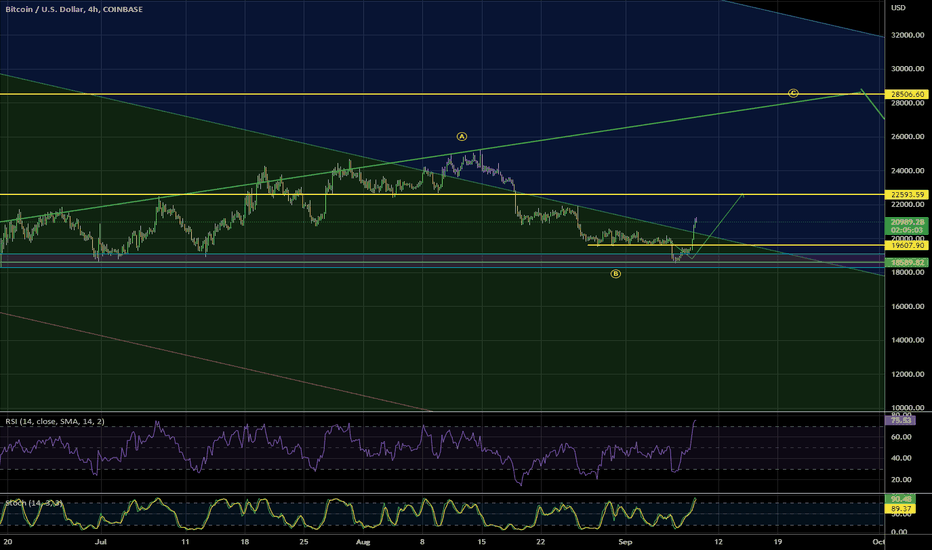

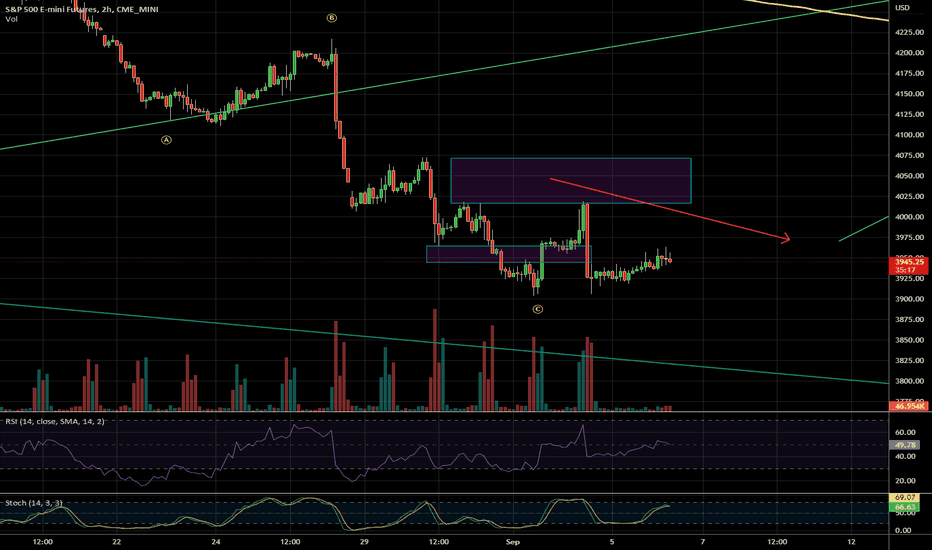

The Monday Notes - SPX500 USOIL Wheat Gold DXY BTCAll in the video, expecting a pullback but how much is hard to say if it's a B wave. Logic tells me to feed the bears just enough before they take away the plate, but we'll have to see how CPI is reacted to tomorrow. Oil looks very good for a move above 100 still, Wheat could still be a Flat completing, but I'm not concerned about a pullback if it does. Gold, looks good for more upside after a pullback and the Dollar looks good for a bounce and then more downside. BTC should follow the markets, target of 22500 is close, they may pullback before it gets hit. Good luck to all.

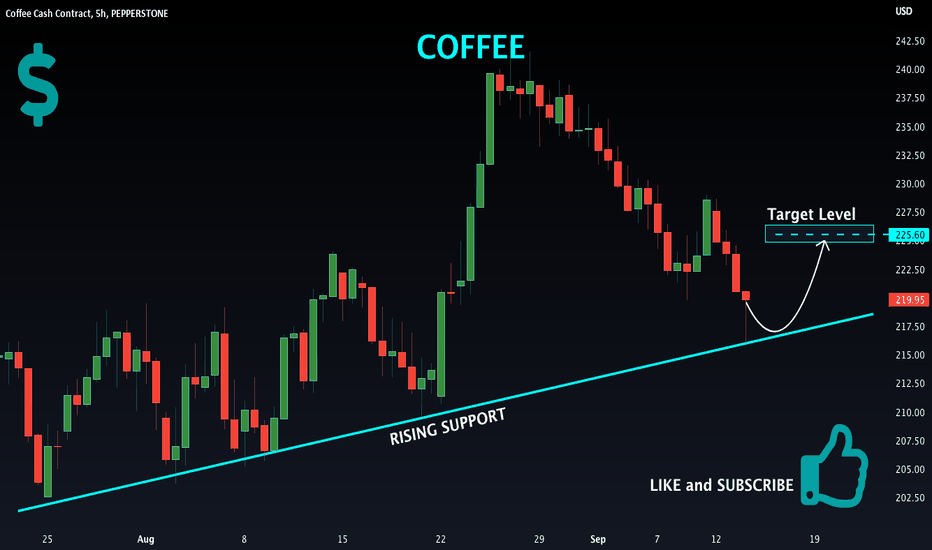

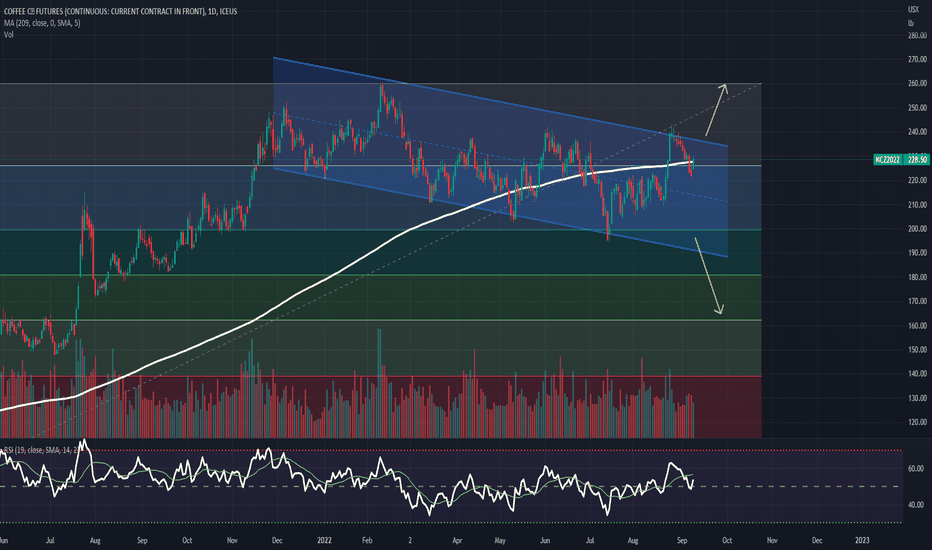

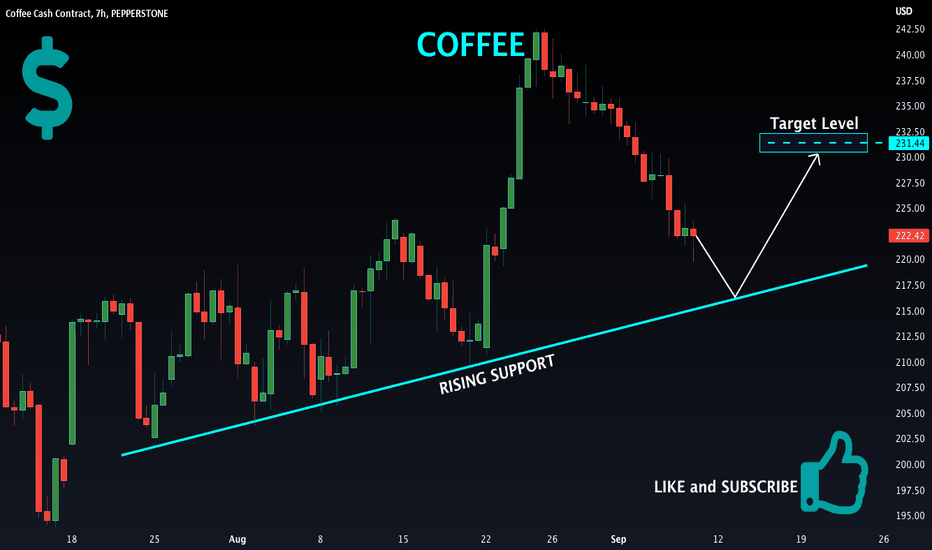

KC !! Wait to what will happen in the next DaysKC was on a long-range since December 2021 after a massive uptrend.

the break of the range may give an essential signal to position long on Coffee.

if the market breaks down, it could be a significant signal to go short and expect a target 0.5 Fibonacci retracement (162.30$)

Market update Friday - SPX500 USOIL WHEAT GOLD BTC All in the video - SPX looks toppy around 4080, USOIL looks bullish for a move over 100 over the coming weeks, Wheat has two possibilities, but ultimately I think it's bullish either way. Gold one more low possible but GDX is leading upwards as of now. BTC nice but rsi is over stretched, needs a pullback.

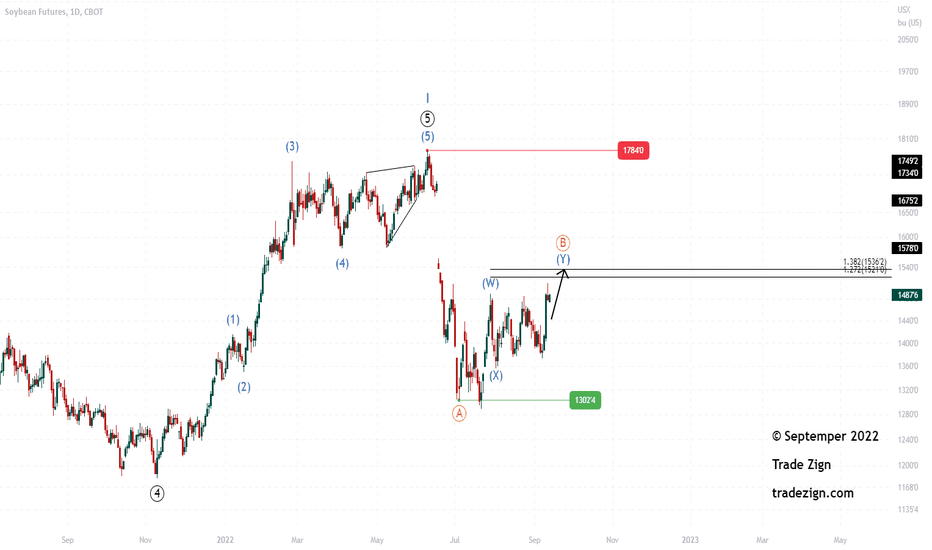

Commodity Soybean idea (09/09/2022)Soybean

we expect the decline in the coming period and the end of the correction in wave ((ii)). and the beginning of the decline. But the main resistance remains at 1432.26. Breaking this level indicates that there is a more corrective bounce, and the bearish scenario is over.

Something is happening with Wheat futuresWheat got nuked in late May, as it re-tested the high. It did a full retrace, -36%. Impressive even for meme stocks let alone one of the most precious commodities on the planet.

Wheat has spent Jul and Aug in the area of intense demand, which just happens to be around EMA(100) , from what I can see everyone is waiting for first harvest numbers to start sending futures higher.

I'm expecting explosive few weeks, perhaps even hitting $12 again before the first snows in the northern hemisphere.

The monthly chart is even more explicit:

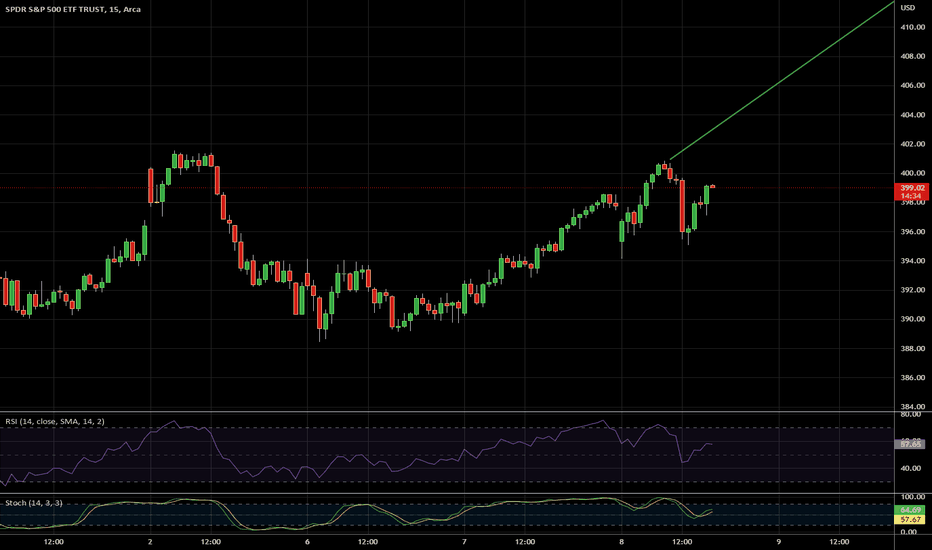

The Powell pop - SPY OIL WHEAT GOLD DXY BTCUnexpected rally on Spy to 413 looks possible for next week. All the usual markets are covered. Wheat is still good but it's been a tough trade. Oil probably to 92 but it's possible one more low to 78-79 could happen first. Gold and metals I think continue the rally as DXY pulls back more. BTC same. Good luck!

Update on the usual supects - SPX 500 OIL Wheat Gold DXY BTCI forgot bonds, will update if I need to- they still are sucking as of now. SP500 looks like it wants to rally, a hold over 3930 hourly chart would be a long. If we have one more down it will likely be the bottom for a few weeks. Oil could drop to 80 before a bounce. Wheat has a breakout and people are starting to pay attention to it. Gold looks ok and may be in the process of making a Wykoff topping structure. DXY likely pullback here now that all the cheerleaders are on the field. BTC rally to 22500 and if more, 28-29k. Good luck!

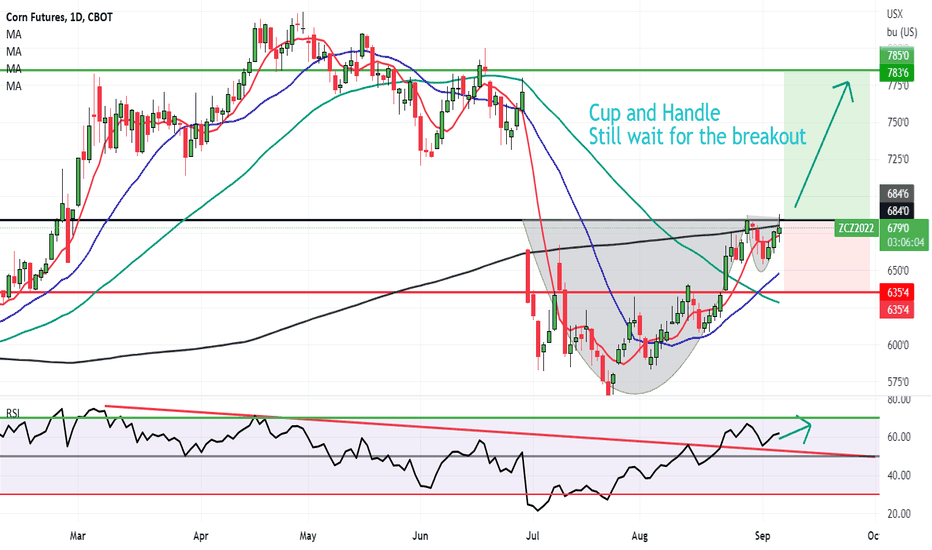

It's Corn! - Long and juicy for upsideCorn future is looking almost perfectly ripe for the picking.

Cup and Handle forming nicely and just waiting for the breakout.

RSI broke out of its downtrend bearish divergence and has bounced on the new support - showing more upside to come.

Then will be an easy long (buy) to hold.

Stop loss will be just under the Handle and the take profit will be 2X risk...

It's corn!

Wheat Futures - ZW - Like Snakes in a CanSnakes in a can is not a great metaphor for food. Nonetheless, that's the pattern that seems to be developing on wheat futures.

All know that the world's food crops are not in good shape. Massive drought tends to kill plants, which ruins harvests, which causes some obvious downside effects in economies.

Each year in recent years, we're running out of supply until the next year's harvest arrives, which replenishes the silos, which means that you won't really feel the pain of a bad harvest until the following year.

Yay for 2022, not so yay for 2023. 2024 is a dark horizon.

On the monthly chart, Wheat ZW swept out the long-term 2008 high in March on the back of the Russian Federation invading Ukraine:

It only swept the high, however, and has since corrected, hard. It's specifically notable that despite the massive dump, wheat did not take out the January pivot in either July, or in August's very gentle stop raid.

In fact, wheat has spent the better part of two months ranging in this accumulation area, which is bad news for bears and good news for bulls.

It's also notable that corn has already had a significant breakout that took out a previous month's high:

Corn Futures ZC1 - Spooling Like a Turbo

(Too bad I had my compass on backwards for that one and picked that it would go down before it would go up, when it just went up in a straight line. But hey, at least I drew my box in the right place -_-)

Contracts of similar category tend to move in the same direction, but at different times, of each other.

To be frank, I believe that this means wheat is all but guaranteed to set all new highs. However, it's a question of when. In reality, price is the easy part and time is the hard part.

When it comes to "when," at least right now, you can tell from the pattern post-stop raid that we're ready to go somewhere, and that somewhere is probably up.

In terms of between now and the end of September, I think that the most realistic targets are July's equal highs at ~845 and July's monthly high at ~940.

I believe that a major commodities supercycle lies ahead. Something that will really be fun to trade but painful for reality. But I also believe that a big shakeout is imminent before we go there. For wheat, based on how its traded, this may mean it provides something of a shelter or a safe haven, running bull while many other things correct and dump.

As the world gets crazy, keep in mind that no matter how the media and the government howls its narrative, the human race is still ultimately on a planet that orbits a sun and is positioned inside of a very, very, very immense Universe.

The more immense the Universe, the less possible it is that we are either the only lives that exist or the highest lives that exist. That is how statistics and probabilities works.

And I am not talking about such and such idea of aliens. I am talking about the idea of "Gods," which I do not regard as limited to the Marxist-smeared religious dogma of a giant old white man wearing a robe in the sky judging you when you swear or drink.

Instead, to speak of Gods is to simply have a rational understanding about the structure of the Cosmos, its multitudinous dimensions, and those higher lives with power that occupy those dimensions and oversee this human stage during the end of a Cosmic Era.

What I am getting at with the above, is that no matter how "chaotic" things get, the chaos is actually a manifest form of order. Things are happening for a reason, are planned both above and below in advance, and no matter how the Earth capsizes and the Sky falls, the tribulation provides an opportunity.

The Divine is ultimately in control of where we are headed, and for good people, there is hope.

So make sure you maintain your kindness, your conscience, your sense of justice, and your rationality. Do your best, and don't lose heart.

In history, humanity's catastrophes, such as famines, have always had a target, and the target has almost never been people who are virtuous and are walking on the traditional path.

Fall trading has begun - SPX 500 USOIL BONDS WHEAT BTC DXY GOLDALl in the video, still bullish on the stock market, but a small sell off first would be appropriate to trap shorts. OIl looks like 92 target should come sooner rather than later. Bonds still under the channel. Wheat still looks great. Gold looks promising and the US dollar likely pulls back to help it. BTC hard to tell but I would think higher after a small sell off.

Corn Futures ZC1 - Spooling Like a TurboBecause virtually the whole world is suffering from massive drought this summer, many crops are in bad shape. This is true with the U.S. cotton crop and it's also true with the U.S. corn crop, which according to USDA reports, barely half of is in good or excellent condition as of last week.

This is significant because the U.S. is the largest global producer of both, and by a huge margin.

This gives good cause to believe that a pump is on the horizon, but when, and how easily will it arrive?

The good news is for latecomers is that it seems as if the Ukraine panic pump and dump from April+ bottomed out in July, based on recent price action. "The second mouse gets the cheese."

There's a big gap on corn and wheat remaining from the June doom candle, which should transpire as a range that gets eaten into as we head into later September and October.

Winter may very well be new all time highs, because the world and humanity is in a lot of trouble. The environment is not in good shape, but to understand what this really means, you have to throw away the leftist-socialist-establishment "carbon" narratives, because those things are not only distractions, but they exist as a Communist Party pretext to take away your Freedom of Movement.

But just look at the lack of water and functioning ecosystem and ask yourself how long the happy is going to remain in North America.

The situation in Europe is already very dangerous.

Regardless, with the way price action has traded this month, it seems likely that corn futures has a good shot of breaking July's high before the end of the month. But it also looks like it may not run in a straight line up and take care of that business on Monday or Tuesday.

If you get a retrace into the 597 range, it seems there's a functional trade. However, it's entirely possible that August fails to break July's high. But if you can get out over 640 all the same before the month closes, you'll have done pretty well.

As for the rest of that gap above, I don't think we see that until the next commodities supercycle starts, likely beginning to ramp in late September-October.

Today is like a turbocharger. They all take a bit to spool. But once they do, it's really fun.

Unless you're the one standing in front of the Ferrari.

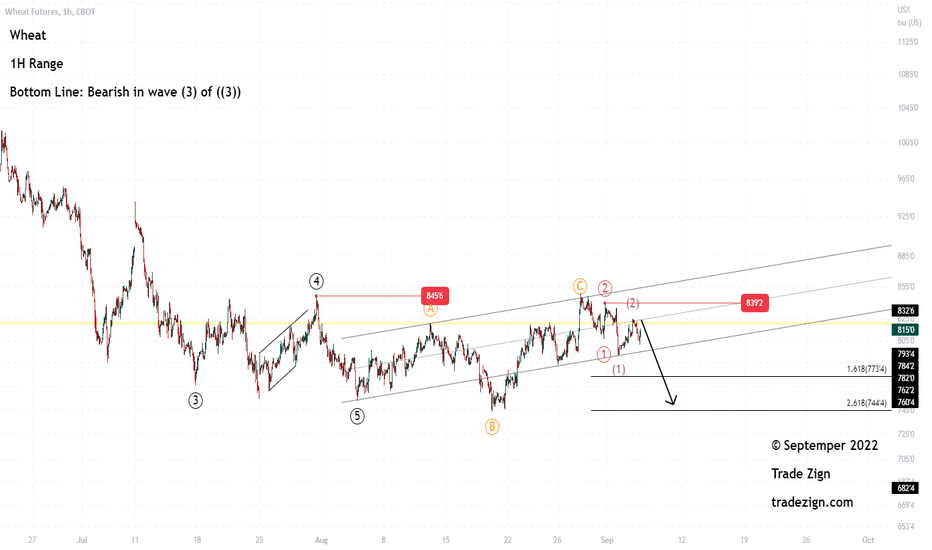

Commodity Wheat idea (06/09/2022)wheat

The completion of the (C) wave of the flat irregular wave, and we expect a drop in wheat in the coming period after ending the correction pattern as we explained, and we expect it to target 773 at 1.618%, or it may continue to 2.618% at 744 since trading is the lowest point of resistance 839.25

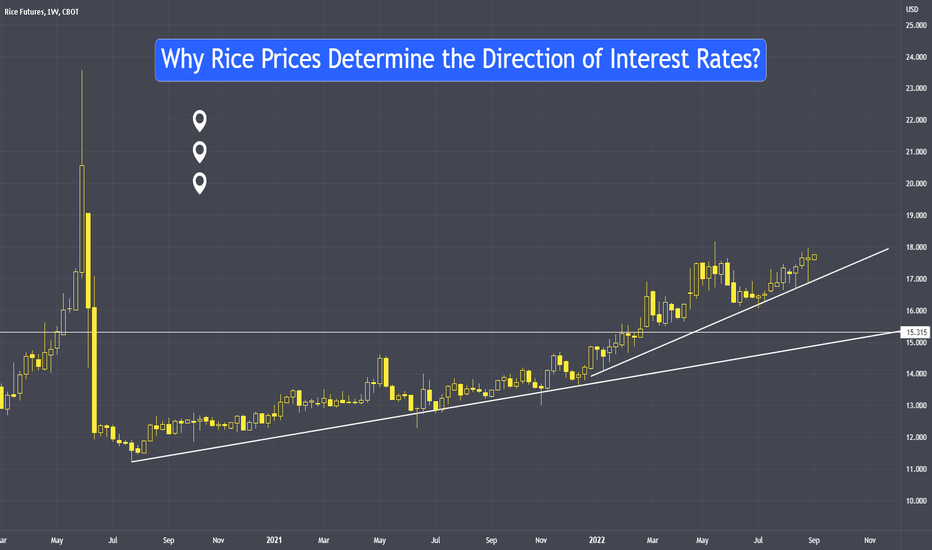

Why Rice Prices Determine the Direction of Interest Rates?Recently, I received questions asking my opinion on their borrowing cost, if they should go for fixed or float rates. We somehow know there is inflation, but not exactly sure how long it will last and how bad it will get. Because higher inflation leads to higher interest rates.

While I cannot advise them as I do not have a banking license to do so. However, I can point them to the commodity markets, I hope by doing so, it can help them to understand and read into the direction of interest rates with greater clarity.

Background on edible commodities:

Rice is a staple in the diets of more than half of the world’s population, especially in Latin America, Asia, and the Middle East. Annual production of milled rice tops 480 million metric tons, which makes it the third most-produced grain in the world after corn and wheat.

An increase in rice prices or edible commodities, it will really add pressure to the existing global inflationary pressure. Hardship will be more intense especially compare to other commodities like crude oil.

In short, people can still live with some inconvenience without cars, but not without food.

Therefore, when food prices become much more expensive, the central banks immediate and urgent measures is to counter it by rising interest rates.

Content:

. Why edible commodities determine the direction of interest rates?

. Technical studies

. How to hedge or buy them?

Rice Market:

91 Metric Tons

$0.005 = US$10

Example -

$0.01 = US$20

$18.00 = 1800 x US$20 = US$18,000

From $18 to $19 = US$10,000

If you are trading this market for the short-term, do remember to use live data than delay ones.

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

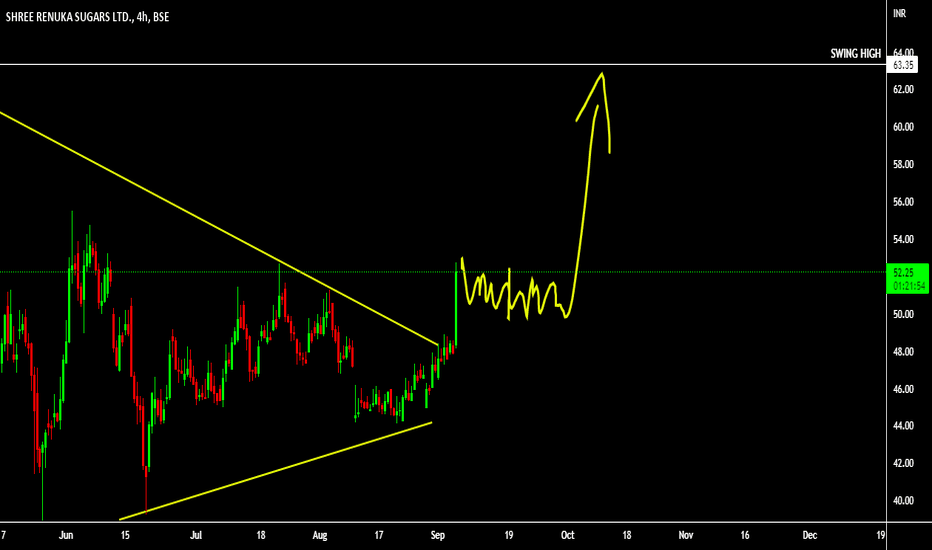

Shree Renuka Sugars - 240 MinsThe Structure looks good to us, waiting for this instrument to correct and then give us these opportunities as shown on this instrument (Price Chart).

Note: its my view only and its for educational purpose only. only who has got knowledge about this strategy, will understand what to be done on this setup. its purely based on my technical analysis only (strategies). we don't focus on the short term moves, we look for only for Bullish or Bearish Impulsive moves on the setups after a good price action is formed as per the strategy. we never get into corrective moves. because it will test our patience and also it will be a bullish or a bearish trap. and try trade the big moves.

we do not get into bullish or bearish traps. we anticipate and get into only big bullish or bearish moves (Impulsive moves).

Just ride the bullish or bearish impulsive move. Learn & Know the Complete Market Cycle.

buy low and sell high concept. buy at cheaper price and sell at expensive price.

Keep it simple, keep it Unique.

please keep your comments useful & respectful.

Thanks for your support....

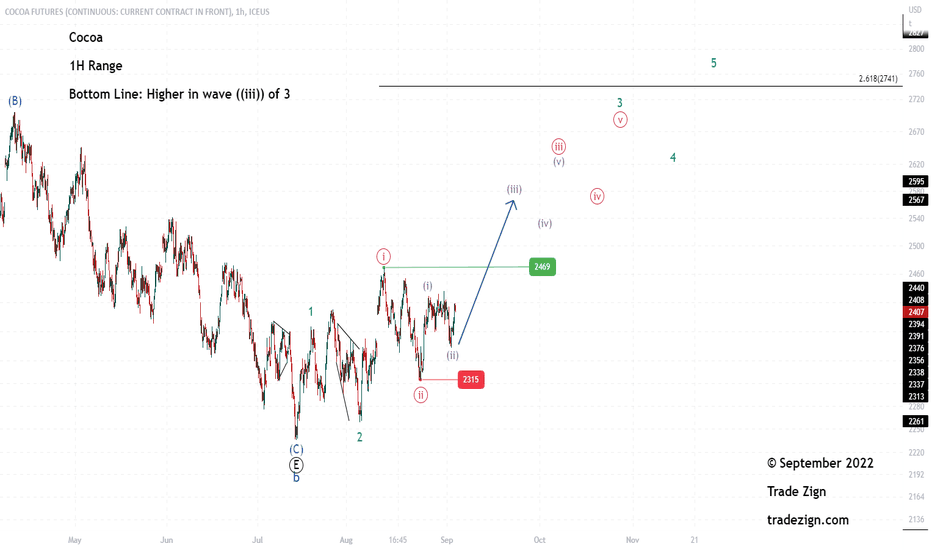

Commodity Cocoa idea (05/09/2022)cocoa

Expecting cocoa to continue rising in the coming period, and this rise depends on the continuation of trading above the support point 2315 and the end of wave ((ii)), and the beginning of the rise in wave ((iii)) targeting prices of 2741 and now we expect cocoa to rise and the end of the decline in wave (ii) at Prices 2356