Reddit, Inc. (RDDT) – Global Growth & Monetization TailwindsCompany Snapshot:

Reddit NYSE:RDDT is a community-centric social media platform, uniquely positioned through user-generated content and authentic engagement. With over 100,000 active communities, Reddit is a magnet for targeted brand advertising and premium ad formats.

Key Catalysts:

AI-Driven International Expansion 🌐

Launched AI-powered post translation in 35+ countries, including Brazil, Germany, and Italy.

This unlocks new audiences and ad monetization in high-growth global markets.

High Margin Business Model 💸

Reported a 90.5% gross margin—highlighting Reddit’s asset-light infrastructure and operational efficiency.

Sets the stage for significant operating leverage as revenue scales.

Ad Revenue Acceleration 📊

Brands increasingly view Reddit as a premium ad environment, given its contextual targeting and deep user engagement.

Expanding tools for advertisers (e.g., Dynamic Product Ads) may enhance monetization per user.

Investment Outlook:

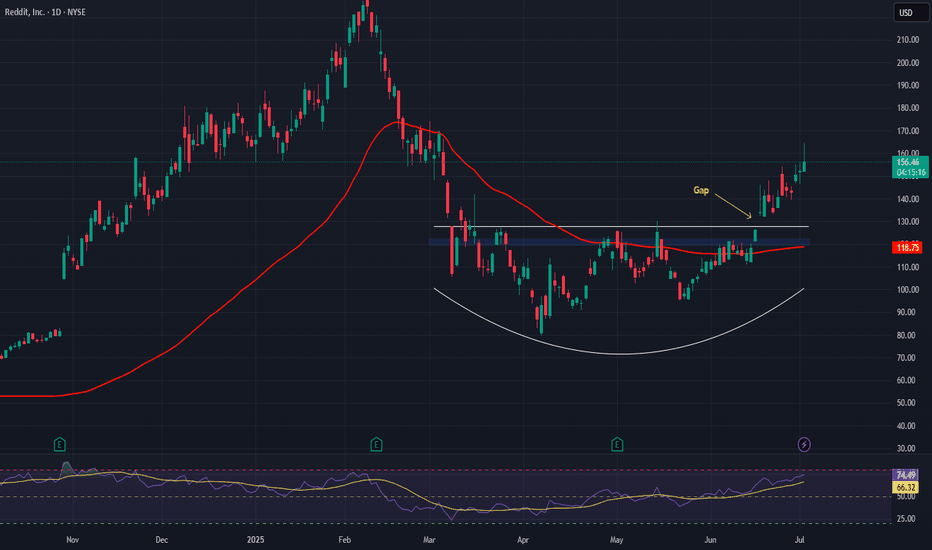

Bullish Entry Zone: Above $120.00–$122.00

Upside Target: $190.00–$195.00, supported by global reach, margin strength, and ad revenue tailwinds.

🧠 Reddit isn’t just a social platform—it’s a monetizable network of influence, fueled by community trust and scalable technology.

#Reddit #RDDT #SocialMediaStocks #AIExpansion #GrossMargin #AdTech #CommunityEngagement #TechStocks #Bullish #DigitalAds #UserGeneratedContent #GlobalGrowth #FreeCashFlow #GrowthStocks

Aiexpansion

Shopify (SHOP) AnalysisCompany Overview:

Shopify NYSE:SHOP is a leading e-commerce platform that continues to grow by expanding into AI-driven solutions and fulfillment services, aiming to optimize merchant growth. Shopify is positioning itself as a major player in the e-commerce ecosystem, particularly with Shopify Plus, which is gaining momentum among large retailers.

Key Catalysts:

AI-Powered Tools for Merchants 🤖

Shopify is integrating AI-driven solutions to enhance marketing, inventory management, and checkout optimization, which improves merchant retention and adoption.

Enterprise Growth 📈

Shopify Plus is experiencing strong adoption among larger retailers, helping diversify revenue and reduce the company's reliance on small businesses. This supports more stable growth.

Long-Term E-commerce Growth 🌐

With e-commerce projected to grow at a 9.5% CAGR through 2030, Shopify holds a 10% market share in the U.S., positioning it for long-term growth in an expanding digital marketplace.

Financial Strength 💰

Free cash flow margin rose to 19%, underscoring Shopify’s robust financial health and ability to reinvest in future growth initiatives.

Investment Outlook:

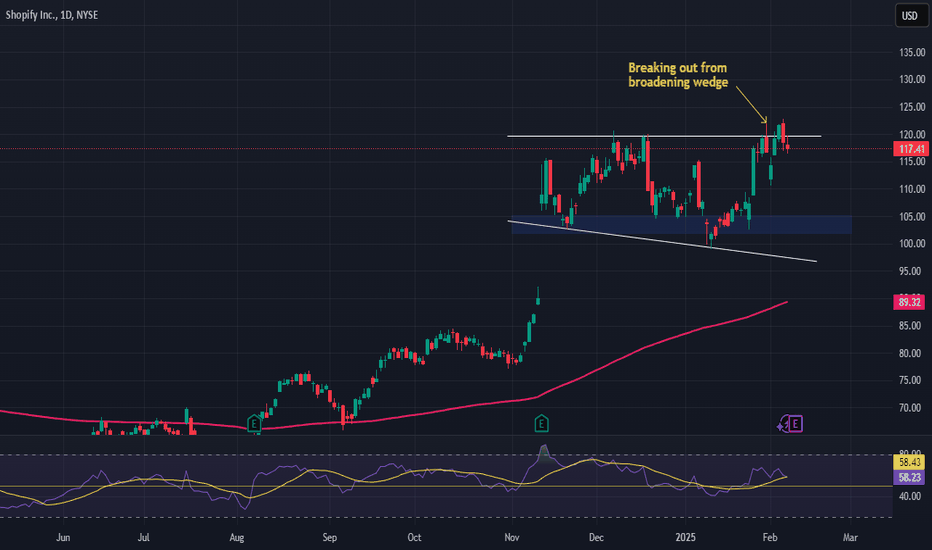

Bullish Case: We are bullish on SHOP above the $102.00-$105.00 range, driven by AI expansion, growing enterprise adoption, and strong cash flow.

Upside Potential: Our price target is $170.00-$172.00, reflecting the company’s dominance in e-commerce and its ongoing innovations.

📢 Shopify—Shaping the Future of E-Commerce and AI. #Ecommerce #AIExpansion #SHOP