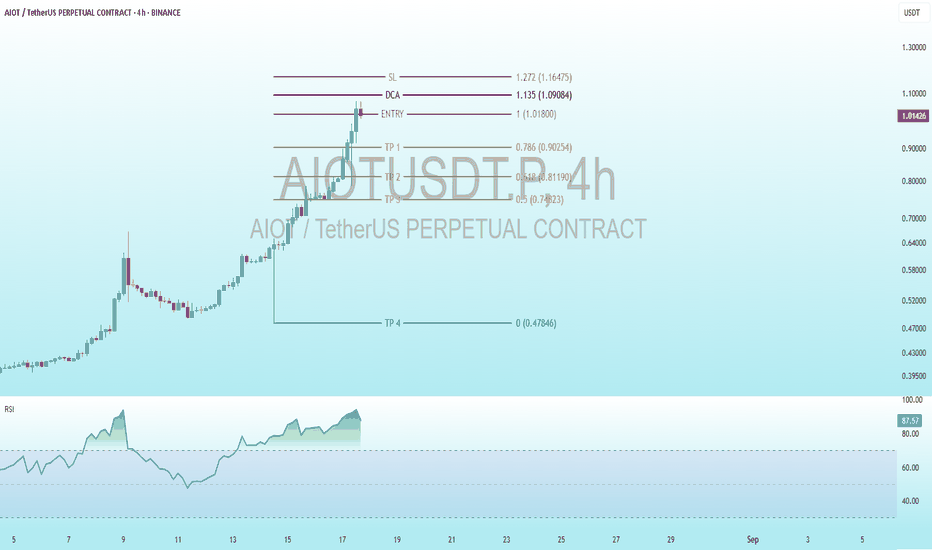

$AIOT Perpetual Surge: 4H Trading Setup with RSI OverloadBINANCE:AIOTUSDT.P

Entry: 1.00 (1.01800 USDT) - The level where the initial purchase is planned.

DCA (Dollar-Cost Averaging): 1.135 (1.09084 USDT) - An additional buying point if the price rises.

SL (Stop Loss): 1.272 (1.16475 USDT) - The level where the loss would be limited.

TP (Take Profit):TP1: 0.786 (0.90254 USDT)

TP2: 0.618 (0.81190 USDT)

TP3: 0.5 (0.74823 USDT)

TP4: 0 (0.47846 USDT) - A lower target, possibly a conservative goal or error.

RSI (Relative Strength Index) Indicator:

The current RSI value is 88.30, which is deeply in the overbought territory (above 70 and nearing 90). This suggests the price may be overextended, indicating a potential reversal or correction soon.

Analysis and Interpretation:

Strategy: The chart uses Fibonacci levels to determine entry, exit, and loss points. The entry is set at 1.01800 USDT, with a DCA at 1.09084 USDT if the price continues to rise, and a stop loss at 1.16475 USDT to protect capital.

Profit Targets: TP1 to TP3 are based on Fibonacci retracement levels (0.786, 0.618, 0.5), indicating a technical approach to taking profits incrementally. TP4 at 0.4786 USDT seems significantly lower and might be a mistake or a long-term target.

RSI: The extremely high RSI value (88.30) signals a strong overbought condition. This could imply an imminent pullback or consolidation, especially if the price fails to sustain its recent upward momentum.

Recommendation:

Monitor the price closely around the entry level (1.01800 USDT) and DCA (1.09084 USDT). Given the overbought RSI, exercise caution with new entries or consider preparing for a potential sell-off.