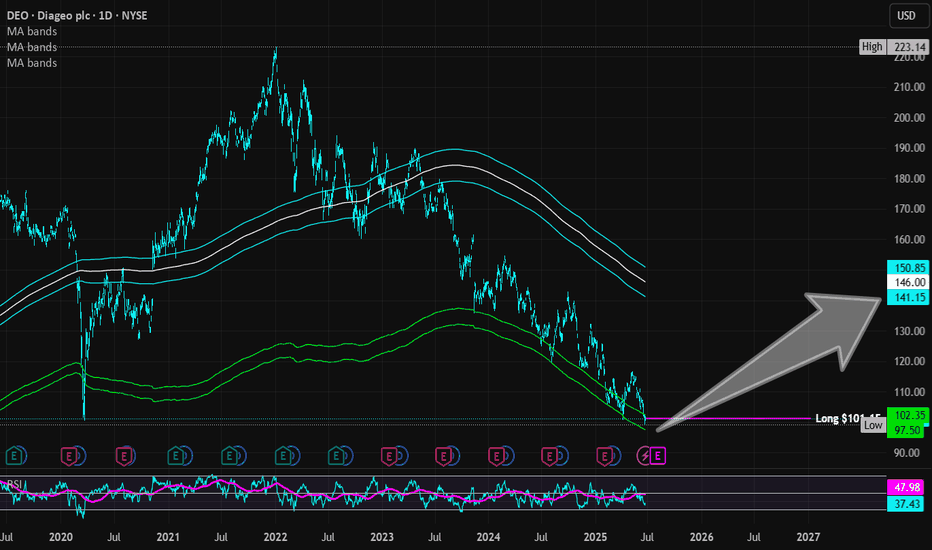

Diageo | DEO | Long at $101.15Diego NYSE:DEO is the owner of alcohol brands such as Johnnie Walker, Crown Royal, Smirnoff, Baileys, Guinness, Tanqueray, Don Julio, Cîroc, and Captain Morgan. The stock has fallen significantly since 2021 due to several factors, such as: post-COVID recovery slowdown; retail/travel disruptions hurting high-margin segments; inflationary pressures raising costs for materials like glass and agave, squeezing margins; consumer downtrading to cheaper alternatives; and macroeconomic headwinds. While tariffs may prolong overall recovery, I do not think it's the end for this company by any means.

Factors likely to drive NYSE:DEO stock higher include:

Interest Rate Cuts : Expected U.S. rate cuts in 2025 could boost consumer confidence and spending, benefiting premium brands. Lower rates may also reduce debt costs, easing pressure on its debt load.

Productivity Initiatives : NYSE:DEO $2B savings program (2025-2027) aims to improve efficiency, margins, and cash flow, potentially restoring investor confidence.

Undervaluation : Trading at 17.5x forward earnings (below historical 21x), the stock may attract value investors.

From a technical analysis perspective, NYSE:DEO has been riding my "crash" simple moving average zone. While the momentum has a strong downtrend, entry into this "crash" zone typically only happens a few times before a trend reversal. But there is a good probability, that my "major crash" zone (currently in the $80s) is possible before a true reversal. Regardless, without a crystal ball, I am starting to form a position and plan to add more if the "major crash" happens with this stock.

Thus, at $101.15, NYSE:DEO is in a personal buy zone with the noted potential for a drop into the $80s due to projected earnings revisions, etc.

Targets into 2027:

$120.00 (+18.6%)

$140.00 (+38.4%)

Alcoholstocks

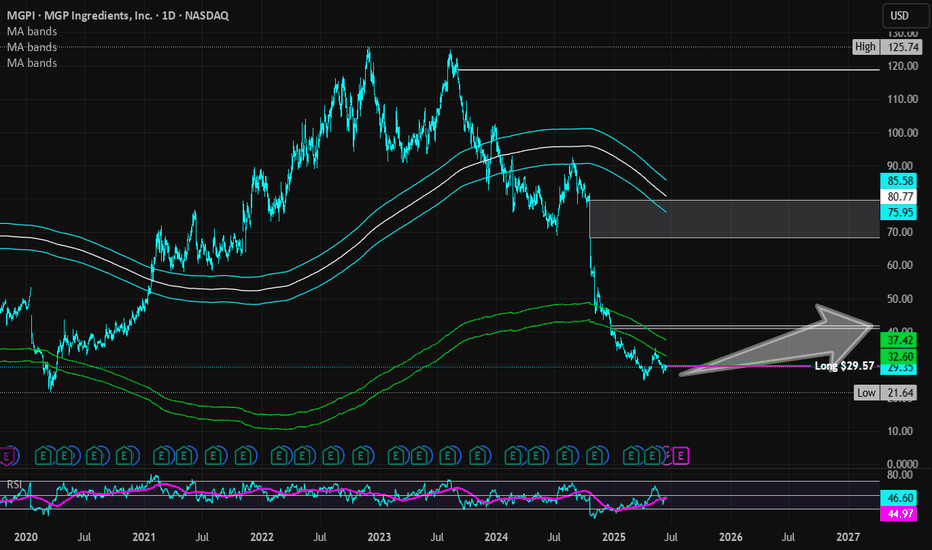

MGP Ingredients | MGPI | Long at $29.57MGP Ingredients NASDAQ:MGPI has been in "crash" phase since 2023 due to lower U.S. liquor consumption, a whiskey glut, a CEO resignation, a facility closure, and a shift to higher-margin business. While currently trading near $30, the book value is at $39, forward price-to-earnings is 8x, debt-to-equity is 0.4x (low), and some insiders have been awarded stocks and options (although, selling has been rather high, too). Earnings and revenue are expected to grow slowly beyond 2025, but this year is anticipated to be the worst in some time. The low expectations may already be priced in, but time will tell. While I do not plan to be a long-term holder of the stock, the price is within my "crash" simple moving average area and the fundamentals aren't terrible. If interest rates are lowered within the next year, I believe this could begin the turnaround for the company (although slow).

Thus, at $29.57, NASDAQ:MGPI is in a personal buy zone for a swing trade.

Targets:

$35.00 (+18.4%)

$40.00 (+35.3%)

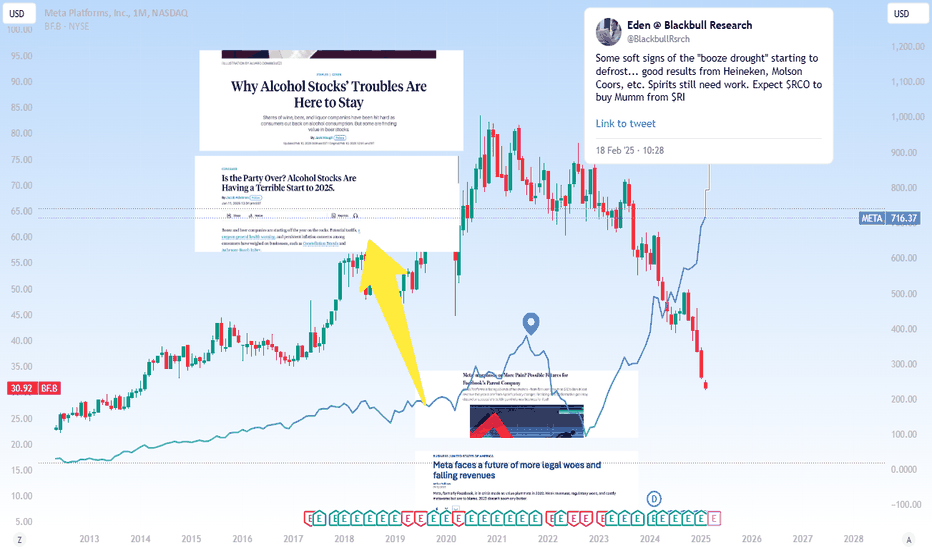

Why booze stocks are so cheap (part 1002)This analysis is provided by Eden Bradfeld at BlackBull Research—sign up for their Substack to receive the latest market insights straight to your inbox.

Now, I do not think Brown Forman will return to 32x earnings anytime soon — if ever — but if you even half the implied return from multiple expansion you still have plenty of upside.

Ditto Remy — I do not love Remy because Cognac, for lack of a better term, is screwed. But there’s still obviously value there and it trades on a very depressed multiple — what’s to say the family has had enough and finds a buyer?

Finally, Diageo. Less upside but more certainty — Guinness sells very well among Gen Z while their spirits portfolio continues to ebb along, if only growth in the low single digits.

Valuations always tend to normalise, especially for companies which make staples. Paying 30x earnings was always too much — I used to look at Brown-Forman enviously, and wish it were cheaper. Well, now it is! And nobody likes it. On chart is a couple of headlines from Barron’s.

I love to go counter-consensus to the media, because usually that’s a sign of peak pessimism. On chart are some headlines about Meta when everyone hated the stock in 2022/2023.

Obviously, the booze stocks are not Meta — Meta is a cash flow machine! Zuck wears a gold chain! Zuck would like us to know he is a Cool Guy!

But still — price drives narrative. Everyone was dissing Meta in 2022 (and I felt like an idiot buying it), now they love it. Ditto booze stocks. People aren’t going to stop drinking. That’s it. That’s the thesis.

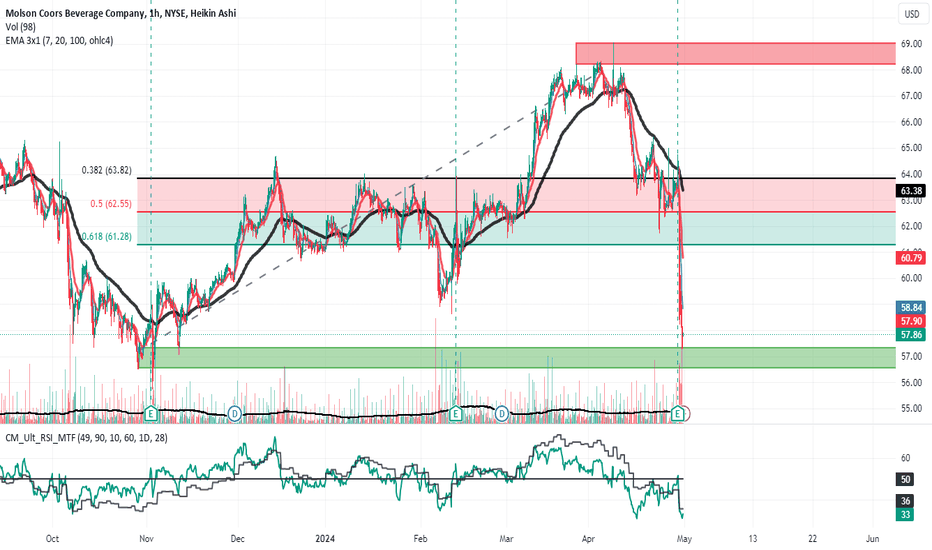

TAP flushed on a good earnings beat into support LONGTAP appears to to have fallen into support on a good earnigns beat Perhaps traders were

expecting a better beat. It is now 15% below the resistance zone where shorts will take

positions and longs will sell- off. TAP has sales and consumer loyalty in its brands. It is

free of the controversies that had bogged BUD down. I see this as an opportunity to get a

decent stock at a discount. My target is 62 at the half way point has designated by the fib tool.