Algolevel

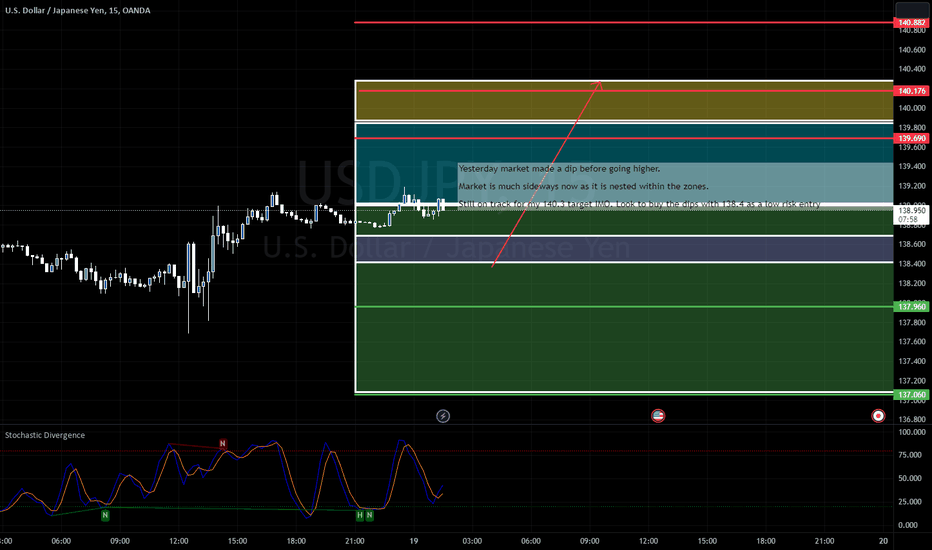

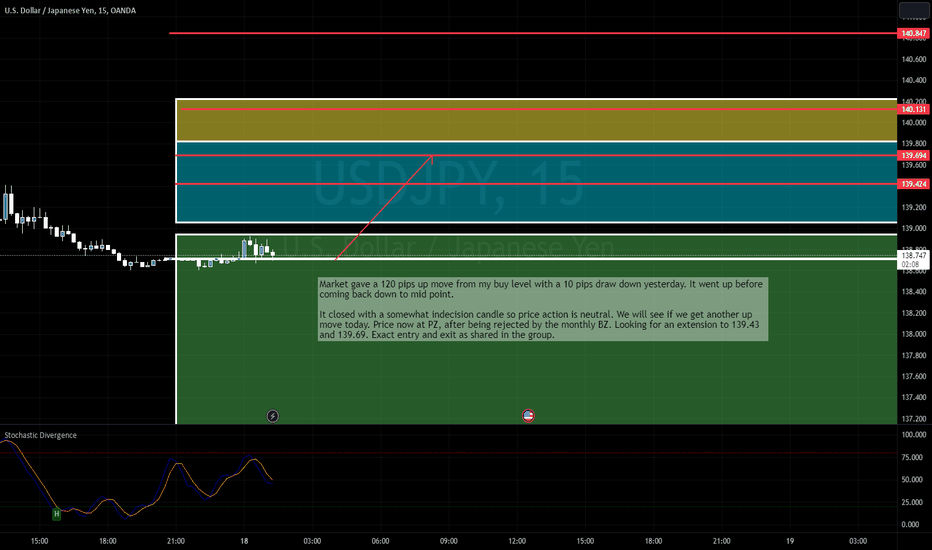

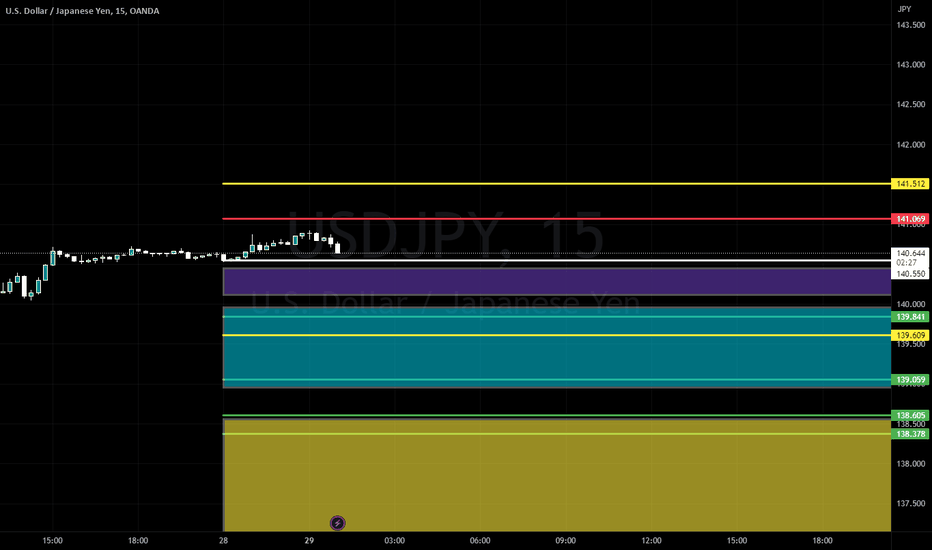

18072023 - #USDJPYMarket gave a 120 pips up move from my buy level with a 10 pips draw down yesterday. It went up before coming back down to mid point.

It closed with a somewhat indecision candle so price action is neutral. We will see if we get another up move today. Price now at PZ, after being rejected by the monthly BZ. Looking for an extension to 139.43 and 139.69. Exact entry and exit as shared in the group.

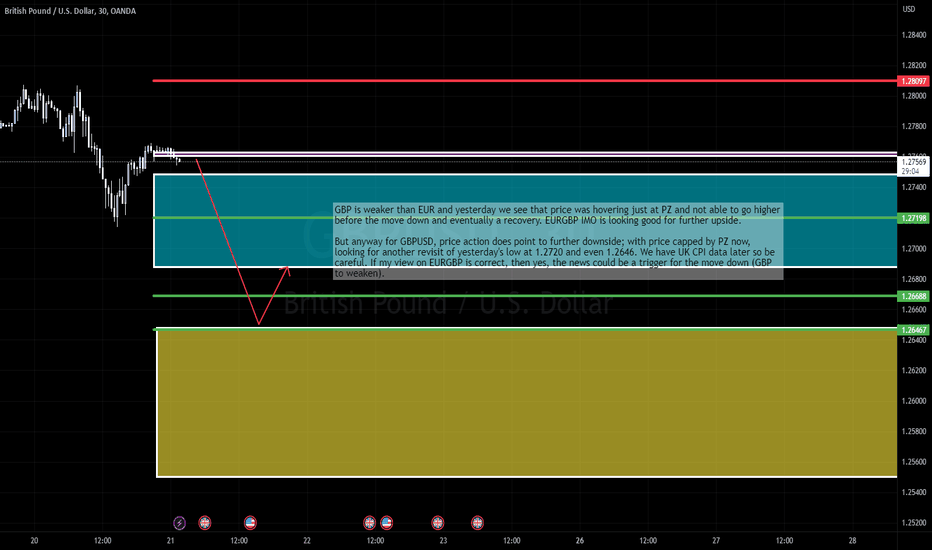

21062023 - #GBPUSDGBP is weaker than EUR and yesterday we see that price was hovering just at PZ and not able to go higher before the move down and eventually a recovery. EURGBP IMO is looking good for further upside.

But anyway for GBPUSD, price action does point to further downside; with price capped by PZ now, looking for another revisit of yesterday's low at 1.2720 and even 1.2646. We have UK CPI data later so be careful. If my view on EURGBP is correct, then yes, the news could be a trigger for the move down (GBP to weaken).

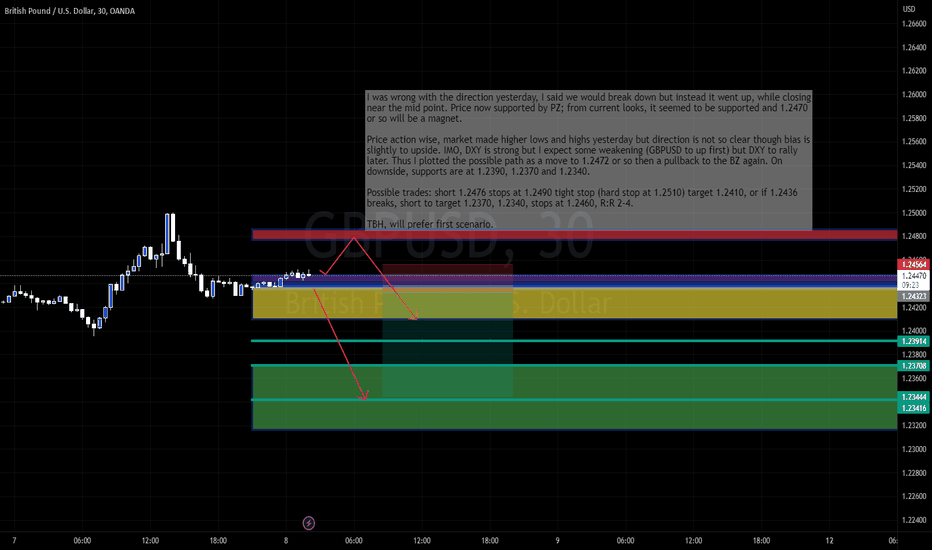

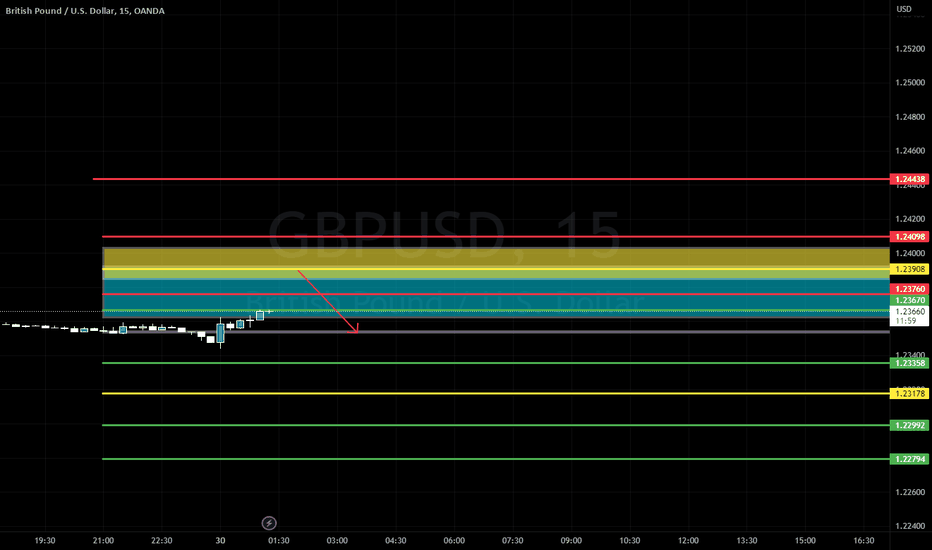

08062023 - #GBPUSDI was wrong with the direction yesterday, I said we would break down but instead it went up, while closing near the mid point. Price now supported by PZ; from current looks, it seemed to be supported and 1.2470 or so will be a magnet.

Price action wise, market made higher lows and highs yesterday but direction is not so clear though bias is slightly to upside. IMO, DXY is strong but I expect some weakening (GBPUSD to up first) but DXY to rally later. Thus I plotted the possible path as a move to 1.2472 or so then a pullback to the BZ again. On downside, supports are at 1.2390, 1.2370 and 1.2340.

Possible trades: short 1.2476 stops at 1.2490 tight stop (hard stop at 1.2510) target 1.2410, or if 1.2436 breaks, short to target 1.2370, 1.2340, stops at 1.2460, R:R 2-4.

TBH, will prefer first scenario.

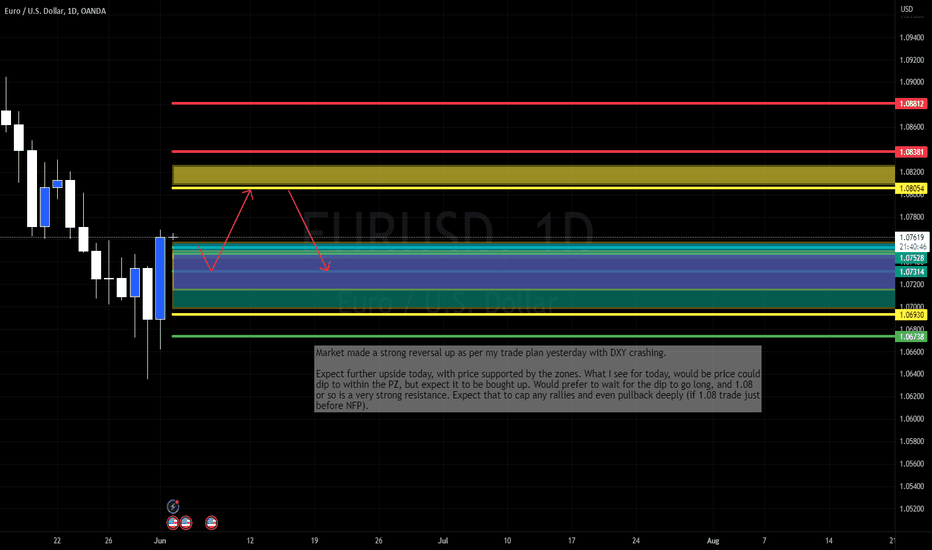

02062023 - #EURUSDMarket made a strong reversal up as per my trade plan yesterday with DXY crashing.

Expect further upside today, with price supported by the zones. What I see for today, would be price could dip to within the PZ, but expect it to be bought up. Would prefer to wait for the dip to go long, and 1.08 or so is a very strong resistance. Expect that to cap any rallies and even pullback deeply (if 1.08 trade just before NFP).

01062023 - #USDJPYUSDJPY gave a good short, with the levels working almost perfectly; price made the initial dip to support, and then rallied to the PHOD on news at 10am EST before it came down to close near the lows with DXY faltering.

For today, 138.91 is possible intermediate support, looking for a bounce here to possibly 139.62 before a next leg down.

31052023 - #GBPUSDGBPUSD gave an initial sell to take out Monday's low before rallying higher. DXY hit a resistance above on the initial sell but came down to 104 (and lower) - the level I mentioned before basing. In a way, I was too aggressive on my 1.2395 level; (though DXY was at 104). Market went past it, to above resistance before coming down and bounced off at this 1.2395 level ( where the daily and weekly BZ meets). Could see some further upside, but would like to see price pullback to 1.2383 or so, fake breakdown before price stabilize and look for up.

In a way, I was too aggressive because the green candles of the previous days does point to bigger upside before any sell could come. For today, I would say that we can see that price is within the zones, held by weekly BZ now, while PZ and daily BZ are below as support.

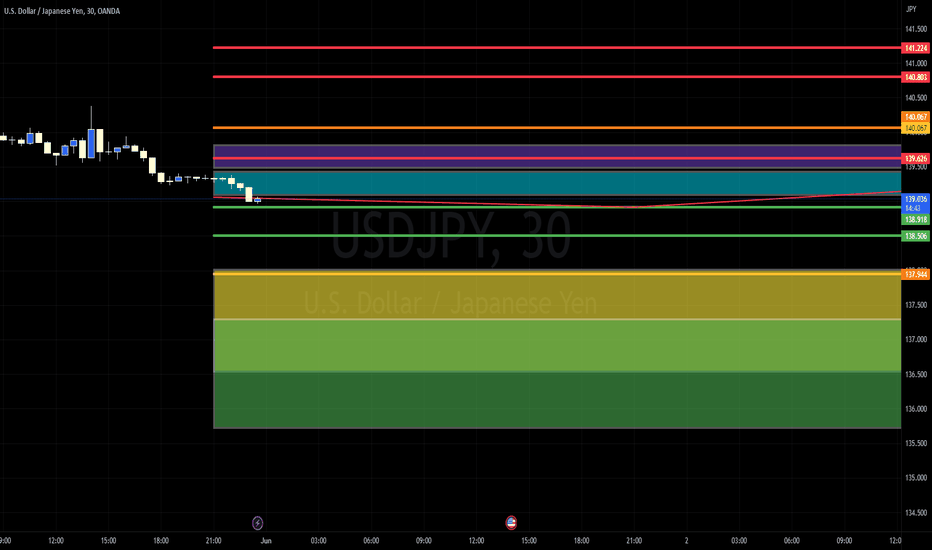

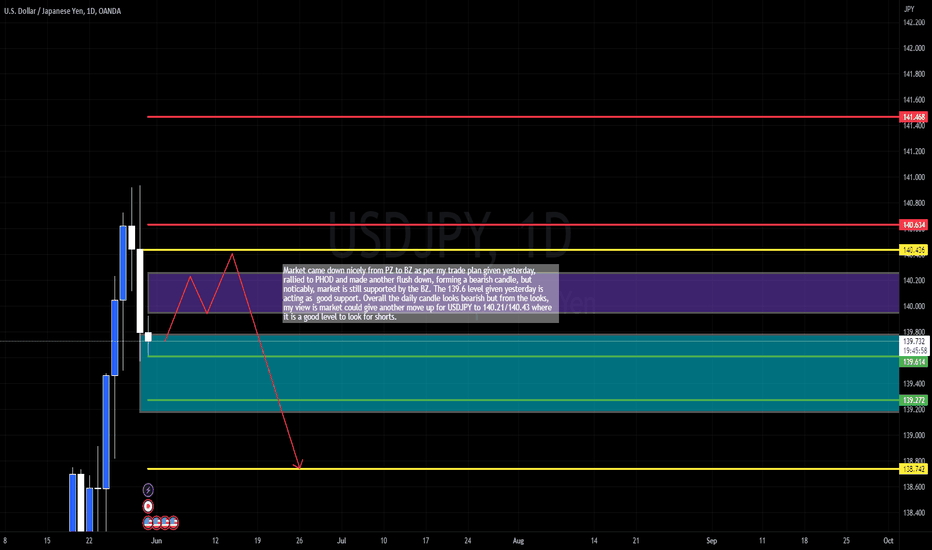

31052023 - #USDJPYMarket came down nicely from PZ to BZ as per my trade plan given yesterday, rallied to PHOD and made another flush down, forming a bearish candle, but noticably, market is still supported by the BZ. The 139.6 level given yesterday is acting as good support. Overall the daily candle looks bearish but from the looks, my view is market could give another move up for USDJPY to 140.21/140.43 where it is a good level to look for shorts.

30052023 - #USDJPYWas looking for a pullback yesterday for a long but did not reach the long level. USDJPY printed a somewhat bearish candle and today it nicely opened below PZ and is coming down to BZ. 139.69 is the level to watch; could see this level today and look for opportunities (with bullish divergence) for a long back to PZ 140.5, but a break could bring us to 139.25

30052023 - #GBPUSDInside bar yesterday; I said that DXY could cool off and indeed GBPUSD went up to my said resistance before GBPUSD came down but overall, it was a small range day because most markets are not open. GBPUSD looking to push up further; thus could see further upside. IMO, 1.2391 could trade today and it is a level to go short from for a move back to PZ (watch DXY 104 for that move up).

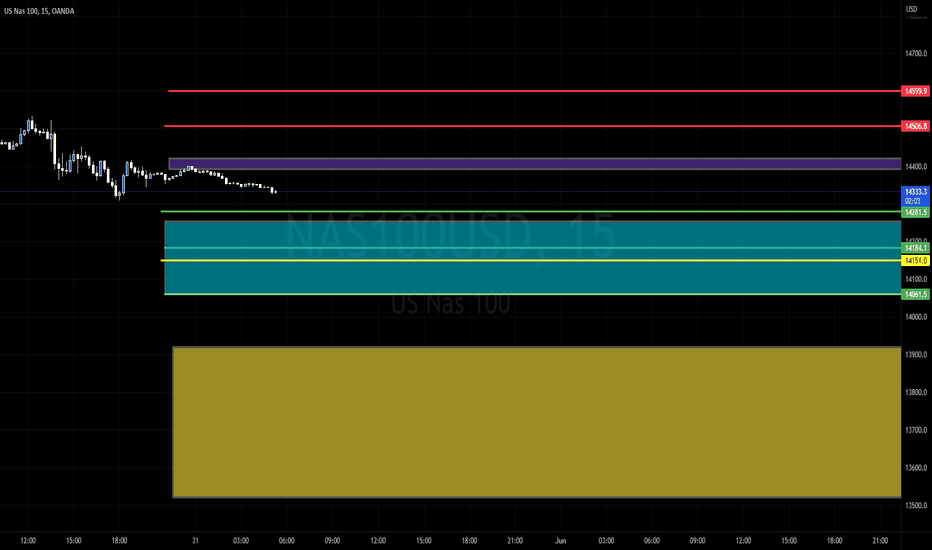

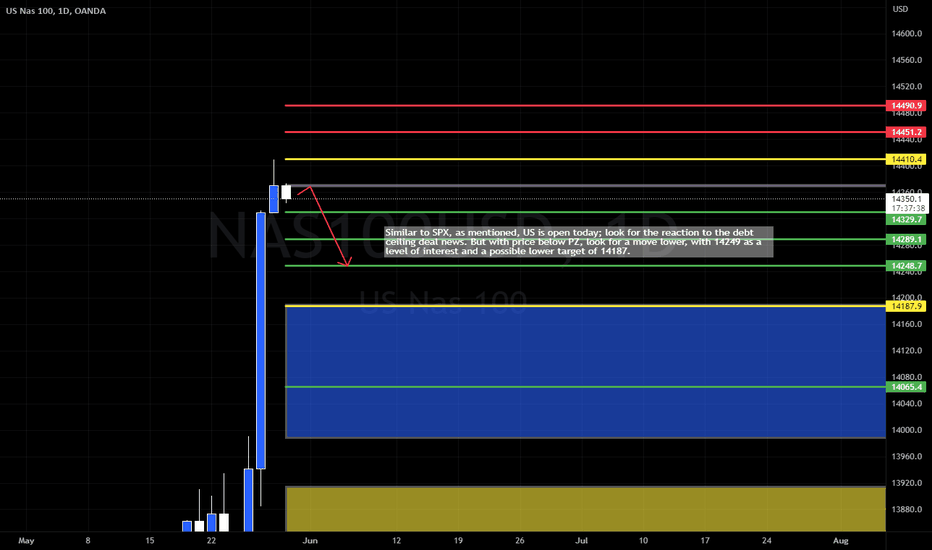

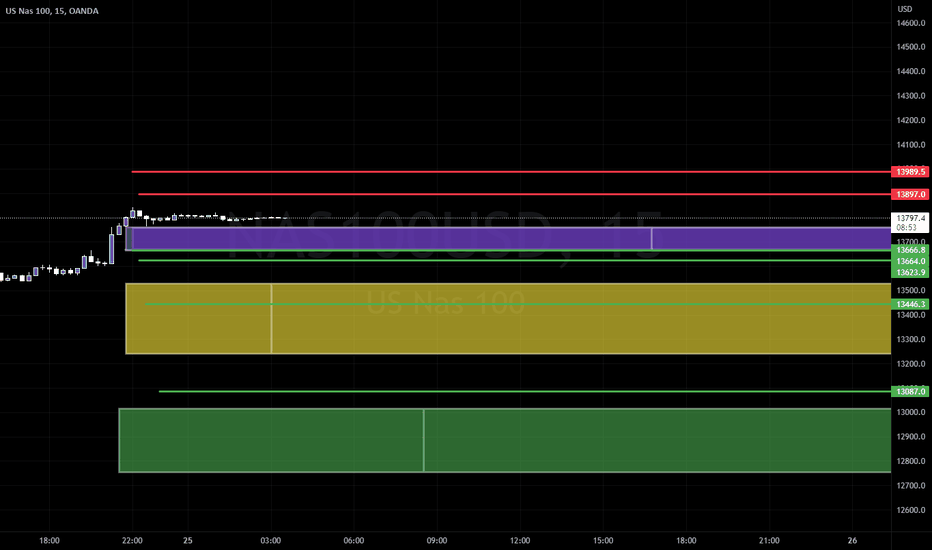

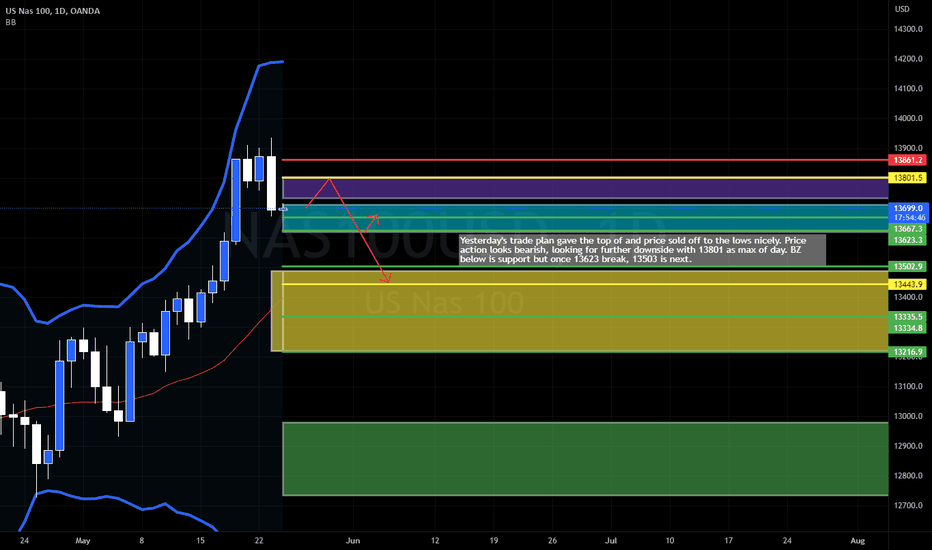

25052023 - $NDXNDX made a huge recovery after the initial sell off, hitting the weekly BZ and rebounded; I would say the initial up was technical, price is oversold at BB extremes but the subsequent rally was due to NDVA. Price is now supported by the BZ and PZ at the same prices thus a double support.

TBH, I thought the rally was rubbish but price action is looking bullish now. I did say that I am not convinced of the rally; thus it would either be a case of NDX strength supporting the other indices, or NDX to falter and bringing SPX down with it.

The location of such a bullish candle is uncommon to say the least, but I would say that to SPX/DJIA would be better candidates to go short from, while using NDX as reference.

25052023 - #GBPUSD Yesterday gave the perfect move; GBPUSD hit PHOD on a fake move up on CPI news then gave a 120pips sell closing lows. I am still bullish DXY and nothing seem to indicate a top, though we could consolidate today. But now GBPUSD coming down nicely. IMO any rally till 1.2396 is a possible short for a move to 1.2306 with a possible further downside to 1.2269.

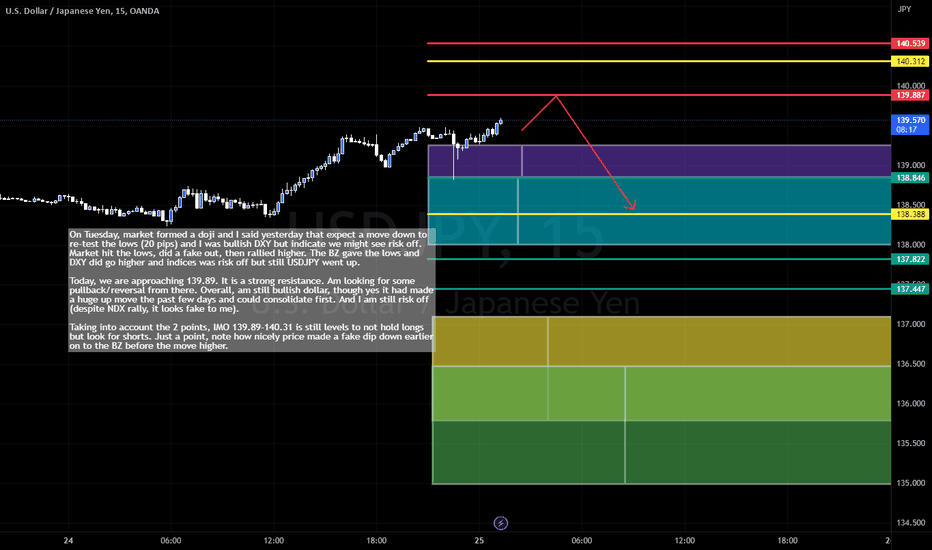

25052023 - #USDJPYOn Tuesday, market formed a doji and I said yesterday that expect a move down to re-test the lows (20 pips) and I was bullish DXY but indicate we might see risk off. Market hit the lows, did a fake out, then rallied higher. The BZ gave the lows and DXY did go higher and indices was risk off but still USDJPY went up.

Today, we are approaching 139.89. It is a strong resistance. Am looking for some pullback/reversal from there. Overall, am still bullish dollar, though yes it had made a huge up move the past few days and could consolidate first. And I am still risk off (despite NDX rally, it looks fake to me).

Taking into account the 2 points, IMO 139.89-140.31 is still levels to not hold longs but look for shorts. Just a point, note how nicely price made a fake dip down earlier on to the BZ before the move higher.

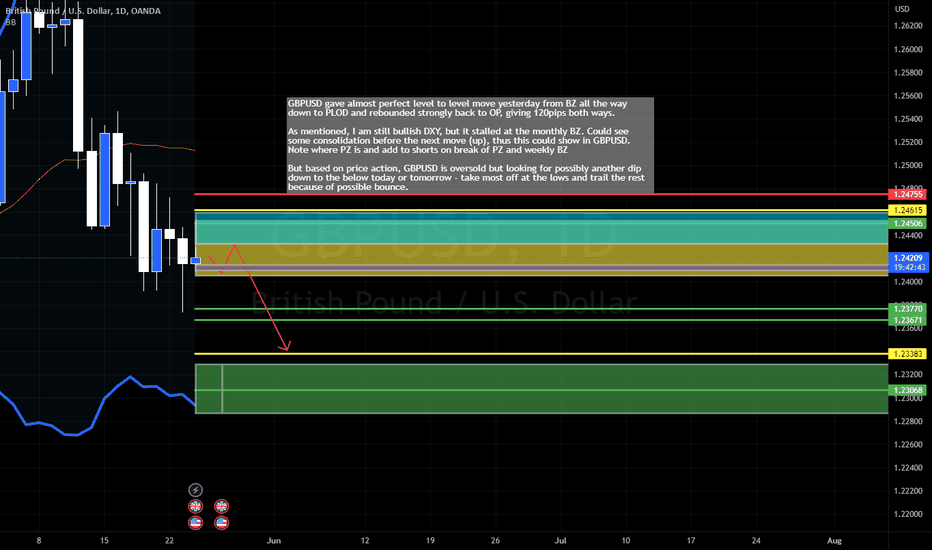

24052023 - #GBPUSDGBPUSD gave almost perfect level to level move yesterday from BZ all the way down to PLOD and rebounded strongly back to OP, giving 120pips both ways.

As mentioned, I am still bullish DXY, but it stalled at the monthly BZ. Could see some consolidation before the next move (up), thus this could show in GBPUSD. Note where PZ is and add to shorts on break of PZ and weekly BZ

But based on price action, GBPUSD is oversold but looking for possibly another dip down to the below today or tomorrow - take most off at the lows and trail the rest because of possible bounce.

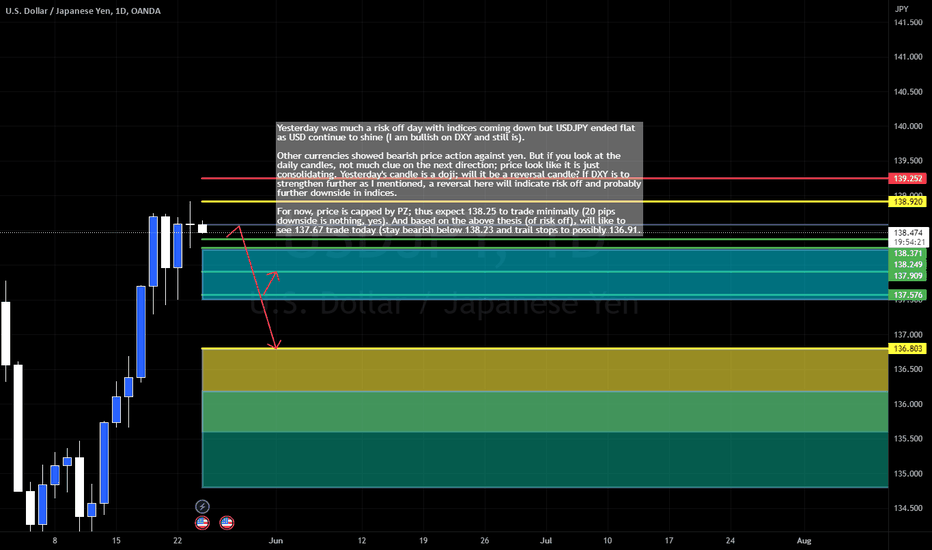

24052023 - #USDJPYYesterday was much a risk off day with indices coming down but USDJPY ended flat as USD continue to shine (I am bullish on DXY and still is).

Other currencies showed bearish price action against yen. But if you look at the daily candles, not much clue on the next direction; price look like it is just consolidating. Yesterday's candle is a doji; will it be a reversal candle? If DXY is to strengthen further as I mentioned, a reversal here will indicate risk off and probably further downside in indices.

For now, price is capped by PZ; thus expect 138.25 to trade minimally (20 pips downside is nothing, yes). And based on the above thesis (of risk off), will like to see 137.67 trade today (stay bearish below 138.23 and trail stops to possibly 136.91.

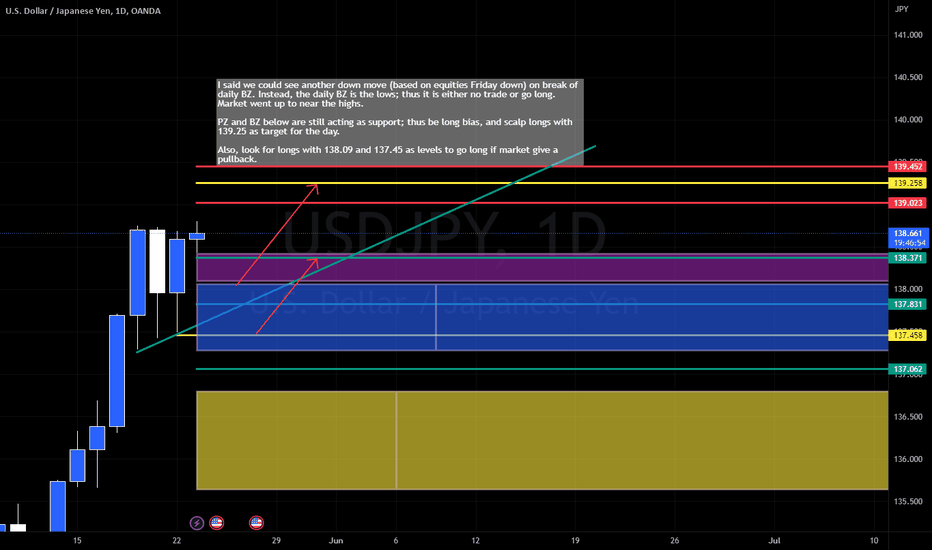

23052023 - #USDJPYI said we could see another down move (based on equities Friday down) on break of daily BZ. Instead, the daily BZ is the lows; thus it is either no trade or go long. Market went up to near the highs.

PZ and BZ below are still acting as support; thus be long bias, and scalp longs with 139.25 as target for the day.

Also, look for longs with 138.09 and 137.45 as levels to go long if market give a pullback.

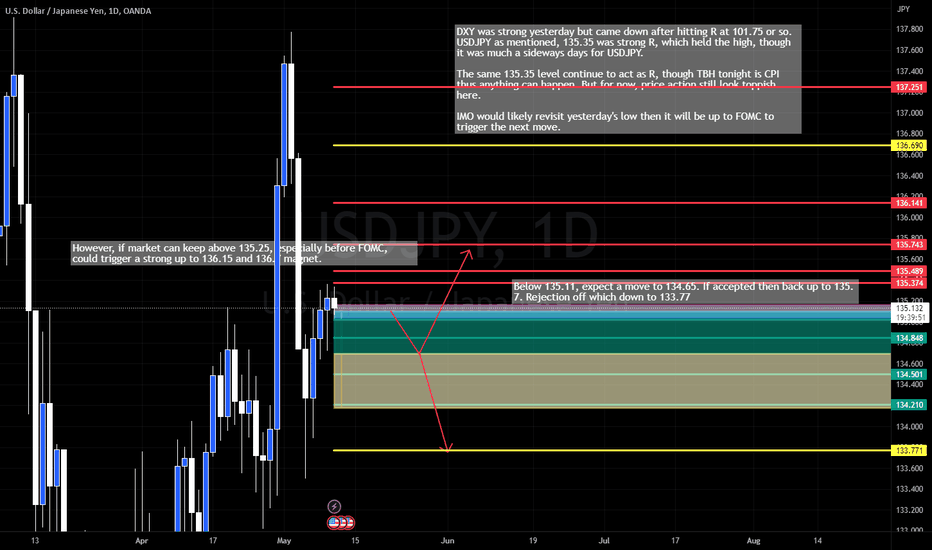

10052023 - #USDJPYDXY was strong yesterday but came down after hitting R at 101.75 or so. USDJPY as mentioned, 135.35 was strong R, which held the high, though it was much a sideways days for USDJPY.

The same 135.35 level continue to act as R, though TBH tonight is CPI thus anything can happen. But for now, price action still look toppish here.

IMO would likely revisit yesterday's low then it will be up to FOMC to trigger the next move.

Below 135.11, expect a move to 134.65. If accepted then back up to 135.7. Rejection off which down to 133.77.

However, if market can keep above 135.25, especially before FOMC, could trigger a strong up to 136.15 and 136.7 magnet.

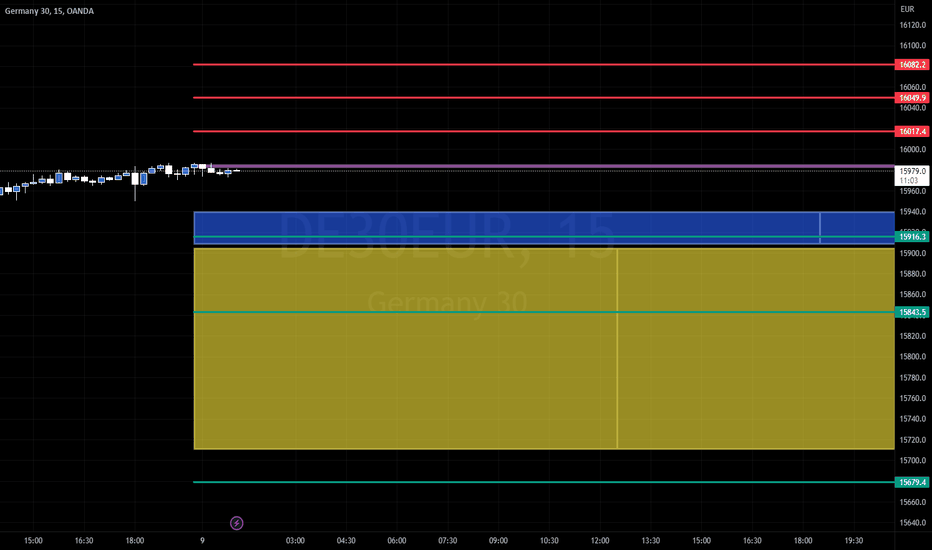

09052023 - $FDAXEerie small range consolidation day yesterday, inside bar. Possible break in either directions.

Above 16017 - long to 16049. Possible rejection from 16049 to 15981.

15983-16017 Neutral

Below 15981 - shorts to 15941, 15915.

15915 - look for bounce on divergence target 15979. Break of 15915 bring us to 15843.