Algorand

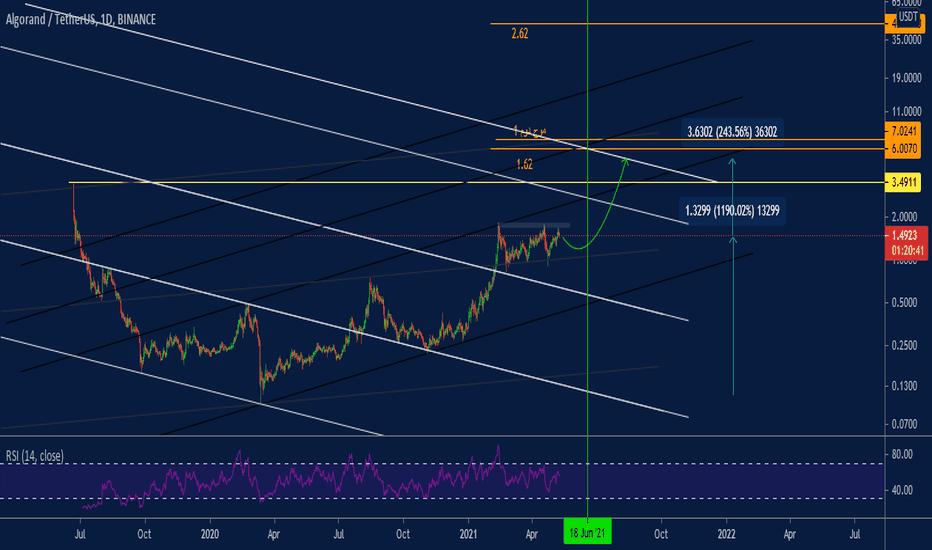

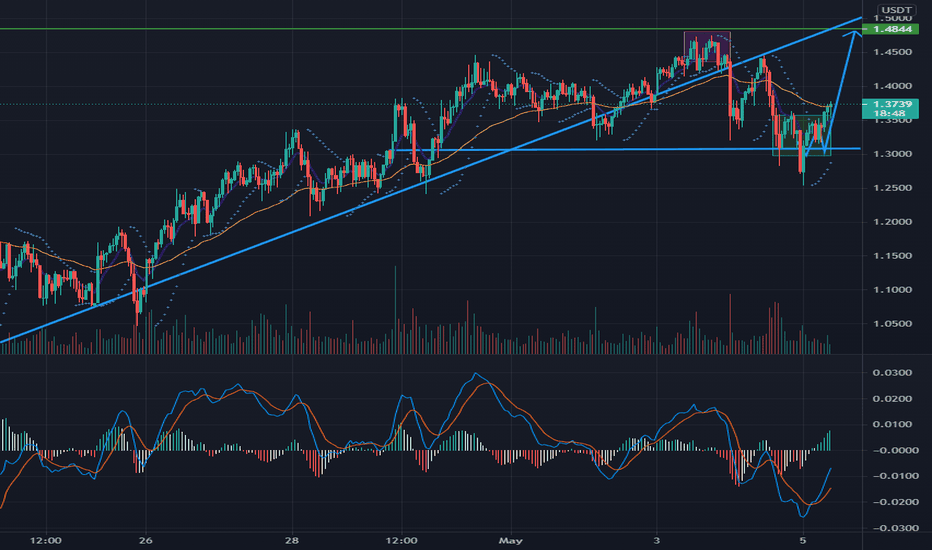

*Read* Algo Strong Bullish Indicators (Early Stage)On 27th Algo entered 0.382 on 27th of April as since been moving between 0.382 and 0.236. I used FIb Retracement on uptrend EMA 9 and EMA 20 back in January towards the peak, since there were no downtrends occurring during the bull run.

Afterwards, we can see 2 Fib Speed Resistance Fans.

1st Fib Speed is used once Algo started bull run between 0.618-0.382 (Retracement), had test between 0.0382 and 0.236 (Retracement) and at the end broke 0.2361(Retracement).

2nd Fib Speed is used at the exact same pattern bull run, but we are yet to see a breaking of 0.236.

If you look closer you can see that breaking from 0.618-0.382 (Retracement) on both Fib Speed Resistance fans was happening between 0.75-0.25 (Fib Resistance).

Now, if we go back at 1st Fib Speed we can see testing from 0.25-0.25(Fib Resistance) and then another break 0.25-0.5(Fib Resistance). Testing is happening at the 2nd Fib speed between the same Fib Resistances as in the 1st Fib Speed.

BINANCE:ALGOUSD BINANCE:ALGOUSD BINANCE:ALGOUSDT

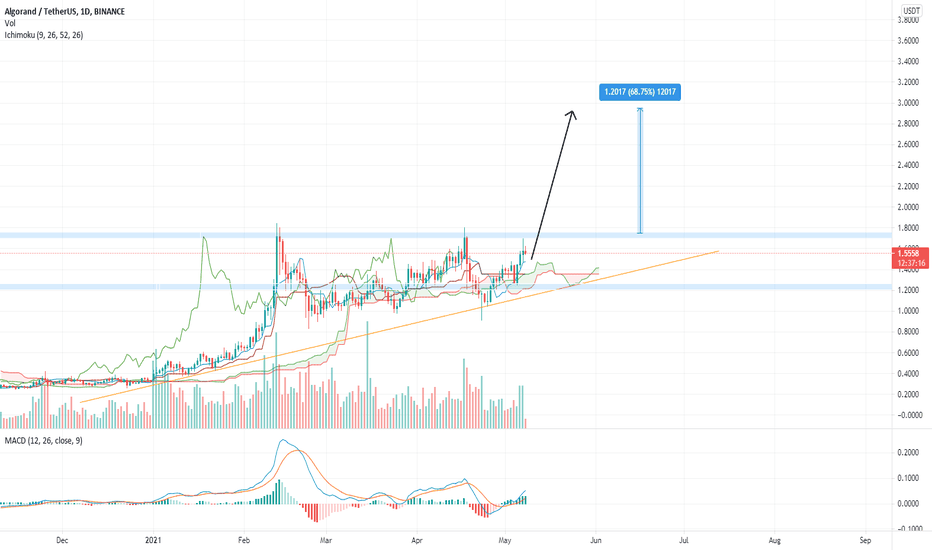

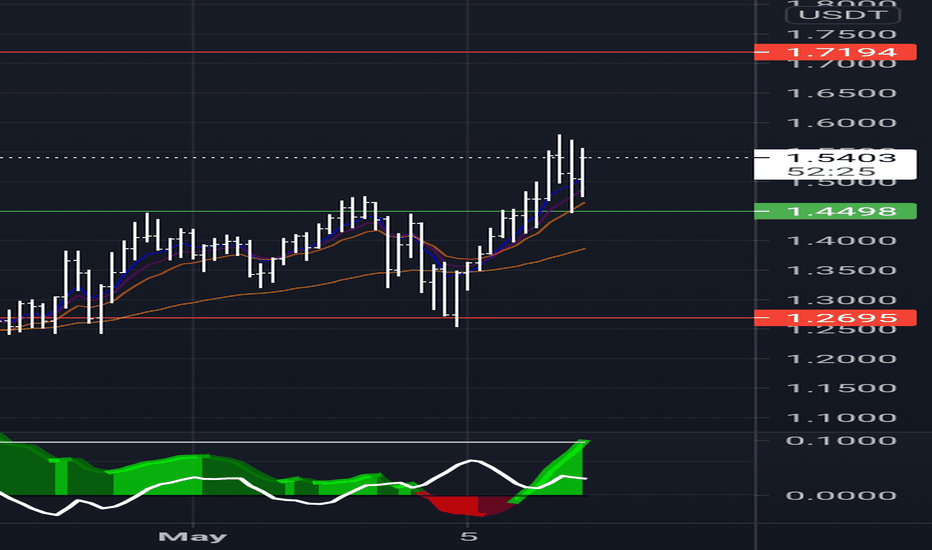

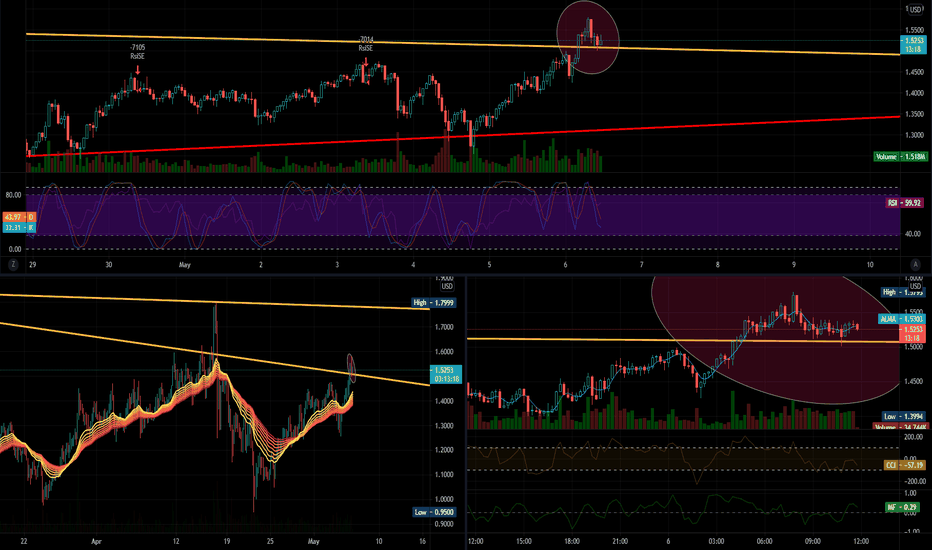

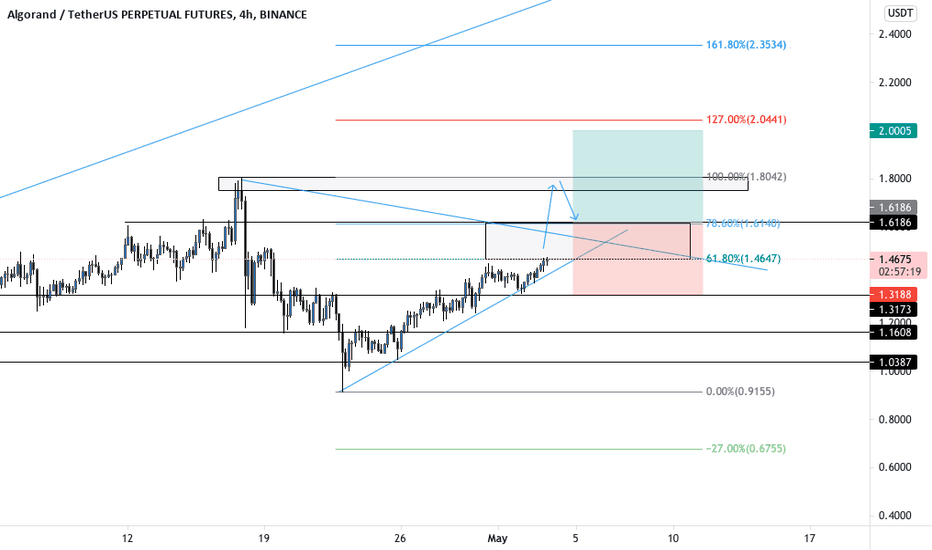

ALGOUSDT | Daily Time Frame | 8 May 2021ALGOUSDT Will pump hard after crossing 1.8$ and this is possible

®Reasons:

✔ Price is above clouds in daily TF (confirmed)

✔ Tenkan-sen crossed Kijun-sen (confirmed)

✔ High volumes is 2 past days (Being noticed)

✔ The opinion of most analysts is Bullish (Optimism)

👍 May be some correction and then go up!

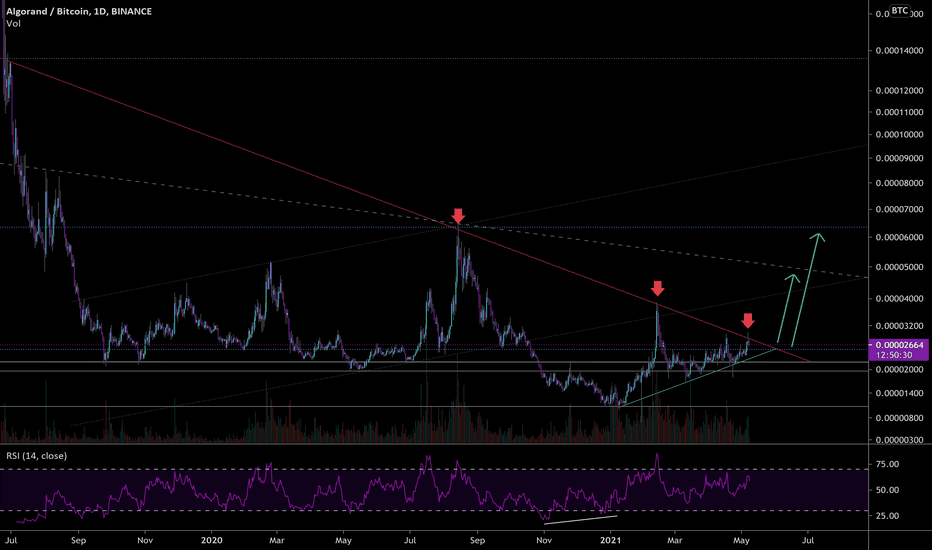

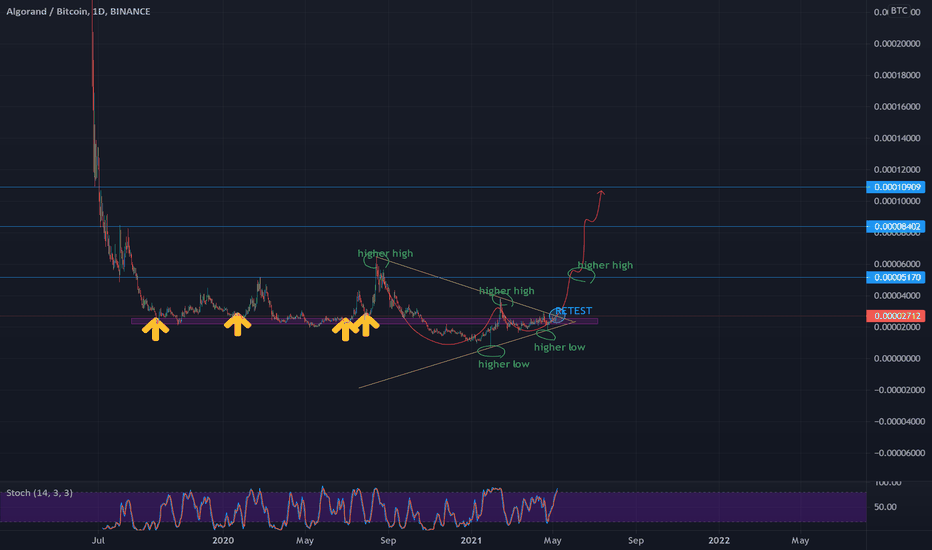

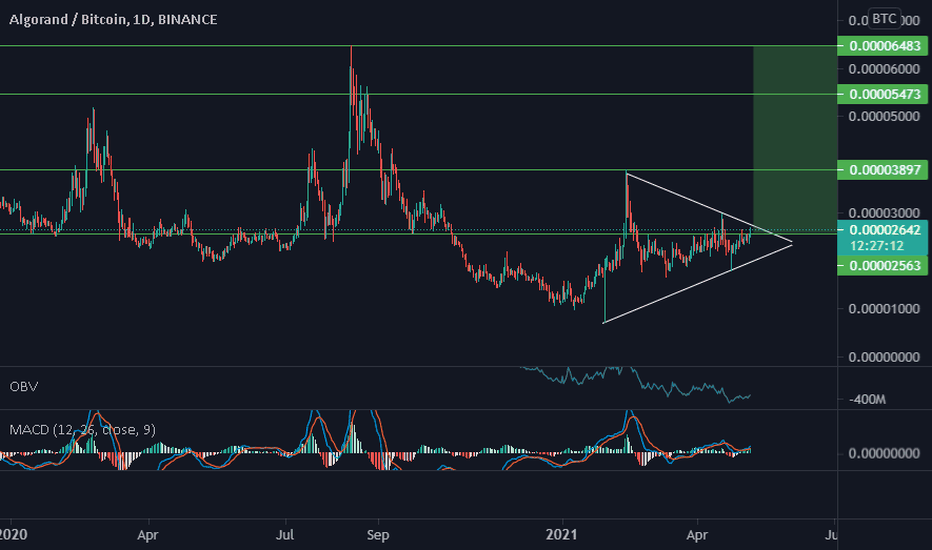

ALGO/BTC Bullish Trade (mid-term)Algorand is looking great and prime for a strong move up. Recent attempt to breakout and retest failed, but this gives us another good entry position. This trade is a mid-term trade, so no expectations of quick gains.

Two potential TP targets for mid-term.

Algo/btc has yet to see some big moves unlike other altcoins the last couple of months. Patience should pay off.

Entry lvls: 2550, 2250.. average into support.

Support: 2192, 1952

Happy Trading <3

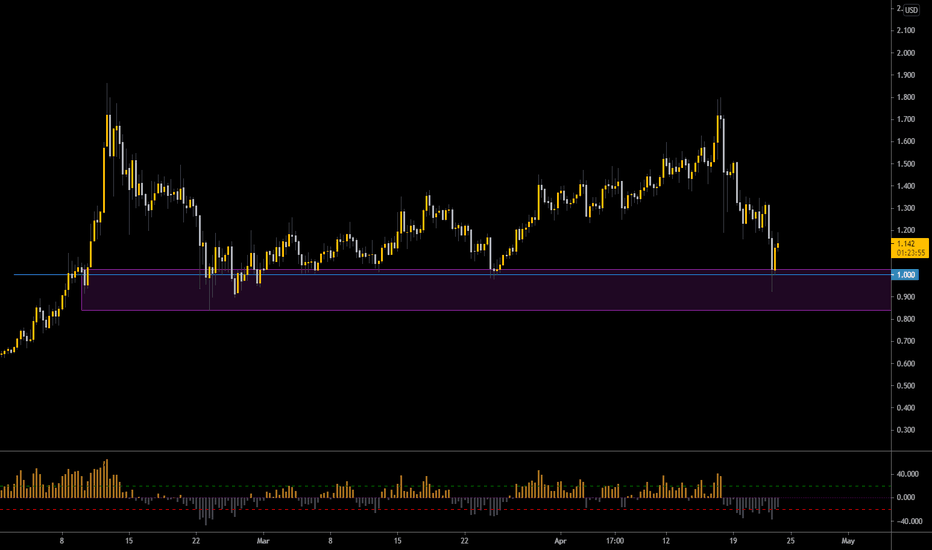

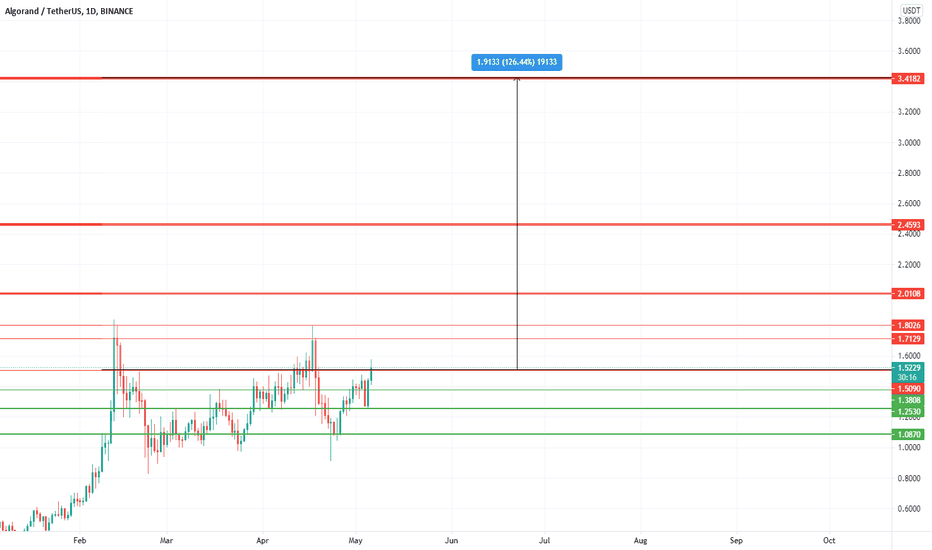

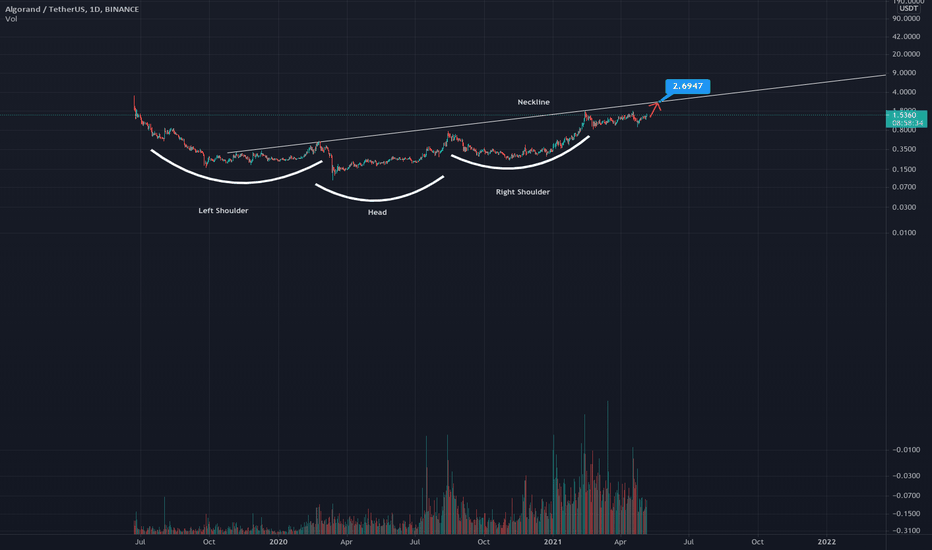

ALGORAND FUNDAMENTAL BUY ZONEAlgorand has bounced successfully from the $1 psychological buy zone in confluence with the fundamental demand area.

This token has a use-case for instant payments with low commissions and rewards through staking. Several payment processors such as NYSE:V & NYSE:MA have shown an intensive interest in this asset since last month. This fact causes the $1 level to be detected as a good buying opportunity, as it is considered reasonable for a token that could be used to pay for goods and services. Its low market capitalization could be a trigger for a very profitable opportunity in a long-term approach .

You should monitor this token, as it is a bit risky to enter while bitcoin decides its next move.

However, we recommend taking advantage of these investment ideas using the DCA (Dollar Cost Averaging) strategy. So that unpredictable dumps or bad timing wouldn't be a problem when entering excellent opportunities.

Check our socials and stay tuned!

Have a good day, Alkalites.

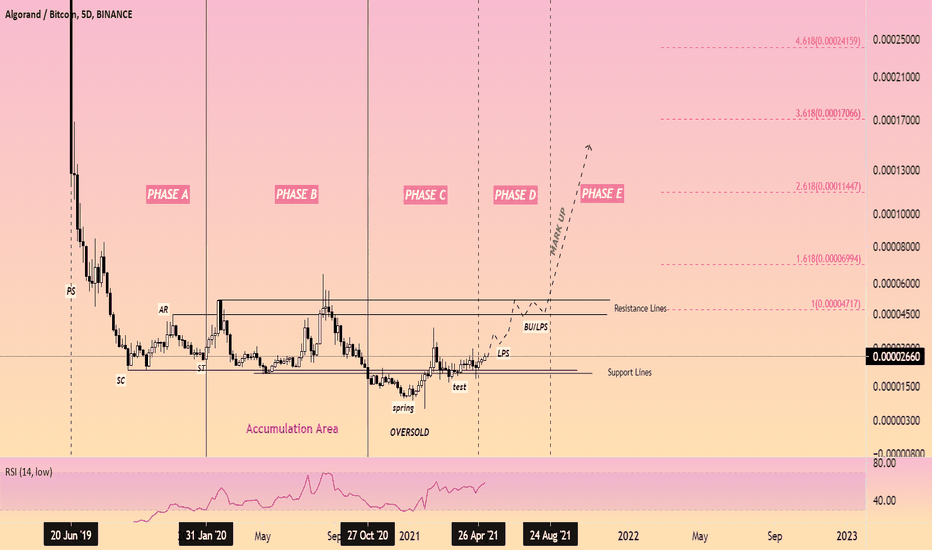

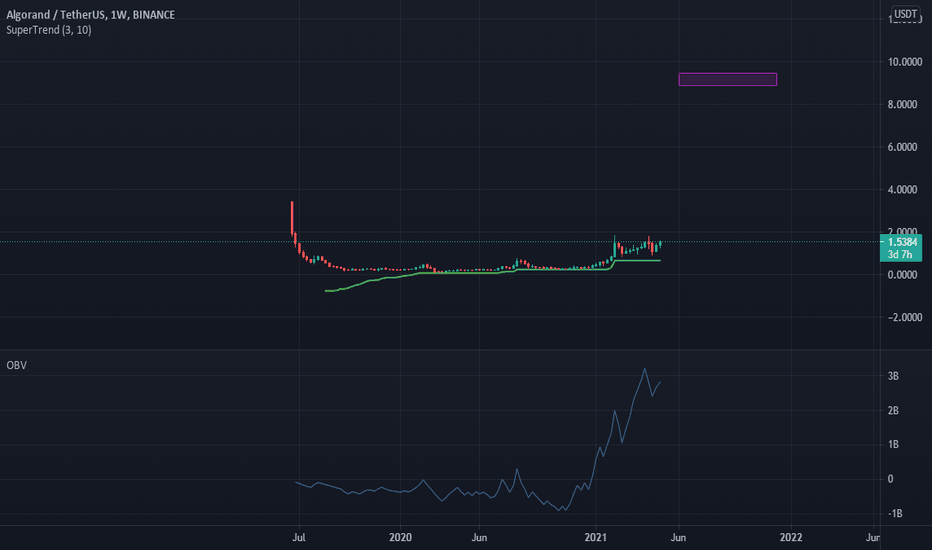

ALL GO RANDPhase D: If we are correct in our analysis, what should follow is the consistent dominance of demand over supply. This is evidenced by a pattern of advances (SOSs) on widening price spreads and increasing volume, as well as reactions (LPSs) on smaller spreads and diminished volumes. During Phase D, the price will move at least to the top of the TR. LPSs in this phase are generally excellent places to initiate or add to profitable long positions.

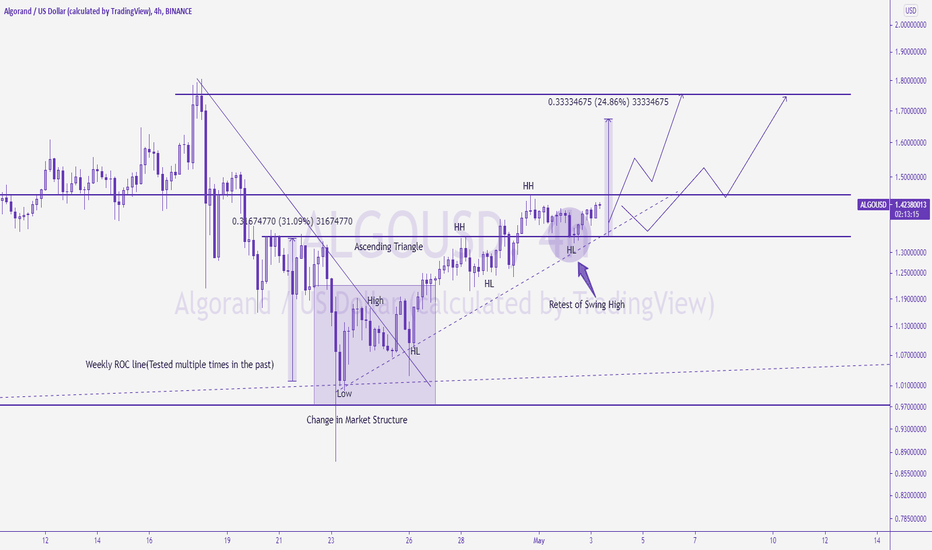

Algorand ALGO-USD Ascending Triangle - Bullish ScenarioPossible scenarios I am looking at:

1. BO of Ascending Triangle

2. Consolidation before the next leg up to ATH

P.S: This is NOT investment advice. This chart is meant for learning purposes only and is a part of my personal journal. Invest your capital at your own risk