Alibaba -how to play this trade with a sea of bad news ?So Alibaba has seen its share of problems in the last months, from intervention from the Chinese government to fear of being delisted in the US from trumps administration in his battle with Chinese stocks to the missing Jack Ma that we still don’t know where he disappeared to ...? a lot of conspiracy theories in that story..

Well with all this mess I choose to look at the technicals and see what they say.

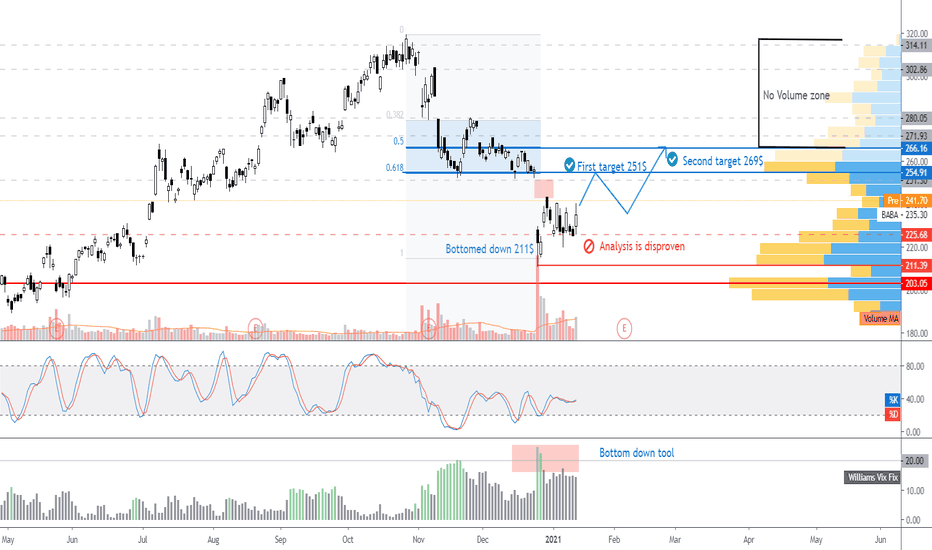

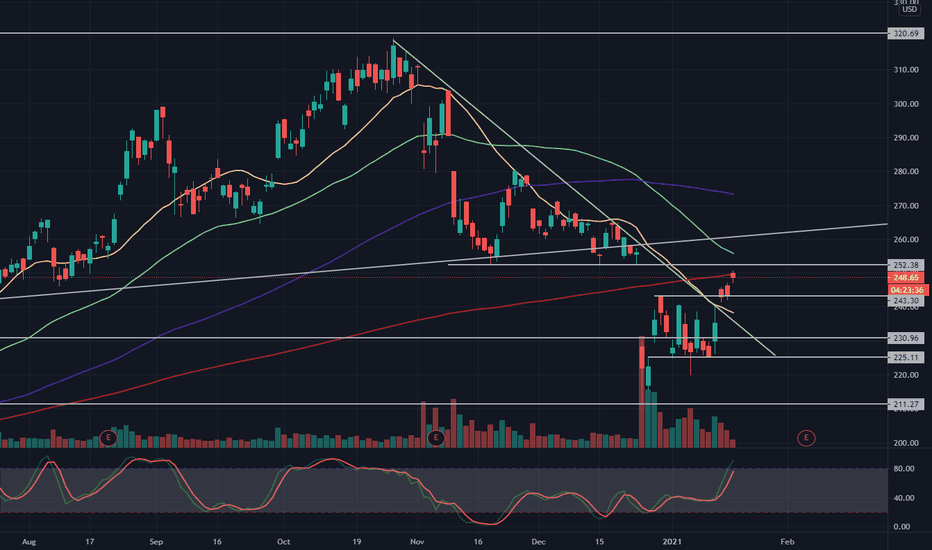

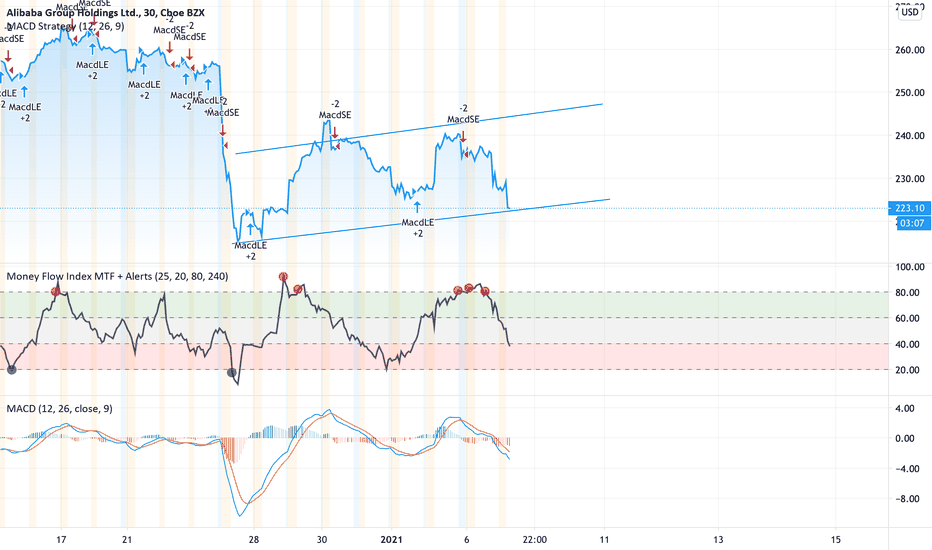

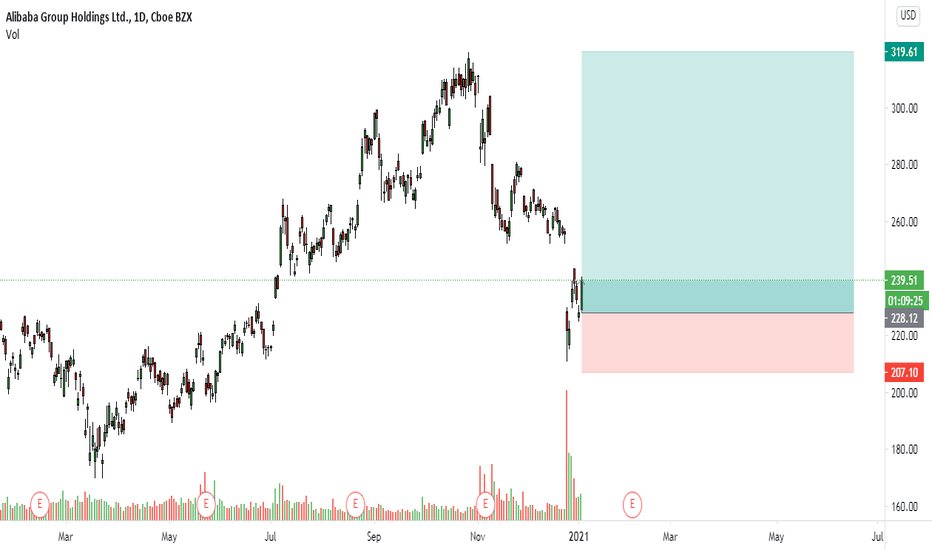

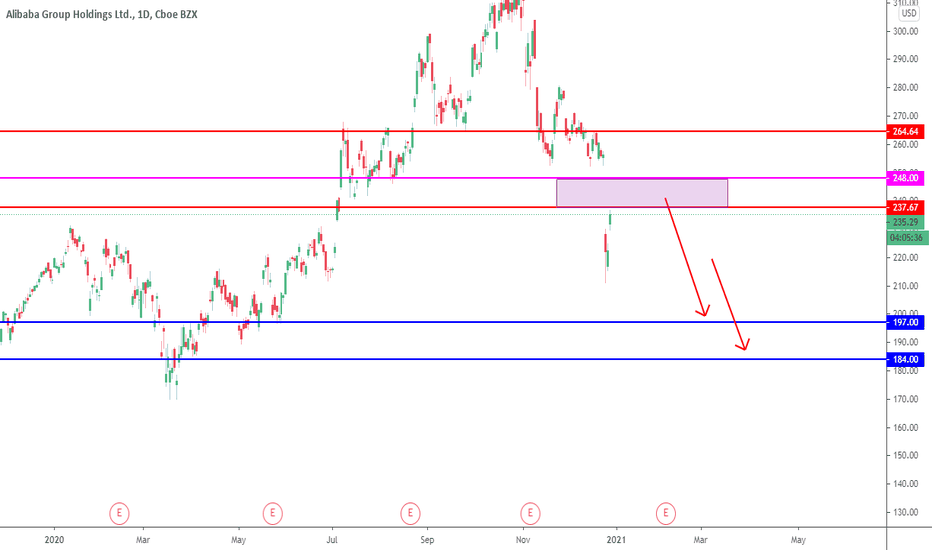

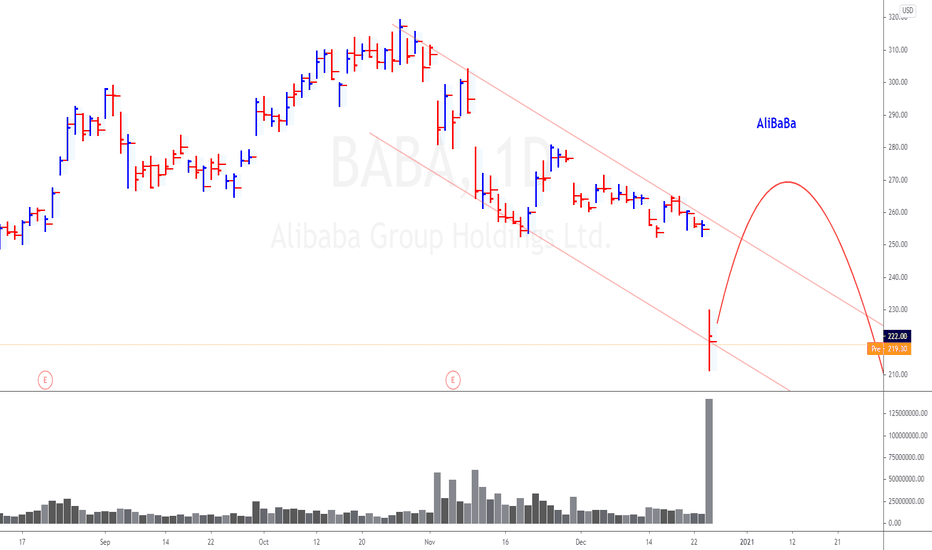

First, we see stock bottomed down to 211$ on Dec 23rd and gave us a new lower low that we can base on. The rise of Alibaba started yesterday on the news that the US will not delist the stock but let's not forget that is NOT what made the stock tumble down but the cancelation of the Chinese government on the IPO of Ant Group and the intent to nationalize both Ant group and Alibaba and of course the missing former English teacher and China’s poster boy for success -Jack Ma.

A lot of bad news and I am here to bet the opposite in the short term (only short term) , from what the chart tells us along with the current sentiment on the stock is that there is a new rise of optimism in the air and the stock will regain some of its loses in the upcoming days to weeks.

The first target for this prediction to come true is a price target of 251$ which will indicate a correction to the 0.618 line, and the fill on the gap of 9$ (241 to 250). If that target is achieved the stock will get more attention and the volume (buzz sentiment) will go up and take the stock to 269$.

At the 269$ I can see we will have a correction downwards back to the 250-255$ line.

We must remember when trading sentiment and fundamental news it's all about what the volume is displaying us as it is a clear mirror to the investor’s behavior.

If we see Alibaba retreating back down to below the 225$ line, then my analysis is disproven and should be ignored!

By the way, on this chart, I used a public analysis tool called the “Bottom down tool”, a great way of seeing if the asset is bottomed down if crosses the 20 line.

This is a high-risk trade and I argue you to do your own DD and keep an eye on the 225$ line to avoid entering too early

Trade safe and a happy 2021 from FDGT!

Alibaba

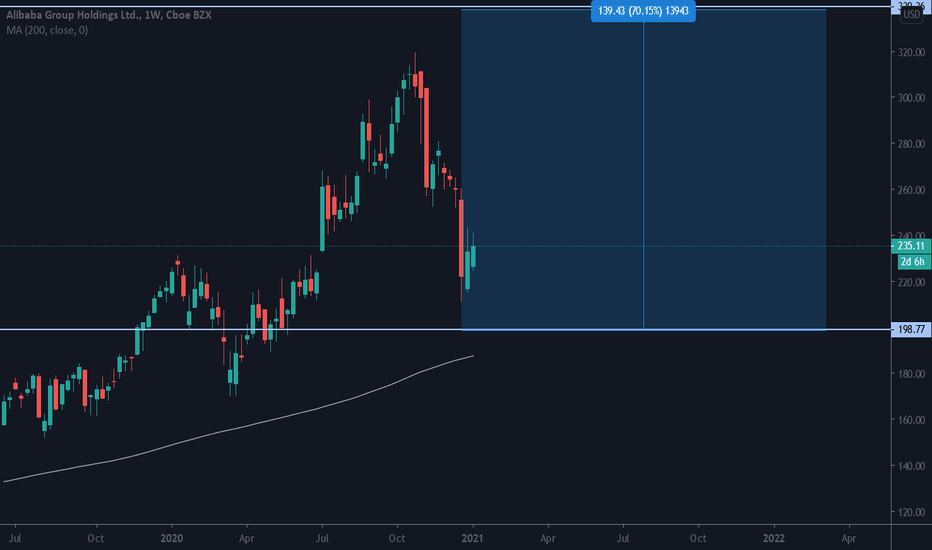

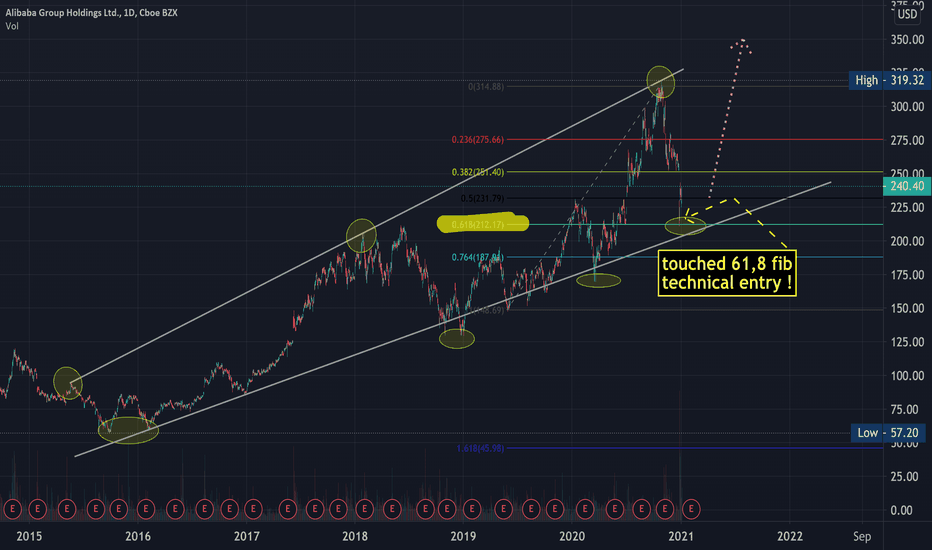

Bullish signals for Alibaba (BABA)Fundamental analysis

1. The stock is fundamentally very cheap (relatively innocent negative news)

2. Analyst consensus target price: 330 (39% upside potential)

3. Growth score of 99 (1-100) (Stockrover)

4. In 2030, 40% of sales will go through internet retail

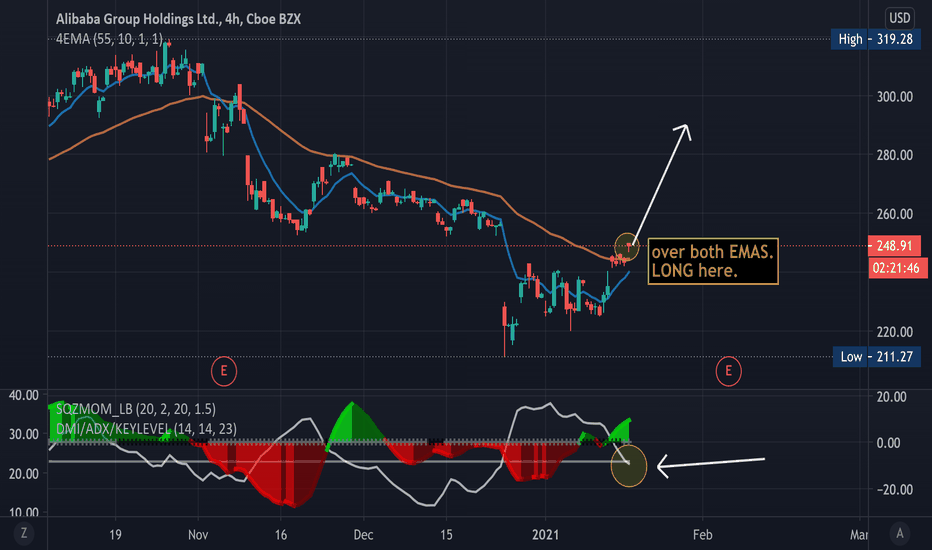

Technical analysis

1. Positive Trend

2. Volume is growing

3. Short-term positive MACD rate

4. Already seeking Support of the MA-10

5. Short term target: 260

6. Long term target / Target 2021: 350

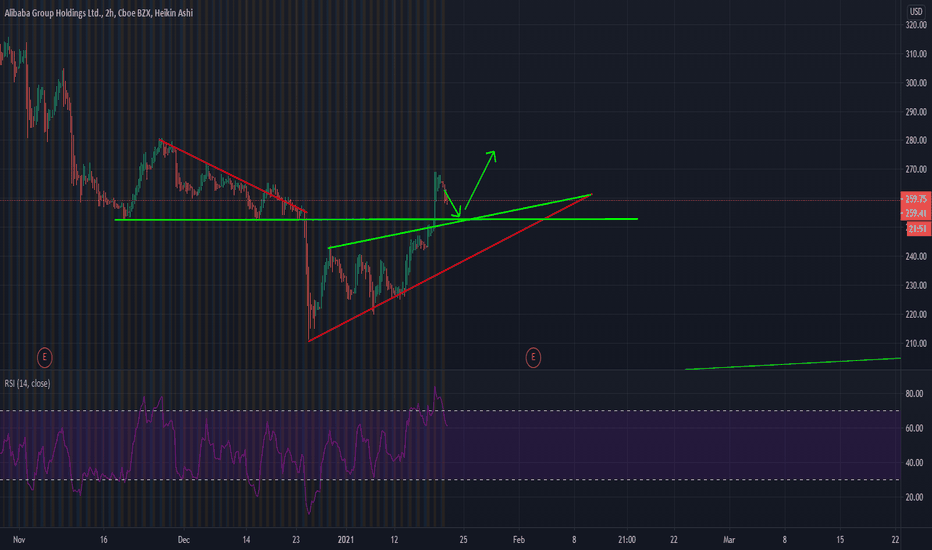

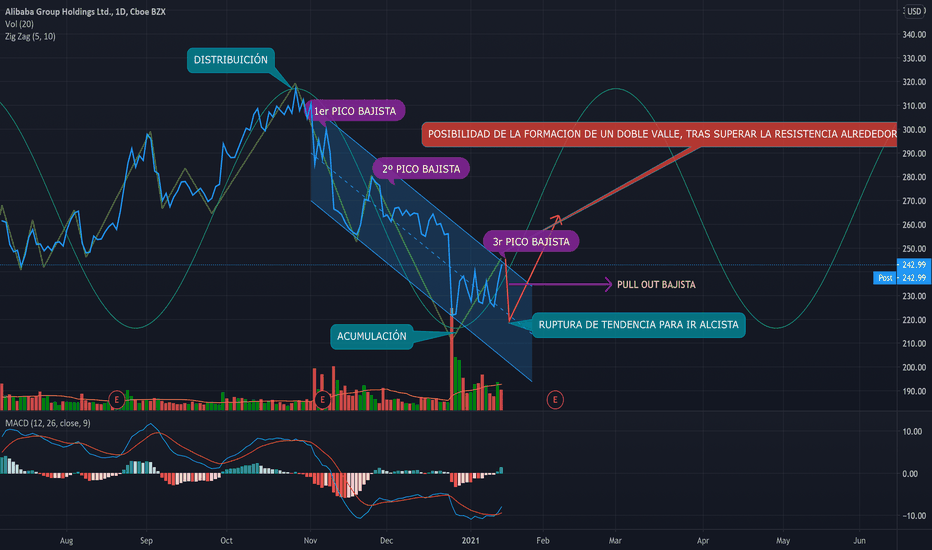

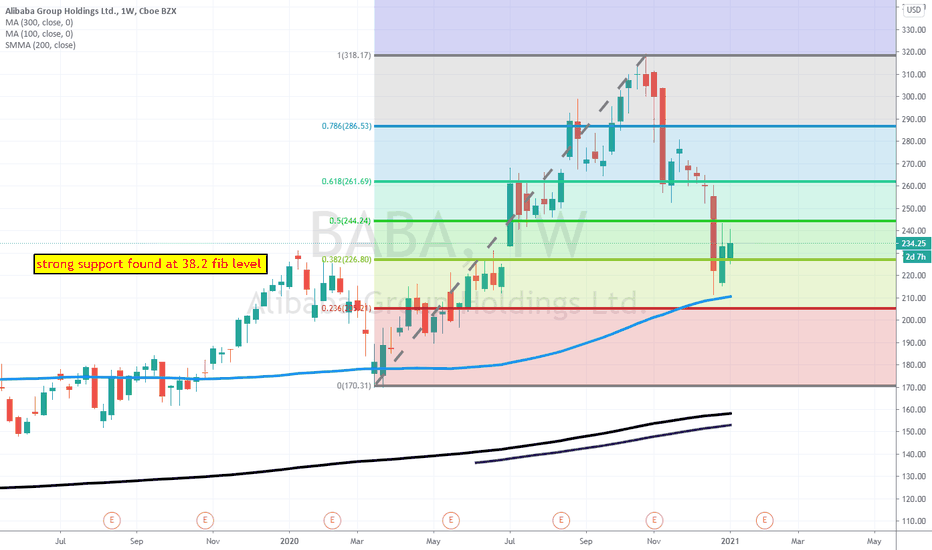

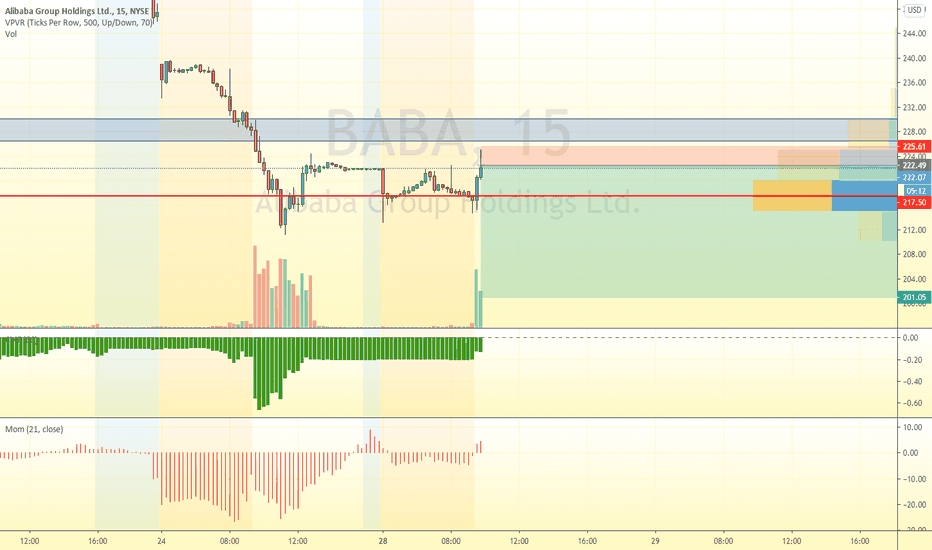

$BABA excelent buy opportunity in AlibabaHolding*Alibaba got it's retrace to technical 61,8 fib level due to investigations from china's govt toward $baba for monopolistic behaviours. This company's fundamentals are just awesome. Just research for yourself, will be amazed. 22% against 5% of amazon in revenue. This company is just exploding and has still much more space on it's way to do that.

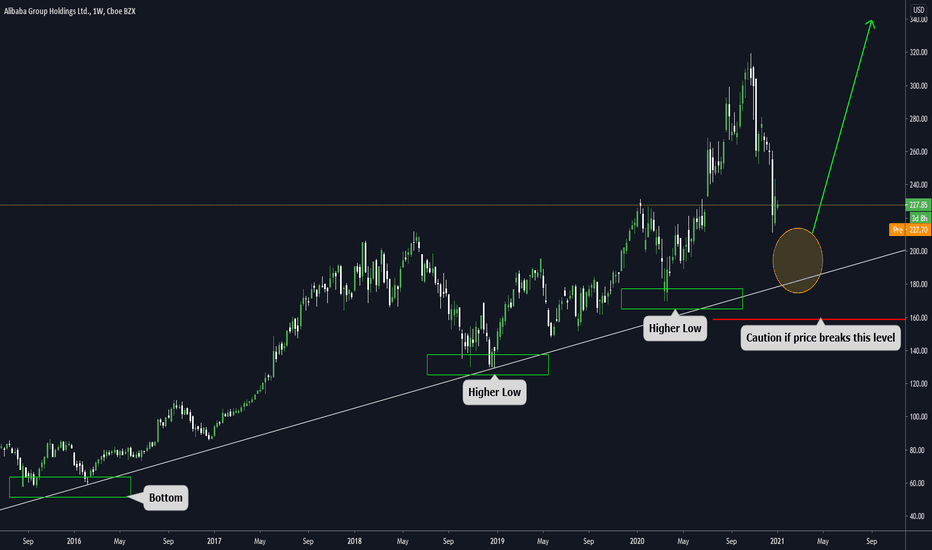

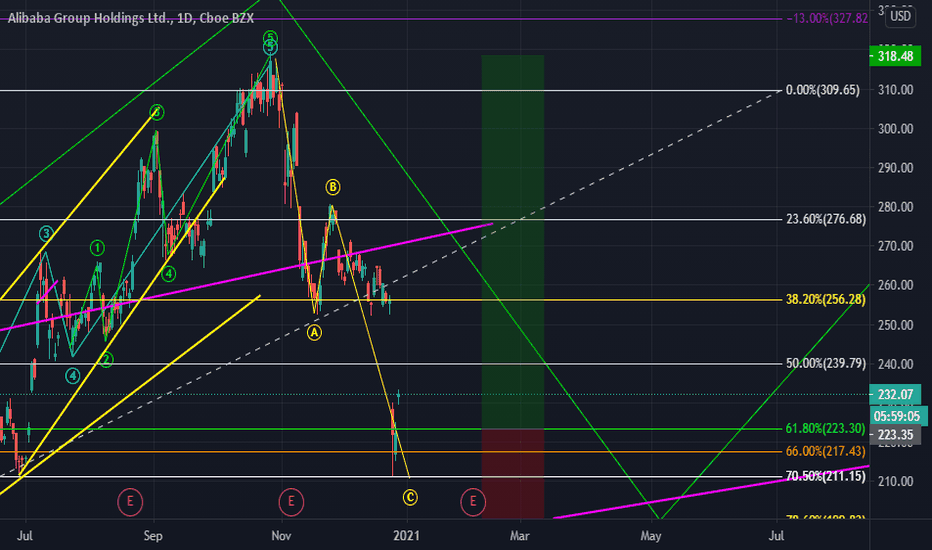

Why is BABA still Bullish?Good morning traders, today we want to show you our analysis in BABA and explain why we consider that this stock continues in a clear uptrend beyond the correction that it is going through the last weeks.

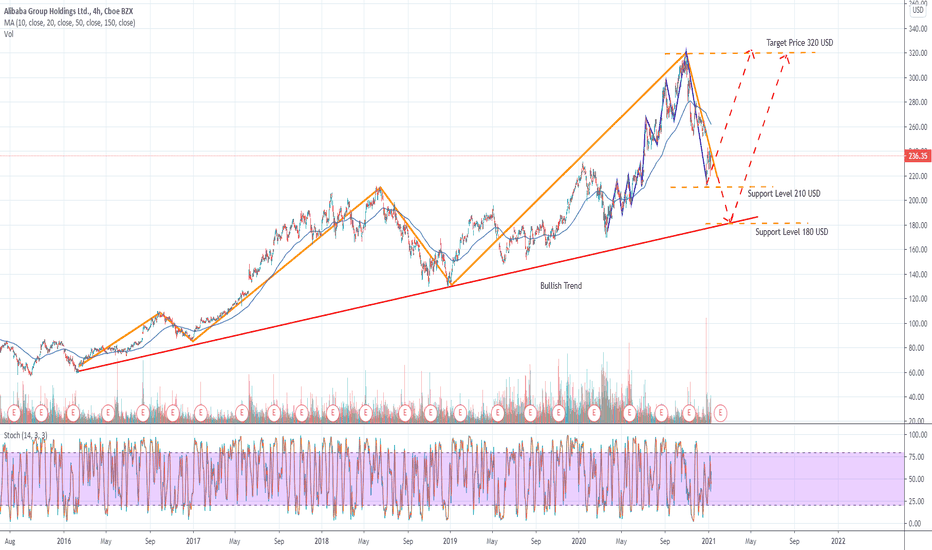

🔸As we can see in the weekly chart, this stock has consistently generated higher highs and lows from the bottom in 2015.

🔸One characteristic that these weekly corrections have is that the majority usually generate a decrease of more than 20%, and the current movement is not the exception.

🔸From historical highs, in November, the price made a downward movement of more than 30% towards the level it is currently at, which has generated a certain alert in many traders that had bullish positions.

🔸As we said previously, this series of highs and lows have not yet been penetrated downwards, so there is still the possibility that the price will find support in the area where it currently is, and that there is also the Ascending Trendline.

🔸It is an area where there will most likely be an interesting demand.

🔸Anyway, we always have to be careful and analyze all possible scenarios so that nothing takes us by surprise.

🔸In case the price manages to break the trendline, and the last low (support zone), we will consider that there may be a change in trend or a more pronounced correction. Until then, the scenario remains a healthy uptrend.

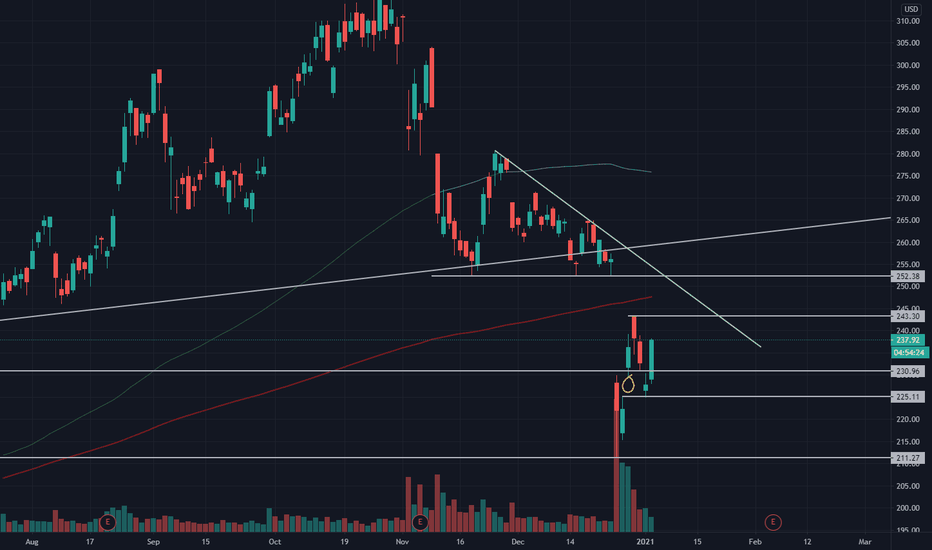

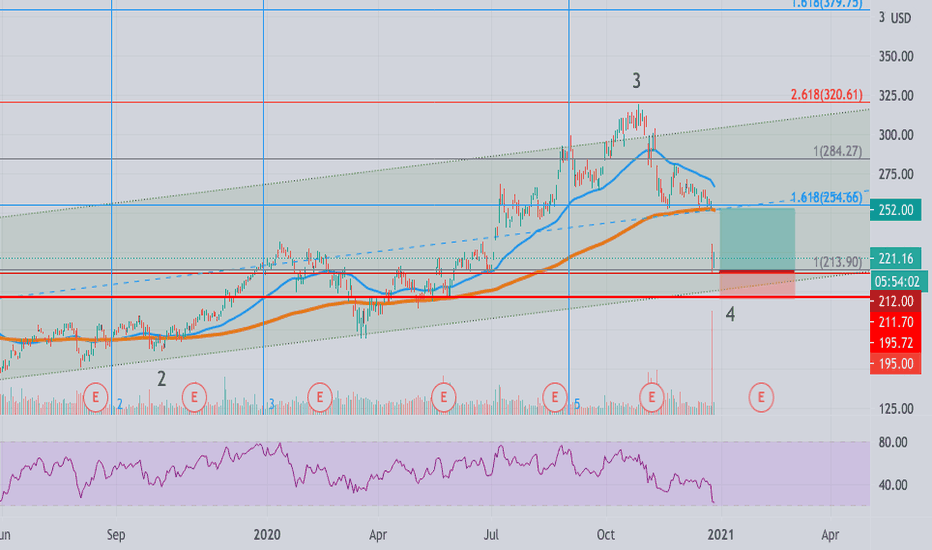

#BABA : How severe will be the punishment?Chinese authorities have decided to punish Jack Ma for the criticism of Central Bank bosses.

Will they destroy the company of remove/jail Ma?

Knowing chinese pragmatism that is unlikely.

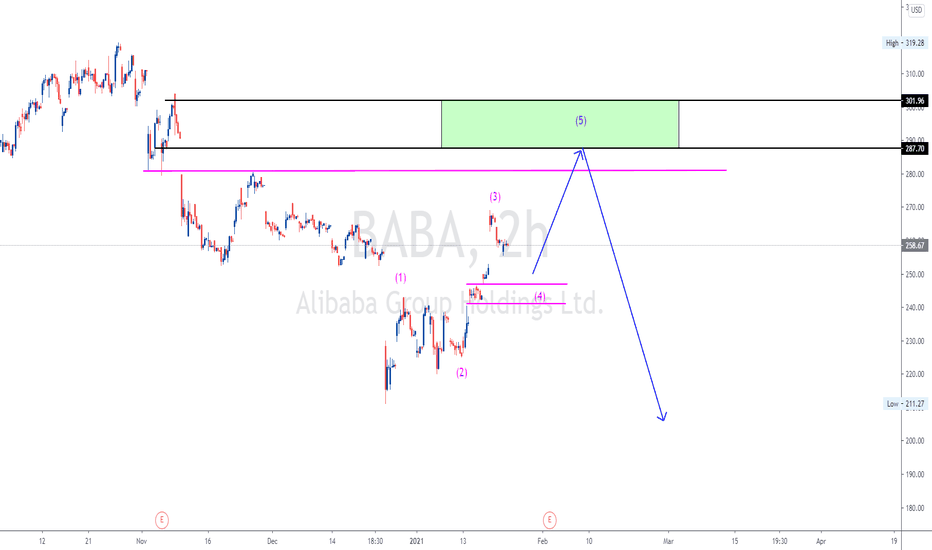

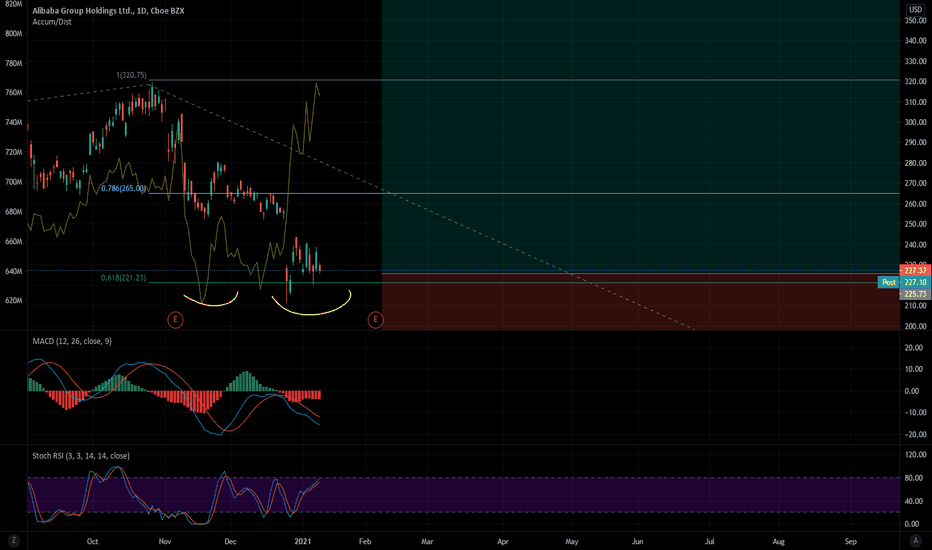

Technically the price growth towards 379 is still possible as long as 196 level holds.

In order to bet on the closure of 23-24 December price gap it make sense to set (preliminary) limit Buy order at 212 with Target at 252 and Stop at 195.

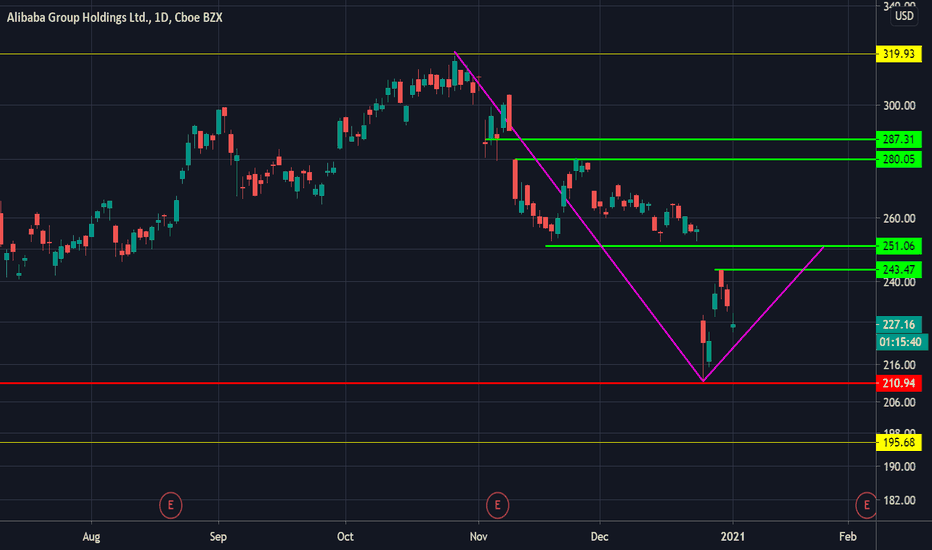

Alibaba (Never Outshine the Master)View On Alibaba (28 Dec 2020)

Jack Ma made 1 big mistake. It is called " Never Outshine the master"

This Kampong boy couldn't just resist the new found fame in recent years and crossed some people.

Now his investors are paying the price.

Alibaba is still a good company but I kind of doubt it will shine again soon. Stocks may go back up to 260-280 but every swing up now is chance to sell, IMO.

Let's see..

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DISCLAIMER:

Any opinions, news, research, analyses, prices or other information discussed in this presentation or linked to from this presentation are provided as general market commentary and do not constitute investment advice.

Sonicr Mastery Team does not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.