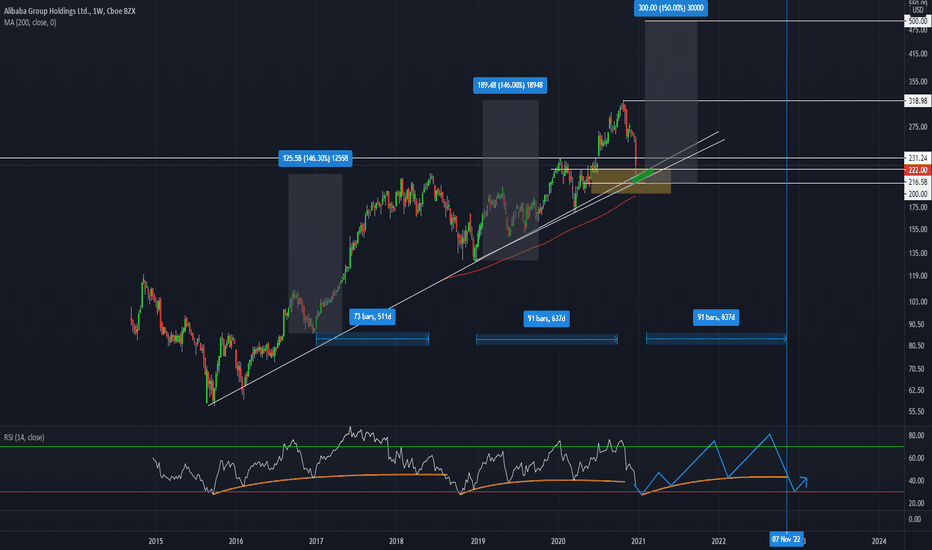

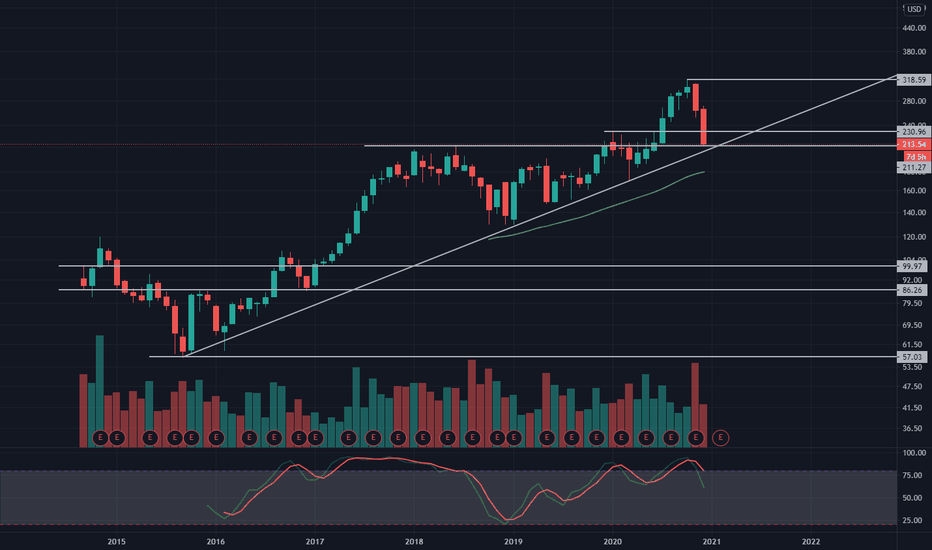

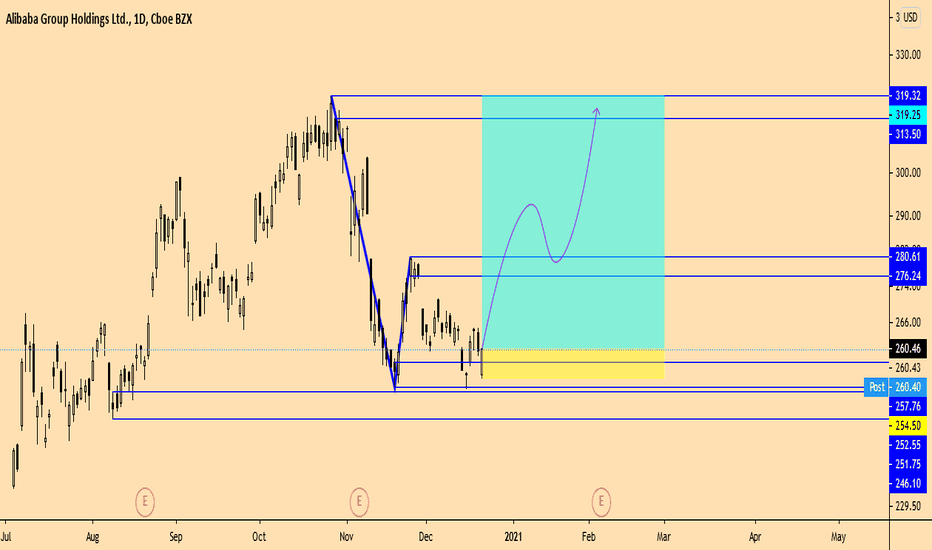

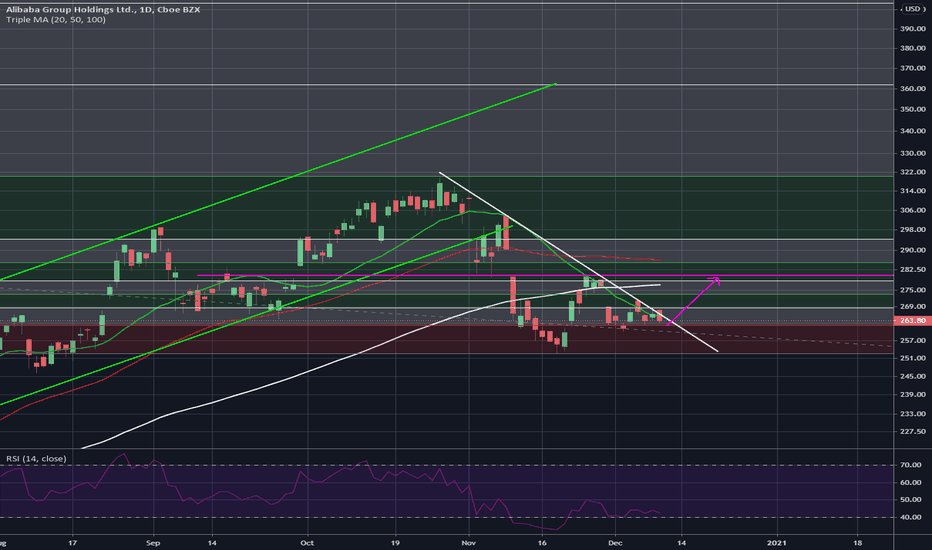

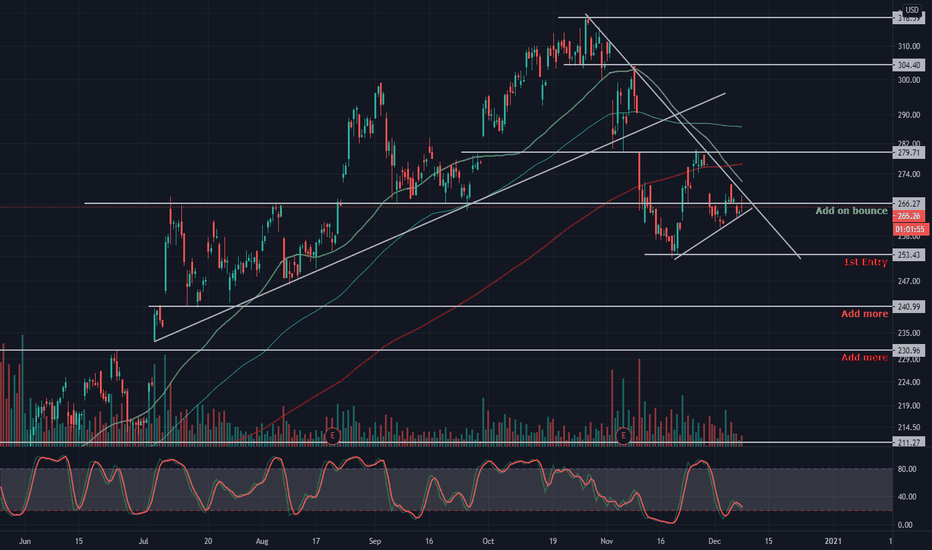

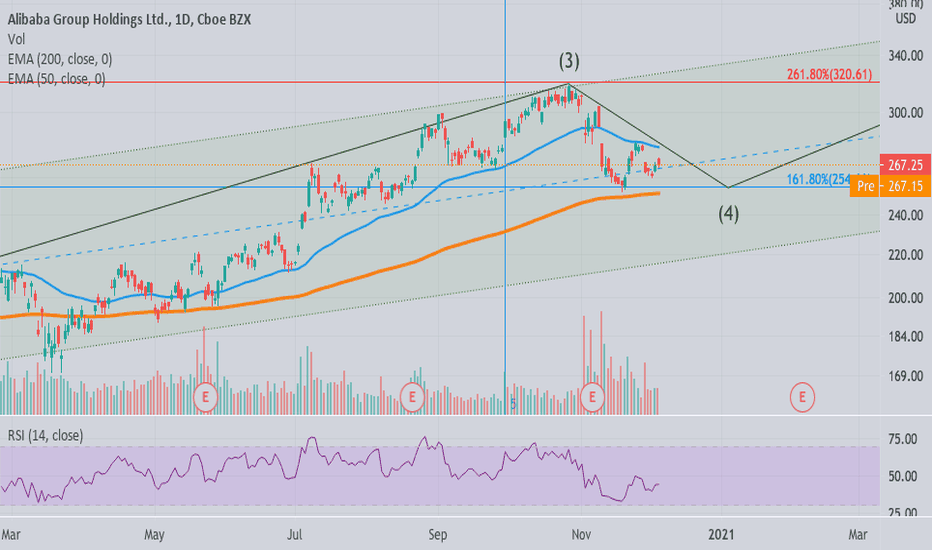

$BABA #BABA Opportunity or Trap? $BABA #BABA This one I got stuck in the trade, but I am not worry too much about it, over the longer term it will go higher, technical wise, we dropped and hit the support levels.

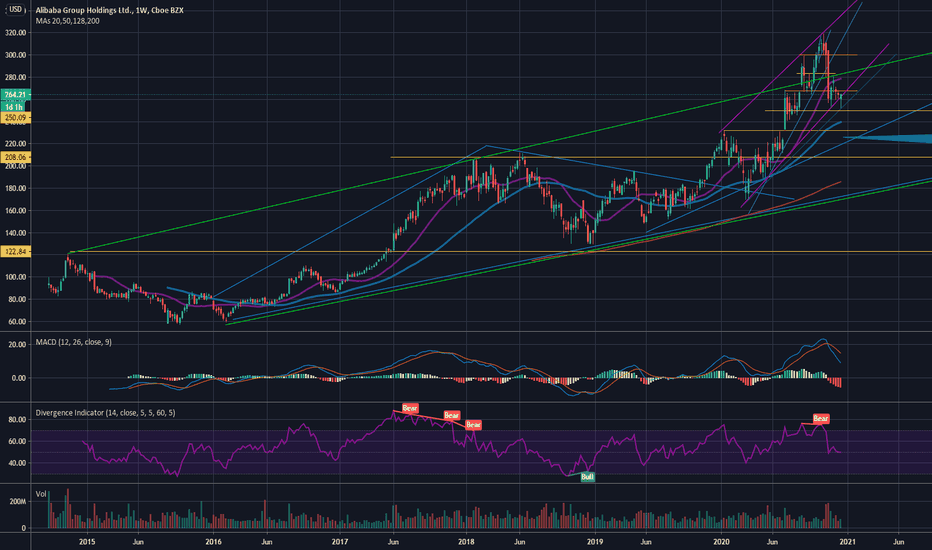

If you take a look at the charts, it hit the weekly 100MA and bounce off it. Also a previous resistance area that now is support. If you have a longer term outlook, this could be a buying opportunity. If you remember AMZN, FB, GOOG all had these anti trust problems then moved much higher later on.

Though there is a risk being this is a Chinese stock and not know what the government can do. I took half my holds off before this drop for a small lost and I kept half my leaps around with some short calls to pay down the cost. I'll just keep selling calls to pay down the leaps and possibly sell some put credit spreads to speed up the process. I wait till it find a bottom and will add to it.

BABA is still one of the largest business in the world and still have huge growth ahead of it. It's moat is very wide, they got their hands on every business in China. They have monthly active users of 846 million people! Compare to Amazon 200 million. So longer term they are still a great company to buy. Your risk is mostly political and geographical because it's base in China.

Alibaba

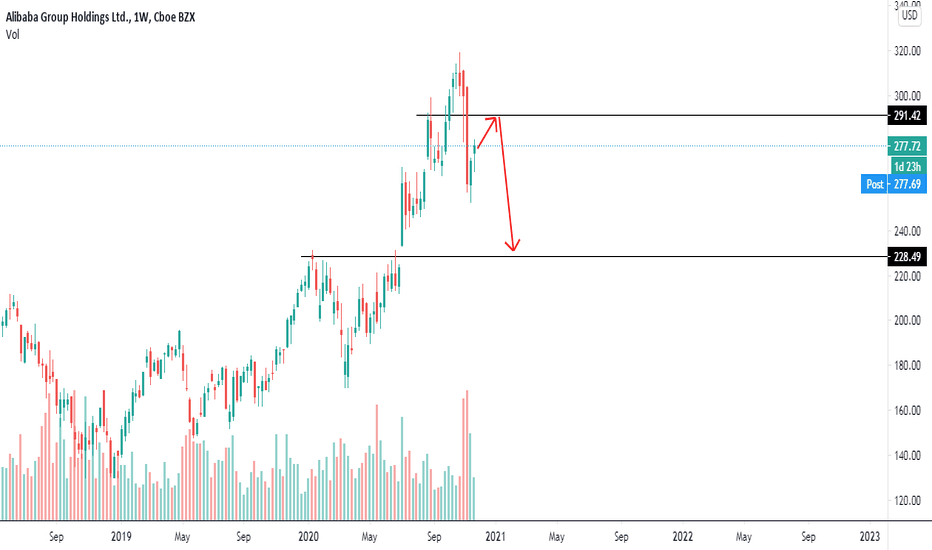

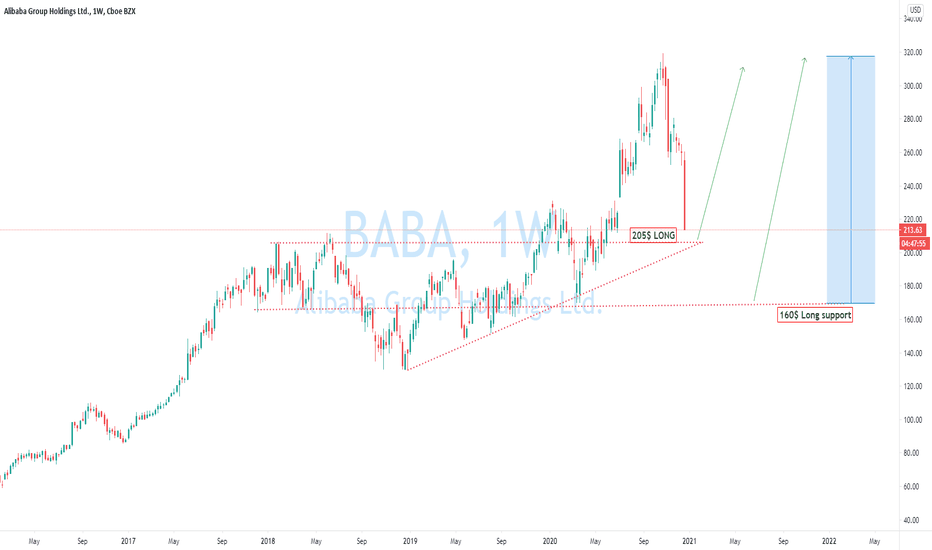

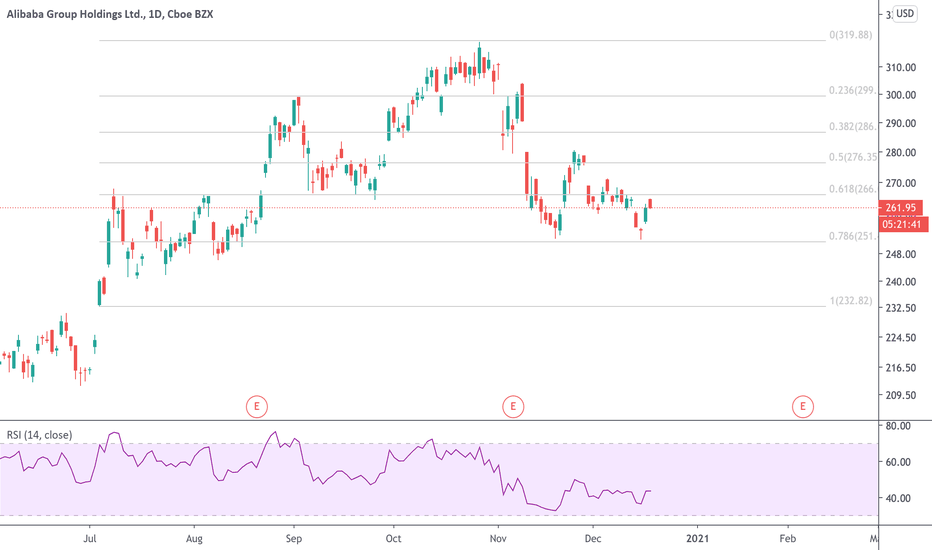

GAP CLOSE - ALIBABA stockFundamental analysis for BABA is not good. They are going to be investigated by the Chinese government for abusing of monopoly position on the market. But the GAP on the chart should be closed. So I am expecting a pull-back to $260. Long term position should be considered. It seems to be the same story as FACEBOOK or GOOGLE sued by the US government.

205$ if break then 167$ Support level for long.Chinese government hit $BABA with antitrust probe and the stock has fallen so far 15% More downside expecting 205$ support level if price breaks out support then next level for long 106$

🛑SUPPORT/RESISTANCE

✅S1= 205$

✅S2=167$

✴️R1=260$

✴️R2=310$

Please like, share, comments and follow me to get daily base analysis.

Thank you for your support, I appreciate it.

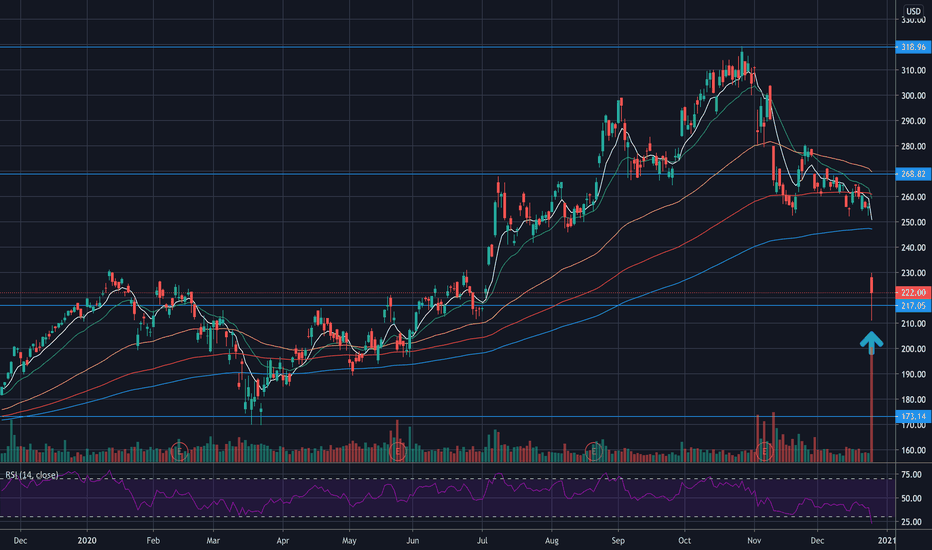

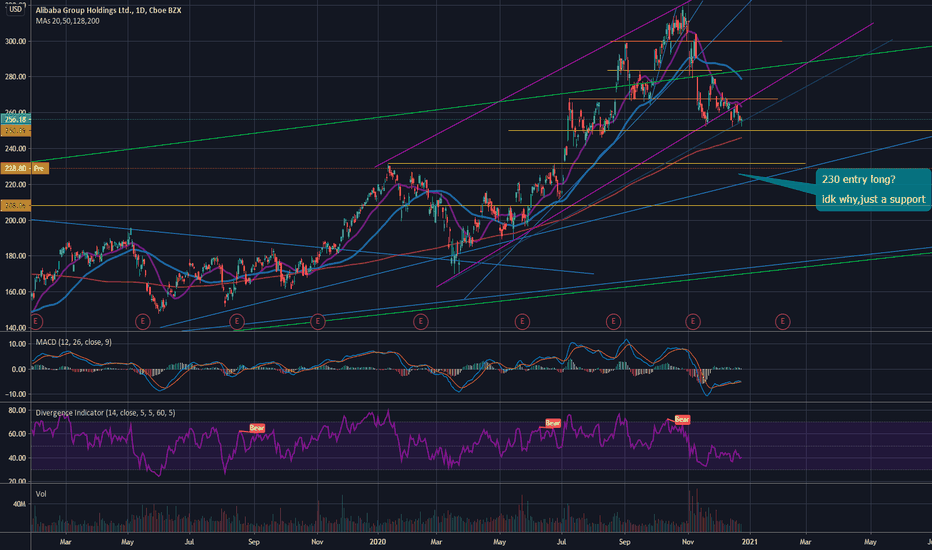

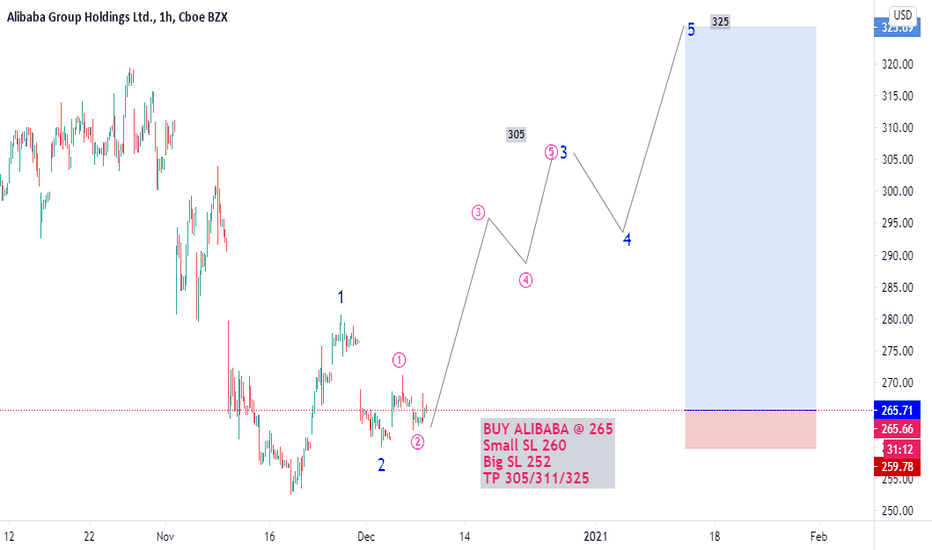

ALIBABAis time to BUY LONG ALIBABA come? well, it is going under the antitrust probe.

anyway, it is still a good stock given the fundamentals, so why should not buy it? well, China is known for its being communist, so if china's boss what Alibaba to stop what it is doing, Alibaba will stop.

but we got to remember that Alibaba, since it is a big one of e-commerce in China, it has yet space to grow, as long as the Chinese population's richness grows.

so, as my previous analysis, at 230 we are in the middle of the old-growth trend, which can be a good point since it is also a support 1 YO.

so, I think ill buy some, it went almost 1/3 down since its ATH (315), so it is a buy for me, after all, the antitrust can continue, but everyone wants Alibaba to go since it Is also helping the Chinese environment (it does a lot actually, not only e-commerce, even if at this time more than 80% of its revenue are from e-commerce)

I think it can be a good BUY THE DIP, but it can go even lower, you just have to be patient and wait for the long run

ALIBABAi just wanted to make you remember that it is YET in the top part of the 5 yo channel.

if u buy here, you buy a 5 yo channel top, AND 2 yo LOST channel.

it CAN be an opportunity, alibaba is surely a good stock, yet, in technical analysis is not good looking after all (I would say only the MA 200 and the $250 support(?) in the daily chart)

but It is also kinda risky, it is Chinese (xi Jinping has kinda a lot of power, even on these big stocks).

chart: idk, it can be a TOP, or a LOST trend, OR 200 days MA.

china: ma should shut up if the stock wanna go up, ma should speak if he wants china as western countries (free)

just we will see, trade safe and do not risk all of your money in a single trade :D

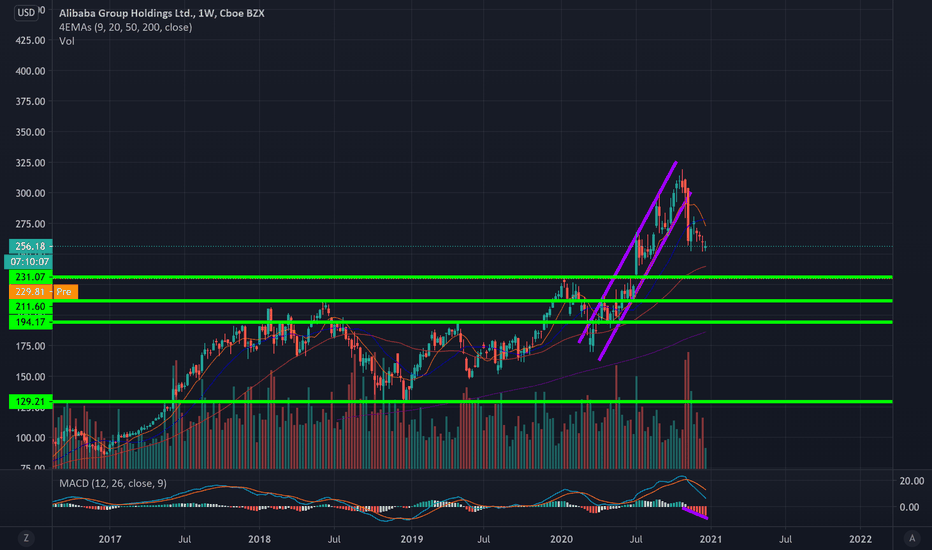

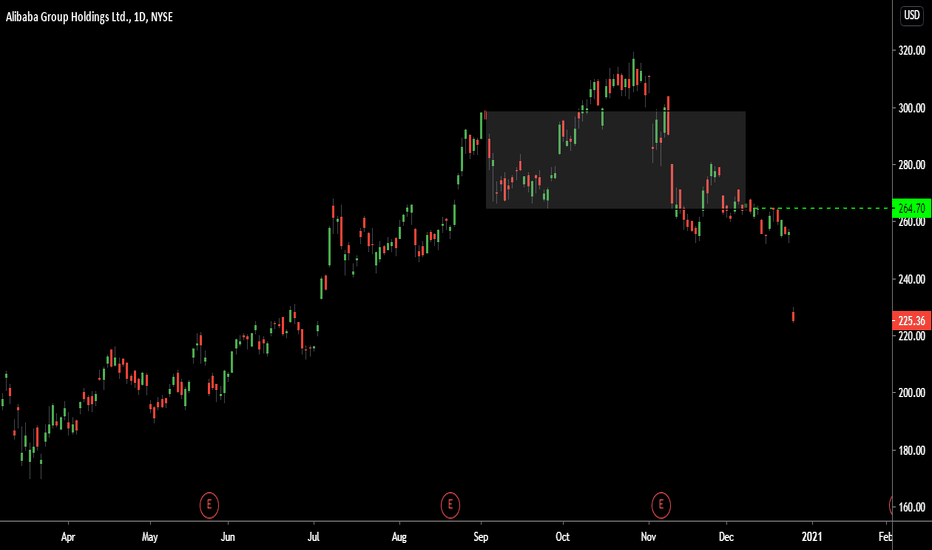

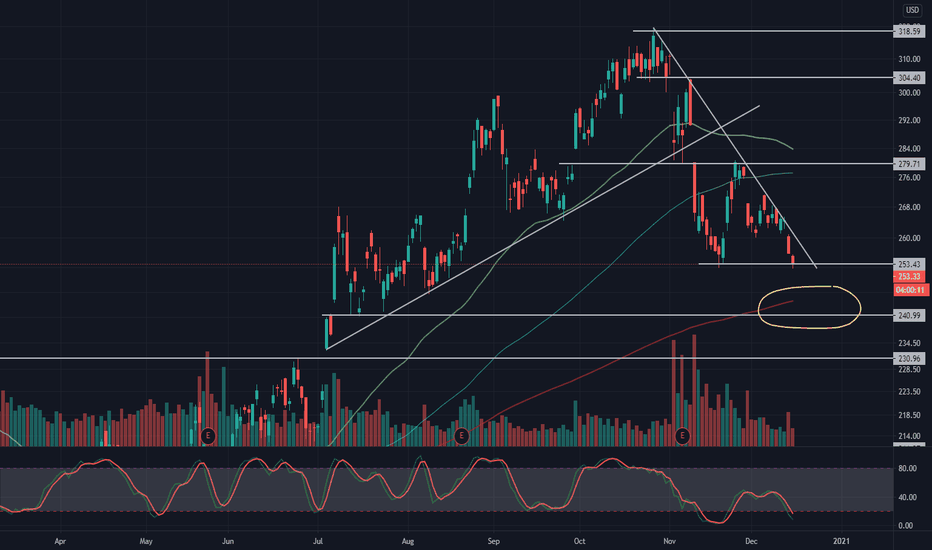

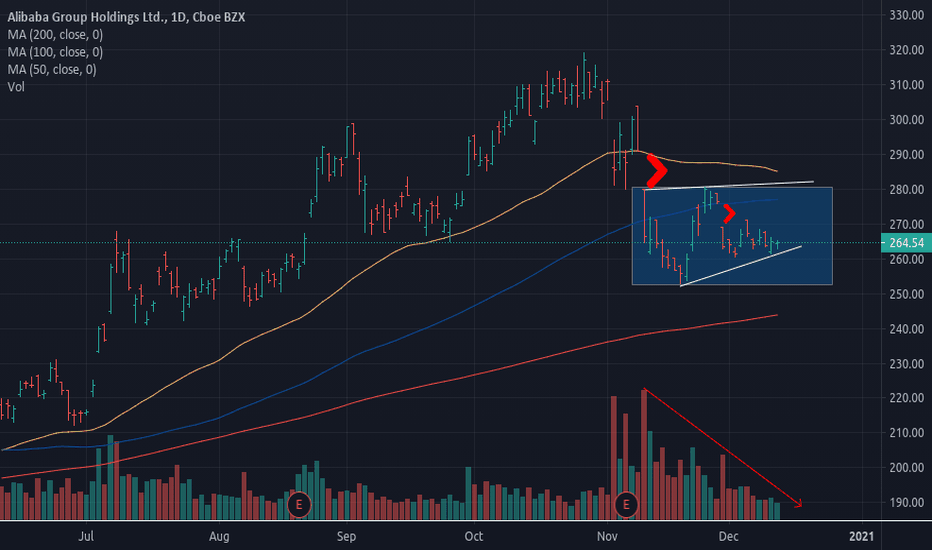

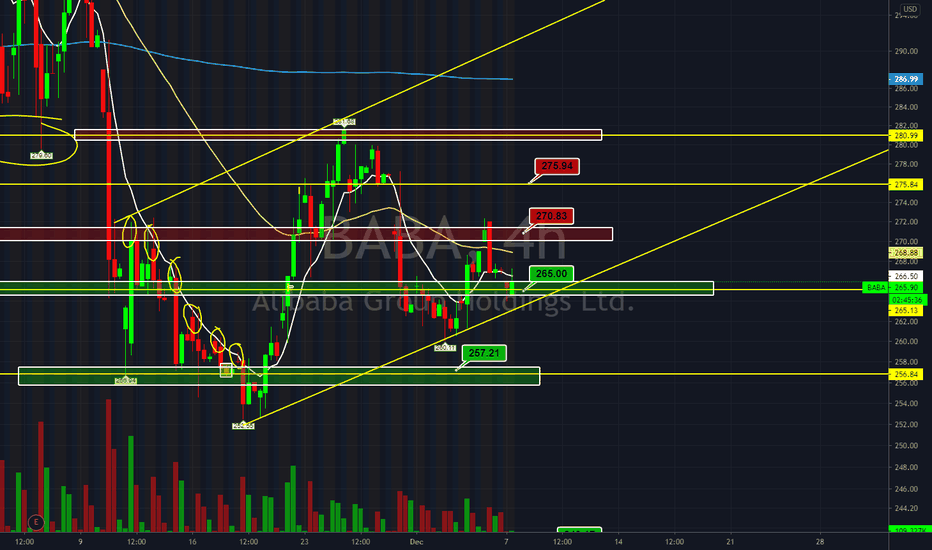

BABA - China/US tension heavy on the stockSince the first news that the US is going to ban Chinese companies to list on the US stock market, $BABA was one of the first to took the hit. This can be seen in the volume spikes when investors started to close their positions.

The two uncovered gaps to the South are also making an impression. Volatility has calmed down since then as seen in the lower volume levels, but we are not witnessing any fresh buying or selling.

Price is currently in a range after getting out of the long-term uptrend.

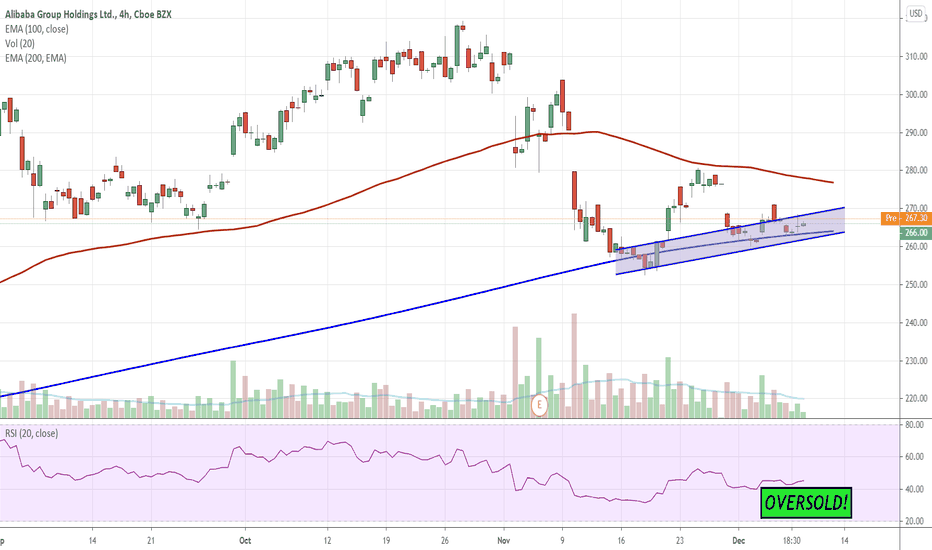

ALIBABA CAN GO UP SHORT TERM We can see on 4h chart that we are close to 200 EMA, and this was solid support last couple of times. Also, RSI is in oversold zone and quiet. It looks like that is time for buying, at least for next 2 weeks for some swing trades. After Christmas I expect for most of the big names to calm down during the holidays.

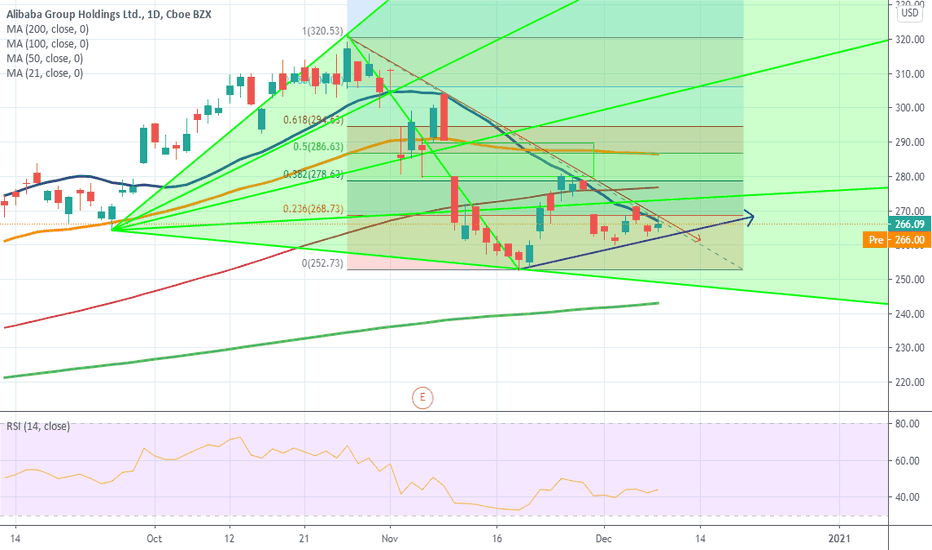

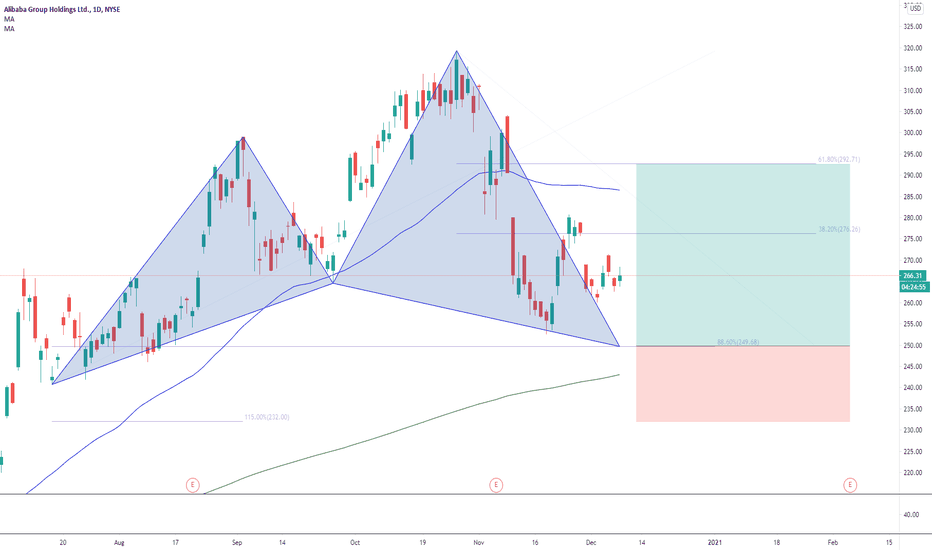

ALIBABA : BULLISH CYPHER PATTERN IN DAILY TIMEFRAME 🔔Welcome back Traders, Investors and Community!

Analysis of #BABA

If you have found this useful then help us support my page by hitting the LIKE button.

If you are not subscribed yet then please feel free to follow my page for daily updates and ideas. Thank you

It means a lot to us!

***

Strategy: Bullish Cypher harmonic pattern

A clear chart is Always the best business card for a trader.

***

Your support and feedback will always welcome

Thank you for your time.

The information contained herein is not intended to be a source of advice or credit analysis

Regards,

Walter

Alibaba Group Holdings Ltd.Monday, 7 December 2020

22:51 PM (WIB)

Alibaba looking great and healthy. Seems no problem internal with the holdings Ltd. It looks normal. It's just a transition move from the top of the head and overbought, to the neckline's formation.

Check for tomorrow if any updated news

Best regards,

RyodaBrainless

"Live to Ride and Ride to Live"

$BABA - "OPPORTUNITY" NYSE:BABA

BABA on a rollercoaster ride with several negative catalysts getting priced-in causing a significant pullback. Down about 17% from its ATH (as of the time of this writing). Waiting for $265 validation of support, watching two other support levels at $257, all the way down to $240. A breakout of $275 resistance is critical to have a chance to test $280 - $300.

Undervalued company, in my opinion, with a significant competitive advantage in China and its growing economy, Ali Cloud is underappreciated and brings a lot of growth potential in the future. A positive catalyst to also watch is the potential ANT Group IPO along with their successful compliance with S. 945 "Holding Foreign Companies Accountable Act".

LONG all the way. Cheers!

-Kaswrp