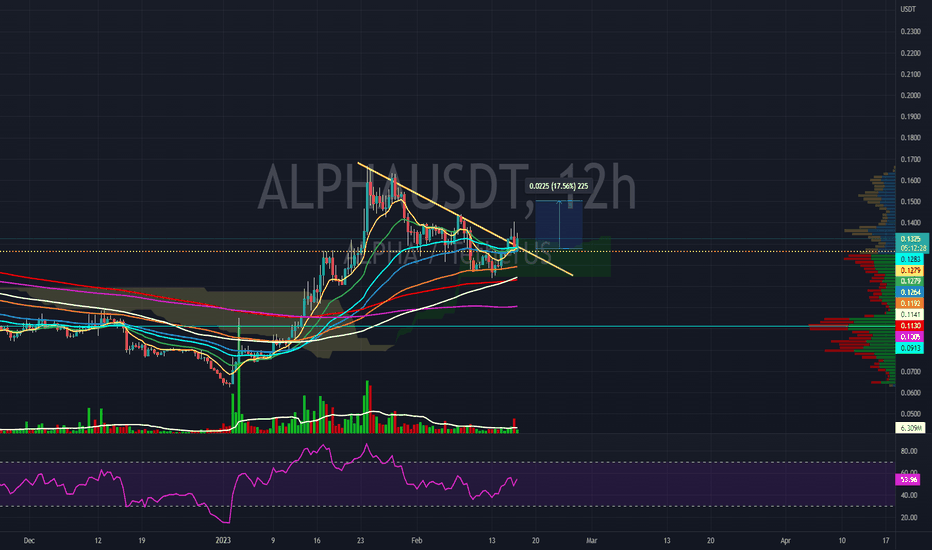

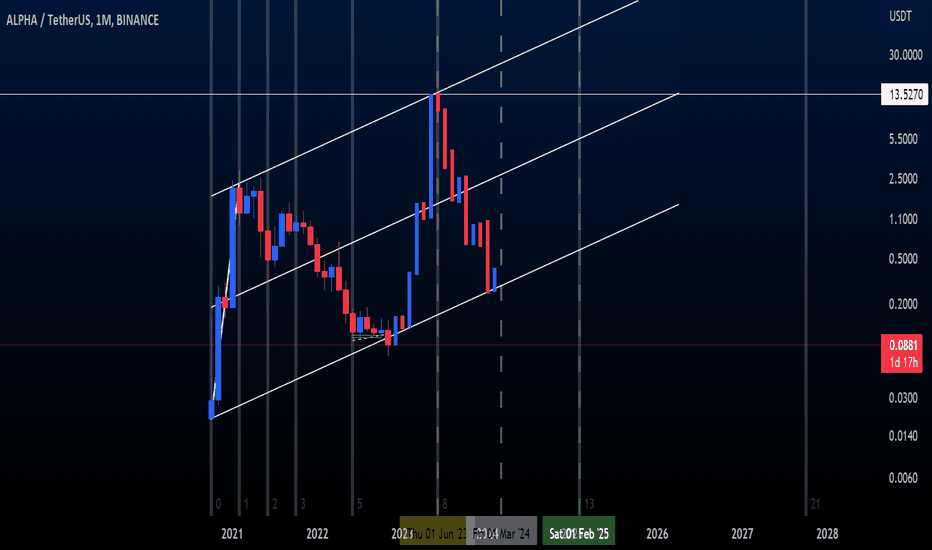

ALPHA CAN GO UP AGAINHi, dear traders. how are you ? Today we have a viewpoint to BUY/LONG the ALPHA symbol.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

ALPHA-C

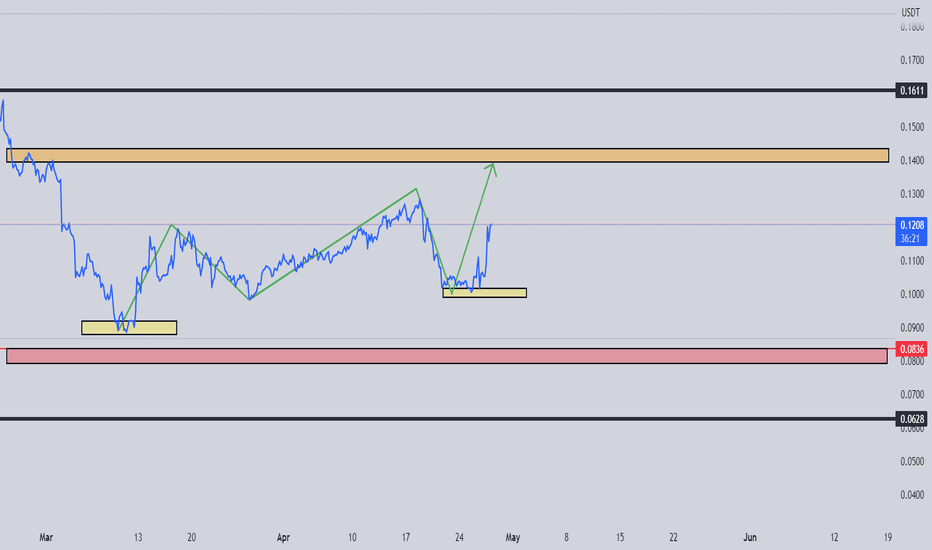

ALPHA : CHART VIEWInteresting to follow ALPHA to see if it's able to gain the 10-18% range for the day trading in the coming time.

The trend should have first a time frame confirmation before it can gain.

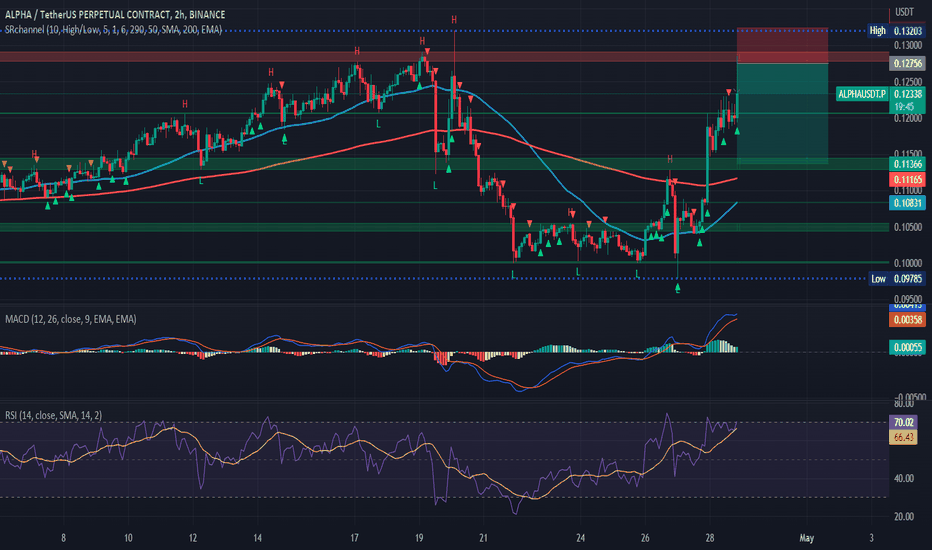

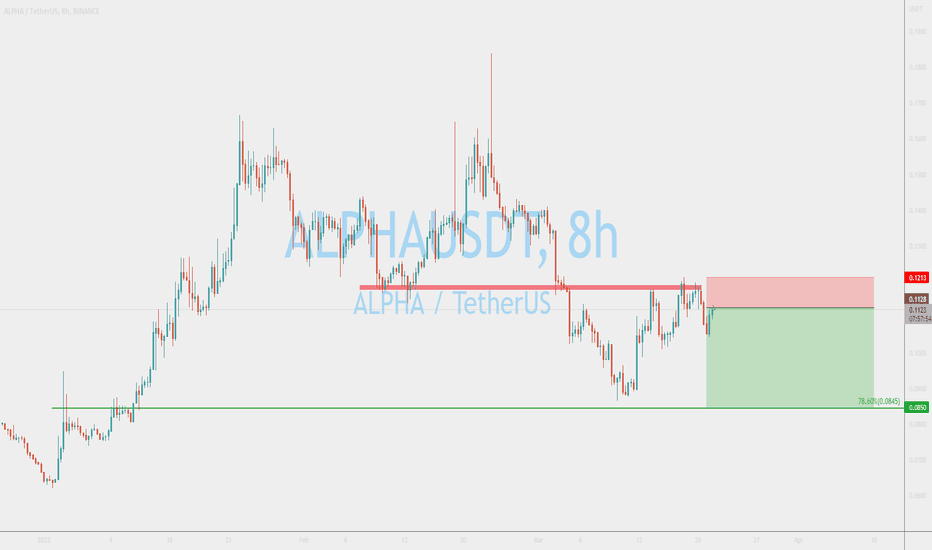

ALPHAUSDT yet another drop incoming ALPHAUSDT is trading right at the resistance. If that resistance holds, we'll see another downside move, potentially producing a new LL.

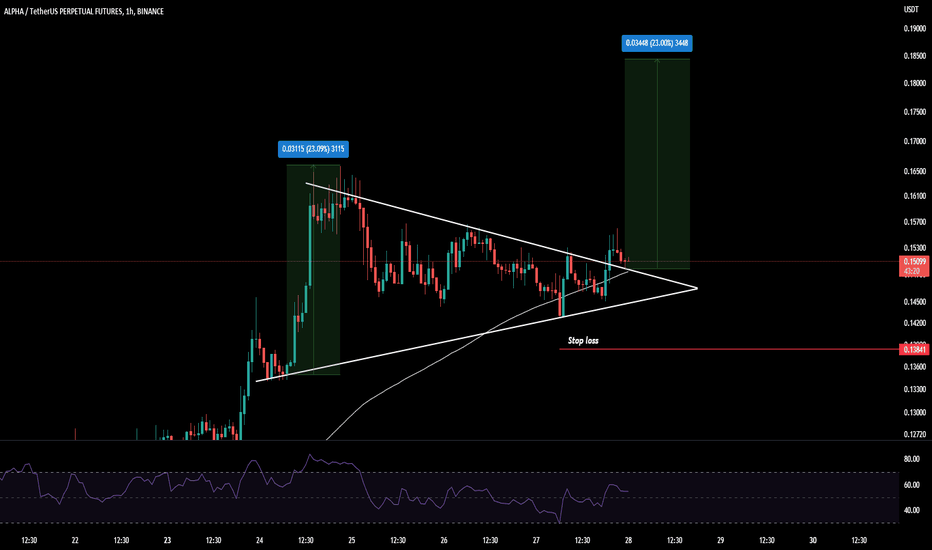

Alpha small scalpALPHA is trying to break the structure to the upside. BTC might dip more so be careful. Risky one.

NOT A FINANCIAL ADVICE + USE STOPLOSS + MANAGE YOUR RISK

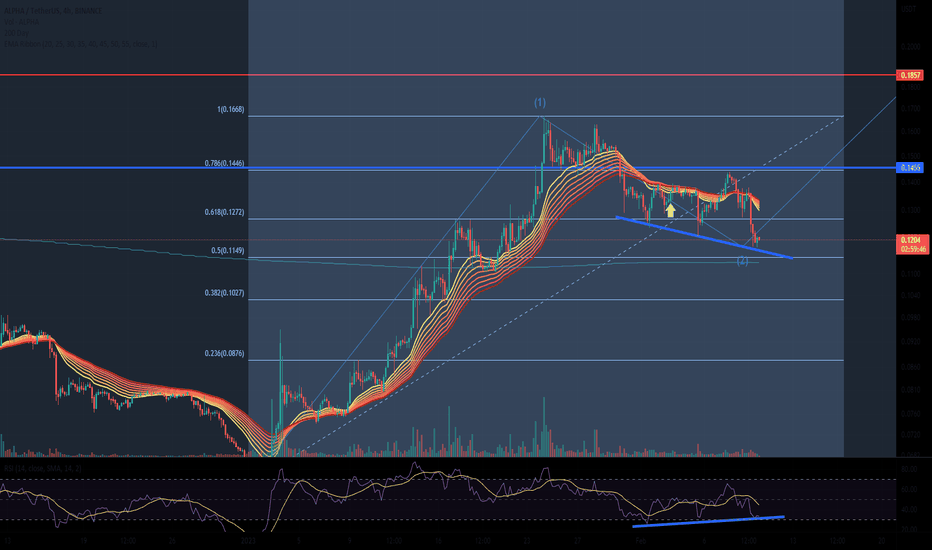

Alpha Venture DAO (ALPHA) forming bullish BAT for upto 35% pumpHi dear friends, hope you are well and welcome to the new trade setup of Alpha Venture DAO (ALPHA).

On a 4-hr time frame, ALPHA with Bitcoin pair is about to complete a bullish BAT move.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade

AlphausdtBreaking descending Channel In daily Timeframe Incase Of successful Breakout Expecting 150 to 200% bulish Wave

For entries Can Look For Breakout On H4 Place Sl According Your Risk Reward Ratio Should Be atleast 1/2

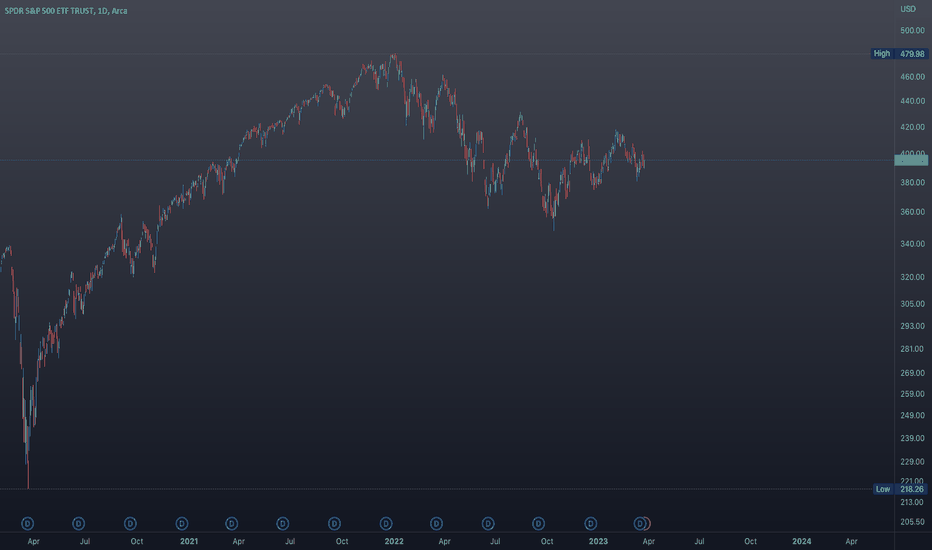

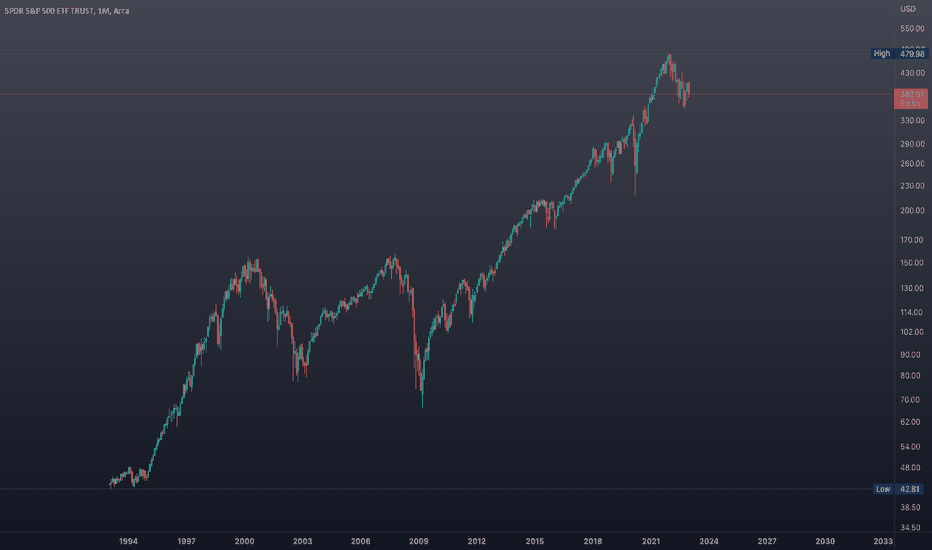

What can A.I. powered trading system do to generate alpha?No wonder trading is hard! I have been watching and learning how to trade the futures for the last couple of years and it’s been a remarkable learning curve for me! The dramatically changing market conditions and extreme volatility can make newbies like me get caught up in emotions and left looking for help.

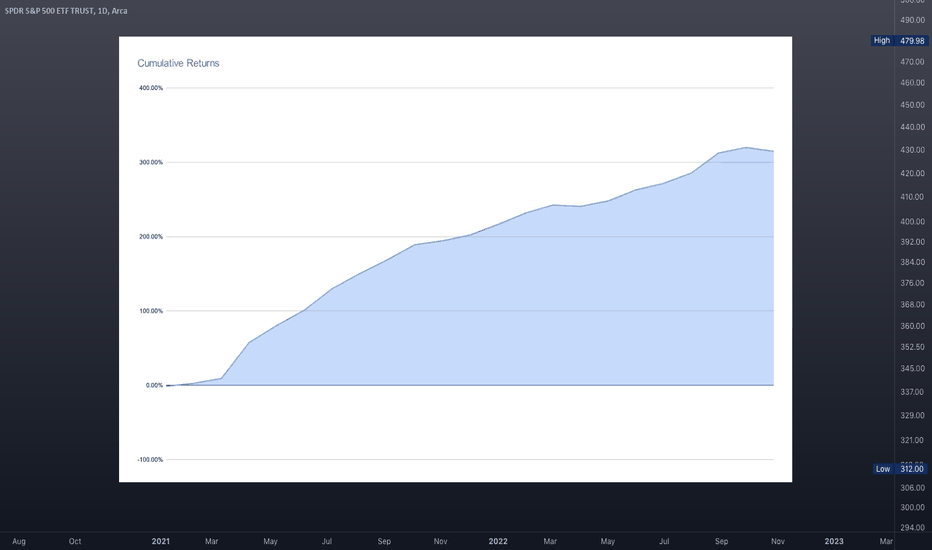

I recently came across a very interesting website that publish their proprietary AI-based trading strategies every morning along with the results these models generated during that trading day. Interestingly, their trading system’s return has been more than double over the last 4 years, while the system’s beta has been ZERO! Does this prove the robustness and fundamental strength of AI-powered trading systems?

Would love to know what other traders think. Feel free to comment.

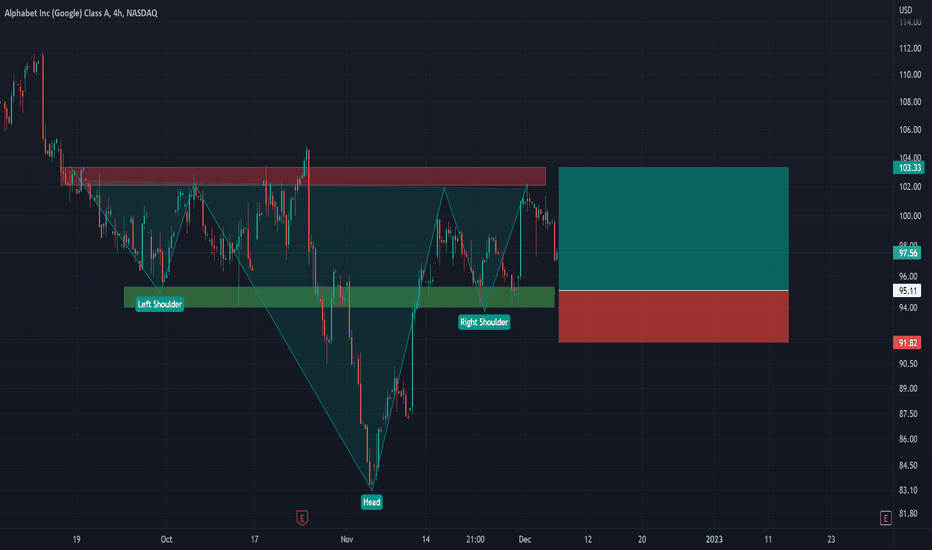

Google in inverted head and shoulders.Alphabet - 30d expiry - We look to Buy at 95.11 (stop at 91.82)

A bullish reverse Head and Shoulders has formed.

Bespoke support is located at 94.20.

Levels below 95 continue to attract buyers.

The primary trend remains bullish.

Dips continue to attract buyers.

Early pessimism is likely to lead to losses although extended attempts lower are expected to fail.

Our profit targets will be 103.33 and 105.33

Resistance: 101.00 / 103.50 / 105.00

Support: 97.00 / 94.20 / 91.80

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

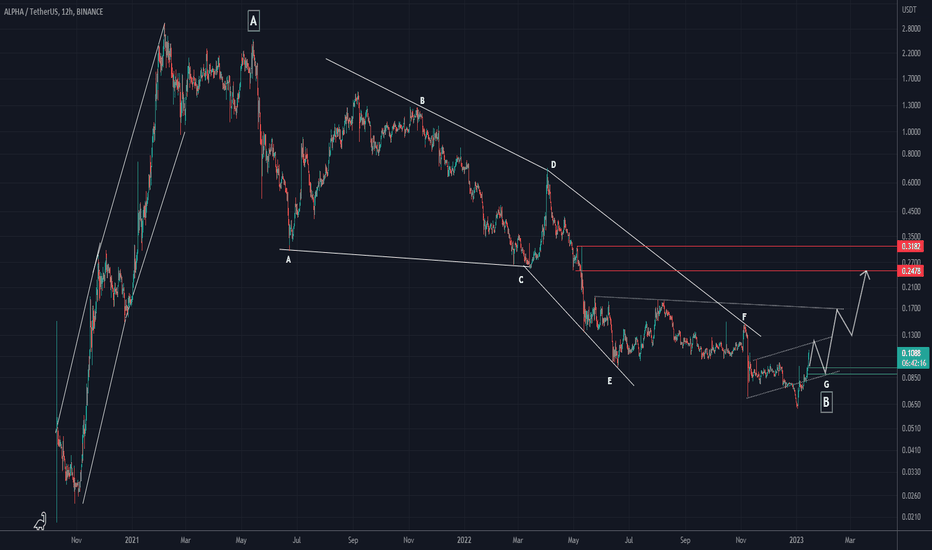

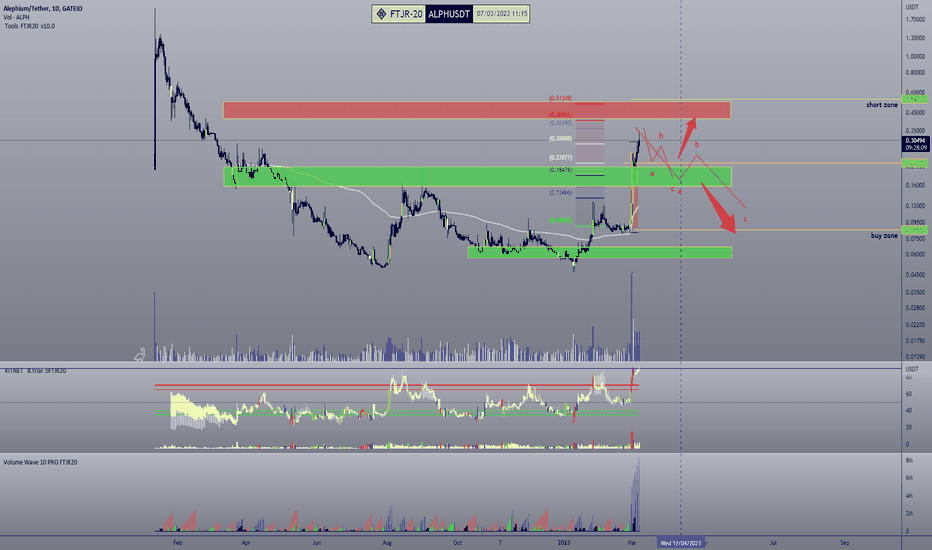

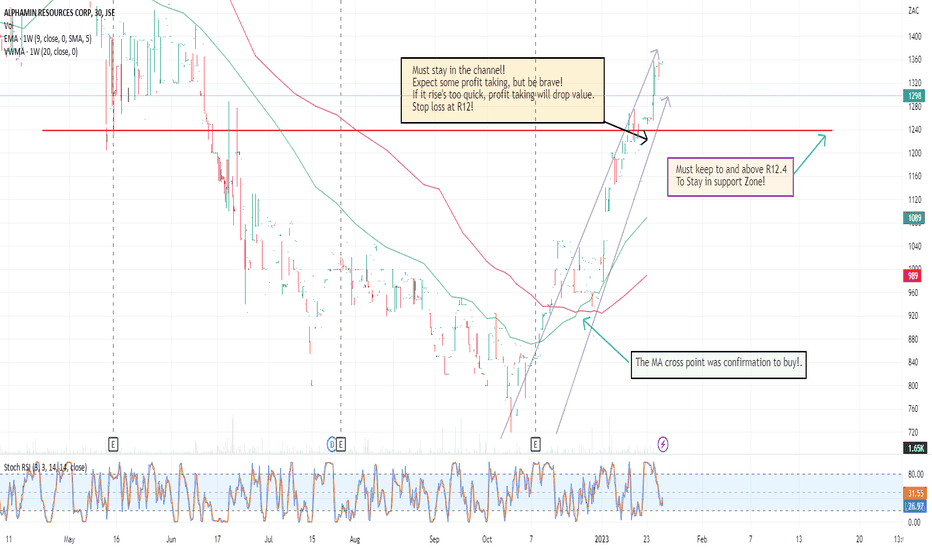

ALPHA.2023My prediction from alpha chart before halving 2024.

If the market trend is upward from the beginning of 2023, there is a high probability that we will see something like this from Alpha. Due to the development of the project and its good cooperation with projects such as MATIC, INJECTIVE, BAND PROTOCOL, OASIS,...

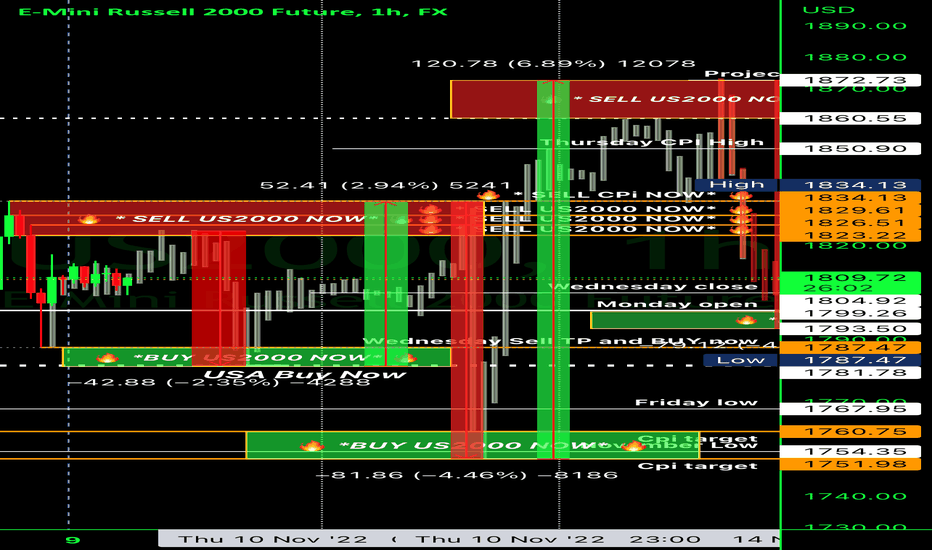

🟢 ALPHAUSDT - 1D (26.09.2022)🟢 ALPHAUSDT

TF: 1D

Side: Long

Pattern Bull Pennant

SL: $0.0939

Leverage: 5x

TP 1: $0.1212

TP 2: $0.1333

TP 3: $0.1431

TP 4: $0.1529

This thing is looking super oversold. It could have a nice run up if BTC pumps.

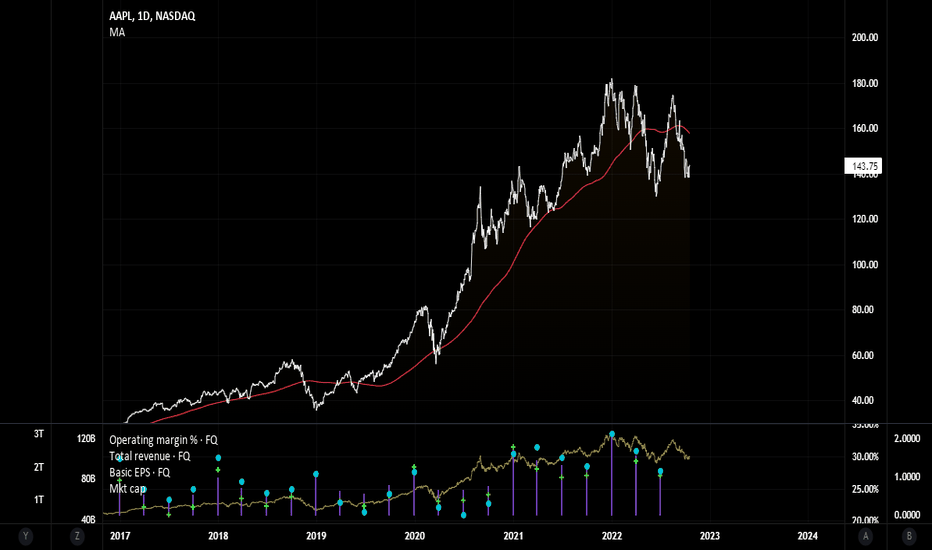

Apple Inc. Price target: $70.00/share

As part of my inverse big tech ETF...

Apple is another SHORT position going into this economic slowdown. Projecting $AAPL to decline about -60% to the 200-D MA, the .618 fib, and the pre-pandemic level.

1) Cause: Operating margin are coming down. Effect: Apple cutting costs (Bearish setup)

2) Market cap still holding on which is why $AAPL hasn't crashed yet.

3) Downward EPS revisions