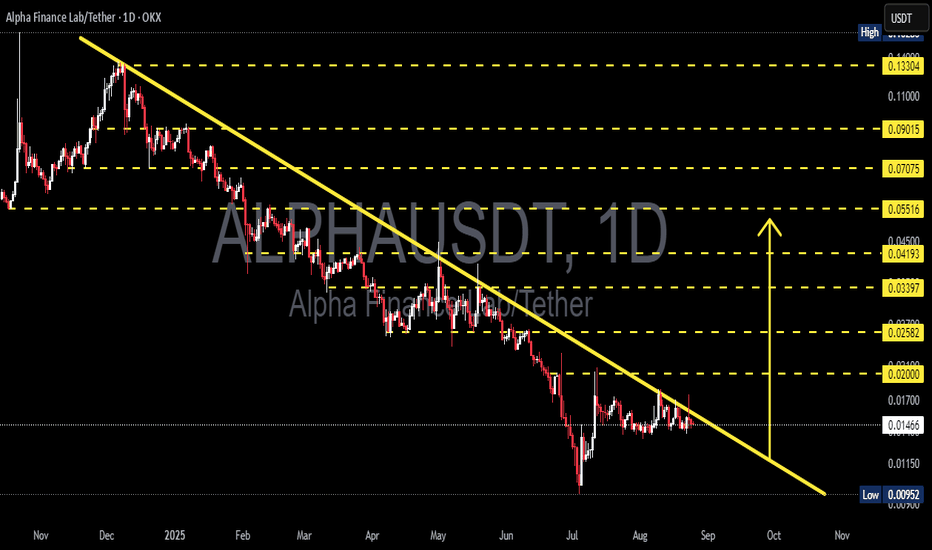

ALPHA/USDT — The Final Battle at the Descending Trendline!Full Daily Analysis

Since early 2025, ALPHA/USDT has been locked in a strong downtrend, forming a series of lower highs and lower lows along a descending trendline (yellow line). Selling pressure remains dominant, yet price action is now consolidating right below the trendline, with a tightening range that signals an explosive move ahead. The market is preparing for a major decision — breakout or rejection.

---

🔎 Structure & Price Pattern

Primary Trend: Long-term downtrend (dominant since Q1 2025).

Current Pattern: Compression zone under descending resistance — a setup often leading to a strong breakout or breakdown.

Nearest Support: 0.00952 (key low).

First Resistance: 0.02000 (psychological + structural level).

Key Levels Above: 0.02582 → 0.03397 → 0.04193 → 0.05516 → 0.07075 → 0.09015.

---

🚀 Bullish Scenario

If price successfully breaks out and closes a daily candle above the trendline (~0.016–0.017):

1. First confirmation: strong bullish daily close + rising volume.

2. Initial Target: 0.02000.

3. Next targets: 0.02582 → 0.03397 → 0.04193.

4. Mid-term potential: 0.05516 up to 0.07075 (+380% from current price).

5. Indicator signals: RSI >50, daily MACD bullish crossover.

📌 Note: A breakout retest of the trendline as support often provides a safer swing entry.

---

🔻 Bearish Scenario

If price fails at the trendline and faces strong rejection:

1. Downside path: revisit minor support 0.012–0.011.

2. Main target: 0.00952 (key chart low).

3. If 0.00952 breaks, further downside to new lows (check weekly chart for deeper historical levels).

4. Bearish confirmation: strong rejection candles + rising selling volume + RSI below 50.

---

🎯 Key Takeaways & Trading Strategy

ALPHA/USDT is approaching a decisive moment.

Breakout above the trendline → potential trend reversal toward 0.02–0.02582.

Rejection from the trendline → continuation of the bearish cycle toward 0.00952.

Aggressive traders: may scale in right after breakout confirmation with tight stops.

Conservative traders: wait for daily close + retest before positioning.

Risk management: never risk more than 1–3% per trade. Fakeouts are common in crypto — patience and discipline are key.

---

“ALPHA/USDT has been trapped under a heavy downtrend for months. Now price is consolidating just below the descending trendline — the decisive move is coming soon. Will ALPHA break out into a new bullish phase, or will bears push it back to the 0.0095 low?

Wait for daily close confirmation before making moves. Remember: in every opportunity lies risk, and proper risk management is your best weapon.”

#ALPHA #ALPHAUSDT #Crypto #Altcoin #TechnicalAnalysis #Breakout #Bullish #Bearish #CryptoTrading #SwingTrade #RiskManagement

Alphausdc

ALPHA inverted H&SAlpha Finance Lab is forming Inverted Head and Shoulders🤷 and if price breaks up I think there is chance for run to 1.1 and even higher. Will set the BUY LIMIT order to catch the pullback to Neckline (testing it from above).

ENTRY : Backtest of the broken Neckline @ 0.9610

SL : Right Shoulder @ 0.9047

TARGET : Inverted H&S target projection @ 1.1030

RRR : 2.6

INVALIDATION : when SL level hit

Check my other stuff in related ideas.

Please like👍, comment🗣️, follow me✒️, enjoy📺!

⚠️Disclaimer: I'm not financial advisor. This is not a financial advice. Do your own due dilingence.