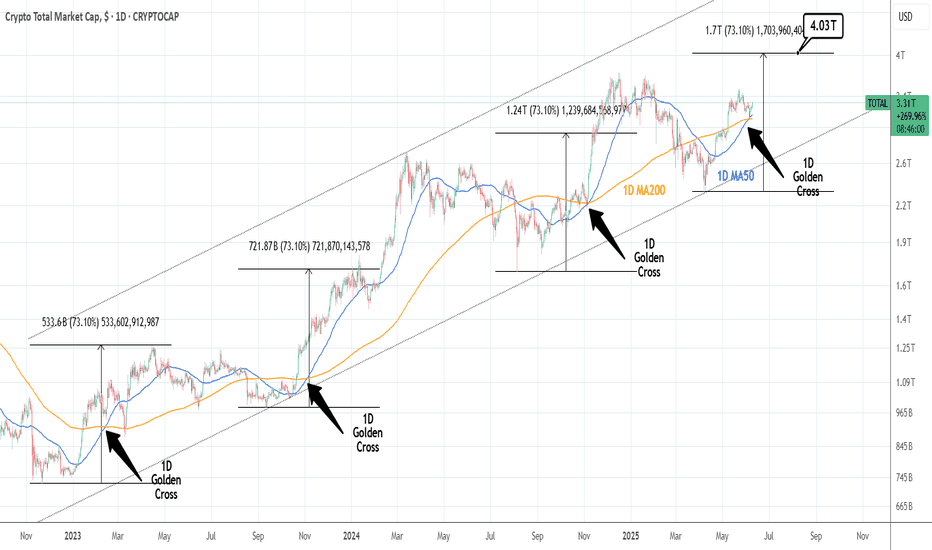

ALTCOINS made a 1D Golden Cross. First since U.S. elections.Crypto Total Market Cap just formed the first 1D Golden Cross ince November 6th 2024, which was right after the U.S. elections. The rally that followed made new highs. Since the Bear Cycle bottom, that is the 4th 1D Golden Cross and the minimum the market surged around such formation was +73.10%. This means that we can expected a 4.03T market cap at least.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Altcoinstrading

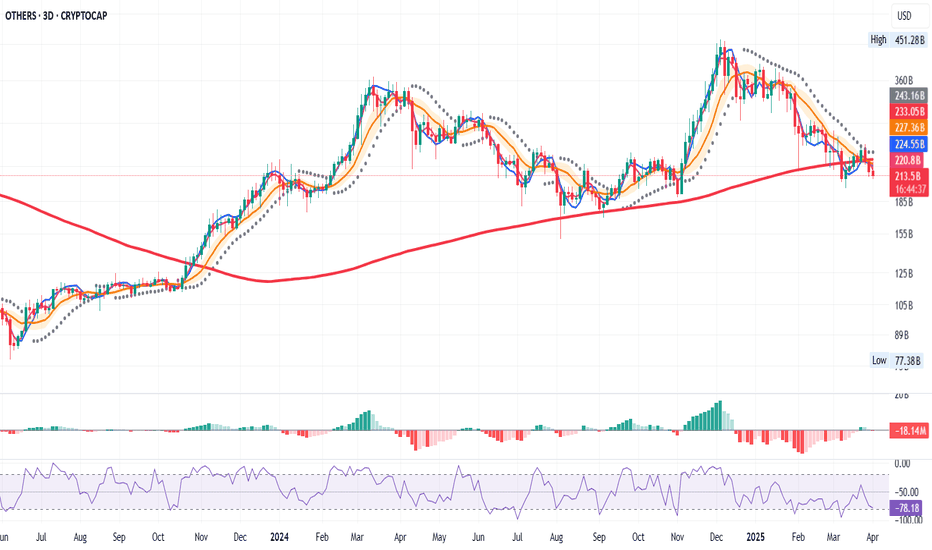

ALTS may be starting an explosive rally.This chart shows the Crypto Total Market Cap (excluding top 10) dominance trading inside a Megaphone pattern that just bottomed. The bearish wave is identical to the first that made a double bottom LL on August 5th and kickstarted an altcoin surge that peaked on December 7th 2024. The first target of this setup is 9.20%.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

The Power of a Trading System with the Right Mental State

📅 April 3, 2025

Over the years, I’ve learned that discipline in trading isn’t just about having a system — it’s about being in the right state of mind to follow that system. 🧘♂️📈

You can have the cleanest rules, the best strategy, and solid backtests … but if your mindset is off, none of it matters. That’s when hesitation creeps in. Or worse — revenge trades, FOMO, or doubt.

So I started focusing on one thing: my internal state before and during a trade. 🧭

🔄 How I Manage My Mindset

✅ 1. Pre-Trade Check-In

Before I trade, I ask:

How do I feel right now?

If I’m not grounded, I don’t trade. Simple. I’ve learned the hard way that it’s not worth it.

🔥 2. Anchoring a Disciplined State

I recall moments where I executed perfectly — calm, focused, in control. I mentally step into that version of myself before every session.

🧩 3. Staying Congruent

During a trade, I pay attention to my behavior. If I notice myself drifting from my plan — I pause, breathe, and realign.

🎯 Why This Works

A trading system gives structure.

But structure means nothing without mental discipline.

By mastering my emotional state, I stopped sabotaging my own edge.

No more reacting from fear. No more chasing. Just clean, committed execution. 🧘♂️✅

💬 Final Thought

Consistency doesn’t come from the market — it comes from me.

So now, before I look at the chart, I check in with myself first.

Because when my state is right, my trading flows. ⚖️✨

If this resonates, drop your thoughts below — let’s grow together.

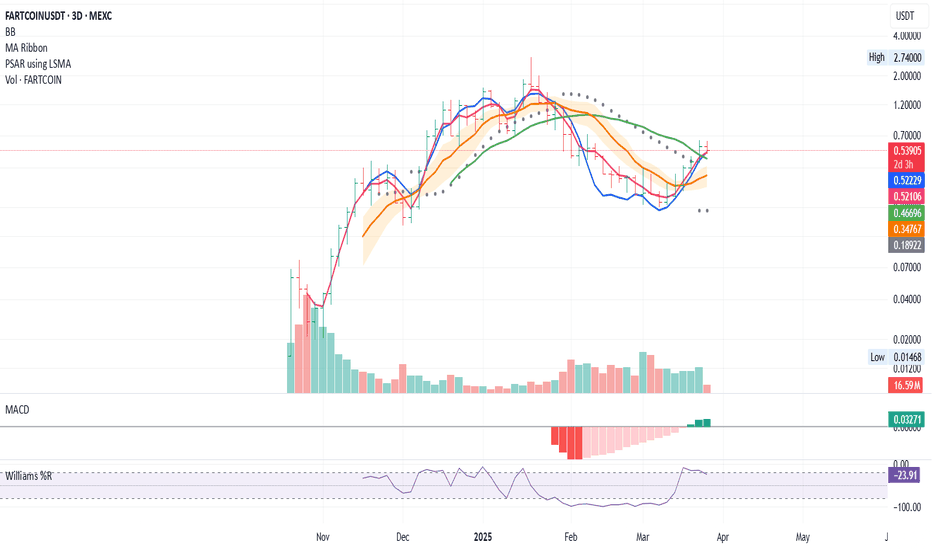

FARTCOIN Long Entry Signal for FARTCOIN / USDT 3Day Time FrameTicker: FARTCOINUSDT

Timeframe: 3D

Analysis:

MLR > SMA: The MLR (blue) is above the SMA (pink), signaling a bullish trend.

MLR > BB Center: MLR exceeds the Bollinger Bands Center Line (orange), showing strong bullish momentum.

PSAR: PSAR dots (black) are below the price, reinforcing the uptrend.

Price > SMA 21: Price is above the 21-period SMA (GREEN), indicating mid to long-term bullish strength for the 3Day time frame.

Trade Idea:

Entry: Consider a long position at this bar close.

Stop Loss: Place SL at the last PSAR level to limit downside risk.

Follow Me: Follow me for exit or profit-taking opportunities.

Outlook: All indicators align for a bullish move. Stay alert for reversal signals or trend shifts.

Risk Warning: Not financial advice, trade at your own risk

Long Entry Signal for ACH/USDT - Bullish Setup (Daily Chart)

Symbol:

Timeframe: Daily

Analysis:

MLR > SMA: The MLR (blue) is above the SMA (pink), signaling a bullish trend.

MLR > BB Center: MLR exceeds the Bollinger Bands Center Line (orange), showing strong bullish momentum.

PSAR: PSAR dots (black) are below the price, reinforcing the uptrend.

Price > SMA 200: Price is above the 200-period SMA (red), indicating long-term bullish strength.

Trade Idea:

Entry: Consider a long position at the daily close.

Stop Loss: Place SL at the current PSAR level to limit downside risk.

Follow Me: Follow me for exit or profit-taking opportunities.

Outlook: All indicators align for a bullish move. Stay alert for reversal signals or trend shifts.

Risk Warning: Not financial advice, trade at your own risk