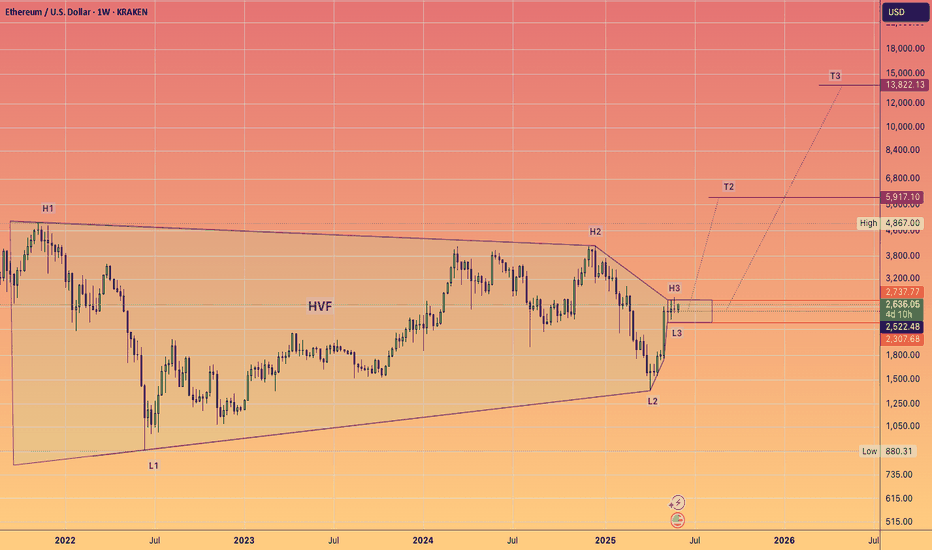

ETH will 5X from HERE! Hit the Like to manifest this.I'm serious hit the like to turn this #HVF into a reality.

I have been monitoring this pattern build out for years now.

BUT we are on the verge on triggering this pattern any day now, and triggering a massive Altcoin run which sucks in capital from all parts of the globe.

@TheCryptoSniper

Altseason

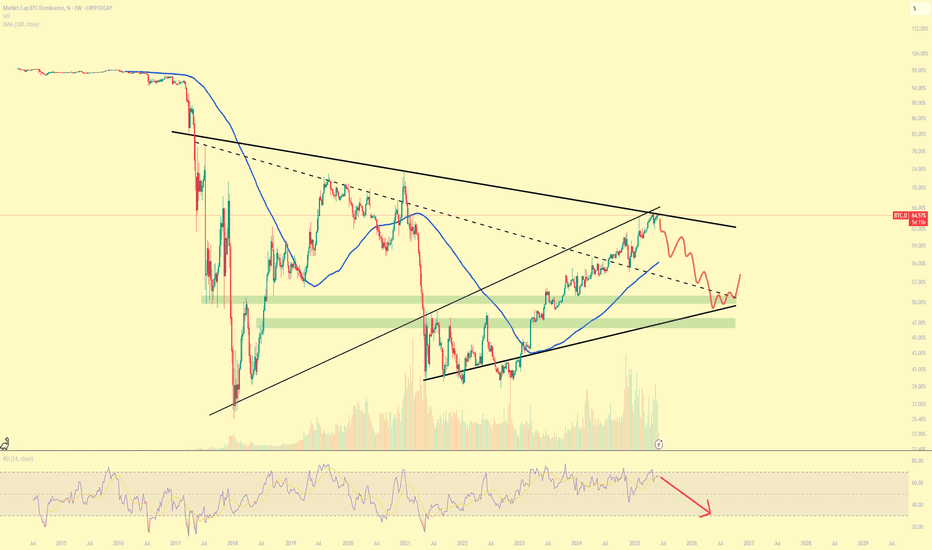

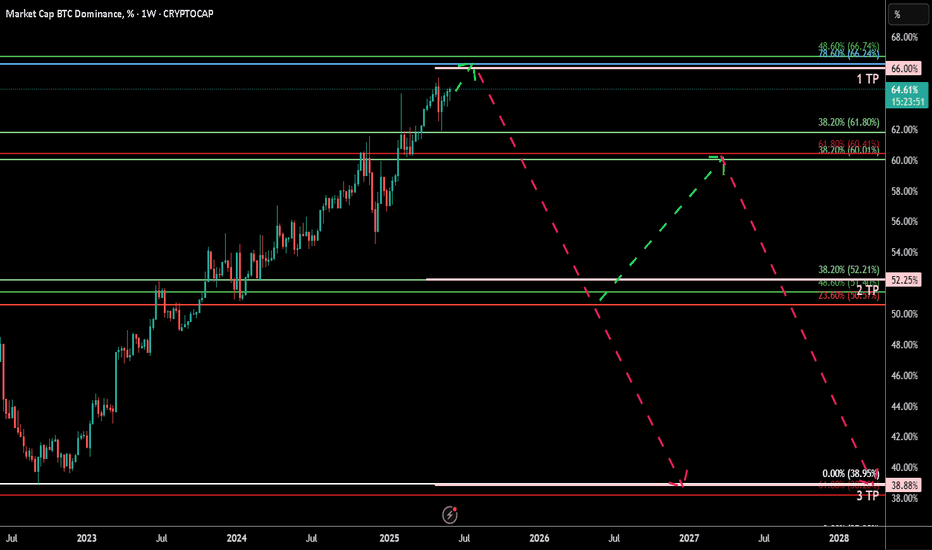

BTC.D forecast until Autust 2025This is an update of previously made forecast.

Now is a reversal week. Some alts may start running this week. But the main alts bullrun will start next week. Altseason will come in waves as usually with main events happening in July-August 2025.

Some lagging altcoins in the outskirts of crypto markets may show incredible profits in the end of August and will mark the end of 2025 summer altseason.

Don't get driven away, don't use leverage. In September we may see DXY reversal and bear market start. This will be epic for leverage and making fortunes.

For 1D charts look my Profile 'Also on'

BTC Dominance looking real heavy up hereWouldn't be surprised in the least if we see a freefall on BTC Dominance over the next few months.

Of course there is no guarantee, and things may look different in a month, however as it stands, I think there is a potential ALT cycle on the cards for 2025.

RSI needs a reset, amongst other things.

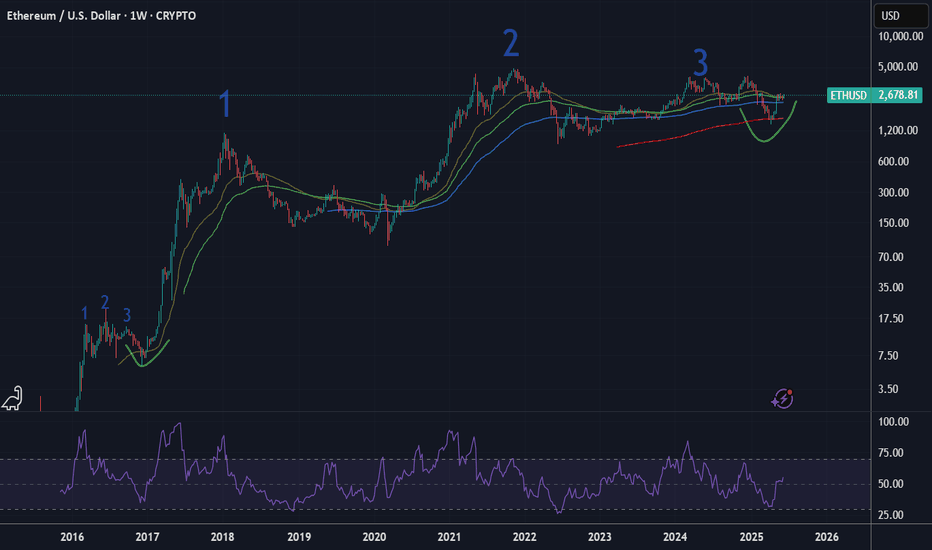

New cycle growth - GTFO moment soonNo analysis, simply an observation of what the market has been preparing for for many years. Since 2017, the ICO era, since then the market has matured to a completely new level.

Be careful with following Ben Cowen and other social influencers.

Given the market maturity since 2017, I believe what we call alts season will turn into a slow steady growth, last time it took a year, this time I think it will be the entire Trump's term if not longer.

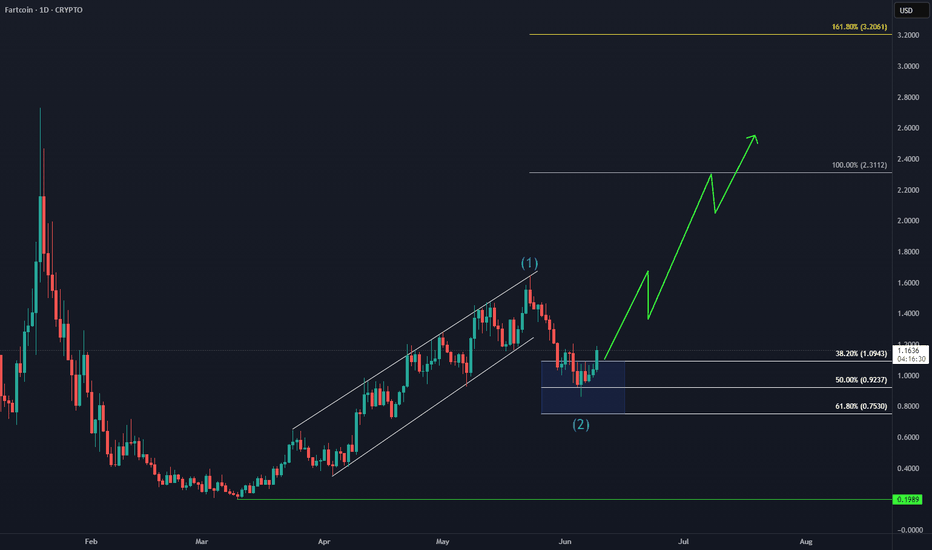

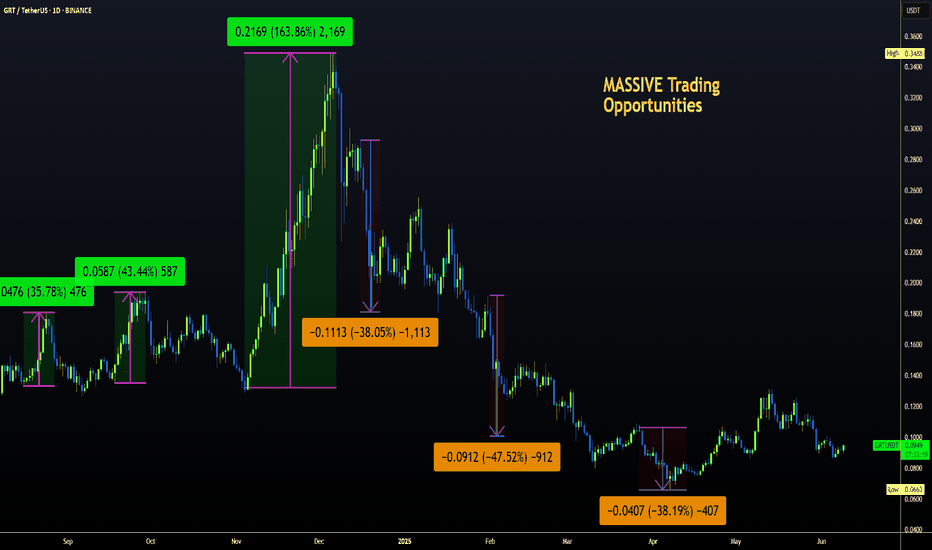

GRT | Altcoins | MASSIVE UPSIDE Potential on The GraphAnother altcoin that has great upside potential is the Graph BINANCE:GRTUSDT

The Graph from a weekly perspective may seem like there's not much action, but if you zoon in to the daily timeframe we see a different picture.

WEEKLY:

VS DAILY:

We can see anything from a +40% increase to a -30% dip in just a few days; a picture that is lost when we look at the weekly. This is IDEAL for swing trading.

Once you've established the general direction from the MACRO, swing trades become very viable (spot). If your patient enough to wait for a few days, a +30% could easily be achieved within a two week timespan.

______________________

BINANCE:GRTUSDT

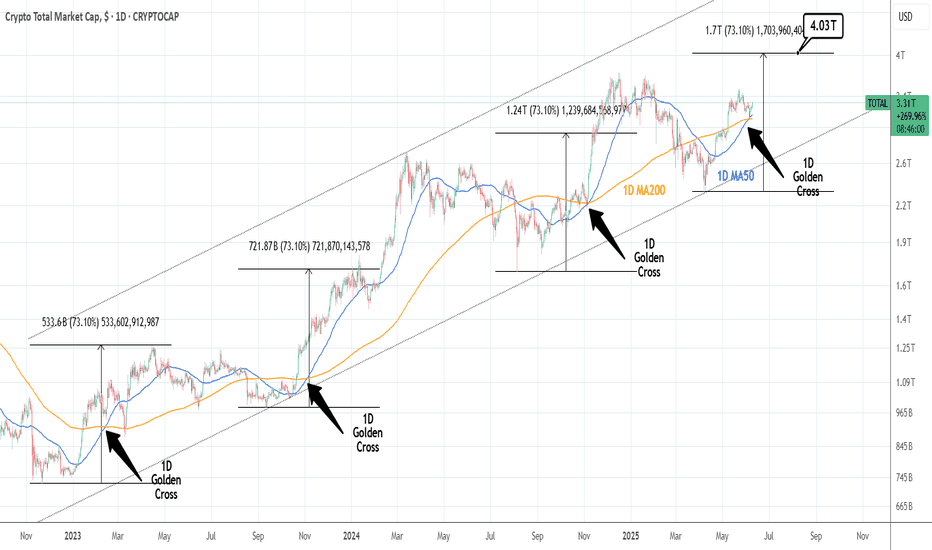

ALTCOINS made a 1D Golden Cross. First since U.S. elections.Crypto Total Market Cap just formed the first 1D Golden Cross ince November 6th 2024, which was right after the U.S. elections. The rally that followed made new highs. Since the Bear Cycle bottom, that is the 4th 1D Golden Cross and the minimum the market surged around such formation was +73.10%. This means that we can expected a 4.03T market cap at least.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

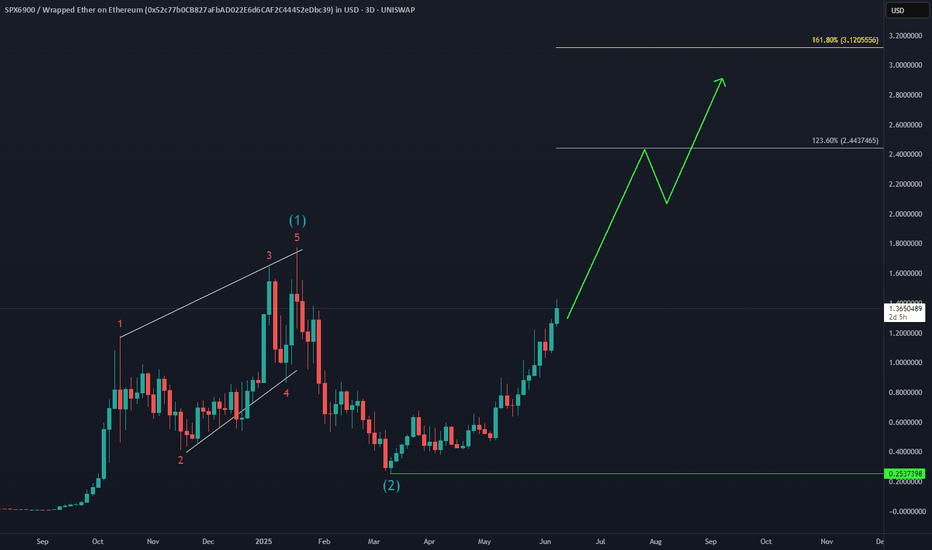

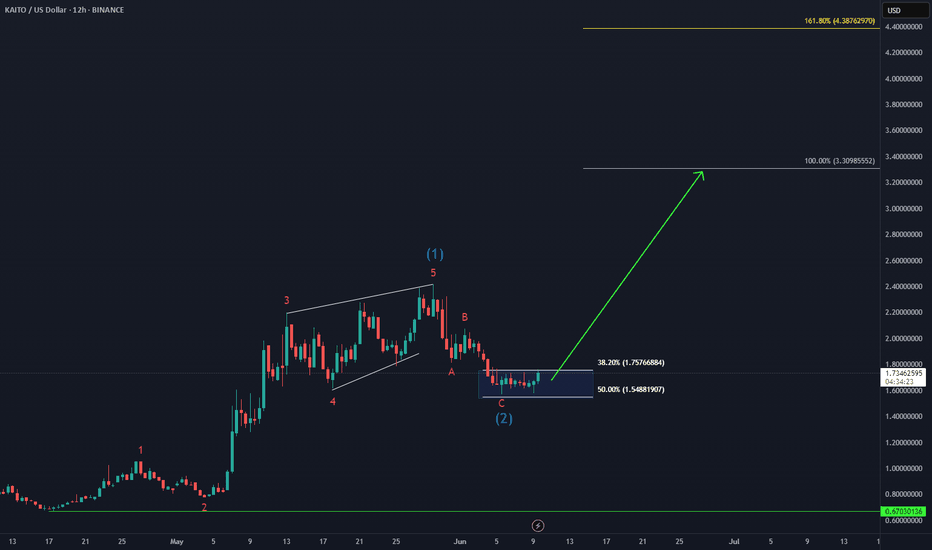

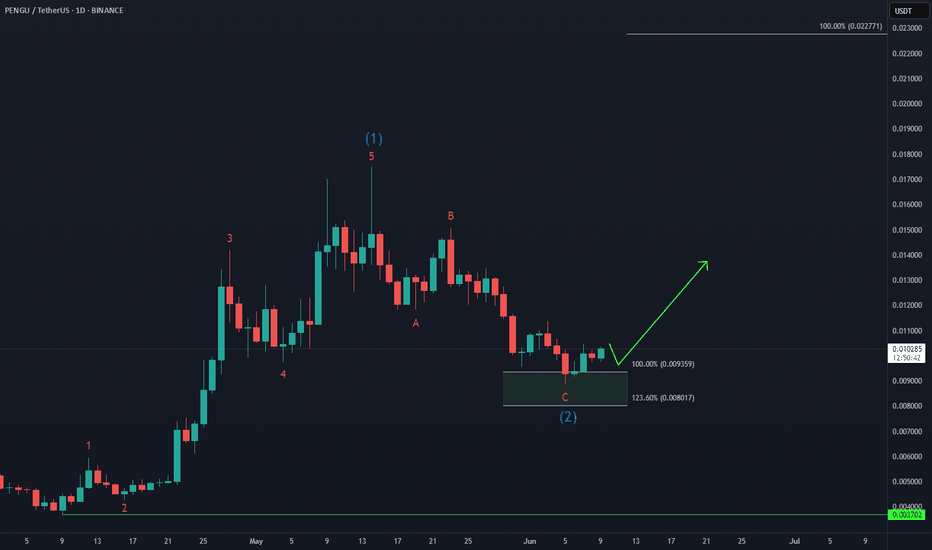

Pudgy Penguins PENGU Gearing Up for a +100% Move! 🐧 BINANCE:PENGUUSDT has completed its 5-wave advance from the April low (wave 1) and corrected with a 3-wave Zigzag structure in wave (2), reaching the buying area at equal legs $0.009 - $0.008.

🚀 Now, it's setting up for wave (3) higher, with an initial target at $0.022.

🌊 Are you positioned to catch the next wave higher?

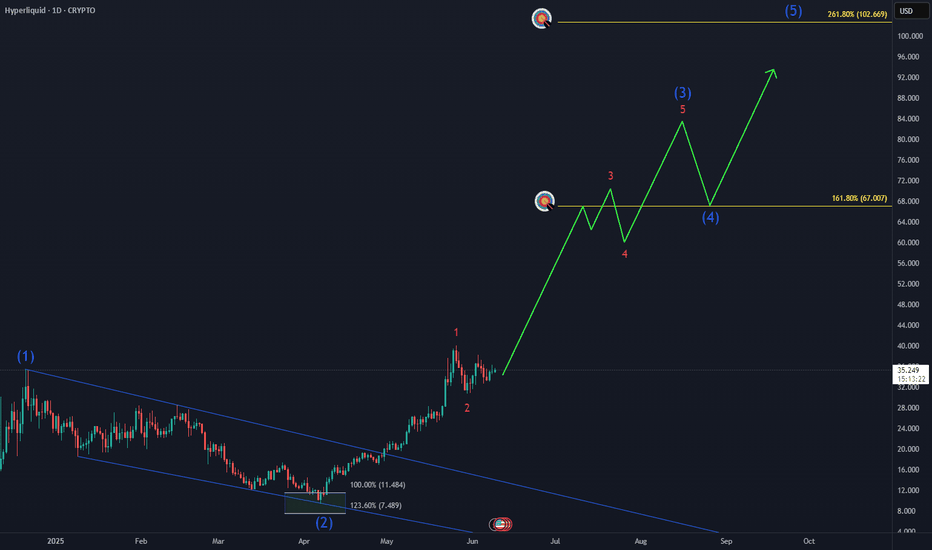

Exploring Bullish Targets for Hyperliquid HYPE🚀 BINANCEUS:HYPEUSD has surged into a new ATH and the most bullish scenario suggests a nest structure forming.

🎯 This setup could lead to an extension beyond the 1.618 Fib level at $66, opening the door for +$100 range in the coming months.

Are you positioned for this breakout? What’s your personal target for this cycle?

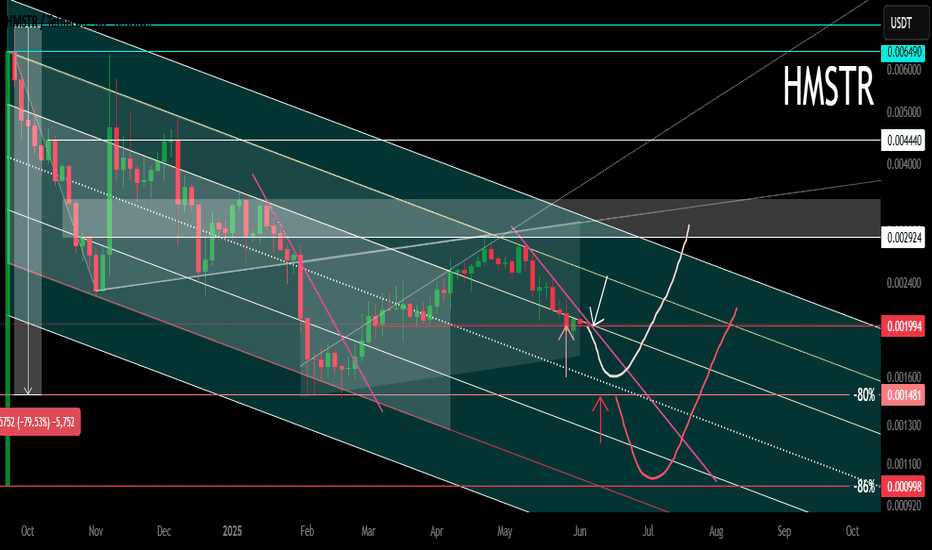

HMSTR Main Trend -80% Descending Channel 08 06 2025Logarithm. Time frame 3 days.

The main trend is a descending channel.

Secondary is an ascending channel.

Local trend is descending and a rollback from the key resistance.

While the price is in a descending channel, it is rational to work and focus on dynamic trend supports/resistances, using this volatility.

Locally, on a breakthrough of the designated trend line. To the resistance of the channel itself (the main trend) from it (the local line of the descending trend) a significant %. Then on the chart you will see a double bottom, or a "dragon" pattern, depending on what time and in what price zone (collecting long stops or without this manipulative action) they will make a reversal of the local trend.

Once again, I will say what was said earlier in the previous updates of this cryptocurrency and similar altcoins. Reductions from listing by -80%. For assets of such liquidity, this is quite small (reversal of the main trend). As a rule, the decline in the main trend occurs by 94-98%, with very rare exceptions. Therefore, remember this, and observe money management. But, if the altcoin market as a whole is reversed after the bitcoin season and consolidation, then they will pump, like everyone else.

If you are not a trader at all, but want to "own" this cryptocurrency in your portfolio, for reasons that are clear to you, then it is rational to collect from key levels - support zones (shown in the idea itself, move the chart), from a smaller amount to a larger one, and the entire amount allocated for such assets is allocated in advance, and not after the fact. You can take a little now, or rather place an order for a breakthrough of the local trend line (optional).

There are a huge number of subscribers on Twitter — 12.9 million people! When the time comes, and it will be rational from the market position, then this “army” will be sent to buy through positive posts. However, everything is as always... Perhaps that is why it is worthwhile to collect such assets in good zones without fanaticism, at least to take a closer look, before the alt season, which everyone has already “buried” (everything is as always).

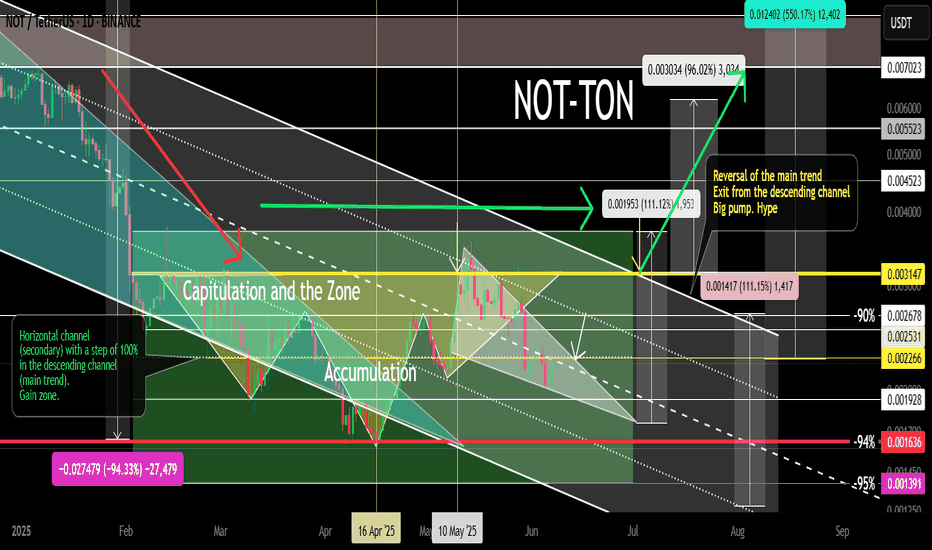

NOT / USD. Local trend. Reversal zones 08 06 2025Local work ("market noise") is not a breakout of the inverted head and shoulders resistance zone (yellow reversal level). A rollback back to the horizontal channel formation zone with a 100% step. Everything is as before, nothing new can happen, for clarity, I showed the % to the key local support/resistance levels.

NOT Main trend. Channel. 16 03 2025

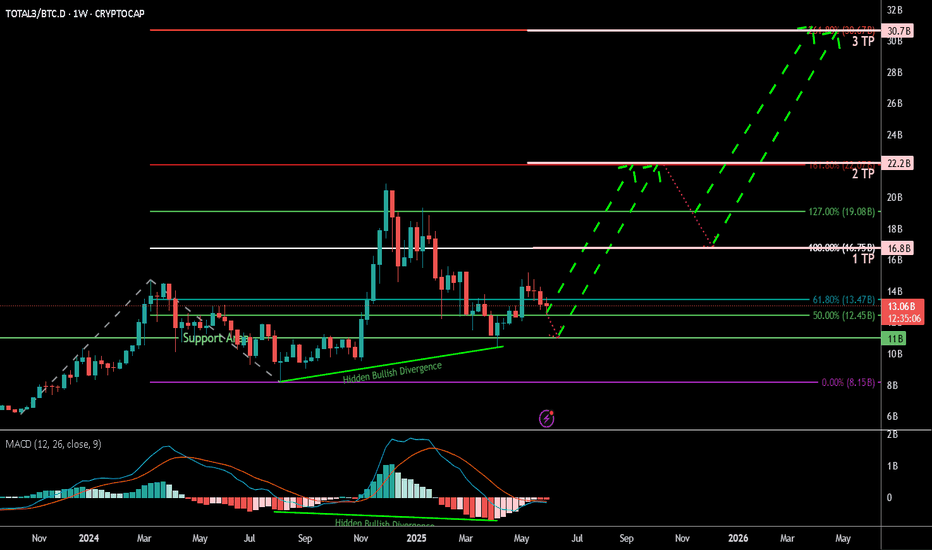

Altseason Index Proxy (TOTAL3 / BTC.D) Weekly TF

Symbol & Timeframe:

* **Symbol**: CRYPTOCAP\:TOTAL3 / CRYPTOCAP\:BTC.D

* **Timeframe**: Weekly (1W),

* **Purpose**: A clean, data-driven proxy for detecting altseason momentum

Technical Structure:

✅ Key Support Zones

* **13.47B (61.8% Fib)**: Critical golden zone; current price consolidation area

* **12.45B (50.0% Fib)**: Lower bound of golden zone

* **11.00B**: Historical support zone

* **8.15B (0.0%)**: Absolute bottom of retracement range

🔹 Hidden Bullish Divergence

* **MACD Histogram & Signal Lines** show hidden bullish divergence

* Price action forming **higher lows** while MACD makes **lower lows**

* Indicates trend continuation potential

🔢 Fibonacci Targets

TP1: 16.8B (100.0%)

TP2: 22.2B (161.8%)

TP3: 30.7B (261.8%)

🔄 Expected Path

* Potential short-term correction toward 12.4B followed by a breakout

* Bullish continuation path sketched with progressive Fib targets

📈 Macro & Fundamental Confluence

📉 Liquidity and Monetary Easing

* Global monetary policy is easing (e.g., Fed pivot expected mid-2025)

* Increased liquidity historically precedes strong altcoin rallies

BTC Dominance Decline

* BTC.D rolling down from long-term highs

* Signals beginning of capital rotation into altcoins

🚀 Emerging Narratives

* Rise of L2s (e.g., Base, zkSync), AI tokens, real-world asset protocols

* Fresh narratives tend to amplify altseason rotations

💼 Institutional Tailwinds

* Spot ETH ETF approvals pave way for alt ETF flows

* Regulatory clarity expected to reduce uncertainty in late 2025

Related Reference Charts:

🌐 TOTAL3 (Altcoin Market Cap Excluding BTC & ETH)

📊 BTC Dominance (BTC.D)

These charts offer standalone confirmation of:

Altcoin strength forming on TOTAL3

BTC dominance facing structural resistance

Composite Altseason Thesis:

1. Liquidity injections + halving = BTC rally

2. BTC.D breakdown + TOTAL3 support = altcoin strength

3. Technical confirmations: hidden divergence, fib confluence

4. Narrative and regulatory catalysts = widespread rotation

**Conclusion**:

We are entering a prime zone for altseason acceleration. Price reclaim above 13.47B and continued BTC.D drop will validate bullish thesis. Monitor closely for breakouts past TP1 and momentum into TP2/TP3.

📌 Current status:

- Price rebounding in the 12.45–13.47B Fibonacci zone (50–61.8%)

- Hidden bullish divergence on MACD + ascending price structure

- BTC.D has rolled off 65% resistance — suggesting capital rotation

📊 Altseason Thesis:

1. Post-halving BTC rally → profit dispersion into altcoins

2. Macro conditions (Fed pivot, record liquidity) enabling risk-on environment

3. Technical confirmation via index momentum and fib structure

4. Narrative tailwinds: Layer-2 adoption, AI-crypto, altcoin ETF catalysts

📈 Targets:

- TP1 @ 16.8B (100% Fib)

- TP2 @ 22.2B (161.8% Fib)

- TP3 @ 30.7B (261.8% Fib)

🟢 Key support: 12.45–13.47B zone; breakout + BTC.D collapse = altseason trigger.

BTC.D (Dominance at Critical Fibonacci Confluence) 2025 Weekly

**Summary:**

Bitcoin Dominance (BTC.D) is testing a major Fibonacci confluence near the 66% level. This zone historically acts as a major pivot and may signal either a continued dominance rally or a potential reversal setting the stage for altseason. We use three layered Fibonacci retracements to outline dominant trend zones, key resistances, and projected targets.

**Chart Context:**

This chart uses **three distinct Fibonacci retracements** to map the historical and projected behavior of BTC dominance:

1. **Primary Fib** (100% to 0%): Captures the macro move from BTC.D \~100% down to its 0% level at \~0%, which aligns with the first altseason (2018–2019).

2. **Secondary Fib** (100% to 38.88%): Maps the first bearish wave to identify potential recovery levels. BTC.D retraced up to the 61.8% (\~73.68%) but failed to break further.

3. **Third or the Current Fib** (73.68% to 38.88%): Maps the latest bearish fall in BTC.D. As of now, BTC.D is hovering at the 78.6% retracement level of this move, indicating heavy resistance.

**Key Technical Observations:**

* **1st TP (Resistance):** 66% — Strong Fibonacci confluence zone:

* Fib2 48.6% ≈ Fib3 78.6%

* Major reversal zone historically

* **2nd TP (Support):** 52.25% — Multi-Fib confluence:

* Fib1 48.6%, Fib2 61.8%, Fib3 38.2%

* **3rd TP (Ultimate Support):** 38.88% — Historical BTC.D bottom, aligned with the first altseason.

* Intermediate Fibonacci confluences between 48%–60% serve as layered support during decline phases.

**Indicators:**

* No external indicators used; pure multi-frame Fibonacci confluence.

* Price action structure and historical patterns highlight potential market rotation zones.

**Fundamental Context:**

The current phase of the market reflects increasing speculative activity in altcoins while Bitcoin consolidates. Historically, high BTC.D correlates with Bitcoin-led rallies, while a sharp drop often triggers altseason.

* Growing inflows into ETH, SOL, and possible now XRP, and mid-cap alts suggest capital rotation.

* If BTC.D faces rejection from 66%, the market could enter a new altseason phase.

* Macro tailwinds (e.g., easing monetary policy, risk-on sentiment) support altcoin performance in the medium term.

**Philosophical or Narrative View:**

BTC.D acts as a barometer of market risk preference. As confidence expands beyond Bitcoin, money flows into altcoins—like tributaries branching off the main river. The rejection from major confluences signals this psychological shift, marking phases of creative decentralization.

**Related Reference Charts:**

* TOTAL3 Fibonacci Setup (Altcoin market excluding BTC & ETH):

* TOTAL2 Correction Probabilities:

**Bias & Strategy Implication:**

* **Primary Bias:** Bearish rejection from 66% followed by correction to 52% and potentially 38.88%.

* **Alternative Scenario:** Brief breach above 66% before reversal.

* Traders may consider rotating into altcoin exposure if BTC.D confirms reversal at the confluence zone.

**Time Horizon:**

* Mid to Long Term (1–6 months outlook)

* Weekly timeframe tracking

**Notes & Disclaimers:**

* This analysis is for educational purposes. Market conditions may evolve rapidly.

* Use proper risk management when acting on dominance signals.

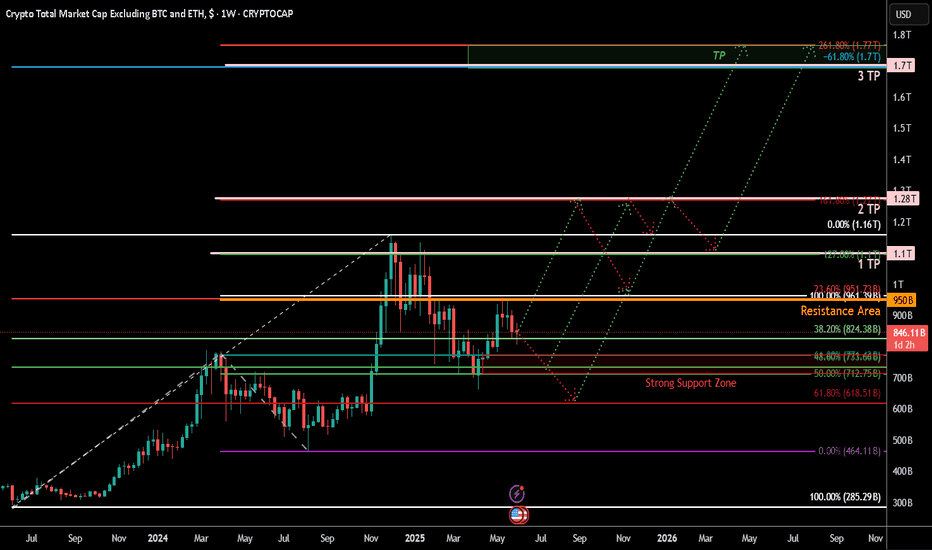

TOTAL3 – Altcoin Market Cap (Excluding BTC & ETH) Weekly TF 2025Summary

TOTAL3 is currently in a macro bullish cycle and undergoing a mid-cycle correction. The chart presents a Fibonacci-based structural roadmap with 3 Take Profit zones, identifying both correction supports and breakout targets. There is a high probability of short-term downside before a significant altcoin rally.

🌈 Chart Context

Fibonacci Retracement (Primary Leg):

100% = 285.3B

0% = 1.16T

Trend-Based Fibonacci Extension

A = 285.3B

B = 775B

C = 464.11B

Price as of analysis: ~845.62B

Key Technical Observations

Support Levels:

61.8% Fib Retracement = 618.5B

Strong Confluence Zone: Fib Retracement 48% + Fib Extension 50–61.8% (highlighted on chart)

38.2% Fib Retracement = 824.38B

Resistance Levels:

951.73B: 23.6% Retracement + 100% Extension – strong resistance zone before $1T psychological level

Take Profit Zones:

1 TP (1.1T) = 127% Fib Extension (Upper leg of parallel extension)

2 TP (1.28T) = 161.8% Fib Extension

3 TP (1.7T) = -61.8% Fib Retracement and 261.8% Extension confluence zone

Pattern & Projection:

The structure suggests a possible correction phase to lower support before continuation.

Bullish continuation expected after corrective phase, shown by the projected dotted path.

Structure: Bullish structure with healthy correction in mid-phase of the macro uptrend.

Fundamental Context

Altcoin Lag: TOTAL3 remains ~40% below its ATH, while BTC and ETH have already hit new highs.

Liquidity Shift Expected: Altcoin capital rotation tends to follow after BTC dominance stabilizes or drops.

Macro Backdrop:

Fed expected to cut rates later in 2025

Stablecoin legislation and ETF narratives building altcoin trust

Institutional inflows are slowly diversifying from BTC to ETH and large-cap alts

These suggest a possible shakeout or deeper correction before altseason breakout gains strength.

Bias & Strategy Implication:

Bias: Bullish Mid-Term – Correction Before Continuation

Expected Scenario: Pullback to strong support zones (824B–733B–618B), followed by a sustained breakout toward 1.1T–1.7T.

Invalidation: Weekly close below 618B may delay bullish structure and extend correction.

Strategy:

Long entries at support zones with tight invalidation

Scaling out near TP1, TP2, TP3 based on market momentum

Philosophical View

Patience is the virtue of the second leg in a macro trend. The correction serves to eject the impatient, reprice risk, and strengthen conviction. When TOTAL3 rises from deep support, it will be not just price but confidence that rallies.

Related Reference Charts

TOTAL Market Cap Structural Breakout:

TOTAL2 Altcoin Chart with Fibonacci Path:

✅ Tags

#TOTAL3 #AltcoinMarket #Fibonacci #Altseason #CryptoCorrection #CryptoMacro #TechnicalAnalysis #BullishOutlook #MidCycleCorrection #Crypto2025

⚠️ Notes & Disclaimers

This analysis is educational and not financial advice. Markets are inherently risky. Do your own research and manage risk accordingly.

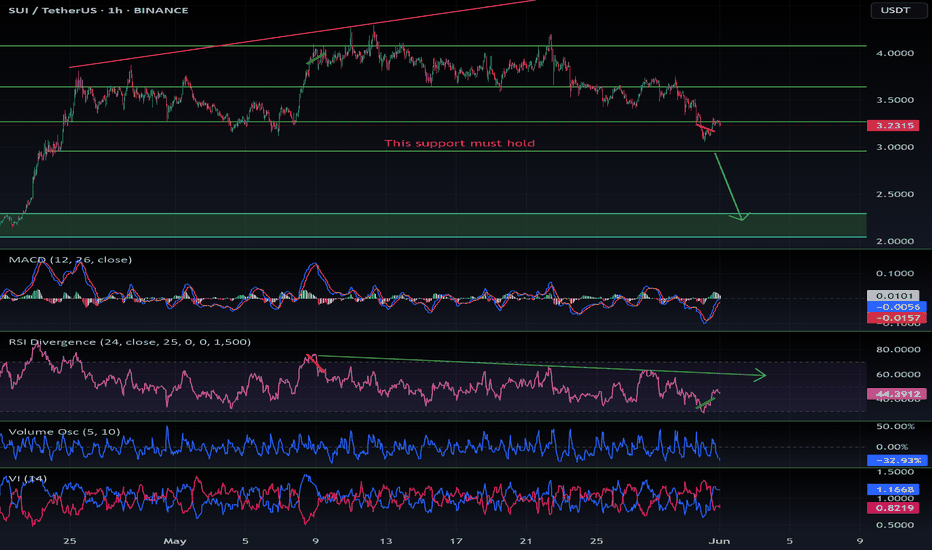

$SUI: $2.95 must hold!CRYPTOCAP:SUI is following the broader altcoin market and entering a correction phase. As shown in the chart, CRYPTOCAP:SUI has already broken through two key support levels and is now hovering just above a critical support at $2.95.

If this level fails to hold, the next major support lies within my green box at $2.20 — which could present a strong buying opportunity.

However, proper risk management is essential — make sure to place your stop losses accordingly.

DYOR (Do Your Own Research).

#SUI #Altcoins #CryptoCorrection #SupportLevels #BuyTheDip #CryptoTrading #TechnicalAnalysis #DYOR

DYOR

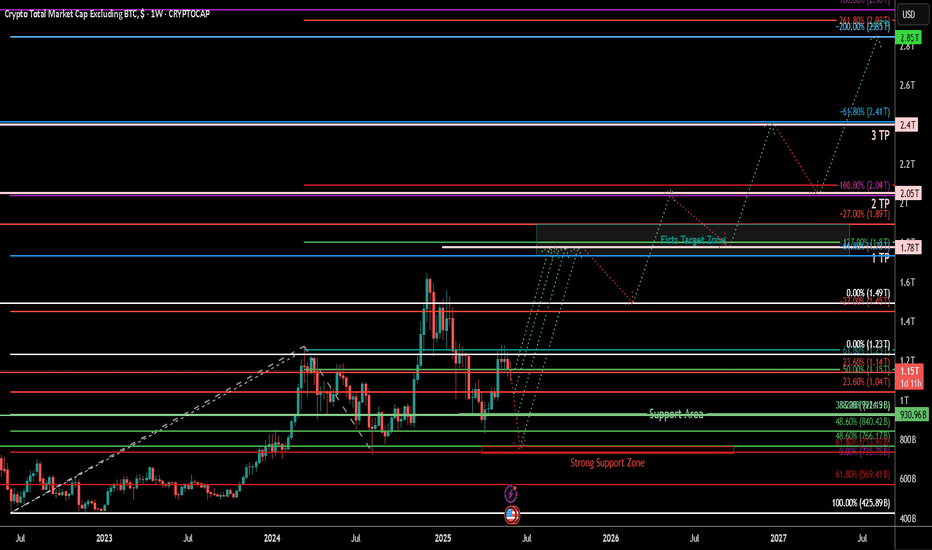

TOTAL2 – Altcoin Market Cap (Weekly TF) 2025

**Summary:**

The TOTAL2 chart (crypto market cap excluding BTC) is showing a structurally bullish formation after a deep retracement and a higher low confirmation. This setup suggests a potential multi-phase rally toward 2.98T and beyond, with defined support zones and Fibonacci targets aligned with liquidity cycles. This analysis visualizes the expected roadmap based on trend-based Fibonacci extensions, retracement levels, and psychological market phases. Notably, the outlook includes the possibility of an initial correction to retest strong support zones before the market begins its ascent.

**Chart Context:**

TOTAL2 represents the aggregated market capitalization of all crypto assets excluding Bitcoin. Historically, it reflects capital rotation into altcoins, especially following BTC dominance peaks. The current chart shows strong reaccumulation above the 1T support zone, with Fibonacci confluences hinting at a sustained recovery pattern. Dotted arrows illustrate a wave-like projection of accumulation, rally, retracement, and expansion. The possibility of a near-term correction to lower support zones is also embedded in the path structure.

**Key Technical Observations: and Levels**

TP1 = 1.78T

TP2 = 2.05T

TP3 = 2.4T

TP4 = 2.85T

* **Secondary Fib Retracement :** 0% = 1.23T, 100% = 425.89B

* Key zones: 23.6% = 1.04T, 38.2% = \~840.42B, 61.8% = \~569.41B

Possible Support Levels: 1.04T, 930B, 840B, 766B, 735B,

* **Trend-Based Fib (A-B-C):** A = \~420B, B = \~1.23T, C = \~735B

* This projection aligns with TP1 at 1.78T

* **Support Area:** Around 1T psychological zone (930B)

* **Strong Support Zone:** 735 Bto775B

* **First Target Zone:** Between 1.73T and 1.89T (early resistance + Fib cluster)

**Indicators:**

* Weekly structure forming higher lows

* Long-term Fib retracements respected

* Trend-Based Extension projecting 1.618 move

* No divergence, confirming strength

**Fundamental Context:**

* Liquidity conditions are improving globally with rate cuts expected into late 2025.

* ETH and ecosystem tokens are likely to lead altcoin recovery.

* Regulatory clarity and ETF flows add legitimacy to broader crypto allocations.

* Historical alt-seasons emerge from BTC profit rotation—TOTAL2 leads that shift.

* However, several macro risks may trigger a correction before rallying:

* The Crypto Fear & Greed Index is currently high, suggesting overbought conditions.

* Macroeconomic uncertainties (e.g., inflation, rate hike fears) can suppress short-term risk appetite.

* Regulatory tightening across major jurisdictions introduces hesitation in capital deployment.

* Technical signs of a five-wave drop in BTC hint at a larger ABC correction scenario.

* DAT (Digital Asset Treasury) exposure among public firms may lead to forced liquidations during downturns.

**Philosophical or Narrative View:**

This is not just a market cycle—it's a reflection of decentralized innovation reclaiming narrative dominance. After fear-induced lows, TOTAL2's rise echoes the resilience of builders, protocols, and investor conviction. Each Fibonacci level acts like a checkpoint in the unfolding story of crypto's evolution beyond Bitcoin.

**Related Reference Charts:**

*

**Bias & Strategy Implication:**

* **Bias:** Bullish with short-term corrective risk

* **Accumulation Zone:** 1.0T–1.23T

* **Initial Risk:** Price may revisit the **Support Area (1T)** or even the **Strong Support Zone (775B–725B)** before a sustained move higher.

* **Partial TP:** 1.78T–2.05T

* **Extended TP:** 2.4T–2.98T

* Caution near TP4–Bonus zones as distribution risk increases

* Invalidated if closes below 725B (structure break)

**Notes & Disclaimers:**

This is a structural macro outlook and not financial advice. Markets are dynamic and subject to rapid shifts in sentiment, liquidity, and regulation. Always use risk management.