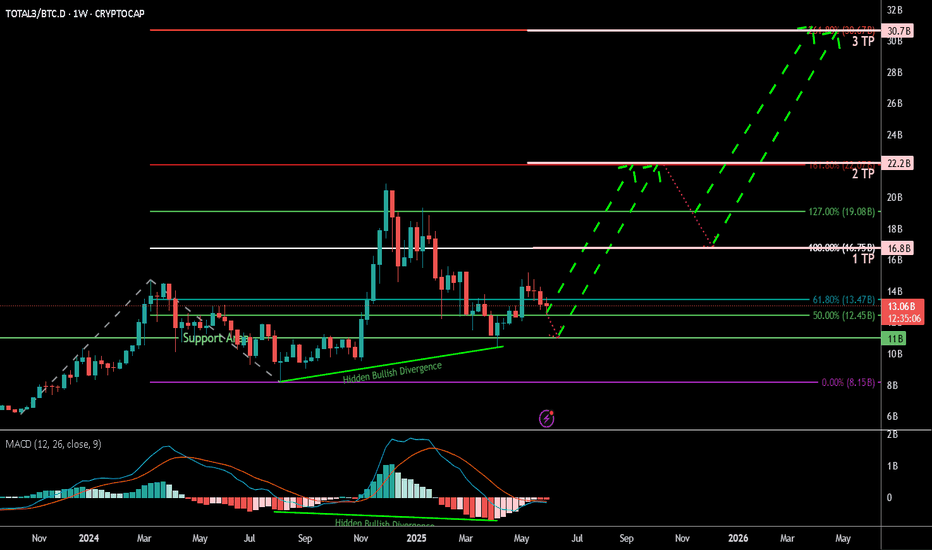

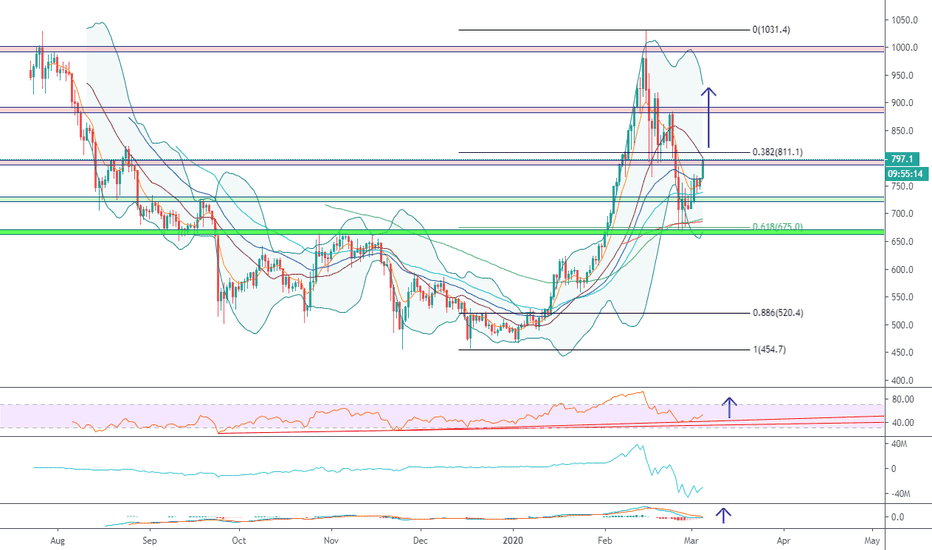

Altseason Index Proxy (TOTAL3 / BTC.D) Weekly TF

Symbol & Timeframe:

* **Symbol**: CRYPTOCAP\:TOTAL3 / CRYPTOCAP\:BTC.D

* **Timeframe**: Weekly (1W),

* **Purpose**: A clean, data-driven proxy for detecting altseason momentum

Technical Structure:

✅ Key Support Zones

* **13.47B (61.8% Fib)**: Critical golden zone; current price consolidation area

* **12.45B (50.0% Fib)**: Lower bound of golden zone

* **11.00B**: Historical support zone

* **8.15B (0.0%)**: Absolute bottom of retracement range

🔹 Hidden Bullish Divergence

* **MACD Histogram & Signal Lines** show hidden bullish divergence

* Price action forming **higher lows** while MACD makes **lower lows**

* Indicates trend continuation potential

🔢 Fibonacci Targets

TP1: 16.8B (100.0%)

TP2: 22.2B (161.8%)

TP3: 30.7B (261.8%)

🔄 Expected Path

* Potential short-term correction toward 12.4B followed by a breakout

* Bullish continuation path sketched with progressive Fib targets

📈 Macro & Fundamental Confluence

📉 Liquidity and Monetary Easing

* Global monetary policy is easing (e.g., Fed pivot expected mid-2025)

* Increased liquidity historically precedes strong altcoin rallies

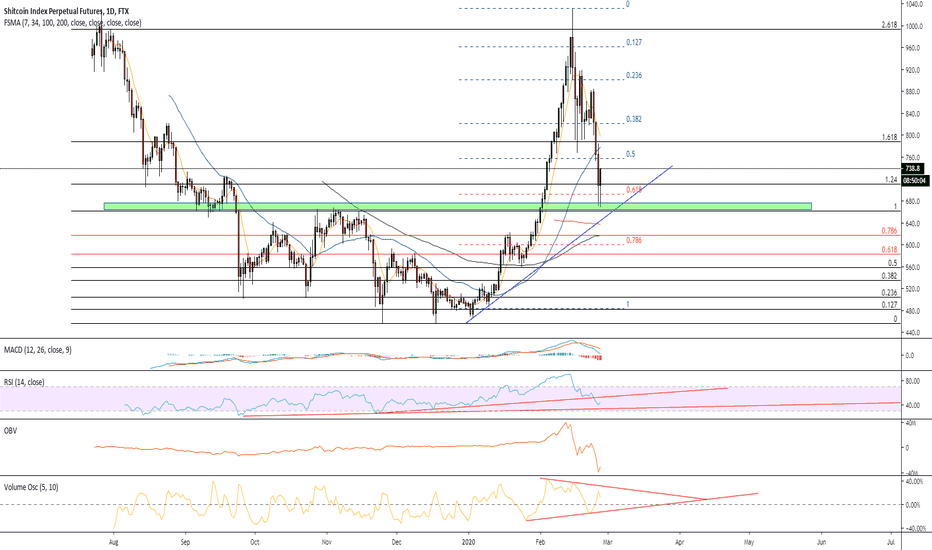

BTC Dominance Decline

* BTC.D rolling down from long-term highs

* Signals beginning of capital rotation into altcoins

🚀 Emerging Narratives

* Rise of L2s (e.g., Base, zkSync), AI tokens, real-world asset protocols

* Fresh narratives tend to amplify altseason rotations

💼 Institutional Tailwinds

* Spot ETH ETF approvals pave way for alt ETF flows

* Regulatory clarity expected to reduce uncertainty in late 2025

Related Reference Charts:

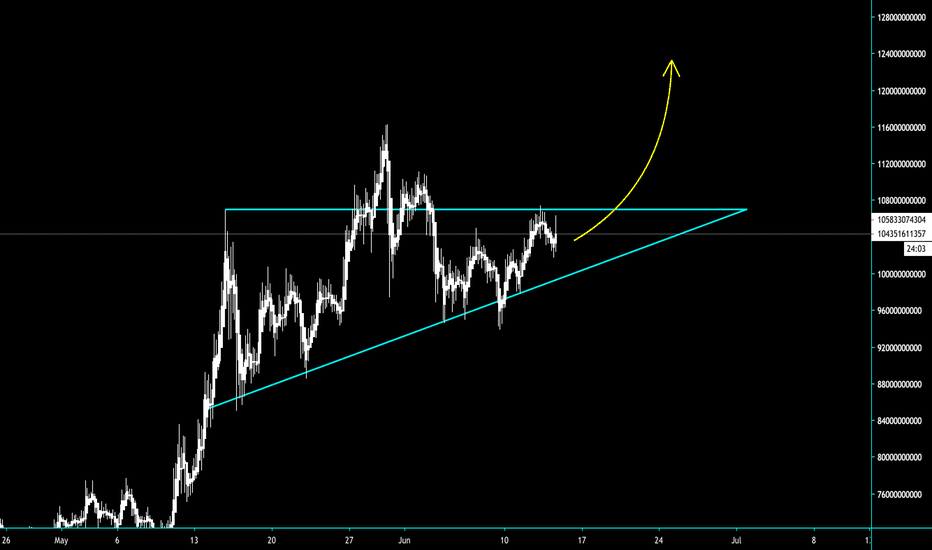

🌐 TOTAL3 (Altcoin Market Cap Excluding BTC & ETH)

📊 BTC Dominance (BTC.D)

These charts offer standalone confirmation of:

Altcoin strength forming on TOTAL3

BTC dominance facing structural resistance

Composite Altseason Thesis:

1. Liquidity injections + halving = BTC rally

2. BTC.D breakdown + TOTAL3 support = altcoin strength

3. Technical confirmations: hidden divergence, fib confluence

4. Narrative and regulatory catalysts = widespread rotation

**Conclusion**:

We are entering a prime zone for altseason acceleration. Price reclaim above 13.47B and continued BTC.D drop will validate bullish thesis. Monitor closely for breakouts past TP1 and momentum into TP2/TP3.

📌 Current status:

- Price rebounding in the 12.45–13.47B Fibonacci zone (50–61.8%)

- Hidden bullish divergence on MACD + ascending price structure

- BTC.D has rolled off 65% resistance — suggesting capital rotation

📊 Altseason Thesis:

1. Post-halving BTC rally → profit dispersion into altcoins

2. Macro conditions (Fed pivot, record liquidity) enabling risk-on environment

3. Technical confirmation via index momentum and fib structure

4. Narrative tailwinds: Layer-2 adoption, AI-crypto, altcoin ETF catalysts

📈 Targets:

- TP1 @ 16.8B (100% Fib)

- TP2 @ 22.2B (161.8% Fib)

- TP3 @ 30.7B (261.8% Fib)

🟢 Key support: 12.45–13.47B zone; breakout + BTC.D collapse = altseason trigger.

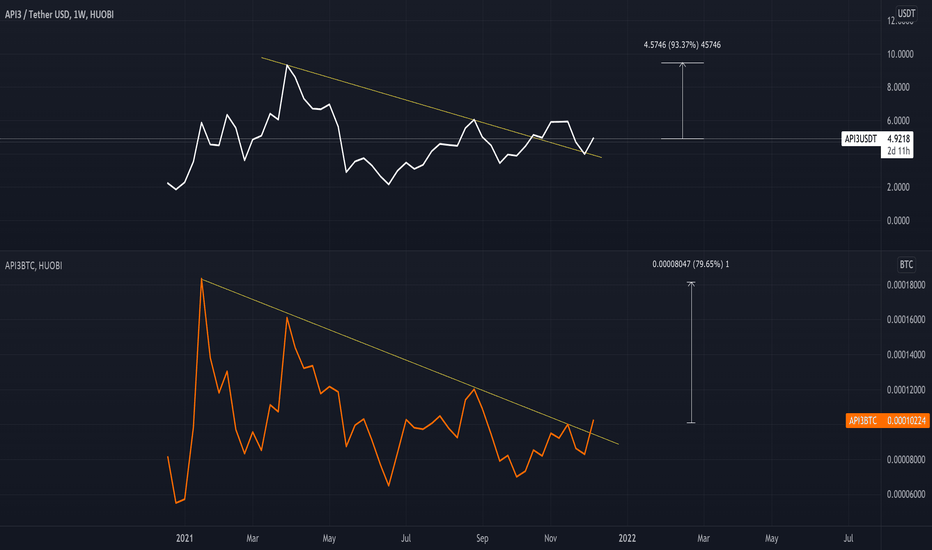

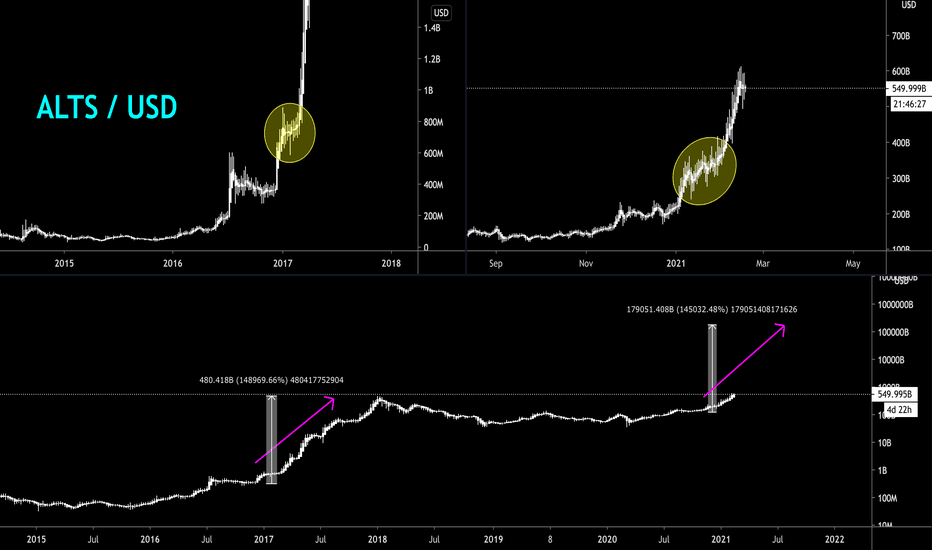

Altsusd

API3 Breakout + Alt/BTC pairingsMost ALT/BTC charts are setting up nicely for a run here as long as BTC continues trading range-bound. This is one primary example of what this play could look like. This area we are trading in could very well be a bull trap; until we see considerable volume in large cap alts, tread lightly in these riskier plays.

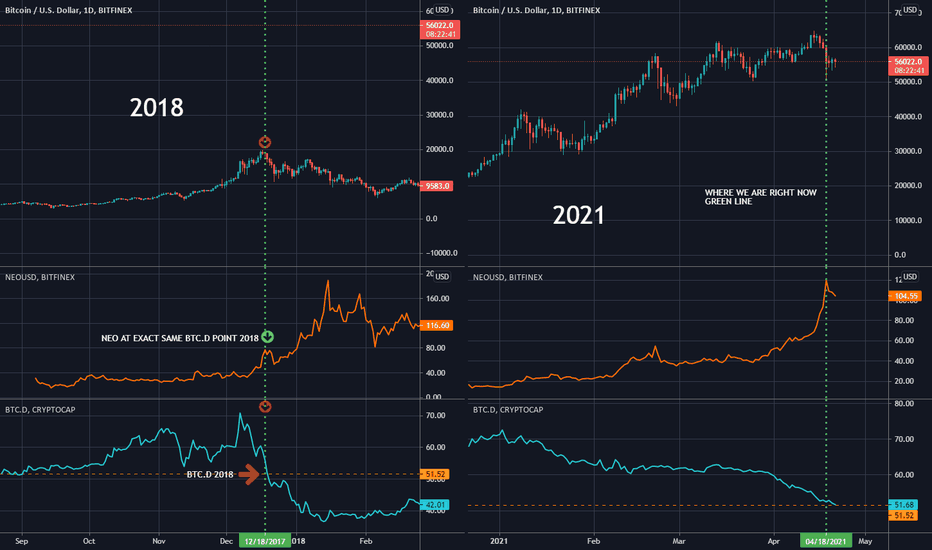

Just Look at This. Where ALT SEASON could be.Looks closely at all the dotted lines and where we were with bitcoin dominance in 2018 when alts peaked and compare to how we look today in the right pane. If BTC.D keeps dropping we could see massive gains. No guarantees. Everything could collapse tomorrow, but the charts provide hope.