Bitcoin Maxis - Brace for Impact !!!🚨 Bitcoin Maxis, brace for Impact 🚨

There is clear, recent evidence that Tether is actively diversifying its reserves and investments by both selling some of its Bitcoin holdings and significantly increasing its exposure to gold, including direct investments in gold mining:

1. Selling Bitcoin and Buying Gold

Tether has reported substantial profits from both Bitcoin and gold price appreciation. In 2024, the company booked. How does Tether generate its profits beyond Bitcoin and gold investments?" with \5 billion coming from unrealized appreciation of its gold and Bitcoin holdings. However, recent reports indicate Tether has been increasing its gold reserves while adjusting its Bitcoin treasury. For example, Tether disclosed holding $8.7 billion in gold bars in its Q2 2025 attestation report, and its gold-backed stablecoin (XAU₮) is backed by over 7.7 tons of physical gold as of April 2025.

2. Entering Gold Mining

Tether is in active discussions to invest in gold mining, aiming to channel its crypto profits into the metals market. CEO Paolo Ardoino has publicly referred to gold as “natural Bitcoin” and expressed a strong affinity for gold as a foundational asset. The company is exploring opportunities across the entire gold supply chain, including mining, refining, and trading.

Tether has already invested over $200 million in Elemental Altus Royalties, a Canadian firm that buys future revenue streams from gold mines, giving Tether exposure to multiple mines with less operational risk.

3. Strategic Shift

Tether’s move into gold and gold mining is part of a broader diversification strategy, which also includes investments in AI, Bitcoin mining, and other sectors. The company’s leadership has repeatedly emphasized gold’s role as a hedge and a complement to Bitcoin.

In summary, Tether is not only selling some Bitcoin and buying gold but is also directly entering the gold mining sector as part of its diversification and profit deployment strategy.

Sources:

www.zerohedge.com

www.coindesk.com

www.fxleaders.com

bitcoinethereumnews.com

BITSTAMP:BTCUSD NASDAQ:TSLA NASDAQ:NVDA NASDAQ:MSTR TVC:DXY TVC:GOLD TVC:SILVER VANTAGE:SP500 FX:EURUSD COINBASE:USDTUSD AMEX:NUGT AMEX:GDX

Altus

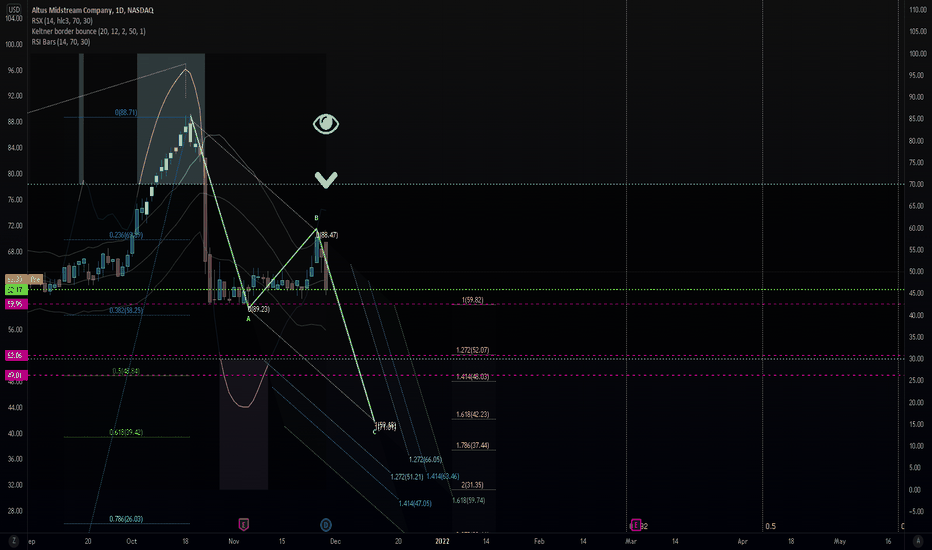

Altus Midstream looking to sail down a waterfall again. ALTMZigzag in formation we surmize. This assumes the greatest drop out of all Elliott described patterns, and most profit by extension. Assuming this is infact a zigzag that we believe that it is.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe!

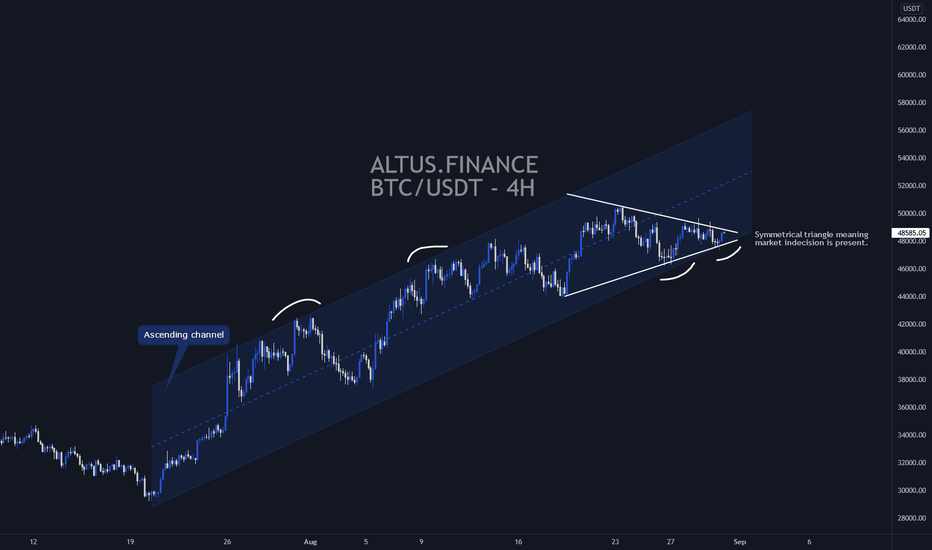

30/08 BTC/USDT ANALYSIS - ALTUS.FINANCEGreetings TradingView!

We are observing something really great here, Bitcoin has been trading in an ascending channel since the 20th of July. Today, just a very short time away from the monthly close and we are experiencing great market indecision as we continue to trade within a tight symetrical triangle. Its difficult to say where the price will go from here as that is the nature of this charting pattern but what we do know is that we are in a clear uptrend, our stance is short term neutral and long term bullish.

Bitcoin has been making a series of higher highs and higher lows, its on track to retest $50,000 once again, next week.

Happy Trading!

ALTUS

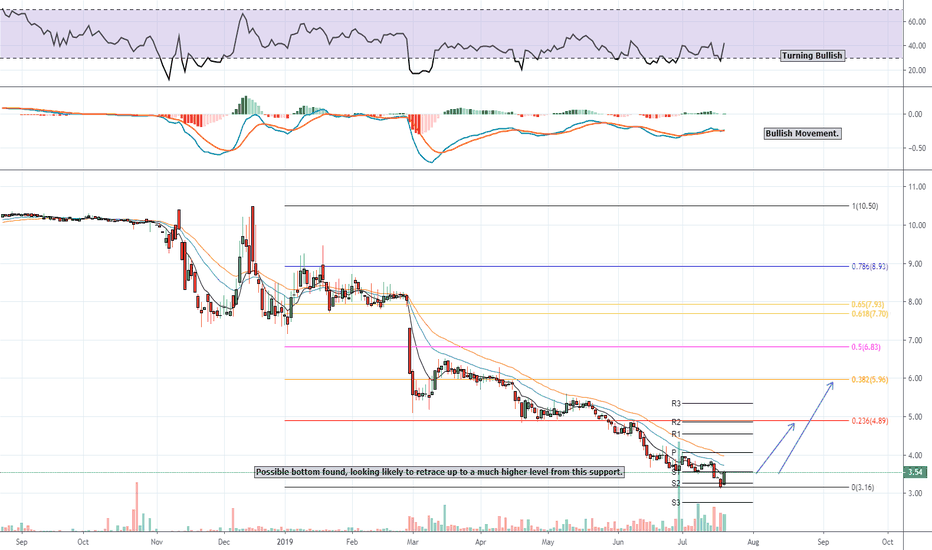

ALTM On Track For Move Up! Company Info:

Altus Midstream Co, formerly Kayne Anderson Acquisition Corp., is a pure-play, Permian Basin midstream C-corporation. The Company owns gas gathering, processing and transportation assets in Alpine High, an unconventional resource play in the Delaware Basin. The Company also owns options for equity participation in five gas, natural gas liquids (NGL) and crude oil pipeline projects from the Permian Basin. Its assets includes 150 miles of transmission and gathering pipelines, compressor stations, mechanical refrigeration units, cryogenic units and associated gas treatment facilities.

Latest News:

Altus Midstream (NASDAQ: ALTM) is building out midstream infrastructure in the Permian Basin to support the growth of its oil and natural gas producing parent, Apache (NYSE: APA). The company is investing in long-haul pipelines as well as constructing new natural gas gathering systems and processing plants. This infrastructure will help move what Apache extracts to market centers along the Gulf Coast. As these assets enter service, they'll supply Altus with steady cash flow backed by long-term contracts with Apache and other customers.

Given the number of midstream assets Altus and its partners have under construction, the company is on track to significantly grow earnings over the next two years. That upcoming upside makes it one of the most compelling growth stocks in its sector. (Source: finance.yahoo.com)

Short Interest:

5.37M 06/28/19

P/E Ratio (with extraordinary items)

235.41

Average Analyst Price Prediction: $5.88

Recommendation Overweight (Update Required)