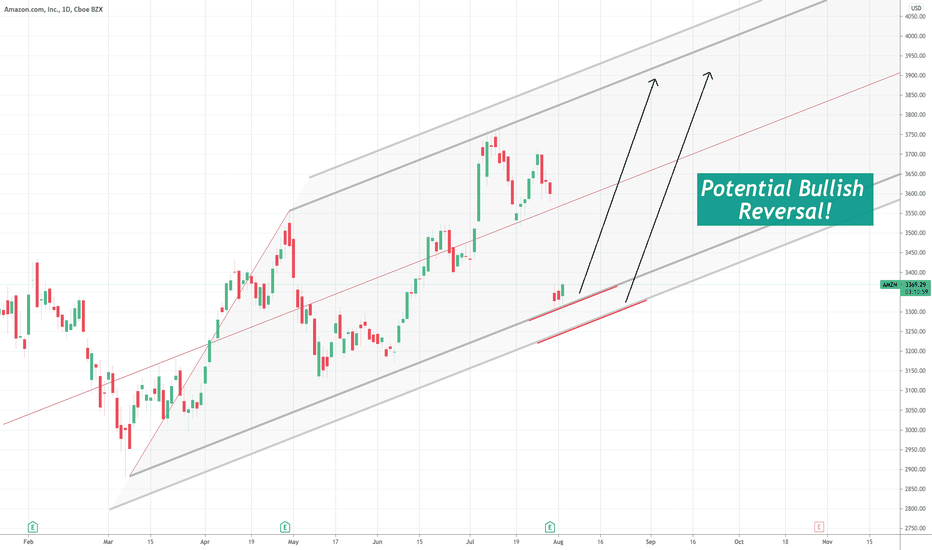

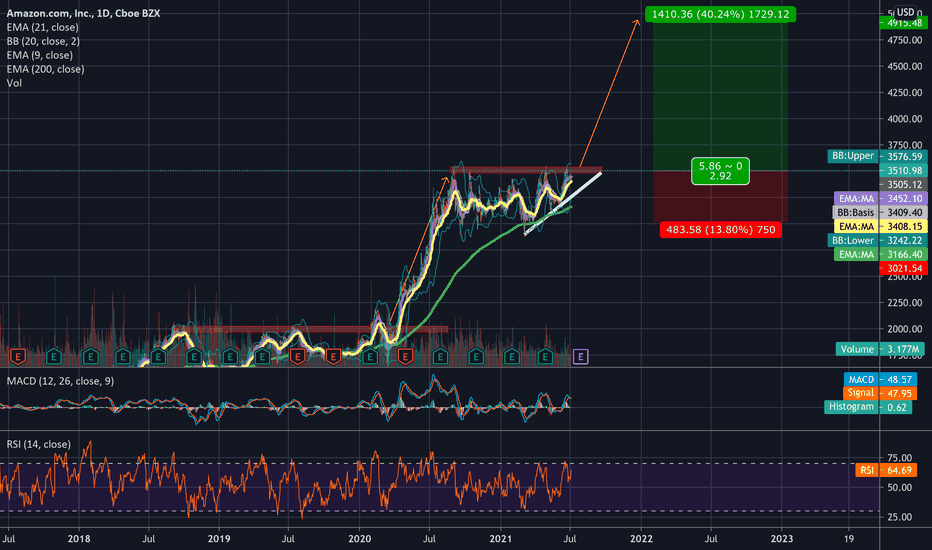

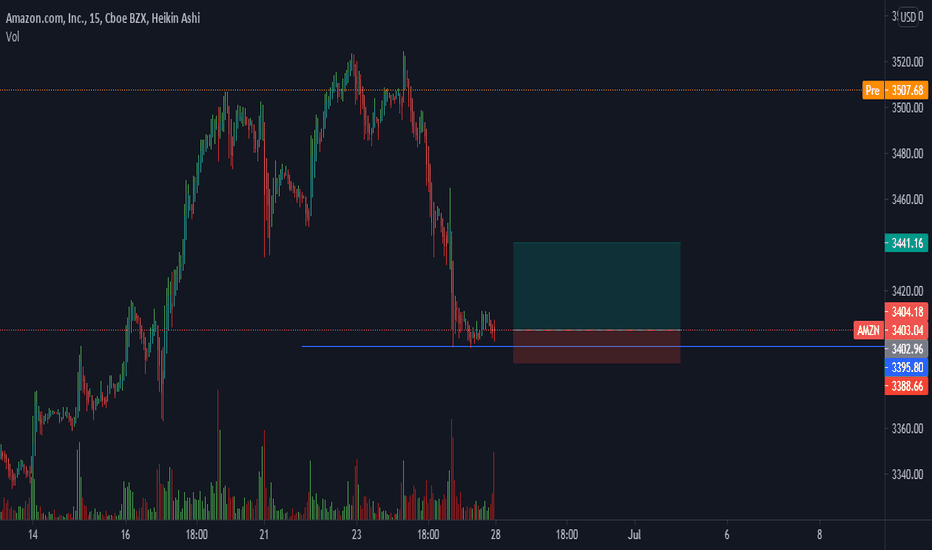

AMAZON Potential Bullish ReversalAmazon saw a sharp sell-off last week after its earnings report. Despite AWS and its ads business seeing incredible growth, the growth in their e-commerce core business seems to be slowing down. For this reason, the stock fell more than 8% on Friday. This is very surprising to me as I expected the market to have priced in this scenario. After all, as the economy opens up, people will want to go out and spend money on other activities rather than buying stuff on Amazon during the lockdown.

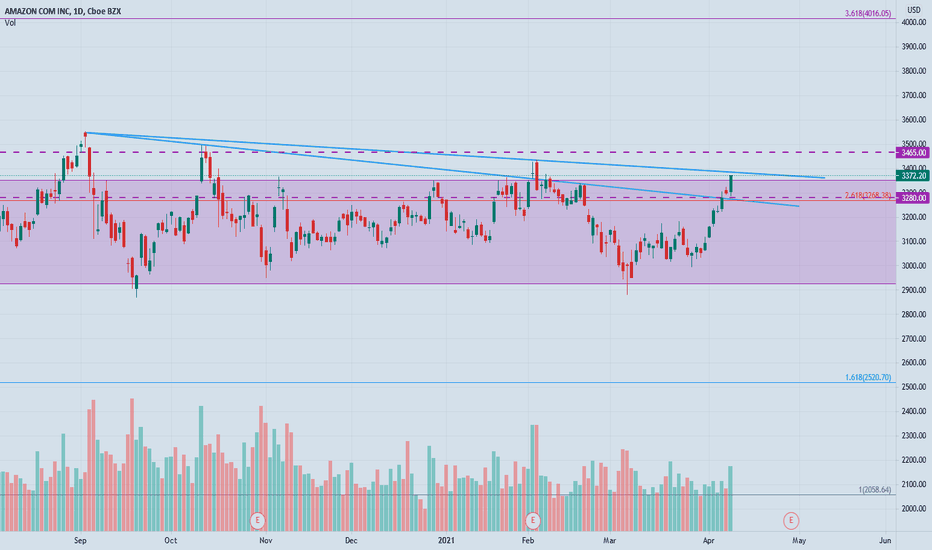

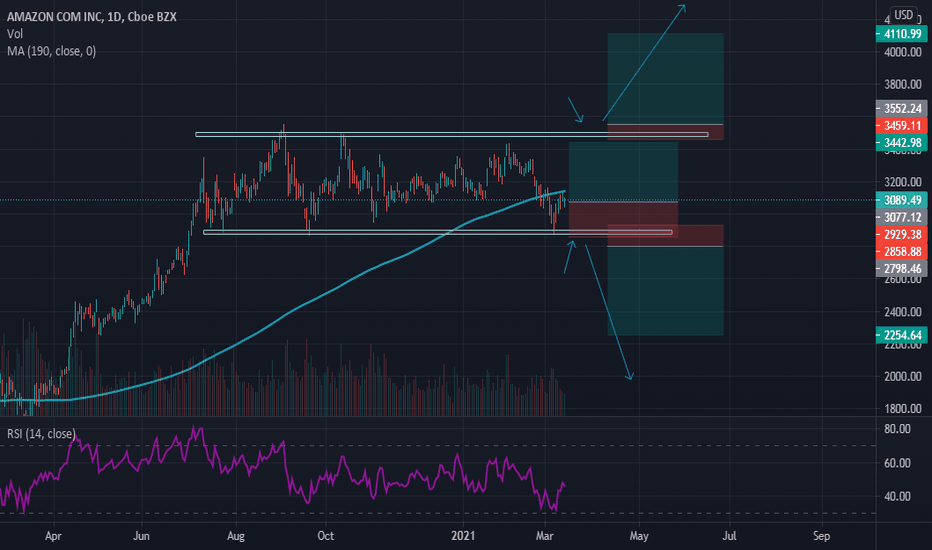

Nevertheless, the price is testing the support level of the channel trend right now. Keep a close eye on the two support levels indicated in red. As long as we hold these support levels there's a good chance a bullish reversal will play out. On the other hand, if we break these support levels, expect more downside.

Amazonlong

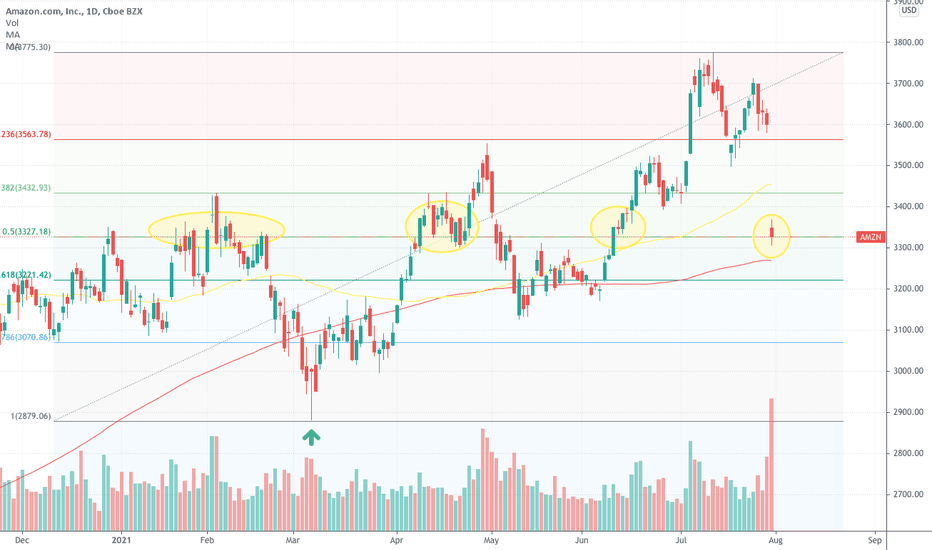

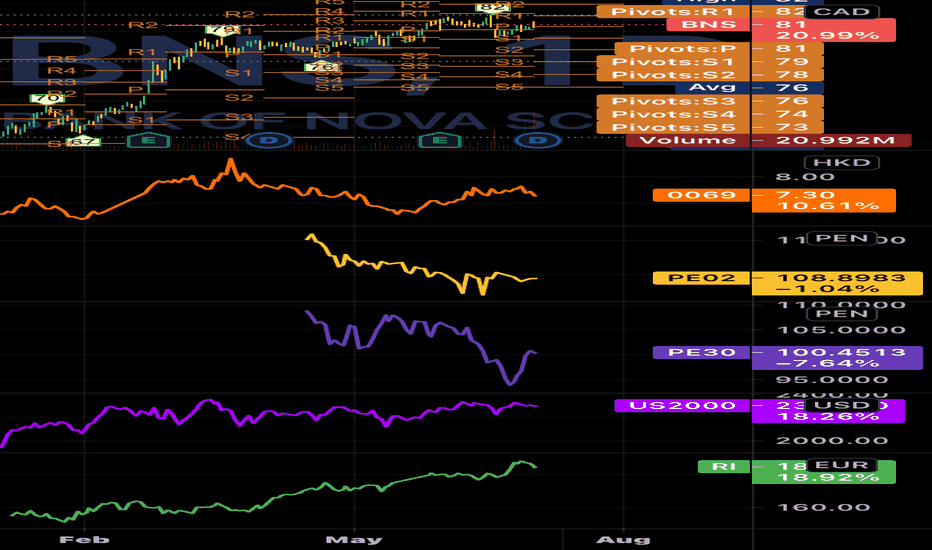

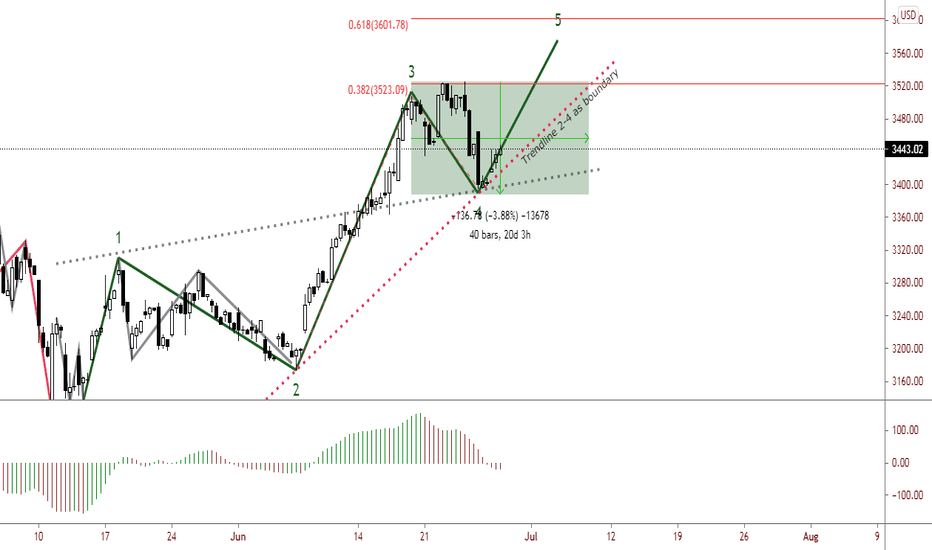

AMZN 50 Fib Hold Or Fold?Looking at AMZN the last time it was at its low-end support, using that as an anchor then plotting out the fibs actually revealed some pretty clear levels. Mainly this 50 fib line has remained a "high traffic" pivot for the stock this year. Even with Friday's gap down, AMZN stock briefly broke below it but held RIGHT at it by the closing bell. Also on the 1 hr, 30 min, and 15 min timeframes, the final candle was a dragonfly doji. Will it hold true to its usual bullish continuation definition or more pullback still in store?

COVID and reopening will likely be supporting "cast members" to determine where the follow-through comes from. Delta cases continue picking up but at the same time, AMZN is somewhat of a hybrid both as a reopening play and a lockdown survivor.

More: Top Reopening Penny Stocks to Buy in August 2021? 3 to Watch

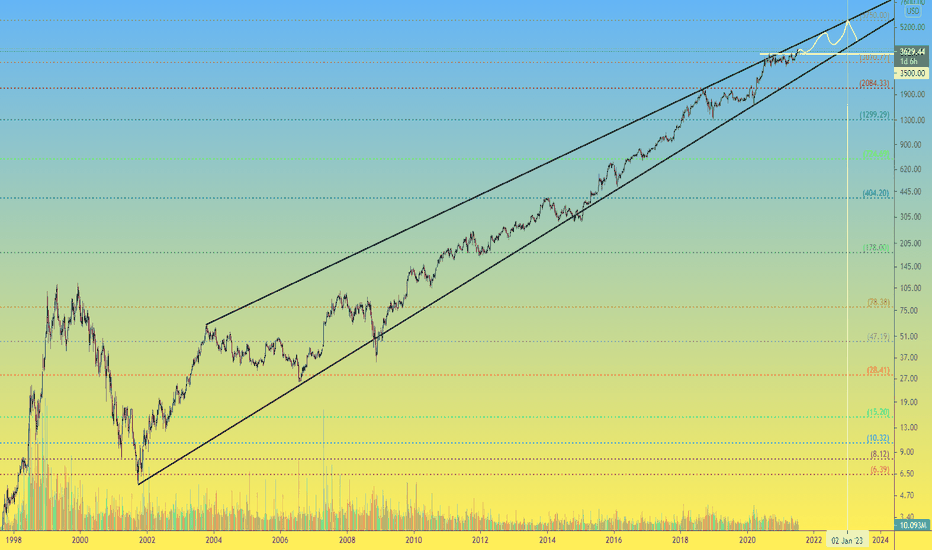

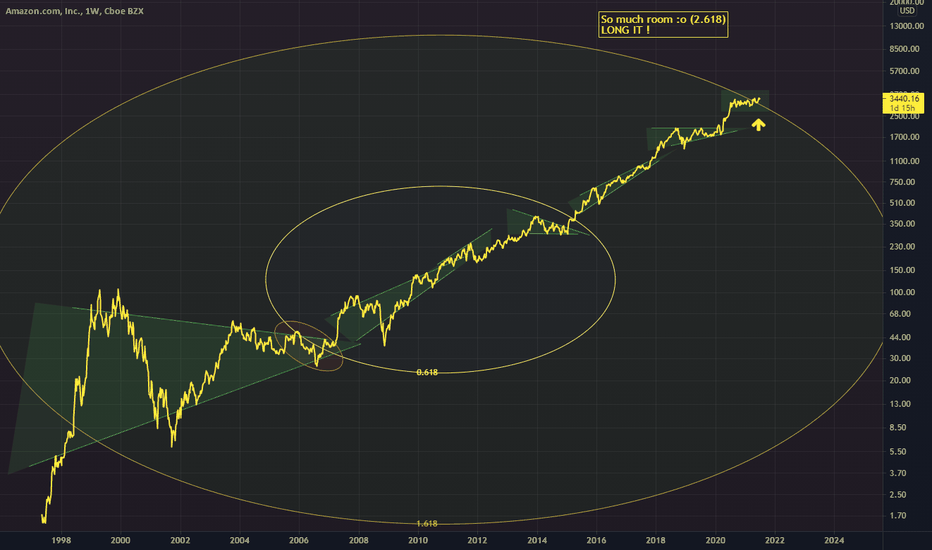

AMZN 1H Amazon stock has an uptrend for 20 years, what next?Amazon.com is one of the first Internet services focused on the sale of real consumer goods, the world's largest company in terms of turnover selling goods and services over the Internet. The company is expanding into e-commerce markets around the world.

Such a "big brother" from “Big five“ , the development of which probably inspires all the Internet platforms. Today, it is difficult to name any innovative industry where Amazon or directly its founder Jeff Bezos would not be involved. They are involved in all industries: from filming movies and TV shows to supermarkets without salespeople, from selling anything online to flying into space.

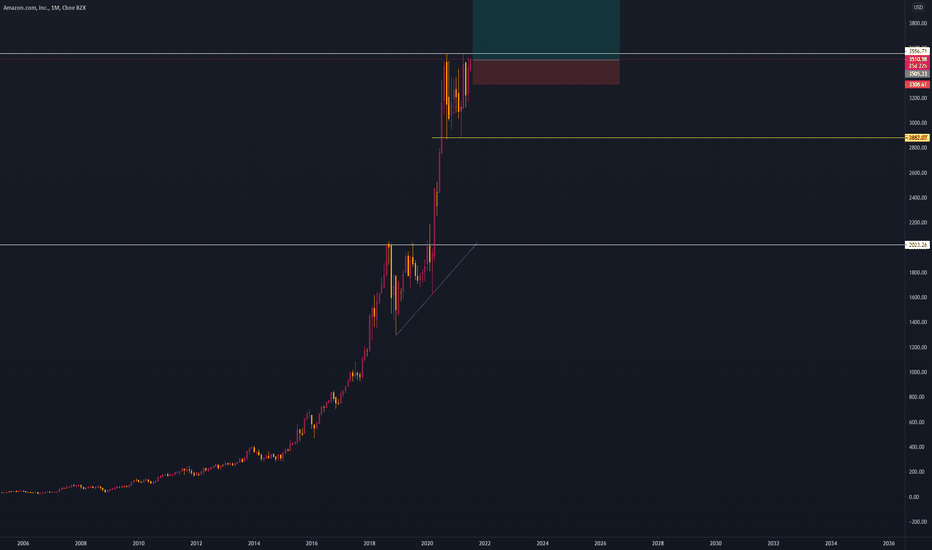

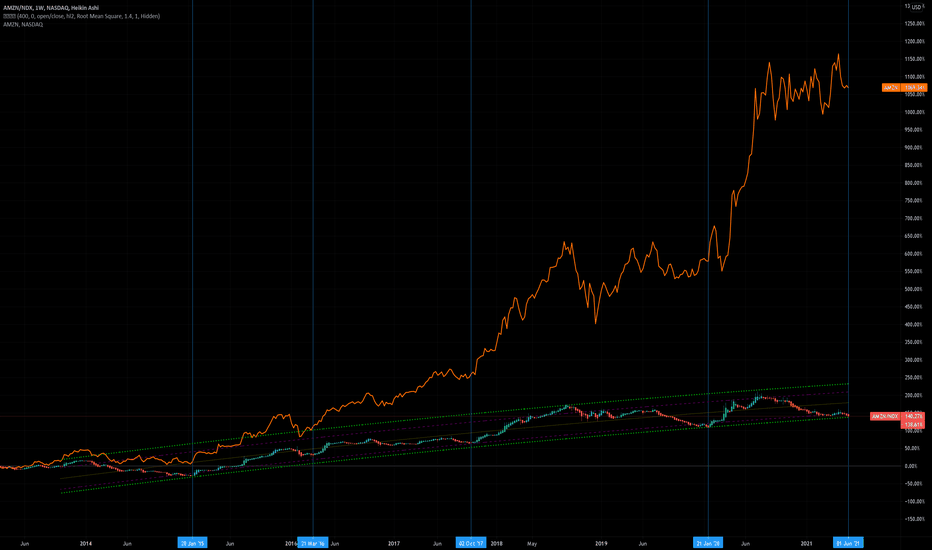

But let's go to the graph, if you looked at our global ideas for the funds' instruments ( by the way, they are all tied to the bottom of this idea ), you should note that all instruments had a consolidation of 8-13 years around the 00s and then a 10-12 year growth trend.

But AMZN shares are different, even special ones — their upward trend , almost without correction, has been going on for 20 years.

From the low of 2001, the share price of AMZN has added more than +60,000% , here even most cryptocurrencies can envy such a powerful and stable growth.

Of course, the higher the price, the more difficult it is to grow, however, we believe there is still potential for growth.

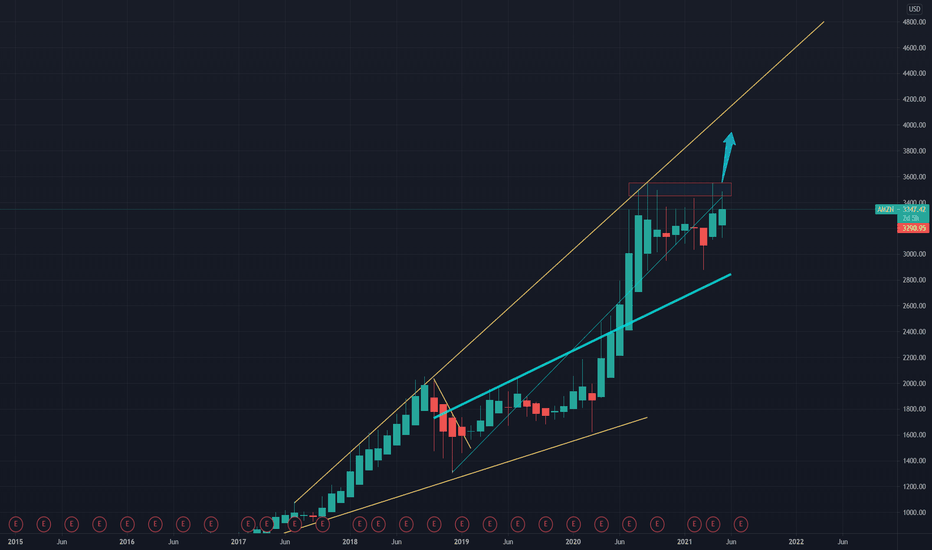

Last year, Amazon's share price was in the consolidation of $2800- $3500. It was gaining strength for the next upward impulse, which took place 2 weeks ago. Now the $3500 level is turned from resistance to support.

If the price does not go much lower than this level, then the forecast of continued growth another 1.5 years to the beginning of 2023 will become very realistic.

The intermediate target for growth can be $4800, and the final target for growth we choose is $5750 . Just imagine, at this level, the price of an A MZN share could rise more than +100,000% from the 2001 low in a single trend. One hundred thousand percent, this is cosmic significance as for funds.

It is good that tradingview retains all the ideas and in 1.5-2 years we will be able to test their effectiveness.

And if you are interested, please like and write a comment. We will update the idea over time, and you will receive a notification about it.

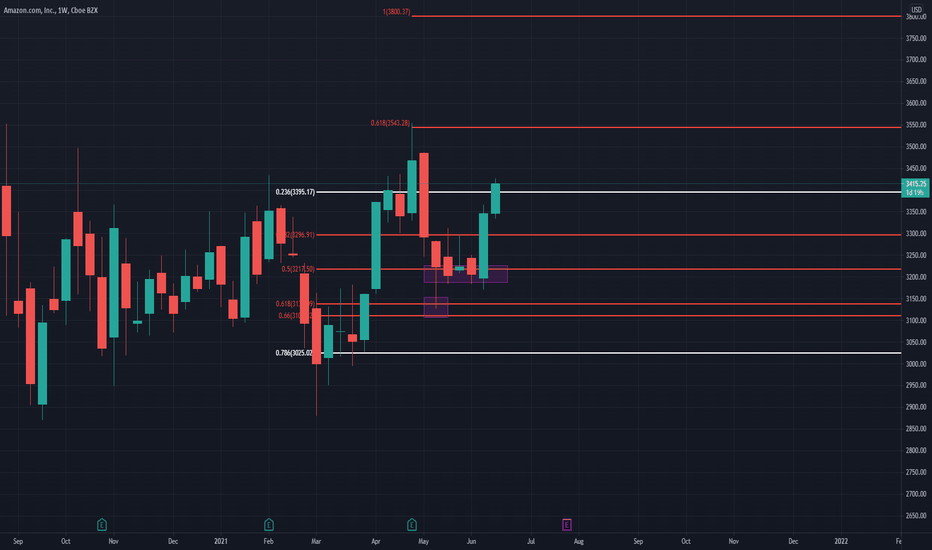

AMZN Long-term LONG/BULLISH - Amazing support for next rise!AMZN Long-term BULLISH/LONG - We had a bounce from the 0.618 and a beautiful support from the 0.5 of the Fibonacci Retracement, next targets are the 0.618 of the Fibonacci Extension ($3543.28) and the 1 ($33800.37) GOOD LUCK AND HAPPY TRADING!

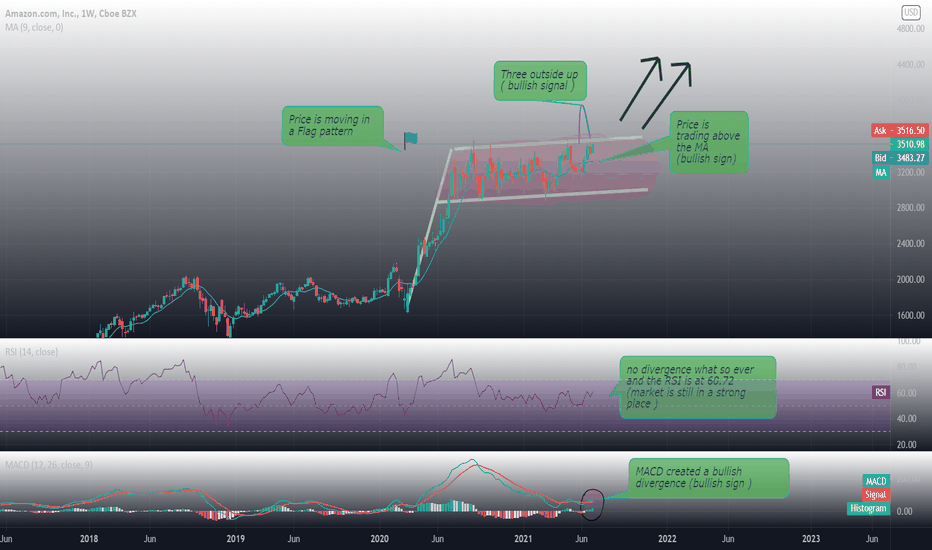

AMAZON inc. 1W analysis 03/07/21Hello everyone , as we all know the market action discounts everything :) we took a look on the AMZN stock weekly chart and noticed no reversal signs yet the market is still in a bullish phase with all the different patters and indicators confirming this . the market seems to formed a flag pattern and its trading in its range for the time being.

Fundamental analysis :

Amazon.com Inc plans to award incoming Chief Executive Andy Jassy more than $200 million in extra stock, which will pay out over 10 years, the company said in a regulatory filing on Friday.

Amazon (NASDAQ:AMZN) will record the grant of 61,000 shares on July 5, the filing said. That's the date Jassy succeeds Jeff Bezos in the online retailer's first CEO transition since its founding in 1994. As of Friday's close, those shares are worth about $214 million.

The award's exact value will depend on how the shares are trading when they pay out in future years, encouraging Jassy to grow a company that's worth $1.77 trillion today. Though Amazon did not disclose the vesting schedule, its previous stock grants have not vested right away.

Jassy's base salary has been $175,000, filings show. On top of that, he has $45.3 million in previously awarded stock that is vesting this year and had $41.5 million vest in 2020.

The annual median pay at Amazon was $29,007 last year across full, part-time and temporary employees worldwide, excluding Bezos, whose base salary was $81,840. The founder's outsized stake in Amazon has made him the richest person in the world.

AMZN's Return On Assets of 8.33% is amongst the best of the industry. AMZN does better than the industry average Return On Assets of -4.11%.

AMZN's Profit Margin of 6.42% is amongst the best returns of the industry. AMZN outperforms 82% of its industry peers. The industry average Profit Margin is -2.95%.

AMZN shows a strong growth in Earnings Per Share. In the last year, the EPS has been growing by 151.08%.

The Revenue is expected to grow by 19.56% on average over the next 5 years.

Make sure to Follow and Like for more content

If you have any questions please ask

Thank you for reading.

Will the MGM deal push AMAZON higher?Amazon is buying MGM Studios for $8.45 billion, the companies announced Wednesday, marking Amazon’s most ambitious move yet into the entertainment business.

The deal is Amazon’s second-largest acquisition. It paid $13.7 billion for Whole Foods in 2017.

What do you think? Will this deal push AMAZON higher towards the 4,000$ mark?

Most likely will,

the FXPROFESSOR

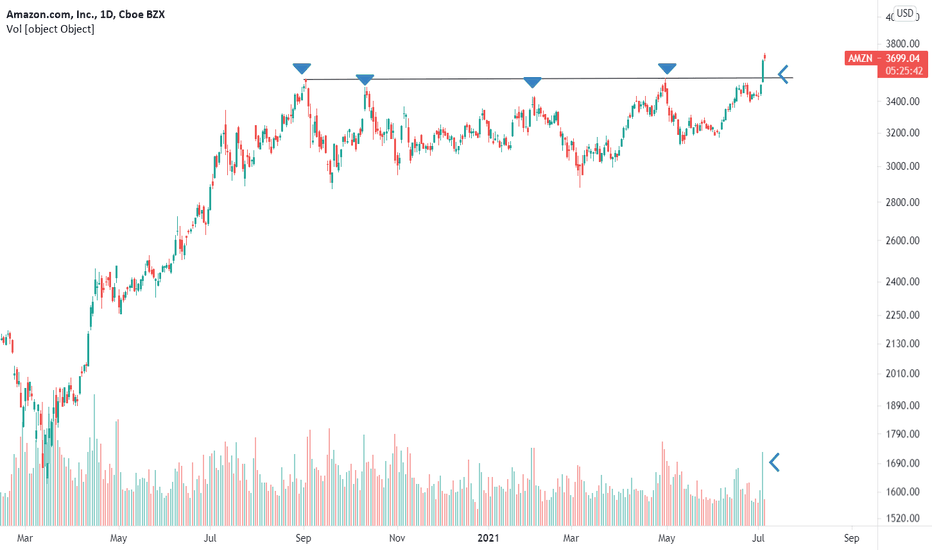

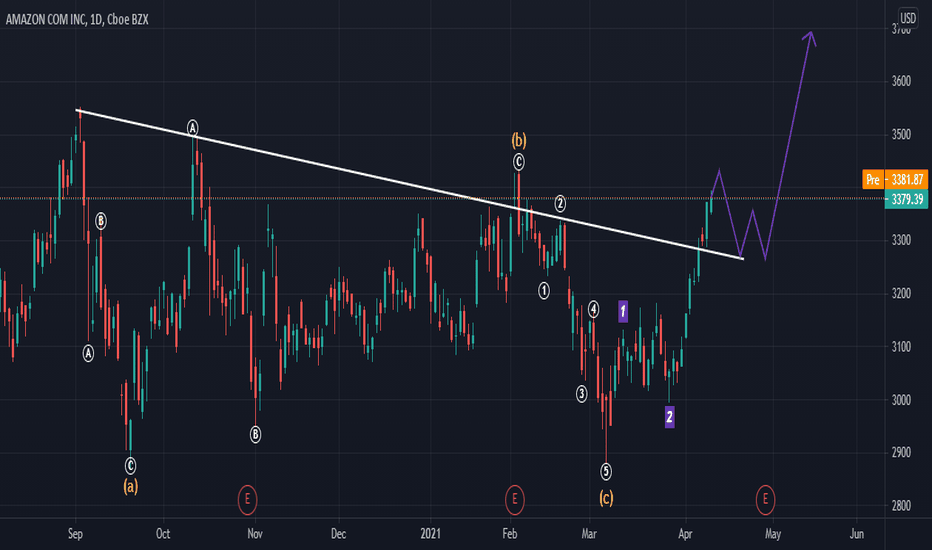

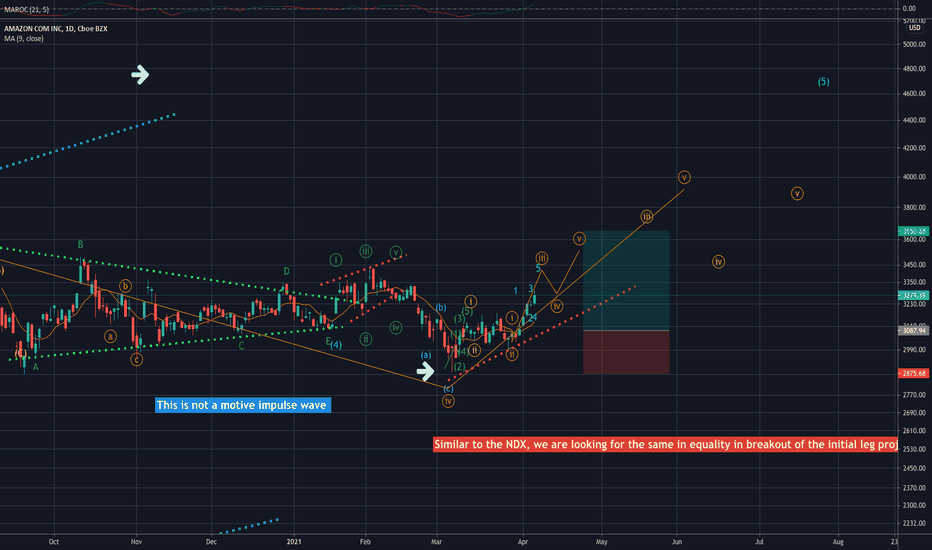

AMZN Bullish Trade Setup AMZN daily chart shows it is setting up for a wave (5) rally that could reach 3800. Up to the daily time frame and above, AMZN remaining bullish against the wave (ii) support level at 2977 for now. We are interested in establishing long positions like a bullish vertical that expires in May 2021.

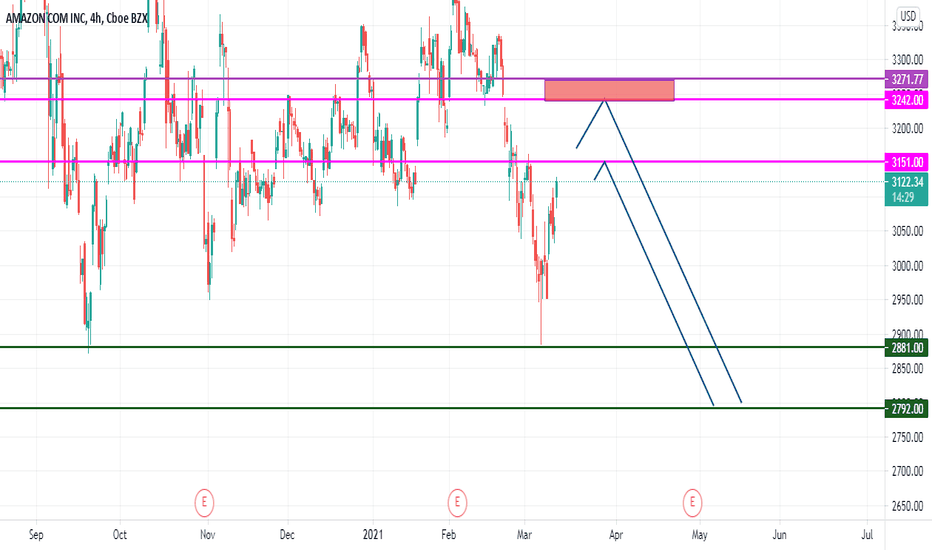

Amazon Price in Triangle Amazon stock price at the triangle support break down below will send the price lower.

amazon stock price must hold above this zone for the next move here amazon chart looks fine here if hold above this lower trend line zone it can move higher and breakout above 3400 $ will send the price to higher level it can easily touch the 4000$ if maintain above the 3500$ psychological support zone.

let's see the price reaction here we will see what market maker is cooking for us