AMD Weekly Trade Alert (2025-07-29)

**🔥 AMD Weekly Trade Alert (2025-07-29) 🔥**

💹 *Momentum Confirmed. Calls Loaded. Let’s Ride.*

📈 **Key Bullish Signals**

✔️ Daily RSI: **83.2** (Rising)

✔️ Weekly RSI: **79.9** (Rising)

✔️ Call/Put Ratio: **2.03** 🧨

✔️ Volatility: Low (VIX = 15.2)

⚠️ Volume Weak (0.9x) – But not a dealbreaker.

---

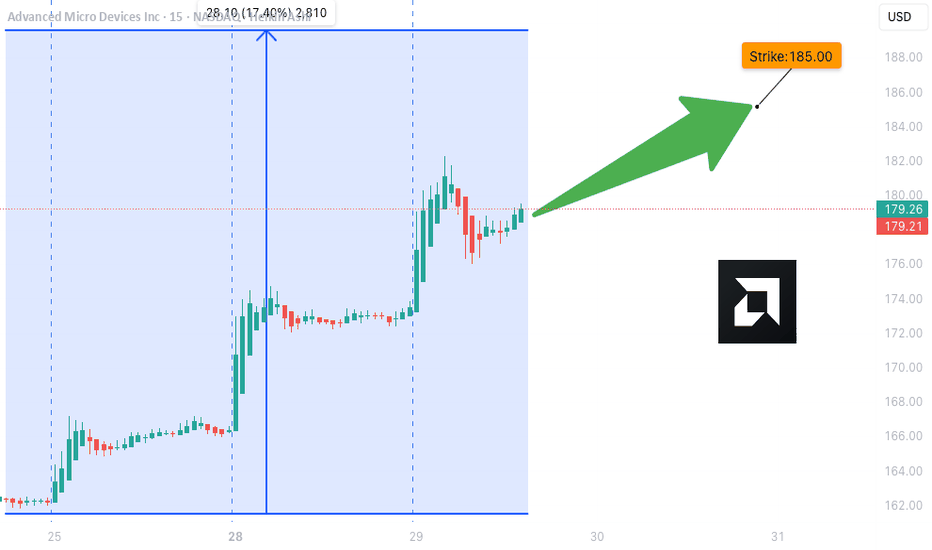

**🎯 TRADE SETUP**

🔹 **Ticker**: \ NASDAQ:AMD

🔹 **Strategy**: Weekly Naked Call

🔹 **Strike**: \$185C

🔹 **Entry**: \$0.66

🔹 **Profit Target**: \$1.32 (100%)

🔹 **Stop Loss**: \$0.33

🔹 **Expiry**: 2025-08-01

🔹 **Size**: 3 Contracts

🔹 **Confidence**: 75%

---

**🧠 WHY THIS WORKS**

🔋 Momentum → STRONG

💰 Institutions are loading up calls

🧘 VIX = calm

⚡ Short gamma risk = fast payoff or cut

---

📢 **Watchlist it. Trade it. Exit fast.**

💬 Comment “🔥AMD” if you’re in.

🔁 Repost if you see \$190 coming.

\#AMD #OptionsTrading #CallOptions #TradingView #WeeklySetup #MomentumPlay #BullishSignal #MarketMomentum

Amdearnings

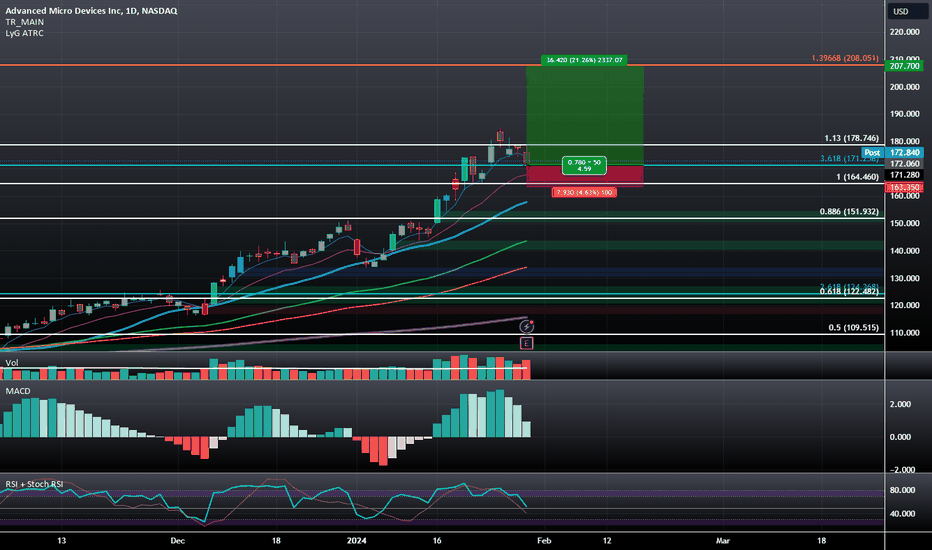

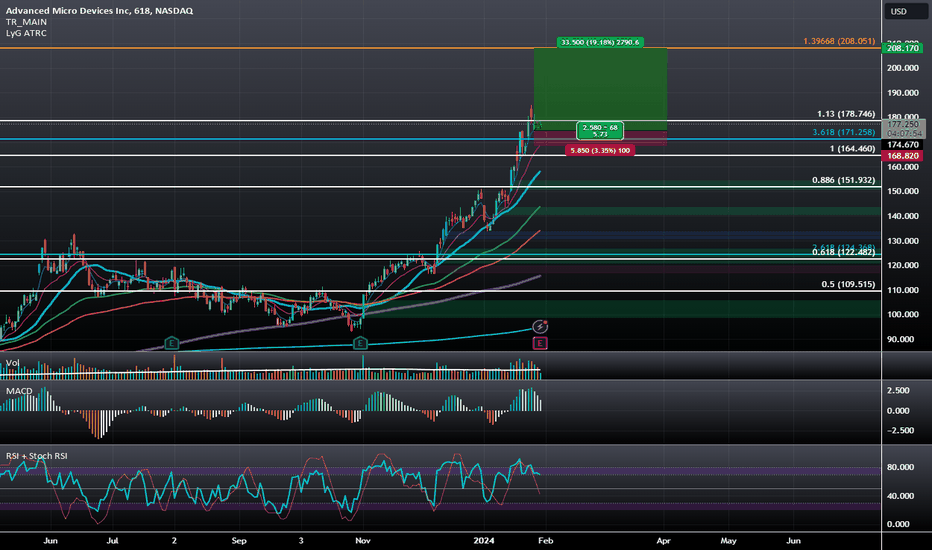

AMD: Targeting HOP Level at $208.051: Holding 3.618 as SupportLast week during earnings, INTC reversed at the PCZ of a Bearish 5-0 after trading just below the highly contested 50 dollar strike. Now AMD is doing something similar, except its highly contested strike is below it at $170-$175. I find it a little bit more likely that AMD goes for a move up towards the 200 level which would align it with the Bearish HOP level where then one may consider switching to a Bearish bias.

I will be playing it via synthetic longs and vertical spreads

This is an updated Post after realizing that AMD just filled a gap visible on the daily, I also felt like reposting it on the daily timeframe because after hours activity does not really matter for the options position.

AMD: Targeting HOP Level at $208.051Last week during earnings, INTC reversed at the PCZ of a Bearish 5-0 after trading just below the highly contested 50 dollar strike. Now AMD is doing something similar except it's highly contested stike is below it at $175. I find it a little bit more likely that AMD goes for a move up towards the 200 level which would align it with the Bearish HOP level where then one may consider switching to a Bearish bias.

I will be playing it via options spreads, in a way that gives some credit in order to reduce risks either being a Vertical or a Butterfly call spread though I may increase my risks a bit and go synthetic long.

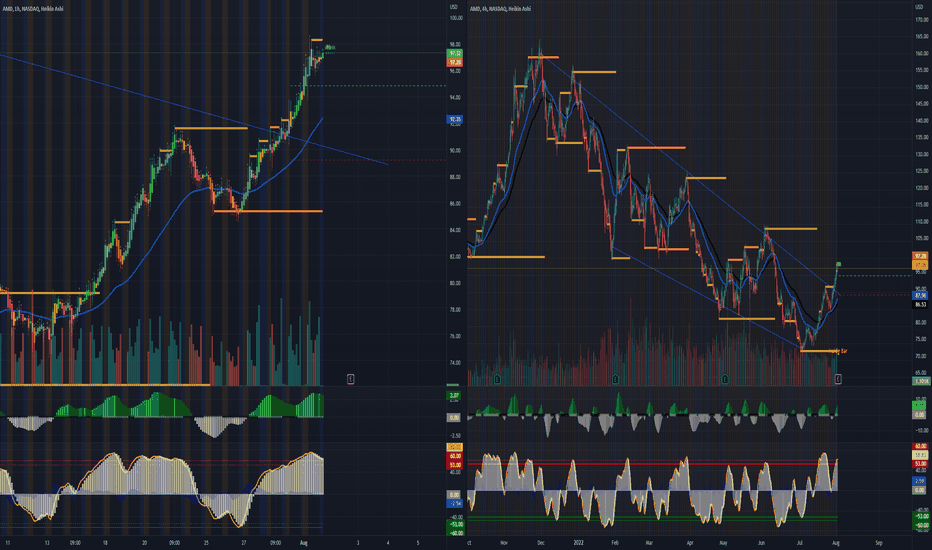

$AMD falling chopstick breakout?AMD breaks out from its 3 day losing streak to 4 day winning streak after the feed week and blue chips earnings. AMD looks like a falling chopstick at 4hr chart. but also clearly visible its lower high movement. with earnings coming up tomorrow after market close. i expect $AMD to pull back along with the overall market as it starts to cool off its steam from 4 day winning streak. or it can go sideway like consolidation and make little move before the market close. AMD could breakout to $100 if they beat the Wall Street EPS estimate with positive guidance.

here my price target for $AMD for monday 08/02/22.

============================================================

For calls; buy above $98.30 and sell at 100.36 or above

For puts, buy below 96.50 and sell at 93.95 or below

============================================================

Welcome to this free technical analysis . ( mostly momentum play )

I am going to explain where I think this stock might possibly go the next day or week play and where I would look for trading opportunities

for day trades or scalp play.

If you have any questions or suggestions on which stocks I should analyze, please leave a comment below.

If you enjoyed this analysis, I would appreciate it if you smashed that LIKE or BOOST button and maybe consider following my channel.