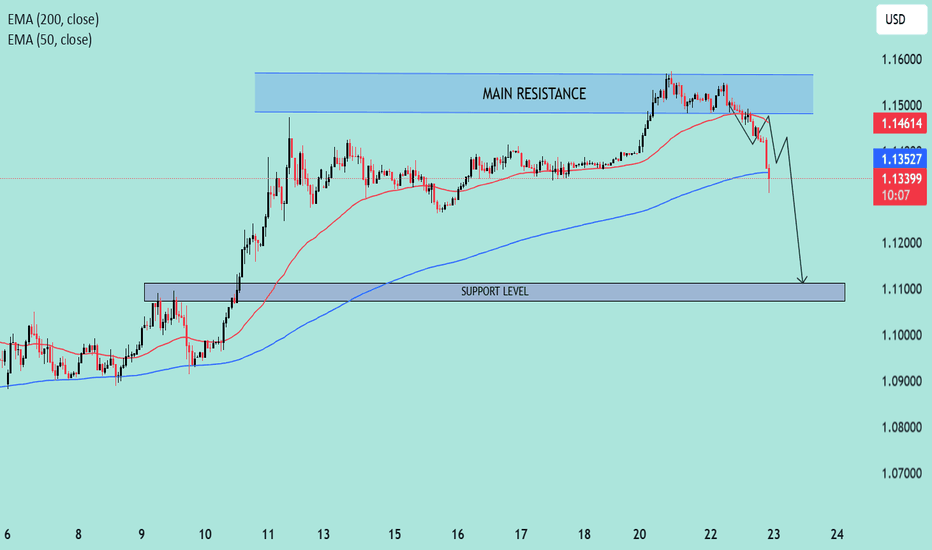

EUR/USD Bearish Setup Unfolding Below Key Resistance📊 Technical Analysis of EUR/USD (4H Chart)

🧭 Chart Overview:

Current Price: ~1.1350

Indicators Used:

EMA 50 (Red): ~1.1311 — acting as dynamic support.

EMA 200 (Blue): ~1.1114 — aligns closely with major support zone.

📌 Key Levels:

🔼 Main Resistance Zone: 1.1375 – 1.1400

Price has tested this zone multiple times, forming a potential double top pattern.

Strong bearish pressure observed each time price enters this area.

🔁 Minor Resistance (Retest Zone): ~1.1325 – 1.1345

Currently acting as a decision zone.

If price fails to hold above this level, it could turn into resistance on the next bearish leg.

🔽 Support Zone: 1.1100 – 1.1130

Converges with EMA 200 — making it a high-probability demand zone.

Potential target for the anticipated drop.

🧠 Price Action & Structure:

Market showed a strong bullish rally previously, breaking through resistance levels.

Now showing signs of exhaustion at the top.

Bearish scenario projected with a lower high forming below the main resistance, followed by a sell-off toward the support zone.

⚙️ Possible Scenarios:

Bearish Scenario (High Probability):

Price rejects the minor resistance → breaks below EMA 50 → continues lower to support.

Target: 1.1110 area.

Bullish Scenario (Low Probability):

Price reclaims and closes above 1.1375 with strong momentum.

Potential breakout and continuation toward 1.1450+.

🧩 Confluences Supporting Bearish Bias:

Lower high formation potential.

EMA 50 starting to flatten.

Failure to maintain momentum above main resistance.

Clean drop path toward 1.1110 if support breaks.

📉 Conclusion:

This setup favors short-term bearish movement, particularly if the price rejects around the 1.1345 level again. A breakdown below the minor resistance zone would likely trigger a sell-off toward the 1.1110 support, in line with the 200 EMA.

Analysis

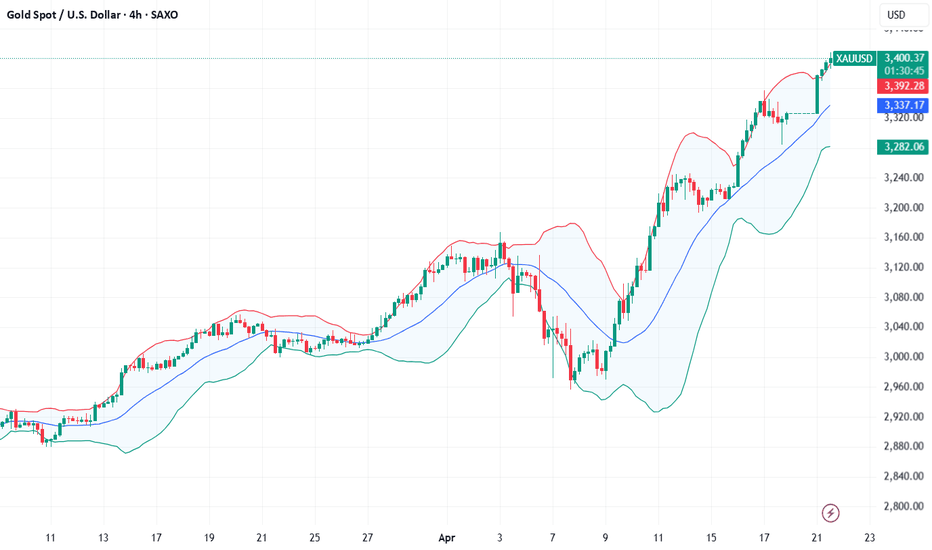

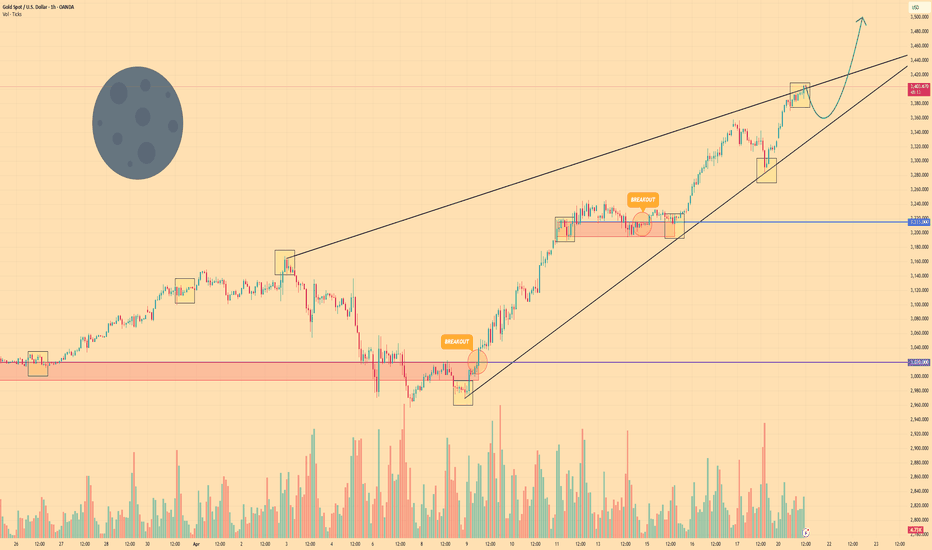

XAU/USD Target Achieved – $3,500 Successfully Hit 🔥 XAU/USD Target Smashed – $3,500 HIT! 🎯💰

Gold has officially reached $3,500, perfectly hitting our projected buy target!

This move confirms the strength of the bullish momentum and technical breakout setup.

🔹 Entry: Above $3,430

🔹 Final Target: ✅ $3,500 – Hit

🔹 Result: High-conviction setup delivered with precision

🔹 Trend: Remains bullish, but profit-taking expected at round number resistance

👏 Massive congrats to all who followed the plan — another clean win on XAU/USD!

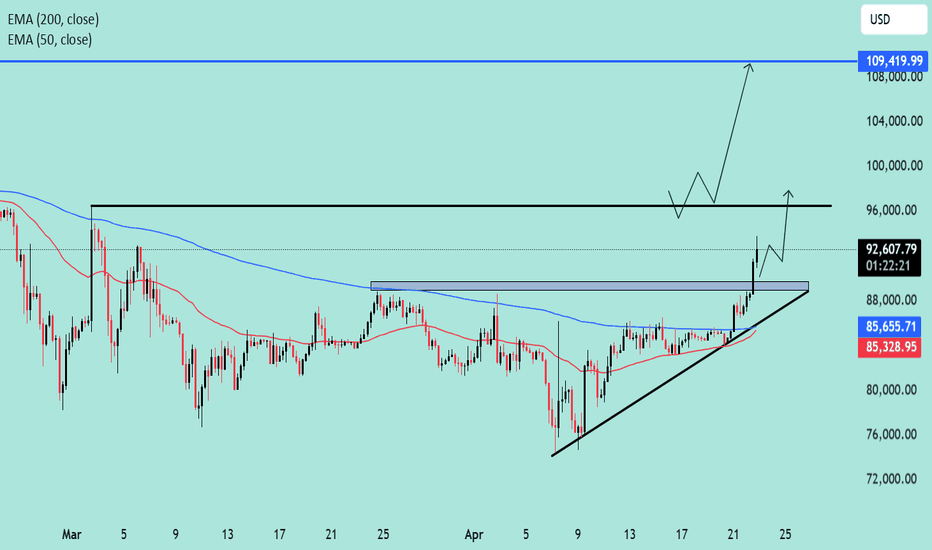

BTC/USD Eyes $109K After Bullish Breakout!!🧠 Chart Type and Indicators:

Chart Type: Candlestick

Indicators Used:

EMA 50 (red line): 85,335.18

EMA 200 (blue line): 85,657.29

🔍 Technical Pattern Analysis:

Pattern Identified: Ascending Triangle

The price has formed higher lows (ascending trendline support) while repeatedly testing a horizontal resistance zone (~$88,000), forming an ascending triangle.

This is typically a bullish continuation pattern when it occurs after an uptrend, though in this context, it's forming after a consolidation, giving more significance to the breakout.

🚀 Breakout Confirmation:

The price has broken above the horizontal resistance and is currently trading at $92,766.51.

Volume is not visible but should be increasing during a valid breakout.

Both EMAs have been decisively breached to the upside, signaling momentum shift in favor of bulls.

🧩 Key Levels:

Support Zone (Post-Breakout Retest): ~$88,000

Previously a resistance zone, now likely to act as support.

Immediate Resistance: ~$96,000

Historical resistance zone shown on the chart with a horizontal black line.

Extended Target (measured move): ~$109,420

Based on the height of the triangle projected from the breakout point.

📈 Price Action Forecast:

Two possible scenarios (depicted with arrows on the chart):

Bullish Continuation:

A retest of the $88,000 zone followed by continuation to $96,000, then $109,420.

Short-Term Pullback:

Price may dip to retest the breakout zone (~$88,000), consolidate, then rally higher.

✅ Bullish Signals Summary:

Breakout from a bullish ascending triangle.

EMAs crossed and price holding above them.

Clear higher highs and higher lows formation.

Momentum suggesting further upside.

🧨 Risks to Watch:

False Breakout Risk: If the price fails to hold above $88,000 and falls back into the triangle range.

Macro Factors: Bitcoin remains sensitive to macroeconomic news and regulations that could disrupt technical setups.

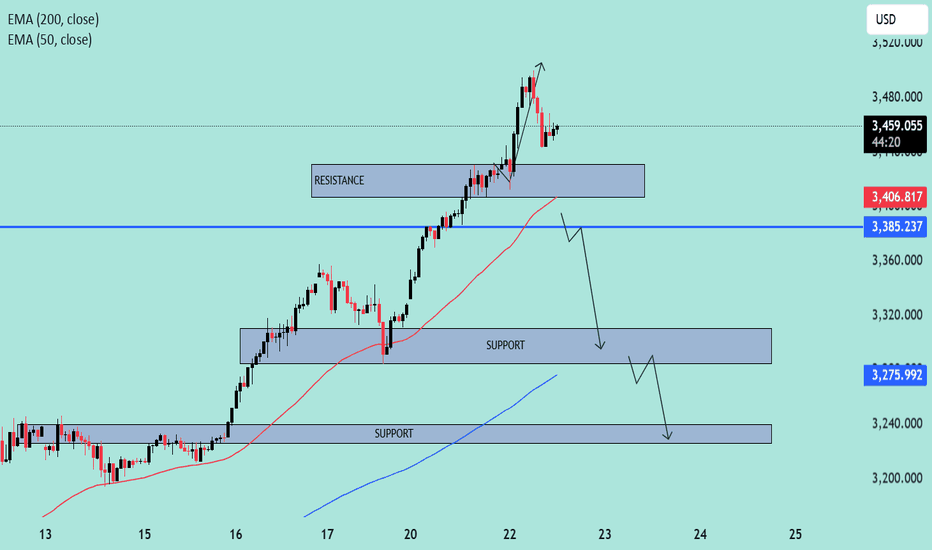

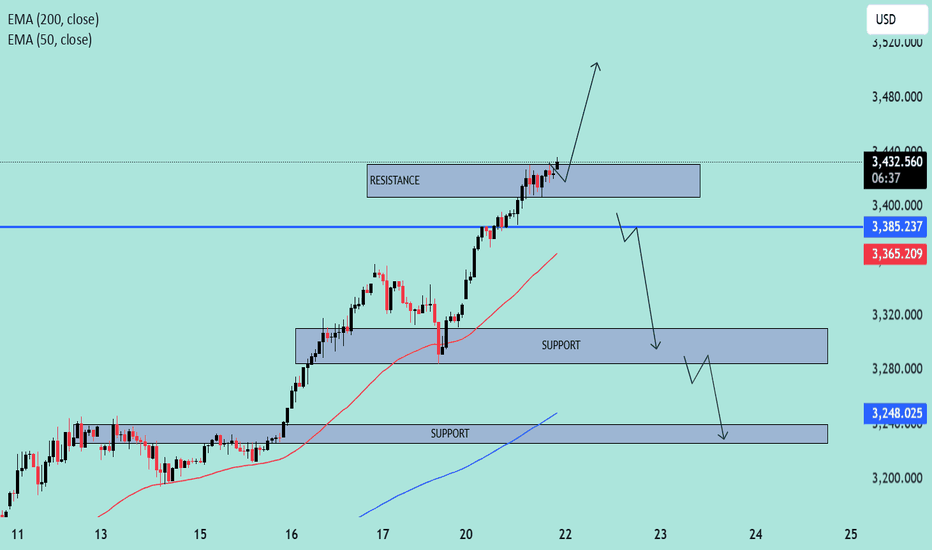

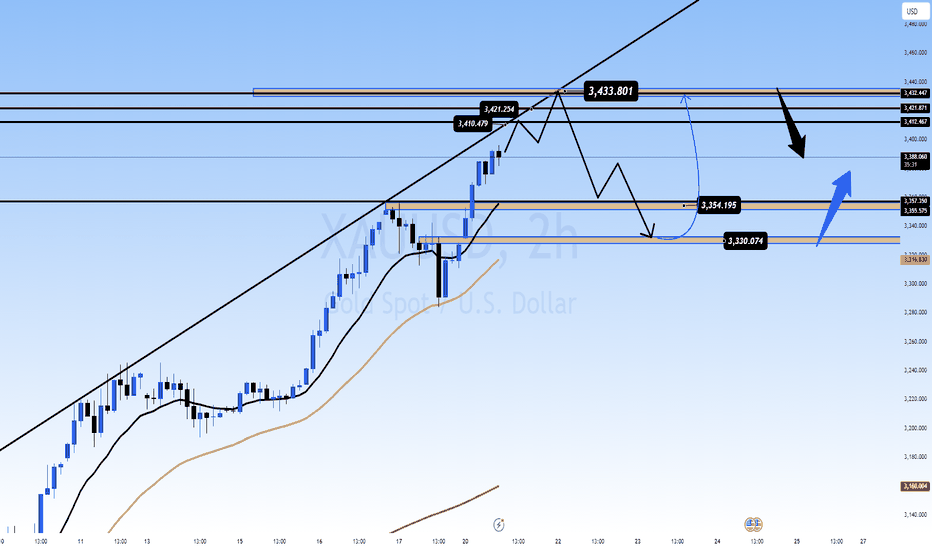

GOLD (XAU/USD) Breakout Watch –Bullish Continuation or Pullback?🔍 Instrument Analysis: XAU/USD (Gold vs USD)

Timeframe: Likely 1H or 4H (based on candle structure)

Indicators:

EMA 50 (Red) – Current value: 3,365.25

EMA 200 (Blue) – Current value: 3,248.04

📈 Current Market Structure

Price: Trading at 3,433.62, in a strong uptrend with higher highs and higher lows.

Trend: Bullish, supported by price trading above both the 50 EMA and 200 EMA.

Key Zones:

Immediate Resistance: ~3,430 - 3,440 zone (currently being tested).

First Support Zone: ~3,315 - 3,330

Second Support Zone: ~3,250 - 3,270

🧠 Scenario Analysis

✅ Bullish Scenario (Primary Bias)

Price is attempting a break and retest of the resistance zone.

If a successful retest confirms it as support, next upside leg could target 3,480+.

Bullish continuation is favored as long as price holds above 3,385 (recent breakout level).

⚠️ Bearish Scenario (Secondary Bias)

If price fails to hold above 3,385, we may see a pullback to:

3,315 - 3,330 support area (reaction likely due to proximity to EMA 50).

A deeper retracement toward the 3,250 zone, aligned with EMA 200, which would be a critical level for bullish continuation or breakdown.

📊 EMA Insight

EMA 50 > EMA 200: Confirms bullish momentum.

The slope of both EMAs is upward, reinforcing current upward trend.

A test of the EMA 50 may offer a buy opportunity if structure holds.

🔔 Trade Outlook

Bullish bias remains intact above 3,385.

Look for bullish price action confirmation (bullish engulfing, pin bars, etc.) on retest of resistance-turned-support.

Monitor volume/activity around 3,385-3,400 for potential rejection or continuation clues.

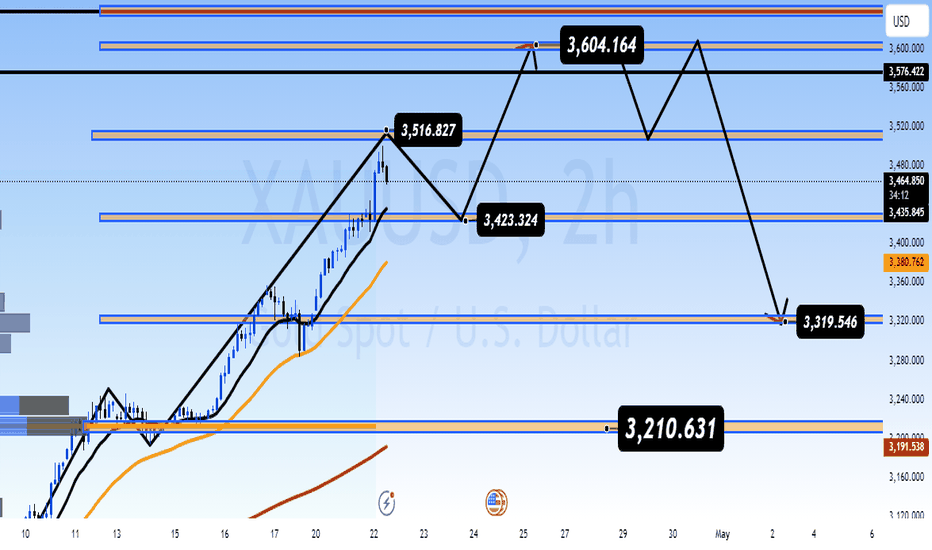

GOLD SMASHES THROUGH $3,450🚨 GOLD SMASHES THROUGH $3,450 – IS THIS THE START OF A GLOBAL FINANCIAL RESET? 🚨

🔥 Unstoppable Surge in Motion 🔥

Gold has soared past $3,450 as Asian markets opened, climbing over $100 a day!

In just two weeks, gold is up by over $500 — this isn’t just a rally, it’s a major structural breakout.

A surge in demand from Chinese funds appears to be fuelling the rise, with increasing evidence that Asia is leading a strategic shift away from fiat risk.

💷 Is the Dollar in Decline? Investors Flee the Old System 💷

The US Dollar Index (DXY) has taken a sharp downturn — confidence in USD is clearly under pressure.

Capital is flowing out of the United States, signalling a move away from the traditional financial order dominated by the dollar.

This gold rally isn't just about price — it's a global vote of no confidence in the status quo.

📉 Implications for the UK

With the pound holding relatively stable against the dollar, this gold spike presents a unique hedge opportunity.

For UK investors, rising gold prices could help offset currency risk and inflation concerns — especially in the face of persistent market uncertainty and geopolitical tensions.

📊 Technical Overview 📊

Gold is currently testing critical resistance around $3,519.

A pullback may see it retest support at $3,416 or as low as $3,210.

Fibonacci levels indicate a likely consolidation zone around $3,416.

The momentum is strong — we could be in the early phase of a global asset rotation.

📈 2-Hour Gold Chart Insight

Recent charts show a parabolic move with significant volume, primarily from Asia-based buyers.

This is not a short-term speculative move — it's likely a long-term strategic repositioning.

🌍 What Comes Next? 🌍

Should gold maintain levels above $3,450, a move towards $3,600 and beyond looks increasingly likely.

Talk of a financial "reset" is no longer just fringe theory — it’s entering the mainstream conversation.

From a UK perspective, now could be the time to:

Re-evaluate gold as a portfolio stabiliser

Reconsider exposure to US-denominated assets

Anticipate further volatility across fiat currencies

📌 Key Price Levels to Watch:

Resistance: $3,519 / $3,601

Support: $3,416 / $3,210

Upside Target: $3,600+

📈 Suggested Trading Zones:

Buy Zone

Entry: $3,424 – $3,422

Stop Loss: $3,418

Take Profit Targets: $3,428 / $3,432 / $3,436 / $3,440 / $3,450

Sell Zone

Entry: $3,604 – $3,606

Stop Loss: $3,610

Take Profit Targets: $3,600 / $3,596 / $3,592 / $3,588 / $3,584 / $3,580

💬 What’s your take? Is gold signalling the end of USD dominance?

Is the UK prepared for a global monetary shake-up? Let’s discuss. 🪙

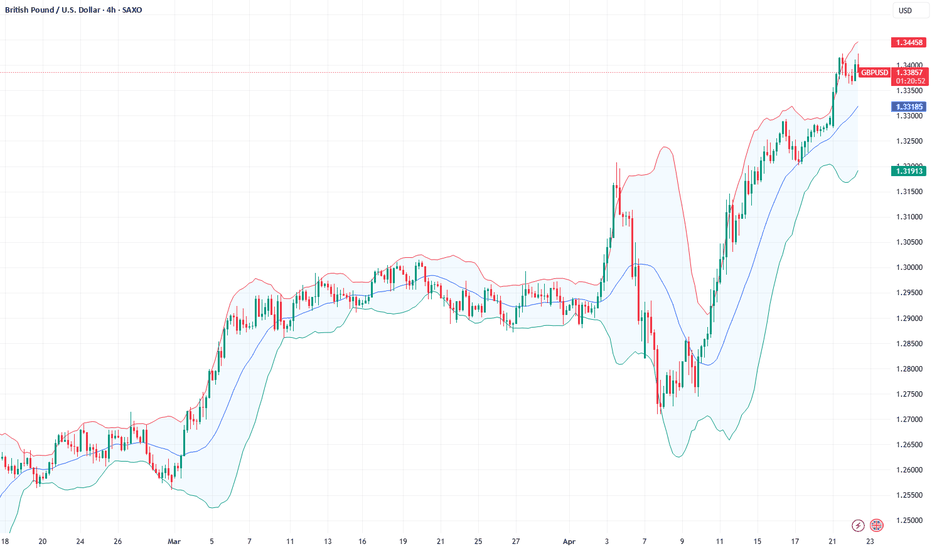

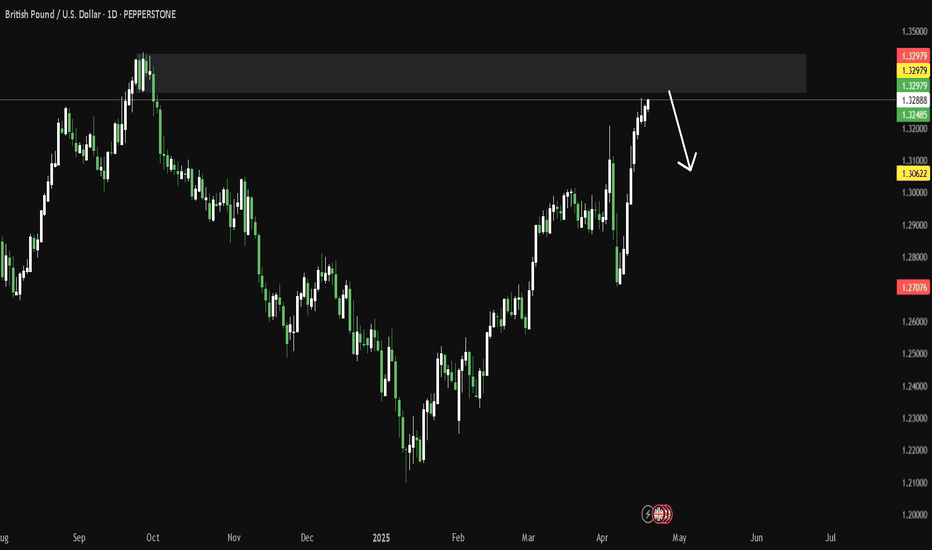

Fundamental Market Analysis for April 22, 2025 GBPUSDGBPUSD:

The GBP/USD pair is trading in positive territory around 1.3370 during the early Asian session on Tuesday. Concerns over slowing growth in the United States (US) and worries over the independence of the Federal Reserve (Fed) are driving the US Dollar (USD) lower and creating a tailwind for the major pair.

US President Donald Trump condemned Powell for continuing to maintain a “wait-and-see” monetary policy until there is clarity on how the new tariff policy will affect the economic outlook. In a Truth social media post, Trump warned that the US economy will slow down if Powell doesn't cut interest rates immediately.

Heightened uncertainty surrounding Trump's tariffs and rising trade tensions between the U.S. and China are undermining the U.S. dollar across the board.

On the other hand, softer UK consumer price index (CPI) inflation data for March and global uncertainty paved the way for an interest rate cut by the Bank of England (BoE) at its May meeting. Financial markets are now betting on an interest rate cut at the Bank of England's May meeting, estimating an 86% probability of this happening, according to LSEG data. This, in turn, could affect the Pound Sterling (GBP) exchange rate against the US Dollar.

Trading recommendation: BUY 1.3425, SL 1.3395, TP 1.3510

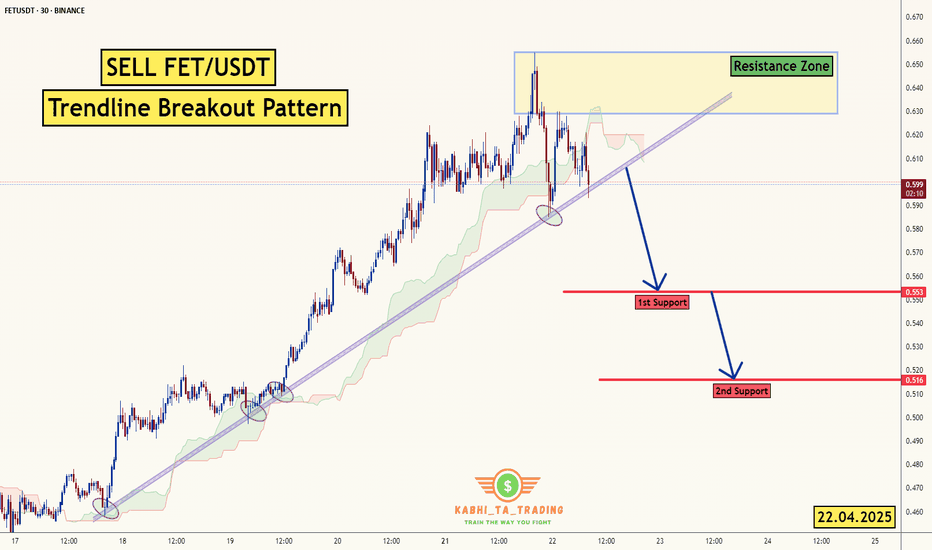

FET/USDT - Trendline Breakout (22.04.2025)The FET/USDT Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 0.553

2nd Support – 0.516

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

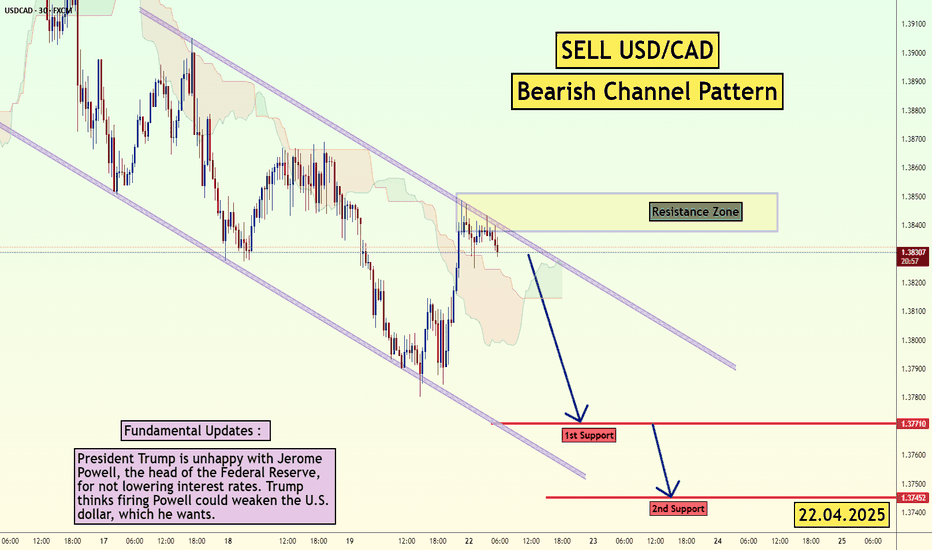

USD/CAD - Channel Pattern (22.04.2025)The USD/CAD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.3771

2nd Support – 1.3745

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

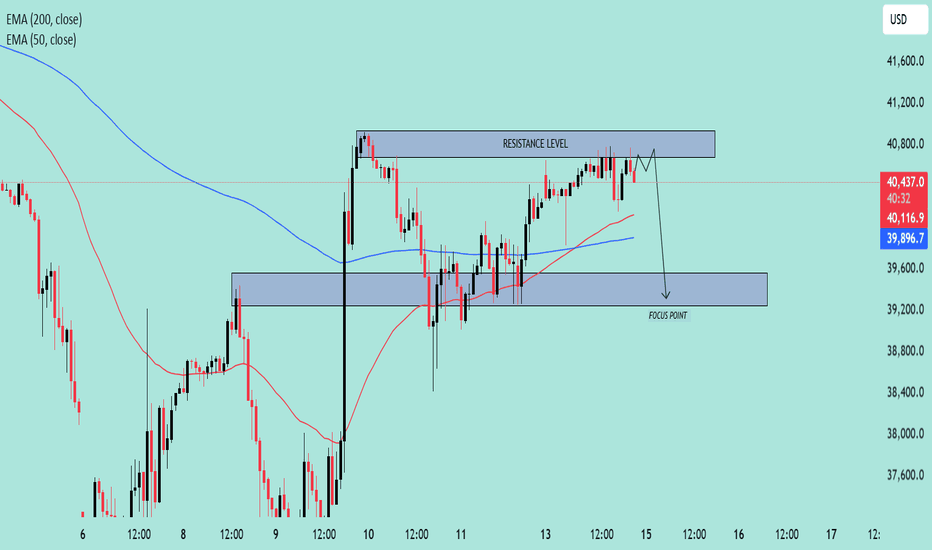

US30 Approaching Key Resistance–Potential Reversal Setup in Play🧠 Chart Overview

Asset: US30 (likely the Dow Jones Industrial Average)

Timeframe: Appears to be 1H or 2H

Indicators:

EMA 50 (Red): 40,119.5

EMA 200 (Blue): 39,897.3

Price at time of chart: Around 40,503

🔍 Key Technical Levels

🔴 Resistance Zone

Range: ~40,750 to 40,850

Price has tested this level multiple times and is currently hovering near it.

The resistance is holding, and no strong breakout has occurred.

🟦 Support / Focus Zone

Range: ~39,200 to 39,600

Marked as the “FOCUS POINT” – likely the expected target on a breakdown.

EMAs Insight:

Price is above both the 50 EMA and 200 EMA, suggesting short-term bullishness.

However, since it’s stalling at resistance, it could flip bearish on rejection.

🧭 Price Action Narrative

The chart suggests a potential fakeout above resistance, followed by a sharp rejection.

The path drawn shows a short-term dip, targeting the FOCUS POINT (support zone).

Rejection at resistance aligns with typical distribution behavior.

📌 Trade Idea (Bearish Bias)

Entry Idea: Short near or just above the resistance level (~40,800)

Target: 39,400 zone

Stop-Loss: Above the resistance level (~40,900+)

Risk/Reward: Favorable if price fails to break above resistance convincingly

📉 Bias: Bearish Reversal

Unless price breaks and closes above resistance with strong momentum, the chart favors a pullback scenario.

Gold (XAU/USD) Bullish Continuation Setup – Key Support Levels 📊 Chart Context & Setup

Chart Type: Candlestick

Indicators Used:

50 EMA (red): Currently at 3,199.009

200 EMA (blue): Currently at 3,123.168

Support Zone: Around 3,157.786 – 3,123.168

Current Price: Approximately 3,211.90

Focus Point (Target Zone): 3,283.810

🧠 Technical Analysis

🔹 Trend Analysis

Overall Trend: Bullish

Price is trading above both the 50 EMA and 200 EMA.

The EMAs are sloping upward, indicating strong momentum.

Golden Cross previously occurred (50 EMA crossing above 200 EMA).

🔹 Key Support & Resistance

Immediate Resistance Zone: Around 3,240

This area is acting as a potential rejection zone, with minor consolidation.

Support Zone (Highlighted): 3,157 – 3,123

This zone was previously a breakout level and now serves as a retest support.

It coincides with the 200 EMA, adding to its strength.

🔁 Scenarios Presented

Scenario A – Bullish Rejection from Immediate Support (3,199)

Price could hold above or near the 50 EMA.

Break and retest of minor resistance could lead to a push toward 3,283.81 (target).

This is a higher-risk entry as the support is not deeply tested yet.

Scenario B – Deeper Pullback to Major Support (3,157 – 3,123)

A drop below current price into the main demand zone.

Bullish engulfing or strong reaction in this zone would offer a high-probability long setup.

Ideal entry point for swing traders, especially if confirmed by volume or bullish candlestick reversal.

🎯 Trade Strategy Suggestion

✅ Long Setup

Entry Option 1: On bullish rejection above 3,199 with confirmation.

Entry Option 2 (Preferred): At strong support zone 3,157 – 3,123 with bullish reversal signal.

Target: 3,283.81

Stop Loss:

For Entry 1: Below 3,157

For Entry 2: Below 3,100 or 200 EMA, depending on aggressiveness

📌 Conclusion

This chart illustrates a classic bullish continuation setup with two potential entry scenarios:

A minor pullback and bounce from the 50 EMA.

A deeper retracement into a strong support zone aligned with the 200 EMA.

The uptrend remains intact as long as the price holds above the 200 EMA and the major demand zone. A break below 3,100 would invalidate the bullish outlook short-term

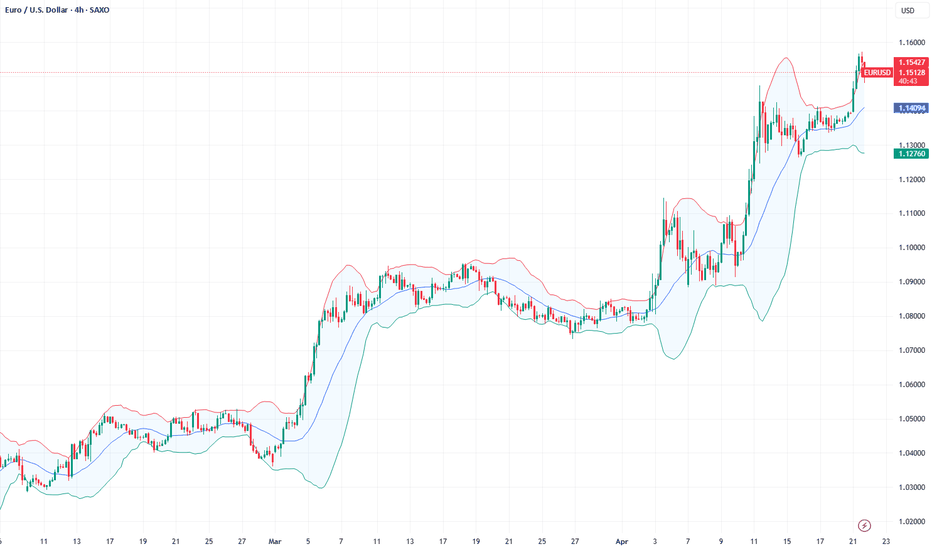

Fundamental Market Analysis for April 21, 2025 EURUSDEUR/USD broke out of a multi-day trading range and hit a new high since February 2022 around 1.1485 during the Asian session on Monday.

Despite “aggressive” comments from Federal Reserve (Fed) Chairman Jerome Powell, uncertainty over US President Donald Trump's trade policy continues to undermine the dollar. Last Wednesday, Powell said the Fed would likely keep the benchmark interest rate unchanged and wait for more clarity before considering any policy adjustments. Meanwhile, Trump's retaliatory tariff announcements undermined investor confidence in U.S. economic growth and drove the dollar to a two-year low early in the new week.

The aforementioned factors largely offset the European Central Bank's (ECB) soft decision last week and served as a tailwind for EUR/USD. On Thursday, the ECB cut interest rates for the seventh time in a year and warned that economic growth would be hit hard by US tariffs, bolstering the case for further policy easing in the coming months.

Moving forward, traders this week will be focused on scheduled speeches by ECB President Christine Lagarde on Tuesday and a number of influential FOMC members this week. In addition, the market's focus will be on the release of flash PMI indices, which could provide new insights into the state of the global economy. This, in turn, may give some impetus to the US dollar and EUR/USD.

Trade recommendation: BUY 1.1520, SL 1.1465 , TP 1.1565.

Gold hits new record — Next stop: $4000!Gold has soared above $3,300 per ounce, setting a new all-time high. Since the beginning of the year, XAUUSD has gained over 20% , and analysts are warning: this may just be the beginning of a rally toward $4,000. As geopolitical tensions flare, supply chains for critical minerals falter, and traditional risk assets crumble, the spotlight is back on gold as the ultimate safe haven.

FreshForex analysts have been forecasting this surge since November 2023. We believe gold will remain a strong investment, supported by a range of powerful factors:

Trade war escalation: Donald Trump has signed executive orders targeting the reduction of U.S. reliance on imported strategic minerals like uranium, cobalt, and rare earths — the market reacted instantly. Conflicts, wars, sanctions, and international tension typically drive investors to seek refuge in gold.

Fed at a crossroads: The probability of a rate cut in May is 92.3% (CME data). Lower interest rates reduce returns on traditional fixed-income instruments like bonds, making gold a more appealing option for investors.

Central banks are stockpiling gold: In Q1 2025, global gold purchases surged 41% compared to 2024. Gold ETFs are holding a record $345.5 billion. Many countries are ramping up gold reserves to diversify away from the U.S. dollar, fueling further demand for physical gold.

Inflation and structural debt crisis in the U.S.: The University of Michigan forecasts consumer inflation at 6.7% — the highest since 1981. Rising yields, budget deficits, and political instability are accelerating capital flight from the dollar.

Goldman Sachs analysts (#GoldmanSac) have once again raised their gold forecast. The investment bank expects gold to reach $3,700 per ounce by the end of this year and $4,000 by mid-2026. Meanwhile, FreshForex believes the $4,000 mark could be tested as early as this year!

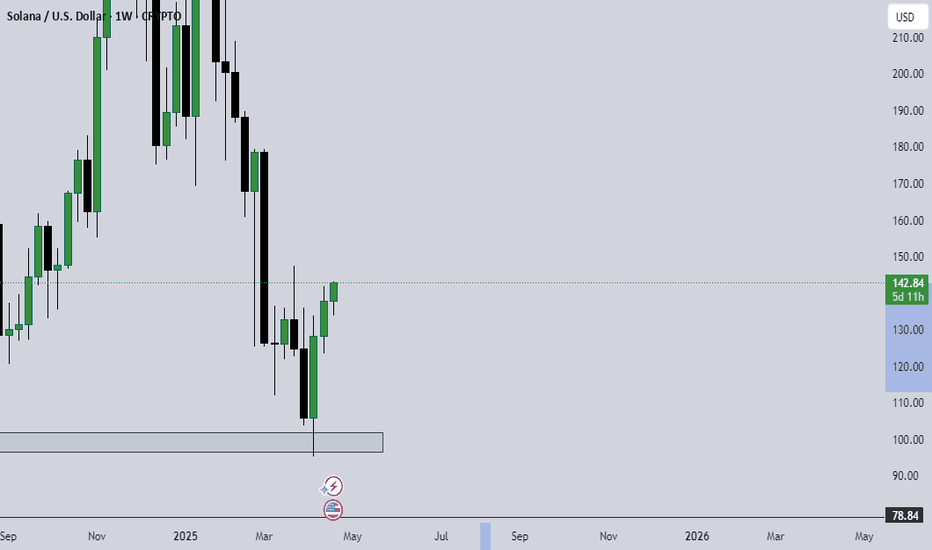

GOLD - Price can make correction and then continue to growHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Price broke out from the lower wedge line and started climbing with confidence, building momentum step by step.

After bouncing off the $3215 zone, it pushed higher and touched the wedge resistance without major rejection.

The current candle formation shows signs of slowing down, hinting at a possible short-term pullback ahead.

Despite that, the structure remains bullish, and buyers are likely to defend local support if the price dips slightly.

With the breakout zones holding firm, I expect Gold to make a correction and then resume the upward path.

My target is set at $3500, where the upper wedge boundary might once again act as key resistance.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Gold Daily Outlook Short-Term Pullback Before Trend Continuation📌 Gold Daily Outlook – Short-Term Pullback Before Trend Continuation? 💡📉

📊 Technical Overview

Gold (XAU/USD) is currently testing a key resistance zone around 3412 – 3414, where we could see short-term selling pressure emerge after recent bullish momentum. Following a strong rally, the market may be preparing for a healthy retracement to collect liquidity before resuming the trend.

The chart shows signs of a potential intraday distribution pattern forming near highs, especially as price struggles to break above resistance during the early Asian session. Today’s outlook leans toward a short-term dip into support zones before buyers potentially step back in.

🔴 SELL ZONE (Short-term Reversal Opportunity)

Entry: 3412 – 3414

Stop Loss: 3420

Take Profit: 3409 → 3400 → 3390 → 3380 → 3370

This is a high-probability reversal zone. If price prints bearish confirmation (e.g., pin bar or engulfing candle), short entries may offer favourable risk-reward setups.

🟢 BUY ZONE 1 – Minor Pullback Area

Entry: 3355 – 3353

Stop Loss: 3348

Take Profit: 3358 → 3370 → 3380 → 3390 → 3400

Ideal for quick buy setups if price reacts cleanly to this mid-structure level.

🟢 BUY ZONE 2 – Deeper Support for Trend Re-entry

Entry: 3335 – 3333

Stop Loss: 3328

Take Profit: 3338 → 3350 → 3360 → 3370 → 3380

If a deeper pullback occurs, this zone may act as a key demand area and offer clean trend continuation opportunities.

🌍 Fundamental Insight

No major economic events are scheduled today, so market direction will likely follow technical structure.

USD is showing mild intraday strength, adding some pressure on gold in the short term.

Overall sentiment still supports gold as a safe-haven, but short-term profit-taking near highs is expected after recent aggressive buying.

⚠️ Strategy Notes

Focus on trading within defined structure: Sell from resistance with confirmation; buy dips at clean support zones.

Avoid FOMO entries – let the market give you confirmation.

Always use clear TP/SL levels – especially in a sensitive market environment like this.

💬 How are you approaching gold today? Looking to fade highs or waiting for dip-buy setups? Drop your thoughts below! 👇👇👇

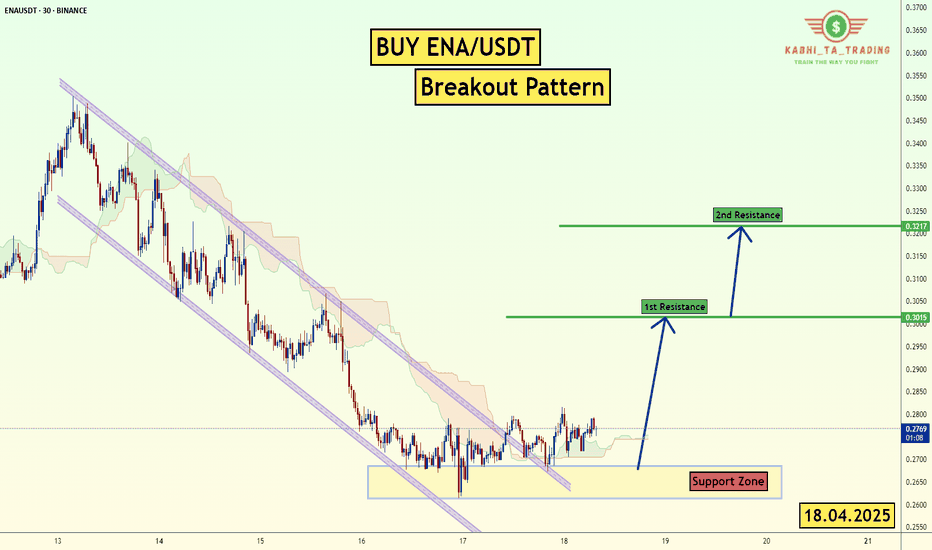

ENA/USDT Breakout Pattern (18.04.2025)The ENA/USDT pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 0.3015

2nd Resistance – 0.3217

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

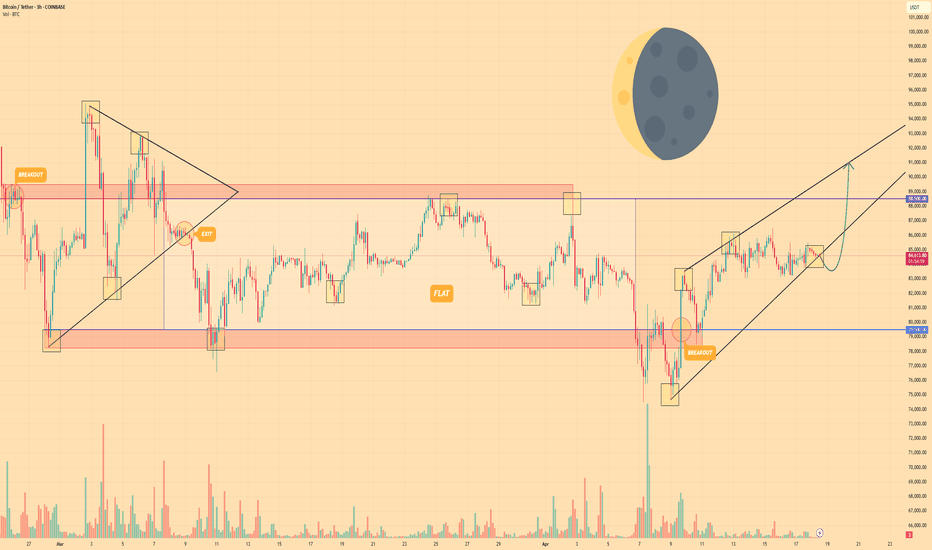

BITCOIN - Price can little correct and then make impulse upHi guys, this is my overview for BTCUSDT, feel free to check it and write your feedback in comments👊

Recently price broke through the $79500 zone after a long phase of flat consolidation and sharp shakeout.

Once bulls reclaimed control, price formed a clean breakout and started building structure inside a wedge.

Momentum carried the price upward, with buyers defending each local dip and creating a stair-step rise.

Now BTC is moving steadily inside the wedge pattern, holding the lower trendline with no strong rejection.

Price is slowly grinding toward the key resistance around $88500, where volatility might return.

If this tempo holds, I expect BTC can grow higher and tag the $91000 points in the next impulsive leg.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

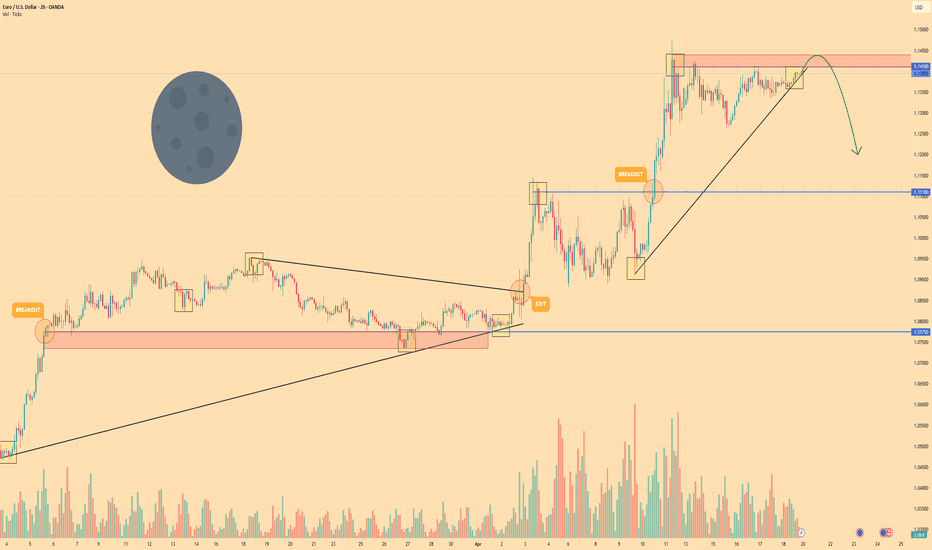

EURO - Price can fall to $1.1200 points, exiting from triangleHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

Price first broke out of a falling wedge pattern, kicking off a sharp rally that gained serious momentum.

The move ran into resistance at $1.1440, where price began stalling and transitioned into a triangle setup.

Since then, price has been wedged inside the triangle, testing highs but struggling to break convincingly.

The support trendline still holds, but each push upward is met with rejection near the resistance ceiling.

Momentum is fading, and with volume drying up, a downside move is becoming more likely from this zone.

I expect that the Euro can break lower from the triangle and fall to $1.1200 points in the upcoming sessions.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

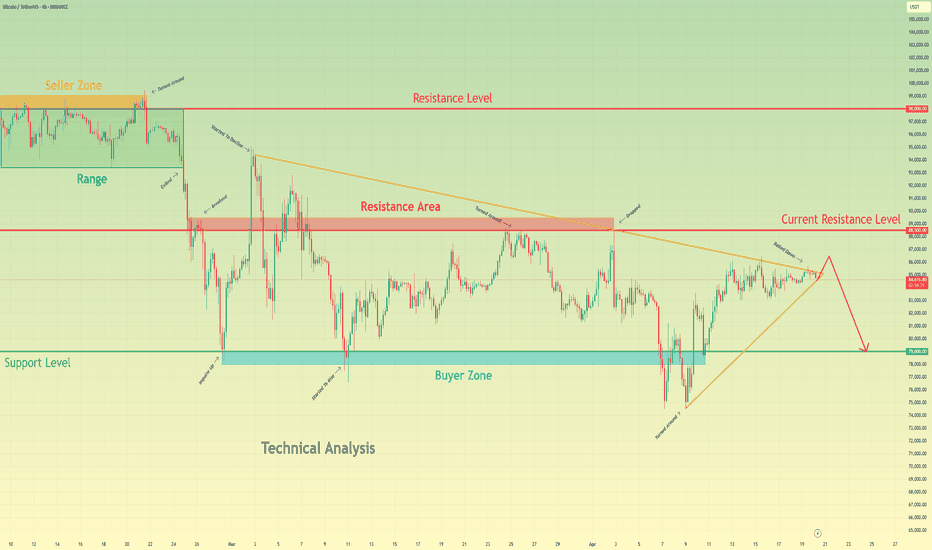

Bitcoin may exit from pennant and fall to support levelHello traders, I want share with you my opinion about Bitcoin. Over the past weeks, the price traded inside a broad horizontal range, repeatedly testing the boundaries of the seller zone and the buyer zone. After several failed breakouts, the price sharply dropped from the upper range and entered a phase of lower highs, forming a downward pennant structure. Inside this pennant, the market continued consolidating under pressure from the resistance area. Each attempt to break above the resistance line was met with rejection, confirming strong selling interest near the current resistance level at 88500. At the moment, BTC is testing the upper boundary of the pennant again. This area aligns closely with the resistance level and the long-term descending trendline. Given this confluence and historical rejection zones, I expect BTC to face resistance and reverse, initiating a decline back toward the 79000 support level, thereby exiting from the pennant, which is my current TP1. The compressed price structure, repeated rejections, and clean pattern formation support this bearish outlook in the short term. Please share this idea with your friends and click Boost 🚀

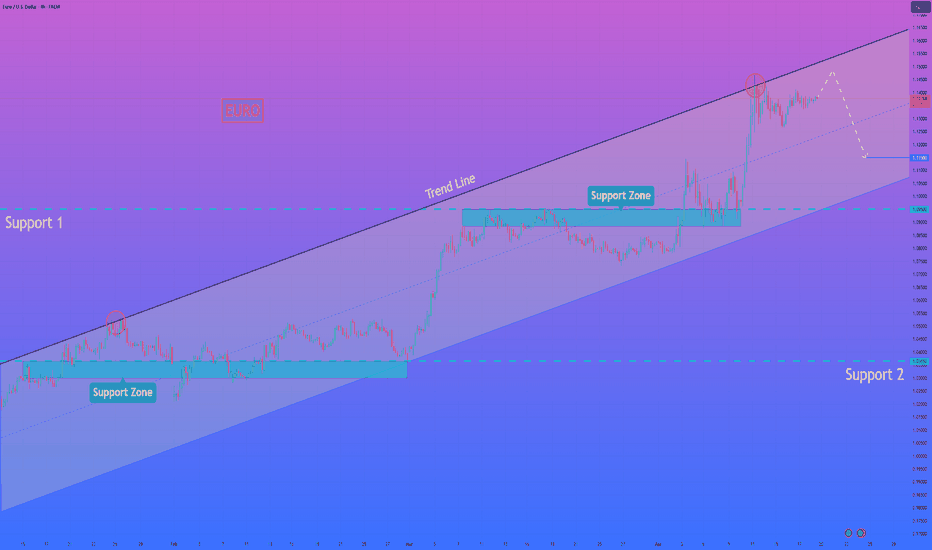

HelenP. I Euro can make correction movement to $1.1150 pointsHi folks today I'm prepared for you Euro analytics. After testing the upper boundary of the ascending channel, the price showed signs of slowing momentum. Earlier, the price steadily climbed within the upward channel, forming consistently higher lows while bouncing from the lower trend line and support zones. During its rally, the price also reclaimed the 1.0950 level, turning it into a solid support zone, and continued higher with minor consolidations along the way. Eventually, the pair reached the resistance trend line at the top of the channel, where sellers began to show activity. This zone aligned with previous local highs and acted as a point of reversal. Following the rejection from the top boundary, the Euro formed a local high and started to flatten, indicating reduced bullish pressure. Now the price is trading slightly below the resistance trend line and remains inside the upward channel. Given the current structure and the latest price action near the upper edge, I expect a downward movement from this zone. My current goal is the 1.1150 points, which aligns with the midline of the channel and a key technical level from recent consolidation. This bearish scenario is supported by the reaction from the upper boundary and the potential for correction within the channel range. If you like my analytics you may support me with your like/comment ❤️

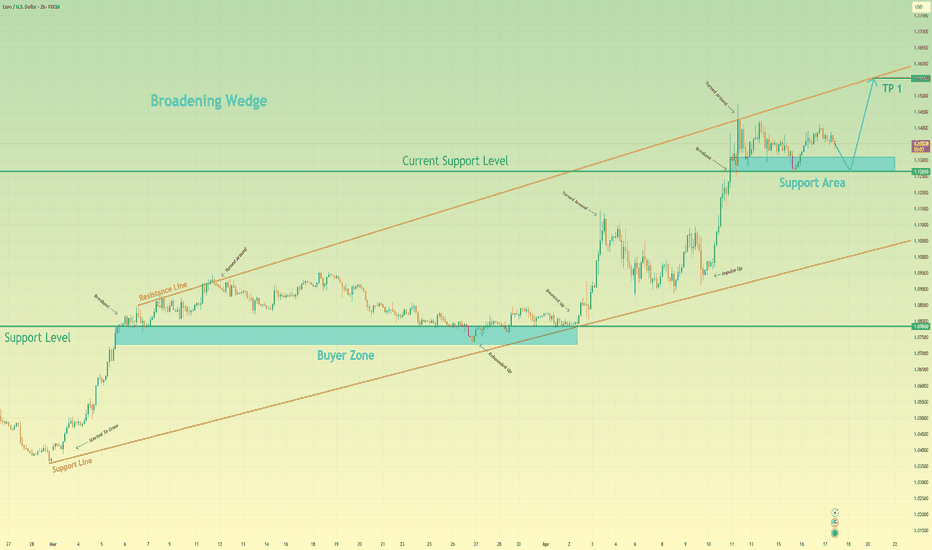

Euro may correct to support area and then rebound upHello traders, I want share with you my opinion about Euro. Looking at the chart, we can see that the price started its growth from the buyer zone between 1.0730 - 1.0785 points, where the price found strong support near the lower boundary of the broadening wedge. After bouncing off that zone, Euro gained momentum and made an impulsive move upward, breaking through the resistance line and establishing a bullish trajectory. Once the pair overcame the 1.1265 level, which is now acting as current support, the price entered a period of consolidation inside the support area between 1.1310 - 1.1265 points. This zone is showing signs of strength again, with the price attempting to stabilize above it. The overall structure continues to respect the boundaries of the broadening wedge, with higher highs and higher lows confirming bullish control. At the moment, EUR is correcting slightly after reaching local highs and is approaching the support area again. A healthy pullback toward 1.1310 - 1.1265 would be in line with the pattern and could trigger the next bullish impulse. Given the ongoing upward structure, the strong support area, and the clear wedge formation, I expect Euro to continue growing toward the upper wedge boundary near 1.1555 points, which is my current TP1. Please share this idea with your friends and click Boost 🚀

GBPUSD Discretionary Analysis: Bounce at 1.33Hello traders.

On GBPUSD, I'm watching this 1.33 zone closely. It's where I'll be looking for a reaction. It can be a solid bounce spot if it shows signs.

Discretionary Trading: Where Experience Becomes the Edge

Discretionary trading is all about making decisions based on what you see, what you feel, and what you've learned through experience. Unlike systematic strategies that rely on fixed rules or algorithms, discretionary traders use their judgment to read the market in real time. It's a skill that can't be rushed, because it's built on screen time, pattern recognition, and the ability to stay calm under pressure.

There's no shortcut here. You need to see enough market conditions, wins, and losses to build that intuition—the kind that tells you when to pull the trigger or sit on your hands. Charts might look the same, but context changes everything, and that's something only experience can teach you.

At the end of the day, discretionary trading is an art, refined over time, sharpened through mistakes, and driven by instinct. It's not for everyone, but for those who've put in the work, it can be a powerful way to trade.

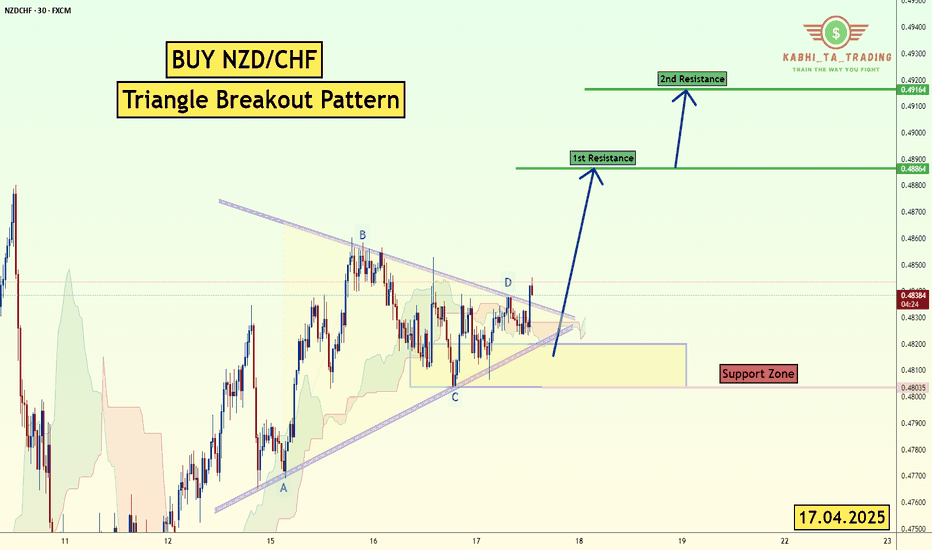

NZD/CHF Triangle Breakout (17.04.2025)The NZD/CHF pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 0.4886

2nd Resistance – 0.4916

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.