Analysis

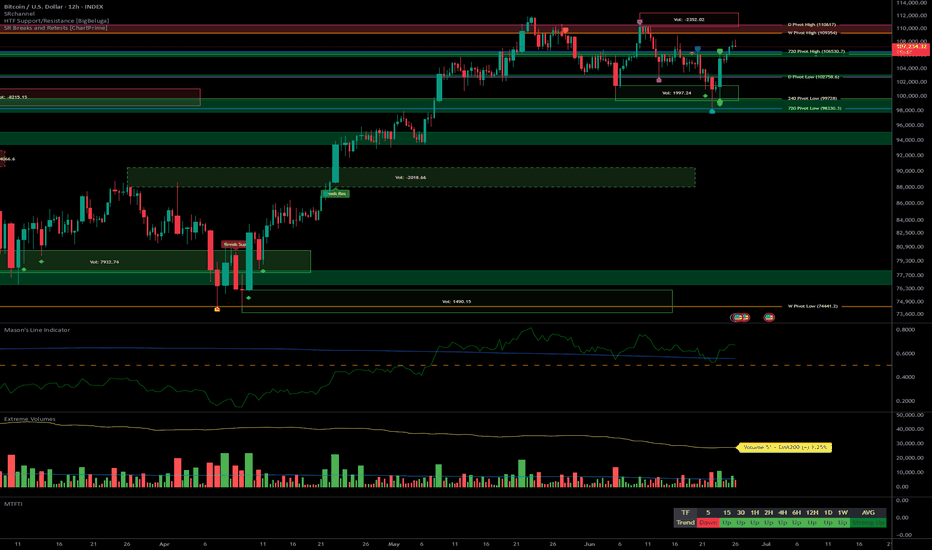

BTC multi-timeframe: bullish momentum and strong support zones__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Clear bullish bias across all timeframes (MTFTI Up everywhere except 5min). Weak selling pressure, no distribution or capitulation signals.

Support/Resistance: Key resistances: 110647–109554 (HTF). Major supports: 102756 (D Pivot Low), 98330 (720 Pivot Low). Multiple buy zones on retracement.

Volume: Recent volumes below "extreme" threshold, no euphoria/capitulation detected.

Multi-TF Behavior: Global bullish alignment, volatility present intraday, but no confirmed reversal risk. Risk On / Risk Off Indicator shows no major anomaly.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Strategic Bias: Structurally bullish market. Prioritize tactical buys on pullback, active risk management.

Opportunities: Reinforce long positions on $106k/$103k/$100k retrace. Partial targets below 110–111k.

Risk Zones: Rejection under 106500–107000 with extreme volume spike = short-term top signal. Invalidation if H1 < 106k or H4 < 102.7k.

Macro Catalysts: US calendar (GDP, durable goods, jobless claims), geopolitics (Russia/Ukraine). No systemic alert, but caution required.

Action Plan: Filter entries on technical supports, exit on extreme sell volume or macro shock.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Compression below historical resistances (109–111k), solid momentum, potential buy zone 102750–98330.

12H: Multiple resistances, uptrend, support confluence 102756–106530 pivot key.

6H: Price under resistance cluster (106530), possible profit-taking on rejection, strong support 102756.

4H: High-range structure, reinforced supports, next breakout could trigger acceleration with volume.

2H: Pivot zone 106500–107200, caution below close, buy zone on correction.

1H: Support stacking structure, no clear breakdown, critical node, aggressive buy 106100–105800.

30min: Compression at range high, caution on buying resistance, key spots 106000/104500.

15min: Possible buyer exhaustion under 108k, tactical buy on support 106000–106500 if confirmed.

Summary: Strong bullish alignment, same key supports, no panic. Risk On / Risk Off Indicator neutral, controlled market, possible whipsaw on short-term TFs but no major reversal sign.

__________________________________________________________________________________

Macro, News & On-Chain Analysis

__________________________________________________________________________________

Macro: Fed and traditional markets calm, no monetary alert. Israel/Iran ceasefire, increased volatility in Europe (Russia/Ukraine). Moderate risk-on sentiment.

Calendar: June 26: US durable goods/GDP/jobless claims (potential volatility).

On-chain: BTC range $100–110k, fundamental support $93–100k, no panic/capitulation. Low spot volumes, bullish digestion phase.

__________________________________________________________________________________

Conclusion

__________________________________________________________________________________

Dominant bias: Up/moderately bullish in short term, focus on retracement buying.

Risk management: Stop H4 < $102.7k, H1 < $106k, scalping: break of 106k with extreme volumes.

Action zones: Reinforce on $106k/$103k/$100k retrace, partial TP below 110–111k, extension if confirmed breakout.

Monitor: Volume, support reactions, macro catalysts.

Summary:

Technical and on-chain context remains bullish; best approach is tactical buying on pullback with dynamic stops. Stay agile in case of extreme selling volume or macro shocks. Act on signals, protect capital.

__________________________________________________________________________________

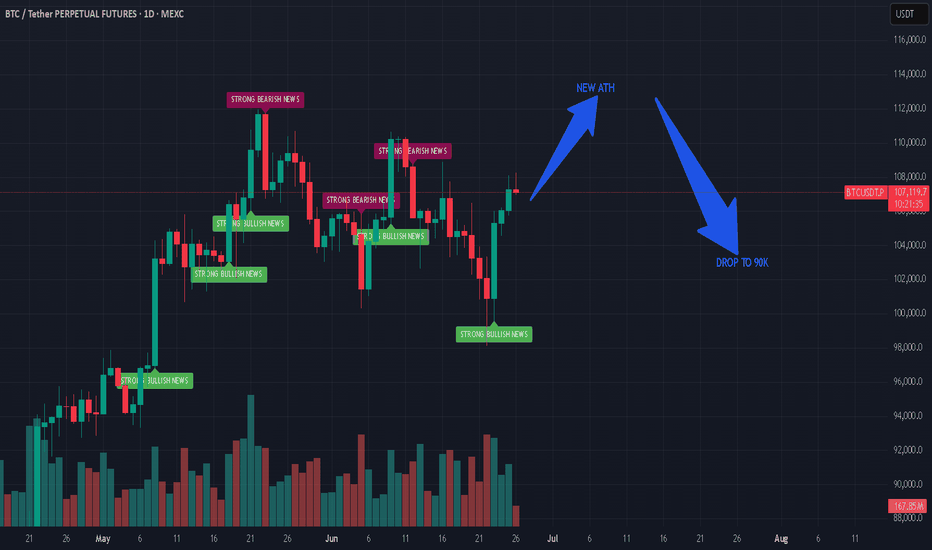

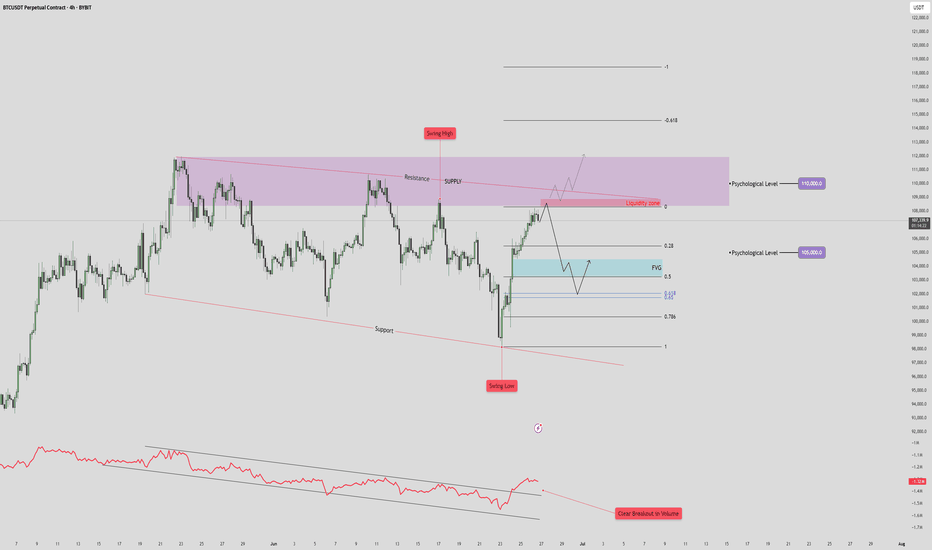

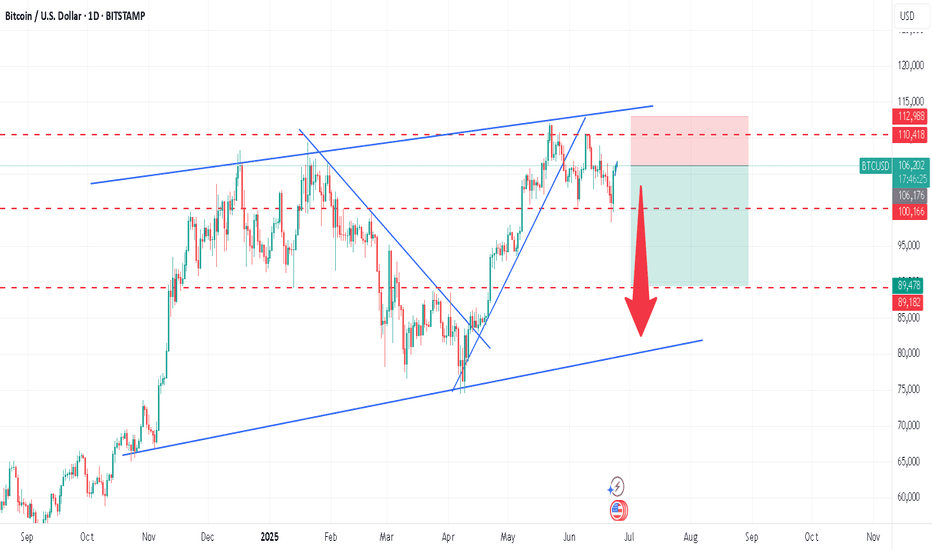

BTC/USDT Drop to 101k?🧠 High Time Frame Context

Trend: Consolidation within a broad range (support and resistance clearly defined).

Key Psychological Levels:

105,000 USDT – minor level, acting as a magnet in short-term PA.

110,000 USDT – major supply confluence and liquidity target.

🟪 Supply & Resistance Zone

Zone: Marked in purple (108.5k-112k).

Key Observation:

Swing high formed inside this zone, indicating liquidity trap.

Potential fake-out or strong rejection from this area.

Strong confluence with a descending resistance trendline, adding to the selling pressure.

🔵 Fair Value Gap (FVG) & Retracement Targets

FVG identified just below the current price (~103.5k-104.5k).

Price is projected to:

Reject from the current high.

Drop to fill the FVG zone.

Possibly bounce between FVG and Fibonacci retracement levels:

0.5

0.618

0.786

🔴 Volume & RSI Divergence

Volume breakout is noted on the last push down (bottom red annotation), followed by a retrace.

OBV shows bullish divergence with price:

🔻 Support Structure

Lower red trendline is a key long-term support.

Previous swing low aligns with this trendline – buyers showed strong interest here.

If FVG fails to hold, expect a retest of this trendline near 97,000–98,000.

📈 Likely Scenarios

Base Case (Neutral-Bearish):

Price rejects current zone (~107,000).

Pullback into FVG (101–104K).

Bounce to 105K (minor resistance), then decide next direction.

Bullish Breakout:

If price breaks and closes above 110K, it invalidates supply zone.

Opens door to 115–118K range.

Bearish Breakdown:

Fails FVG zone.

Tests previous swing low and support (~97K).

Below that, structure becomes macro bearish.

🧩 Summary

Short-Term: Retracement into FVG likely. Monitor reaction.

Medium-Term: Bearish bias while price is below 110K.

Invalidation for bears: Clean break and hold above 110K.

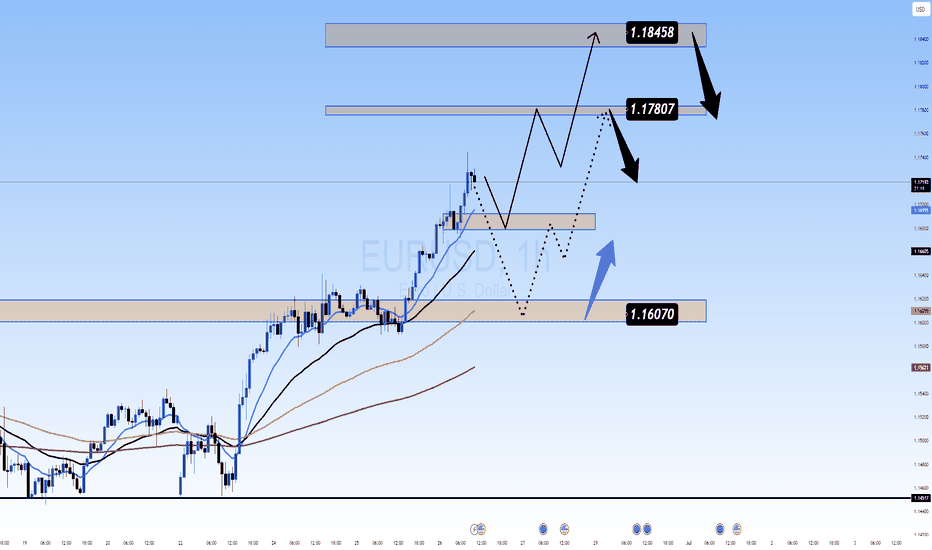

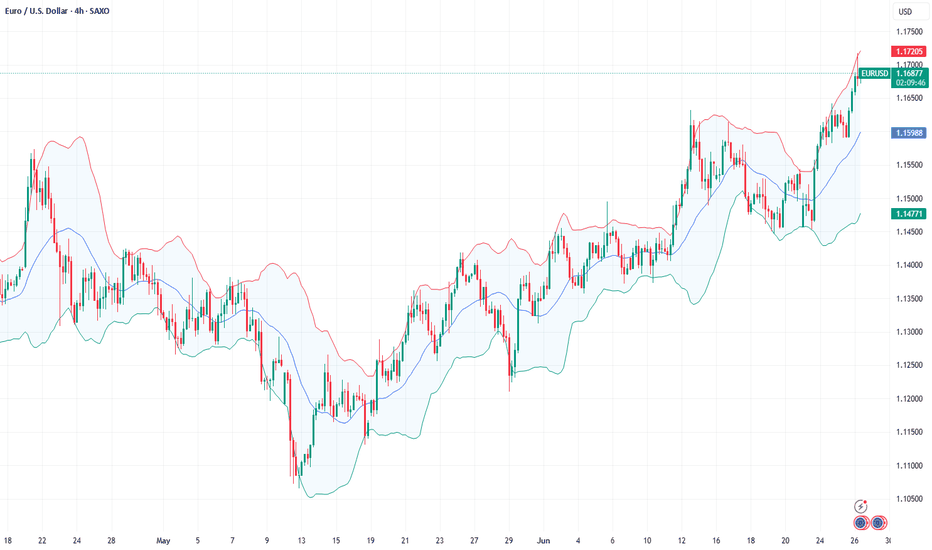

Euro's Surge on USD Weakness – Is 1.20 the Next Stop?EURUSD: Euro's Surge on USD Weakness – Is 1.20 the Next Stop?

Hello TradingView Community!

The EURUSD pair is currently commanding significant attention with its strong upward momentum.

🌍 Fundamental Highlights: Euro's Tailwinds & USD's Headwinds

The Euro has demonstrated notable strength, recently breaching the 1.17 mark to hit its highest level in over 3.5 years. According to ING, if this momentum holds, the next target could be 1.20, contingent on continued USD weakness.

The US Dollar faces considerable pressure following news that President Trump intends to name a successor to Fed Chair Powell soon, sparking concerns about the Fed's independence. Such speculation often leads to expectations of a more 'dovish' monetary policy, weakening the USD.

Adding to the Euro's support are the NATO agreement to increase defense spending targets to 5% and President Trump's seemingly "less aggressive" stance towards the EU.

In summary: Should USD depreciation persist, not only the Euro but other asset classes might also attract capital inflows, particularly given the ongoing uncertainties surrounding inflation risks and monetary policy.

📊 EURUSD Technical Outlook (H4/M30 Chart):

Our technical analysis of the EURUSD chart (image_b73298.png) confirms a clear and robust uptrend, characterized by successive higher highs and higher lows. The EMAs are in a bullish alignment, reinforcing this upward trajectory.

Upside Targets (Potential BUY Zones):

1.17807: The initial potential target if the bullish momentum continues.

1.18458: A higher target representing the next potential resistance zone.

Key Support Levels (Potential BUY Zones for pullbacks):

1.16070: A strong support level where demand could emerge after a correction.

An implied intermediate support around 1.166xx (visually suggested by price action between current levels and 1.16070) could also offer buying opportunities after minor pullbacks.

🎯 EURUSD Trading Plan:

BUY Zone 1 (Intermediate Pullback):

Entry: 1.16600 - 1.16700

SL: 1.16450

TP: 1.16800 - 1.17000 - 1.17200 - 1.17500 - 1.17807 - 1.18000 - 1.18300 - 1.18458

BUY Zone 2 (Strong Support):

Entry: 1.16070

SL: 1.15900

TP: 1.16200 - 1.16400 - 1.16600 - 1.16800 - 1.17000 - 1.17300 - 1.17600 - 1.17807 - 1.18458

SELL Zone (Consider only at upside targets with clear reversal signals):

Entry: 1.18458 (This is an upside target, but also a potential resistance for selling if strong reversal signals appear).

SL: 1.18600

TP: 1.18300 - 1.18000 - 1.17807 - 1.17500 - 1.17200 - 1.17000 - 1.16800

⚠️ Key Factors to Monitor:

Fed Leadership News: Any official announcements regarding the Fed Chair succession will trigger significant USD volatility.

Eurozone Economic Data: Upcoming inflation, GDP, and employment reports.

ECB Statements: The European Central Bank's stance on monetary policy.

Geopolitical Developments: Major tensions or agreements can influence market sentiment.

Trade smart and always manage your risk effectively! Wishing everyone a profitable trading day!

Riding the Wave or Facing a Pullback? Key Levels to WatchGBPUSD: Riding the Wave or Facing a Pullback? Key Levels to Watch!

Hello TradingView Community!

The GBPUSD pair is currently under the spotlight, experiencing significant movements driven by a mix of market sentiment and economic indicators.

🌍 Fundamental Snapshot: GBP's Lift vs. Underlying Pressures

The British Pound has seen a notable surge, climbing near 1.3765 against the US Dollar. This uplift is primarily fueled by market hopes for an imminent announcement of Fed Chair Powell's successor by President Trump, hinting at potential future dovish shifts in Fed policy. Such speculation could dampen USD's strength, benefiting GBPUSD.

However, the outlook isn't entirely clear-cut for the Pound. Fed Chair Powell has cautioned that tariff-induced inflation might prove persistent, adding a layer of complexity to the broader USD sentiment. Domestically, UK employers are reportedly planning workforce reductions to offset rising social security contributions, which could weigh on the GBP.

In essence, GBPUSD is benefiting from potential USD weakness linked to Fed policy expectations, but traders should remain vigilant about internal economic pressures within the UK.

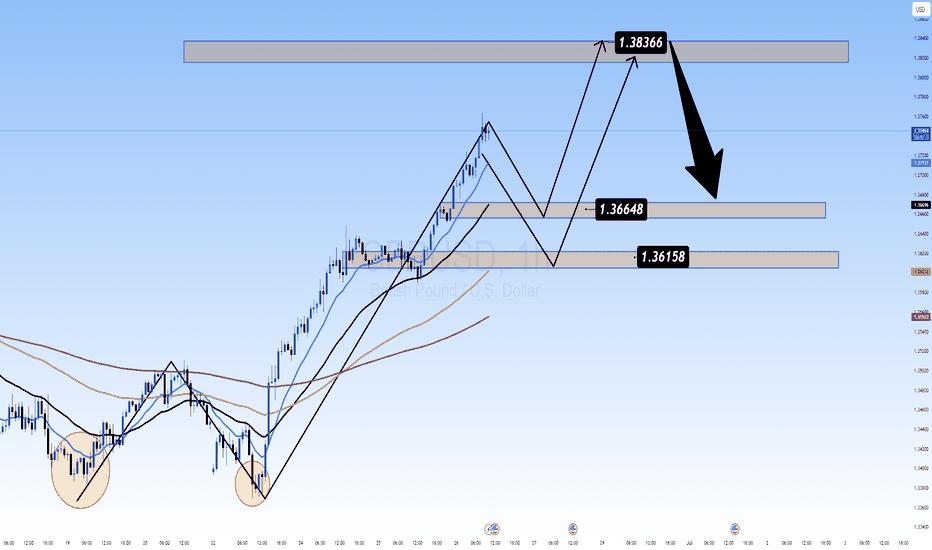

📊 GBPUSD Technical Analysis (H4/M30 Chart):

Our technical analysis of the GBPUSD chart (image_b6d4de.png) reveals a clear uptrend, marked by consistent higher highs and higher lows. The EMAs are also in a bullish alignment, reinforcing this upward momentum.

Key Resistance (Potential Sell Zone): We identify significant resistance at 1.38366. This level could attract selling pressure, suggesting a potential price reversal or consolidation after hitting this mark.

Key Support Levels (Potential Buy Zones):

Initial support lies at 1.36648.

A stronger support area is at 1.36158. These levels could act as bounce points after any corrective moves.

🎯 GBPUSD Trading Plan:

BUY Zone 1 (Near Current Support):

Entry: Consider entries around 1.36648.

SL: 1.36500 (just below support).

TP: Target incremental gains towards 1.36800, 1.37000, 1.37200, 1.37400, 1.37600, 1.37800, 1.38000, and potentially 1.38300 (just shy of major resistance).

BUY Zone 2 (Stronger Support):

Entry: Look for entries around 1.36158.

SL: 1.36000 (below strong support).

TP: Target incremental gains towards 1.36300, 1.36500, 1.36700, 1.37000, 1.37300, 1.37600, 1.38000, and 1.38300.

SELL Zone (At Resistance):

Entry: Consider short entries around 1.38366.

SL: 1.38500 (just above resistance).

TP: Target incremental declines towards 1.38200, 1.38000, 1.37800, 1.37500, 1.37200, 1.37000, 1.36800, and 1.36648 (targeting support).

⚠️ Key Factors to Monitor:

Fed Leadership News: Any official announcement regarding the Fed Chair succession will trigger significant USD volatility.

UK Economic Data: Upcoming reports on employment, inflation, and GDP will directly impact the Pound.

BoE Statements: Monetary policy stances from the Bank of England.

US Inflation/Employment Data: Continues to influence overall USD strength.

Trade wisely and always prioritize robust risk management! Wishing everyone a successful trading day!

XAUUSD: Gold's Inflationary Tug-of-WarXAUUSD: Gold's Inflationary Tug-of-War – Navigating Powell's Remarks & Key Levels

Hello TradingView community!

Let's dive into Gold (XAUUSD) today, as its price action continues to be shaped by the Federal Reserve's (Fed) cautious stance on inflation and interest rates. Recent comments from Fed Chair Jerome Powell are particularly noteworthy.

🌍 Macroeconomic Drivers: Tariffs, Inflation, and Fed's Deliberation

The market finds itself in a complex situation following key statements from Fed Chair Jerome Powell:

Powell indicated that substantial tariffs could trigger a prolonged wave of inflation, potentially moving beyond conventional economic models. This introduces a new and significant factor into the inflation outlook.

Despite recent inflation moderation, Powell stressed the necessity of more data from June and July before considering any rate cuts. This underscores the Fed's cautious approach and lack of immediate urgency.

He also cautioned about the risk of "price shocks turning into persistent inflation".

In this environment, where market sentiment is stretched between hopes for rate cuts and the emerging risk of tariff-driven inflation, Gold maintains its role as a crucial psychological anchor. Should the Fed be slow to react to this potential new inflationary pressure, Gold's appeal could intensify.

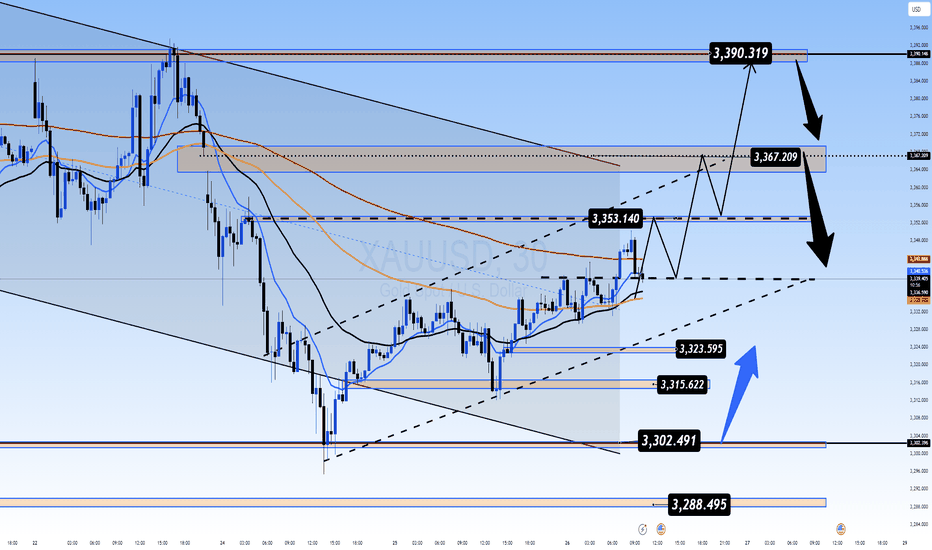

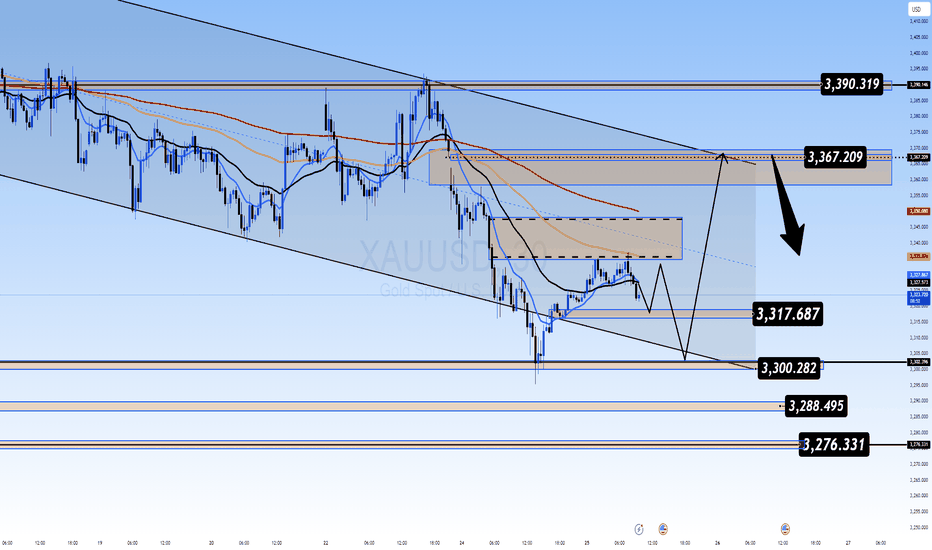

📊 XAUUSD Technical Analysis & Trading Plan:

Based on the XAUUSD charts (H4/M30 timeframe) you provided (e.g., image_008403.png): Gold is currently undergoing a corrective or consolidating phase after a notable pullback. The price is trading below shorter-term moving averages, suggesting either bearish momentum or an accumulation phase.

Key Resistance Zones (Potential SELL Areas):

3,352.383 - 3,353.860: An immediate resistance point, coinciding with the 0.5 Fibonacci level.

Higher up: 3,391.750 - 3,395.000: This represents a very strong previous peak and a major resistance barrier.

Key Support Zones (Potential BUY Areas):

3,317.738 - 3,311.214: An intermediate support area, close to the 0.236 Fibonacci level.

3,302.939 - 3,302.857: A strong demand zone, aligning with the recent low.

Further down: 3,286.257: This is the next significant support level if preceding zones are breached.

🎯 XAUUSD Intraday Trading Plan:

Here are our refined zones and targets for today's trading:

BUY SCALP:

Entry: 3316 - 3314

SL: 3310

TP: 3320 - 3324 - 3328 - 3332 - 3336 - 3340

BUY ZONE:

Entry: 3304 - 3302

SL: 3298

TP: 3308 - 3312 - 3316 - 3320 - 3330 - 3340 - 3350

SELL SCALP:

Entry: 3353 - 3355

SL: 3360

TP: 3350 - 3345 - 3340 - 3335 - 3330

SELL ZONE:

Entry: 3390 - 3392

SL: 3396

TP: 3386 - 3382 - 3378 - 3374 - 3370 - 3360

⚠️ Key Factors to Monitor:

Fed Official Speeches: Any new comments from Fed officials regarding inflation or monetary policy outlook.

US Economic Data: Upcoming inflation (CPI, PCE) and employment reports (NFP) will be crucial for policy expectations.

Geopolitical Developments: Ongoing global tensions consistently bolster Gold's safe-haven appeal.

Trade wisely and always manage your risk effectively! Wishing everyone a profitable trading day!

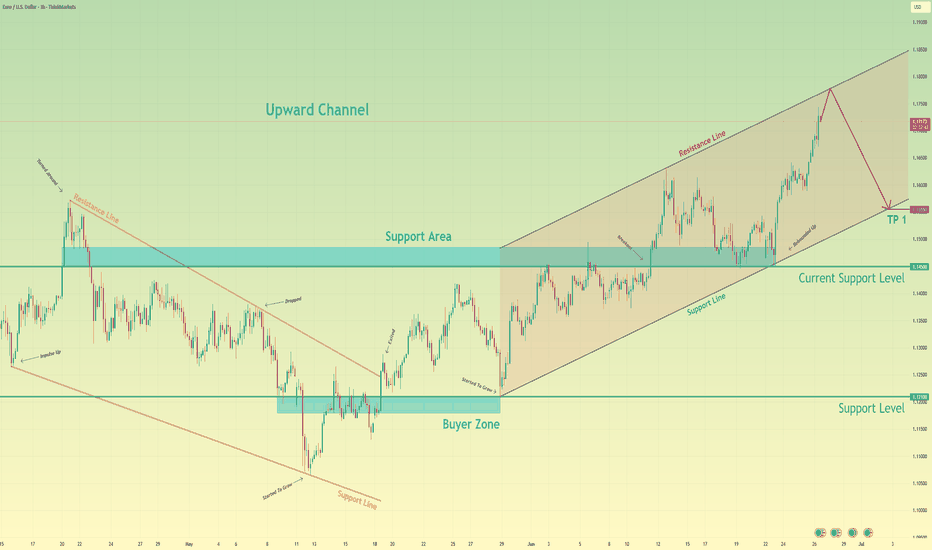

Euro may start to decline to support line of upward channelHello traders, I want share with you my opinion about Euro. Earlier, the price was trading inside a downward wedge, gradually making lower highs and lower lows. After reaching the bottom of the wedge near the buyer zone (1.1210 - 1.1180), we saw a strong bullish impulse that broke through both the resistance line of the wedge and the support area near 1.1450 - 1.1485. This breakout signaled the beginning of a new phase - a transition into an Upward Channel. Since then, the price has been forming higher highs and higher lows, respecting both the upper and lower boundaries of this new structure. Along the way, it has rebounded from the support line multiple times and recently made a strong move up toward the resistance line of the channel. Currently, the price is approaching that resistance line, which may act as a potential reversal area. Given the previous price behavior and the clearly defined channel, I expect the price to reach the top boundary and then start to decline toward the lower support line. That’s why I’ve set my TP 1 at 1.1555 points, which aligns perfectly with the support line of the upward channel. Based on the recent breakout, the structure of the trend, and the reaction from key zones, I remain short-biased for the upcoming sessions. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

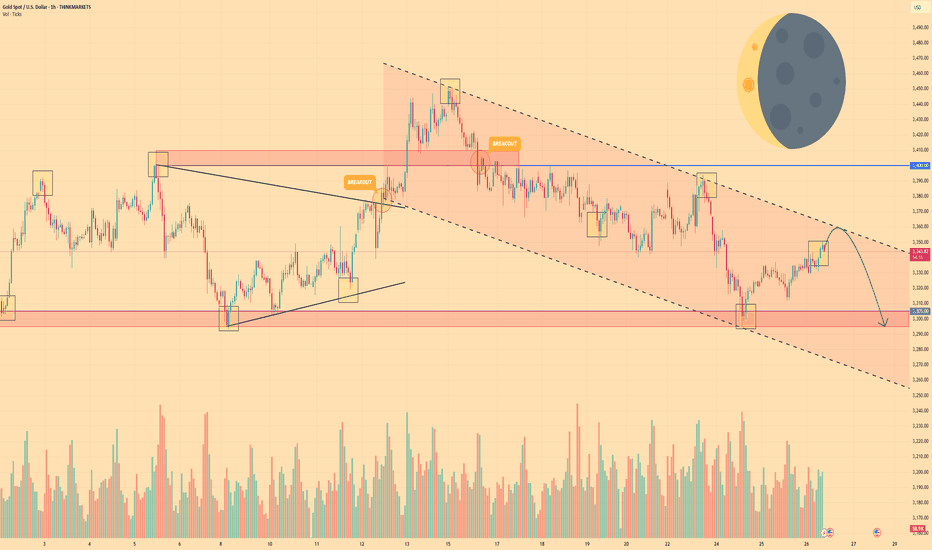

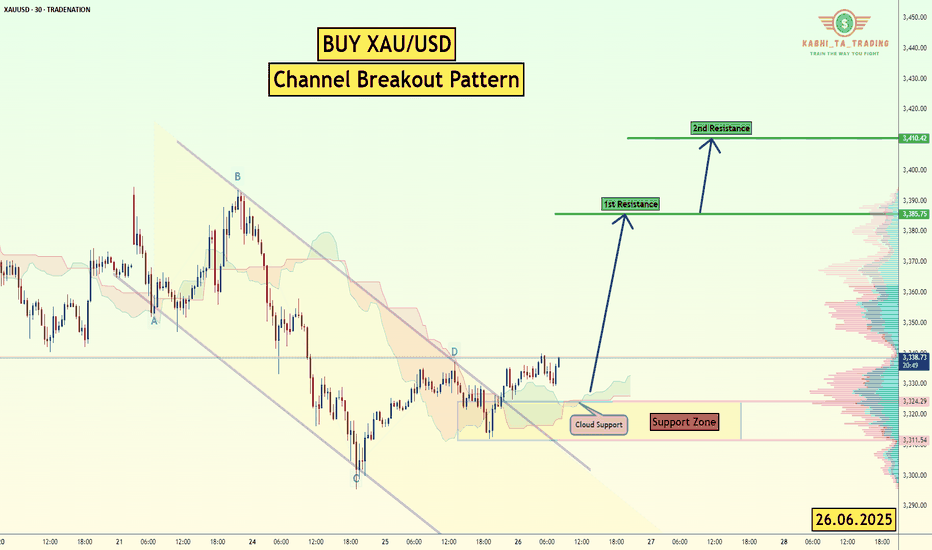

GOLD - Price can continue to move down in falling channelHi guys, this is my overview for XAUUSD, feel free to check it and write your feedback in comments👊

Some days ago price bounced from support level and started to grow to $3400 level, making a small correction before.

When it reached this level, price entered to wedge, where it made a correction and then started to grow.

In a short time, price exited from wedge and soon broke $3400 level, but then it started to decline in a falling channel.

In falling channel, Gold broke $3400 level one more time and in a short time declined to $3305 support level.

After this movement, Gold turned around and started to move up to resistance line of channel.

I expect that Gold can reach resistance line of channel and then start to decline to $3295 support area.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Fundamental Market Analysis for June 26, 2025 EURUSDThe EUR/USD pair continues to rise to 1.16800 during Thursday's Asian session. The US dollar (USD) is weakening against the euro (EUR) as investors worry about the future independence of the US Federal Reserve (Fed). Final data on US GDP growth for the first quarter will be in focus later on Thursday.

US President Donald Trump said on Wednesday that he is considering three or four potential candidates to replace Fed Chairman Jerome Powell. According to the Wall Street Journal, Trump may consider former Fed Governor Kevin Warsh, National Economic Council Director Kevin Hassett, and Treasury Secretary Scott Bessent. Other candidates include former World Bank President David Malpass and Fed Governor Christopher Waller.

This raises questions about a potential weakening of the Fed's independence and a possible decline in its authority, which undermines the dollar and creates favorable conditions for the major currency pair.

Across the Atlantic, European Central Bank (ECB) policymakers are concerned about the economic outlook due to Trump's tariff policy and geopolitical risks. Earlier this week, ECB policymaker François Villeroy de Galhau said that despite current conditions, further rate cuts are still possible. Statements by ECB policymakers may put pressure on the single currency in the near term.

Trading recommendation: BUY 1.16750, SL 1.16300, TP 1.17500

XAU/USD - Channel Breakout (26.06.2025)The XAU/USD pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Channel Breakout Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 3385

2nd Resistance – 3410

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Ather’s Affordable EV Announcement Triggers Market Rally...Technical Analysis:

Ather Energy has successfully broken above the key resistance level of ₹330 and is currently trading around ₹340. This breakout is supported by a noticeable surge in volume, confirming bullish momentum. The ₹330 level, which previously acted as a strong resistance, may now serve as a potential support in the event of a retest. Traders and investors can look for buying opportunities on dips near ₹330, while those already holding the stock are advised to continue holding for further upside.

Fundamental Analysis:

From a fundamental standpoint, Ather’s maiden quarterly results have been encouraging. The company reported a one-third increase in revenue, while its EBITDA loss narrowed to ₹172 crore, down from ₹239 crore in the same quarter last year. This marks a significant step towards operational efficiency and profitability.

Adding to the positive sentiment, Ather recently announced that it will unveil its new EL EV platform and upcoming concept models in August 2025. The highlight of this announcement is that the new scooter will be Ather’s most affordable offering, signaling a strategic push to expand market penetration and compete in the mass segment of the EV market.

Conclusion:

The breakout at ₹330, supported by improving financial performance and strong product pipeline news, suggests a bullish outlook for Ather Energy in the near term. Investors should monitor the ₹330 level for price retest and accumulation opportunities. Holding is recommended for existing investors, while fresh entries can be considered on technical confirmation around support zones.

Note: Due to ongoing global uncertainties, market conditions may remain volatile. Investors are advised to exercise caution and manage risk accordingly.

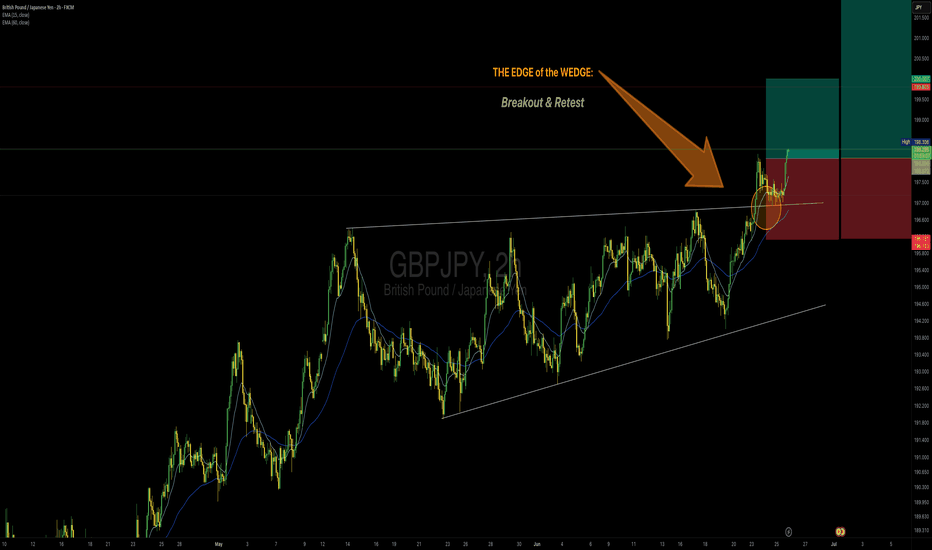

GBP/JPY Bullish Flag (25.06.2025) The GBP/JPY pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Bullish Flag Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 198.46

2nd Resistance – 199.00

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Ready for a new day, please bring another doubler like $EYENReady for a new day, please bring another doubler like NASDAQ:EYEN $5 to $10 or NYSE:SRFM yesterday which were the only 2 trades made and 2 nice wins🙏🏻

USDCAD: Oil Price Weakness Weighs on CAD – Can USD Capitalize?USDCAD: Oil Price Weakness Weighs on CAD – Can USD Capitalize?

Hello TradingView community!

Today, let's analyze the USDCAD pair, which is showing interesting dynamics as the CAD faces pressure from falling oil prices.

🌍 Macro Drivers: CAD Struggles Amidst Lower Oil, USD Upside Limited

The USDCAD pair is caught in a tug-of-war between the Canadian Dollar (CAD) and the US Dollar (USD):

CAD pressured by oil: The Canadian Dollar has seen its gains trimmed, primarily weighed down by lower crude oil prices. Canada, being a major oil exporter, sees its currency directly impacted by these fluctuations.

Oil prices lower: A recent truce between Israel and Iran is keeping crude oil prices significantly lower (16% below Monday's highs), directly affecting CAD's strength.

USD's limited upside: Despite CAD's weakness, the US Dollar's upside attempts are being constrained by recent soft US economic data and persistent hopes for Federal Reserve (Fed) monetary policy easing.

In summary, USDCAD is seeing a slight upward tick due to a weaker CAD from oil price drops, but the USD's rally is somewhat capped by Fed easing expectations.

📊 Technical Analysis & USDCAD Trading Plan

Based on the USDCAD chart (H4/M30) provided:

Overall Trend: USDCAD is trading within an ascending channel, but shows signs of weakness near the channel's upper boundary. Price appears to be forming a lower high after a previous upward move.

Key Price Levels:

Potential SELL Zone (Resistance): Clearly identified around 1.36989. This is a strong resistance level, coinciding with recent local highs. Selling pressure is likely to emerge here.

Key Support (Potential BUY Zone): Around 1.36734 and further down at 1.36431. The 1.36431 level is particularly significant, aligning with a major Fibonacci level (1.382) and acting as a robust demand area from prior price action.

Moving Averages (EMAs): Price is trading near the EMAs (black, orange, red), indicating a consolidation phase and potential for a significant move.

Projected Price Action: The chart suggests that USDCAD could pull back from the current resistance zone (1.36989) towards the support levels below, particularly 1.36431, before potentially finding buying interest to resume an upward trend.

🎯 USDCAD Trading Plan:

SELL ZONE: 1.36989

SL: 1.37050

TP: 1.36900 - 1.36850 - 1.36800 - 1.36750 - 1.36700 - 1.36600 - 1.36500 - 1.36431

BUY ZONE: 1.36431

SL: 1.36300

TP: 1.36500 - 1.36550 - 1.36600 - 1.36650 - 1.36700 - 1.36750 - 1.36800 - 1.36900

⚠️ Key Factors to Monitor:

Crude Oil Prices: Any significant movements in crude oil will directly impact the CAD.

US Economic Data: Upcoming reports on inflation and employment from the US could heavily influence Fed policy expectations and USD strength.

Bank of Canada (BoC) Policy: Statements or decisions from the BoC will also be a critical factor affecting the CAD.

Trade smart and stay vigilant! Wishing everyone a successful USDCAD trading day!

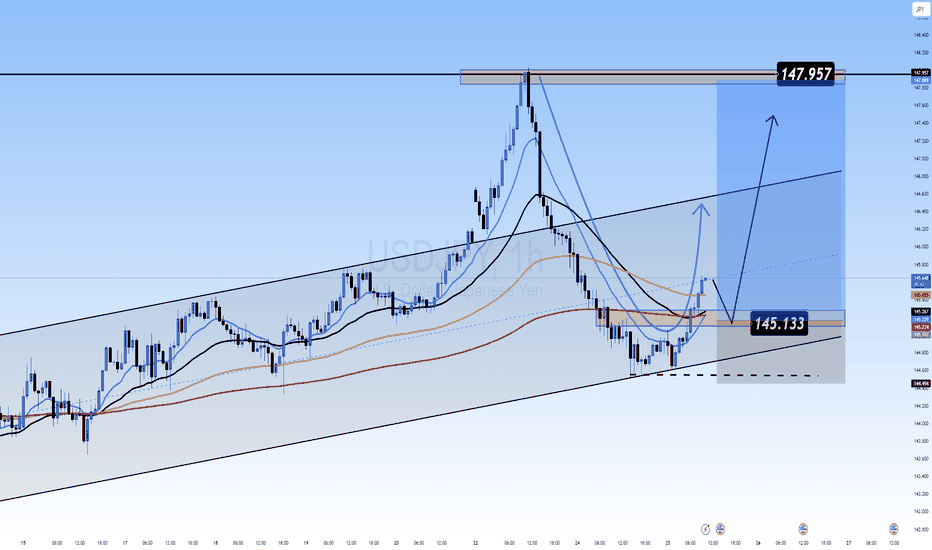

Downtrend Slowing – Recovery Opportunity After Correction?USD/JPY: Downtrend Slowing – Recovery Opportunity After Correction?

Hello TradingView community!

Today, let's focus on analyzing the USD/JPY pair, which is showing interesting developments after its recent correction.

🌍 Macro Overview: USD/JPY Under Current Pressures

The market is observing shifts in the dynamics of the USD/JPY pair:

UOB Group's 24-Hour View: The USD experienced a sharp decline from 148.02 on Monday to 144.49, despite being "oversold". This indicates a slowing in the downtrend, though caution remains.

Retest Expected: According to UOB Group, there's a likelihood of USD/JPY retesting the 144.50 level before a more sustained recovery can be expected.

Downside Limited: A drop below 144.50 cannot be ruled out, but based on current momentum, any further weakness is unlikely to reach 144.00.

Resistance Levels: On the upside, resistance levels are noted at 145.20 and 145.55.

Overall, USD/JPY is in a phase of seeking equilibrium after a significant decline.

📊 Technical Analysis & USD/JPY Trading Plan

Based on the USD/JPY chart (H4/M30) you provided:

Overall Trend: The pair has undergone a relatively deep corrective decline after reaching a local peak, but appears to be seeking a strong support zone.

Key Price Levels:

Crucial Resistance (SELL Zone): Clearly at 144.894 - 145.178. This is an confluence area of Fibonacci levels and local highs where selling pressure could emerge strongly.

Important Support (Potential BUY Zone): Around 143.800 - 143.500. This represents a potential bottoming area where demand might be strong enough to push the price higher.

Projected Price Action: After the sharp decline, USD/JPY might retest the 144.50 area. If it holds above key support levels, an upward move towards resistance zones is plausible, as indicated by the arrows on the chart.

🎯 USD/JPY Trading Plan:

BUY ZONE: 143.800 - 143.500

SL: 143.400

TP: 144.000 - 144.200 - 144.500 - 144.800 - 145.000 - 145.200 - 145.500

SELL ZONE: 144.894 - 145.178

SL: 145.300

TP: 144.700 - 144.500 - 144.200 - 144.000 - 143.800 - 143.500

⚠️ Key Factors to Monitor:

US and Japanese Economic Data: Upcoming reports on inflation and employment from both nations could significantly impact Fed and BoJ policy expectations.

BoJ Policy Decisions: Any shifts in the Bank of Japan's stance will create strong volatility for the JPY.

Global Risk Sentiment: Changes in overall market sentiment can also affect JPY crosses.

Trade smart and stay informed! Wishing everyone a successful USD/JPY trading day!

Can it Reach New Highs as USD Weakens?EUR/USD: Euro's Resilience Holds Strong – Can it Reach New Highs as USD Weakens?

🌍 Macro Landscape: EUR/USD Rides Risk-On Sentiment and Fed Cut Hopes

The Euro (EUR) is showing significant strength, maintaining its position near a three-year high against the US Dollar (USD). This resilience is largely fueled by a moderately positive risk appetite in the market.

Simultaneously, the US Dollar is facing considerable downward pressure. This weakness stems from recent weaker-than-expected economic data from the United States and increasing market expectations for the Federal Reserve (Fed) to implement interest rate cuts. If US economic indicators continue to soften, it could solidify the case for earlier Fed rate cuts, further undermining the USD and potentially boosting EUR/USD.

🏦 Central Bank Policy: Diverging Paths for ECB and Fed

Federal Reserve (Fed): The market is increasingly pricing in the likelihood of Fed interest rate cuts. Weaker US data strengthens this narrative, as the Fed might be compelled to ease monetary policy to support economic growth. This dovish outlook for the Fed is a key driver of USD weakness.

European Central Bank (ECB): While the provided information focuses on the EUR's strength due to broader market sentiment and USD weakness, the ECB's more measured approach to monetary policy compared to the Fed's potential easing can create a favorable interest rate differential for the Euro, attracting capital flows.

This divergence in central bank policy expectations—with the Fed leaning towards cuts and the ECB maintaining a more cautious stance—creates a tailwind for the EUR/USD pair.

🌐 Capital Flows: Money Favors Euro Amidst USD Softness

Global capital flow models suggest that funds are increasingly moving towards assets perceived as offering better relative value or stability. As US yields become less attractive due to anticipated Fed rate cuts, capital may flow out of USD-denominated assets.

This outflow from the USD naturally benefits currencies like the Euro, especially given its current positive momentum driven by a moderate risk-on environment. The re-pricing of Fed policy risk directly influences these capital movements, contributing to the upward trajectory of EUR/USD.

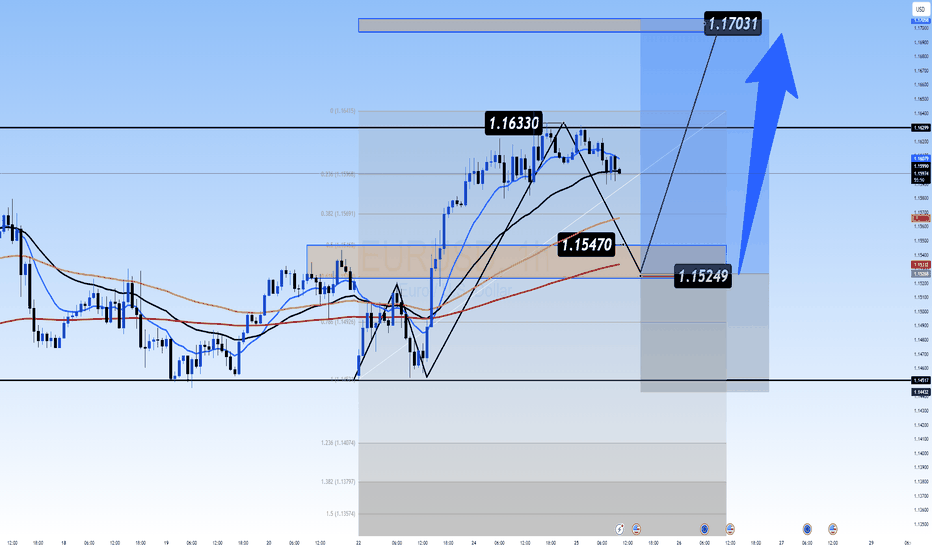

📊 Technical Structure (H4 Chart Analysis): EUR/USD Eyes Key Resistance Levels

Based on the provided EUR/USD H4 chart:

Uptrend intact: The pair continues to exhibit a positive trend, characterized by higher lows and higher highs within an ascending channel.

Key Resistance Levels:

Initial Resistance: 1.16330. This level aligns with recent highs and the top of the minor channel. A break above this suggests further bullish momentum.

Major Resistance Zone: 1.17031. This is indicated as a significant resistance area, potentially a long-term target or a reversal point. A break here would confirm strong bullish conviction.

Key Support Levels:

Immediate Support: 1.15470. This level has acted as a support point, aligning with the EMA 200 and a Fibonacci retracement level, indicating a potential bounce area.

Strong Support Zone: 1.15249. This zone represents a robust demand area, aligning with previous price action and serving as a crucial level for bulls to defend.

Moving Averages (EMA 13-34-89-200): The price is trading above the short-term and long-term EMAs, suggesting strong bullish momentum. The EMAs are fanning out and showing a bullish alignment, reinforcing the uptrend.

Projected Price Action: The chart suggests that the price might retrace towards the 1.15470 or 1.15249 support zones before resuming its upward trajectory towards the 1.16330 and potentially 1.17031 resistance levels.

🎯 Trade Strategy Recommendations:

Scenario 1 – BUY the Dip:

Entry: Look for bullish confirmation around 1.15470 - 1.15249.

Stop-Loss: Below 1.15100 (or a level below the 1.15249 support for risk management).

Take-Profit:

TP1: 1.15600

TP2: 1.15800

TP3: 1.16000

TP4: 1.16200

TP5: 1.16330 (Targeting the immediate resistance)

TP6: 1.16500

TP7: 1.16800

TP8: 1.17031 (Targeting the major resistance)

Scenario 2 – SELL the Rally (Counter-trend/Reversal):

Entry: Look for bearish confirmation around 1.16330 - 1.16400 or higher near 1.17031.

Stop-Loss: Above 1.16500 (or above 1.17100 if selling at higher resistance).

Take-Profit:

TP1: 1.16200

TP2: 1.16000

TP3: 1.15800

TP4: 1.15600

TP5: 1.15470 (Targeting the immediate support)

TP6: 1.15249 (Targeting the strong support zone)

⚠️ Key Events to Watch:

Upcoming US Economic Data: Any further weak data could solidify Fed rate cut expectations and weigh on the USD.

ECB Official Statements: Comments from ECB members on inflation or monetary policy could impact EUR's strength.

Global Risk Sentiment: A continued moderate risk-on environment will generally support the EUR against the USD.

Trade smart and stay informed! Wishing everyone a successful trading day!

Powell's Softer Tone Hints at Gold's LiftoffXAUUSD: Powell's Softer Tone Hints at Gold's Liftoff – Ready for a July Rally?

Hey everyone!

Let's dive into XAUUSD today! We've got some sweet news from Fed Chair Jerome Powell that could be a game-changer for Gold.

🌍 Macro Edge: Gold Breathes Easier as Rate Pressures May Ease!

Gold's recent climb is largely thanks to Powell's "soft-spoken" remarks. He's openly admitted that tariff-driven inflation is lower than expected, even subtly hinting at earlier rate cuts – perhaps as soon as July!

Despite his "no need to rush" stance, the market's getting a clear message: if inflation keeps cooling down, the Fed will have room to loosen policy sooner. This is music to Gold's ears! Lower rates mean a reduced opportunity cost for holding Gold (which doesn't yield), making it far more attractive to investors.

🌐 Capital Flows: Gold vs. USD – Who's the Next Safe-Haven King?

Market liquidity always dances to the tune of interest rates and risks. Gold and the USD typically share the safe-haven crown during volatile times.

However, if Powell's "dovish tilt" holds, and the Fed cuts rates soon, prepare for a significant capital shift:

USD might cool off: Lower US yields reduce the USD's appeal.

Gold takes the spotlight: With lower holding costs and persistent global geopolitical uncertainties, Gold could see a surge in demand.

The market's re-pricing of Fed policy is already bolstering Gold, signaling a potential upside move on the horizon!

📊 Technical Insight (H4/M30 Chart): Gold Breaking Free, Targeting Higher Peaks!

Looking at our XAUUSD chart (H4/M30, based on your image):

Channel Breakout: Gold has clearly broken out of its prior descending channel! This is a positive sign, indicating weakening selling pressure and a potential trend reversal. Price is consolidating, possibly forming a new accumulation pattern or a minor ascending channel.

Key Levels to Watch:

Potential SELL Zone (Resistance): Around 3352.383 - 3371.205. This is a major historical resistance cluster where Gold has previously met strong selling pressure. Watch for rejection here.

Higher Resistance: 3391.750 - 3395.000. A decisive break above this level would signal a more robust long-term bullish trend.

Current BUY Zone (Support): Around 3302.939 - 3311.214. This is a critical demand zone where strong buying interest is likely to emerge, aligning with recent lows.

Next Key Support: 3286.257. This is the next line of defense if the current BUY zone breaks.

🎯 Trade Plan & Key Zones:

BUY ZONE: 3286 - 3284

SL: 3280

TP: 3290 - 3294 - 3298 - 3302 - 3306 - 3310 - 3315 - 3320

BUY SCALP: 3302 - 3300

SL: 3295

TP: 3306 - 3310 - 3314 - 3318 - 3322 - 3326 - 3330

SELL ZONE: 3353 - 3355

SL: 3360

TP: 3350 - 3346 - 3340 - 3335 - 3330 - 3320

SELL ZONE: 3372 - 3374

SL: 3378

TP: 3370 - 3366 - 3362 - 3358 - 3354 - 3350

⚠️ What Else to Watch For:

More Fed Official Speeches: Any new comments on inflation or policy will keep the market buzzing.

Geopolitical Developments: Ongoing global tensions can always boost Gold's safe-haven appeal.

Let's trade smart and stay sharp! Wishing everyone a successful trading day!

Fundamental Market Analysis for June 25, 2025 USDJPYEvents to pay attention to today:

17:00 EET.USD - Fed Chair Jerome Powell will deliver a speech

17:30 EET.USD - Crude oil inventory data from the Department of Energy

USDJPY:

The Japanese yen (JPY) remains in the lead against the US dollar during Wednesday's Asian session and remains close to the weekly high reached the day before, amid a combination of favourable factors. The summary of opinions from participants at the Bank of Japan (BoJ) meeting in June showed that some policymakers called for interest rates to be kept unchanged due to uncertainty about the impact of US tariffs on the Japanese economy. In addition, the fragile truce between Israel and Iran and trade uncertainty are supporting the Japanese yen as a safe-haven currency.

Meanwhile, investors seem convinced that the Bank of Japan will raise interest rates again amid mounting inflationary pressure in Japan. These forecasts are confirmed by Japan's producer price index (PPI), which rose for the third consecutive month in May and remained above 3% year-on-year. In contrast, traders are factoring into their prices the likelihood that the Federal Reserve (Fed) will further lower the cost of borrowing this year. This, in turn, is causing US dollar (USD) bulls to tread cautiously and suggests that the path of least resistance for the lower-yielding Japanese yen remains upward.

Trading recommendation: SELL 144.900, SL 145.100, TP 144.000

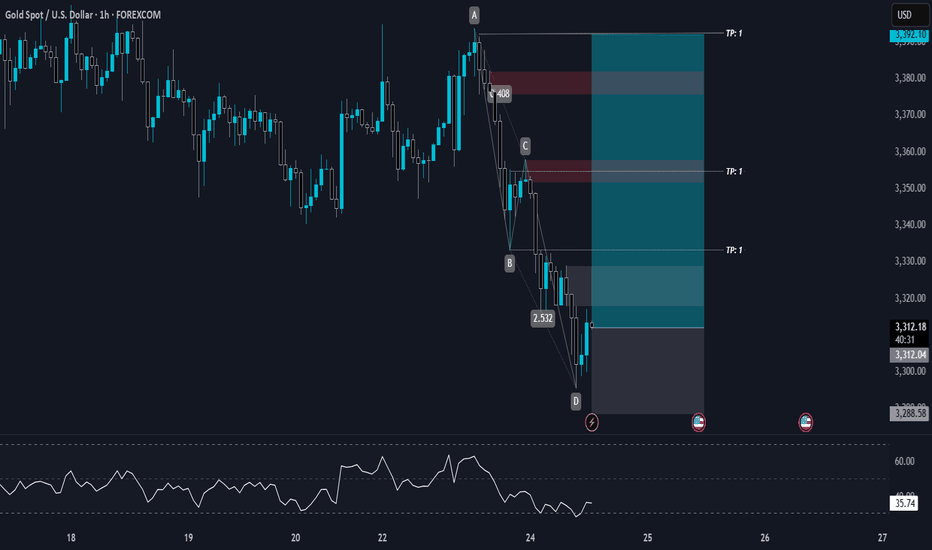

XAUUSD 1H | Harmonic AB=CD | Sentiment Reversal in PlayGold has formed a clean Harmonic AB=CD Pattern, with price currently sitting at the PRZ (Potential Reversal Zone). This aligns with technical expectations for a possible bullish shift.

🗓️ The recent sharp sell-off in Gold was heavily influenced by the ongoing Iran-Israel conflict, triggering fear, panic, and speculative selling. Despite Gold's fundamentally bullish bias as a safe-haven asset, market sentiment overpowered fundamentals in the short term.

🔍 On the 30min LTF, we have a crystal-clear Bullish Divergence on RSI, adding further confluence that downside momentum is weakening, and a corrective reversal may unfold from this area.

Bias:

✅ Harmonic AB=CD complete — PRZ active

✅ LTF Bullish Divergence (30m) confirmed

✅ Price action showing exhaustion at key support

✅ Expecting potential bullish reaction and relief rally

⚠️ As always, waiting for confirmation with proper risk management. Market remains sensitive to geopolitical headlines.

💡 DYOR — Do Your Own Research before executing trades.

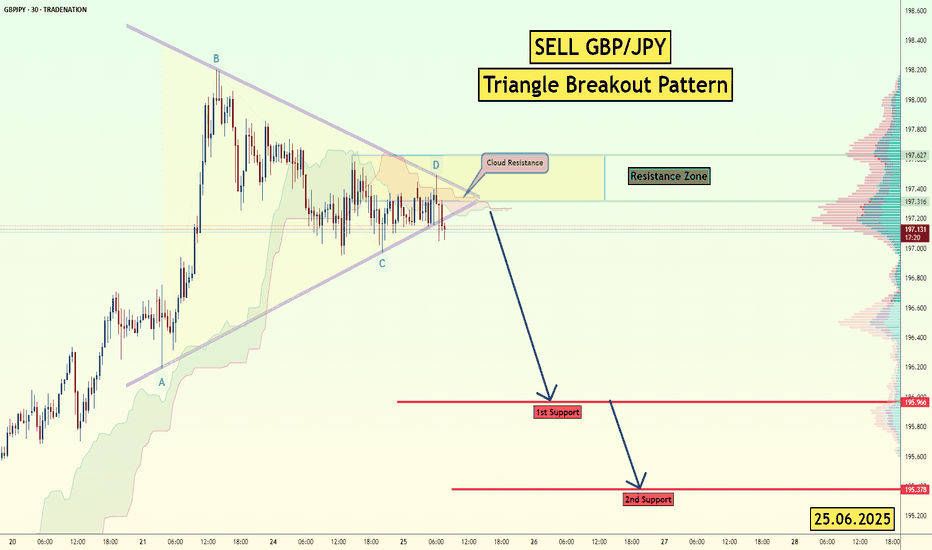

GBP/JPY Triangle Breakout (25.06.2025)The GBP/JPY Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 195.96

2nd Support – 195.37

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

APX Rebound in Play?📈 “APX Rebound in Play? Eyeing the AUD 1.55 Resistance”

Appen (APX) has shown a significant uptick today, closing at AUD 1.040 (+5.58%) with a sharp volume spike (8.96M shares) that could suggest accumulation. After a long downtrend, price appears to be consolidating above key support near AUD 1.00, forming a potential base for reversal.

🔍 Chart Highlights:

Support Zone: AUD 1.000 – strong historical level holding.

Resistance Targets: → AUD 1.555 → AUD 1.655 → AUD 1.785

R/R Setup: Defined green zone shows potential upside if momentum continues; red zone clearly marks invalidation below support.

🧠 Thesis: If APX maintains momentum and holds above AUD 1.00, we may be witnessing a structural shift with upside potential toward AUD 1.78 in stages. Breakout traders might watch for confirmation via volume and price action at each resistance.

💬 “Could we be looking at an early-stage reversal or just a dead-cat bounce? Watching the 1.00 level closely.”

#ASX #APX #APPEN #MJTRADING #TRADING #SHARE #STOCKMARKET #BUY #CHART #MONEYMANAGEMENT