AND

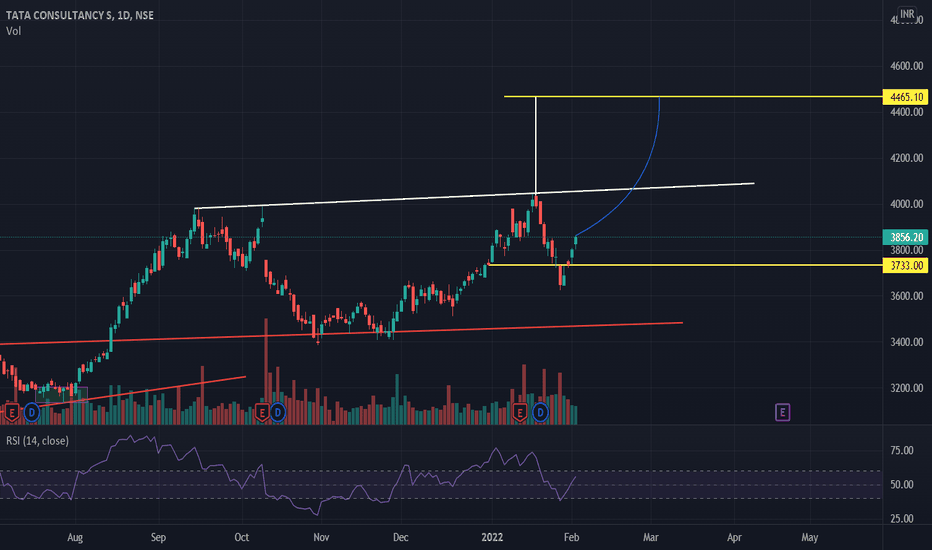

TCS LongTCS has been a fundamentally good stock which ultimately is good to hold for a long time. However, The recent budget has also been focused on IT which is an added advantage for IT Sector.

At present, the chart shows Cup and handle pattern which will fetch 10% and above on breakout. I'm holding TCS for quite a while now and looking forward to investing more.

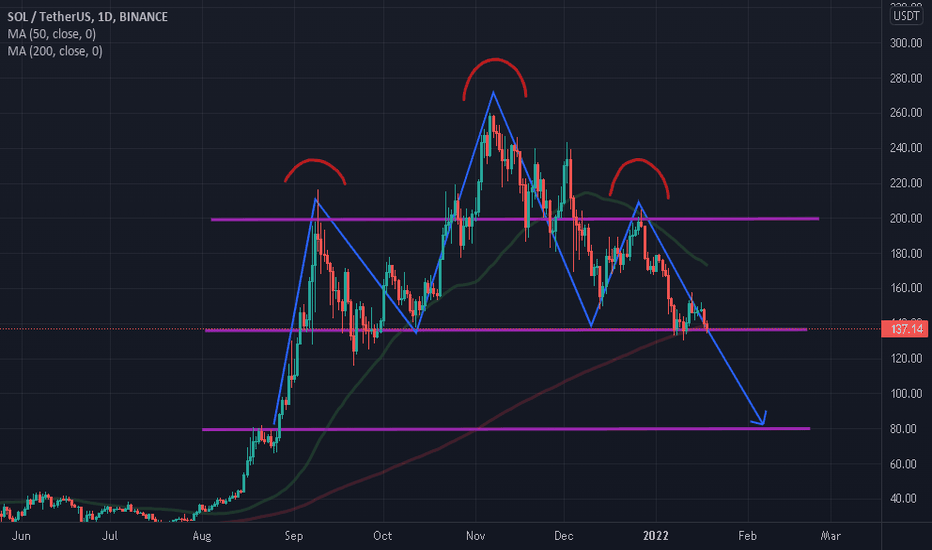

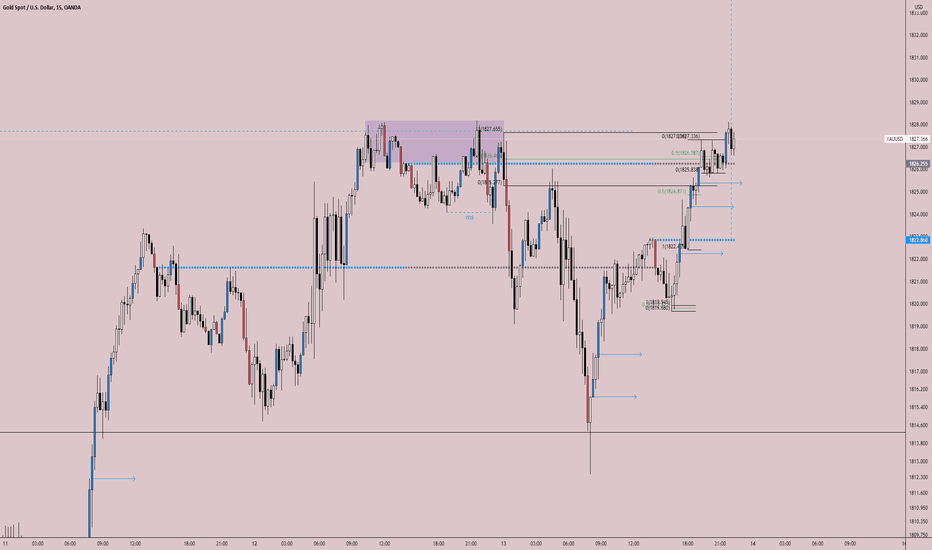

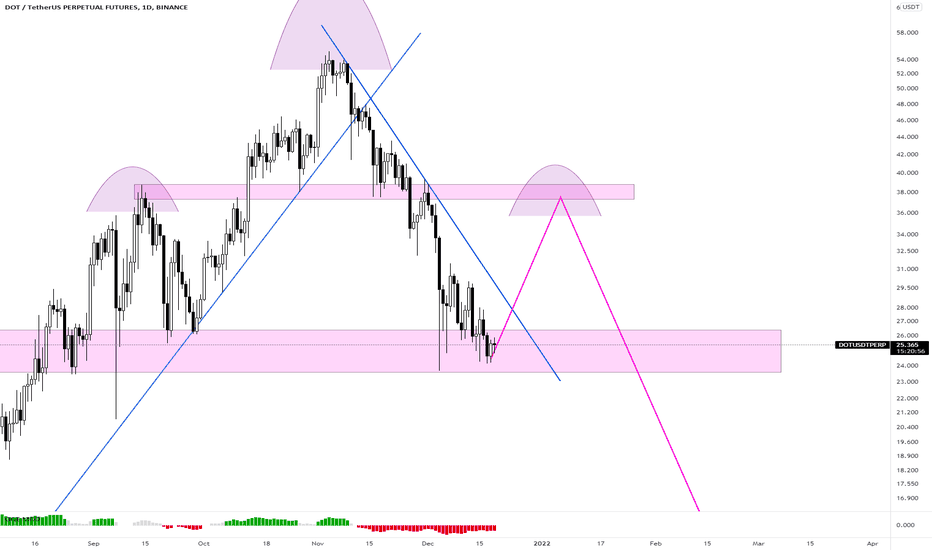

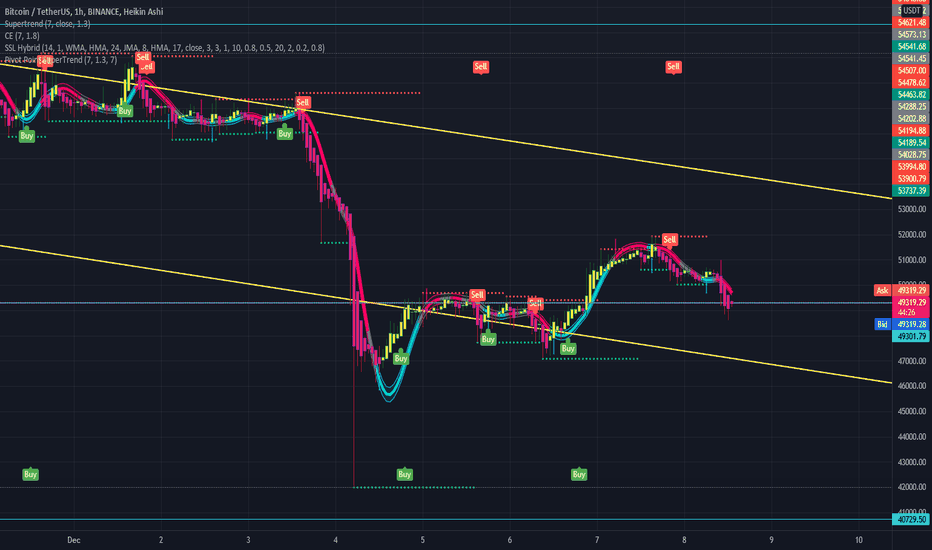

Reverse Cup And Handle SetupHello Traders.Here we Have A Reverse Cup and Handle retesting And Ready for A Sell!Sell!Sell! Ultimately I see Price Going to the .618 Fibb Level,Going Back to trend line Then Testing Off the .382 level Before Breaking out of A Triangle Pattern On the Daily To the upside. We See How it plays Out. For Now Hop onto The Sell!

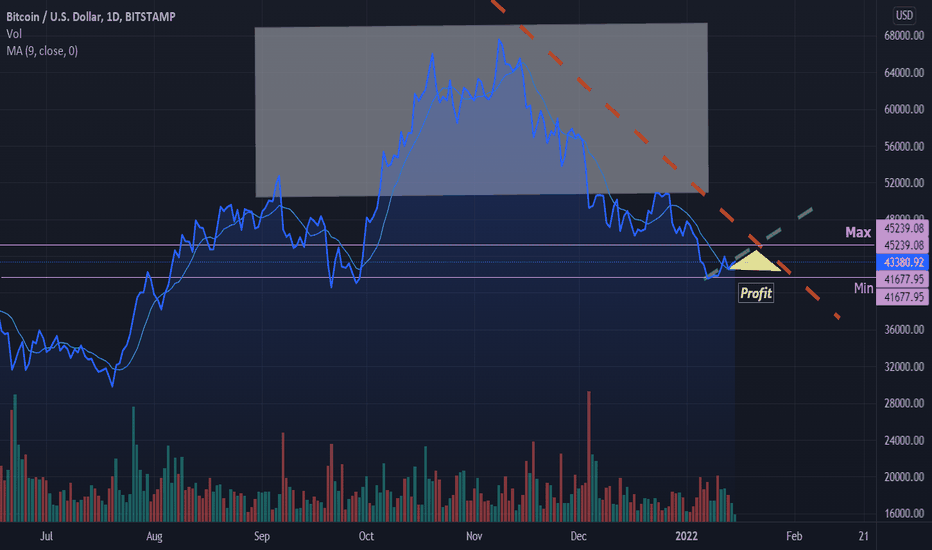

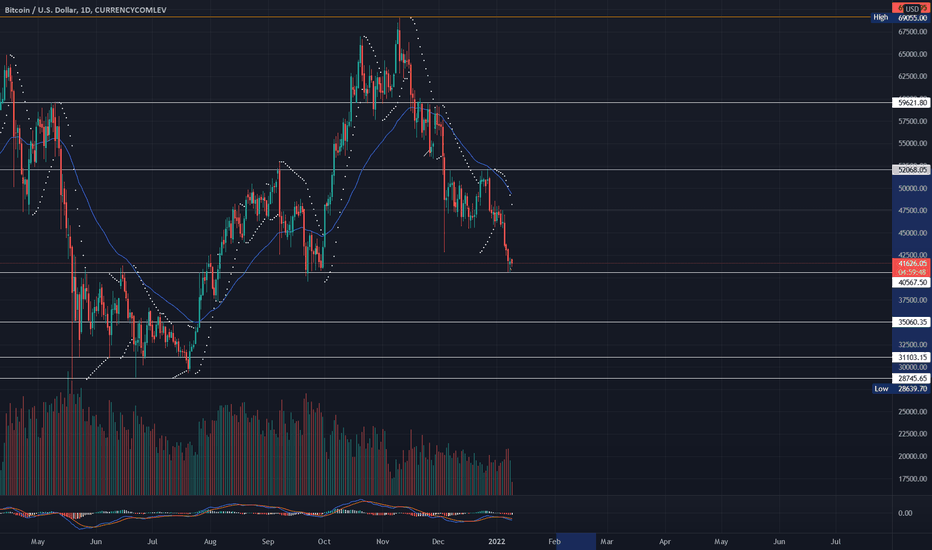

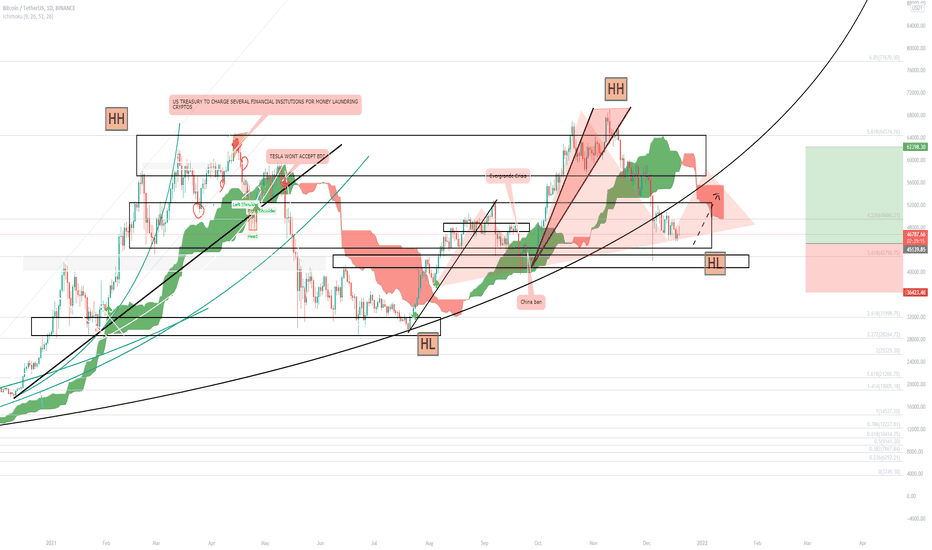

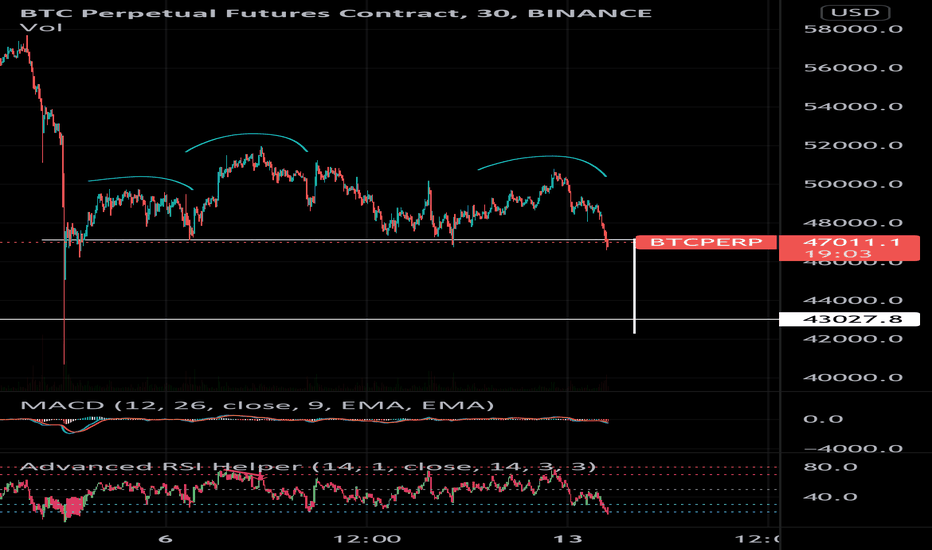

What Is the Future of Crypto and Bitcoin in Short and Long TermsBitcoin fell down fast at the first days of the New Year’s Eve, and just a few days ago, on January the 8th, it was getting sold just about 40K USD. The crypto market is highly inflated. Inflation of crypto market and Bitcoin following the New Year’s Eve, and especially after the Kazakhstan governmental shutdown of the crypto mining networks, potentially might be bearish, not only to the cryptocurrency value but also to the stock market over the early months of the year. Meanwhile, experts analysis proofs long term increments in crypto market price that would just pass 80K USD in near future this year, and then possibly it might hit 110K USD, and much more. Thereby, as the Bitcoin value badly hit 40K USD (as a short term falling minimum) last days, and on the contrary as the crypto markets just had some good trades last days, and especially while meaningful hopes are brightly observable at the sight showing that the crypto markets are getting boosted again over the next days by a higher rate of impressive traders, thereby, fortunately, the cryptocurrency market shall hit a desirable value, once again, too soon (above 45K USD). But because of vast social stress over the current pandemic that what if probably the CoVid issue affects the Digital Money, and also because, as it was discussed above, the Kazakhstan’s cryptocurrency mining complaints yet threatening the crypto market, it might be predictable that the next month would not be such a good month for the crypto and stock markets and for the investors (and the price may fall below the 40K USD broker). Below, I have just illustrated a schematic chart eliciting my self-opinions regarding the effects of the moving average bars on the Bitcoin price just during the Jan of 2022.

Look at my personal-forecast of the Bitcoin price in short term (The snapshot of the chart of current idea)

Now, after a distinguished increment in crypto price once, over the next days in late third quarter of the Jan, 2022, thereafter, it could be not an ideal market for crypto during this Feb. But following the spring we must see a huge difference in the crypto markets value hopefully.

Head and ShouldersPerfect head and shoulder pattern ready to drop. Still in bearish market with sentiment only continuing. Going back to the monthly there is a double drop forming to its fullest. Is this the beginning of the end for bitcoin???

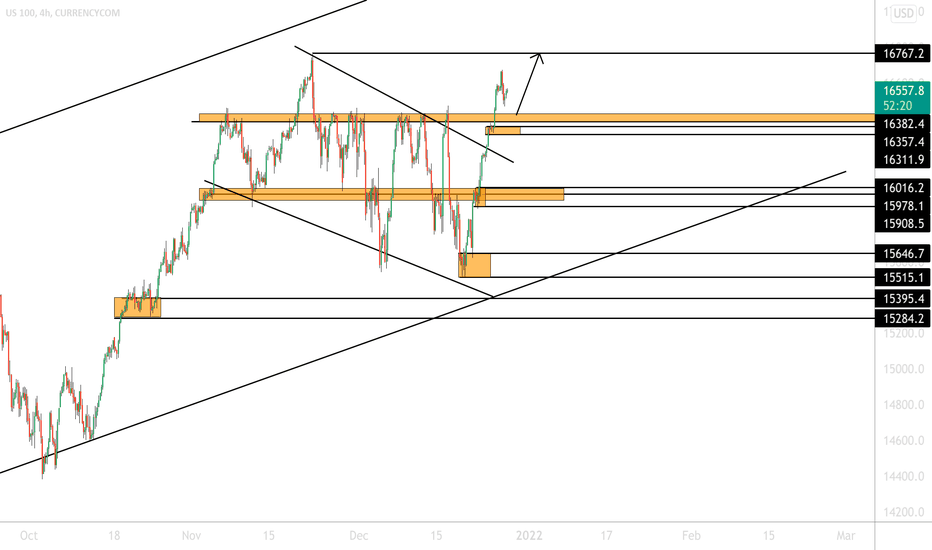

Nas 100 long There is a possible long in Nas 100. provided we get a retracement , the tow levels would be a good place to go long

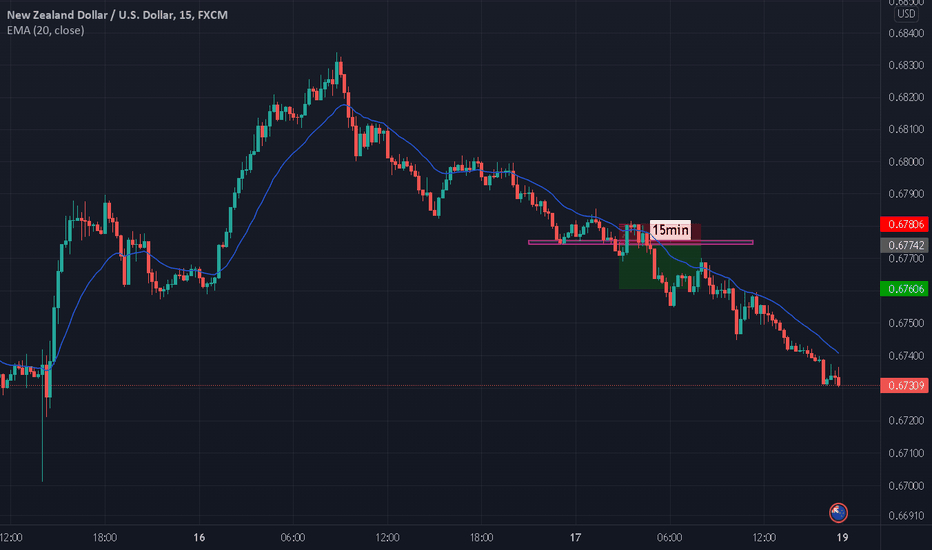

NZDUSD tradeHey everyone,

i pinned, where i go to the short trade. When is the risk 2%. So this week i have two trades. First 4%, this is -2%. My week have now 2% in profit.

For my idea is the next level, because i have see next trade with bad stoploss. For me is mistakes, which me push up.

Jindrich.

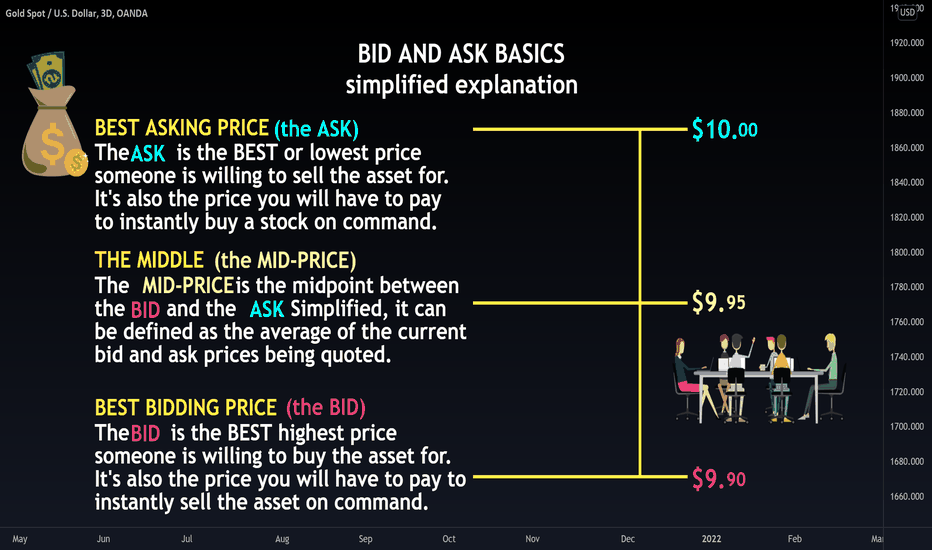

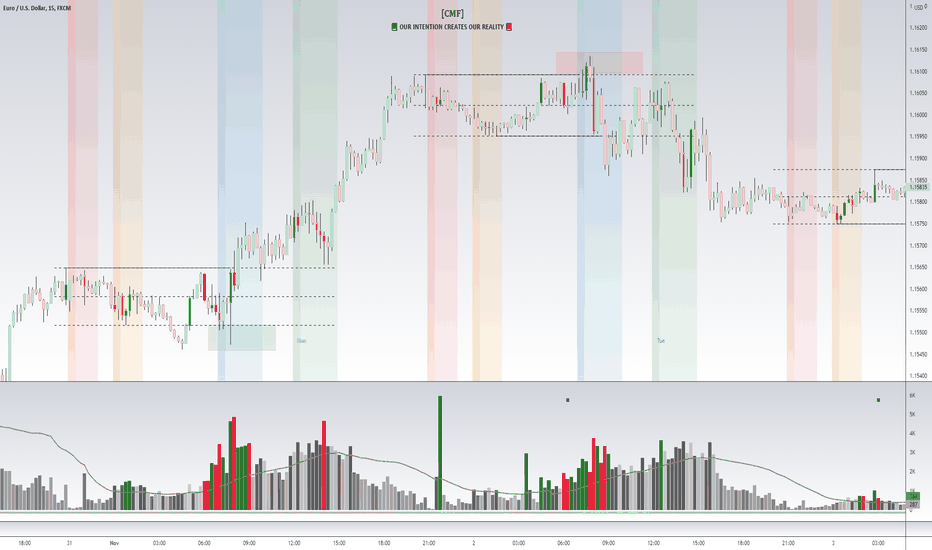

BID AND ASK BASICS📚

🔴In all markets, there is a price at which a market participant is willing to buy an asset and a price that suits the seller. At the same time, traders intend to carry out a purchase and sale transaction only within the amount that is profitable for them.

⚠️In the foreign exchange market, the ask line is the cost of buying an asset or the price that is set by the broker in the Buy order.

⚠️Bid - accordingly, the cost at which the broker opens a sell order when accepting an application for the sale of currency from a trader.

❗️The spread is the difference between ask and bid prices. To be more precise, the spread is the difference between the best bid and ask offers for a specific asset over a certain period. Thus, the spread is dynamic, changing over time. The spread value is formed by the initial value set by the broker, as well as due to the volatility of the currency. The spread can vary from 0.1 to 100 points.

✅In the market of physical goods, a similar example can be given: a seller and a buyer, haggling, narrow the difference between prices that satisfy them, bringing them to one at which they make a deal.

✅In the foreign exchange market, the spread between prices is the commission charged by the broker. It should be borne in mind that the broker takes a commission regardless of the volume of the transaction and its result.

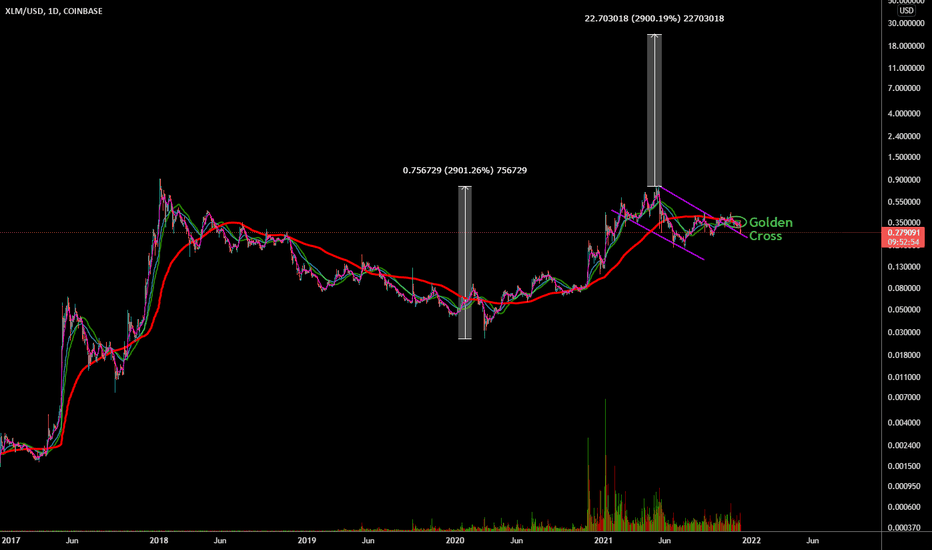

XLM Backtesting Handle of GIANT C&H?!XLM Has been building this potential cup and handle since the '17 top. Has Bitcoin topped and we are starting a new bear market without coins like $XLM $DASH $EOS $XRP etc not hitting previous ATH's?

In my opinion this could just be backtesting the handle (Last shakeout) before really something special here.

#NotFinancialAdvice

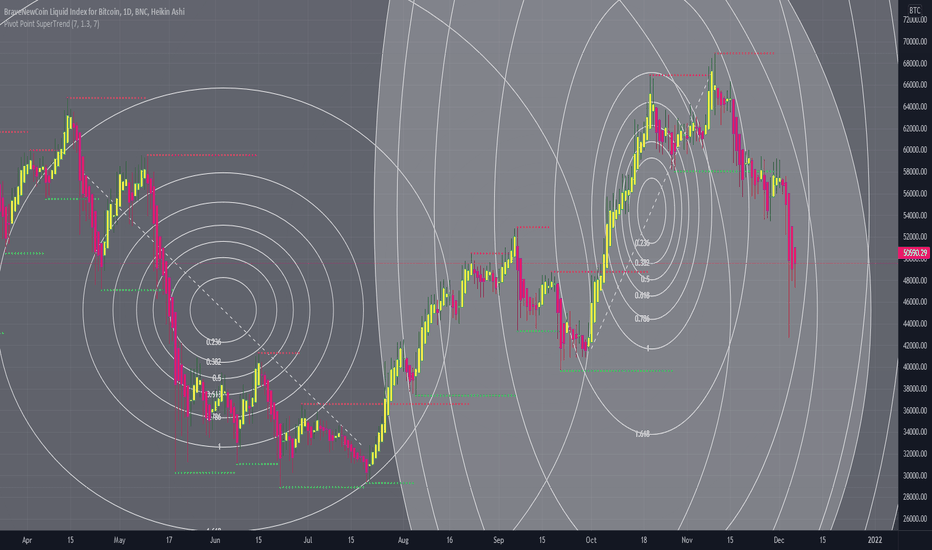

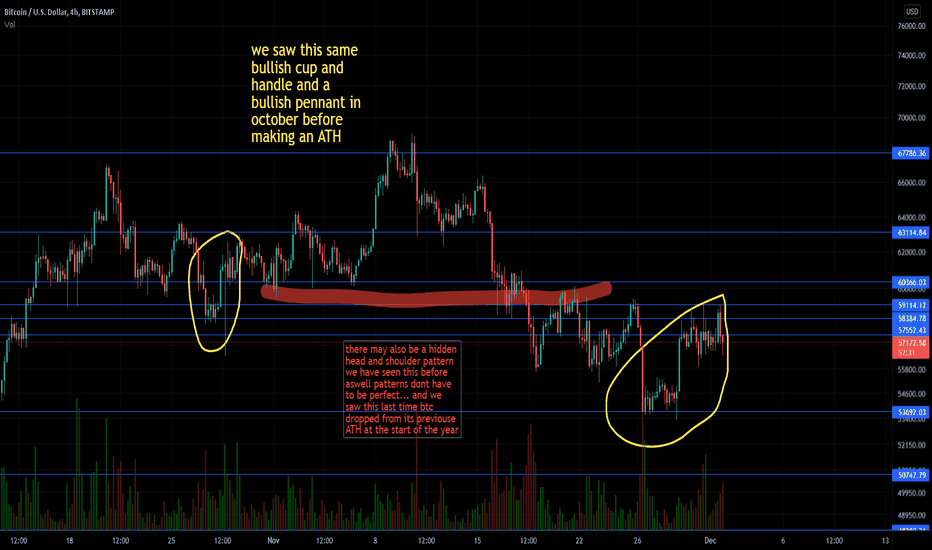

BTC patterns 4hr up or down who knows how this will play out, things seem as indecisive as ever and this this chart doesnt help....

Just a couple of observations....

Trying to learn so feed back is welcome.

i guess in the short term i will be holding until i get some confirmation on what the market wants to do.