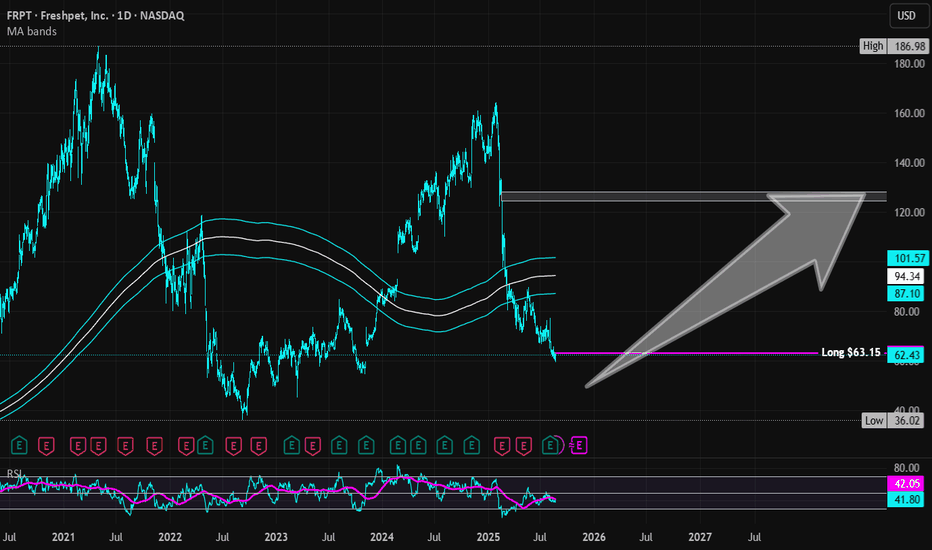

Freshpet | FRPT | Long at $63.15Freshpet's NASDAQ:FRPT future growth looks very good based on *current* estimates. The company's revenue is anticipated to grow from $1.18B–$1.21B in 2025 to ~$1.9B by 2028, implying an annual growth rate of ~13–17%. NASDAQ:FRPT targets a 22% adjusted EBITDA margin by 2027, with adjusted EBITDA expected at $190M–$210M in 2025. The stock is definitely not "cheap" right now with a price-to-earnings of 92x. However, the growth projections look solid if they can maintain the pace of growth through a tumultuous economy - the pet market is wildly resilient.

Since February 2025, insiders have grabbed over $931,764 in shares at an average price of $100.93. The only open price gap below the current price was a closed yesterday. A blaring price gap between $124-$128 is likely to be closed - just a matter of when. With very low debt (debt-to-earnings of 0.5x), Quick Ratio over 3 (heathy), and Altman's Z-score of 3+ (low bankruptcy risk), the company appears extremely healthy. I think there is a chance the price could reach into the high $40's and $50's in the near-term, but long term... if the projections are correct... the company looks poised from major profit.

Thus, at $63.15, NASDAQ:FRPT is in a personal buy zone with near-term risk of a drop into the high $40s and $50s.

Targets into 2028:

$90.00 (+42.5%)

$125.00 (+ 97.9%)

Animalhealth

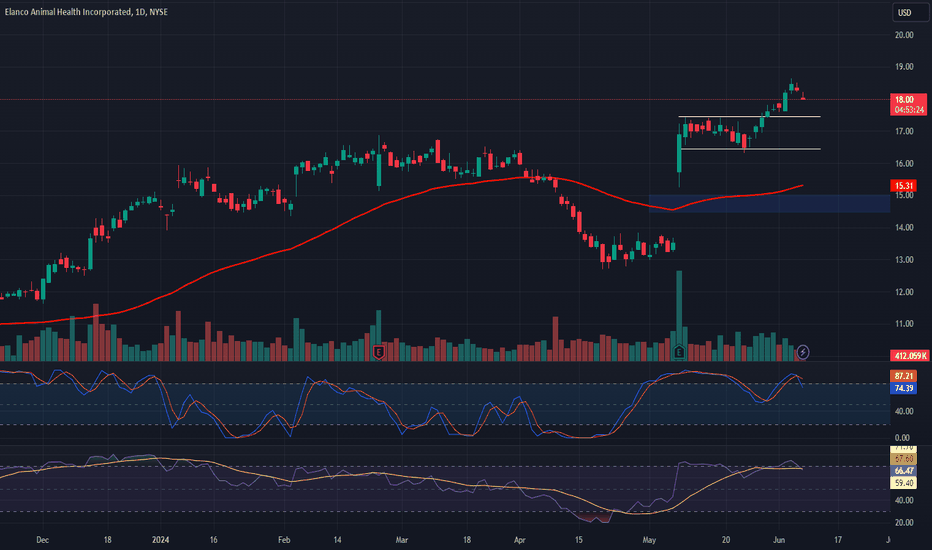

Elanco Animal Health Inc | ELAN | Long at $11.16Elanco Animal Health NYSE:ELAN is riding my historical simple moving average and likely to make a move up soon. Insiders have recently been awarded options and bought $483,000+ worth of shares. Became profitable this year, low debt, P/E = 15x.

Long at $11.16

Targets:

$12.50

$14.50

$16.00

$17.50

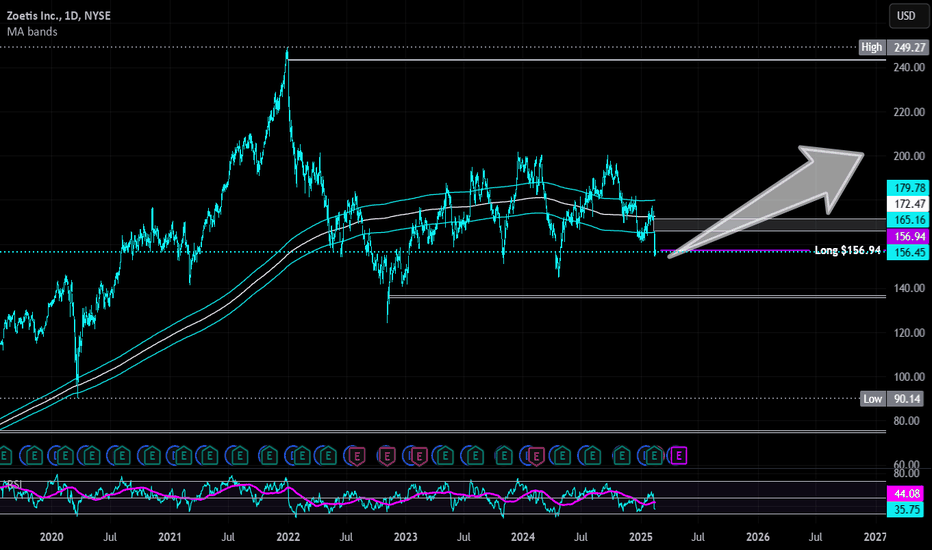

Zoetis | ZTS | Long at $156.94Zoetis NYSE:ZTS , the largest global animal health company, generated more than $9 billion in revenue in 2024 and earnings have grown 9.3% per year over the past 5 years. Free cash flow for FY2024 was over $2.2 billion. Dividend consistently raised every year for the past for years (currently 1.28%). The growth of the company isn't expected to slow any time soon, and I believe the animal health care market will grow right alongside the human health care market - if not potentially faster (people love their pets).

Thus, at $156.94, NYSE:ZTS is in a personal buy zone. There may be some near-term risk with the potential for a daily price-gap close near $136.00, but I personally view that as an even better buy opportunity (unless fundamentals change).

Targets

$170.00

$180.00

$200.00

Elanco Animal Health (ELAN) AnalysisMarket Position:

Elanco Animal Health NYSE:ELAN focuses on innovating and marketing products for pets and farm animals. CEO Jeff Simmons credits the company's growth to "accelerating contribution from innovation, stabilizing core volumes, price growth, and improved market conditions in Europe."

Sector Growth:

Animal health is a promising sector for growth investors, driven by increasing pet ownership, with 70% of U.S. households now owning a pet, up from 56% in 1988. As a major player, Elanco stands to benefit significantly from this trend.

Regulatory Approvals:

Elanco recently received continued approval from the EPA and support from the FDA for its Seresto flea and tick collar for dogs and cats. This development opens a significant new revenue stream and is likely to drive the stock price higher.

Investment Outlook:

Bullish Outlook: We are bullish on ELAN above the $14.50-$15.00 range.

Upside Potential: With a target set at $22.00-$23.00, investors should monitor Elanco’s innovations and market expansions, particularly with products like Seresto, to capitalize on the growing demand in animal healthcare.

📊🐾 Stay updated on Elanco Animal Health for promising investment opportunities! #ELAN #AnimalHealth 📈🔍