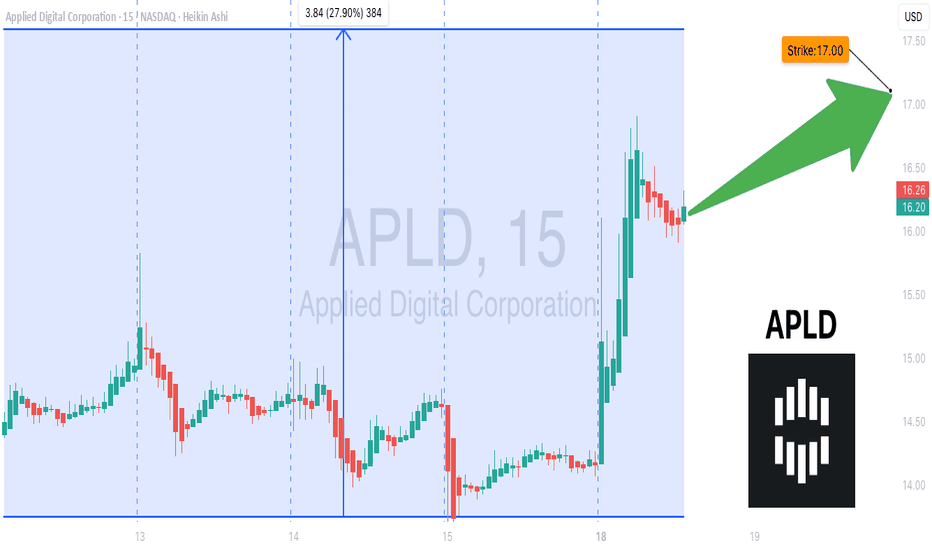

APLD Gamma Squeeze Watch: Calls Loading Into Expiry! 🚀 APLD Weekly Options Trade Analysis (2025-08-18)

### 🔎 Comprehensive Summary

APLD weekly options data shows **strong bullish sentiment**, supported by:

* **Call/Put Ratio:** 2.40 (heavy call bias)

* **RSI:** >70, confirming strong momentum

* **Institutional Flow:** Aligns with bullish catalysts (price target upgrades)

⚠️ **Weakness:** Weekly volume didn’t surpass the prior week, raising some caution.

---

### 📊 Agreement & Disagreement

✅ **Agreement Across Models:**

* Strong bullish trend confirmed by RSI & call/put ratio

* Volatility environment favorable (low VIX)

* Best trade setup: **Calls**

❌ **Disagreement:**

* Some models emphasize weak volume as a potential risk

* Others dismiss this due to strength in bullish momentum

---

### 📝 Trade Plan

* **Overall Market Direction:** ✅ Bullish

* **Strategy:** Buy single-leg, naked calls with strong liquidity

**Trade Setup**

* 🎯 **Strike:** \$17.00 Call

* 📅 **Expiry:** Aug 22, 2025 (4 DTE)

* 💵 **Entry Price:** \$0.45

* 🛑 **Stop Loss:** \$0.23 (\~50% premium)

* 🎯 **Profit Target:** \$0.90 – \$1.12 (100-150% gain)

* ⏰ **Entry Timing:** Market open

* 📈 **Confidence Level:** 80%

---

### ⚠️ Key Risks

* **Gamma Risk:** High with only 4 DTE — position requires tight monitoring

* **Volume Weakness:** May hinder sustained breakout if institutional support falters

---

## 📊 Trade Snapshot

* **Instrument:** APLD

* **Direction:** CALL (LONG)

* **Strike:** \$17.00

* **Entry Price:** \$0.45

* **Target:** \$1.00+

* **Stop:** \$0.23

* **Expiry:** 08/22/2025

* **Size:** 1 contract

* **Confidence:** 80%

* **Signal Time:** 2025-08-18 12:05:33 EDT