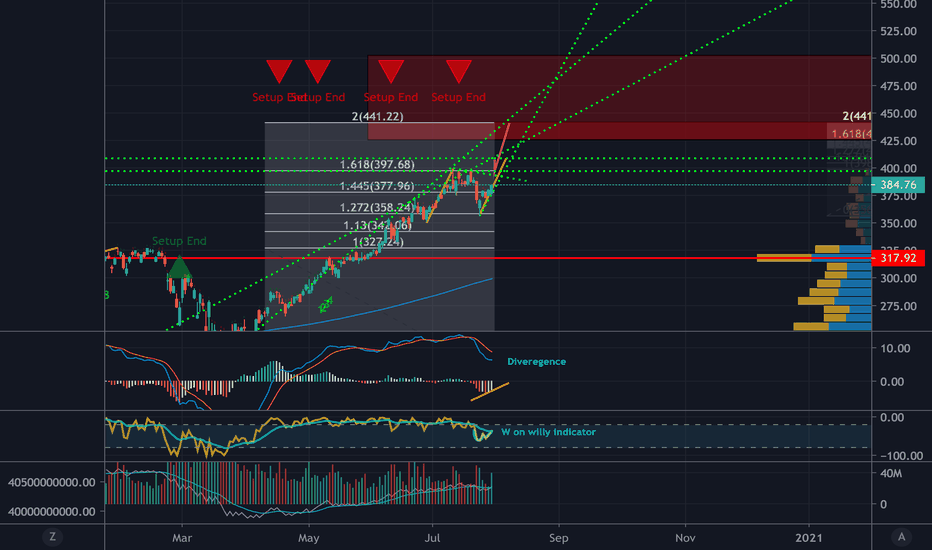

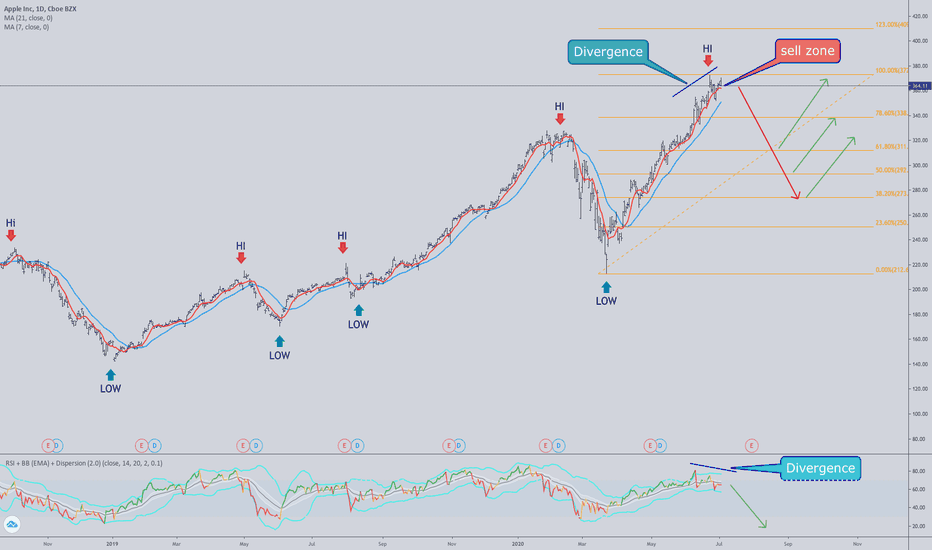

TECH BUBBLE 2.0The tech Crash in 2000 took 3 years to bottom out... and longs lost 80% in that time.

The 2008 financial crash took 2 years to bottom out, and longs lost 57% in that time.

The 2020 crash... oh, I think it hasn't even started yet... I would stick to short positions or day/swing trading... and I wouldn't even consider going long on anything until the Lower Bollinger band is hit on the monthly chart... currently at 5991

I think we all know what's coming... It'll be a fun ride if you're prepared in either direction.

GL.

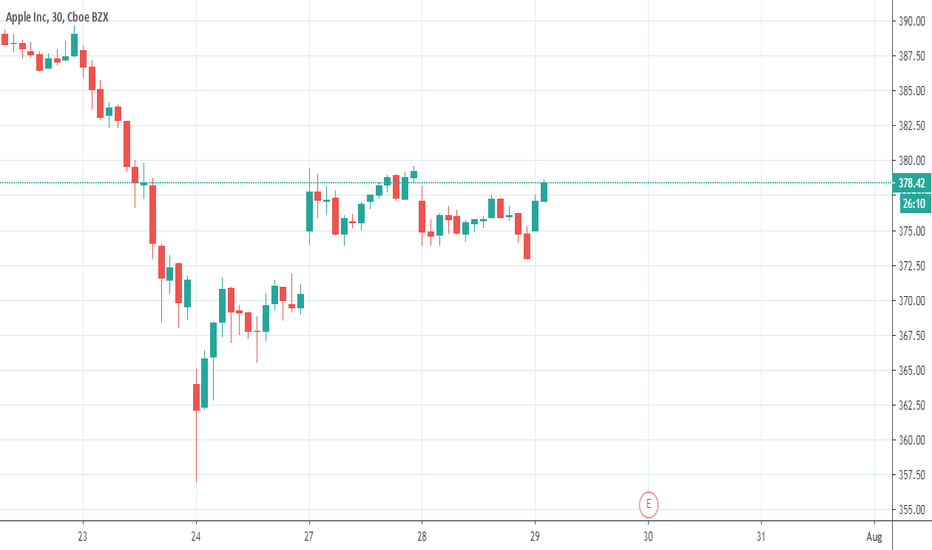

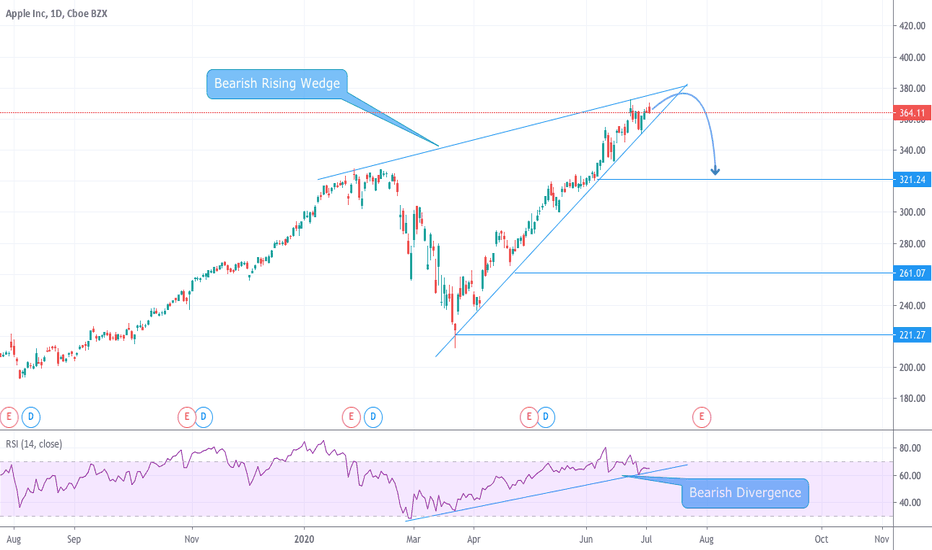

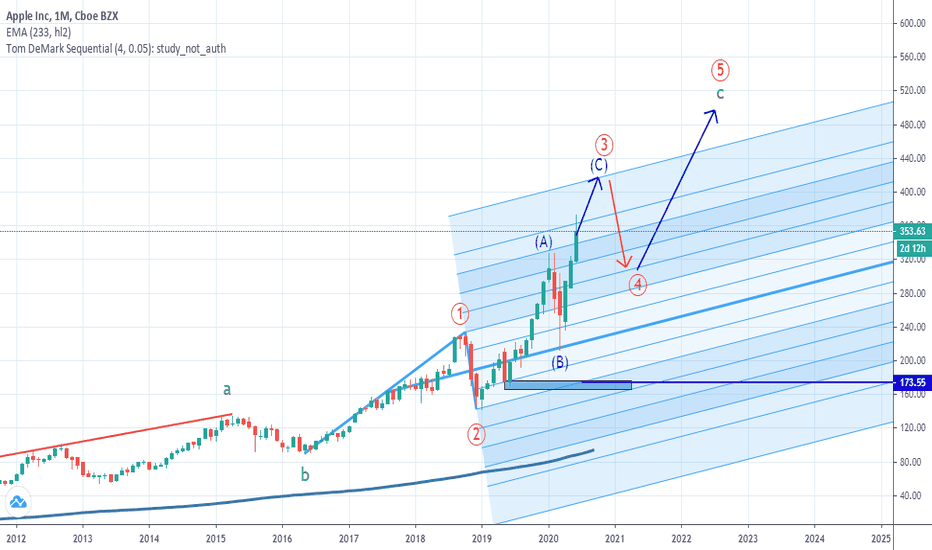

APPL

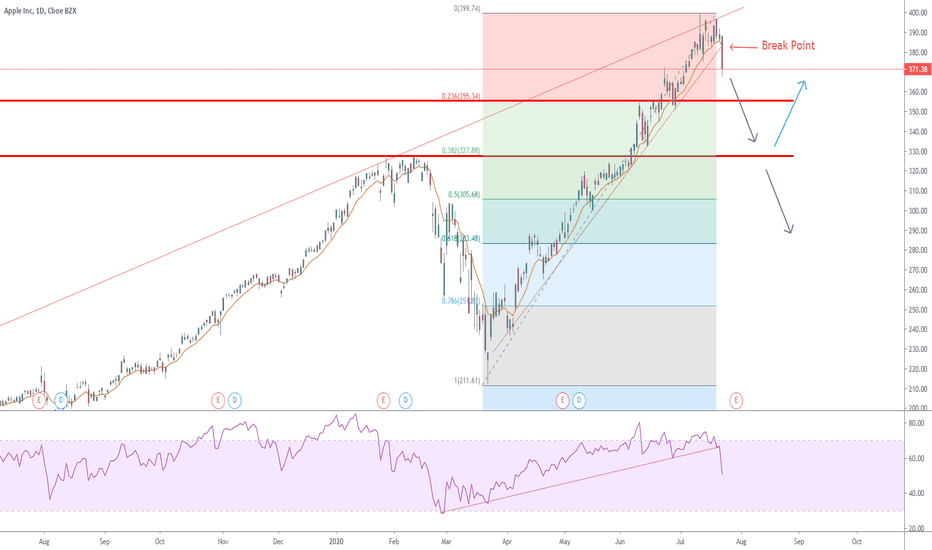

Short $AAPL against $450 or in any rally

Hello Sophisticated Trader,

My last analysis on the $APPL stock was spot on, so I'm taking another look at it. I projected this price by year-end, however, market action has exceeded expectations. Fundamental is great for the company and the approved 4-1 stock split would send the pair back to over $100 in a month. In the meantime, technical are overbought, while the rumors of 3000 satellites are giving the share price a boost. Still, I'm shorting the rally for the lower price to buy.

Remember to Like, Comment, and Follow.

Let's Make Money Together!

Happy Trading!

Dr. Lydia Smith

Where we teach you what you need to know to be a profitable trader.

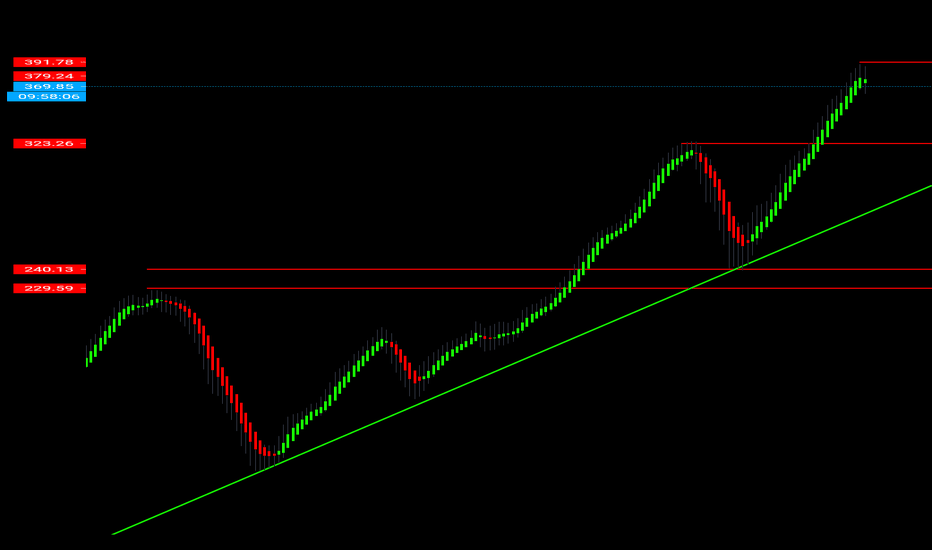

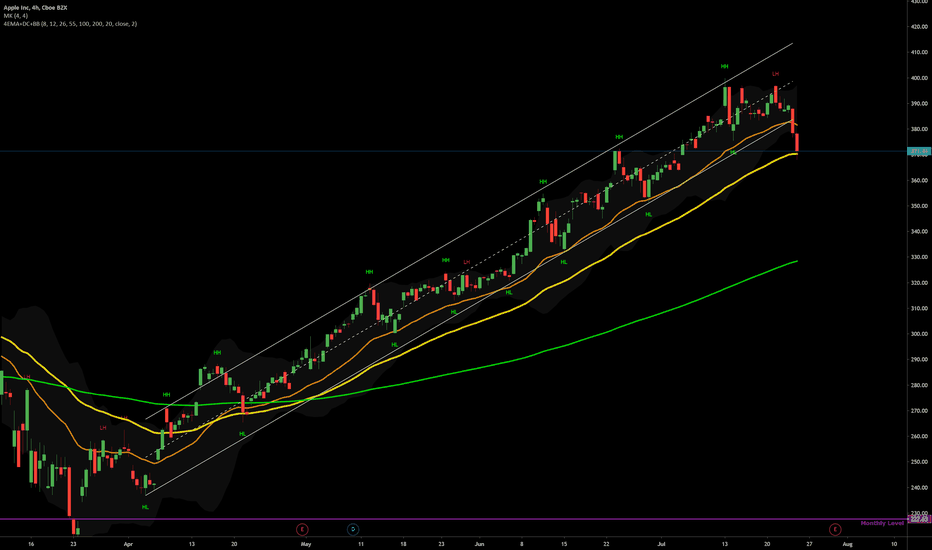

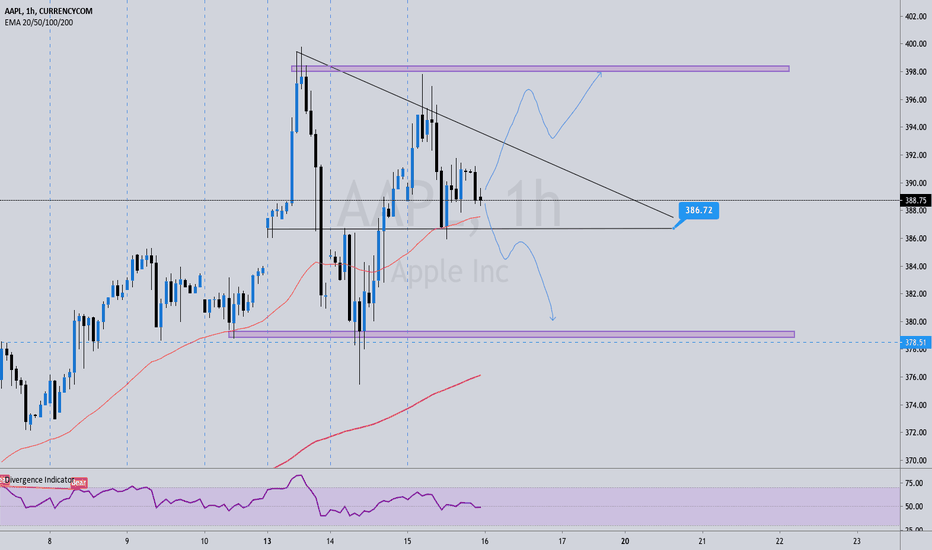

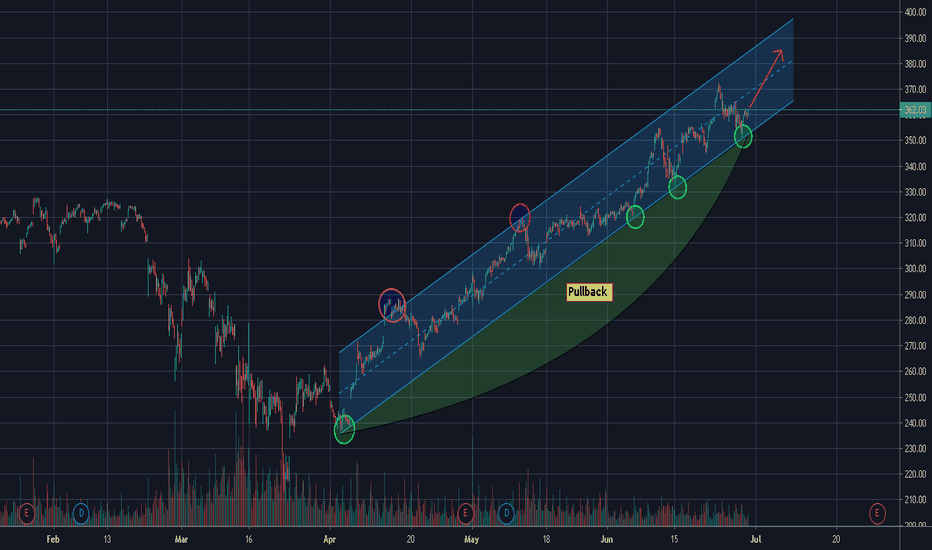

APPLE LONG AUG 14-21 ! BULLS WAKING UP?FA Event: Stock split, retail may jump in on a pump initiated by institutions. Not an easy trade by any means, we do have momentum on our side but $408 is the end of what could be an AB=CD pattern shown on the chart. Expecting a pull back to get in on a scalp trade.

Long apple. Note key levels on the chart. Following strict stop loss.

If we re-test 397.80 Level as shown on the chart, entering long calls for $420 Strike.

Stop loss below 386.50 Level as shown.

Please follow and your feedback on charts would be highly appreciated :)

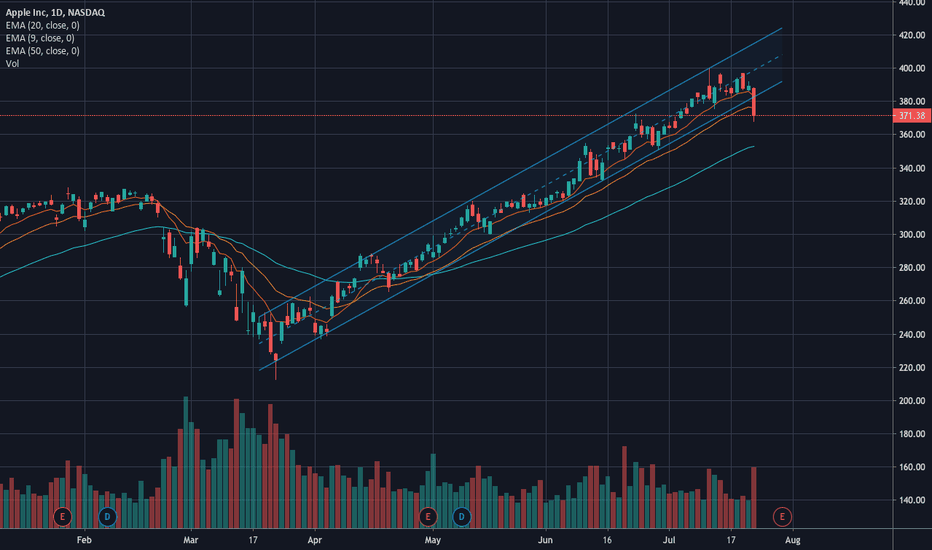

Apple Stock Giving Us Doji Power.We want to focus on apples stock now as the 3 day is showing signs of a doji candle, ema dots shift red and the rsi shifts for a Crossover in overbought territory.

July 29th we get a close to see how valid this formation will setup. We want to see the candle close and begin to shift red also to align all indications. Hold your horses, let it play.

I have this one on my radar.

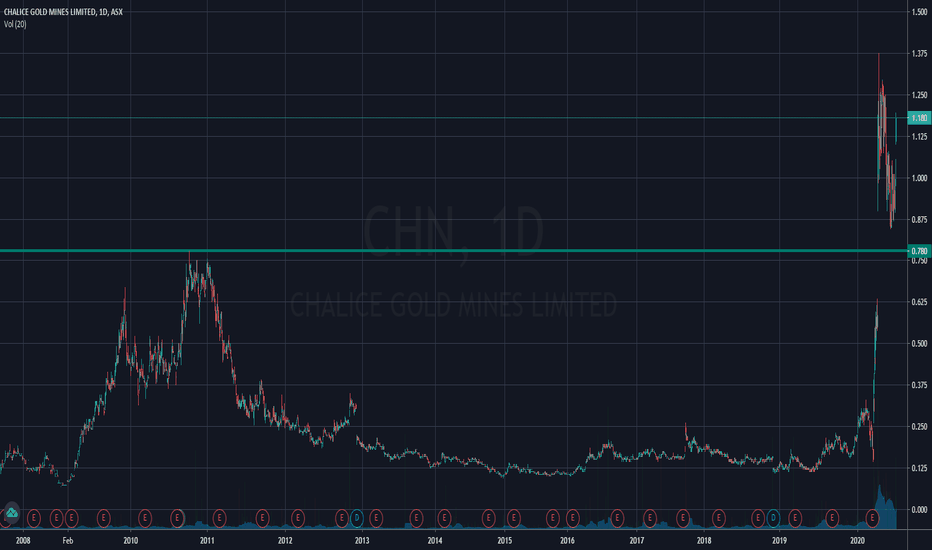

Chalice Golde Mines Major Breakout $CHNChalice Golde Mines Major Breakout of 10 year base. The bigger the base the higher in space. Three district scale exploration properties in the best and most prolific areas in Australia. Tier one assets. Exploring near some of the most profitable mines in the world including the Fosterville Gold Mine owned by Kirkland Lake Gold (NYSE / TSX: KL | ASX: KLA) and 22Moz @ 15g/t Au Bendigo Goldfield.

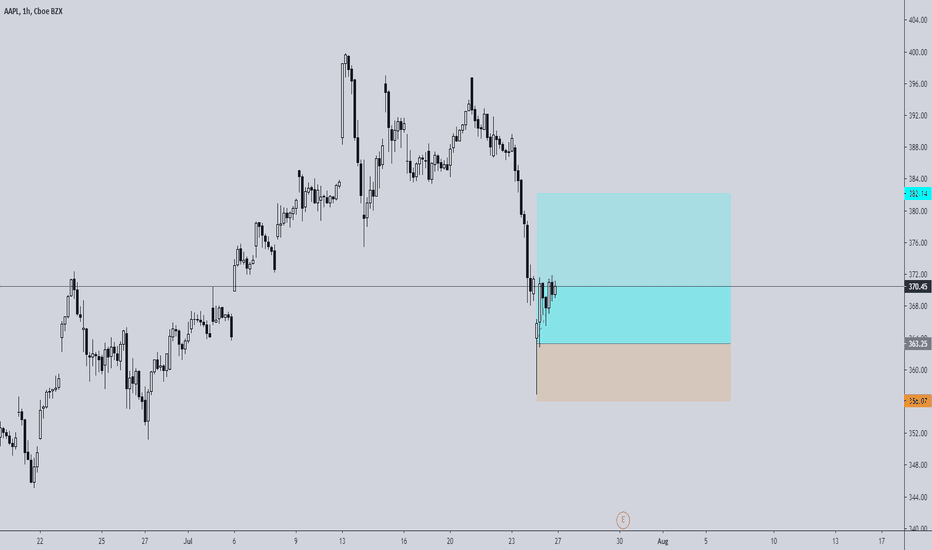

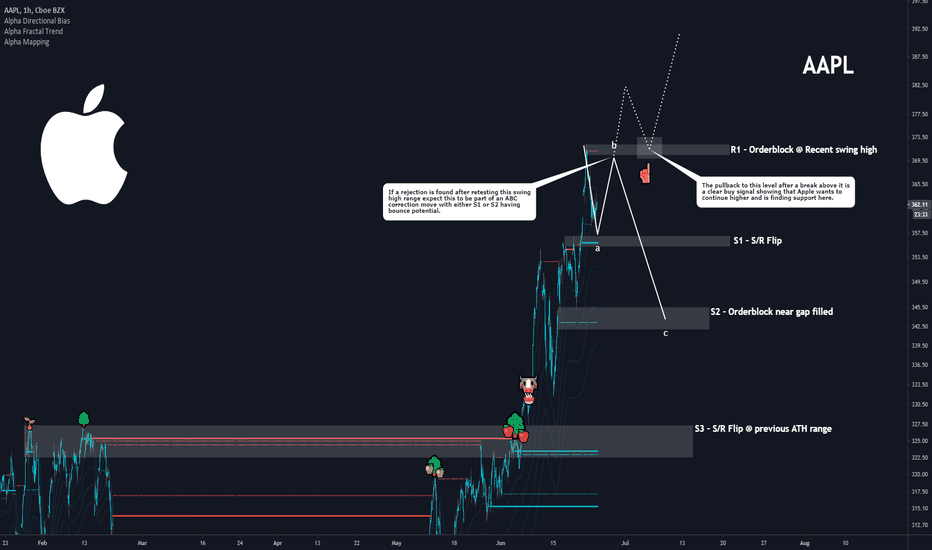

Can APPL Confirm the Bullish Trend? Today we will do a full technical analysis on APPLE INC on the 1H and explain why I recommend bullish (long) trade advice, and also discuss the bearish scenario.

As we can see the upper resistance of this ascending channel is definitely weaker than the support line.

With break-out , the resistance didn't hold well. Also we can see a break-out got rejected, but we have to keep this behavior in mind so you don't get stopped out when you want to enter a short.

This lower support line of the ascending channel is very strong and it has at least 4 confirmed touches.

Now that the price is at the close to the middle line of the channel, so we can see two scenarios play out. Either it breaks upwards and we can enter a long towards the upper resistance of the channel, or it breaks downwards and we can short until the lower strong support line.In general, because APPLE is trending upwards recently.

I would advice to have a bullish bias here and suggest the most likely scenario of a bullish continuation

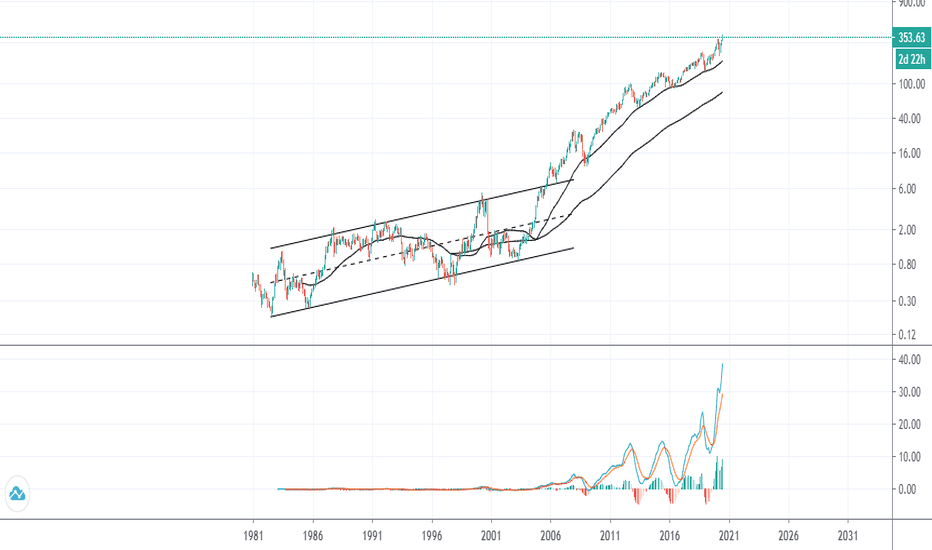

Apple Inc. Ticker: $AAPL Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. It also sells various related services. The company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, HomePod, iPod touch, and other Apple-branded and third-party accessories. It also provides digital content stores and streaming services; AppleCare support services; and iCloud, a cloud service, which stores music, photos, contacts, calendars, mail, documents, and others.

Name: Apple Inc.

Ticker: AAPL

Exchange: NasdaqGS (Nasdaq Global Select)

Founded: 1977

Sector: Technology

Industry: Technology Hardware, Storage and Peripherals

Market Cap: US$1.533t

Shares outstanding: 4.33b

Website: Apple.com

Number of Employees: 137k (Sep 27, 2019)

Location: One Apple Park Way, Cupertino, California 95014, United States

Apple is the company with the most market capitalization at the moment.

The 20 companies with the largest market capitalization (Billions) as of today are:

AAPL: 1581.34

MSFT: 1519.27

AMZN: 1373.93

GOOGL: 983.79

FB: 671.48

BABA: 595.99

BRK.B: 426.15

V: 412.99

JNJ: 367.97

WMT: 339.01

MA: 299.13

JPM: 298.49

PG: 291.85

UNH: 280.93

TSM: 278.65

HD: 263.91

INTC: 247.73

NVDA: 233.45

Shareholders Returns:

1 Year: AAPL: 88.8% Industry: 72.1% Market: 5.6%

3 Year: AAPL: 156.2% Industry: 135.7% Market: 33.5%

5 Year: AAPL: 203.5% Industry: 182.1% Market: 61.7%

Price to Earnings (PE) Ratio: 27.56x

Share Price vs. Fair Value: Current Price: US$353.63 Fair Value: US$265.36

33.3% Overvalued

Future Growth:

How is Apple forecast to perform in the next 1 to 3 years based on estimates from 36 analysts?

7.8% Forecasted annual earnings growth

Future Return on Equity: Future ROE: AAPL's Return on Equity is forecast to be very high in 3 years time (175.9%).

Past Performance:

How has Apple performed over the past 5 years?

3.8%Historical annual earnings growth

Quality Earnings: AAPL has high quality earnings.

Financial Health:

Short Term Liabilities: AAPL's short term assets ($143.8B) exceed its short term liabilities ($96.1B).

Long Term Liabilities: AAPL's short term assets ($143.8B) do not cover its long term liabilities ($145.9B).

Debt to Equity History and Analysis:

Debt Level: AAPL's debt to equity ratio (139.6%) is considered high.

Reducing Debt: AAPL's debt to equity ratio has increased from 34.6% to 139.6% over the past 5 years.

Debt Coverage: AAPL's debt is well covered by operating cash flow (68.8%).

Interest Coverage: AAPL earns more interest than it pays, so coverage of interest payments is not a concern.

Dividend:

What is Apple current dividend yield, its reliability and sustainability?

0.93% Current Dividend Yield.

Management:

How experienced are the management team and are they aligned to shareholders interests?

3.7yrs Average management tenure

CEO: Tim Cook (58yo) 8.83yrs Tenure US$11,555,466 Compensation.

Mr. Timothy D. Cook, also known as Tim, has been the Chief Executive Officer of Apple Inc. since August 24, 2011. Mr. Cook served as the Chief Operating Officer of Apple Inc., from October 14, 2005 to August 24, 2011. He was responsible for all of Apple's worldwide sales and operations, including end-to-end management of Apple’s supply chain, sales activities and service and support in all markets and countries. He also Headed Apple’s Macintosh division and played a key role in the continued development of strategic reseller and supplier relationships, ensuring flexibility in response to an increasingly demanding marketplace.

Compensation vs Market: Tim's total compensation ($USD11.56M) is about average for companies of similar size in the US market ($USD11.56M).

Compensation vs Earnings: Tim's compensation has been consistent with company performance over the past year.

Leadership Team:

Name: Timothy Cook Position: CEO & Director Tenure: 8.83yrs Compensation: US$11.56m Ownership: 0.020% $299.8m

Name: Luca Maestri Position: CFO & Senior VP Tenure: 6.08yrs Compensation: US$25.21m Ownership: 0.00064% $9.8m

Name: Jeffrey Williams Position: Chief Operating Officer Tenure: 4.5yrs Compensation: US$25.21m Ownership: 0.0028% $43.2m

Name: Katherine Adams Position: Senior VP Tenure: 2.5yrs Compensation: US$25.23m Ownership: 0.00052% $8.0m

Experienced Management: AAPL's management team is considered experienced (3.7 years average tenure).

Experienced Board: AAPL's board of directors are considered experienced (8.8 years average tenure).

Insider Buying: AAPL insiders have only sold shares in the past 3 months.

Dilution of Shares: Shareholders have not been meaningfully diluted in the past year.

Recent Insider Transactions:

Date: May 12,2020 Sell US$1,372,539 Chris Kondo 4491Shares Max Price: US$305.62

Top Shareholders:

Top 25 shareholders own 41.99% of the company.

Name: The Vanguard Group, Inc. Ownership: 7.77% Shares: 336,728,608 Current Value: $119.1b Change %: 2.25% Portfolio %: 3.46%

Name: BlackRock, Inc. Ownership: 6.34% Shares: 274,684,501 Current Value: $97.1b Change %: -1.11% Portfolio %: 2.96%

Name: Berkshire Hathaway Inc. Ownership: 5.66% Shares: 245,155,566 Current Value: $86.7b Change %: -2.28% Portfolio %: 32.69%

Name: State Street Global Ownership: 4.17% Shares: 180,558,954 Current Value: $63.9b Change %: -1.26% Portfolio %: 4.4%

Name: Kms Financial Services Ownership: 2.65% Shares: 114,827,553 Current Value: $40.6b Change %: 14855.28% Portfolio %: 24.07%

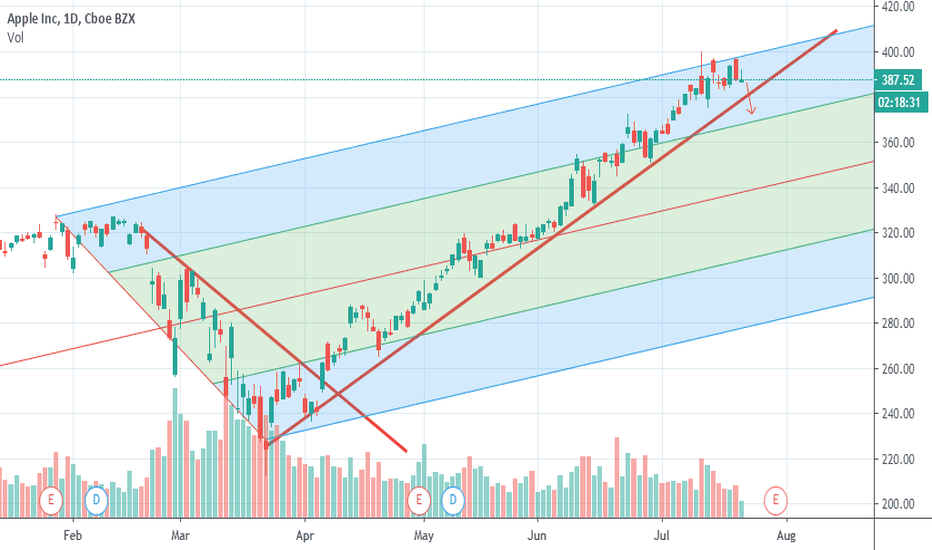

APPLE 🟩🟨🟥 True Facts About Justin Bieber's Love of Apple💬Apple closed some stores for COVID related reasons in some states, but it also opened stores due to re-openings in other states. That is sort of mixed news for Apple.

Meanwhile, the fear in the market over a bearish IMF report and some rising COVID cases is legitimate.

Overall, however, there is logic and reason to bet on Apple.

Apple just made a string of bullish announcements at their recent digital-only keynote and Apple's chart is generally very bullish and tends to respect support/resistance levels.

Let's take a look at some Apple levels that the bulls will need to deal with to keep this tech giant's bull run going.

Hit that 👍 button to show support for the content!

Help the community grow by giving us a follow 🐣

-----

Support:

S1: The S1 S/R flip and pivot point is a logical place for the bulls to find support if they should need it.

S2: The S2 orderblock is good backup support for the bulls. The market is a bit jittery right now, so it wouldn't be shocking to see a further correction and a reaction at S2.

S3: Finally, the S3 S/R flip and price pivot point at the previous all-time high (ATH) range should hold if a more substantial correction ends up being needed. Apple has every reason to keep running, but no asset is immune to the eventual correction after a big run.

Resistance:

R1: The R1 orderblock at the recent swing high and all-time high is the only identifiable level of resistance for Apple. As the only current level, it'll be important for the bulls to break this one and find support on top of it.

-----

Summary:

There are two likely paths for Apple.

One path we see the bulls quickly take out the all-time high and then find support on top of previous resistance.

The other path we see a continuation down, likely after a rejection of R1.

The path downward becomes more likely if the virus fears ramp up, as without fear it is hard to see why investors aren't rushing back into Apple.

Resources:

www.cnbc.com + www.cnn.com + www.npr.org

✨ Drop a comment asking for an update, we do NEW setups every day! ✨

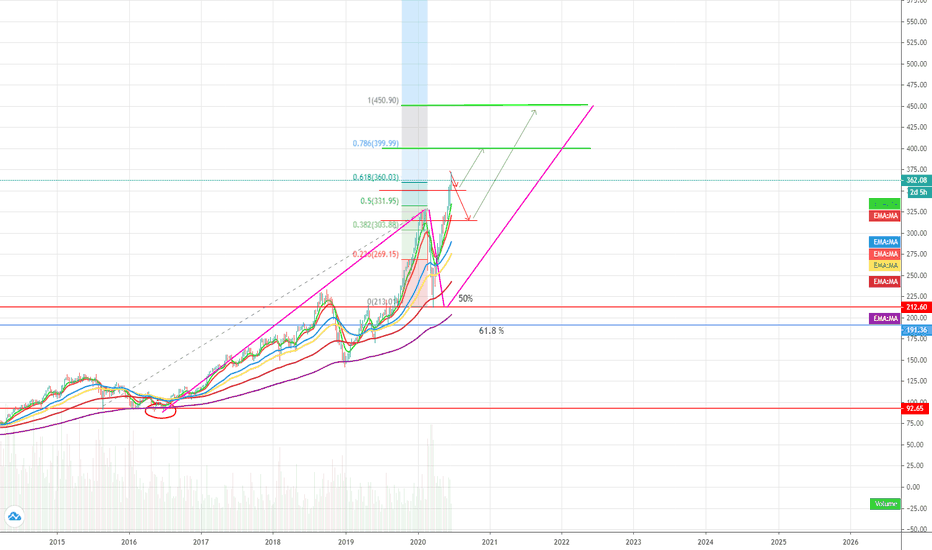

APPL potential short ($310-$350) ,then continuation $400-$450APPL looks to be setting up for a short. Entire market spills today, but we could see short and small correction down to $310-$350, however overall trend continues until $390-$450 (previous upward trend had a retrace down to 50% fibonacci line).