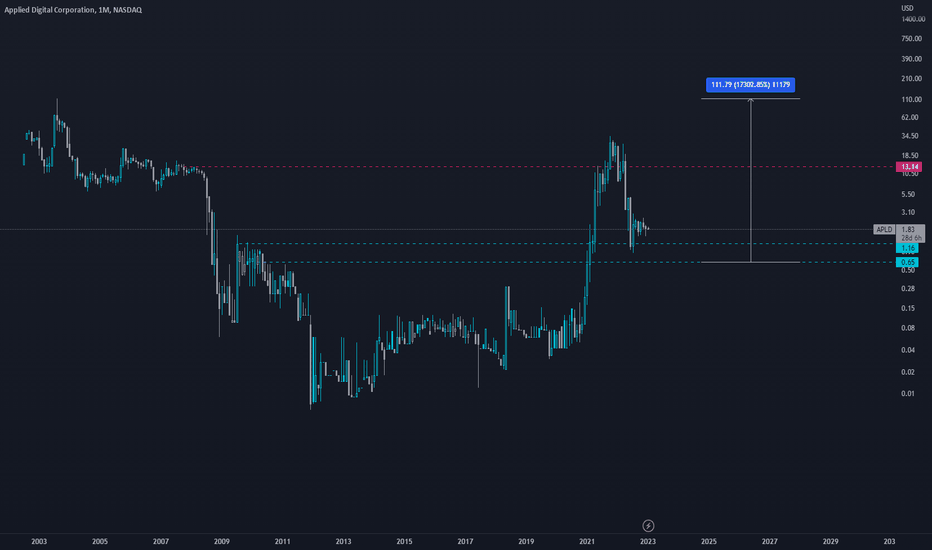

APLD (Applied Digital):EARNINGS TRADE SETUP (2025-07-30)

🚨 **EARNINGS TRADE SETUP: APLD (Applied Digital)**

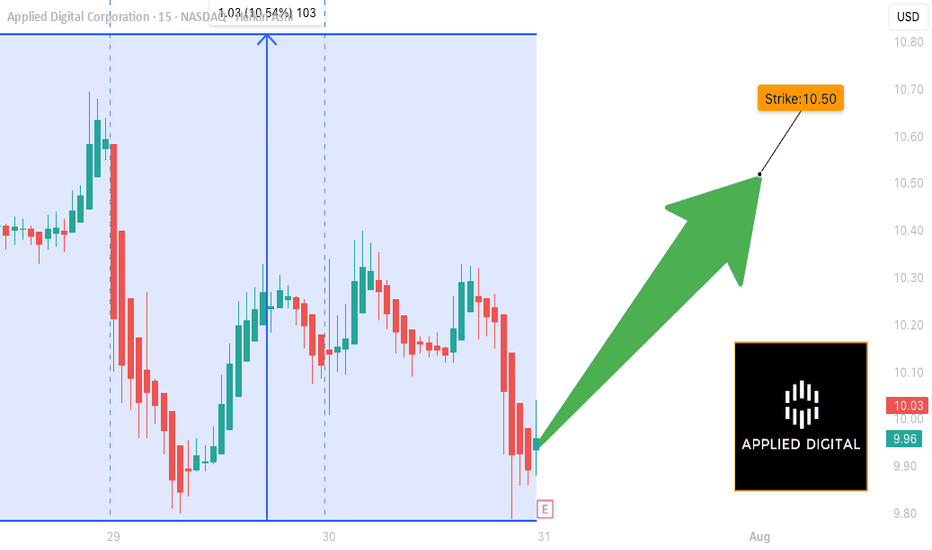

🗓️ Earnings: **July 31 (AMC)**

💥 Confidence: **65% Moderate Bullish**

🔥 Recent Run: **+94% past 3 months**

🧠 AI Infrastructure Hype + High IV = Opportunity

---

### 📊 FUNDAMENTALS SNAPSHOT

🟢 **Revenue Growth**: +22.1% YoY

🔴 **Profit Margin**: -110.4%

🔴 **Operating Margin**: -34.7%

⚠️ Historical EPS Beat Rate: **12% only**

📈 Analyst Target: **\$14.61** (+42.8% upside)

🔎 **Verdict**: High growth, deep losses — speculative with upside

---

### 🧠 OPTIONS FLOW

💣 **High IV Crush Risk**

🟥 **Put Wall**: \$10.00 (6,700 contracts)

🟩 **Speculative Calls**: \$10.50 & \$11.00 loaded

⚖️ Mixed Sentiment → Tilted Bullish

---

### 📉 TECHNICAL CHECK

💹 Price: **\$10.12**

📉 Below 20D MA (\$10.31)

📌 Support: **\$10.00**

📌 Resistance: **\$10.50**

⚠️ RSI Cooling → Watch for breakout or rejection

---

### 💥 TRADE IDEA

**🎯 Call Option — Strike \$10.50 — Exp 08/01**

💵 Entry: \$0.57

🚀 Profit Target: \$2.28 (200–400% ROI zone)

🛑 Stop Loss: \$0.285

📈 Size: 1 contract (2% of portfolio)

🕓 Exit: 1–2 hours post earnings to avoid IV crush

---

### 🧠 TRADE LOGIC

Risky setup — but technicals + AI narrative + speculative flow = **earnings lotto ticket with strategy.**

💬 *"Speculation with structure beats blind YOLO."*

---

📌 Tag a trader who likes calculated risk 📈

📉 Don’t forget to scale OUT, not just IN.

\#APLD #EarningsPlay #OptionsTrading #TradingView #AIStocks #YOLOWithStops #IVCrushProof #CallOptions #SwingTrade #BullishSetup

Applieddigital

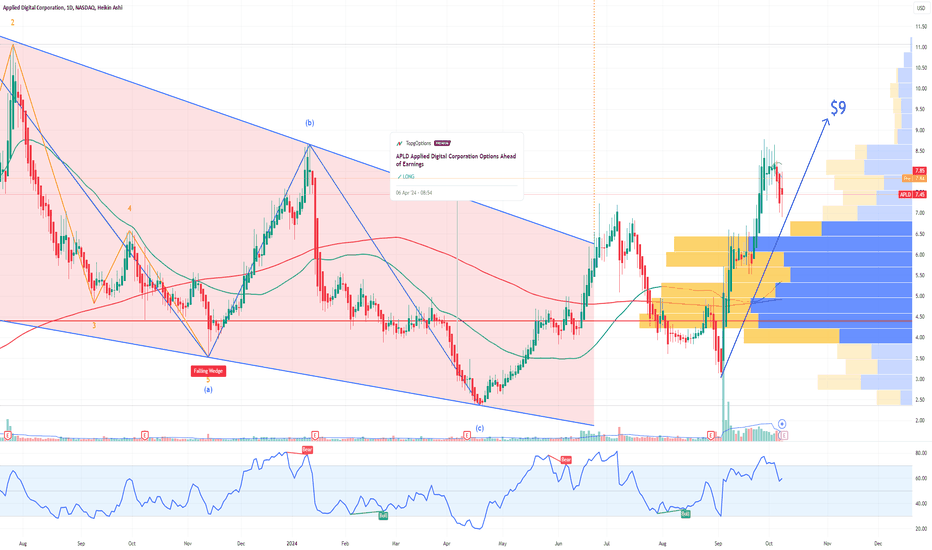

APLD Applied Digital Corporation Options Ahead of EarningsIf you haven`t bought the dip on APLD:

Now analyzing the options chain and the chart patterns of APLD Applied Digital Corporation prior to the earnings report this week,

I would consider purchasing the 9usd strike price Calls with

an expiration date of 2024-11-15,

for a premium of approximately $1.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

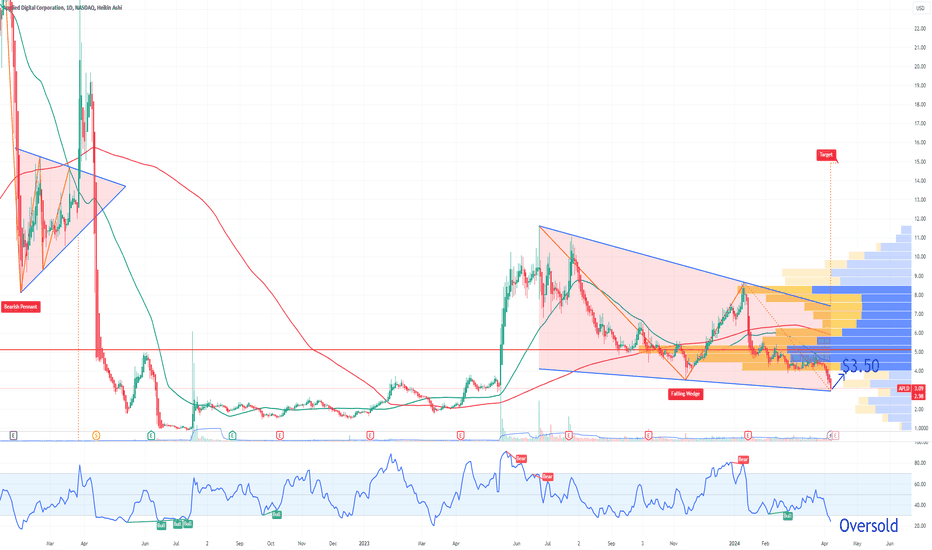

APLD Applied Digital Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of APLD Applied Digital Corporation prior to the earnings report this week,

I would consider purchasing the 3.50usd strike price Calls with

an expiration date of 2024-4-19,

for a premium of approximately $0.12.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

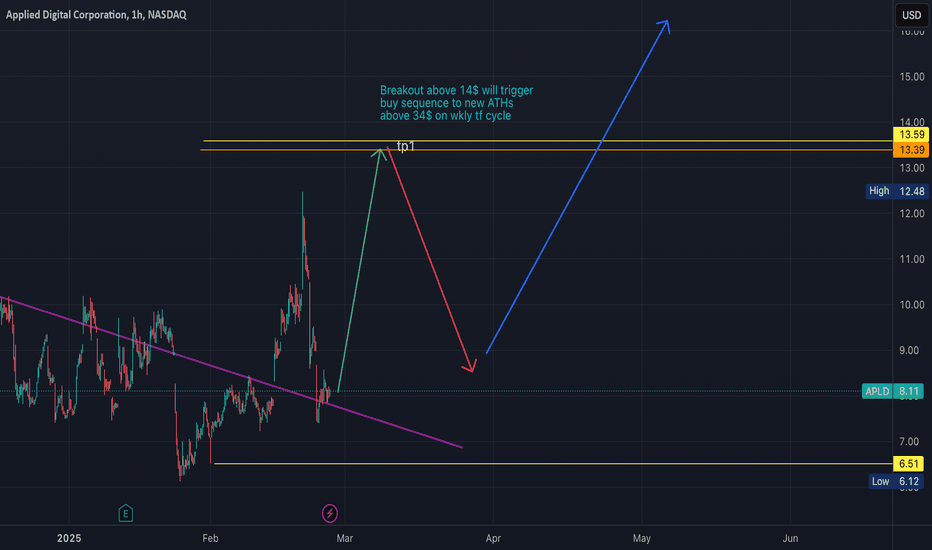

APLD looking okaynot the worst scenes here on the blockchain space. all of these stocks seem to follow the market as a whole, with the push towards cbdc these stocks could really take off again in the future. would keep your head up and be careful since theres significant risk however the upside is huge.