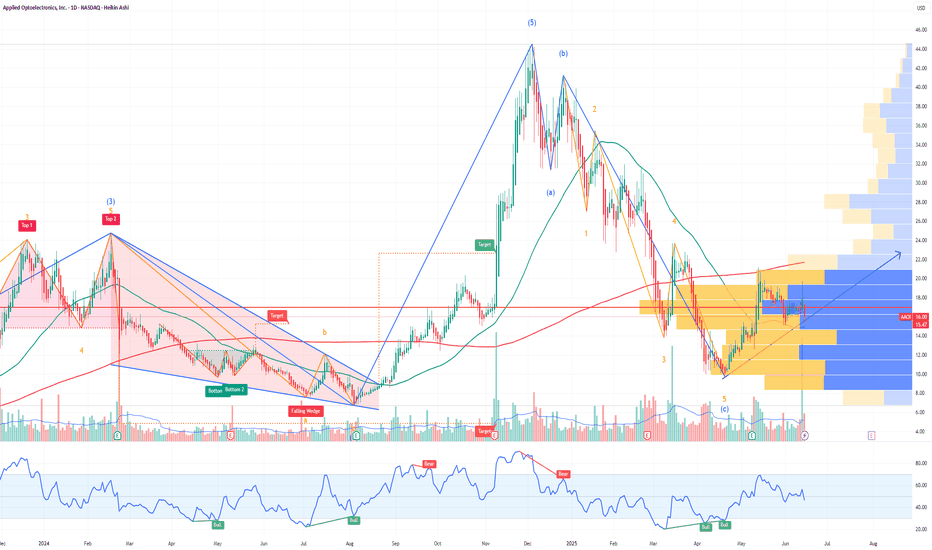

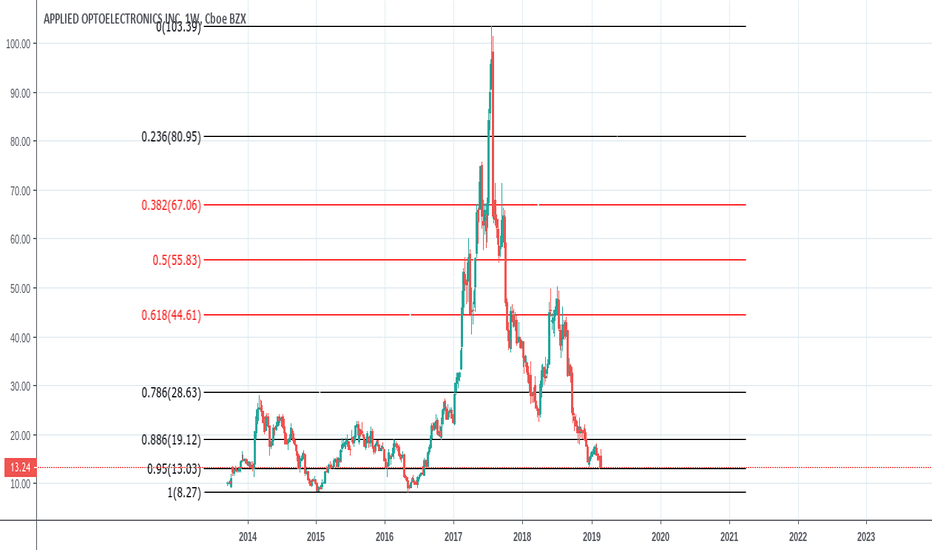

AAOI Applied Optoelectronics potential rally by EOYApplied Optoelectronics AAOI is well-positioned for a strong rally toward $24 per share by the end of 2025, supported by multiple operational and strategic catalysts. A key recent development—the warrant agreement with Amazon—adds a powerful endorsement and financial backing that enhances the bullish case.

1. Amazon’s Strategic Warrant Agreement: A Major Vote of Confidence

On March 13, 2025, AAOI issued a warrant to Amazon.com NV Investment Holdings LLC, granting Amazon the right to purchase up to approximately 7.95 million shares at an exercise price of $23.70 per share.

About 1.3 million shares vested immediately, with the remainder vesting based on Amazon’s discretionary purchases, potentially up to $4 billion in total purchases over time.

This agreement signals Amazon’s strong confidence in AAOI’s technology and its critical role as a supplier of high-speed optical transceivers for Amazon Web Services and AI data center infrastructure.

The warrant price near $24 effectively sets a floor and a valuation benchmark, supporting the thesis that AAOI’s stock could reach or exceed this level by year-end.

2. Major Data Center Wins and Hyperscale Customer Re-Engagement

AAOI recently resumed shipments to a major hyperscale customer, with volume shipments of high-speed data center transceivers expected to ramp significantly in the second half of 2025.

This re-engagement with a key customer aligns with the surging demand for AI-driven data center infrastructure, providing a strong revenue growth catalyst.

3. Robust Revenue Growth and Margin Expansion

Q1 2025 revenue doubled year-over-year to nearly $100 million, with gross margins expanding to over 30%, reflecting operational efficiencies and favorable product mix.

The company expects to sustain strong quarterly revenue ($100–$110 million) and ramp production capacity to over 100,000 units of 800G transceivers per month by year-end, with 40% manufactured in the U.S.

4. Manufacturing Expansion and Supply Chain Resilience

AAOI is scaling manufacturing in the U.S. and Taiwan, enhancing supply chain robustness and positioning itself to benefit from potential government incentives for domestic production.

Its automated, largely in-house manufacturing capabilities provide a competitive edge in meeting hyperscale and AI data center demand.

In conclusion:

Amazon’s warrant agreement at a $23.70 strike price not only provides a direct valuation anchor near $24 but also serves as a powerful strategic endorsement of AAOI’s technology and growth prospects. Combined with robust revenue growth, expanding manufacturing capacity, and key customer re-engagement, AAOI has a compelling case to reach or exceed $24 per share by the end of 2025.

Appliedoptoelectronics

Applied Optoelectronics (AAOI) AnalysisCompany Overview:

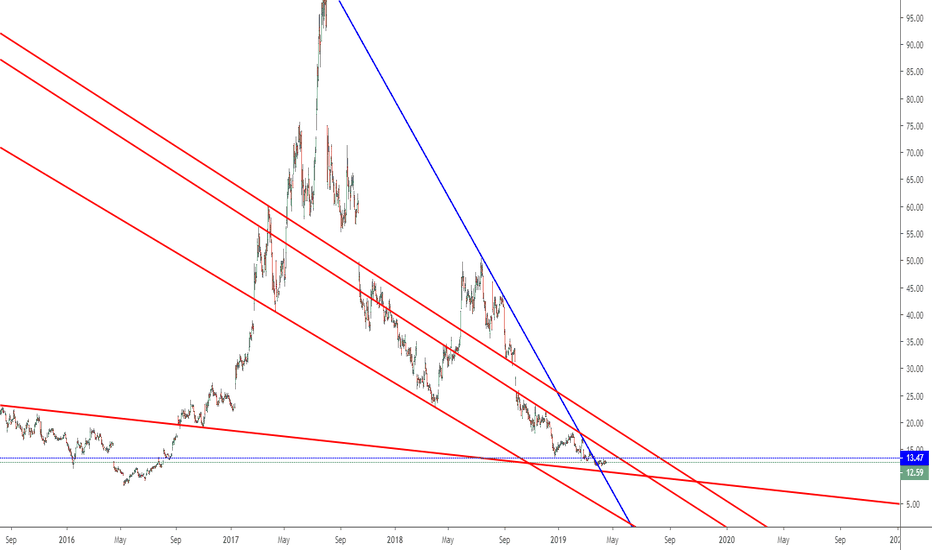

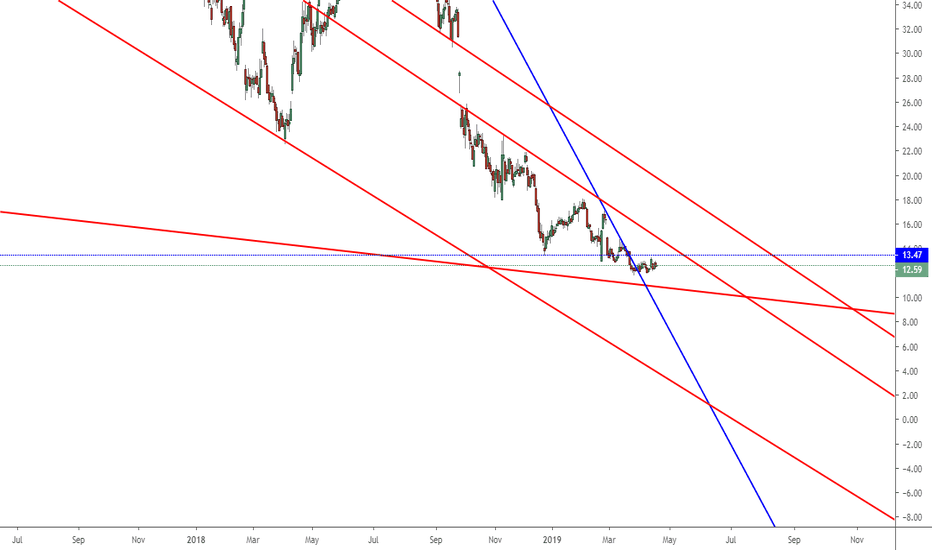

Applied Optoelectronics NASDAQ:AAOI specializes in optical network solutions, serving data center, telecom, and broadband markets. With a focus on high-speed fiber optics, AAOI is at the forefront of next-generation communication technologies.

Key Growth Drivers

Innovative Fiber Designs:

Partnership with Credo Technology:

Joint development of 400G and 800G fiber optic solutions addresses rising demand for high-speed, low-latency networks in data centers.

These innovations lower power consumption and costs, strengthening AAOI's competitive edge.

Positioned to capitalize on the ongoing shift toward 800G architectures as hyperscalers scale their infrastructure.

Strategic Index Inclusion:

Russell 3000 Index Membership:

Elevates AAOI’s profile among institutional investors, potentially increasing liquidity and long-term stock valuation.

Patent Lawsuit Potential:

Ongoing litigation against Accelight Technologies could result in financial gains or licensing agreements, adding a non-operational upside to AAOI’s valuation.

Market Positioning and Tailwinds

Expanding Demand for Fiber Optics:

Rapid adoption of cloud computing, 5G, and AI drives demand for higher bandwidth and lower latency.

AAOI’s ability to deliver cost-effective and energy-efficient solutions positions it well in this competitive market.

Diversified Customer Base:

Serving key markets—data centers, telecom, and broadband—provides revenue diversification and reduces dependence on a single vertical.

Operational Strength:

Continued R&D investments ensure a pipeline of innovative products, maintaining AAOI’s technological leadership in optical components.

Financial and Stock Outlook

Bullish Momentum Above $28.50-$29.00:

With its innovative product line and strategic advancements, AAOI is well-positioned for growth.

Upside Target: $60.00-$65.00, reflecting optimism about its market share expansion and potential litigation gains.

Investor Appeal:

Strategic partnerships, inclusion in the Russell 3000, and innovation-focused operations make AAOI attractive to growth-focused investors.

Increased institutional interest could serve as a catalyst for sustained stock performance.

Conclusion

Applied Optoelectronics is strategically positioned to benefit from the increasing demand for high-speed optical networks. Its focus on cost and energy-efficient fiber solutions, coupled with institutional tailwinds, underscores its growth potential.

📈 Recommendation: Bullish on AAOI above $28.50-$29.00, targeting $60.00-$65.00.