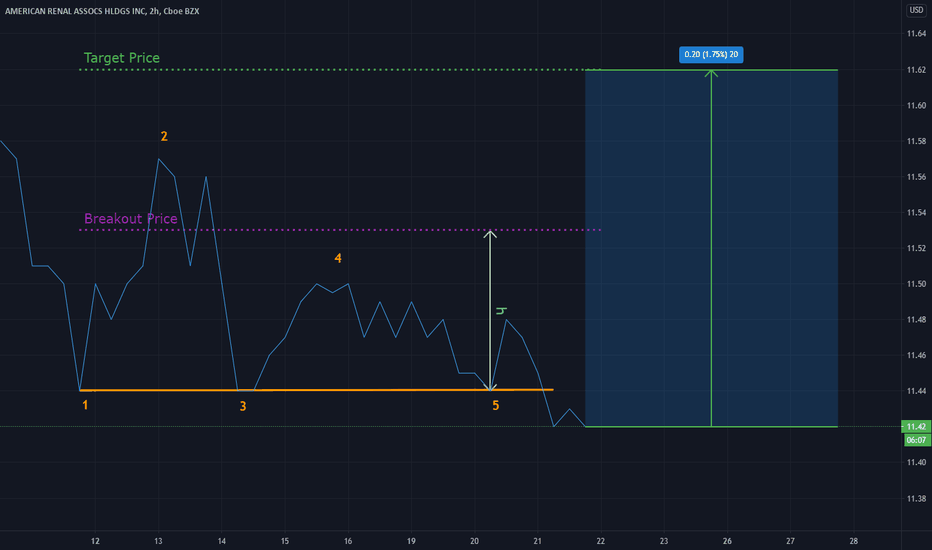

ARA, Triple Bottoms (bullish)I found this pattern at tickeron website with the following data:

STATUS = Confirmed

CURRENT CONFIDENCE = 90%

TARGET (EXIT) PRICE = 11.62 USD

BREAKOUT (ENTRY) PRICE = 11.53 USD

DISTANCE TO TARGET PRICE = 1.74%

EMERGED ON = Oct 19, 12:00 PM (EDT)

CONFIRMED ON = Oct 20, 12:00 PM (EDT)

WITH CONFIDENCE LEVEL = 98%

The Triple Bottom pattern appears when there are three distinct low points (1, 3, 5) that represent a consistent support level. The security tests the support level over time but eventually breaks resistance and makes a strong move to the upside.

This type of formation happens when sellers can not break the support price, and market participants eventually pour in.

Trade idea

Once the price breaks out from the top pattern boundary, day traders and swing traders should trade with an UP trend. Consider buying a security or a call option at the breakout price level. To identify an exit, compute the target price by adding the pattern’s height (highest price minus the bottom price support level) to the breakout level the highest high. When trading, wait for the confirmation move, which is when the price rises above the breakout level.

To limit potential loss when price suddenly goes in the wrong direction, consider placing a stop order to sell at or below the breakout price.