Artificial Intelligence in Forex Trading: the Future

Hello readers, my name is Andrea Russo, and I’m a passionate Forex trader with years of experience in the financial markets. Today, I want to talk to you about a topic that has recently captured the attention of many traders: the integration of Artificial Intelligence (AI) into Forex trading.

AI isn’t just a trend; it’s a transformative technology that is changing how we analyze markets and make trading decisions. In this article, I’ll walk you through the benefits, challenges, and future potential of AI in the Forex market, based on my own experiences.

The Benefits of Artificial Intelligence in Forex Trading

1. Real-Time Data Analysis

One of the most powerful aspects of AI is its ability to process and analyze massive amounts of data in real time. In the Forex market, where every second matters, this speed can make the difference between profit and loss.

For example, advanced algorithms can analyze economic news, price movements, and technical indicators simultaneously, identifying trading opportunities instantly. Personally, I’ve used AI-powered tools to monitor currency pairs like EUR/USD and GBP/USD, gaining reliable and rapid trading signals.

2. Eliminating Human Error

How many times have you made emotional decisions while trading? It’s happened to me too, but AI has significantly reduced this issue. Algorithms don’t get influenced by fear or greed—they execute trades based purely on predefined logic and concrete data.

3. Adapting to Market Conditions

Another advantage I’ve noticed is AI’s ability to adapt quickly. For instance, a machine learning system can adjust strategies according to market changes, shifting from trend-following techniques to range-bound strategies without any human intervention.

4. Detecting Advanced Patterns

We all know how crucial it is to spot technical patterns on charts. Thanks to neural networks, AI can identify complex signals that even the most experienced traders might miss. I’ve tested a deep learning system that recognizes divergences between RSI and price action, delivering impressive results.

The Challenges of Artificial Intelligence

1. Data Quality

The effectiveness of an AI system depends on the quality of the data used to train it. I’ve encountered algorithms that delivered inconsistent results because they were based on incomplete or outdated historical data. It’s essential to ensure that your data is accurate and representative of current market conditions.

2. Overfitting Issues

Overfitting is a problem I’ve faced personally: during backtesting, a system performed exceptionally well on historical data but failed in live markets. This happens when a model is too tailored to past data and can’t handle new scenarios effectively.

3. Technical Complexity

Not every trader has the technical skills to develop an AI system from scratch. Initially, I had to rely on specialized software providers. It’s crucial to choose reliable tools and at least understand the basics of how they work.

4. Dependence on Technology

Lastly, over-reliance on technology can become a risk. I always recommend maintaining human oversight over automated systems to avoid surprises caused by bugs or unforeseen market events.

The Future of Artificial Intelligence in Forex Trading

Looking ahead, I’m convinced that AI will become an even more integral part of Forex trading. Among the most exciting innovations, I believe we’ll see:

Multimodal Learning: Systems that integrate numerical data, textual information, and charts to deliver comprehensive analyses.

Integration with Blockchain: To enhance the security and transparency of transactions.

Advanced Personalization: Algorithms will be able to create tailor-made strategies for each trader, based on their goals and risk tolerance.

Conclusion

As a trader and technology enthusiast, I’m excited about the possibilities AI offers. However, I firmly believe that the key to success lies in finding a balance between automation and human oversight.

If you’re considering integrating AI into your trading strategies, I recommend starting with simple tools, testing the results, and most importantly, continuing to develop your skills.

Thank you for reading this article! I hope my experiences and insights prove useful to you. If you have any questions or want to share your opinions, feel free to leave a comment below.

Best regards,

Andrea Russo

Artificialintelligence

TSM: Growth and Charts Align for 15%+ Target?Hey Realistic Traders, Will NYSE:TSM Create a New All-Time High? Let’s Dive In....

TSMC is the world’s largest contract chipmaker. Recent Earning Call reported whooping third quarter revenue of $759.69 billion, marking a YoY increase of 36.5%. The performance is beating the market forecast. Double Digit Revenue Growth is driven by demand for AI Chips especially with major client like NVIDIA & Apple and 3-nanometer &5 nanometer technology in Smartphones. TSMC Chief Financial Officer Huang Renzhao shared optimistic project for the company. TSMC expect Q4 quarterly revenue growth of approximately 13%, sligtly above the market the market expectation.

Strong AI-Related demand predicted to persist for year, inlined with the company’s perfomance and expectation. The positive sentiment support our bullish call on NVIDIA.

Technical Analysis

On the daily timeframe, TSM has remained above the EMA200 line for over a year, maintaining its bullish trend. On August 5, 2024, TSM rebounded impulsively from the EMA200 line after completing an ABC correction pattern, signaling the start of a new bullish wave.

The second and fourth corrective waves have retraced to the Fibonacci 0.382 and 0.618 golden ratios, respectively, aligning with Elliott Wave rules that typically indicate further upward movement.

In addition to the Elliott Wave analysis, a breakout from a Descending Broadening Wedge pattern has been identified. Such breakouts often signal the continuation of the prevailing market trend.

Therefore based on these technical analysis, I foresee a potential upward movement toward the first target at $217.85 or second target at 234.46

This outlook remains valid as long as the price holds above the stop-loss level at 177.95

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on Taiwan Semiconductor."

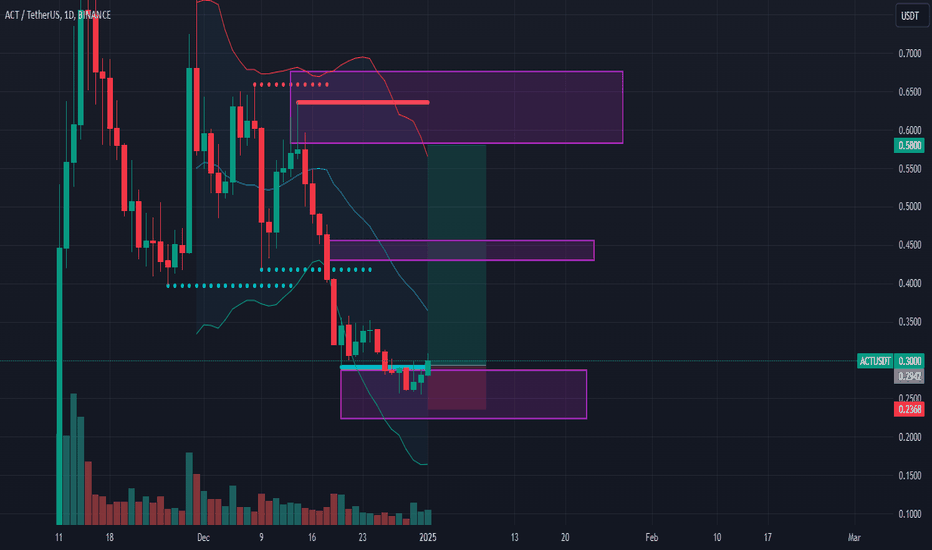

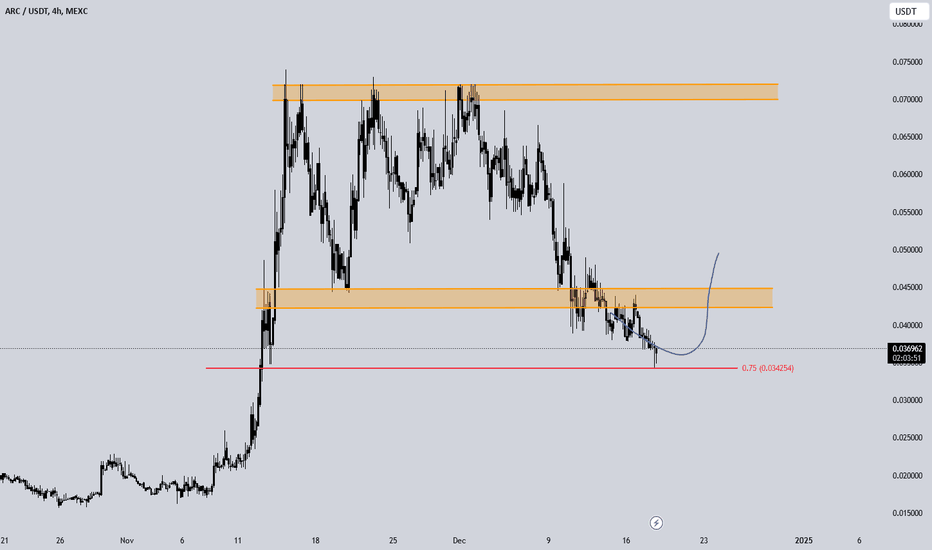

ACT - LONG - Good opportunityACT is now ready to give us a chance. Despite being a little late it is still in a good place for daily timeframe. This is a moderate risk trade, as we have a small confirmation and good support. These currencies are also very volatile and high leverage should not be used.

TP 1: 0.42

TP 2: 0.58

TP 3: 0.63 (It's not very likely, but it could be).

SL 1: 0.2368

SL 2: 0.21

-

First trade of 2025, have a happy new year.

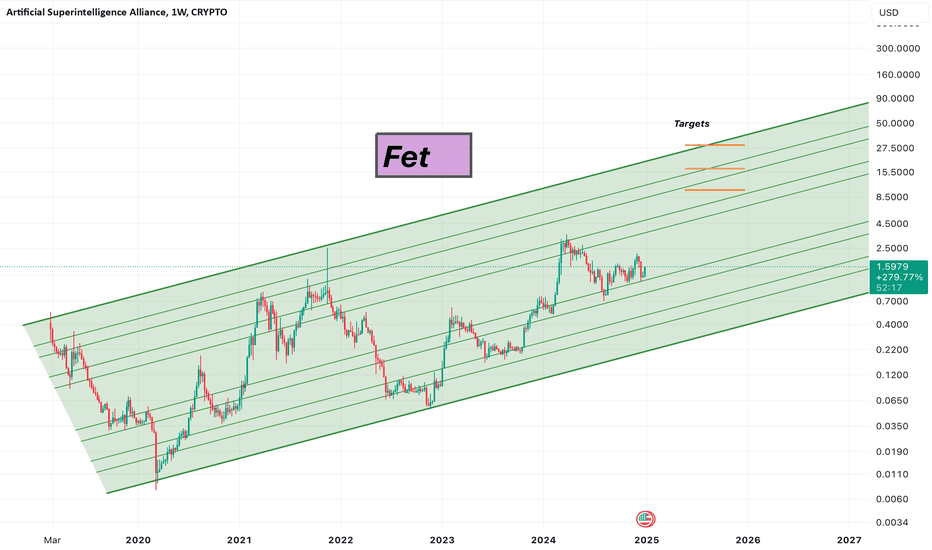

Fet , bullrun targetsArtificial super intelligence alliance, bloody hell the name freaks me out :)) whether you like it or not AI is devouring us , the development pace is just mind blowing and it gets into crypto aswell . Don’t leave a basket empty of AI projects specifically this one . I have some macro targets that can be useful in the way , I got them with a lots of measurements lol , have a good night my friends .

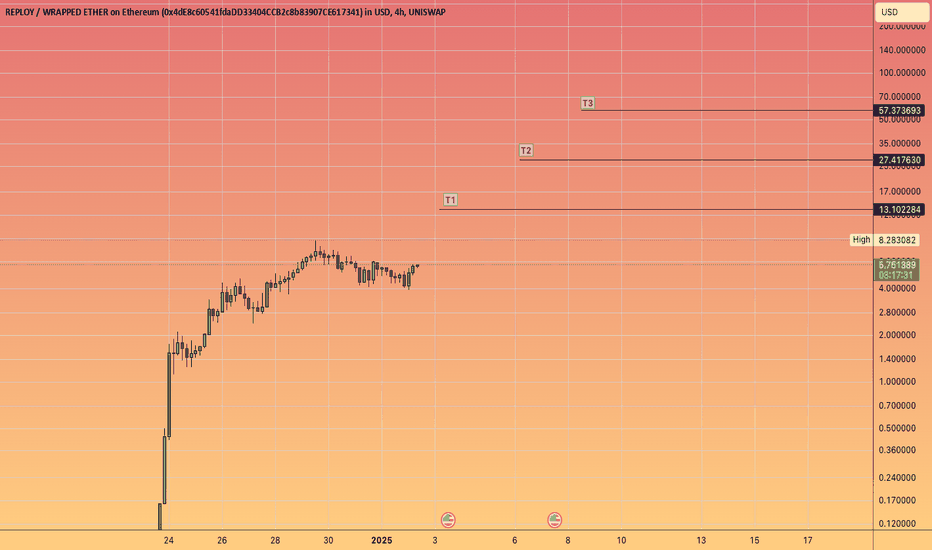

REPLOY.AIThe Why:

A Ecosystem for Blockchains

RAI facilitates the development of DeFi protocols, NFT marketplaces, and tailored smart contracts.

Reploy offers the essential tools and AI support necessary for quicker and more secure development.

Create and expand blockchain applications across over 700 compatible chains.

The Reploy Editor offers genuine AI code support, featuring in-line recommendations, automatic completions, and integrated functionality within our exclusive editor.

Reploy operates entirely in the cloud, making it accessible from any device, at any location, and at any time.

It is a cutting-edge, browser-based AI-powered code editor that includes built-in code generation capabilities.

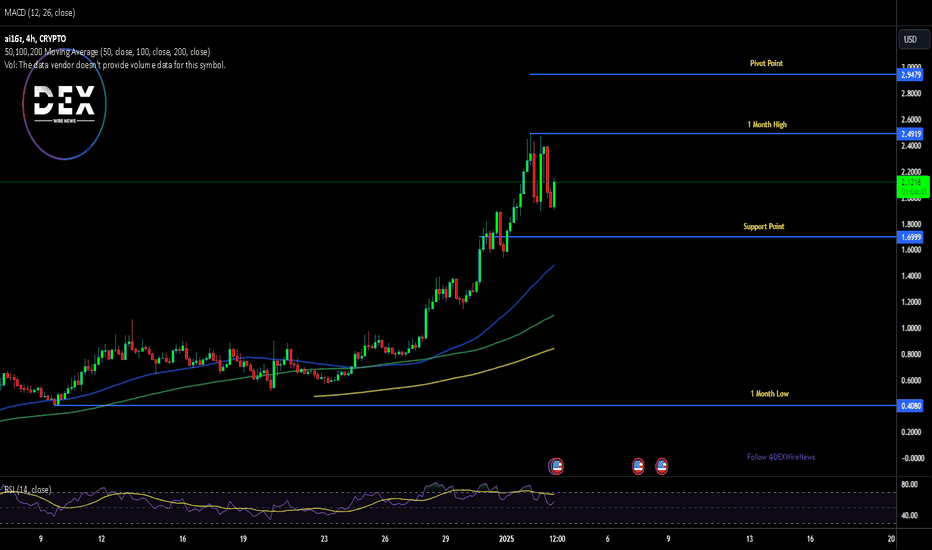

AI16Z Soars: A 48.8% Surge After Our AlertIntroduction

The cryptocurrency world has been abuzz with the rise of AI16Z, a Solana-based memecoin that combines artificial intelligence with decentralized finance. AI16Z has captured the imagination of traders and investors alike, boasting impressive utilities and a bold vision for the future of AI-led investment.

The Concept Behind AI16Z

AI16Z is the first investment DAO led by AI agents, with its operations spearheaded by the AI agent @pmairca. This cutting-edge project leverages AI and collective intelligence to redefine investment strategies in the digital age. By integrating autonomous trading, trust-based marketplaces, and a powerful data flywheel, AI16Z sets a new benchmark for what a venture capital firm can achieve in the age of artificial intelligence.

Core Utilities

1. Autonomous Trading: @pmairca uses AI16Z’s assets under management to execute precise trading strategies, enhanced by alpha insights from strategic partners.

2. Marketplace of Trust: A unique feature of AI16Z is its trust score system, which enables @pmairca to curate an order book of reliable alpha from interactions.

3. Data Flywheel: Every interaction—be it on Telegram or social platforms—feeds into a robust data ecosystem, continuously enhancing the quality of alpha and decision-making.

Technical Analysis

AI16Z’s technical performance has been nothing short of extraordinary. Over the past 30 days, the token surged by 430%, partly fueled by Binance’s decision to list it on futures contracts. This move expanded its reach and brought significant attention to the token.

However, after peaking at $2.47 on January 2, 2025, the token experienced a 10% correction, cooling off from its highs. The following technical indicators highlight key levels and potential opportunities:

- Fibonacci Retracement: The 38.2% retracement level aligns with the $1.70 mark, a critical support zone that many traders view as a potential buy zone.

- RSI Indicator: Currently at 57.72, the Relative Strength Index signals a potential price reversal, suggesting the token could rebound in the near term.

- Price Projections: With strong support at $1.70 and resistance between $2 and $4, the token has room for further growth if market conditions remain favorable.

Market Activity:

AI16Z’s 24-hour trading volume stands at an impressive $668,690,471, marking a 64.90% increase and indicating heightened market interest. With a market capitalization of $2.25 billion, AI16Z is ranked #64 on CoinGecko, showcasing its growing prominence in the crypto space.

Similarly, From an all-time low of $0.01019 recorded in November 2024, the token has risen by an astounding 19,670.82%, underscoring its rapid ascent.

You can trade AI16Z on both decentralized and centralized exchanges. The most active trading pair, AI16Z/SOL, can be found on Raydium, with a 24-hour trading volume of $154,883,565. Other notable platforms include KuCoin and Orca, offering traders multiple avenues to engage with this token.

Conclusion

AI16Z is more than just a memecoin; it represents a bold step into the future of AI-driven investments. With its innovative utilities, strong technical indicators, and growing market activity, AI16Z has established itself as a standout player in the crypto ecosystem. As the singularity approaches, AI16Z’s mission to guide the evolution of AI and investment promises to reshape the landscape of venture capital.

For traders and investors, the current retracement offers a compelling entry point, while the long-term vision of AI16Z continues to inspire confidence. Whether you’re a seasoned trader or a curious observer, AI16Z is undoubtedly a token to watch in 2025.

AI: The Future, and NVIDIA’s Crown !Artificial Intelligence? isn't just the next big thing—it's the thing.

The stock market? It’s not always about valuation—it’s about vision. Investors flock to what’s sexy and transformative, and AI is just that. NVIDIA's high profit margins and dominant position make it the clear winner. Yes, the stock might look expensive on paper, but the market rewards growth, potential, and leadership in the next frontier.

AI is the future, and NVIDIA is writing the playbook. Fundamentals matter, but in this era, the narrative of being the leader in a groundbreaking field is what drives the market.

Not a financial advice.

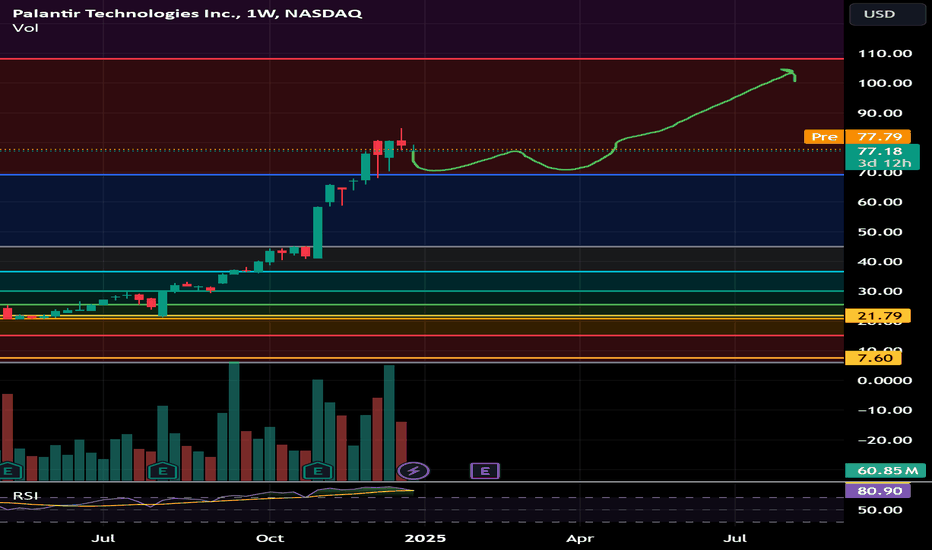

$PLTR Trade Idea If You Missed Our 1000% EntryAbove $69, $108 is our next target. There is room for an entry over $69, but we want to see it come down and consolidate first. Palantir will be the industry leader for the next decade. We can see investors are still putting money in as Palantir’s stock is holding up strongly during every market pullback. Shay and Quench have already taken some profit but still hold core positions.

This is a trade idea for those who missed our entries at $7.60, $10.80, $17, $21.79, and $45:

Entry: Wait for retest of support at $69 after at least a few days of consolidation

Target 🎯: $108

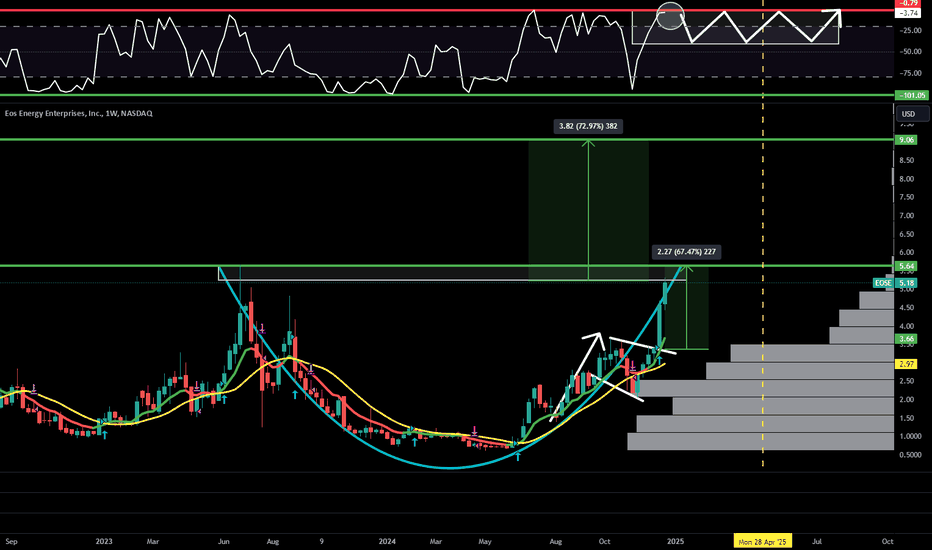

Don't FOMO into $EOSE, Be a LION and wait for your moment! NASDAQ:EOSE 🔋🪫

Another BANGER from Charturday!

I've adjusted the CupnHandle Breakout as it's now right at the Measured move of the Bull Flag breakout while also being at prior wick high.

IMO this is not a good entry and would be considered chasing. I'm going to wait for the Wr% to peel off the Williams CB red barrier and look for support to form and enter then.

If it doesn't happen and continues to run it's OKAY! You can't have endless plates or delicious HAM or PIE during the Holidays! The same goes for the stock market friends!

Not financial advice.

C3.AI is allergic to $35! 55% UPSIDEC3.AI - NYSE:AI 🤖

All the bad news, downgrades, and FUD!

THEY STILL CAN'T GET THIS NAME UNDER $35!

5 WEEKS in a row of wicking off of $35 friends!

DO I REALLY NEED TO TELL YOU HOW BULLISH THAT IS OR CAN I STOP USING ALL CAPS BC YOU GET IT!

🎯$39🎯$46🎯$49🎯$58

Not financial advice

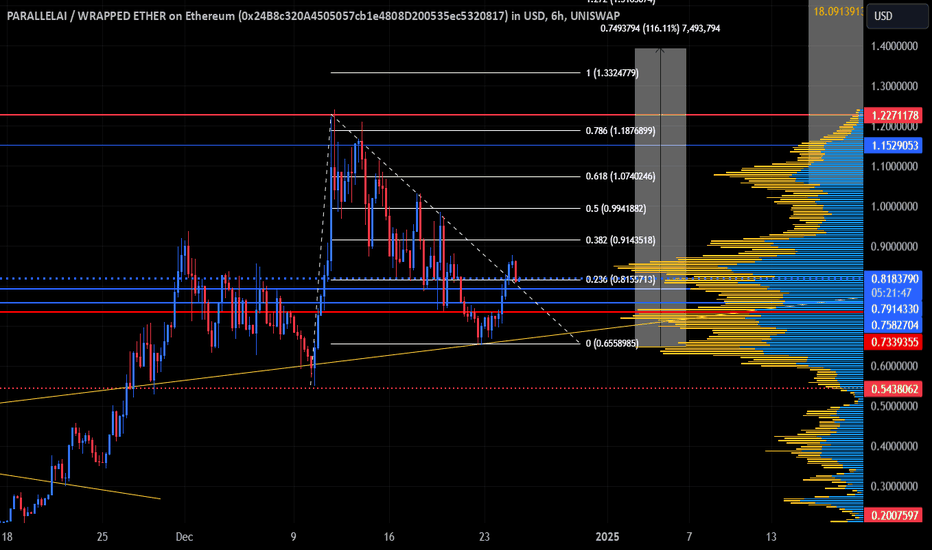

PAI Parallel AI spotted something when messin' with Fib EXTFollowers know I am bullish as all get out on PAI, They can take any current computer language program today, run it thru the Parallel-izer AI and then it will execute running in a parallel format and therfore use less GPU Space and time, only $80 Mil M/C and Fully Diluted. No one else has this tech on the blockchain. $2-$4 bILLION M/C is possible,

I drew a Fib Extension in white and left in the trend line(dashed) and on the 6 hr PAI is breaking out of a down trend, and just re-tested it. Now for a run, but do watch out for a lower high, If that happen PAI would form a Head and Shoulders to the down side.

Get in now and ride the train! ATH 1.19 currently .80c

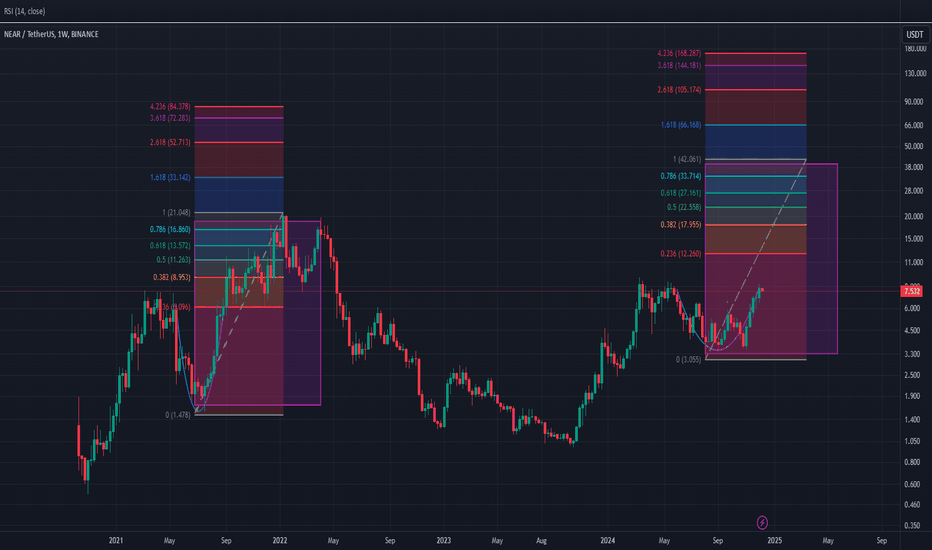

$NEAR Price Potential? Price Predictions That Will Surprise YouI was analyzing with the trend-based Fibonacci extension, looking for similar setups of significant price movements. In 2021, we can see that after that big dip, CRYPTOCAP:NEAR only reached the 1.0 level of the Fibonacci extension, which is a conservative or decent level. So, if we overlay the same retracement, we get a target of $40-$42. I think that's a decent return and definitely possible in the upcoming 90 days, which is usually how long the alt season lasts.

However , the AI narrative is quite big right now, and CRYPTOCAP:NEAR is the leading AI cryptocurrency at the moment. This could potentially help it reach the 1.618 level, or the blue zone, which is $66. If we take the average of the conservative price and the blue zone price, we get $53.

I would suggest taking profit at $35-$42 if you want to be conservative and $53-$66 if you're seeking more upside movement but are willing to take on more risk.

MarketCap needed for both prices:

40USD×1.22B CRYPTOCAP:NEAR =48.8BUSD

53USD×1.22B CRYPTOCAP:NEAR =64.66B USD

It's definitely doable in the Bullrun we're gonna have, CRYPTOCAP:NEAR is a great project but remember to DYOR !

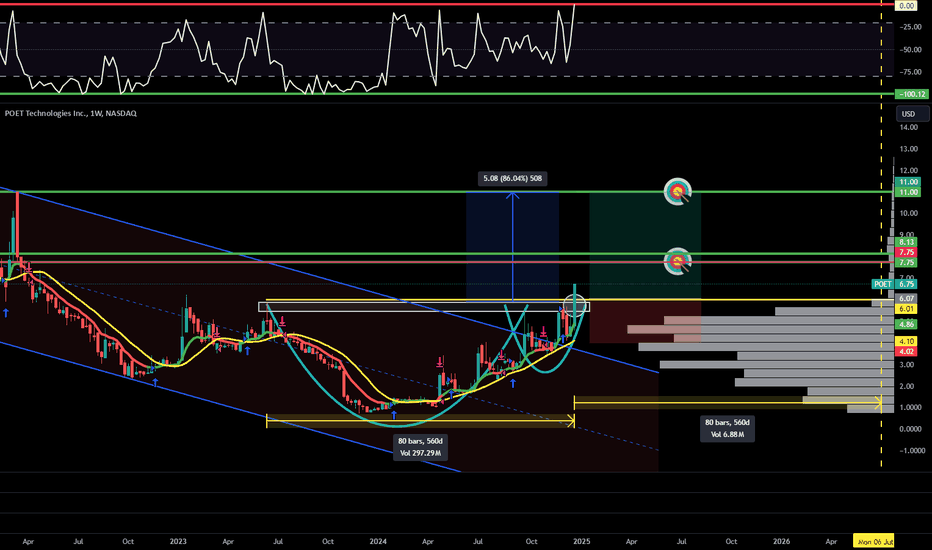

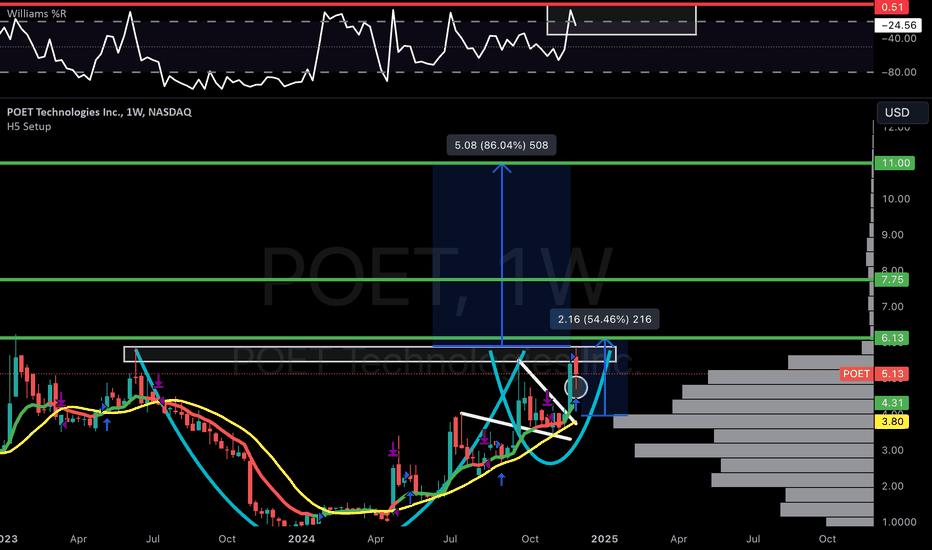

Is $POET the next AI RUNNER?! 86% UPSIDENASDAQ:POET

A great looking H5 Setup that just needs a breakout!

Warning: High Risk/ High Reward Small Cap

-H5 indicator is GREEN

-Pennant breakout that needs a retest. Measured move is $6.13 which puts us to a breakout of the Cup&Handle!

-Williams Consolidation Box needs to create support and bounce in order to be live! A big pullback to retest the Pennant breakout then bounce would be a perfect area for an entry into this trade.

-Large Volume Shelf with nothing but SPACE above.

📏$6.13 🎯$7.75 📏$11

Not Financial Advice - NFA

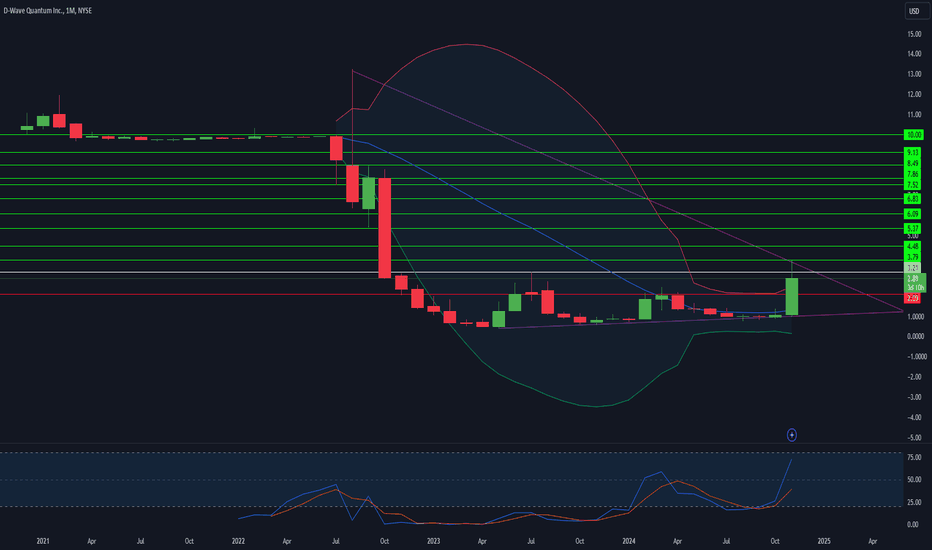

Can Computation Transcend Its Own Limits?In the vast, unexplored terrain of technological innovation, D-Wave Quantum Inc. emerges as a pioneering navigator, challenging the fundamental constraints of computational science. Their groundbreaking 4,400+ qubit Advantage2™ processor represents more than a technological milestone—it is a quantum leap that promises to redefine the very boundaries of problem-solving across complex domains like materials science, artificial intelligence, and optimization.

The true marvel of this quantum revolution lies not merely in processing speed but in a fundamental reimagining of computational potential. Where classical computers navigate problems sequentially, quantum computing exploits the bizarre, counterintuitive properties of quantum mechanics—enabling simultaneous multiple-state calculations that can solve intricate challenges up to 25,000 times faster than traditional systems. This isn't incremental improvement; it's a paradigm shift that transforms computational impossibility into potential reality.

Backed by visionary investors like Jeff Bezos and strategic partners including NASA and Google, D-Wave is not simply developing a technology—it is architecting the future's computational infrastructure. By doubling qubit coherence time, increasing energy scale, and expanding quantum connectivity, the company is methodically dismantling the barriers that have historically confined computational thinking. Each breakthrough represents a portal to unexplored intellectual territories, where problems once deemed unsolvable become navigable landscapes of potential insight.

The quantum frontier beckons not just as a technological challenge, but as an intellectual invitation—a profound question of how far human knowledge can stretch when we liberate ourselves from conventional computational thinking. D-Wave's Advantage2 processor is more than a machine; it is a testament to human imagination, a bridge between what is known and what remains tantalizingly unexplored.

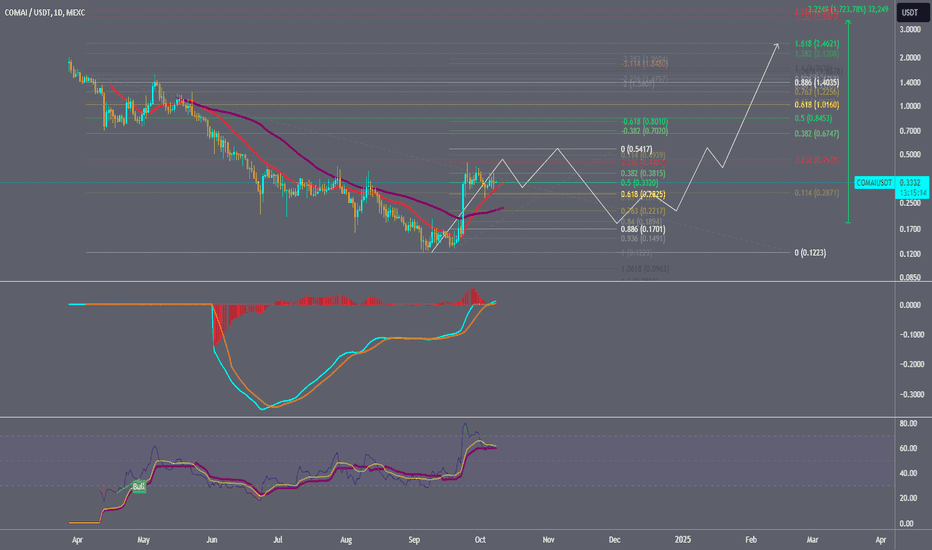

COMMUNE AI or COMai: Collaborative Artificial IntelligenceProject description:

COMMUNE AI is a decentralized platform focused on collaborative artificial intelligence, allowing users and developers to create, share, and improve AI models through decentralized data sharing and community-driven AI model optimization, all powered by blockchain.

Type of project:

Decentralized AI collaboration and data sharing platform.

Is it under a block?:

Yes, COMMUNE AI operates on Ethereum and compatible blockchains, utilizing smart contracts to enable decentralized collaboration on AI models, data sharing, and token-based incentives for contributions.

Latest update or news:

As of July 2024, COMMUNE AI launched its AI Model Repository, where users can collaborate on improving AI models in a decentralized manner and earn $COMai tokens for their contributions, driving community engagement and development.

Narrative:

Decentralized AI, collaborative machine learning, community-driven AI, and blockchain-powered AI infrastructure.

Why is it a good investment?

Institutional Backers and Angel Investors:

Outlier Ventures:

Outlier Ventures has backed COMMUNE AI, recognizing its potential to reshape how AI models are built, shared, and optimized by leveraging decentralized collaboration and blockchain technology.

Animoca Brands:

Animoca Brands, a leader in blockchain gaming and decentralized ecosystems, has invested in COMMUNE AI due to its focus on creating open, collaborative AI infrastructure.

Framework Ventures:

Framework Ventures has supported COMMUNE AI, seeing the opportunity to develop a decentralized AI ecosystem where users and developers can collaborate on AI solutions in a transparent, incentivized environment.

Angel Investors:

Ben Goertzel (Founder of SingularityNET):

Goertzel, known for his advocacy for decentralized AI, has shown interest in COMMUNE AI’s mission to enable community-driven AI model optimization, though there is no confirmed direct investment.

Trent McConaghy (Founder of Ocean Protocol):

McConaghy has expressed support for projects that focus on decentralized data sharing and AI collaboration, aligning with COMMUNE AI’s goals of democratizing AI development through blockchain.

Futuristic Use Case:

Collaborative AI model optimization:

COMMUNE AI enables users and developers to work together on optimizing AI models, allowing for continuous improvements through decentralized collaboration and rewarding contributors with $COMai tokens.

Decentralized data sharing for AI training:

COMMUNE AI’s platform allows users to securely share data for AI model training, ensuring privacy and transparency while improving the quality of AI models. This decentralized approach encourages more participants to contribute valuable data.

AI model repository for developers:

The AI Model Repository provides developers with access to a wide range of community-driven AI models that can be integrated into various applications, including decentralized finance (DeFi), gaming, and healthcare.

Incentive-driven AI research:

COMMUNE AI incentivizes AI researchers and developers to contribute to the platform by rewarding them with $COMai tokens, creating a sustainable ecosystem for ongoing AI research and development.

Why will it make a significant amount of profits?

Unique competitive edge:

COMMUNE AI stands out by creating a decentralized, community-driven AI platform that encourages collaboration and knowledge sharing, providing a more open and democratic alternative to centralized AI development environments.

Growing demand for decentralized AI solutions:

As the need for secure, scalable, and community-driven AI solutions increases, COMMUNE AI’s platform will attract more developers, researchers, and contributors, driving the demand for $COMai tokens.

Revenue from collaborative AI services:

COMMUNE AI generates revenue by providing access to its decentralized AI model repository and data-sharing services. As more developers and enterprises use the platform, the demand for $COMai tokens will rise, ensuring a sustainable revenue model.

Long-term potential in AI and blockchain convergence:

As AI continues to play a critical role in industries such as healthcare, finance, and autonomous technology, COMMUNE AI’s decentralized platform is well-positioned to be a leader in the convergence of AI and blockchain, driving long-term value for $COMai token holders.

Karrat looks ready to make a moveKarrat has just has a green signal (cross up) on the macd/rsi super

typically, this leads to at least a few days of grinding upwards for $Karrat. I'd expect to see a 5-10% move within the next 12-48 hours followed by possibly a 20-30% over all move for this next 1-2 weeks.

Keep in mind Karrat has been in this ranging since it launched a few months back and there will most likely be a lot of profit taking as usual in the marked areas and most likely the current peak target short term is in the $0.70-$0.80 range.

However, in the bigger picture I'm expecting Karrat to go much, much higher by the end of this cycle so depending on how frequent you like to be with your trading etc. you might want to only reduce 25% in that target area and then another 25% in the $1-$1.25 range and then ride the rest out until it does something spectacular later in the cycle.

Karrat has been making all the right moves during this cycle and now has their own blockchain as well as they are a TOP TIER NFT play. These things only add to the fact that they have a AAA rated working game.

Many are not even catching the fact that they may end up also being an RWA play before you know it.

Oh and did i mention this is ALSO a quality A.I. play, lol.

The ENDLESS opportunities with this coin make it seem Super CHEAP IMO at these levels and even at $1.25

I expect this to see a min. of $3.50-$5 this cycle and would not be at all surprised if it totally eclipsed these targets all together and pulls off being the $axie of this cycle.

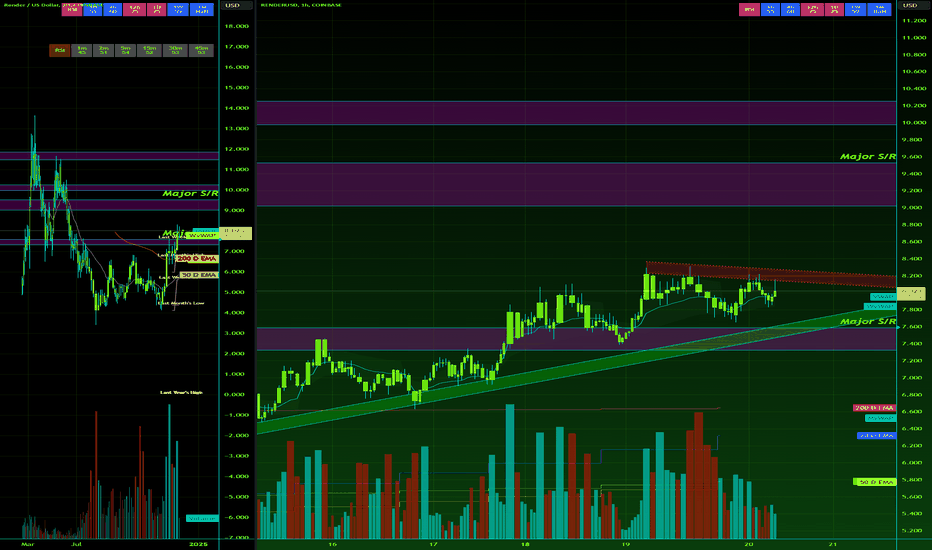

Will ReRender after 100%Render is an AI play.

That statement alone will make this thing see some crazy moves. But technically speaking, it has held up great on support while most other alts pulled back 20-40%+.

Looking at all time highs for this on eventually, in the meantime I want to see it break each major S/R level, and come back to retest it. Creating a nice stair stepping pattern over the course of weeks/months to solidify support and confirm bulls want to stay in this thing no matter the move.

Im not gonna cry if it goes straight up, but ill be much more concerned about a significant pullback if that happens.

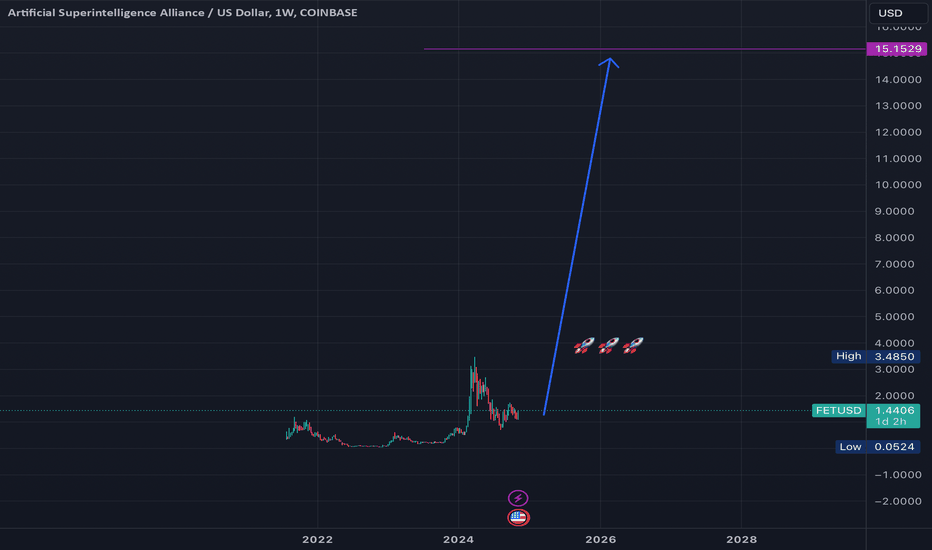

few understand how quickly this FET token is going to do 10x title says it all. few understand the strength and speed at which this is going to make a 10x move. likely far more than 10x towards the end of the current new bull cycle.

AI-related coins are garnering increasing attention from traders and investors. I personally like the team and project. something to look into if you haven't yet done so.

lots of strength in price action has been observed previously in this one. I see it ready to make a 10x move AT LEAST from current level during this renewed buy cycle on BTC. likely by summer 2025.

patience will pay sizable returns to those with the discipline required to hold.

the token is called Artificial Superintelligence Alliance and ticker is FET on Coinbase.

Remember:

"The profit isn't made in the buying or the selling, but in the waiting" - Munger

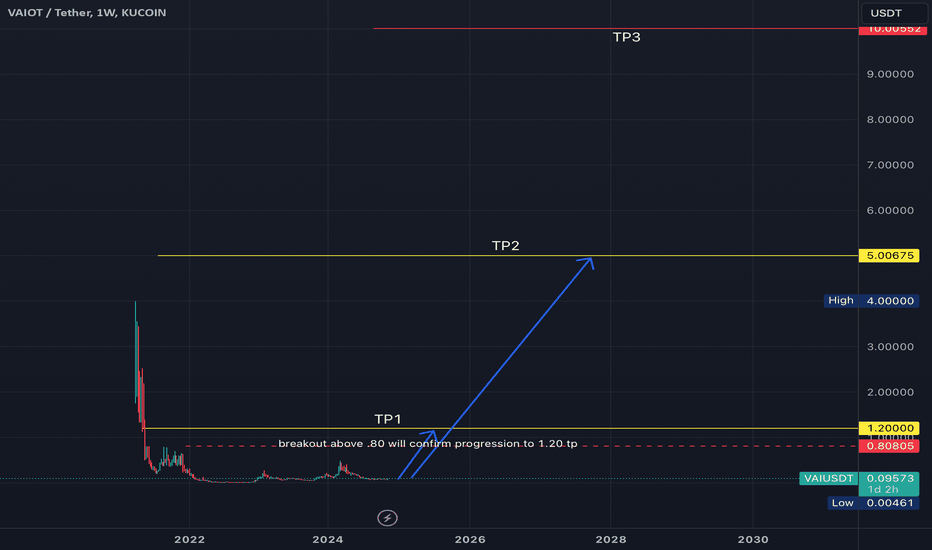

AI -related crypto named VAIOT ready to pump 50-100xwith BTC having confirmed the breakout to a new buy cycle on the monthly tf, we finally have this darling ready to move higher.

weekly setup shows full retracement to nearly the bottom of the prior buy structure.

breakout above .80 will confirm progression to 1.20 as TP1;

once 1.20 is surpassed, I believe the fundamentals and potential of this company will warrant a price in the 5.00$ even 10.00$ ranges so those are the TP2 and TP3 levels.

SL at .07

Enjoy. and You're Wellcome!

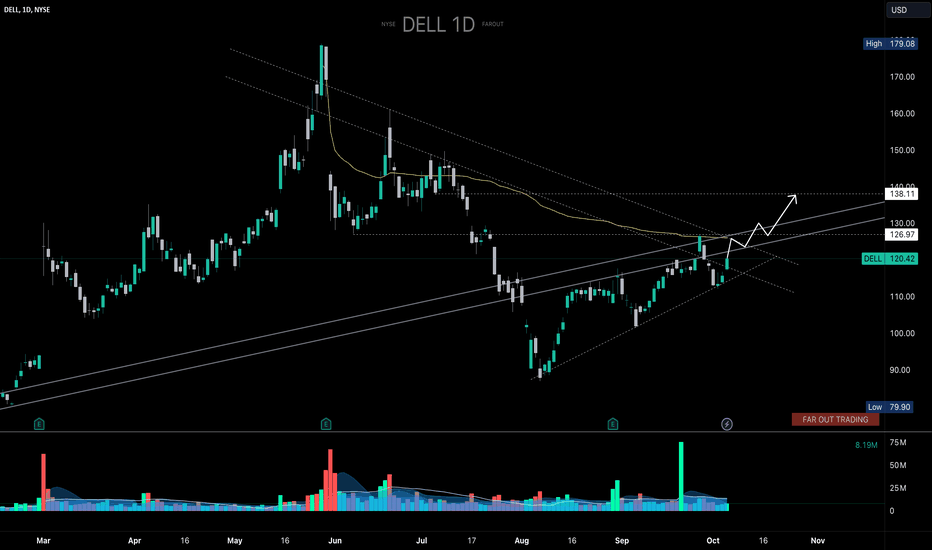

Shorts Trapped Into Insider Selling | DELL I've been actively trading DELL with my private community members and I believe the company is gearing up for another positive run. Despite the news about Michael Dell selling more shares, which may have trapped some short-sellers, DELL is making strategic moves such as reducing costs, rejoining the S&P500, and aiming to capture market share from SMCI.

With this in mind, I see two potential entry points:

a. Enter the trade above $121.50, aiming for $127.

b. Enter the trade once it breaks $127, targeting $138.

Personally, I prefer the second option. DM me with any questions!