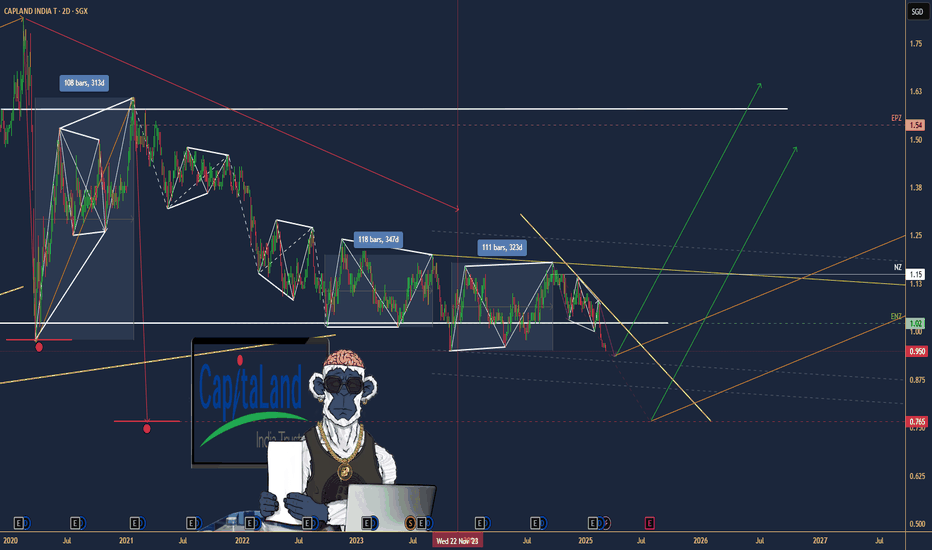

$CY6U: CapitaLand India Trust – Bangalore Boom or Borrowing Bust(1/9)

Good afternoon, Tradingview! ☀️ SGX:CY6U : CapitaLand India Trust – Bangalore Boom or Borrowing Bust?

At 1.02 SGD, is this Indian office play a hidden gem or a debt-laden mirage? Revenue’s up, insiders are buying—let’s unpack the curry! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: 1.02 SGD 💰

• Recent Moves: Modest gains in 2025, per trends 📏

• Sector Buzz: India’s office market heating up 🌟

It’s a slow simmer, but spice is brewing! 🔥

(3/9) – MARKET POSITION 📈

• Market Cap: Around 1.36B SGD (1,333.5M shares) 🏆

• Operations: Office projects, Bangalore expansion ⏰

• Trend: Revenue hit S$278M, up from S$234M 🎯

Rooted in India’s growth soil! 🌱

(4/9) – KEY DEVELOPMENTS 🔑

• Expansion: Bangalore office buy locked in 🔄

• Insider Buying: Confidence despite earnings dip ahead 🌏

• Sentiment: Cautious cheers, per market vibes 📋

Scaling up, but debt’s the side dish! 🍛

(5/9) – RISKS IN FOCUS ⚠️

• Earnings Drop: 39% decline forecast over 3 years 🔍

• Borrowing: Heavy reliance raises eyebrows 📉

• Global Noise: China stimulus, trade jitters ❄️

Spicy risks on the horizon! 🌩️

(6/9) – SWOT: STRENGTHS 💪

• Revenue Jump: S$278M from S$234M last year 🥇

• India Play: Bangalore’s office boom 📊

• Insider Faith: Buying signals grit 🔧

A curry with some kick! 🍲

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: Debt load, earnings slide ahead 📉

• Opportunities: India’s resilience, market gaps 📈

Can it spice up profits or just heat debt? 🤔

(8/9) – 📢At 1.02 SGD, revenue up, insiders in—your vibe? 🗳️

• Bullish: 1.20 SGD soon, India shines 🐂

• Neutral: Flat, risks weigh ⚖️

• Bearish: 0.90 SGD, debt bites 🐻

Drop your take below! 👇

(9/9) – FINAL TAKEAWAY 🎯

CapitaLand’s Bangalore bet and S$278M revenue pop tasty 📈, but debt and a 39% earnings dip loom 🌫️. Volatility’s our mate—dips are DCA spice 💰. Scoop low, rise steady! Gold or ghee?

Asiamarkets

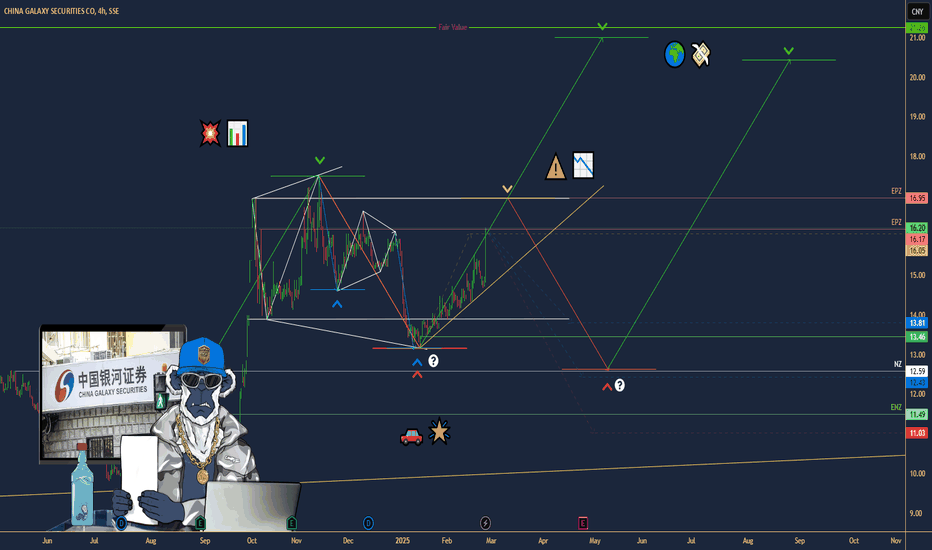

CHINA GALAXY ($601881.SS) Q4—STEADY IN CHINA’S STORMCHINA GALAXY ($601881.SS) Q4—STEADY IN CHINA’S STORM

(1/9)

Good morning, TradingView! China Galaxy (601881.SS) is buzzing—$ 35.37B ‘24 revenue, up 2.23% 📈🔥. Q4 hints at grit—let’s unpack this securities star! 🚀

(2/9) – REVENUE HUM

• ‘24 Haul: $ 35.37B—2.23% up from $ 34.6B 💥

• Steady: X says no big dips—brokerage shines 📊

• Edge: Tough market, still ticking

Galaxy’s humming—China’s steady hand!

(3/9) – EARNINGS ZAP

• ‘24 Profit: $ 10.13B—up 45.6% YoY 🌍

• EPS: $ 0.63—beats ‘23 slump 🚗

• Q4 ‘24: X buzzes resilience—details soon 🌟

Galaxy’s profit surges—market maestro!

(4/9) – BIG MOVES

• Lead: Tops brokerage, futures—$ 36.26B 🌍

• No Merge: CICC rumor nixed—solo run 📈

• Cash: $ 115.03B net—loaded vault 🚗

Galaxy’s flexing—steady as she goes!

(5/9) – RISKS IN SIGHT

• China Slow: Demand wobbles—yikes ⚠️

• Regs: Rules tighten—costs nip 🏛️

• Volatility: Trading dips could sting 📉

Hot run—can it dodge the heat?

(6/9) – SWOT: STRENGTHS

• Broker King: $ 36.26B—top dog 🌟

• Profit: $ 10.13B—45.6% zing 🔍

• Cash: $ 115.03B—rock solid 🚦

Galaxy’s a steady beast—built tough!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Slow 2.23%, China lean 💸

• Opportunities: Digital boom, stimulus lift 🌍

Can Galaxy zap past the bumps?

(8/9) – Galaxy’s Q4 buzz—what’s your vibe?

1️⃣ Bullish—Profit shines bright.

2️⃣ Neutral—Solid, risks hover.

3️⃣ Bearish—China stalls it out.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

Galaxy’s $ 35.37B ‘24 and $ 10.13B profit spark zing—steady champ 🌍🪙. Low P/E, but risks lurk—gem or pause?