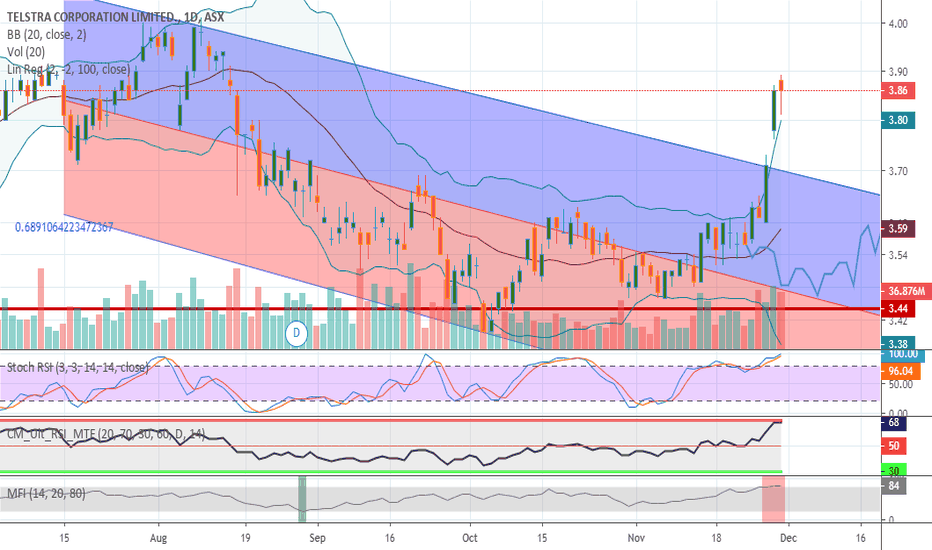

Watching #TLS #ASXCurrently not in Telstra, but they do again have the edge on the 5G game in Australia. But right now in the short term anyway we are overbought.

Lets take a look.

The Price is currently above both the Bollinger band and Linear Regression, which to my eyes if I was holding I would be watching the RSI MFI & Stochastic RSI very closely. I am expecting them to turn down very soon and that would be a sell.

What TLS has going for it is that, because the price has closed above the Linear Regression while it is in a downward direction tells me that the long term direction has changed and we will see higher prices and if 3.64-3.80 can hold it would be great for the bulls.

So expect a drop to those above levels, but higher prices over the years.... if we don't have a whole market turn

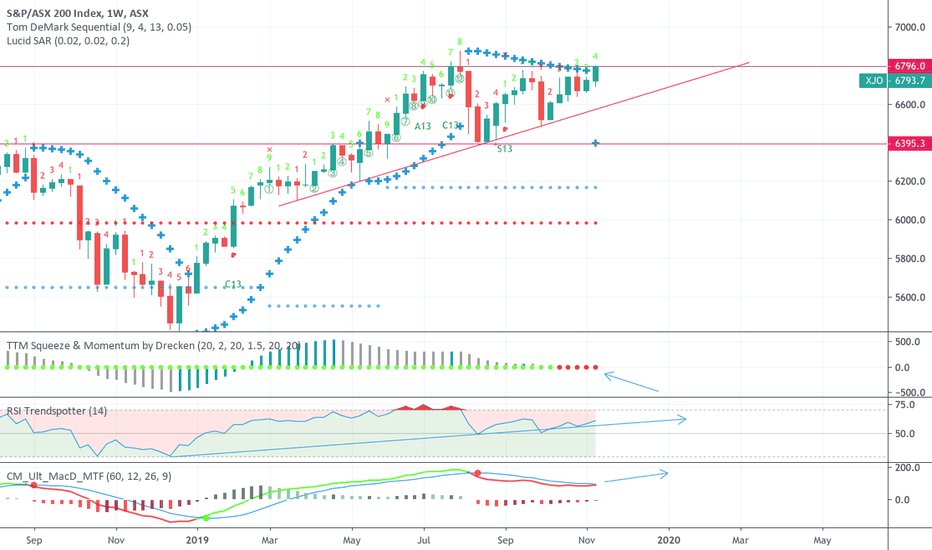

Asx200

Inghams Group (ING) Potential for 13% gap upING getting squeezed tight into this corner, RSI holding above 50 showing change to bullish bias. Possible 13% profit if it breaks and gaps up.

Entry: $3.30 - Just above short term resistance/ breakout line

Target: $3.75 - 13.64%, this area is the top of the gap

Stop Loss: $3.07 - 6% stop loss as that would confirm that it was wrong and trend change

Relatively new to this so I welcome all feedback/criticism.

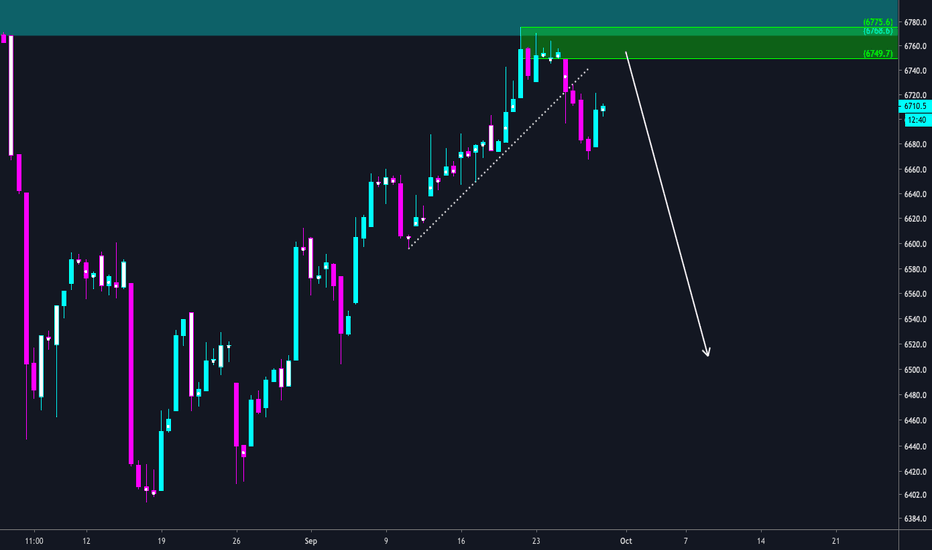

Big Decision Time for XJO ASX200 Next Week? $XJOThe TTM Squeeze indicator attempts to identify periods of consolidation in a market. ... The dots across the zero line of the TTM Squeeze indicator will turn RED, signifying this period market compression.

So breakout or a sell off next week for $XJO?

hmmm, we are close to a breakout or a double top...MACD and RSI are looking bullish at the moment.

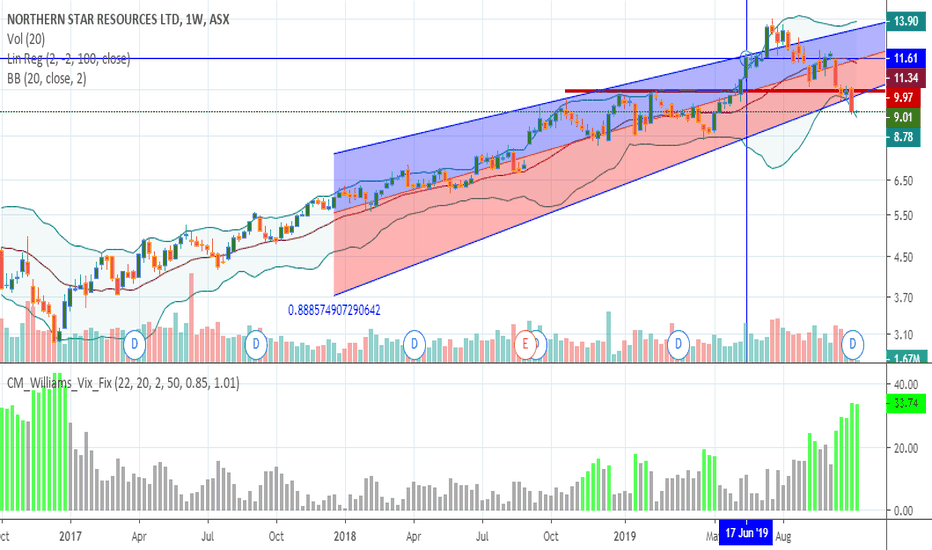

Northern Star oversold #ASXGold Stock Northern Star has had a great run to $14.06, since than it has pulled back to where it is today $9.00

Weekly This is oversold and could be a great time to buy re-buy. The price is below the BBand and RegLin plus the oversold indicator is flashing above 30 making this a great buy IMO.

What to watch out for: A dead cat bounce which is around $10.00 if we can get past that its back to normal and will hit past $14 in the near future.

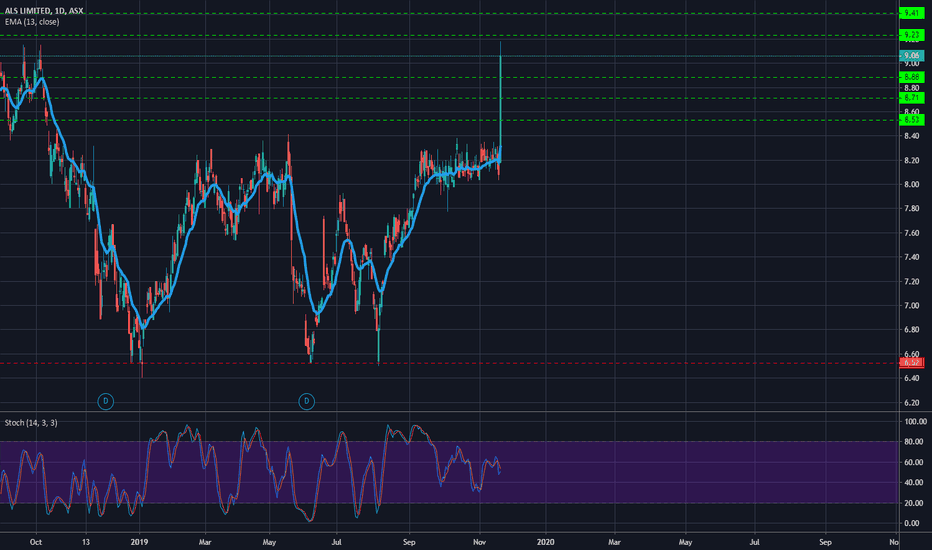

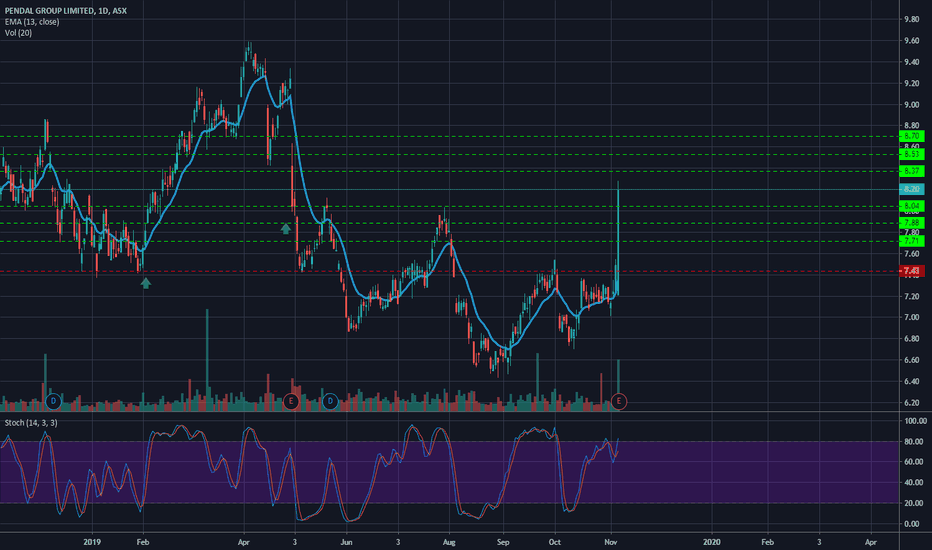

Looking for a short A bit overextended from yesterday close, looking for short between $8.37 and $8.04 range.

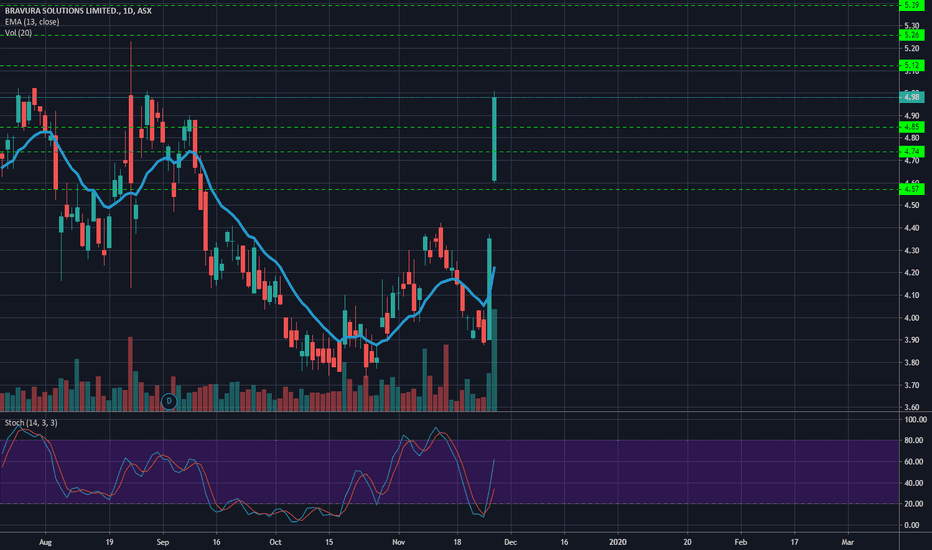

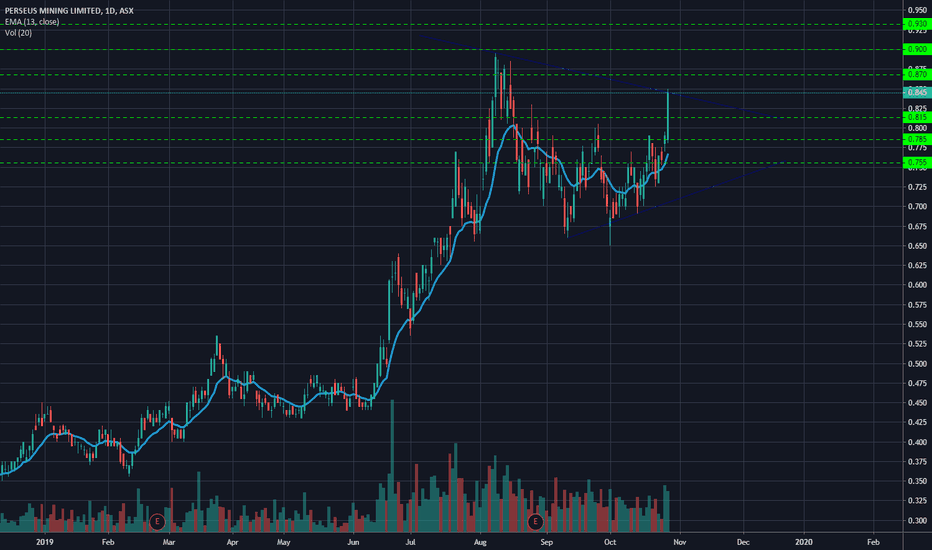

Looking for a short This stock gain 13.33% yesterday and now i think its a bit over extended at this point, looking for a short between the range of $4.83 and $4.64.

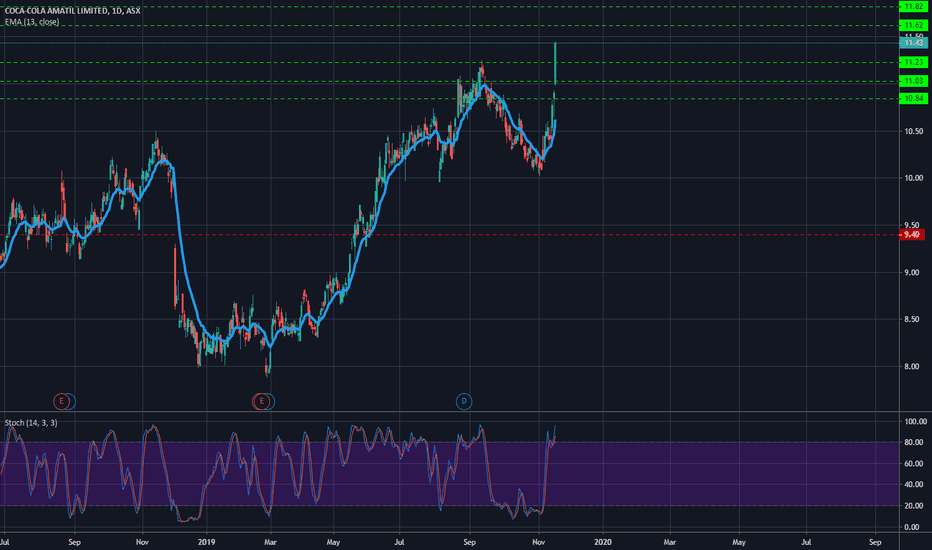

Looking for a short GMA is overextended from yesterday, got rejected at $4.09 and close ten cents below. I have gather data for the past 249 days and the mean of this stock -0.23% with a median of -0.38% stating there is more negative days then positive. Also with Kurtosis its 9 and the skew 0.02 as well, this data just gives me more information about my short basis. Looking to short between $4.03 and $3.87 and 1 standard deviation is 77%.