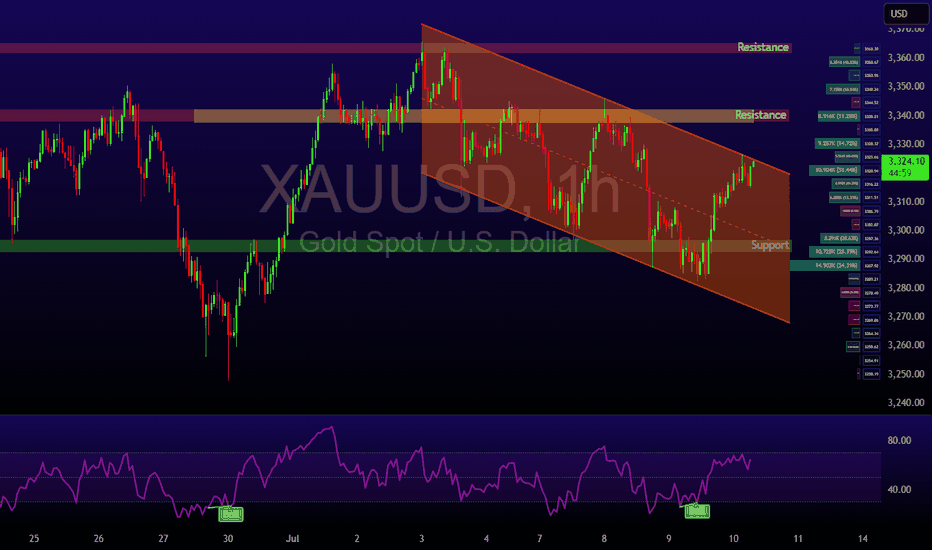

Gold (XAU/USD): Tugged Between Tariffs and Treasury YieldsGold is finding renewed interest from two forces: falling real yields and a cautious Fed. Despite the dollar’s strength, we’re seeing the yellow metal hold above $3,300. Treasury yields are sliding, and global central banks, especially China’s PBOC, are still net buyers of gold. The World Gold Council reported $38 billion in inflows to gold ETFs in the first half of the year, the highest in five years.

Technically, support remains stiff at the 50-day EMA ($3,305), with a ceiling at $3,340. If broken, $3,360 - $3,400 comes back into play. But failure to hold above $3,300 opens downside risk to $3,246, and possibly $3,185.

Atfx

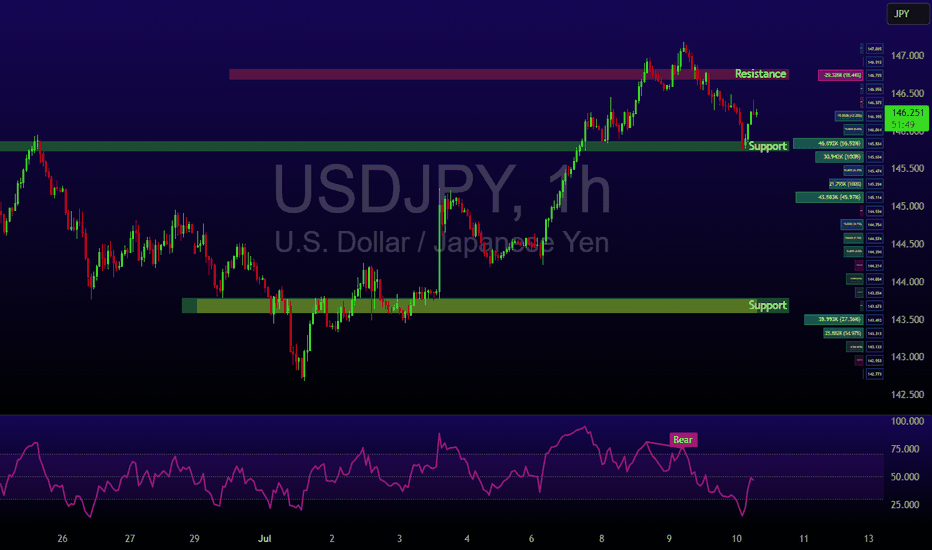

USD/JPY: Still a Safe-Haven Tug of WarUSD/JPY had surged past 147 on the back of Trump’s tariff letter to Japan—but quickly pulled back as risk appetite stabilized and Treasury yields softened. Price action now sits around the low-146s.

Technically, the 100-day SMA is providing key support just below 146.00. If bulls hold this level, we could see another push toward 147.20–148.00. On the downside, any surprise from upcoming Fed speakers or Japanese trade negotiations could send the pair testing the 144.00 zone again. Traders are watching Osaka closely, U.S. Treasury Secretary Scott Bessent is expected to meet Japanese officials at the World Expo, which could shape sentiment fast.

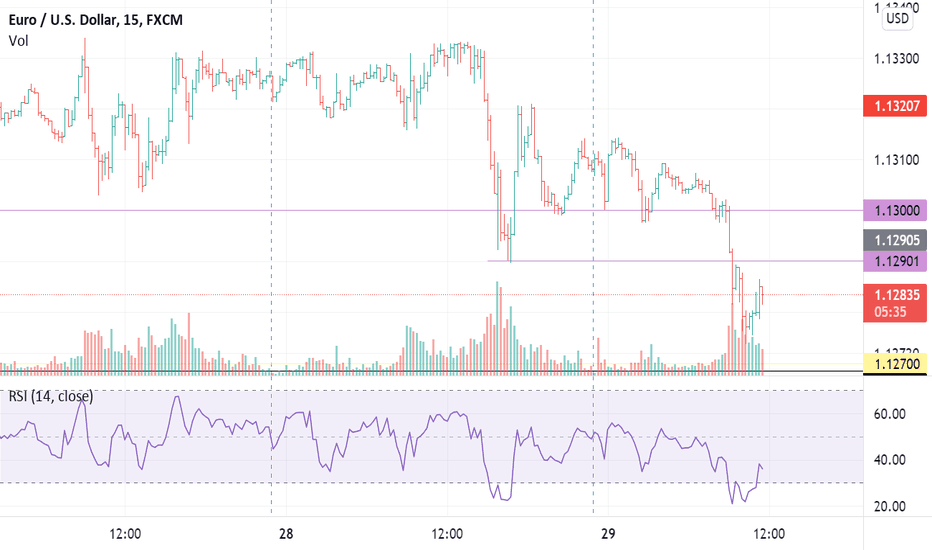

EURUSD SHORT SETUP You should be looking at the DXY, as at the time of writing, DXY at 96.36 rallying from weekly support, the target is our next weekly resistance at 96.8437. This just means the dollar will rally for a coming couple of days. Okay then, now we're looking to make some trades on EURUSD, please note that we spotted this trade yesterday and took off 0.23% on the downside. We're still on 0.20% profit of 0.56 Standard Lots and we wish to add one more position. Looking at the 15 minutes chart. Price went below yesterday's low and Is currently rallying to what we call support == resistance.

Thanks for reading!

If you find this helpful, please like and follow, we'll keep you updated with signals and market analysis on FX and CRYPTO.