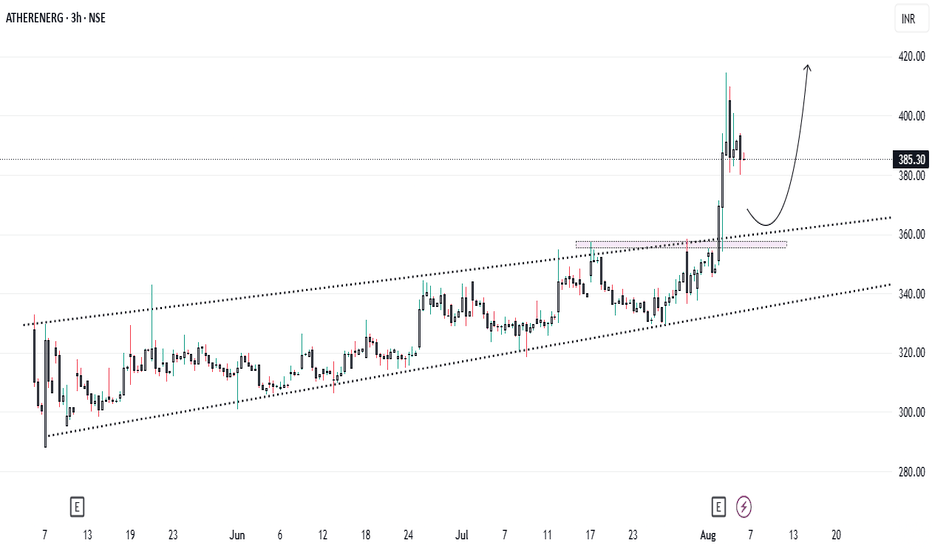

Ather Energy Breaks Out! What's Fueling the 13% Surge..?Since its stock market debut, Ather Energy had been gliding within a smooth upward channel until something major shifted this week. On the back of stellar Q1 FY26 results, the stock did something bold:

✅ Broke the channel

✅ Shot up 13% in a single day

✅ Hit a fresh 52-week high near ₹394

So, what’s driving this electric rally? And more importantly, what’s the next smart move for investors ?

🔍 Q1 Results: Narrower Loss, Explosive Growth

On August 4, 2025, Ather Energy dropped its first earnings report post-listing, and the numbers turned heads:

* 📉 Net loss trimmed to ₹178.2 crore (vs. ₹182.9 crore YoY)

* 🚀 Revenue surged 79% YoY to ₹645 crore

* 🔋 Vehicle sales jumped 97% YoY to 46,078 units

* 🛵 Family scooter “Rizta” became a hit, now 60% of total sales!

Management also highlighted better cost control, improved operating efficiency, and a margin boost of nearly 1,700 basis points YoY — a sign the business is scaling fast without burning as much cash.

📈 Chart Talk: Breakout Confirmed, Entry at ₹357 ?

Technically speaking, Ather had been moving in a classic ascending channel since its listing. But the Q1 numbers triggered a powerful breakout:

* ✅ Channel resistance broken

* ✅ Huge bullish volume

* ✅ Momentum carried the stock to ₹394 intraday

Now, for those waiting on the sidelines, the ideal entry opportunity could come around ₹357, where:

* The previous resistance could act as new support

* It aligns with 38–50% Fibonacci retracement

* A healthy pullback may offer a low-risk, high-reward setup

📊 Analyst View & Expansion Strategy

* 🏬 **95 new experience centers opened in Q1

* 🌍 Market share expanded to 14% pan-India, 22% in South India

* 🏦 HSBC initiated coverage with a ‘Buy’ rating and ₹450 target

Even amidst tough EV competition (Ola Electric, TVS, Bajaj), Ather is building a tech-driven moat with strong brand equity, energy-efficient performance, and now promising financials.

⚠️ What to Watch Out For

* 🔧 A temporary rare-earth supply disruption due to China’s export policy — management says risk is under control.

* 🧾 Still **not profitable, so long-term earnings trajectory needs close tracking.

* 🔋 EV sector competition remains fierce; execution will be key.

📌 Final Word: Wait for the Dip ?

Ather’s breakout is backed by both strong fundamentals and a bullish technical setup. If the stock pulls back to the ₹357 zone, it could present an excellent opportunity for those who missed the initial run.

📍Plan:

* ✅ Add to watchlist

* 🔁 Wait for pullback

* 🛑 Stop-loss below ₹340 (if entering at ₹357)

* 🎯 Short-term targets: ₹394 (previous high), ₹420+, ₹450 (HSBC target)

Ather is charging ahead. Are you ready to plug in ?⚡

Ather

Ather Energy Rangebound, But ₹330 Breakout Could Spark Upside... Ather Energy’s Maiden Quarterly Results Reflect Positive Momentum

Ather Energy recently reported its first quarterly results, showcasing a significant improvement in its financial performance. Revenue surged by approximately one-third, while EBITDA loss contracted to ₹172 crore from ₹239 crore year-on-year, indicating a clear path towards profitability.

On the technical front, Ather Energy’s stock is consolidating within a defined range, with the ₹330 level as a key resistance point. A sustained breakout above ₹330, accompanied by strong volume, could trigger a bullish continuation and offer a potential long trade opportunity. Traders should monitor price action closely around this level and confirm the breakout before entering long positions.