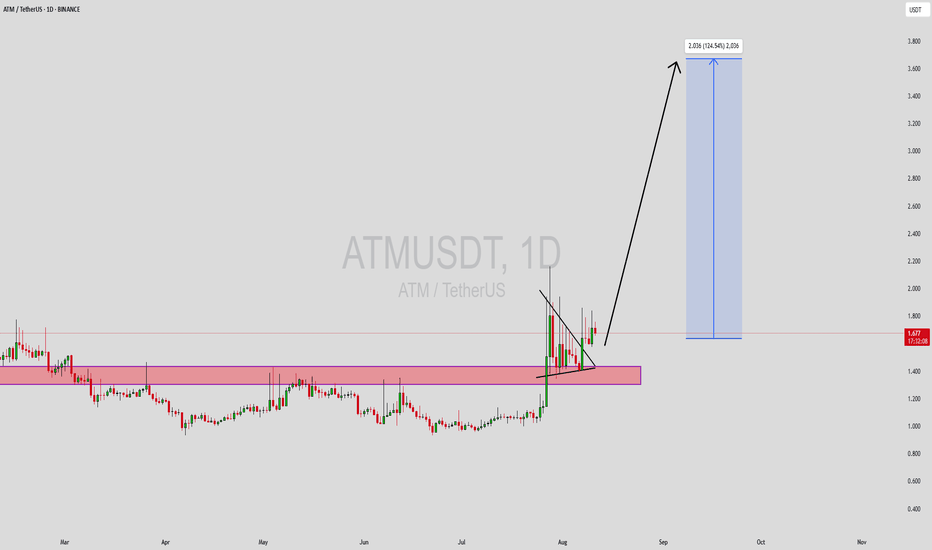

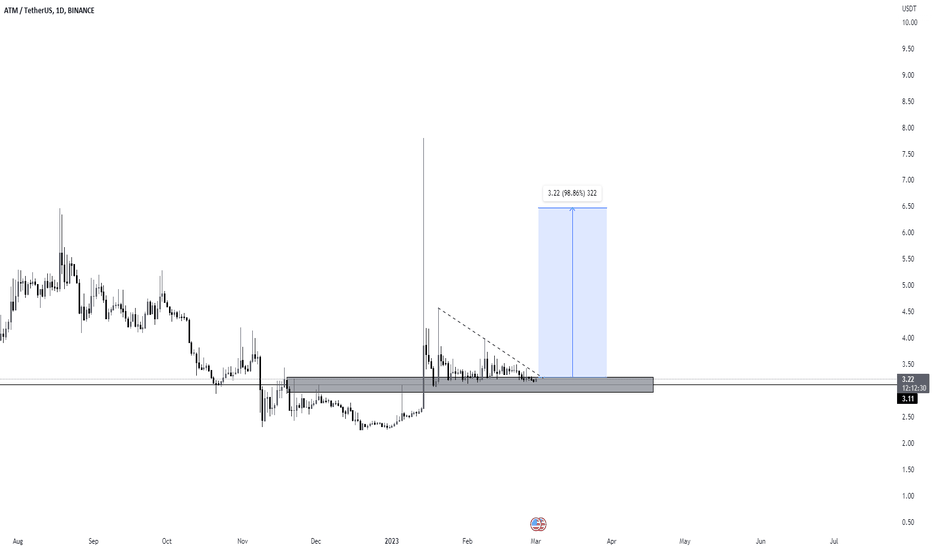

ATMUSDT Forming Descending TriangleATMUSDT is currently tracing a descending triangle pattern, typically viewed as a bearish continuation formation—but it can also flip into a bullish reversal when occurring at market lows or consolidation zones. This chart structure features a series of lower highs pushing into a flat support level, indicating that bullish interest is holding firm despite weakening upside momentum. A breakout above the upper trendline, particularly backed by strong volume, would signal a trend shift.

Volume has stayed solid throughout the pattern's formation, suggesting accumulation near support. If ATM can convincingly break upward through the upper boundary, we could see a robust rally in the range of 90% to 100%+—a substantial opportunity for swing traders.

Investor focus is heating up, with technical setups like symmetrical triangles and ABCD formations hinting at upside potential. Such pattern recognition, combined with rising volume and sentiment, makes this a high-probability trade setup.

Watch for a breakout above resistance with confirming volume and consider it a possible entry zone. Proper risk control around the support area will be key in capitalizing on this potential rally.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Atmusdtanalysis

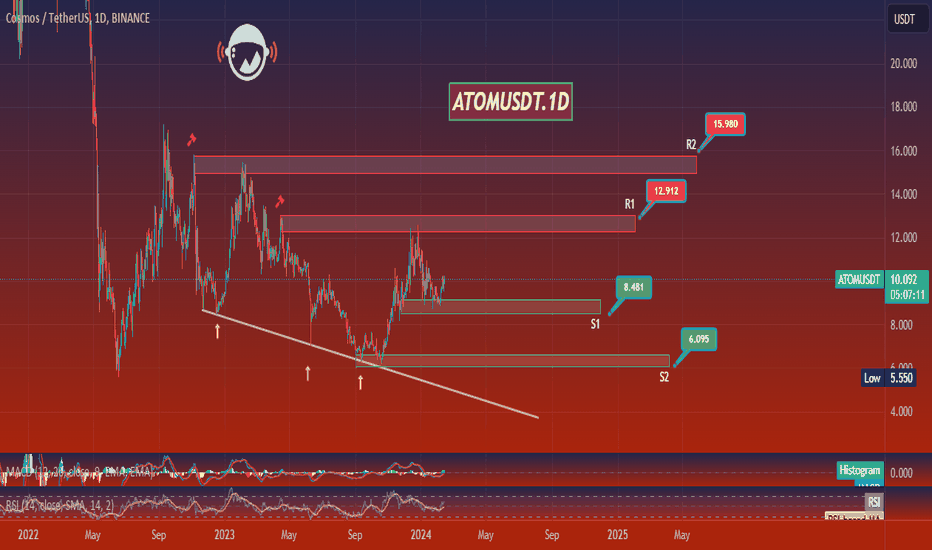

ATOMUSDT.1DBased on the given market data, the ATOM/USDT pair is currently trading at $10.075. The Relative Strength Index (RSI) on the 4-hour, 1-day, and 7-day charts are 61.07, 58.54, and 56.02 respectively. This suggests a slightly bullish trend because the RSI values are above 50 but below 70, which is considered a neutral zone.

The Moving Average Convergence Divergence (MACD) for the 4-hour, 1-day, and 7-day charts are 0.093, 0.122, and 0.271 respectively. This indicates a bullish trend as the MACD values are positive.

The Bollinger Bands (BB) on the 4-hour, 1-day, and 7-day charts are 10.381, 10.271, and 12.020 respectively. The current price is below the middle band in all three timeframes, indicating that the price is in the lower range of the Bollinger Bands, which could suggest a potential upward movement.

The support levels on the 4-hour, 1-day, and 7-day charts are gradually decreasing, while the resistance levels are increasing, suggesting a broadening price range.

In conclusion, the ATOM/USDT pair is showing a slightly bullish trend in the short term. However, the broadening price range may indicate increased volatility in the future. As always, it is essential to consider other market factors and use proper risk management techniques when trading.