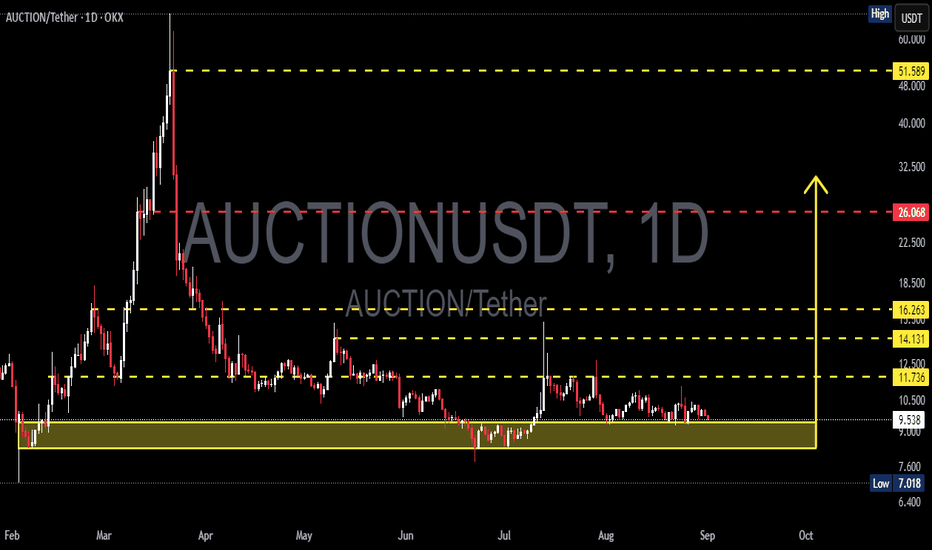

AUCTION/USDT — Major Accumulation or Bearish Continuation?🔎 Overview

The AUCTION/USDT pair is currently moving sideways within the critical demand zone of $7.02 – $9.55 (yellow box). This area has acted as a strong accumulation level since July, serving as the last line of defense for buyers before potential continuation to the downside.

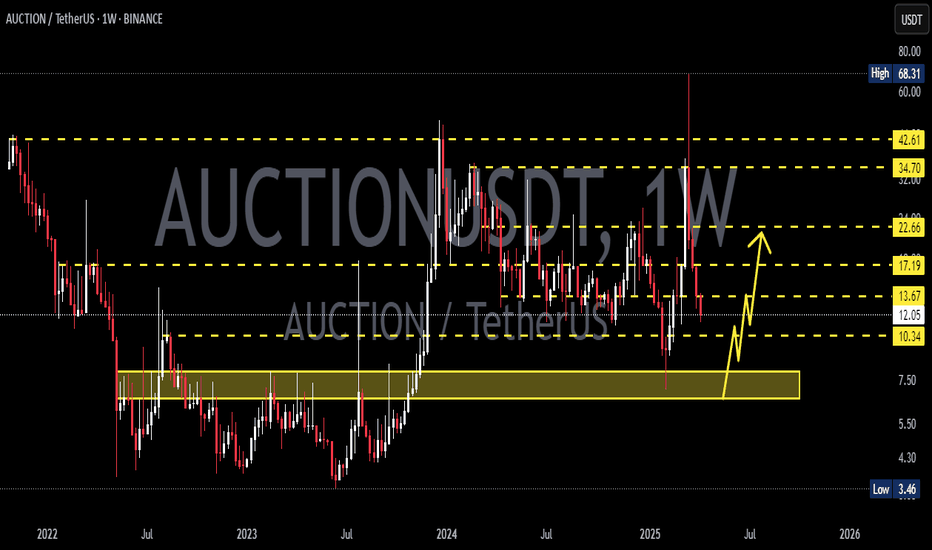

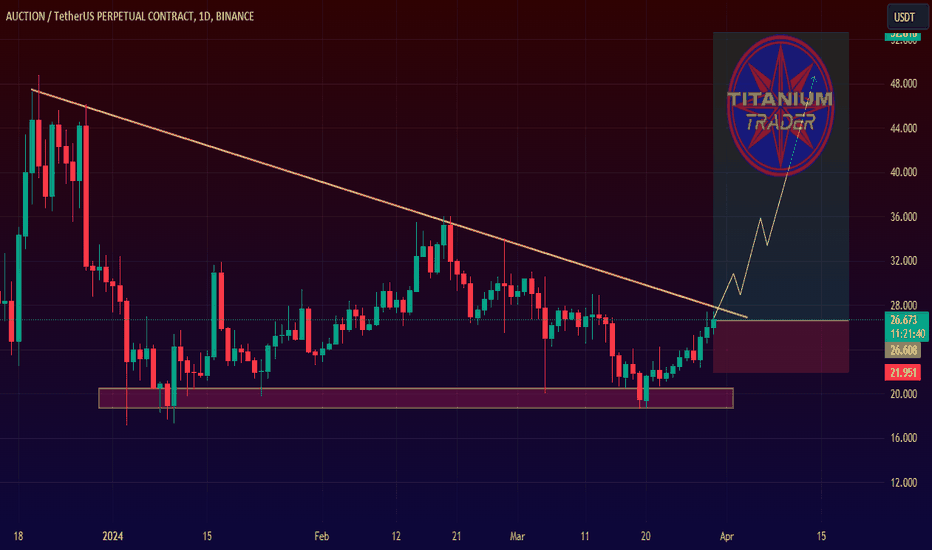

The mid-term structure remains bearish, as price continues to print lower highs since the peak at $51.59. However, this prolonged consolidation opens the possibility of forming a strong base for a reversal, should buyers hold this key zone.

---

🧩 Price Structure & Pattern

Main Trend (1D): Bearish → consistent lower highs from the ATH.

Current Pattern: Sideways within demand zone. Potential formation of an Accumulation Base or Double Bottom (W pattern) if a bullish breakout occurs.

Key Support: $9.55 → $7.02 (demand zone).

Step-by-Step Resistances: $11.736 → $14.131 → $16.263.

Major Resistance: $26.068 (psychological level & strong supply).

---

📈 Bullish Scenario

If price holds the demand zone and breaks above $11.736, upside targets become more realistic:

First target: $11.736 (minor resistance).

Second target: $14.131.

Third target: $16.263 (major barrier and liquidity zone).

With strong momentum + volume, retest towards $26.068 becomes possible.

👉 Bullish confirmation = daily close above $11.736 with volume expansion.

👉 Entry ideas:

Spot accumulation in the $7.0–$9.5 range with a stop below $7.0.

Breakout entry above $11.7 after retest confirmation.

---

📉 Bearish Scenario

If buyers fail to defend the zone, especially on a daily close below $7.02, the selling pressure could accelerate:

Possible continuation into lower liquidity areas ($6.4 – $5.5 range).

Breakdown from this base may trigger panic selling, as long-term demand zones often lead to sharp moves when invalidated.

👉 Bearish confirmation = daily close below $7.02.

👉 Entry idea: Short after confirmed breakdown and failed retest of the demand zone.

---

⚖️ Key Notes & Risk Management

The $7.0 – $9.5 zone is the battlefield between bulls and bears. As long as it holds, reversal potential remains.

Breakdown = bearish bias takes over.

Risk management:

For longs → stop below $7.0.

For shorts → stop above $9.5 (if breakdown is valid).

Beware of false breaks — always wait for daily close confirmation.

---

📝 Conclusion

AUCTION is at a make-or-break level. Will the $7.0–$9.5 demand zone become the foundation for a bullish reversal towards $11.7 → $14.1 → $16.2, or will it collapse into a bearish continuation towards deeper lows?

➡️ Patience is key — wait for confirmation before committing.

➡️ This zone will decide the next major direction for AUCTION in the coming weeks.

#AUCTION #AUCTIONUSDT #CryptoAnalysis #AltcoinSetup #PriceAction #SupportResistance #BreakoutOrBreakdown #CryptoTA #SwingTrade