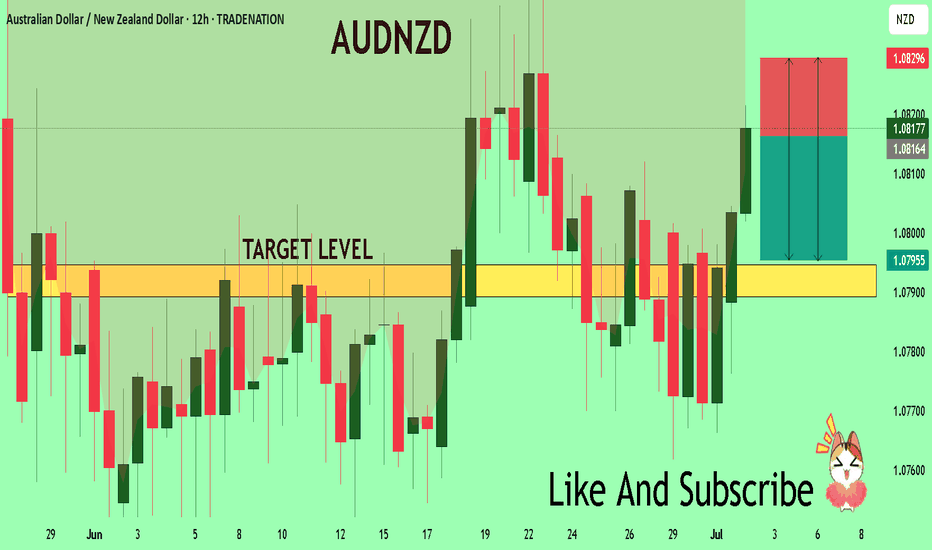

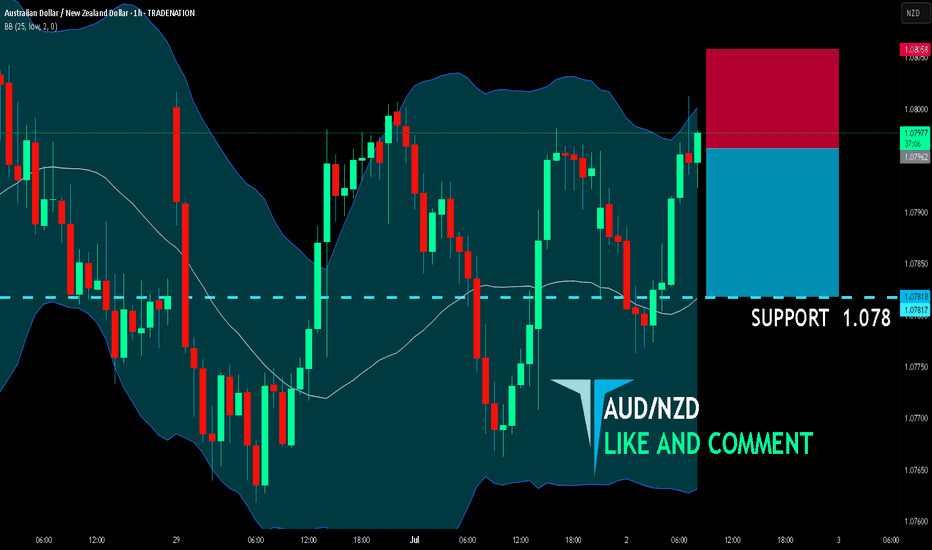

AUDNZD Will Collapse! SELL!

My dear friends,

Please, find my technical outlook for AUDNZD below:

The price is coiling around a solid key level - 1.0816

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.0794

Safe Stop Loss - 1.0829

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUD (Australian Dollar)

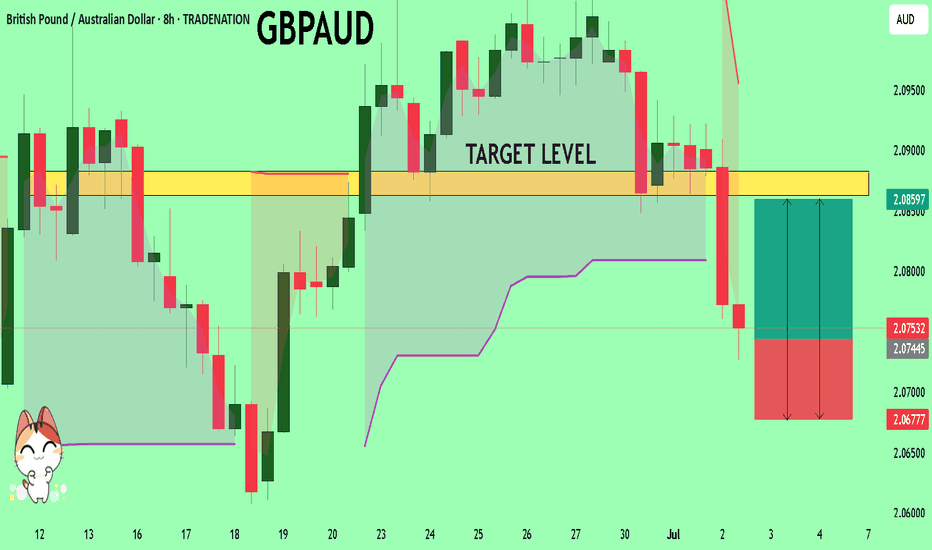

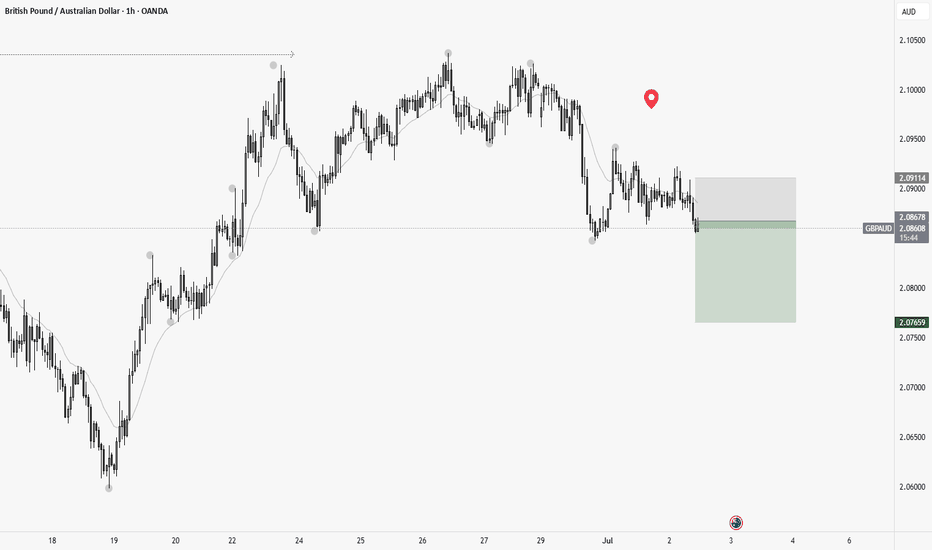

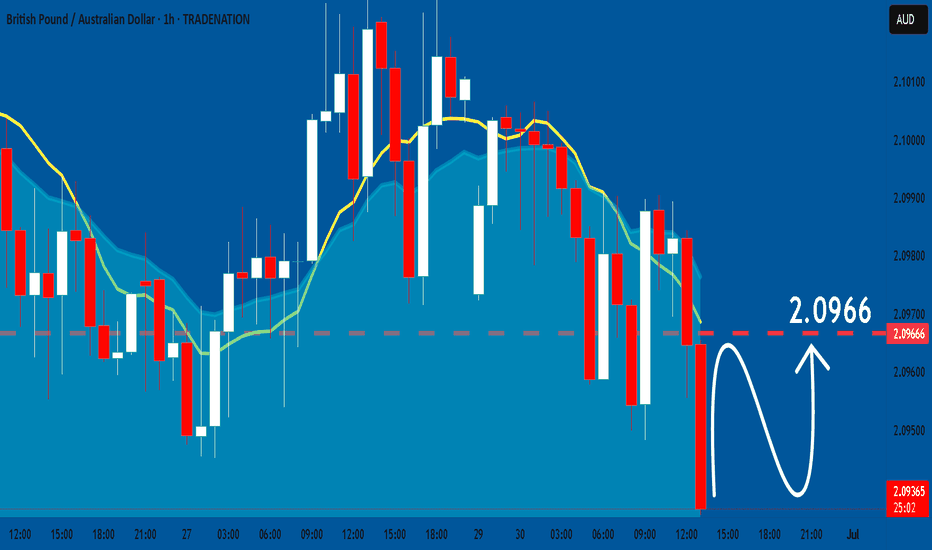

GBPAUD Technical Analysis! BUY!

My dear friends,

My technical analysis for GBPAUD is below:

The market is trading on 2.0742 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 2.0862

Recommended Stop Loss - 2.0677

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

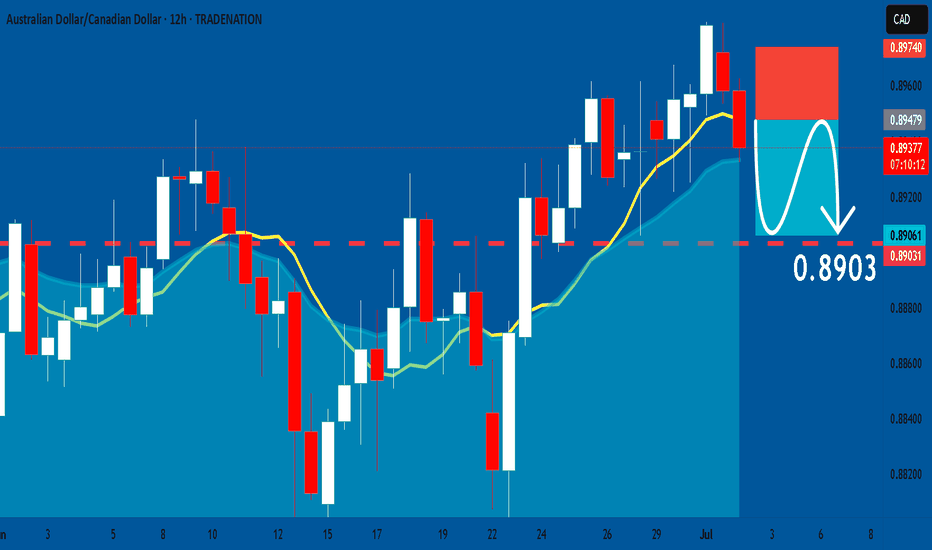

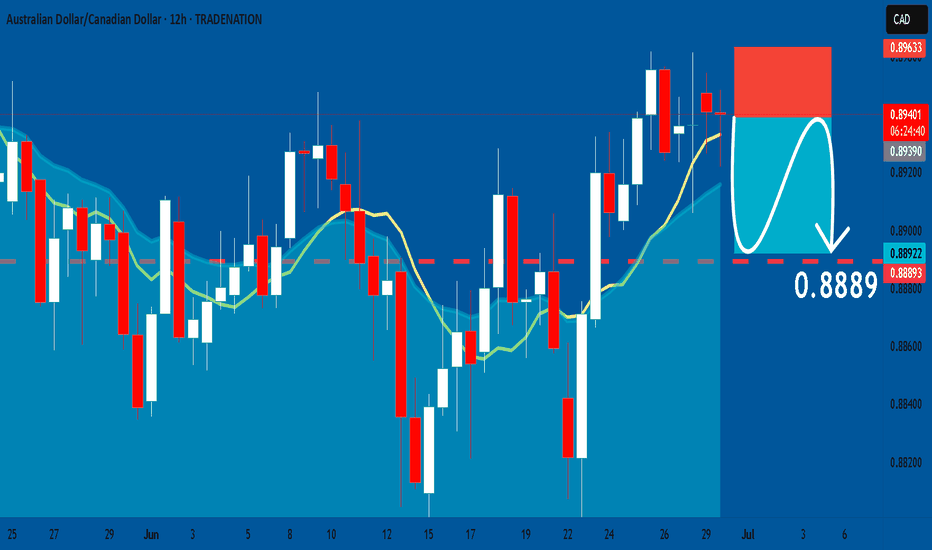

AUDCAD: Bearish Continuation & Short Trade

AUDCAD

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short AUDCAD

Entry - 0.8947

Sl - 0.8974

Tp - 0.8903

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

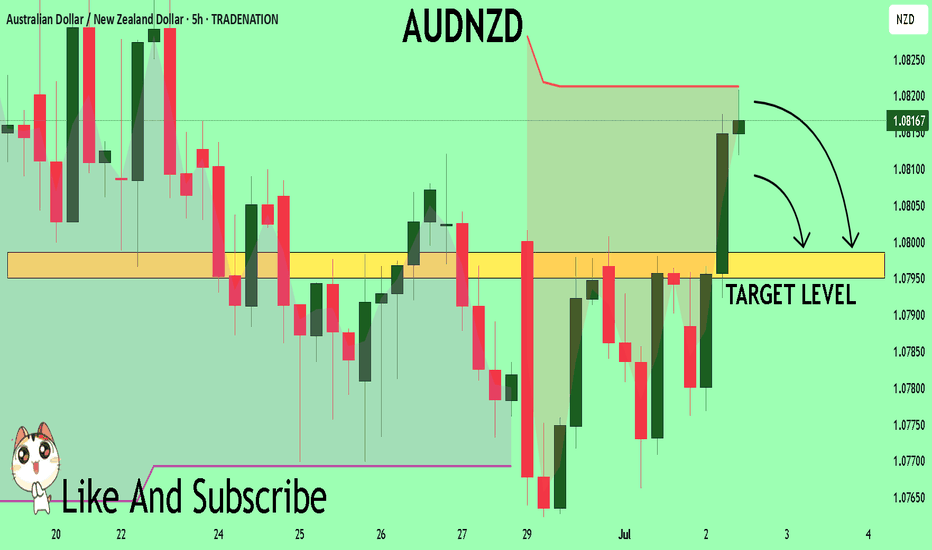

AUDNZD The Target Is DOWN! SELL!

My dear subscribers,

AUDNZD looks like it will make a good move, and here are the details:

The market is trading on 1.0817 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.0798

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GbpAud - Sell IdeaAccording to last week's traders' report, retail traders changed the number of positions, being bullish on GA.

In this way, institutions tend to move the price in the opposite direction

In technical terms, there has been a sweep of Equal Highs on the higher-timeframes and the price, after catching all this liquidity, has changed structures. In addition, it is trading below the 4H and 1H EMA, respecting consecutive imbalances.

Let's see how this trade goes.

You vs You

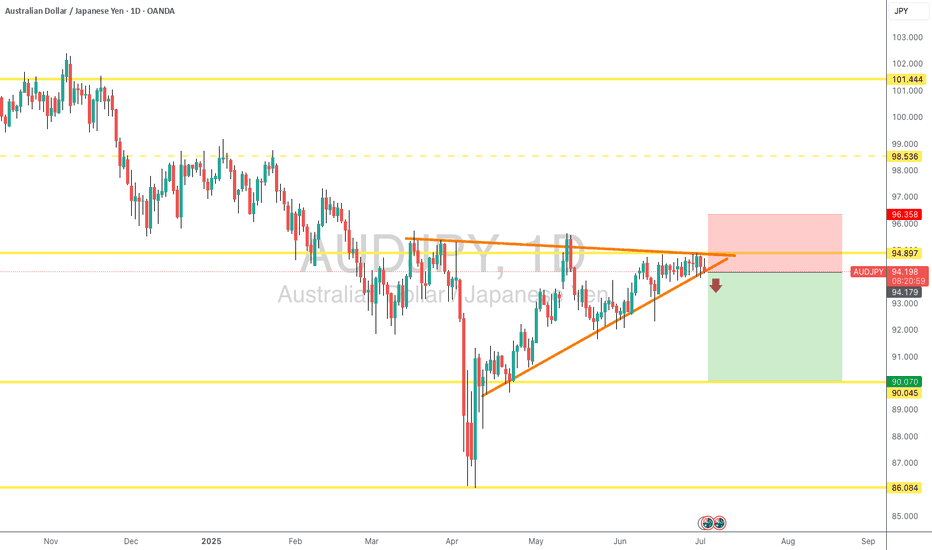

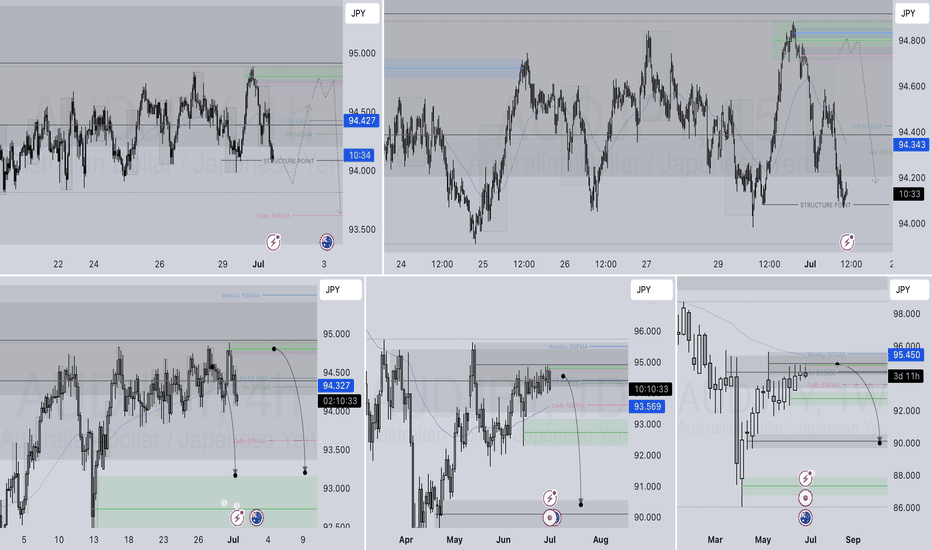

AUD/JPY# AUD/JPY: Two High-Probability Bearish Setups 🎯

## Overview

AUD/JPY continues to respect its macro downtrend structure, offering two compelling bearish opportunities as price approaches critical resistance levels. Currently trading at 94.398, the pair sits at an inflection point between key support and resistance zones.

---

## 📊 Setup 1: Resistance Zone Rejection (Primary)

### Key Level: 95.289 (Major Resistance)

This level has proven its significance multiple times:

- ✅ Strong resistance throughout recent months

- ✅ Clear seller dominance at this zone

- ✅ Confluence with descending channel structure

### Entry Strategy:

1. **Wait** for price to approach 95.289

2. **Identify** bearish rejection patterns:

- Pin bars / Shooting stars

- Bearish engulfing candles

- Multiple wick rejections

3. **Enter** short on confirmed rejection

4. **Stop Loss**: 95.50-95.60 (above resistance)

5. **Targets**:

- TP1: 93.240 (1:2 RR)

- TP2: 92.271 (1:3.5 RR)

---

## 📊 Setup 2: Rising Wedge Breakdown (Secondary)

### Pattern Recognition:

A textbook rising wedge has formed since the May lows - a bearish reversal pattern within the larger downtrend context.

### Entry Strategy:

1. **Monitor** the lower wedge trendline

2. **Wait** for decisive breakdown with volume

3. **Enter** short on retest of broken support

4. **Stop Loss**: Above recent swing high

5. **Target**: 93.240 support zone

---

## 📈 Market Structure Analysis

### Macro Trend: BEARISH 📉

- Consistent lower highs and lower lows from 102+ levels

- Currently in corrective bounce phase

- Respecting descending channel boundaries

### Current Position:

Price trapped between:

- **Resistance**: 95.289

- **Support**: 93.240

- **Deep Support**: 92.271

---

## ⚠️ Risk Management

**Patience is key!** Current price offers poor risk/reward. Wait for:

1. **Scenario A**: Test of 95.289 resistance → Short opportunity

2. **Scenario B**: Break below wedge support → Short opportunity

3. **Scenario C**: Break above 95.289 → Invalidation, stay flat

### Position Sizing:

- Risk per trade: 1-2% of account

- Adjust position size based on stop distance

---

## 🎯 Trade Summary

**Bias**: BEARISH 🐻

**Preferred Setup**: Resistance rejection at 95.289

**Risk/Reward**: Minimum 1:2

**Timeframe**: Daily

---

*Remember: The best trades come to those who wait. Let price come to your levels, don't chase!*

**What's your view? Drop a comment below! 👇**

*Disclaimer: This is not financial advice. Always do your own research and manage risk appropriately.*

---

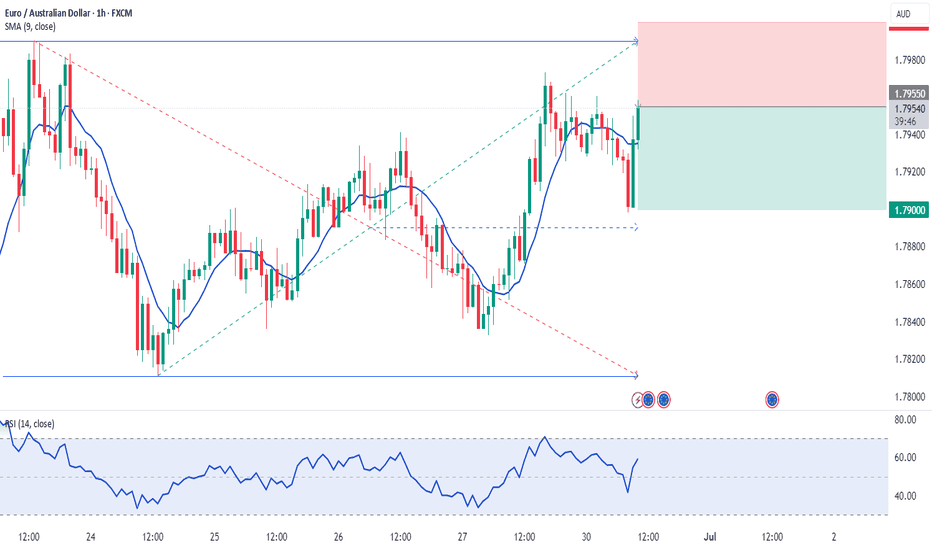

EURAUD -0.7% Short and AUDUSD MistakeA short position taken on EURAUD for a small loss after manually closing before swaps. I have also included a breakdown of a +4% AUDUSD long I was looking at taking but a small error on my behalf that caused me to stay out of the trade. Full explanation as to why I executed on this position and made the decision to manually close at the level I did.

Any questions you have just drop them below 👇

AUD/NZD SHORT FROM RESISTANCE

AUD/NZD SIGNAL

Trade Direction: short

Entry Level: 1.079

Target Level: 1.078

Stop Loss: 1.080

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

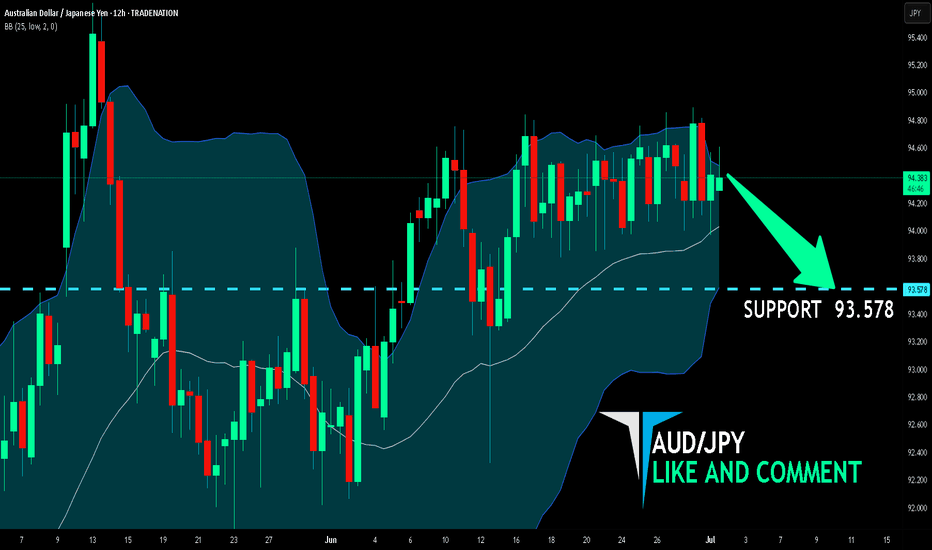

AUD/JPY SENDS CLEAR BEARISH SIGNALS|SHORT

Hello, Friends!

We are now examining the AUD/JPY pair and we can see that the pair is going up locally while also being in a uptrend on the 1W TF. But there is also a powerful signal from the BB upper band being nearby, indicating that the pair is overbought so we can go short from the resistance line above and a target at 93.578 level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDJPY - let's do it again!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

As per our last AUDJPY analysis (attached on the chart), it rejected the first blue circle zone and surged in a parabolic manner.

📈AUDJPY is currently retesting the intersection of the blue trendline and red support.

📚 As per my trading style:

As #AUDJPY is around the latest blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

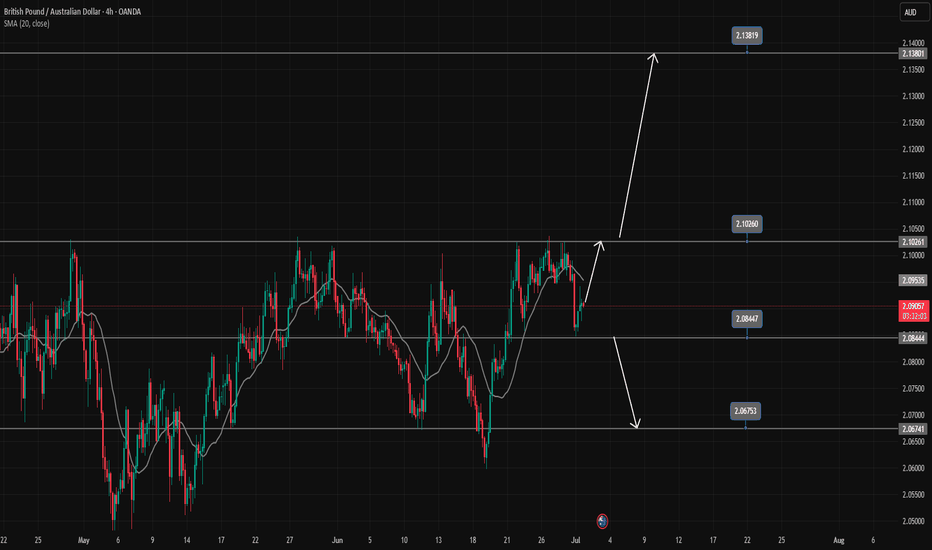

GBPAUD waiting for conditions to break out of the wide rangeGBPAUD found some buying momentum at the 2.085 support in today's trading session. In the long term, the pair's trading range is wide, extending from 2.102 to 2.067. A breakout of this range will form a new trend.

A BUY trading signal is confirmed when the pair breaks the resistance at 2.10200.

A SELL signal is confirmed when the pair breaks the support at 2.085.

📈 Key Levels

Support: 2.085 - 2.067

Resistance: 2.102 - 2.138

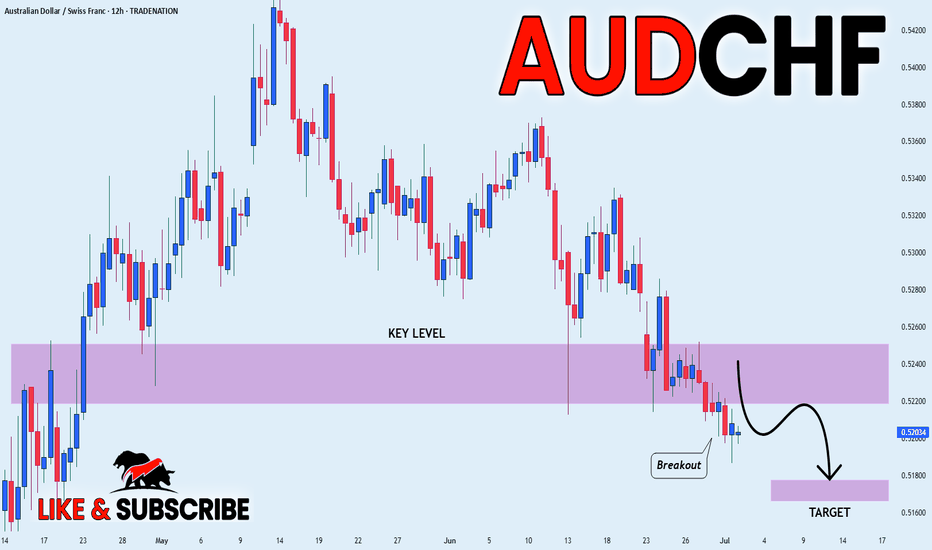

AUD_CHF BEARISH BREAKOUT|SHORT|

✅AUD_CHF is going down currently

As the pair broke the key structure level of 0.5240

Which is now a resistance, and after the pullback

And retest, I think the price will go further down

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

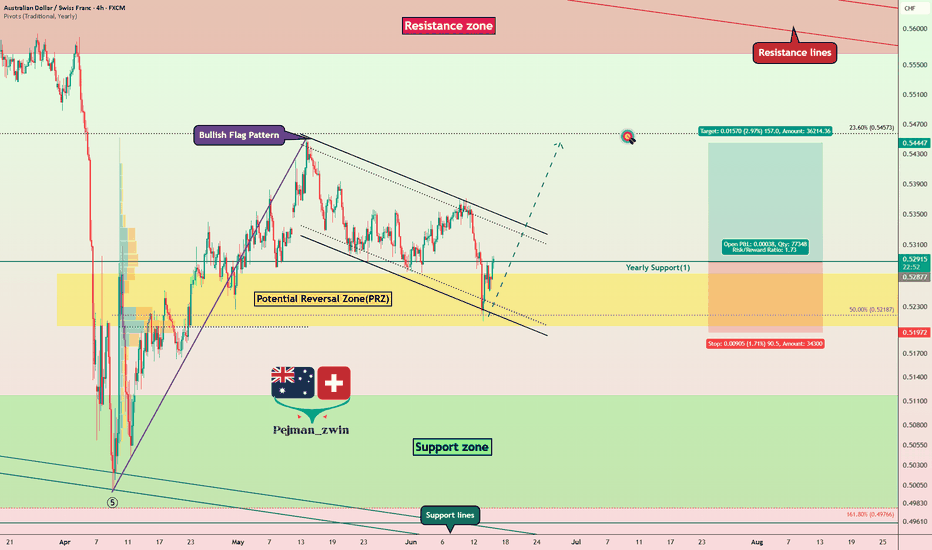

AUDCHF: Bullish Flag from PRZ — Rally to 0.54444?AUDCHF ( OANDA:AUDCHF ) bounced from the Potential Reversal Zone (PRZ) , which aligns with the Yearly Support(1) and the 50% Fibonacci level of the previous bullish impulse.

From a Classic Technical Analysis perspective , AUDCHF appears to be breaking out of a Bullish Flag Pattern , which may suggest the continuation of the previous uptrend .

This bullish reaction also confirms the importance of the Support zone(0.51166 CHF-0.49773 CHF) , where buyers stepped in aggressively.

In terms of Elliott Wave theory , it seems that AUDCHF has completed the bearish waves and we should wait for the bullish waves .

I expect AUDCHF to continue rising after a successful breakout from the flag’s upper boundary . If momentum sustains, the target could be around 0.54444 CHF .

Note: Stop Loss (SL) = 0.51972 CHF

Australian Dollar/ Swiss Franc Analyze (4-hour time frame).

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

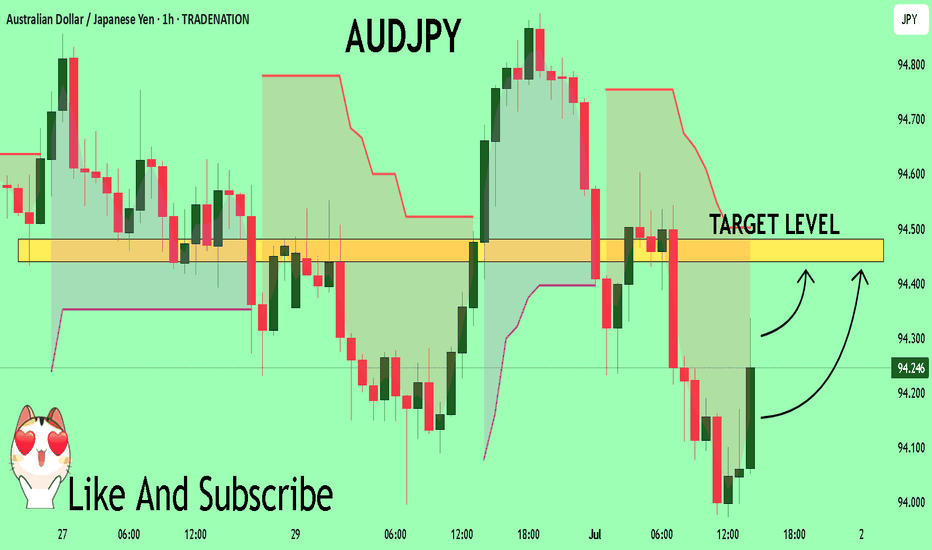

AUDJPY Trading Opportunity! BUY!

My dear subscribers,

My technical analysis for AUDJPY is below:

The price is coiling around a solid key level - 94.200

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 94.441

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUDJPY SHORT FORECAST Q3 W27 D1 Y25AUDJPY SHORT FORECAST Q3 W27 D1 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today! 👀

💡Here are some trade confluences📝

✅Weekly Order Block Identified

✅Daily Order block identified

✅4H Order Block identified

✅15' Order block identified

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

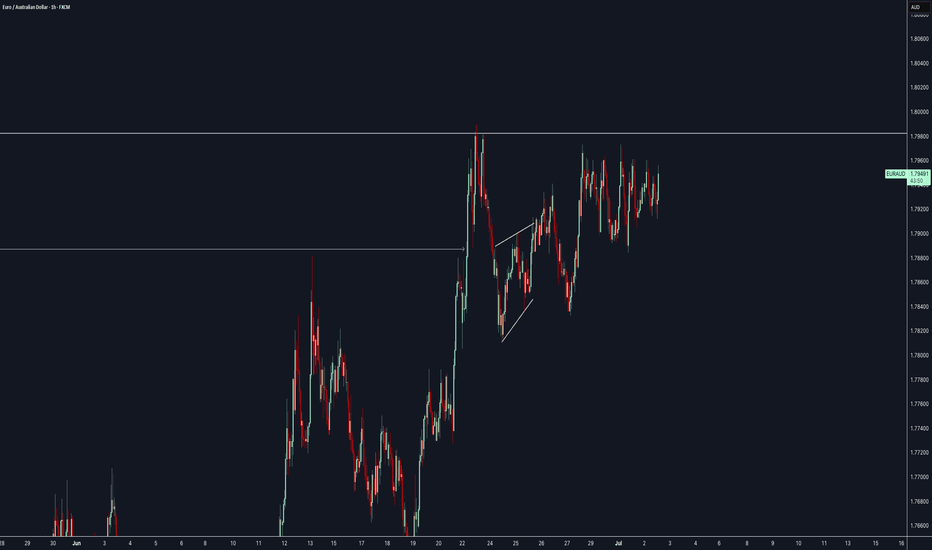

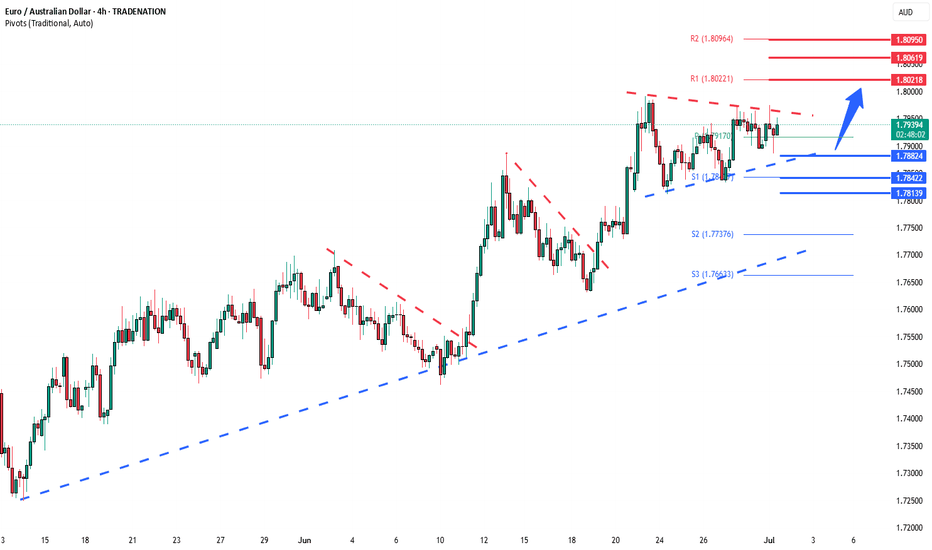

EURAUD Energy buildup - coiling pattern The EURAUD currency pair maintains a bullish bias, underpinned by the prevailing upward trend. Recent sideways consolidation in intraday price action suggests a potential continuation pattern within the broader uptrend.

The key level to watch is 1.7880, marking the lower boundary of the recent consolidation range. A corrective pullback toward this level, followed by a bullish bounce, could trigger a fresh rally targeting resistance levels at 1.8020, then 1.8060, and potentially 1.8090 over the medium term.

Conversely, a decisive breakdown below 1.7880, confirmed by a daily close beneath this support, would invalidate the current bullish outlook. This would expose the pair to deeper retracement targets near 1.7840, followed by 1.7810.

Trend Bias: Bullish above 1.7880

Key Support: 1.7880, 1.7840, 1.7810

Key Resistance: 1.8020, 1.8060, 1.8090

Conclusion:

EURAUD remains technically constructive while holding above 1.7880. Traders should monitor this level for bullish continuation signals. A bounce from this zone could reinforce the uptrend, while a break and close below it would shift momentum and open the door for a deeper corrective move.

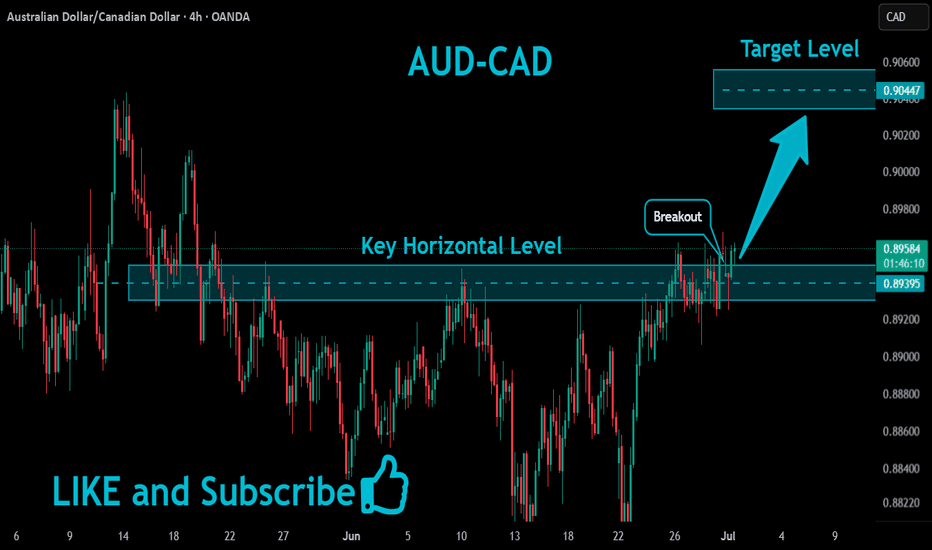

AUDCAD Is Going Up! Long!

Please, check our technical outlook for AUDCAD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 0.895.

Considering the today's price action, probabilities will be high to see a movement to 0.900.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

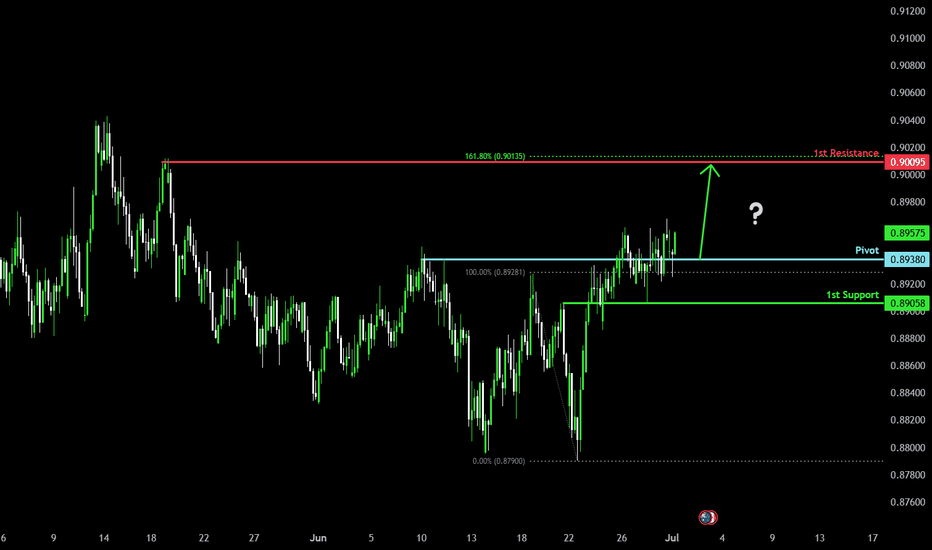

Bullish momentum to extend?AUD/CAD has bounced off the pivot and could potentially rise to the 1st resistance which lines up with the 161.8% Fibonacci extension.

Pivot: 0.8938

1st Support: 0.8905

1st Resistance: 0.9009

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

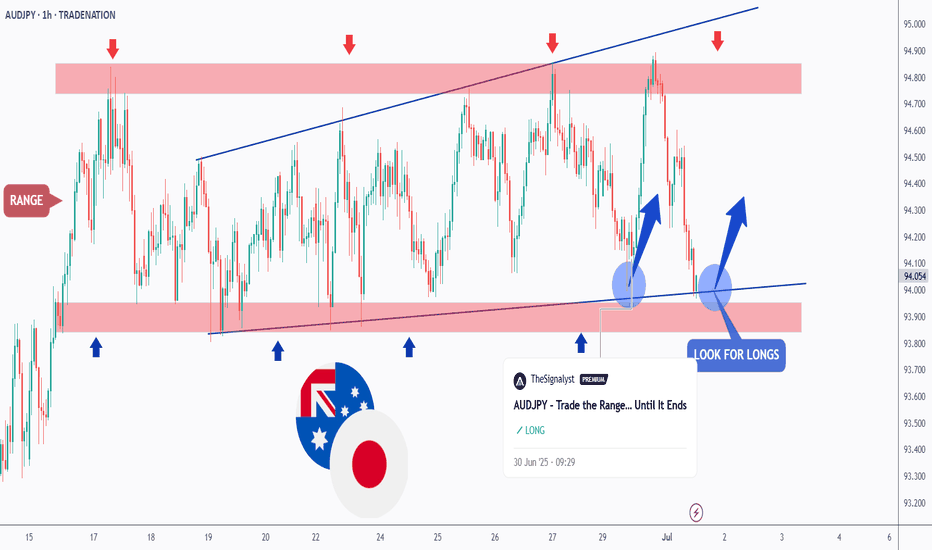

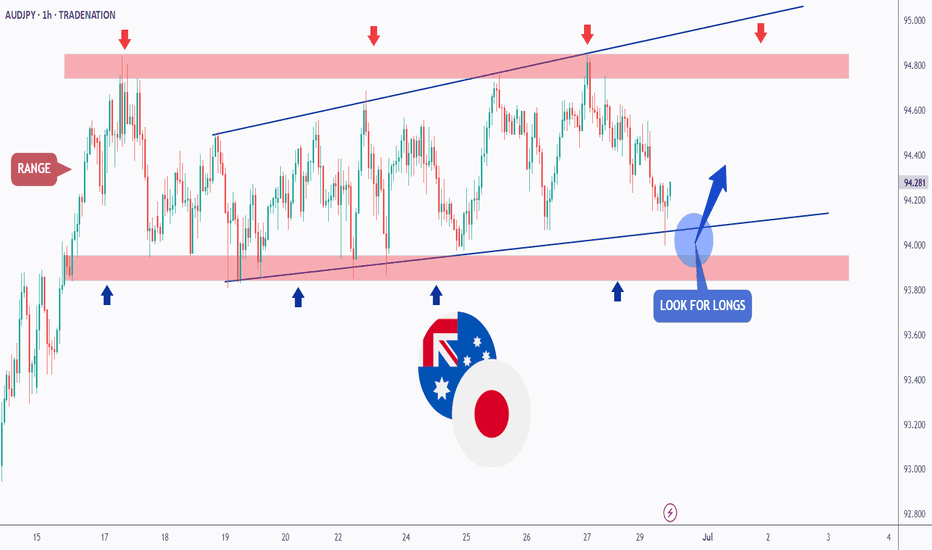

AUDJPY – Trade the Range… Until It EndsHello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈AUDJPY has been trading within a big range marked in red.

Moreover, the it is retesting the lower bound of its rising channel marked in blue.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #AUDJPY approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDCAD: Short Trade with Entry/SL/TP

AUDCAD

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell AUDCAD

Entry Level - 0.8940

Sl - 0.8963

Tp - 0.8889

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPAUD: Growth & Bullish Continuation

Balance of buyers and sellers on the GBPAUD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the buyers, therefore is it only natural that we go long on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️