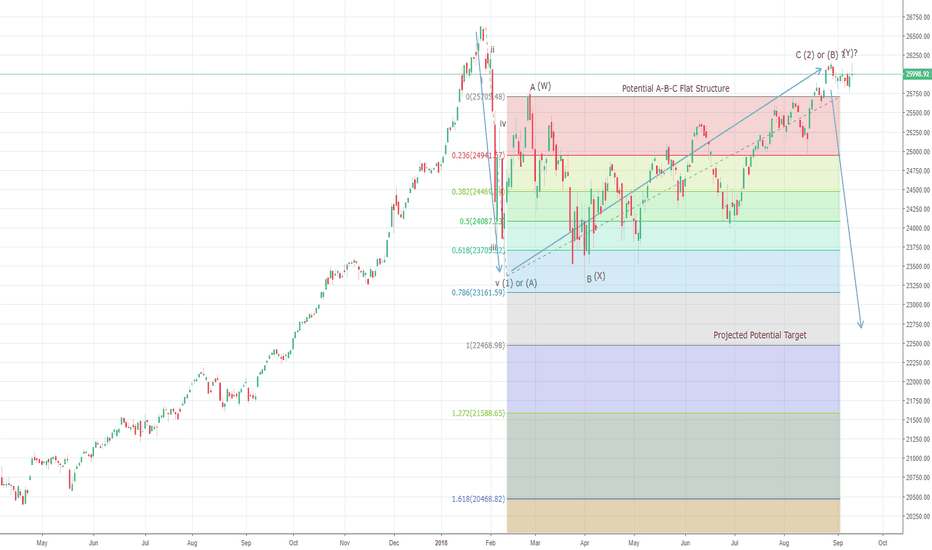

Dow Jones potential op in place at 26150 levels ?Dow Jones daily chart view has been presented here again after few trading sessions. Looking at the wave structure, the indice could be still working on a potential flat A-B-C at least. Please note that Dow has remained almost unchanged since past few trading sessions and could be possible that a potential top is in place at 26150 levels. Also note that a standard flat structure would remain valid till prices stay below 26600 levels going forward. A safe trading strategy could be to remain short from here, with risk at 26600 levels. If this wave structure holds well, we could see a sharp reversal lower towards 23000 levels at least.

Disclaimer:

This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

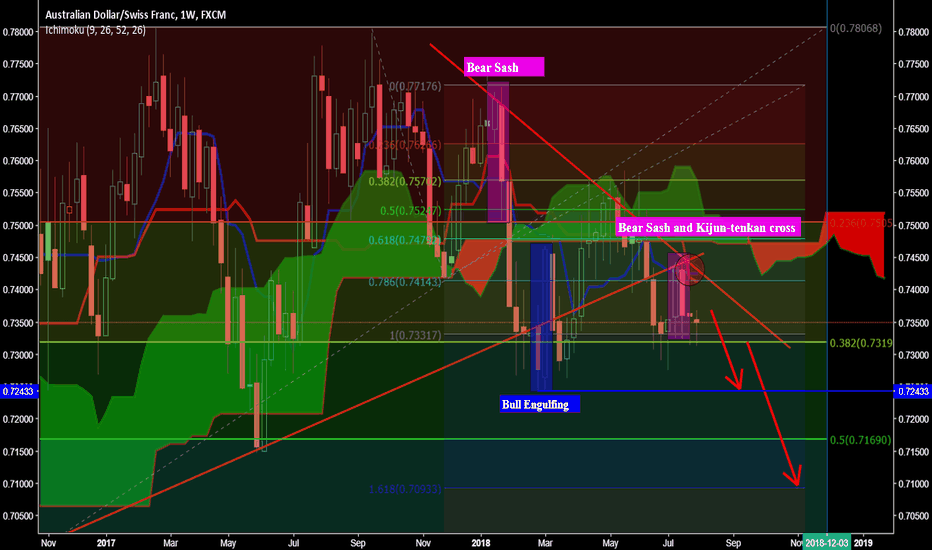

Aud-chf

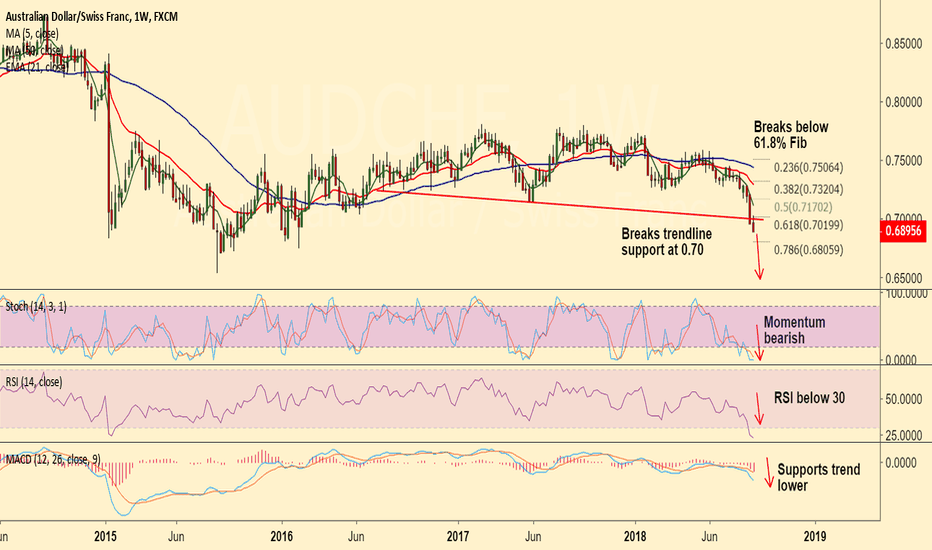

AUD/CHF closes below 61.8% Fib, bias bearish, tgt 78.6% FibAUD/CHF Bias Bearish

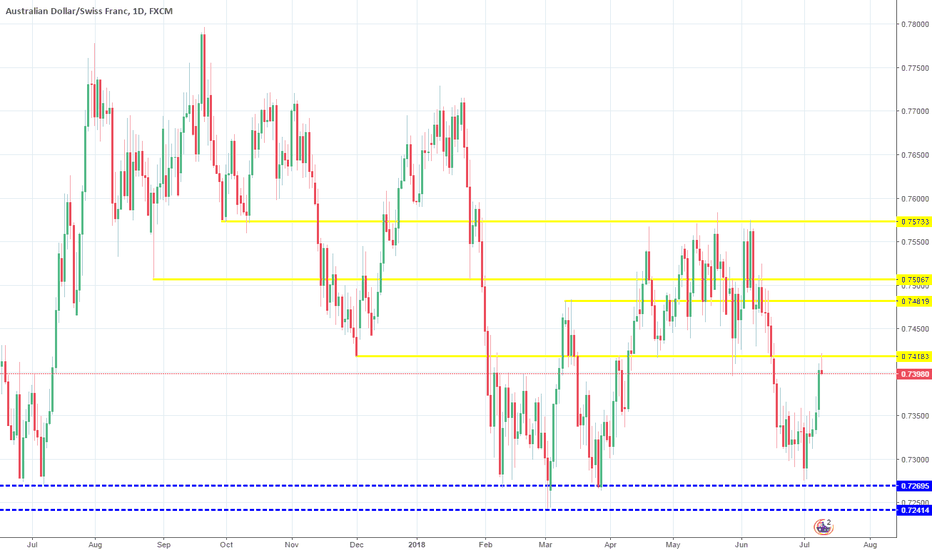

- Price has breached major trendline support at 0.70

- Momentum studies are highly bearish

- Bollinger Bands on weekly charts are widening

- MACD supports trend lower

Support levels - 0.6805 (78.6% Fib), 0.6752 (Feb 2016 low), 0.67

Resistance levels - 0.6964 (5-DMA), 0.70, 0.7108 (21-EMA)

Stay short on upticks, SL: 0.7108, TP: 0.68/ 0.6755

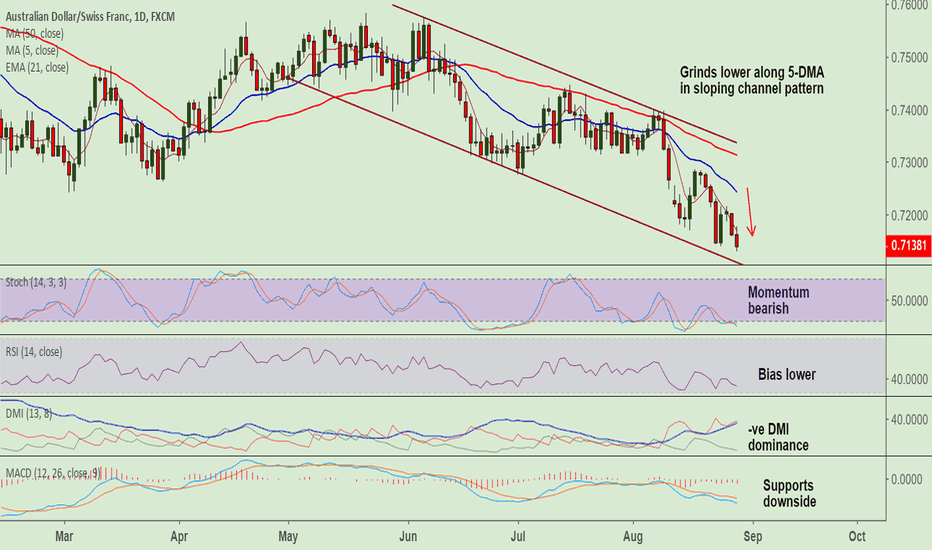

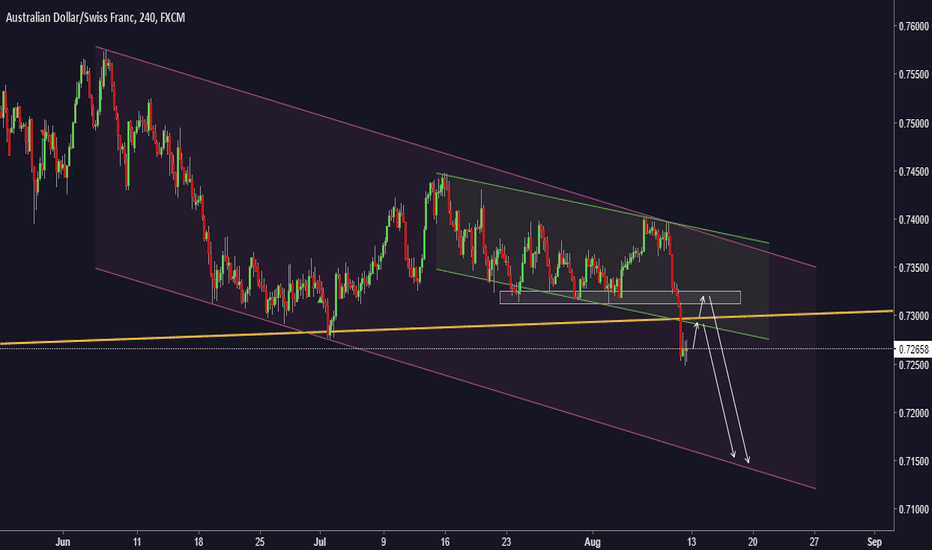

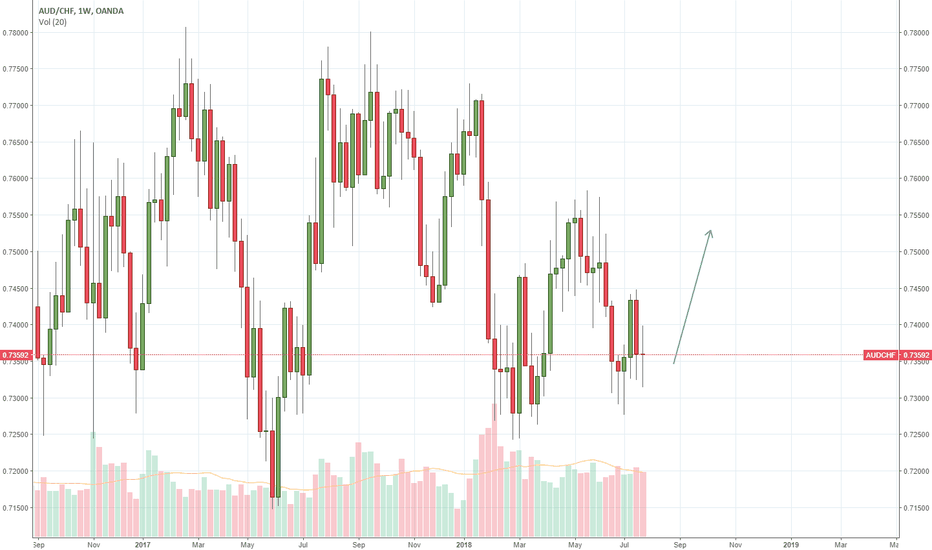

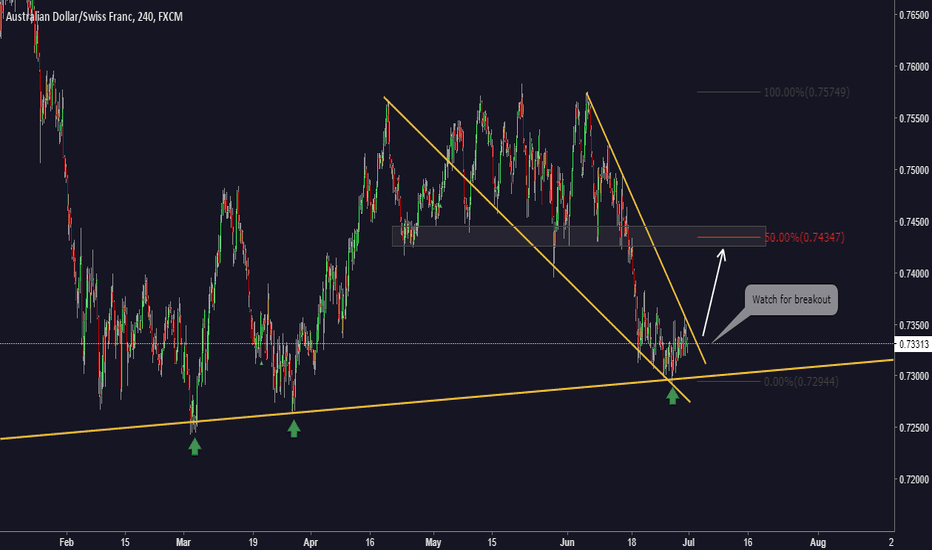

AUD/CHF eyes channel base at 0.71, stay short AUD/CHF extends grind lower along 5-DMA, hits 2-year lows at 0.7130.

Technical analysis supports bearish bias, we see scope for further weakness.

Upside remains capped at 5-DMA and major moving averages are sloping downward.

Momentum studies are highly bearish, RSI biased lower and below 50 levels.

Price is falling in a downward sloping channel and next major bear target lies at channel base at 0.71 levels.

On the flipside break above 5-DMA finds next major resistance at 21-EMA at 0.7244.

Violation at channel top reverses downtrend in the pair.

Support levels - 0.7130 (session low), 0.71 (channel base), 0.7032 (2016 low)

Resistance levels - 0.7169 (5-DMA), 0.7246 (21-EMA), 0.73

Stay short on upticks, SL: 0.7175, TP: 0.71/ 0.7035

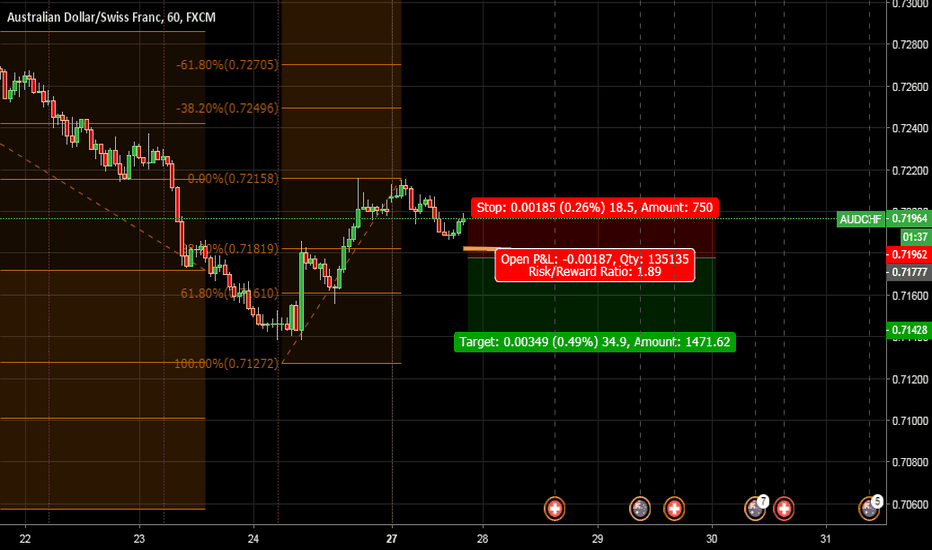

AUDCHF ShortStill bearish in AUD in general despite their new PM because of risks from US-China trade war, and slightly bullish in CHF for the same reason. Entered a short stop order with conservative SL between 0-38.2 fib lines and TP @0.71428 (weekly support).

www.poundsterlinglive.com

www.dailyfx.com

www.forexcrunch.com

Daily:

Weekly:

Confidence: B (because of the unpredictable nature of trade wars)

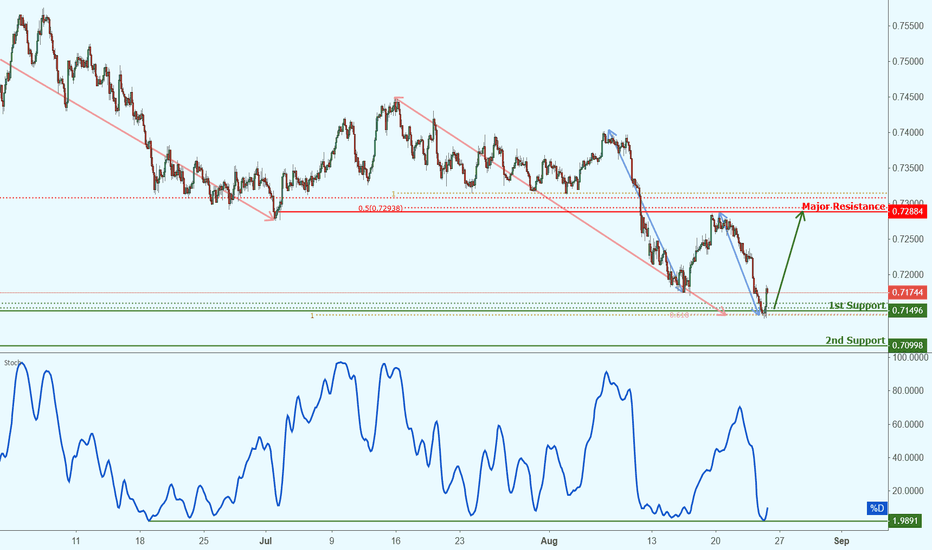

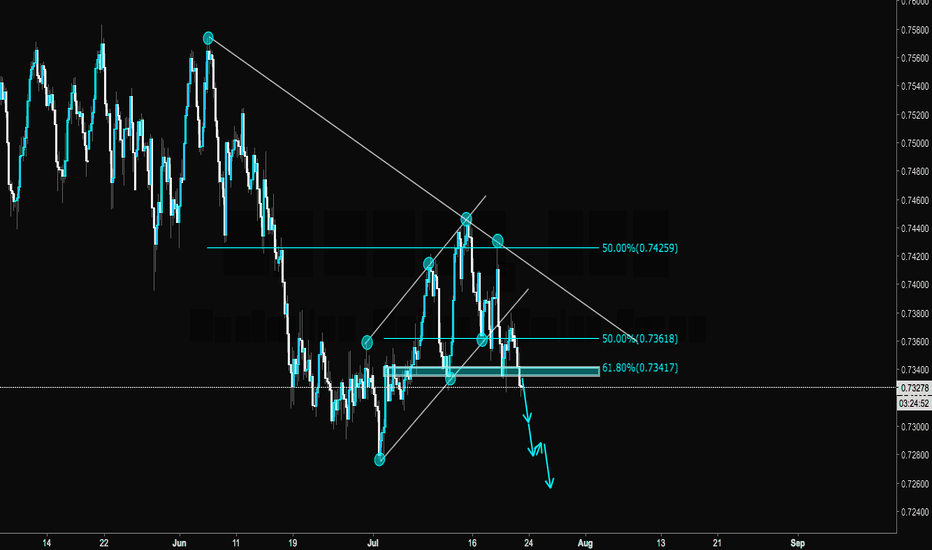

AUDCHF approaching support, potential bounce! AUDCHF is approaching our first support at 0.7149 (horizontal swing low support, 50%, 61.8%, Fibonacci retracement, 100%, 61.8% Fibonacci extension) where a strong bounce might occur above this level pushing price up to our major resistance at 0.7288 (horizontal overlap resistance, 50%, 38.2% Fibonacci retracement, 100% Fibonacci extension)

Stochastic (89,5,3) is also approaching our resistance and a reaction below this level might see a corresponding drop in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

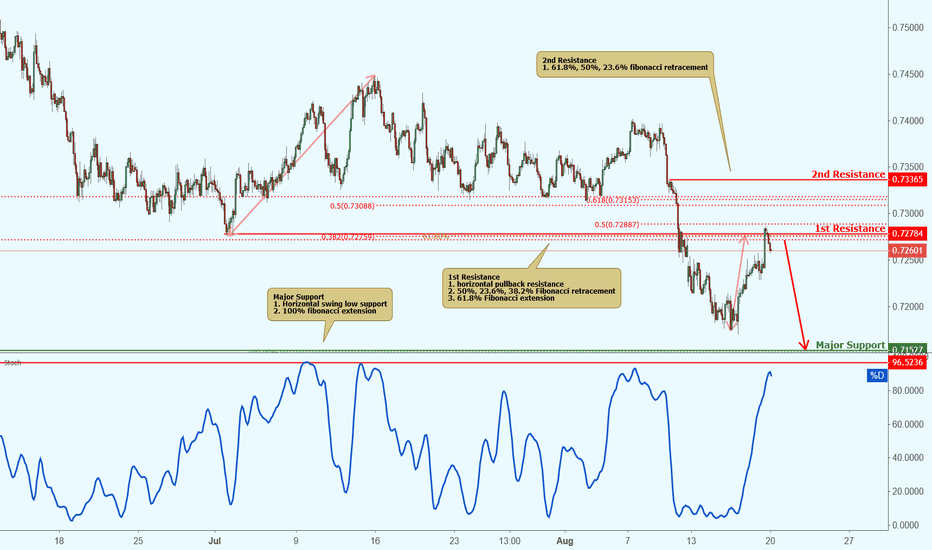

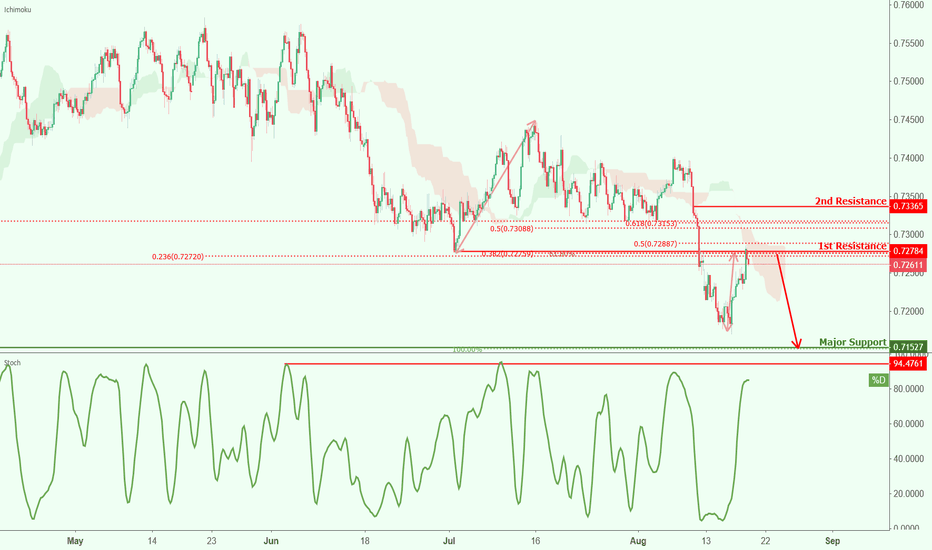

AUDCHF approaching resistance, potential drop! AUDCHF is approaching our first resistance at 0.7278 (horizontal pullback resistance, 50%, 23.6%, 38.2% Fibonacci retracement, 61.8% Fibonacci extension) and a strong reaction might occur below this level pushing price down to our major support at 0.7152 (horizontal swing low support, 100% Fibonacci extension). Ichimoku cloud is also showing signs of bearish bias in line with our bearish bias.

Stochastic (55,5,3) is also approaching our resistance and a reaction below this level might see a corresponding drop in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

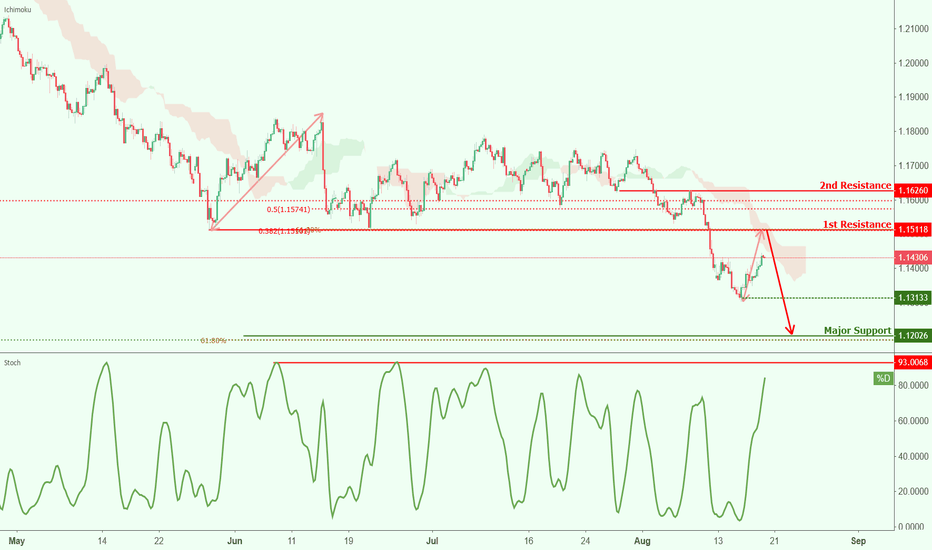

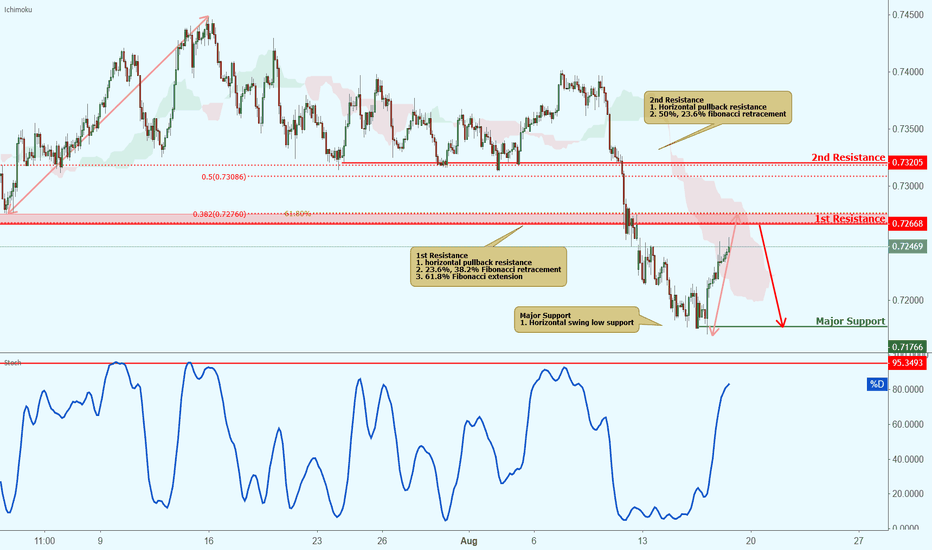

AUDCHF approaching resistance, potential drop! AUDCHF is approaching our first resistance at 0.7278 (horizontal pullback resistance, 23.6%, 38.2% Fibonacci retracement, 61.8% Fibonacci extension) and a strong reaction might occur below this level pushing price down to our major support at 0.7152 (horizontal swing low support, 100% Fibonacci extension). Ichimoku cloud is also showing signs of bearish bias in line with our bearish bias.

Stochastic (21,5,3) is also approaching our resistance and a reaction below this level might see a corresponding drop in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

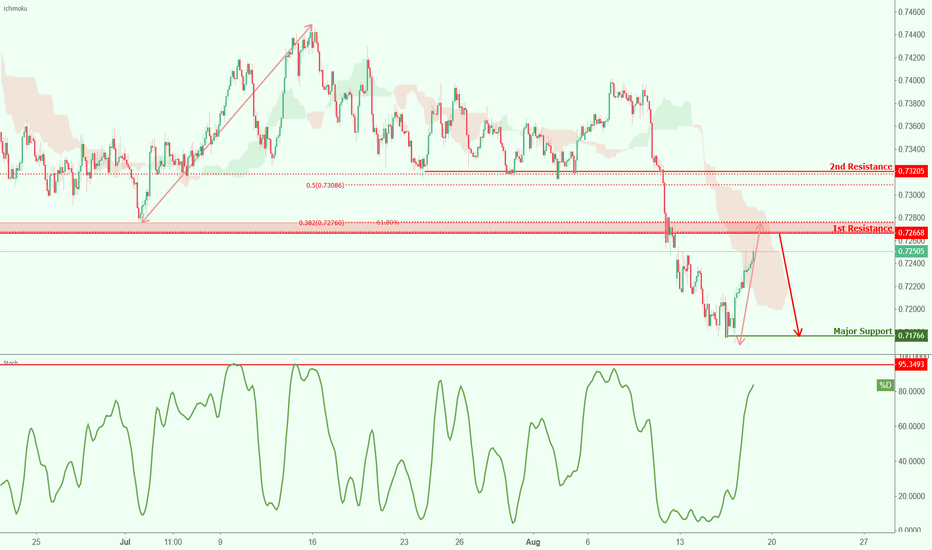

AUDCHF approaching resistance, potential drop! AUDCHF is approaching our first resistance at 0.7266 (horizontal pullback resistance, 23.6%, 38.2% Fibonacci retracement, 61.8% Fibonacci extension) and a strong reaction might occur below this level pushing price down to our major support at 0.7176 (horizontal swing low support). Ichimoku cloud is also showing signs of bearish bias in line with our bearish bias.

Stochastic (34,5,3) is also approaching our resistance and a reaction below this level might see a corresponding drop in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

AUDCHF approaching resistance, potential drop! AUDCHF is approaching our first resistance at 0.7266 (horizontal pullback resistance, 23.6%, 38.2% Fibonacci retracement, 61.8% Fibonacci extension) and a strong reaction might occur below this level pushing price down to our major support at 0.7176 (horizontal swing low support). Ichimoku cloud is also showing signs of bearish bias in line with our bearish bias.

Stochastic (34,5,3) is also approaching our resistance and a reaction below this level might see a corresponding drop in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

AUDCHF approaching support, potential bounce! Price is approaching our first support at 0.7316 (Horizontal swing low support, 76.4% Fibonacci retracement, 61.8% Fibonacci extension) where a strong bounce might occur above this level pushing price up to our major resistance at 0.7392 (horizontal swing high resistance, 61.8% Fibonacci retracement, 61.8%, 100% Fibonacci extension).

Stochastic (55,5,3) is also approaching support and a bounce off this level might see a corresponding rise in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

AUDCHF approaching support, potential bounce!Price is approaching our first support at 0.7316 (horizontal swing low support, 61.8% fibonacci extension, 76.4% fibonacci retracement) and a strong bounce might occur above this level pushing price up to our major resistance at 0.7396 (horizontal swing high resistance, 61.8% Fibonacci retracement, 100% Fibonacci extension).

Stochastic (55,5,3) is also approaching our support and a bounce off this level might be a good precursor for a potential rise in price.

Trading CFDs on margin carries high risk.

Losses can exceed the initial investment so please ensure you fully understand the risks.

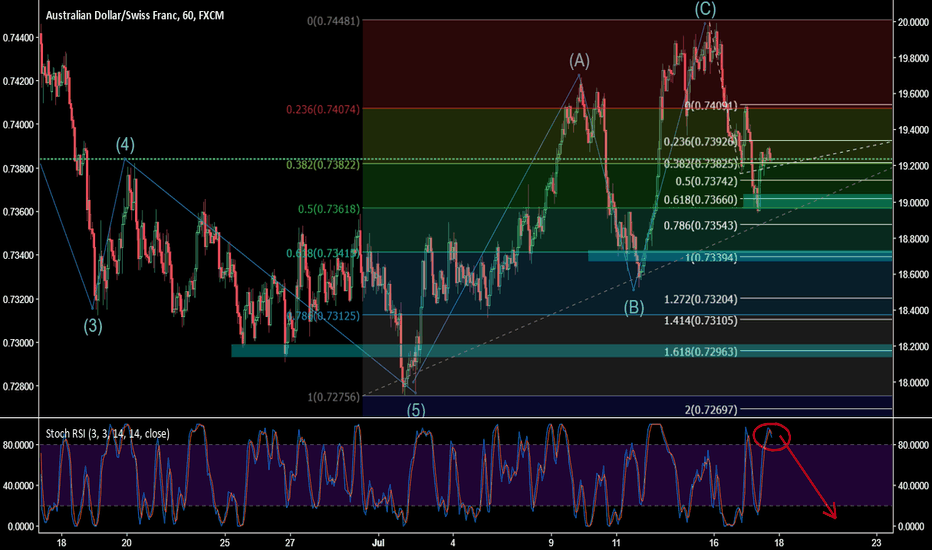

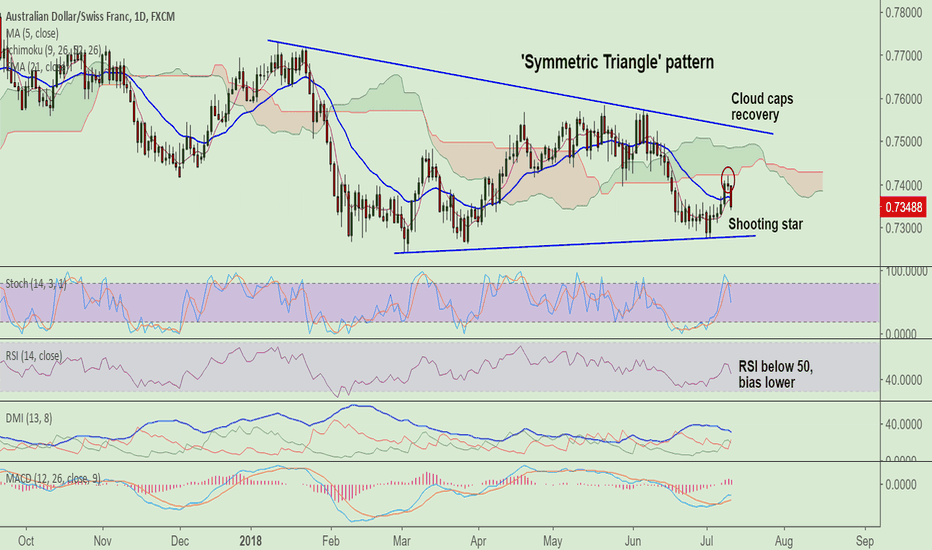

AUD/CHF slumps, 'Shooting Star' suggests further declinesAUD/CHF extends weakness after upside was rejected at daily cloud.

We evidence a 'Shooting Star' pattern formed on the daily charts which supports further weakness in the pair.

Price action has retraced below 21-EMA and 5-DMA, eyes major trendline support (Triangle Base) at 0.7280.

Breach at 'Triangle Base' raises scope then for test of 0.7242 (2018 lows).

Bearish invalidation only on break above cloud base.

Support levels - 0.73, 0.7280 (trendline), 0.7263 (Mar 28 low), 0.7242 (2018 lows till date)

Resistance levels - 0.7366 (5-DMA), 0.7370 (21-EMA), 0.74

Good to stay short on upticks, SL: 0.7375, TP: 0.73/ 0.7280/ 0.7245