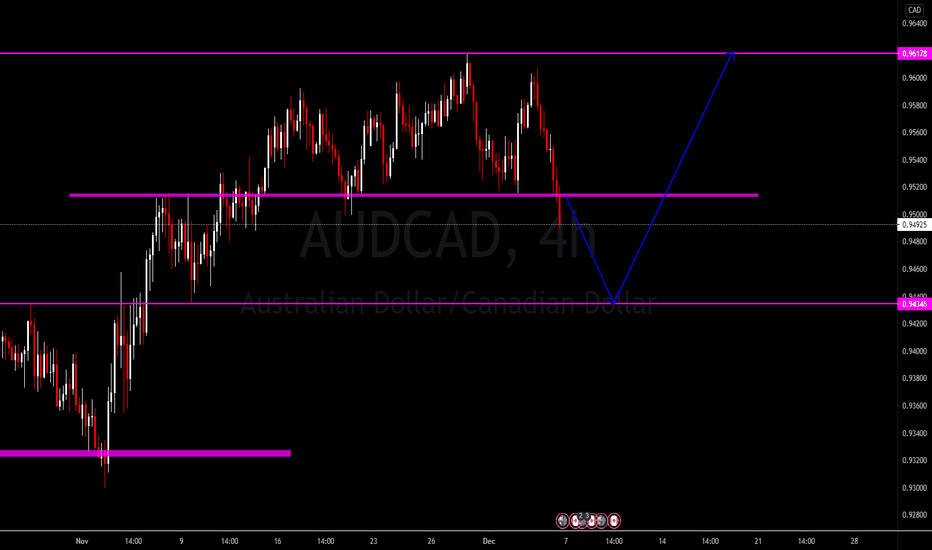

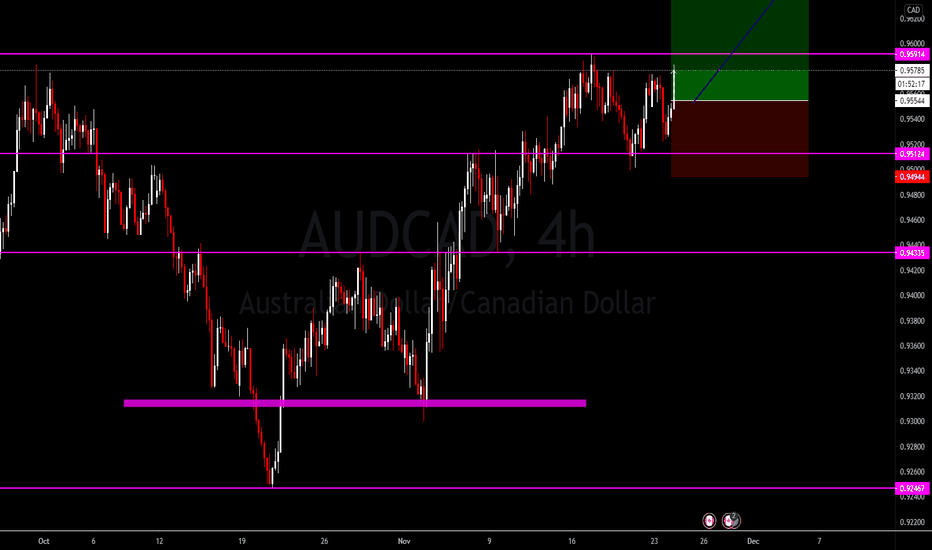

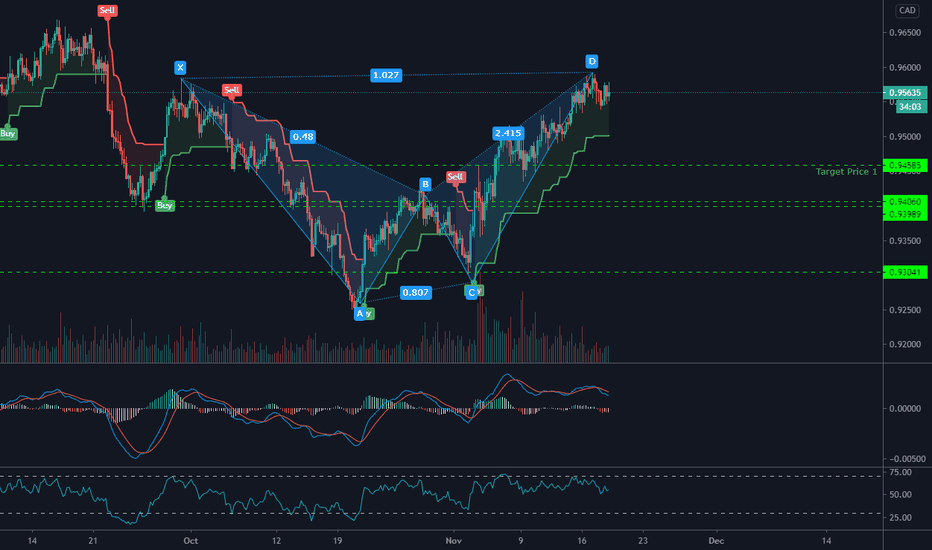

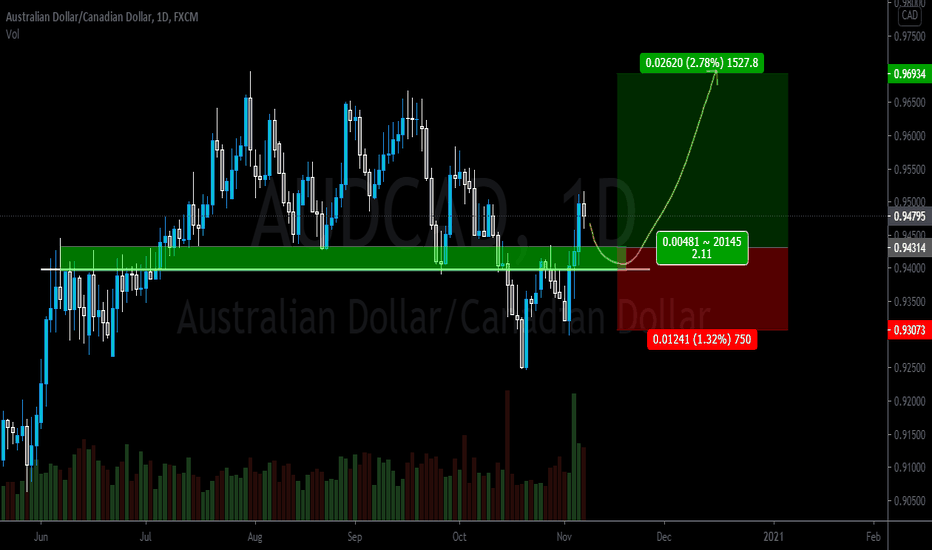

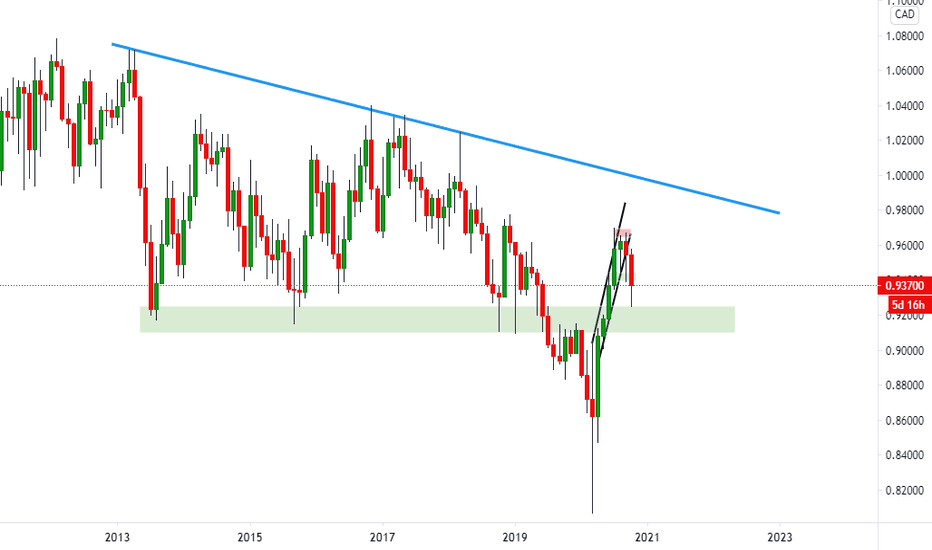

AudCad- drop of 250+ pips to follow?For the past 6 months or so, AudCad traded in a range between 0.97 and 0.93 (more or less). Now the pair just made the first leg down from the top of the range and I expect this drop to continue.

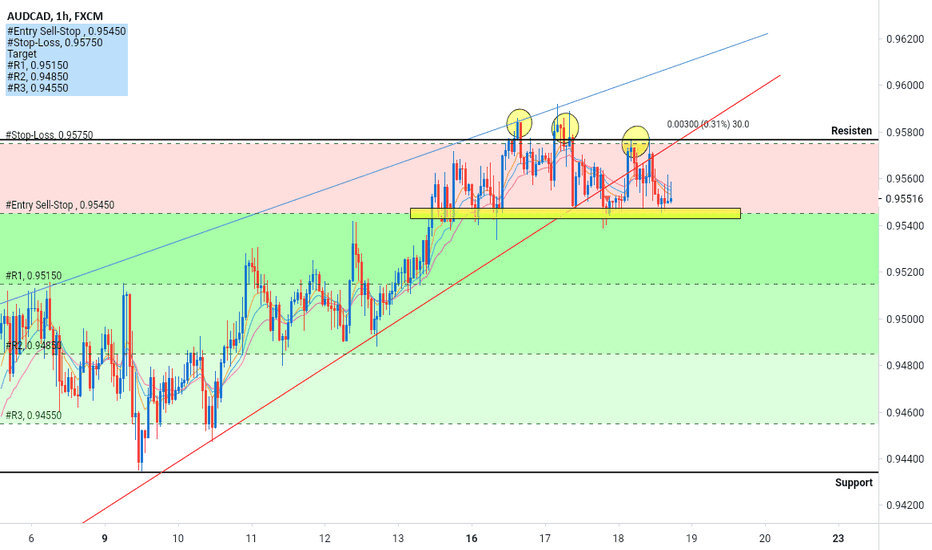

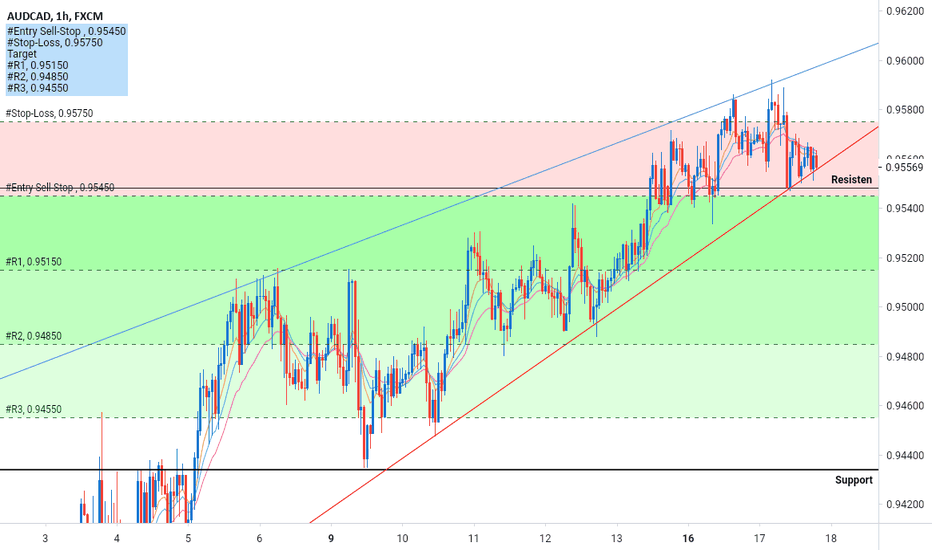

Sell rallies is my strategy and 0.9520-0.9550 should provide a good sell zone.

My outlook is bearish as long as the pair is under 0.9650 on a daily close bases

Audcadforecast

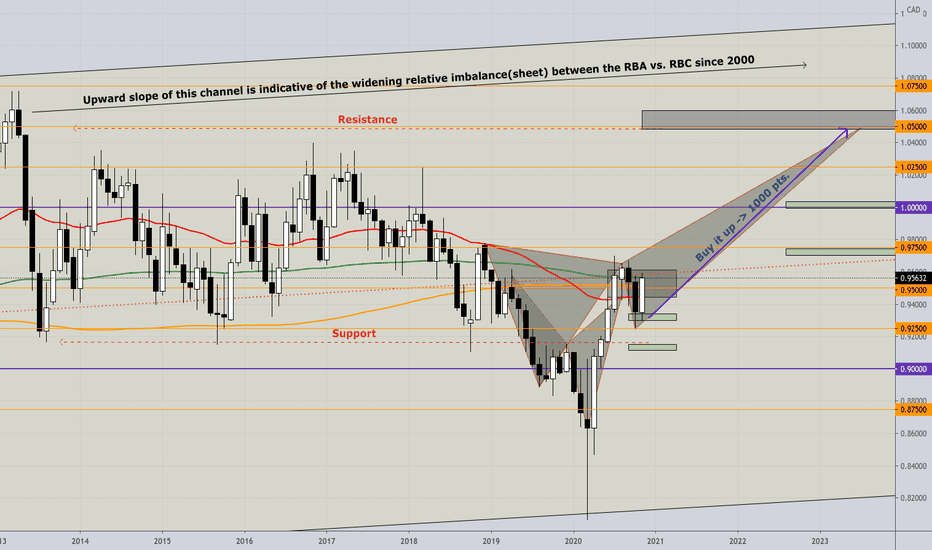

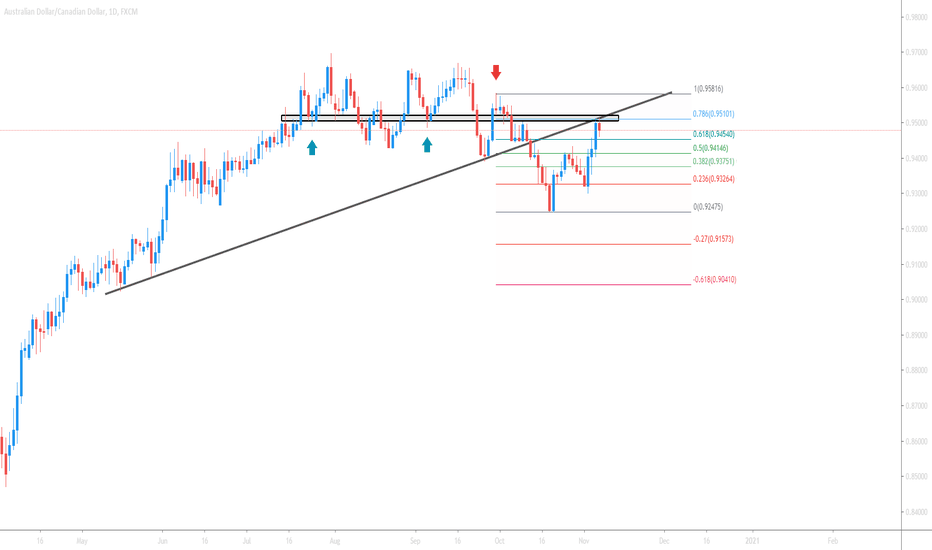

AUDCAD - LONG; LongtermHere the upward sloping channel is indicative of the relative and ever increasing deterioration of the Royal Bank of Canada's balance sheet relative that of the Royal Bank of Australia's. - A significant and still increasing fiscal power versus new debt issuance capacity, advantage RBA. This unlikely to change anytime soon - i.e. for years if not more. Naturally this relationship remains entirely dependent on China's economic status, at any give time.

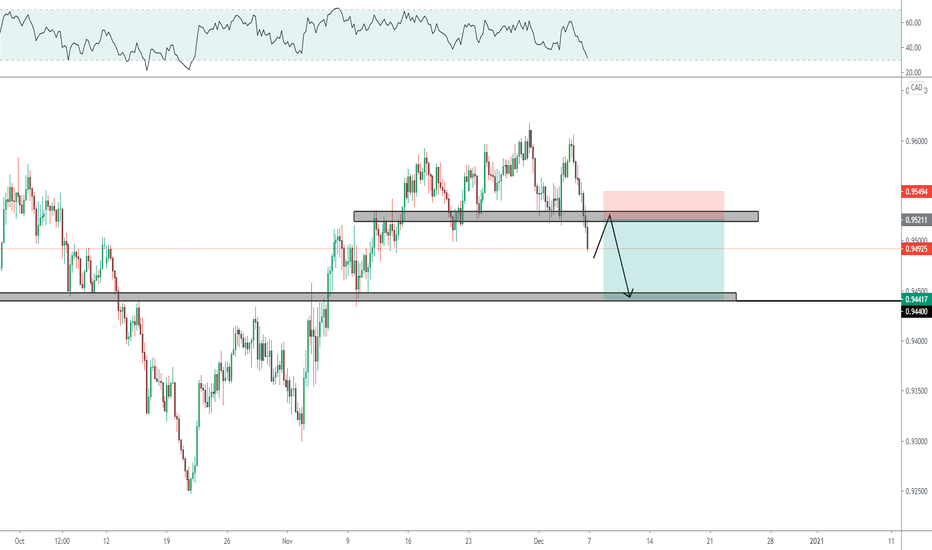

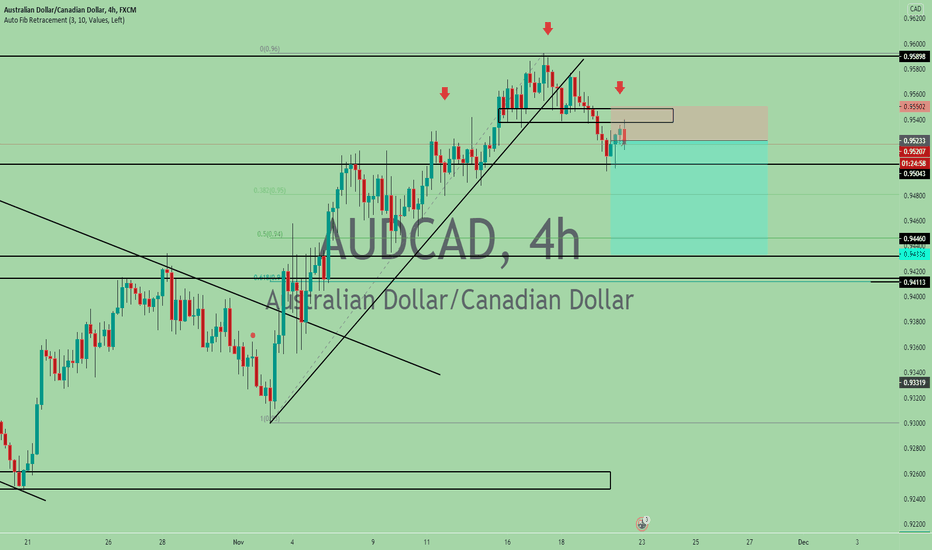

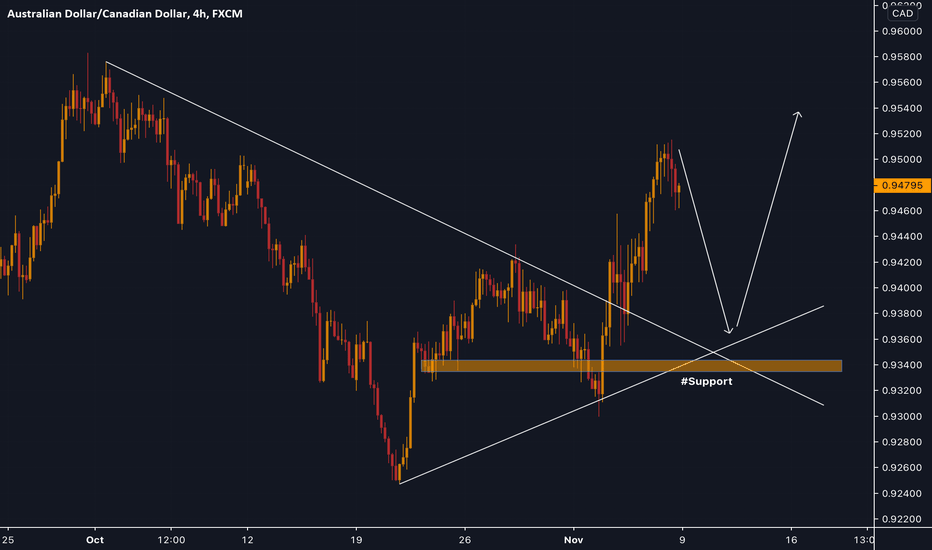

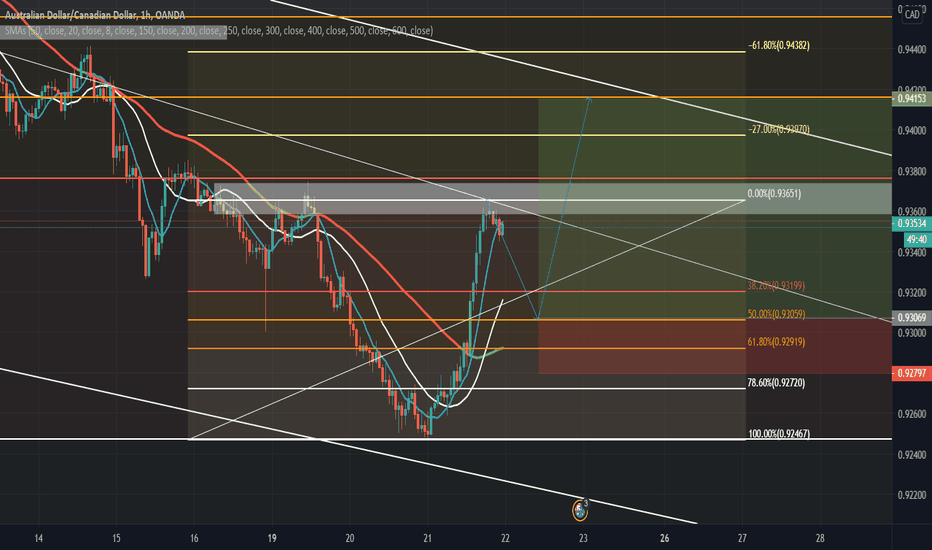

AUDCAD It will go to the rising trend line +180 PipsWelcome Back.

Please support this idea with LIKE if you find it useful.

***

It may head to the downside to retest the rising trend line, in case the trend is not broken, it will head to the upside and greater resistance will form than the previous one.

***

Here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

Remember this analysis is not 100% accurate No single analysis is To make a decision follow your own thoughts.

***

The information given is not a Financial Advice.

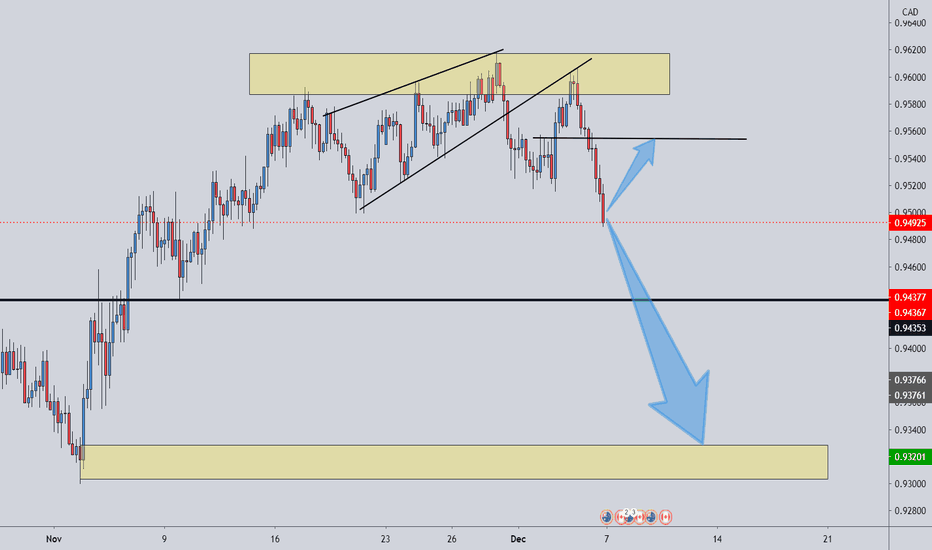

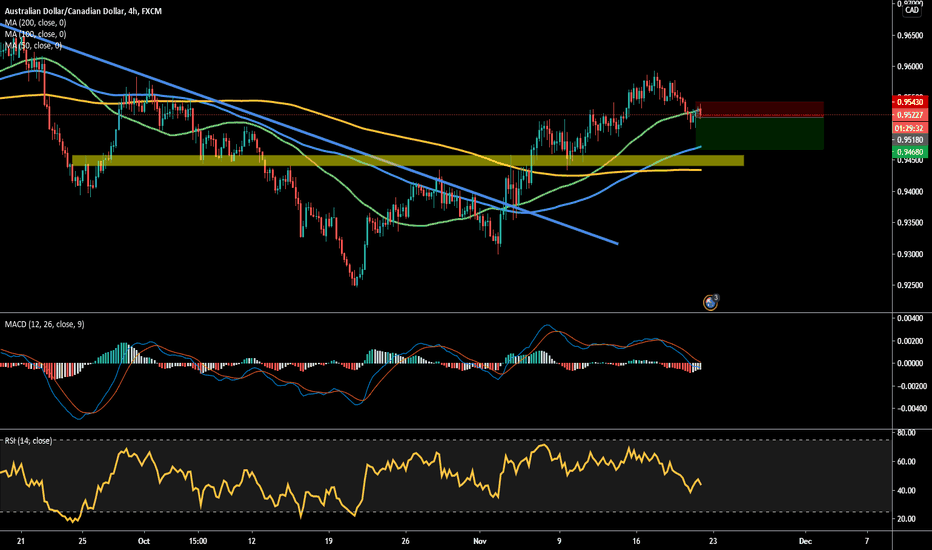

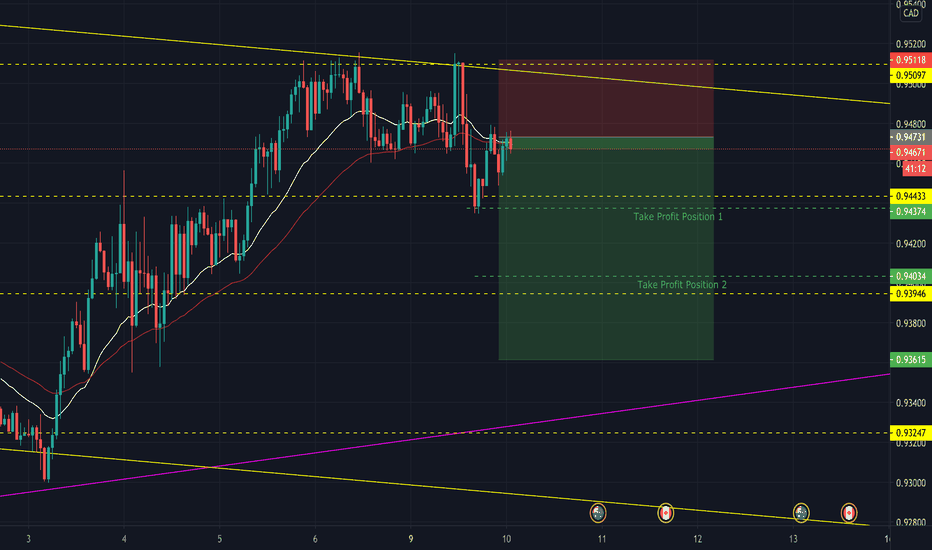

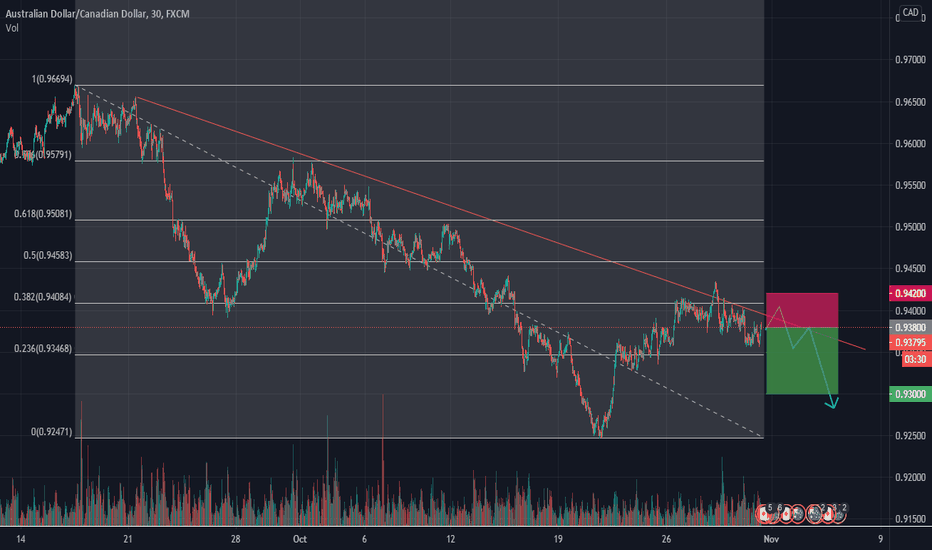

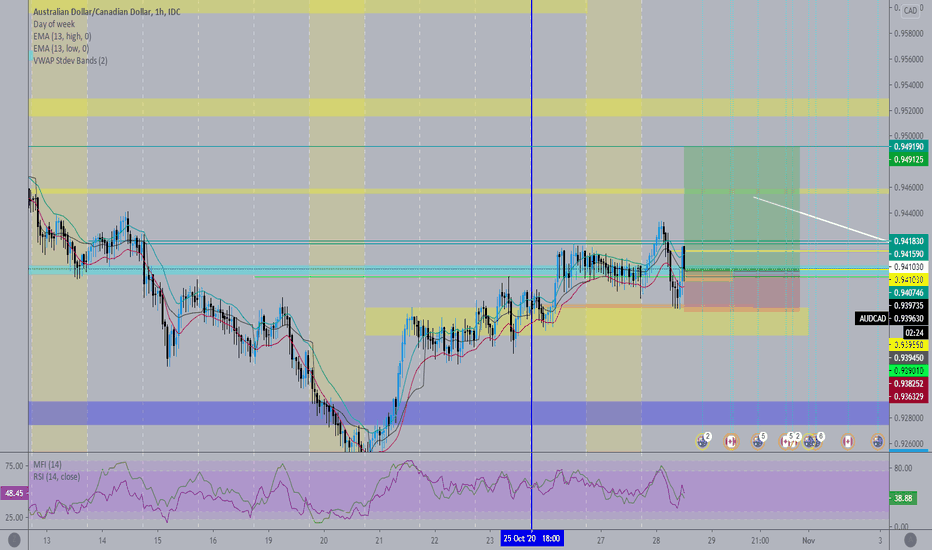

AUDCAD - SHORTAUDCAD is on a downward trend and is capped by the fibbo resistance around 0.9410 and the downward trend line just below that. The asset remains responsive to risk off mood which we could see play out with the current volatility that lies ahead around the US election. We saw it test the 0.9347 fibbo support a few days ago and have since bounced. I remain a seller of the rallies as I feel that the market is trading a blue wave at the moment and therefore and change of view no matter how big or small, will cause a risk off mood and this trade should come into play. I have opened a short at 0.9360, SL 0.940 (on the close) and finally a TP 1: 0.9347 TP2: 0.9303.

AUDCAD - SHORTAUDCAD is on a downward trend and is capped by the fibbo resistance around 0.9409 and the downward trend line just above that. The asset remains responsive to risk off mood which we could see play out with the current volatility that lies ahead around the US election. We saw it test the 0.9347 fibbo support yesterday and have since bounced. I remain a seller of the rally's. I have opened a short at 0.9380, SL 0.9420 (on the close) and finally a TP 1: 0.9347 TP2: 0.9303.

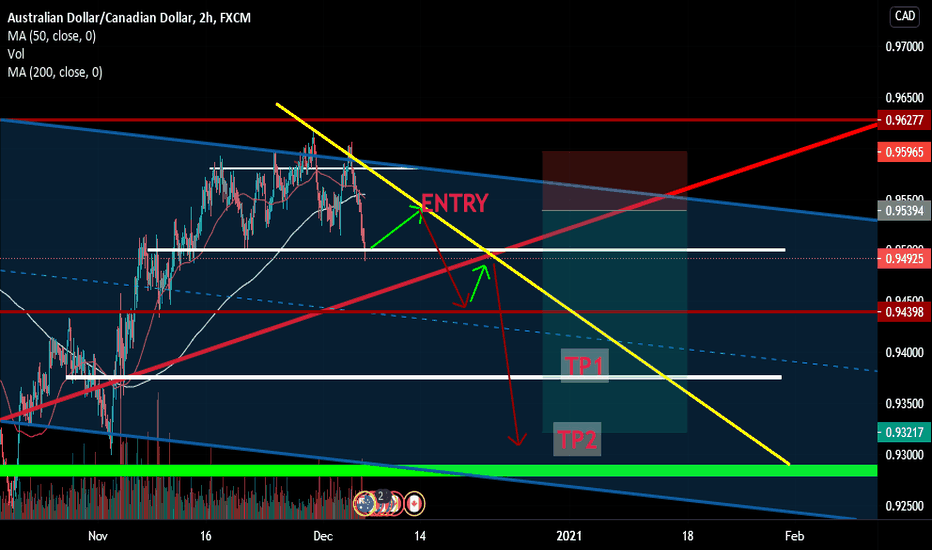

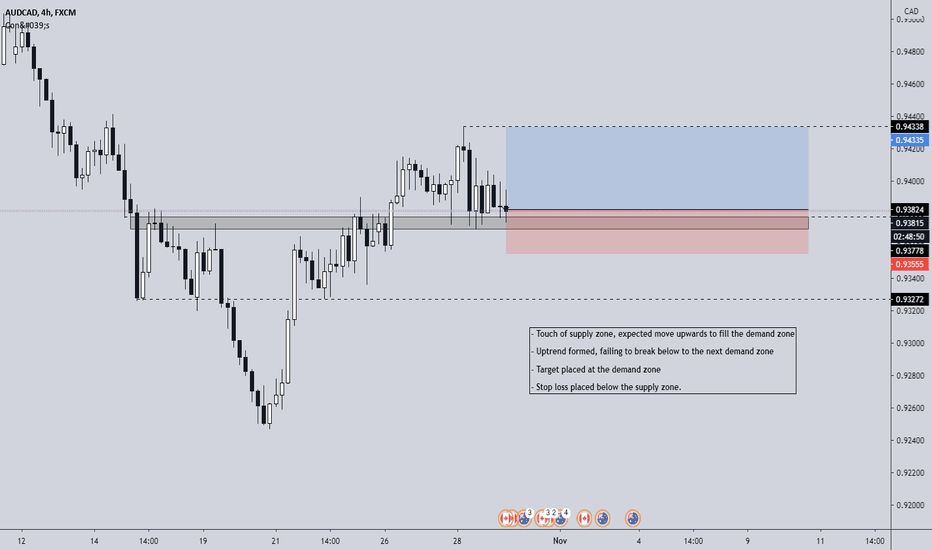

AUD/CAD Daytrade-execution!! SHORTAUD/CAD Daytrade-execution!! SHORT

27/OCT

Market-Sell : 0.93930

Stop-loss : Close Break 0.94240

Target : 0.92100

note :

Our chart is simple as possible to make it easier for you to see the chart.

- This is an execution signal. you can enter the market now

Good luck 👍

AUDCAD ideia-The ideia here is to wait for a pullback into the 50% fib area in the 1h candle (around 0.93070). At that point, we can enter in a long position with at takeprofit at 0.9415 and SL 0.92795.

-Since it will probabliy take a few hours, we can leave a buy limit around 0.93070

- For the more conservative people, you can wait for a confirmation candle.

(Analysing the 1d, 4h and 1h candle)