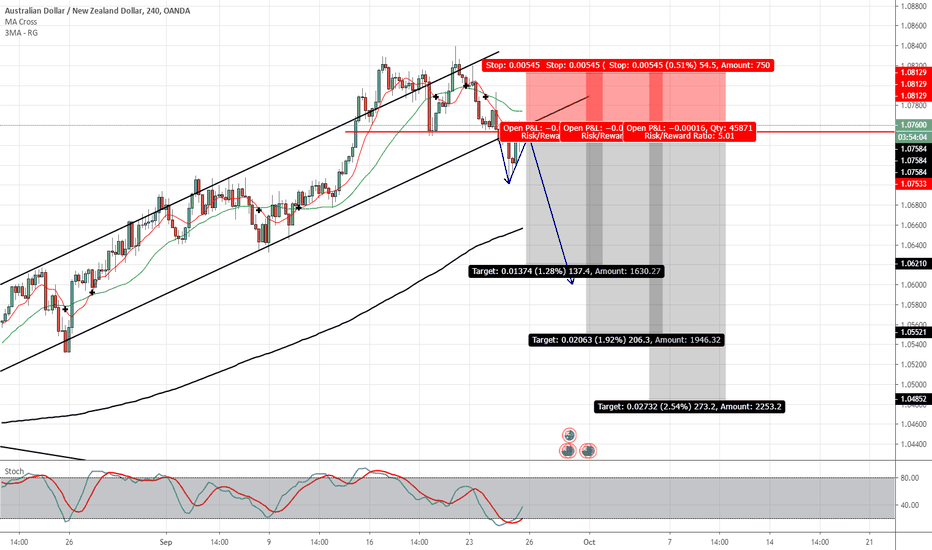

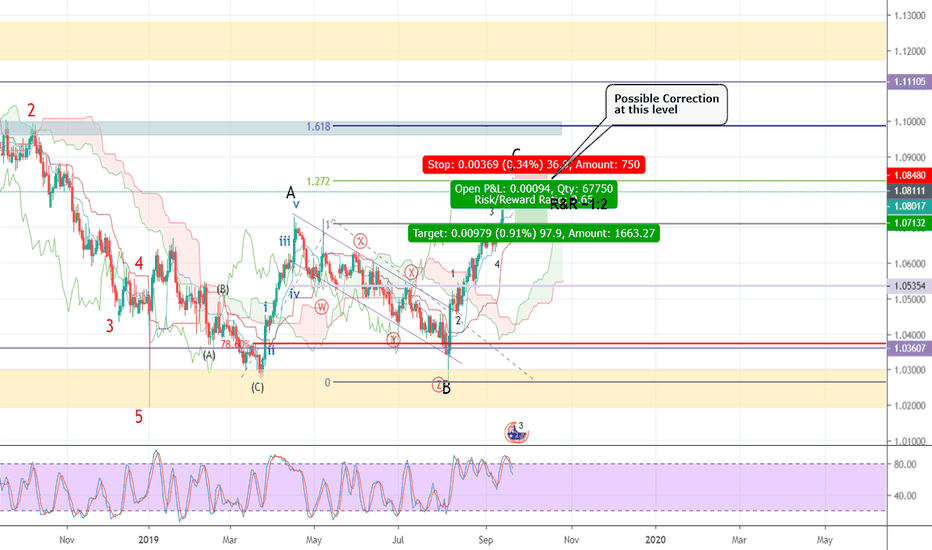

AUDNZD ShortA L O H A

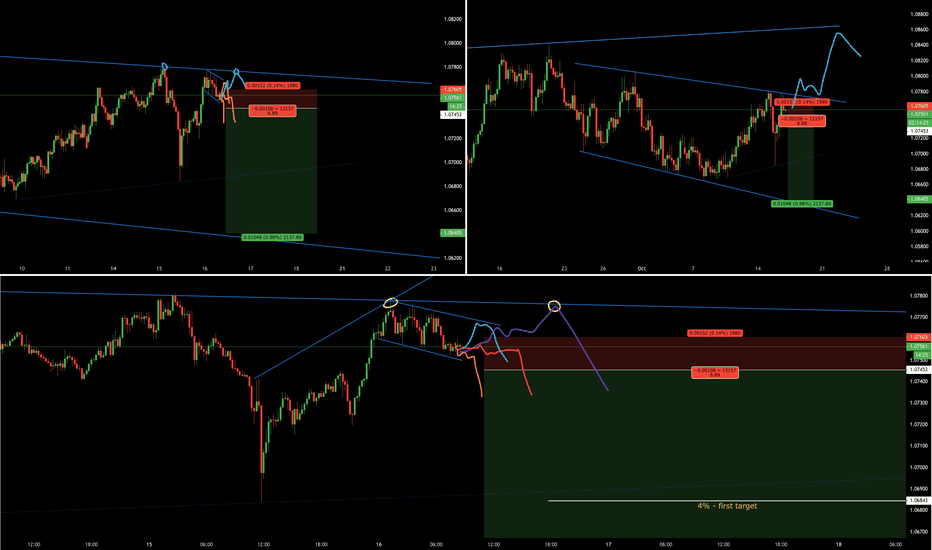

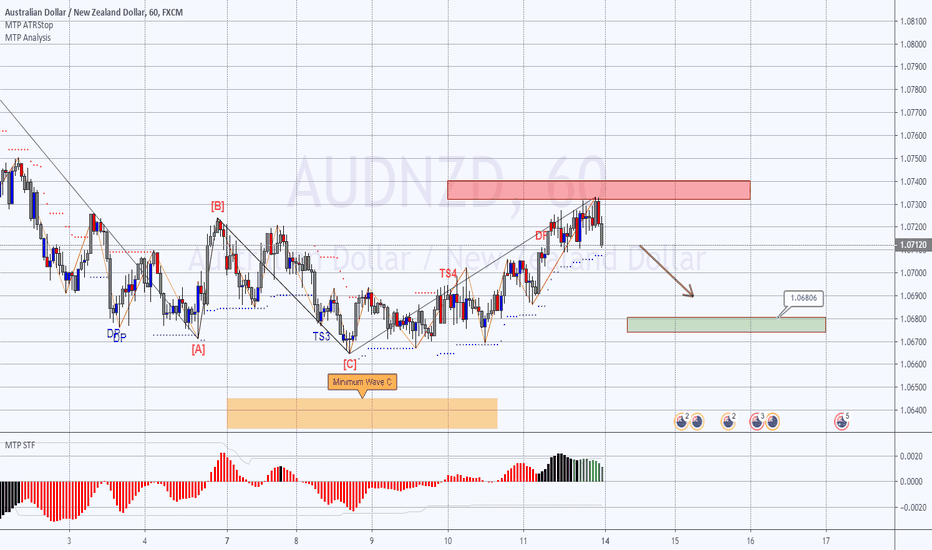

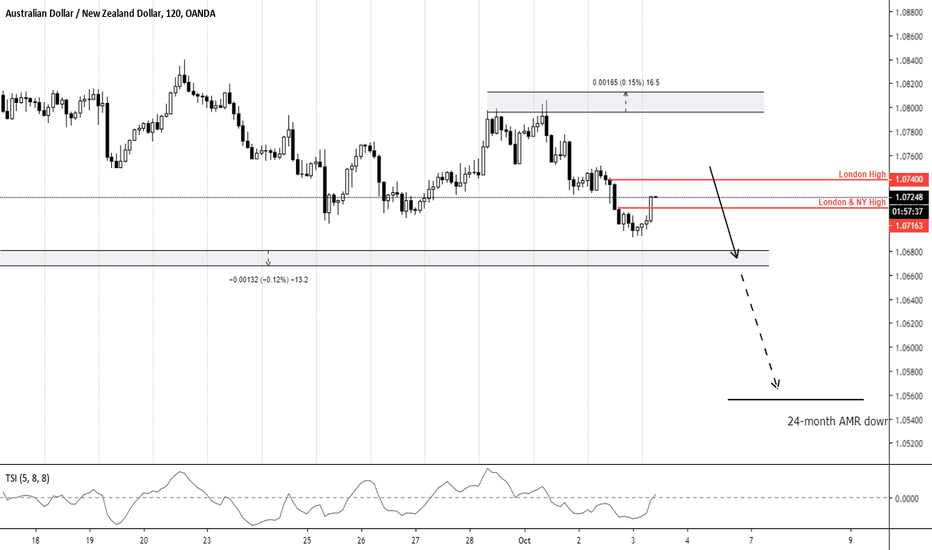

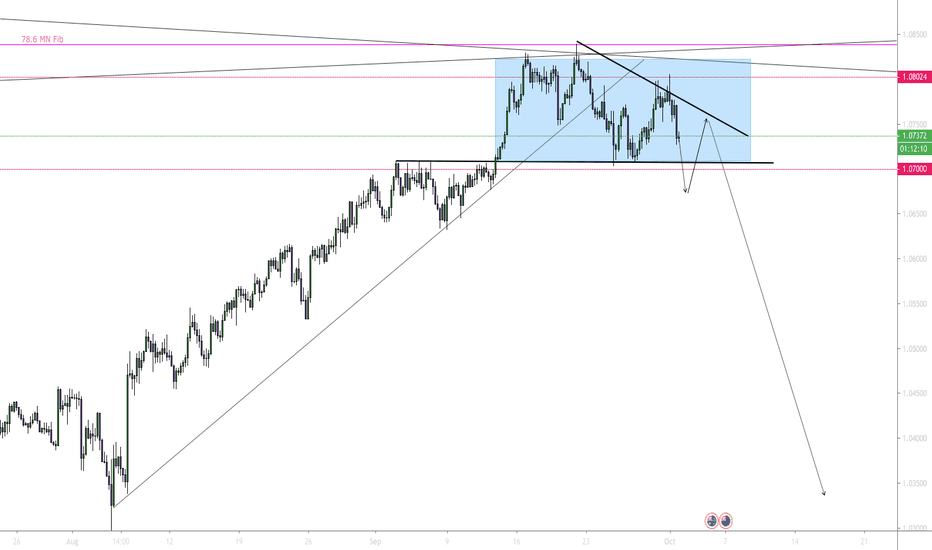

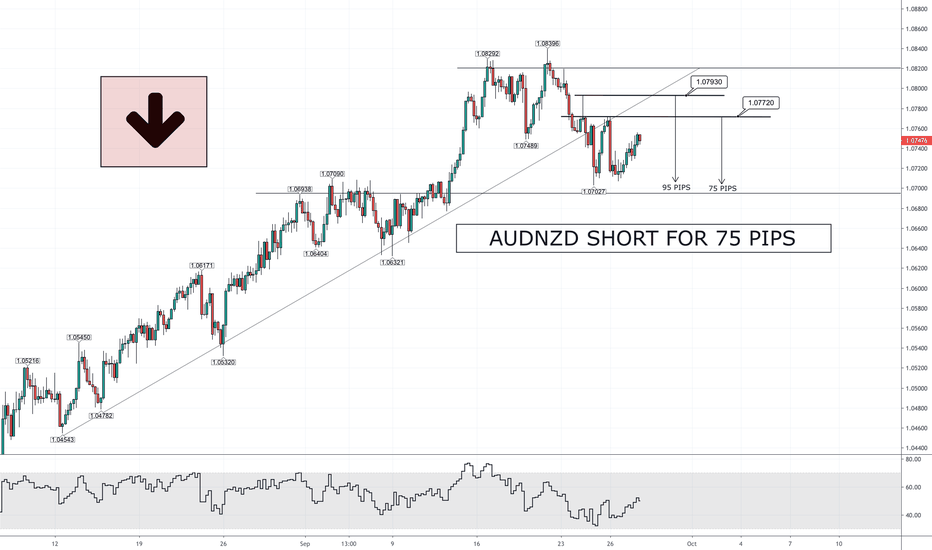

- Daily in area of scoop pattern creating a double top and currently in a corrections which mean it can still head up and touch the outer trend line creating even better scoop/double touch pattern.

Multiple ways this can go but the setup are really clean to me, when price moves i think there will be a lot of opportunities here.

Let me know what you guys think!

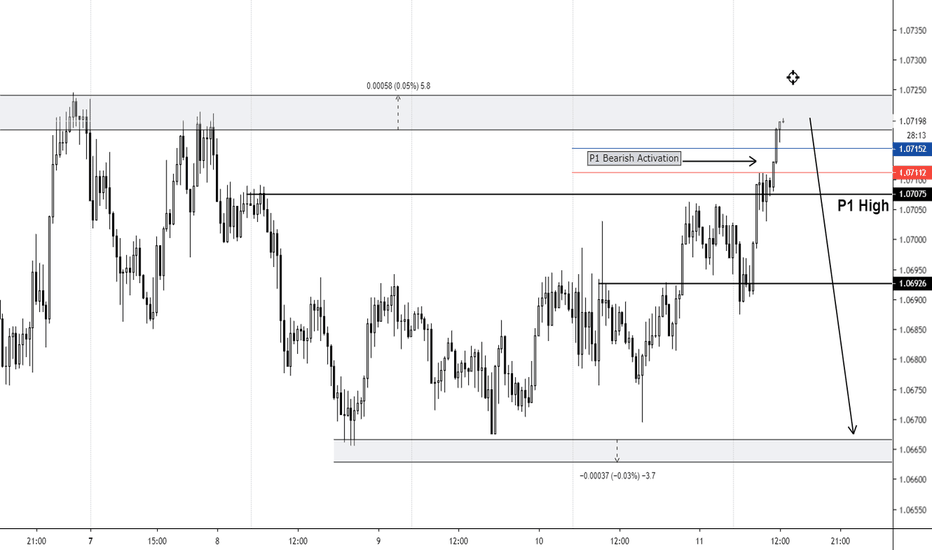

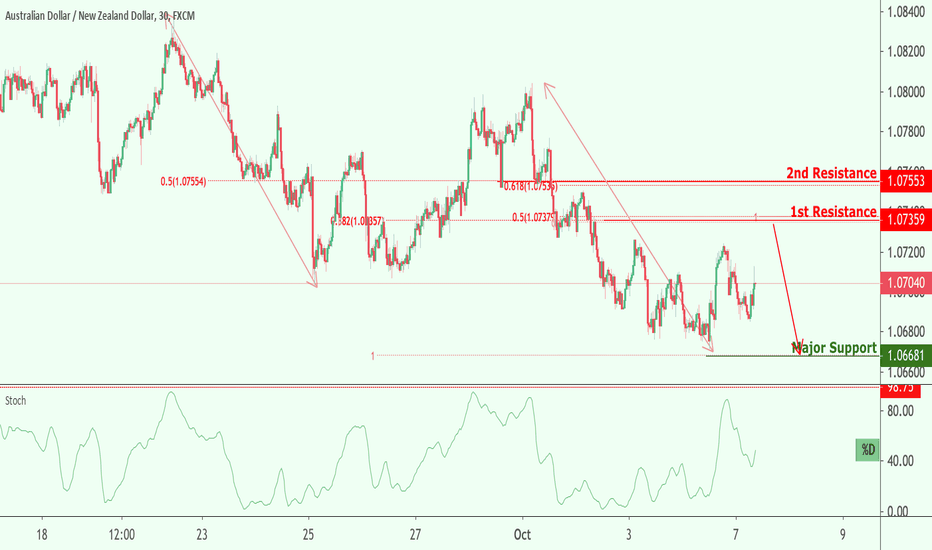

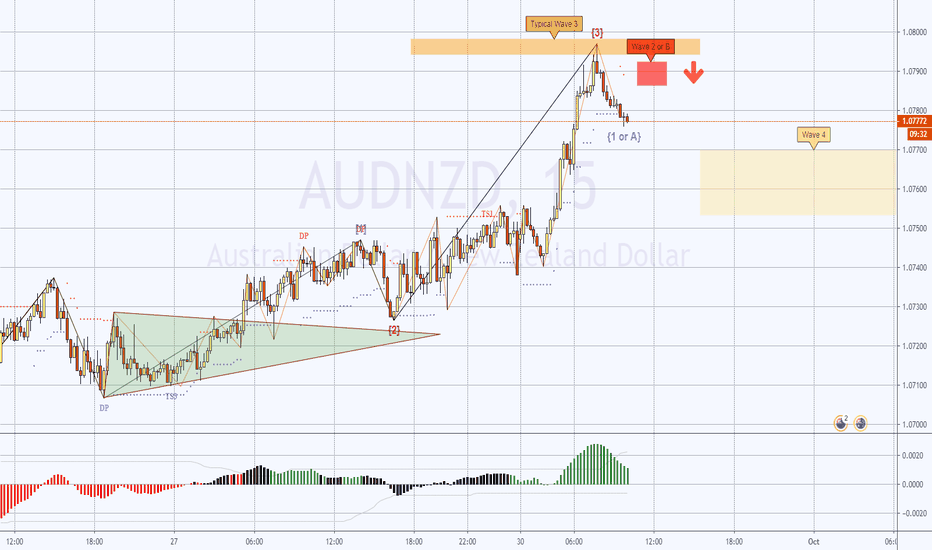

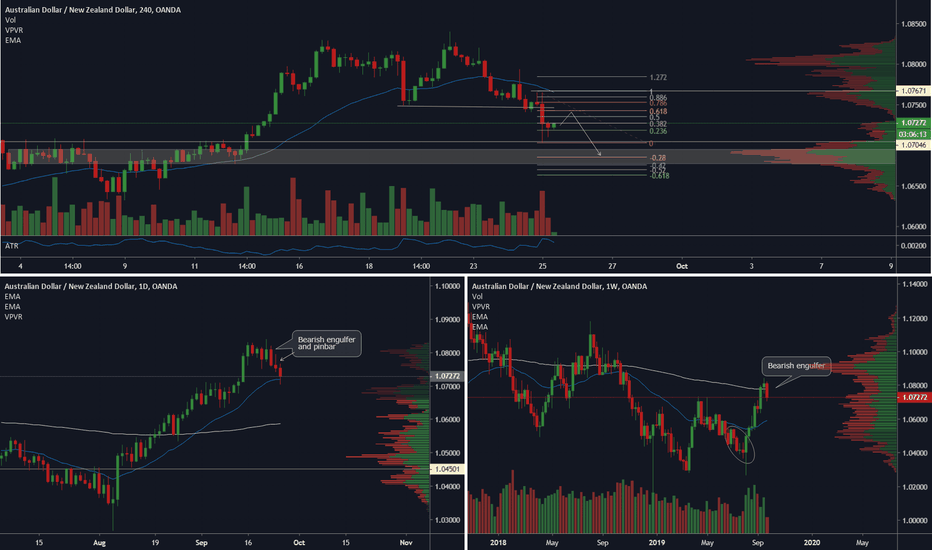

15 min - correcting/ hover after a small impulse down within a descending channel.few potential that it could reject off the dotted trend line but with strong momentum across the Aussie. it's possible to break down further. maybe this is it.

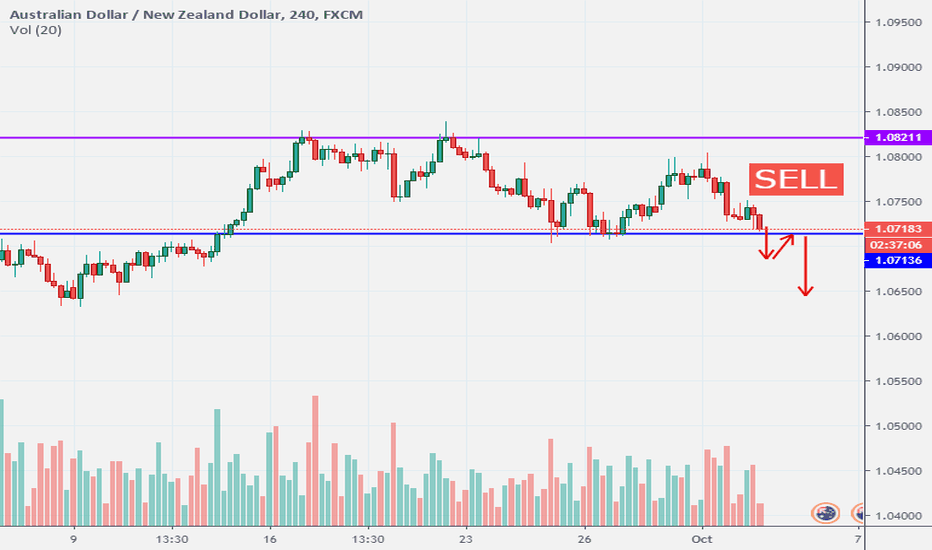

4hr - letting the market set this up, if there is a bearish close that engulfs the previous bull candle, a type of confirmation of the double top within the descending channel.

1hr - Its not a strong bearish impulse rejecting and could be forming a bigger correction.

Although I do see some bullish opportunities it's possible they will be short term, overall looking to sell this pair.

PS: what does "beyond technical analysis mean?" lol

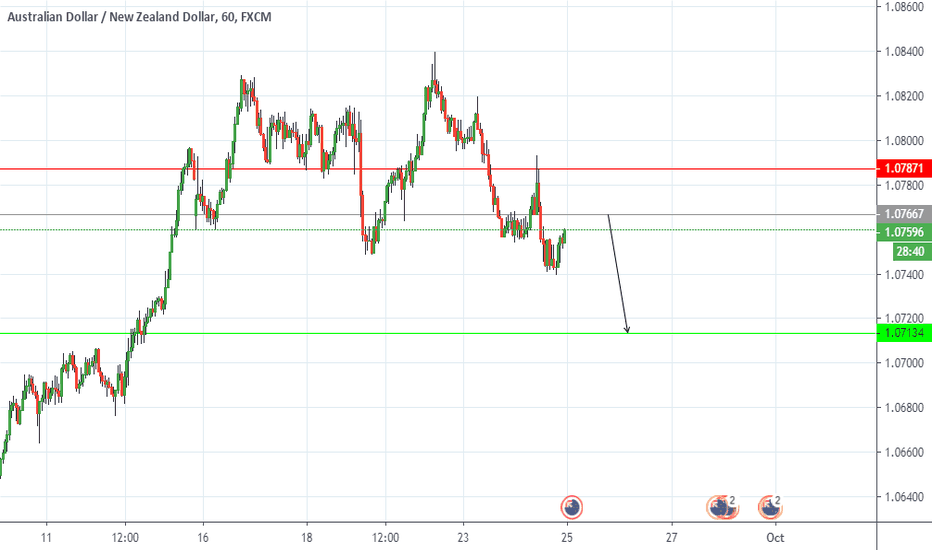

Audnzdshort

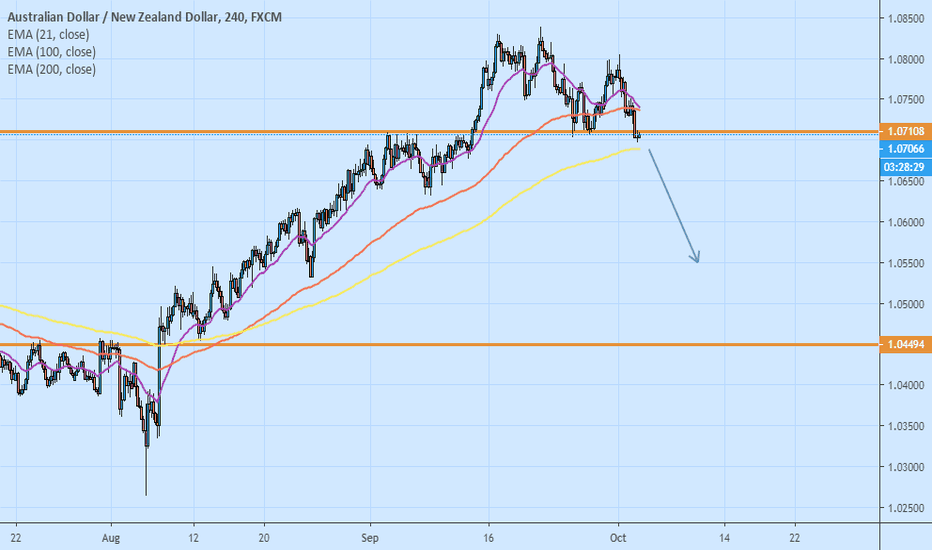

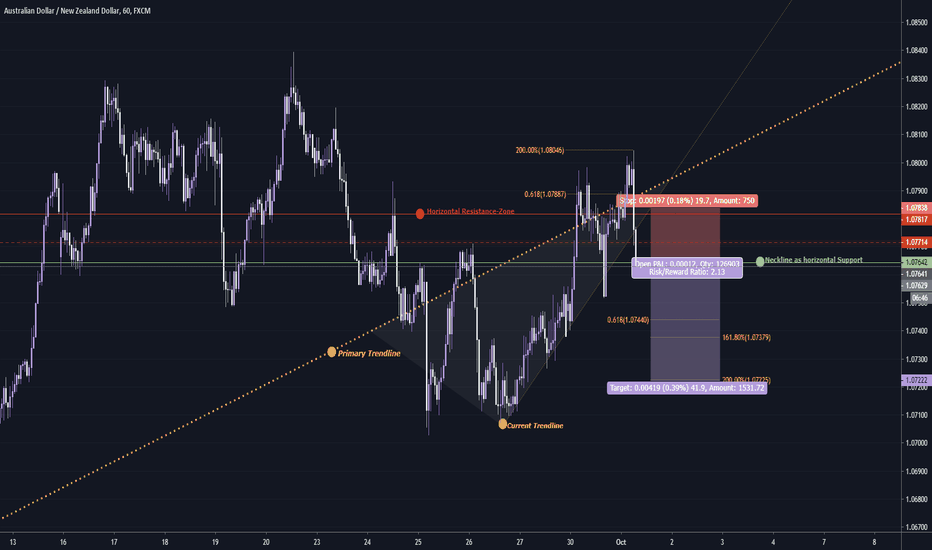

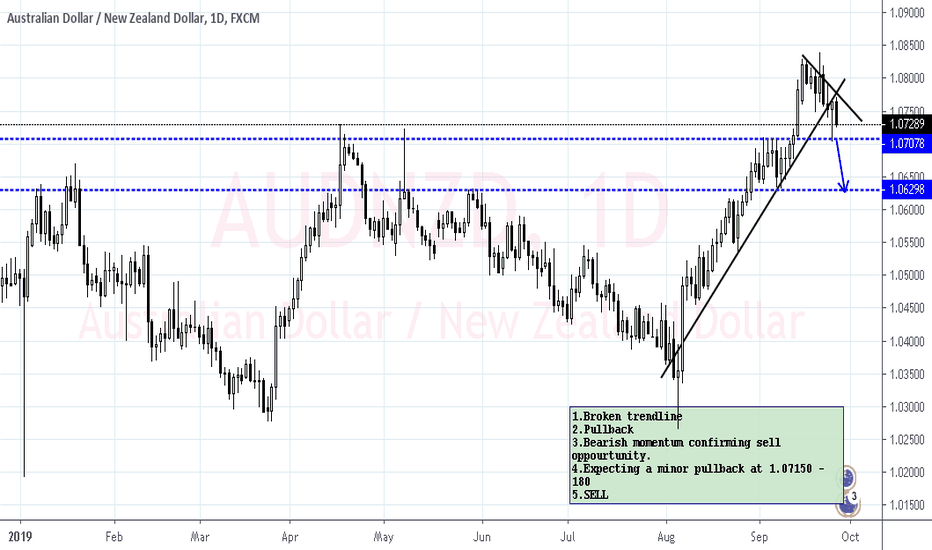

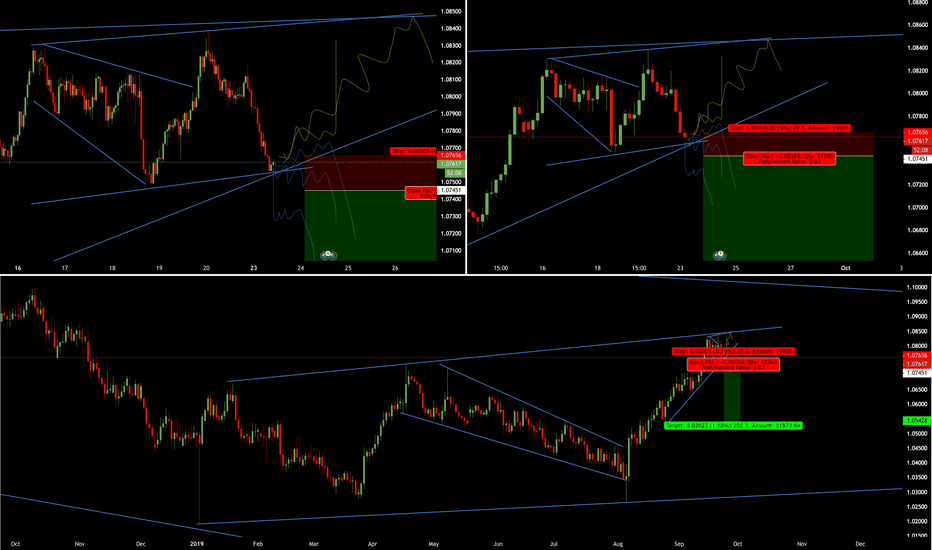

AUD/NZD: DAytrade-OPPORTUNITYHey tradomaniacs,

welcome to another free signal of WEEK #40 Nr.2!

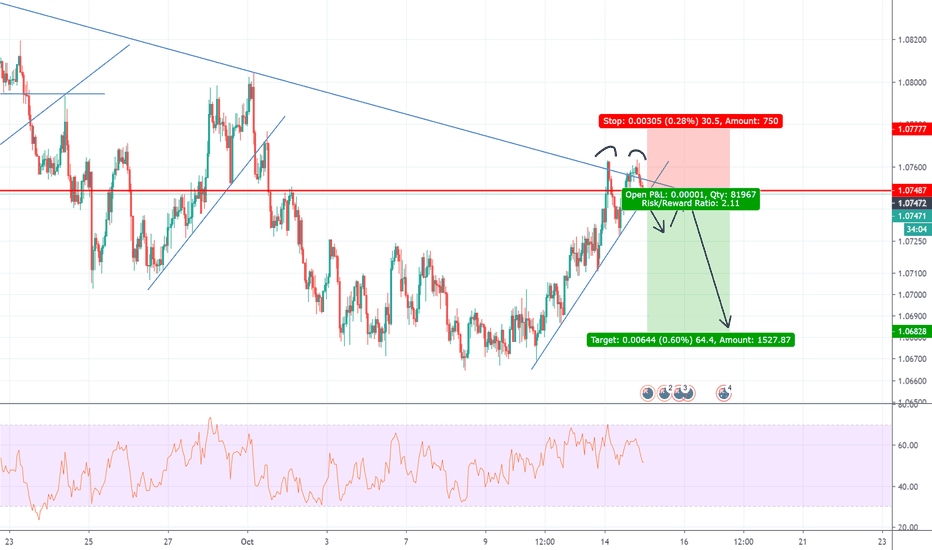

Important: Wait for the market to break below the neckline.

After that we want to see a retest and rejection before we sell.

-----------------------------

Type: Daytrade

Sell here: 1,07643

Stop-Loss: 1,07838

Target 1: 1,07443

Target 2: 1,07372

Target 3: 1,07222

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

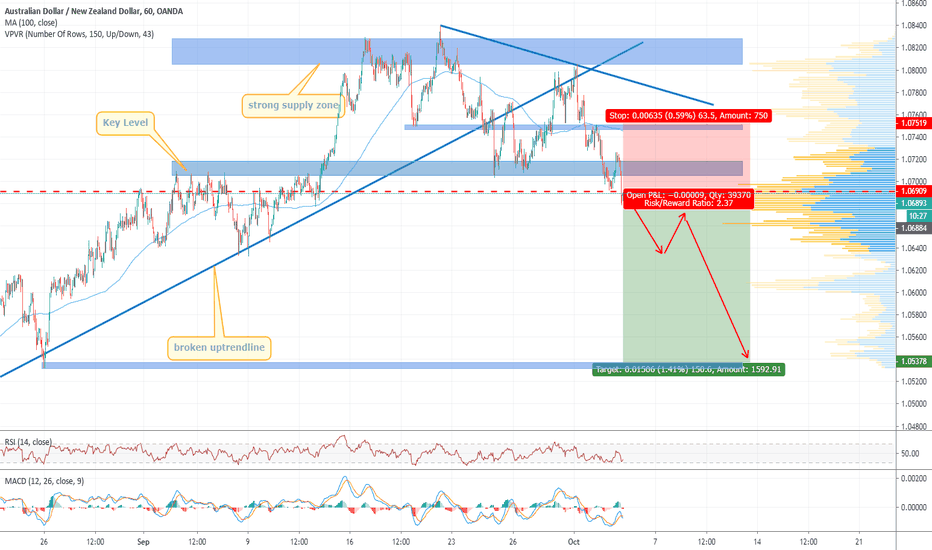

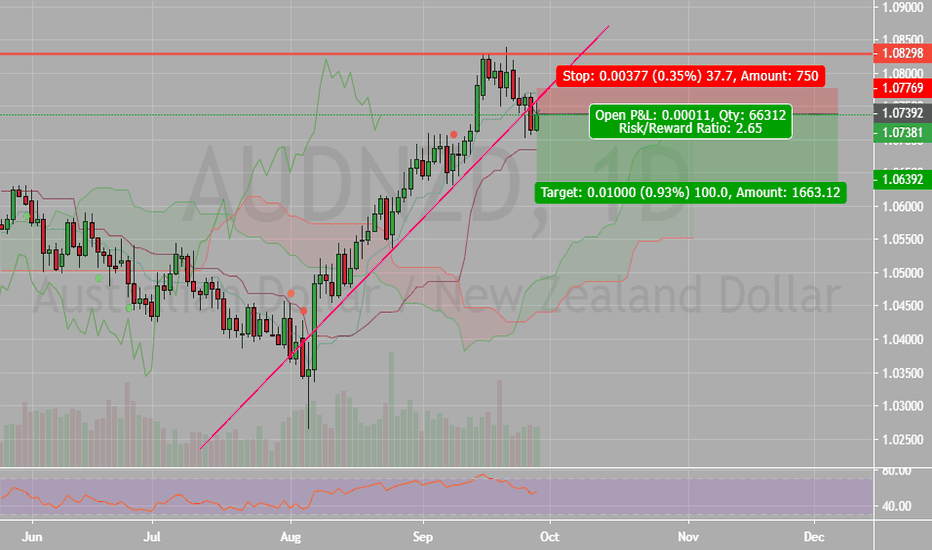

AUDNZD ShortPlenty of activity in the markets to start the week! AUDNZD moved nicely.

There was an opportunity for a short on the second touch of the outer trend line (reversal high test followed by bearish engulfing candle on the 4HR chart)

D - Still a couple of hours away from the close but price is in an overall valuable area as it is just after the third touch within a big ascending channel.

4hr - breaking down nicely but remaining patient for a corrective structure in a possible continuation. a go to entry is a hover/ascending channel near the double bottom/ascneding trend line

1hr - similar to the 4hr, it is in an area of a double bottom and can possible head back up for a third touch within a bigger corrective pattern, however its more probable it will continue down if there is a nice correction.

currently still in the USDJPY position- was taken out on the first trade from spreads and gapping but was reentered last night over, yen pairs looking nice for shorting!