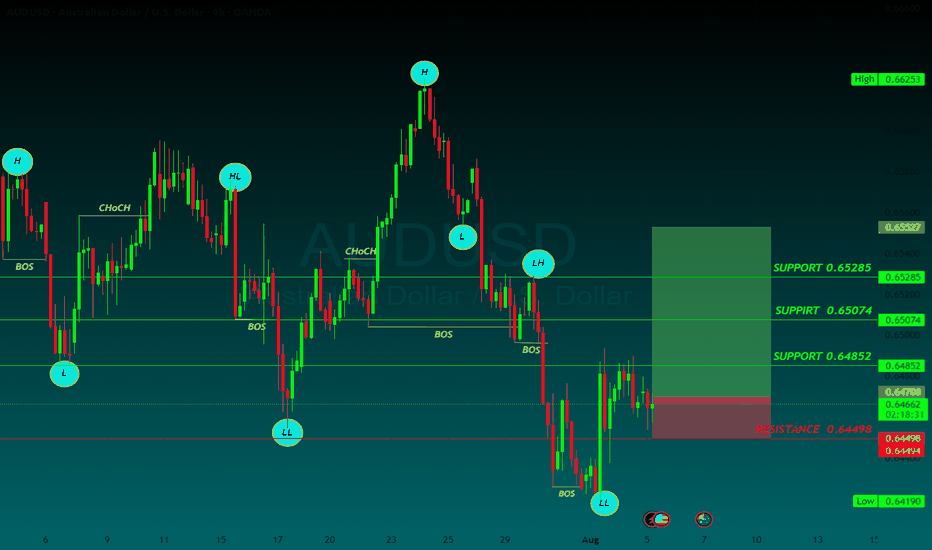

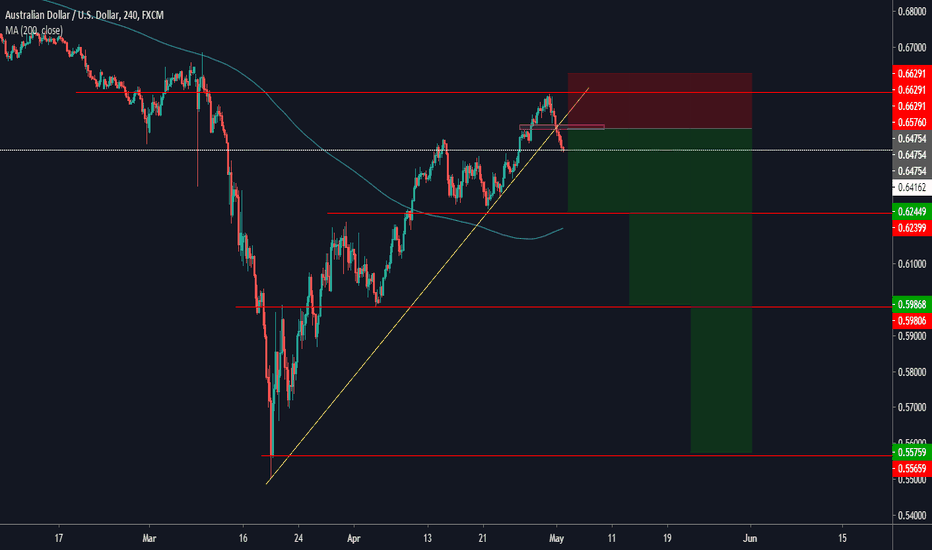

AUDUSD BUY

AUD/USD rises to near 0.6480 as accelerating Fed dovish bets weigh on US Dollar

The AUD/USD pair moves higher to near 0.6480 during the European trading session on Monday. The Aussie pair gains as demand for risk-perceived assets has increased, following an increase in market expectations that the Fed could resume its monetary expansion cycle in the September meeting

The AUD/USD currency pair, commonly known as the “Aussie”, represents how many US dollars (the quote currency) are needed to purchase one Australian dollar (the base currency). Alongside the New Zealand Dollar (NZD) and the Canadian Dollar (CAD), the AUD is considered a commodity currency due to Australia’s significant exports of raw materials such as precious metals, Oil, and agricultural products.

The Reserve Bank of Australia (RBA) has historically maintained higher interest rates compared to other industrialized nations. Combined with the relatively high liquidity of the AUD, this has made the AUD attractive for carry traders looking for higher yields.

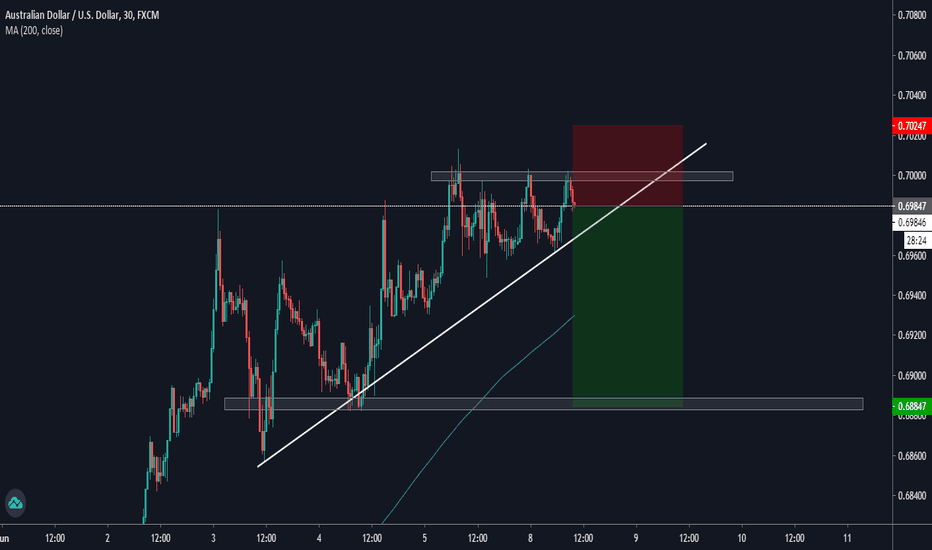

SUPPORT 0.64852

SUPPORT 0.65074

SUPPORT 0.65285

RESISTANCE 0.64498

Audusdchart

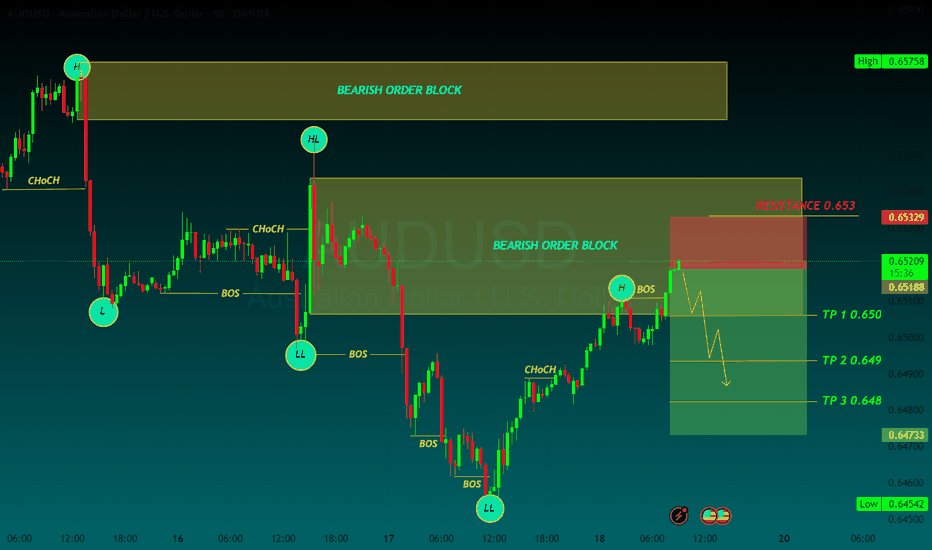

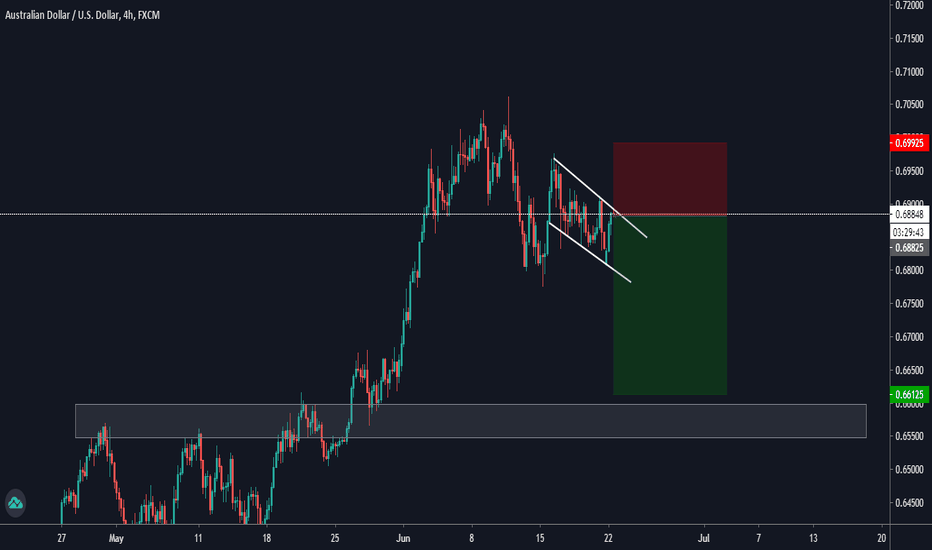

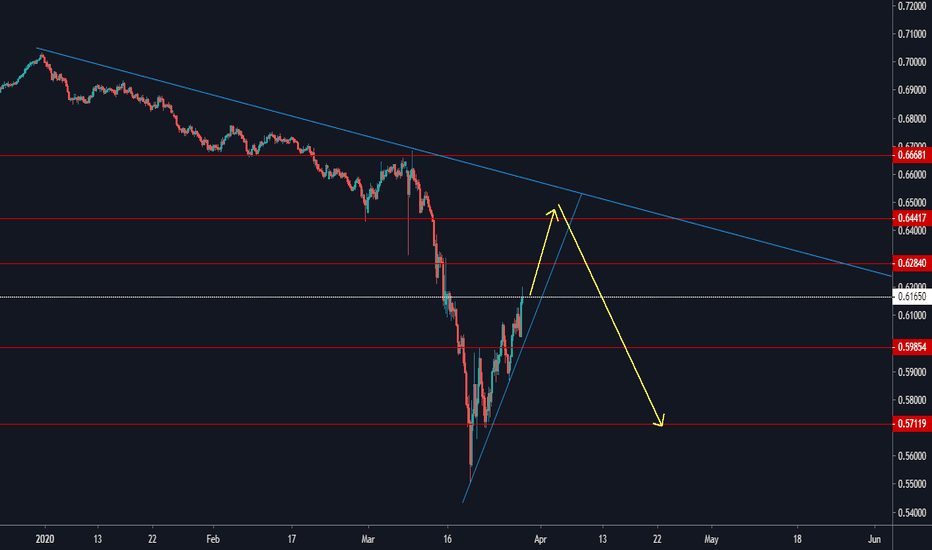

AUDUSD SELLAUD/USD dives to three-week lows near 0.6560 after weak Australian employment data

The Australian Dollar is one of the weakest performers of the G8 currencies on Thursday, hammered by a disappointing Australian Employment report and the overall risk-averse market, which is boosting demand for safe-haven assets, such as the US Dollar

The battle between the Australian Dollar (AUD) and the US Dollar (USD) will be one worth watching in 2025, with central banks stealing the limelight. The Reserve Bank of Australia (RBA) has kept interest rates at record highs whilst most of its overseas counterparts started the loosening process. The US Federal Reserve (Fed), on the other hand, has trimmed the benchmark interest rate by 100 bps through 2024 and aims to slow the pace of cuts in 2025. The central banks’ imbalance aims for record lows in AUD/USD

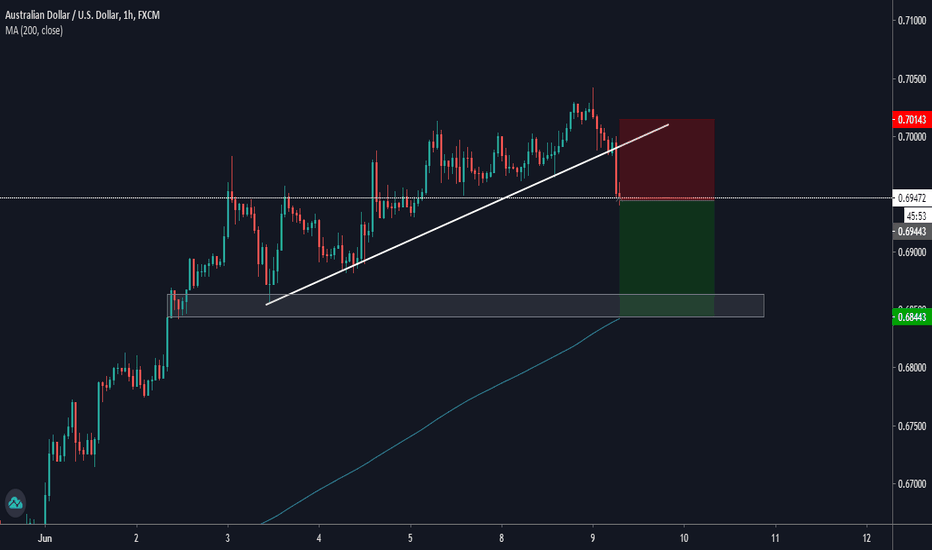

TP 1 0.650

TP 2 0.649

TP 3 0.648

RESISTANCE 0.653

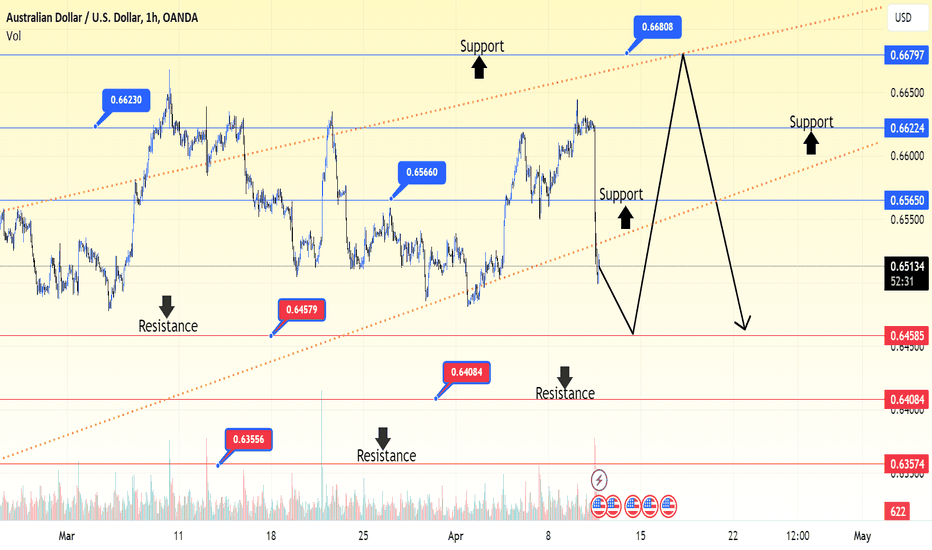

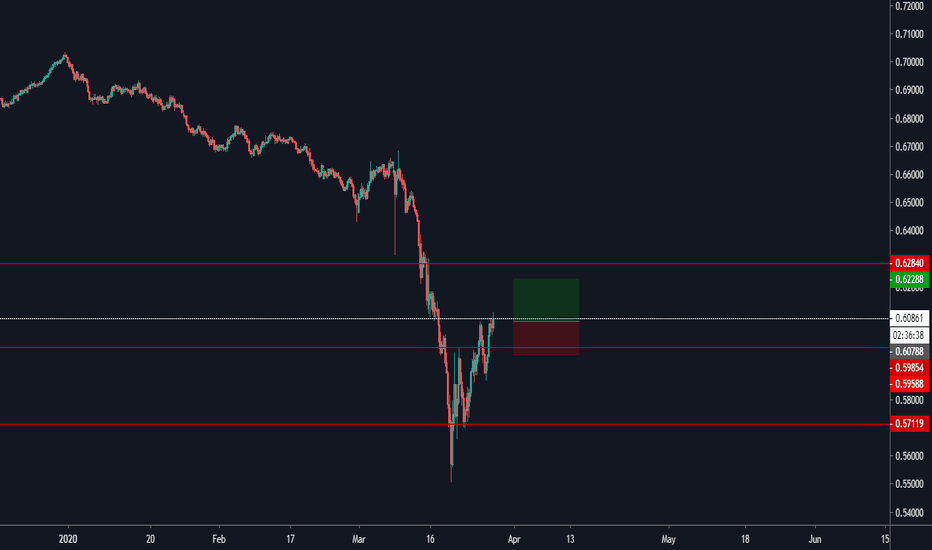

audusd shortAUD/USD (Australian Dollar - US Dollar) is one of the most frequently-traded currency pairs in the world. The AUD/USD rate, as shown in the real-time price chart, tells traders how many US Dollars are needed to buy a single Australian Dollar. Follow the AUD/USD live with the interactive chart and read the latest forecast and AUD/USD news to boost your technical and fundamental analysis when trading this pair.

AUD/USD has entered into a sideways range on the short-term charts. The pair has just formed a bearish candlestick at the range highs and is looking poised to weaken. A move back down is possible towards the range lows at 0.6420.

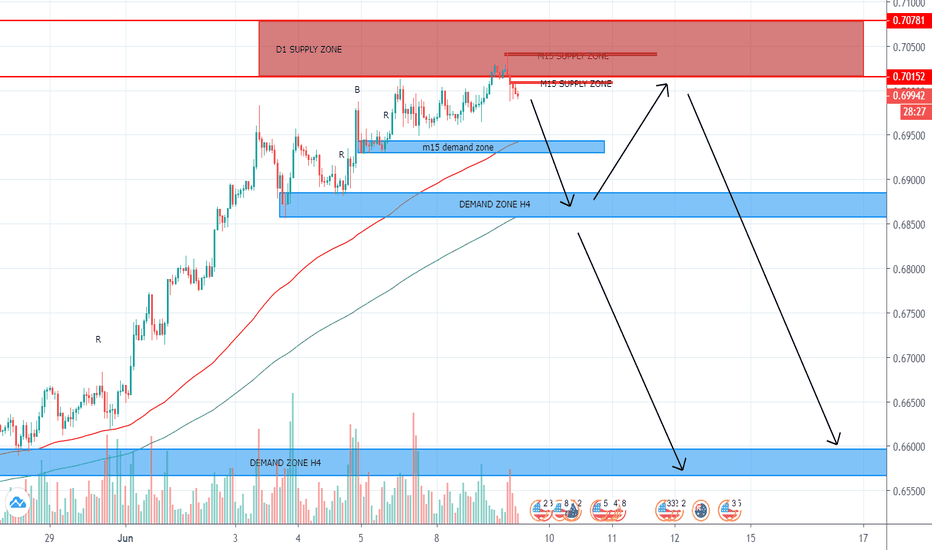

If sellers remain in control, AUD/USD could fall to the April low of 0.6480 (April 1), followed by the March low of 0.6477 (March 5) and the 2024 bottom of 0.6442 (February 13). Breaking below this level may result in a test of the 2023 low of 0.6270 (October 26), prior to the round level of 0.6200.

Further upward is projected to initially test the April top of 0.6644 prior to the March peak of 0.6667 (March 8) and the December 2023 high of 0.6871. Further north, the July top of 0.6894 (July 14) precedes the June peak of 0.6899 (June 16) and the critical 0.7000 mark.

Looking at the big picture, the pair is projected to maintain its bearish trend while below the important 200-day SMA.

On the 4-hour chart, the pair's constructive bias appears threatened. The support comes at 0.6498 ahead of 0.6480. On the other hand, immediate resistance is at 0.6644, before 0.6667. Furthermore, the MACD stayed bullish, and the RSI fell to around 31.

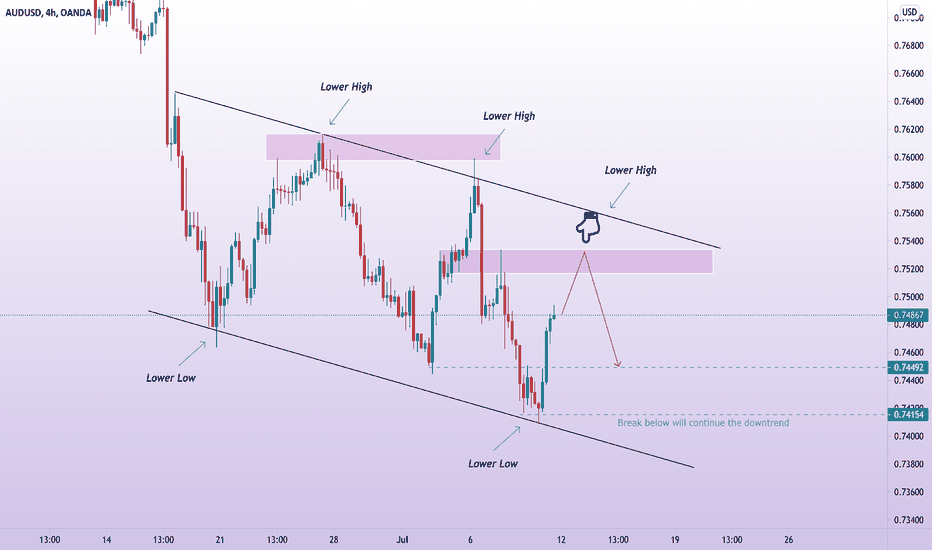

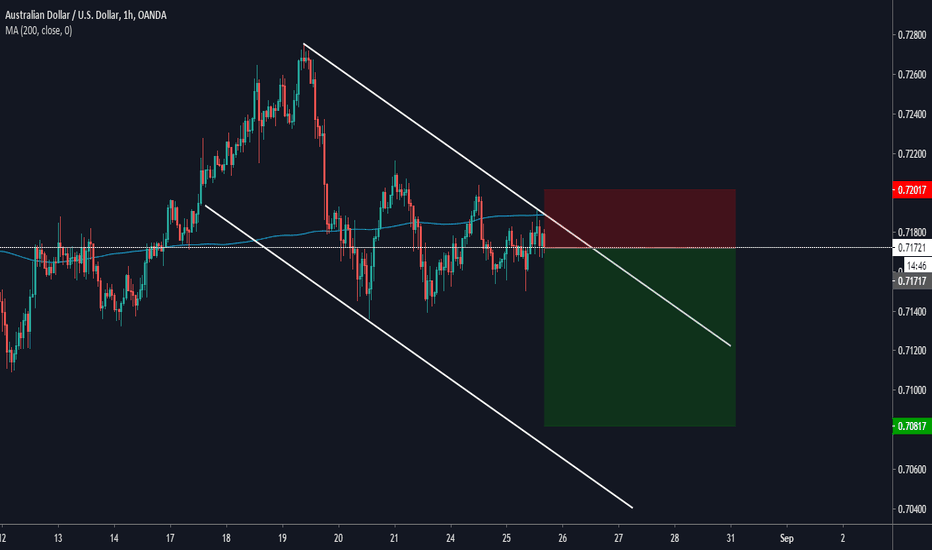

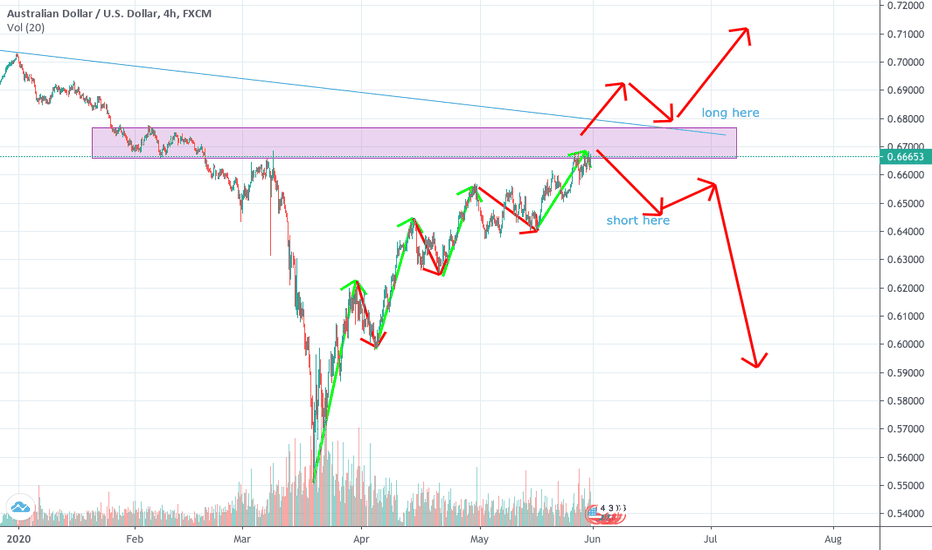

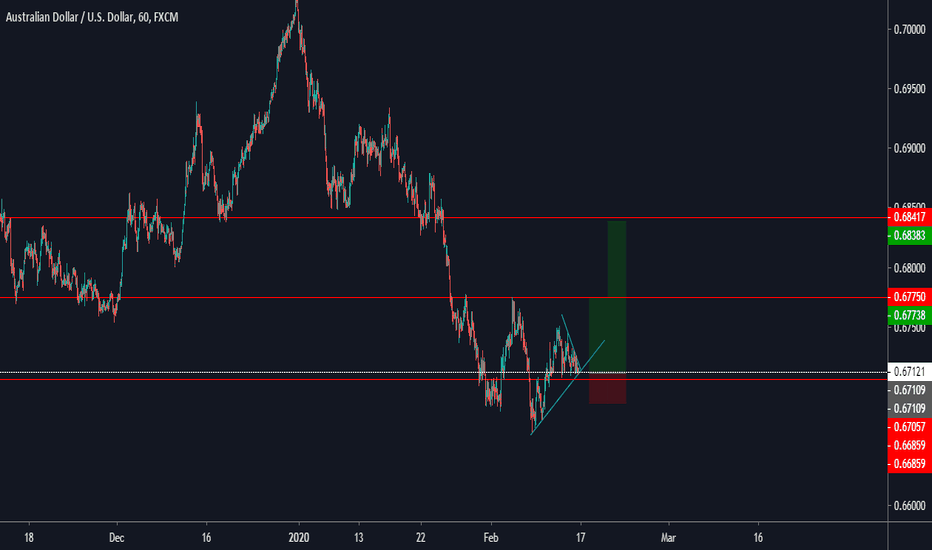

AUDUSD more room to the downsideRight on the chart you can see AUDUSD seems moving within a downward channel. The area between 0.7530 & 0.7510 is a swing low area. I have a strong sense that market might go down from there to 0.7450 area. After that it can show consoliadtion. But my bias is bearish until it breaks the lower high formation. Also by removing the lower low, 0.74 area, will push market even lower.

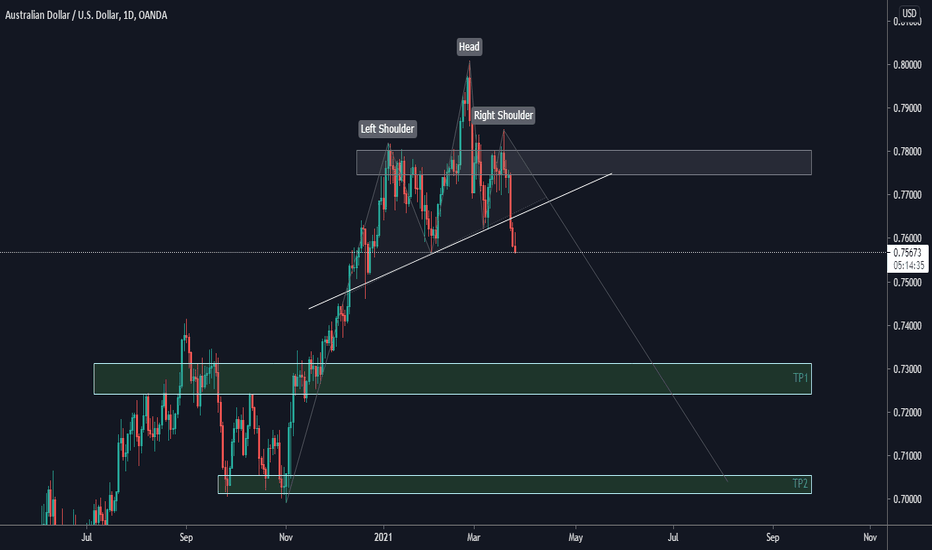

[AUDUSD W4 Mar 2021]AUDUSD

Short Setup

Classic head and shoulder pattern

A short entry at the trendline or zone after a pullback is more favourable.

After a year's long of impulse movement upwards (Mar'20 - Mar'21). Now it seems like price is finally making a significant correction down. hence the said pattern is forming

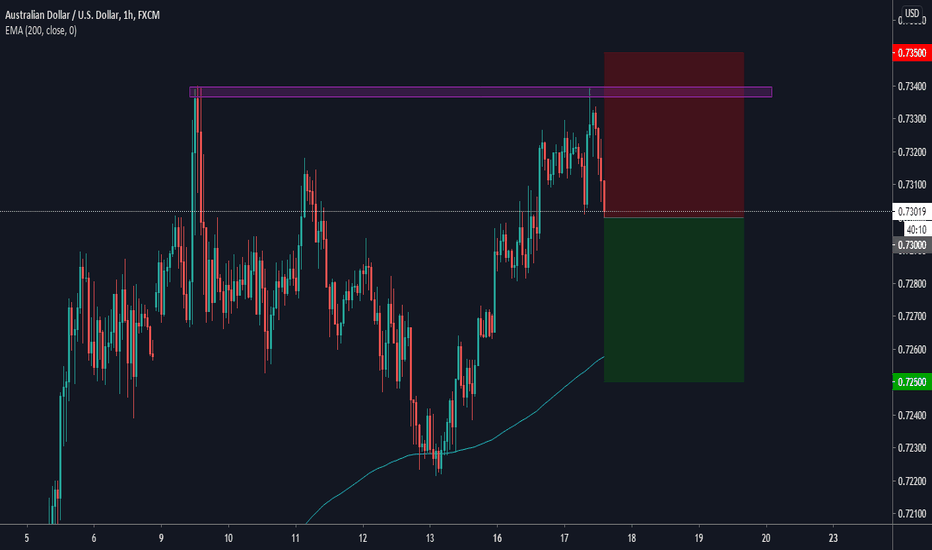

AUDUSD SELLThis is a great oppoturnity for sell for AUDUSD pair. The price currently hitting the daily Supply Zone and returning to the downside. However, maybe little retracement to the m15 supply zone may occur. The bearish formation may occur at least until they meet the m15 demand zone. This zone still not too strong for fully bullish chart. My opinion is it will go bearish until the h4 demand zone and retrace back to D1 supply zone and go bearish all the way. Also, my second opinion is it continue bearish until it meet the next h4 demand zone.