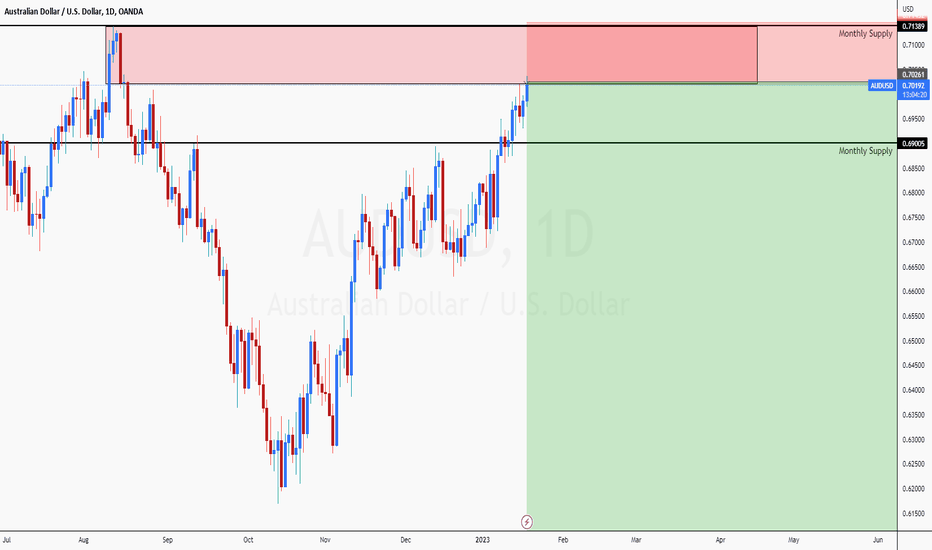

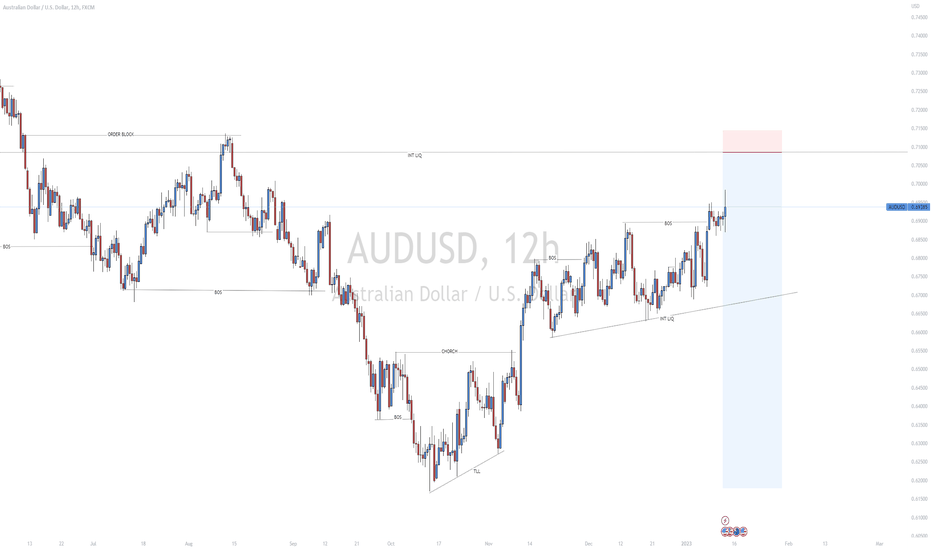

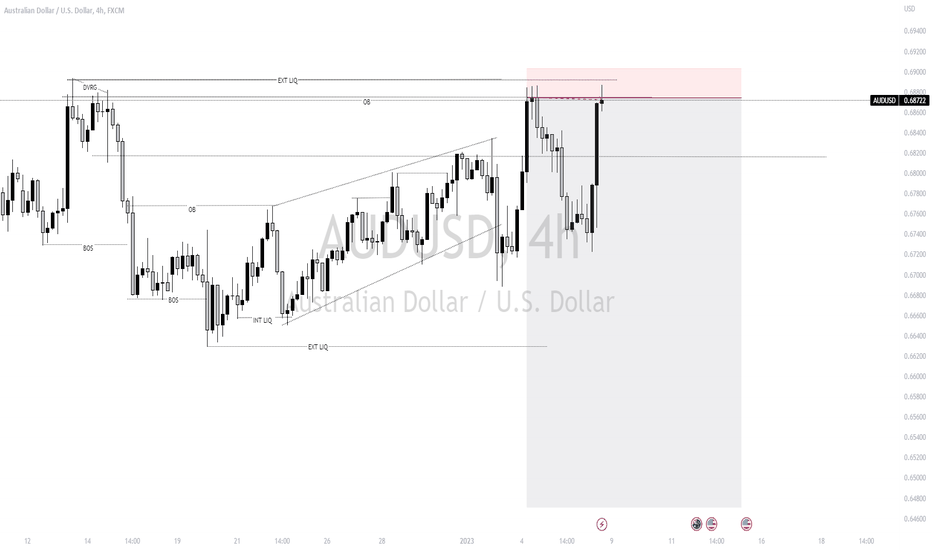

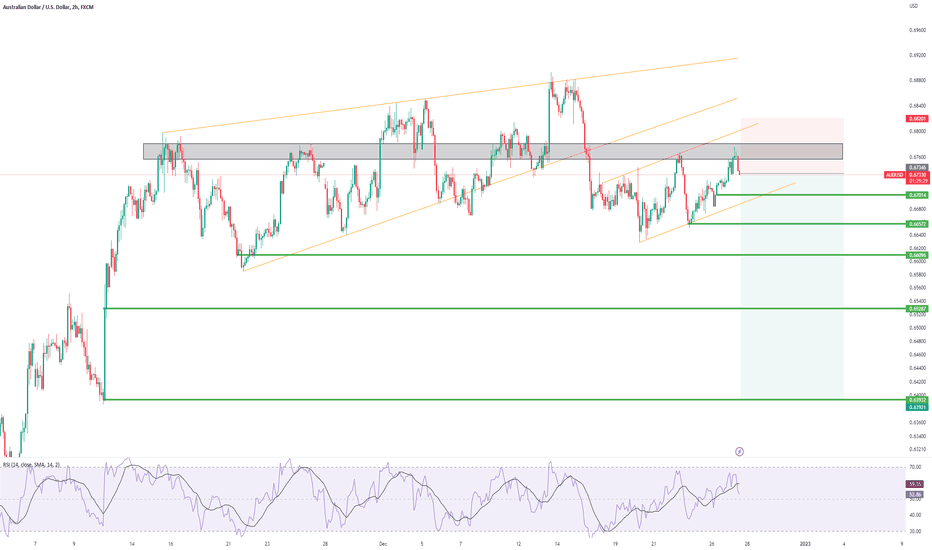

Time To SELL ??We are deep inside a Monthly SUPPLY/SELL zone with a strong resistance located @ 0.71 thus now is a good time to start to look for a sell signal for a move down to test the newly formed WEEKLY DEMAND/BUY zone starting at the 0.66 area.

What I expect to occur over the next period is maybe a spike up to test the 0.71 the market may spike above it as could be an area where there may be some liquidty, I will wait for my TRFX indicator to give me a signal on a chart between 6hr and daily chart only then will my sell trade to be confimed.

Once in the trade we should get an easy drop down to the 0.68 level which was a previous HIGH in the current uptrend this is the first easy target for the position second target will be the weekly DEMAND/BUY zone this will also be a good area to look to buy this pair again for a move up towards the 0.73 area.

Enjoy

Audusdsell

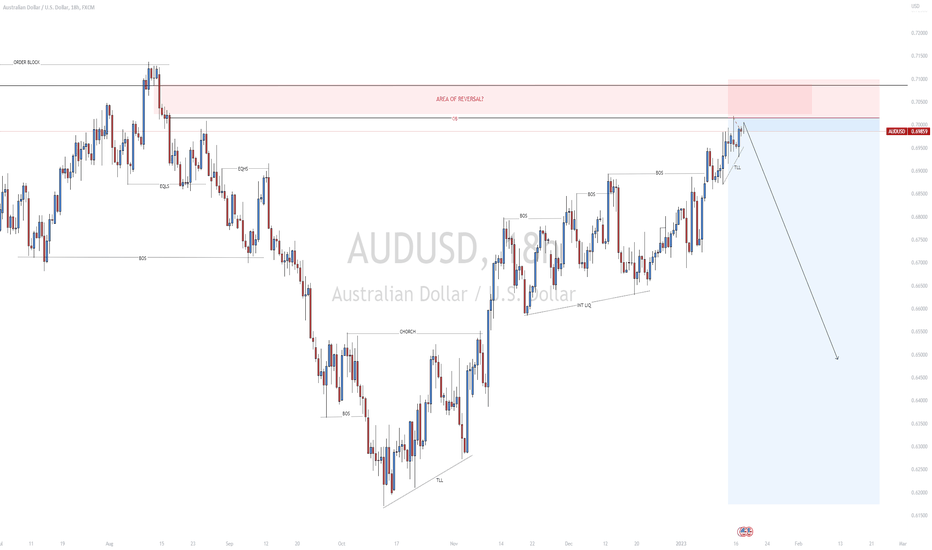

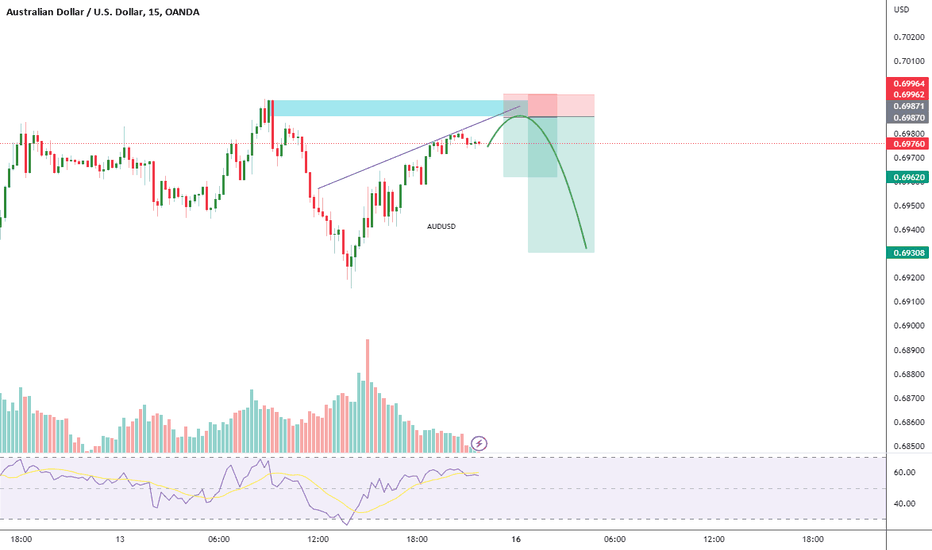

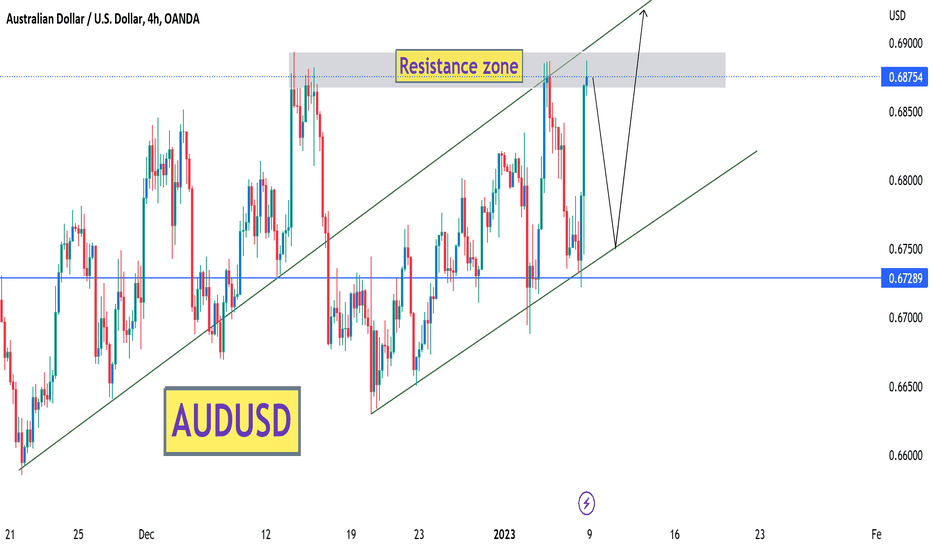

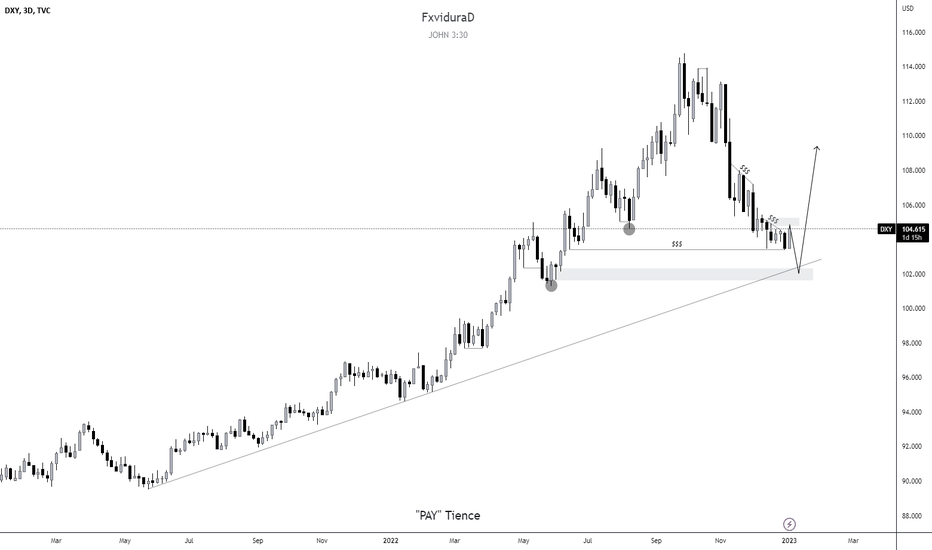

AUDUSD-Hello Traders, hope you all are progressing and improving everyday so am I, here is quick look on #audusd the pair has been bullish ever since we had NFPs and CPI data, however, as we are expecting DXY to be bullish, in our opinion there is higher probability of dxy to be bullish in coming days and hey, trading is all about proability and knowledge right?. So let's use this setup to book some profit.

-What you all think about this pair?

-It would be really appreciated if you can show the support by liking the idea and following us!!!

#AUDUSD- SHORT EXPECTING THIS MOVE!-After recent data (CPI/INTIAL JOB LESS CLAIMS) we have now clear understanding of #DXY/

-DATA projected that 6.5% CPI which is an prediction of FED ensuring that they are not looking to increase rate hikes any time soon.

-Expecting DXY will continue falling until it reaches 100.00 price area zone.

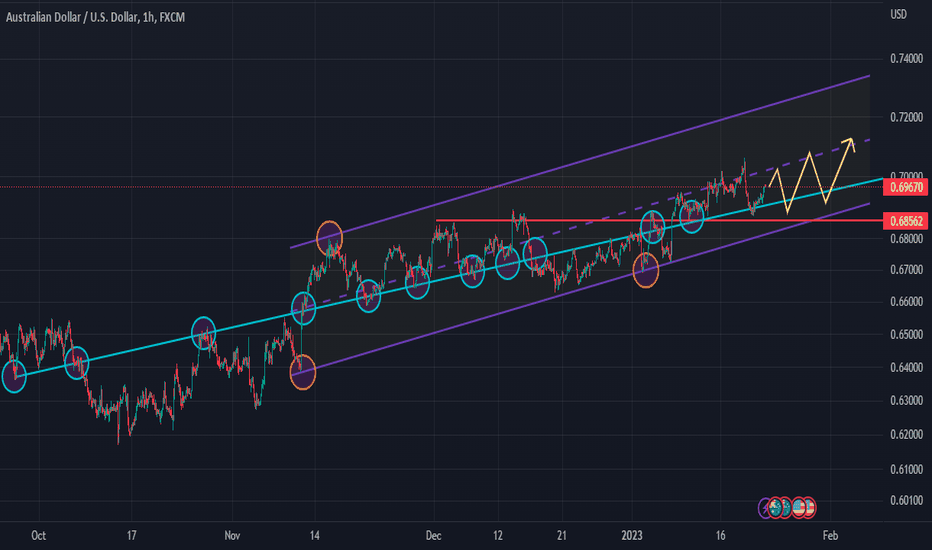

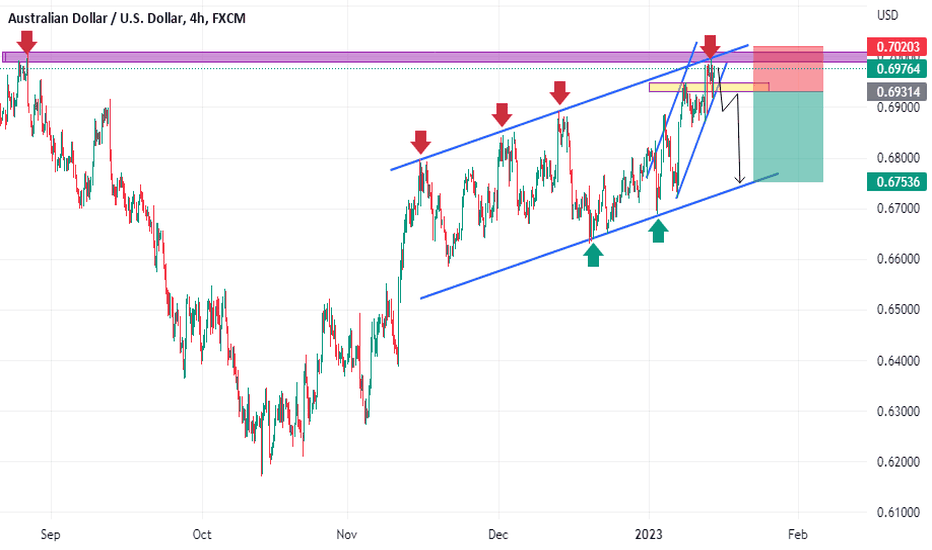

AUD/USD :: Playing with the trend line .AUD/USD :::

The price is in an upward trend and has created a valid trend line. If it is generally stated: the price reacts to this line, that is, if the price is above the line, it will go down, and if the price is below the line, it will go down. It will move upwards, which will result in corrective movements .

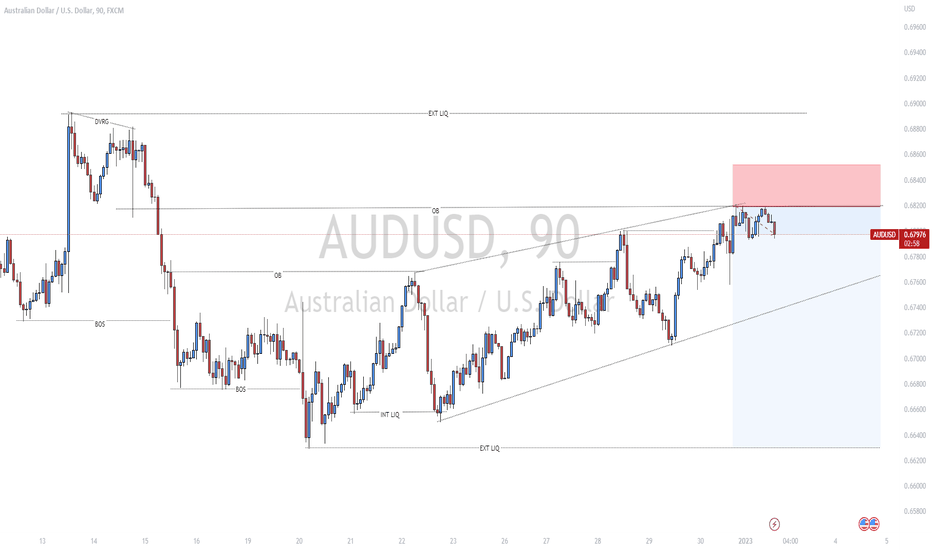

AUDUSD Trading Plan - 12/Jan/2023Hello Traders,

Hope you all are doing good!!

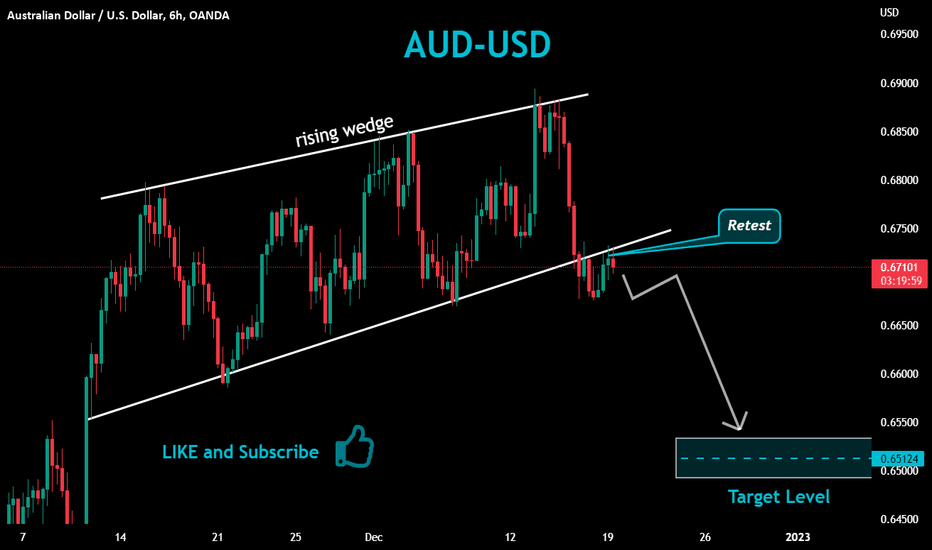

I expect AUDUSD to go Down after finishing the current wave.

Here, we are expecting a bigger correction as of now & if we get that, then the updated idea will be shared for the next potential trade.

Look for your SELL setups.

Please follow me and like if you agree or this idea helps you out in your trading plan.

Disclaimer: This is just an idea. Please do your own analysis before opening a position. Always use SL & proper risk management.

Market can evolve anytime, hence, always do your analysis and learn trade management before following any idea.

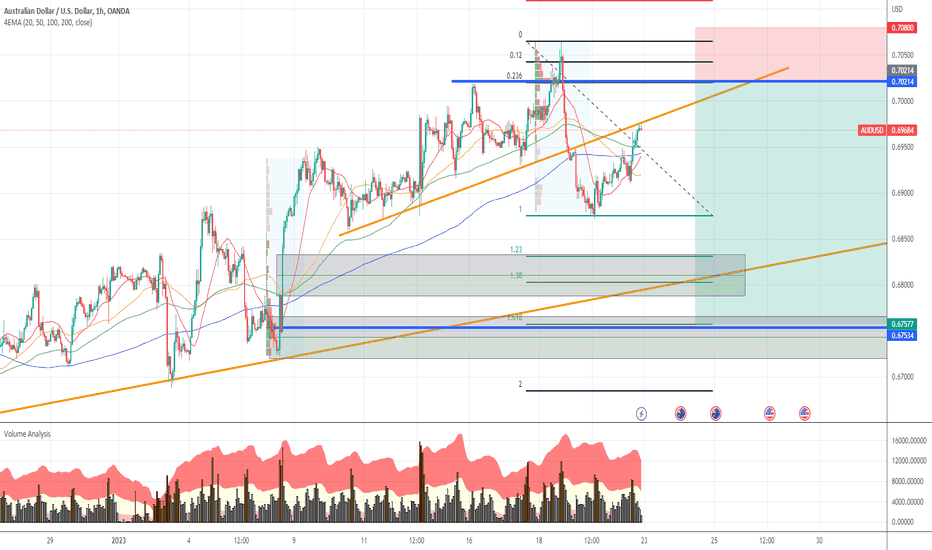

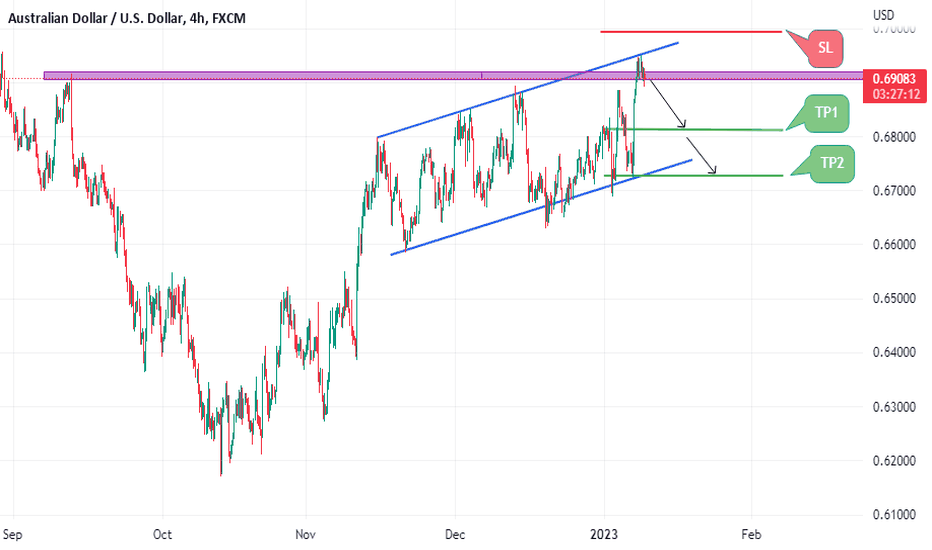

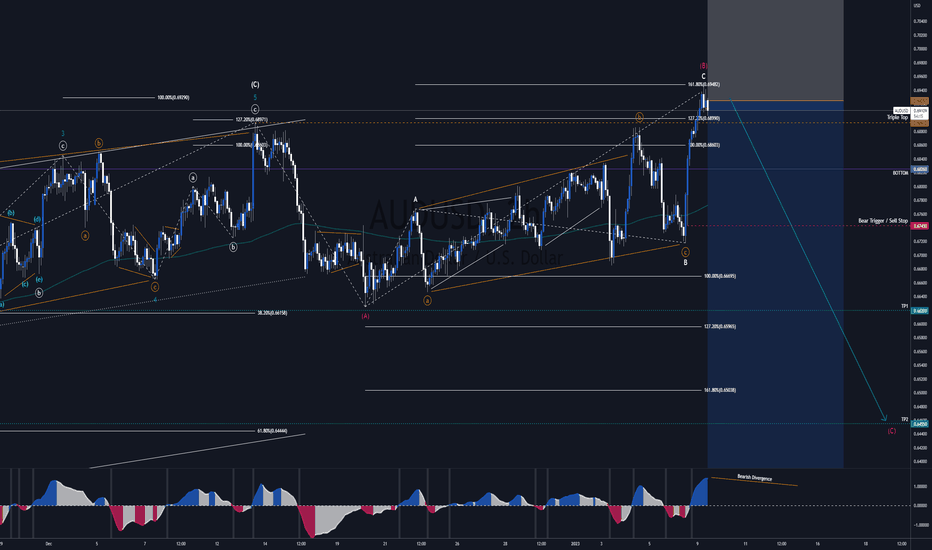

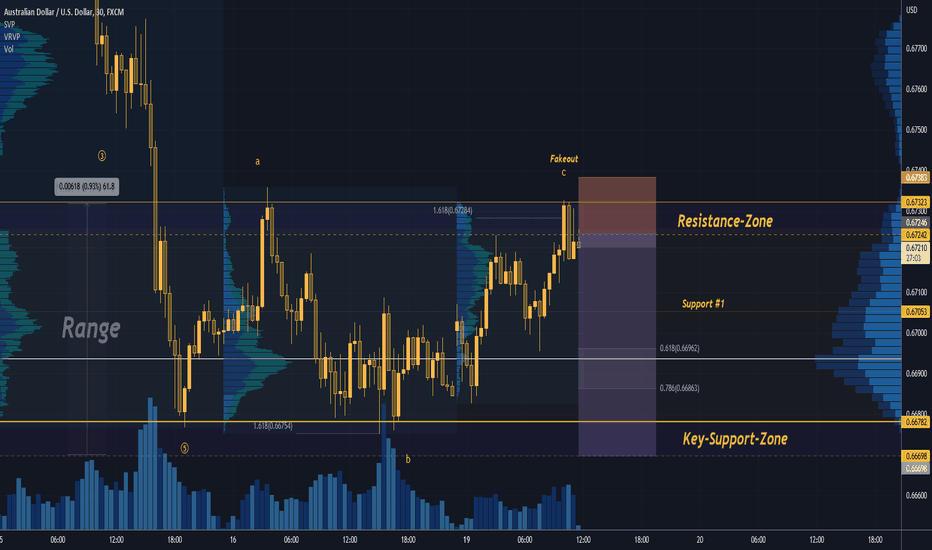

AUDUSD SHORT: Sell-Off In ImpulseAUDUSD is showing considerable weakness signs.

The structure on the up-side since mid-December is Corrective.

A sell-off in a big degree is expected.

I am anticipating Intermediate (C) (red).

My Aussie technicals:

* Ending Diagonal in Intermediate (C) (white)

* Elliott Wave Reversal Pattern

* Upcoming Bearish Divergence

* Running Flat in Minor B (white)

* Double Top Pattern

* Supply Zone

* 161.8% Fibonacci Extension

AUDRUSD SELL Signal:

* Entry @ 0.69250

* SL @ 0.7100

* TP1 @ 0.6620

* TP2 @ 0.6455

* TP3 @ 0.6325

* Safety Measure: when in the green, moving SL to BE.

* SELL Stops on the way down, after pull-backs.

Many pips ahead!

Richard, the Wave Jedi.

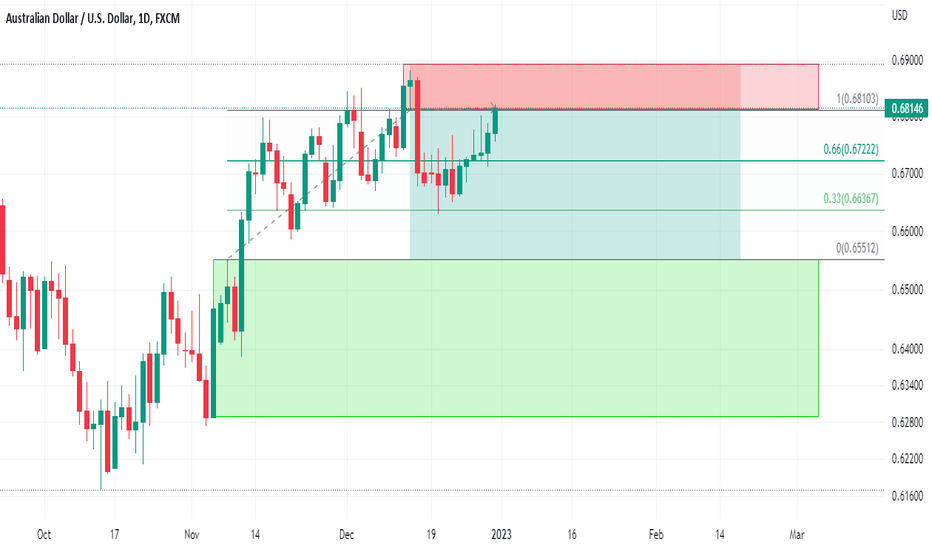

AUDUSD SHORT FOR Risk : reward of 1:3

As per the Daily chart we clearly see that Price has violated Demand Zones and we have a Fresh Daily Supply Zone formed, Price is aleady coming from a Monthly Supply in the higher timeframes and hence the Target is a Monthly Demand formed at 0.65512.

Once Price violates a Demand in lower timeframes like 1H and 4H we will have another trade with an amazing Risk: Reward ratio. But for now 1:3 is also a considerable Risk to reward ratio hence shorting.

Happy Money Making !!!