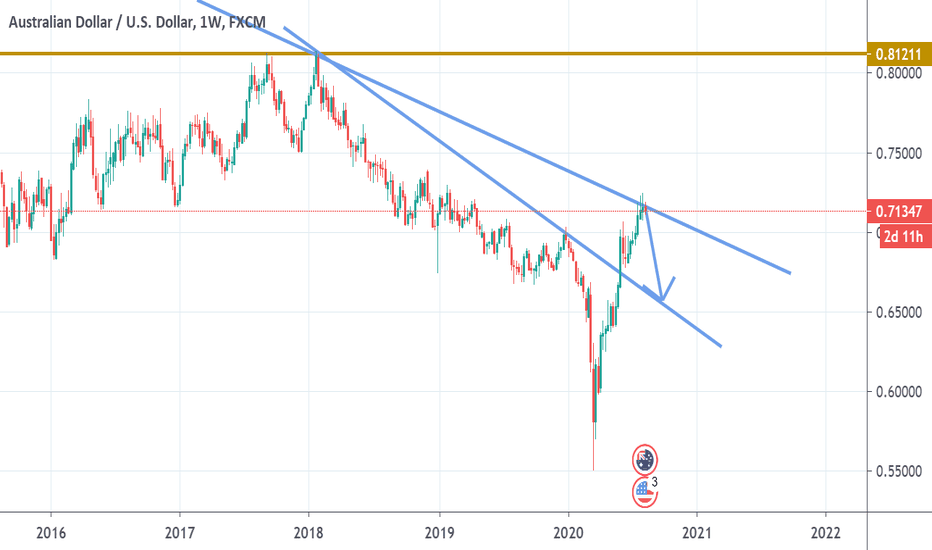

Audusdsell

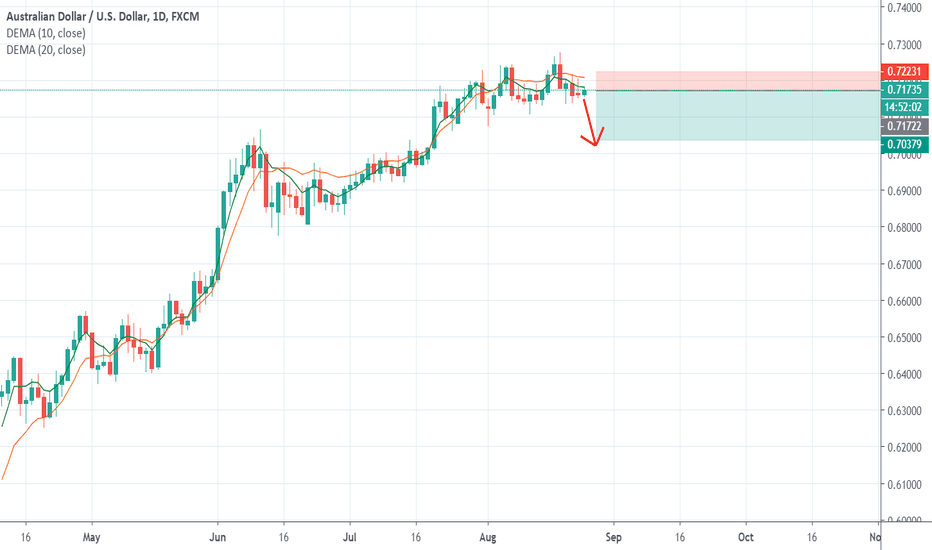

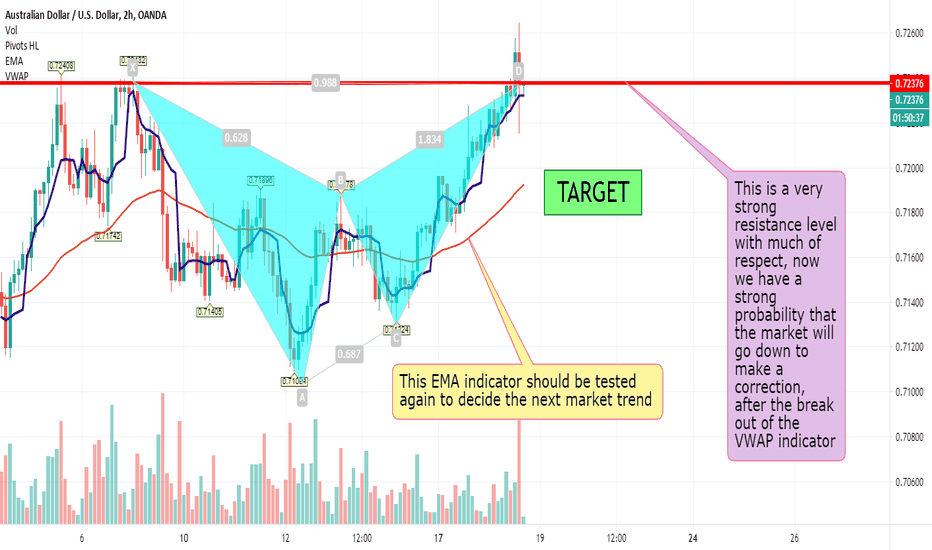

AudUsd- waiting for a catalyst Like its sister Nzd, AudUsd is consolidating in a range for the last 4 days.

Yesterday we have a pin bar which is also contained in the previous red candle indicating a lack of power to stay above 0.72.

I'm bearish this pair as long as the price stays under 0.7220 on a daily close basis and a dive under 0.7140 should accelerate losses towards 0.7 important figure.

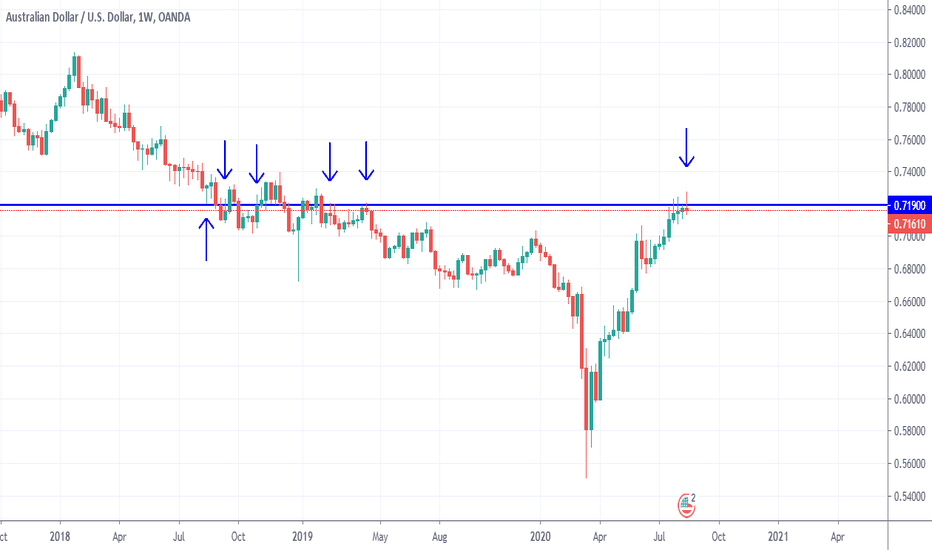

STEVIE WONDER doing technical analysis.0.71900 is a strong support and resistance level as you can see from where i have marked with arrows on the chart, historically price touches this level and bounces, if you do a bit of back testing you can see for yourself. Also bulls have tried to push price through this level for the last 5 weeks failing to do so, this week i see bears taking control and pushing price lower with USD continuing its strength on from Friday.

This setup is so simple its almost too good to be true, but this trade will probably be your most profitable 1 this year.

I suggest only to take this trade if your own analysis lines up with mine! It is never good going into a trade blindly, if that's what you do then you might as well ask Stevie Wonder to do your technical analysis. You will never get anywhere in trading or life in that matter if you want everything done for you and handed to you on a plate! The world doesn't like lazy people.

Anyway if you want to know anything don't be scared to message me.

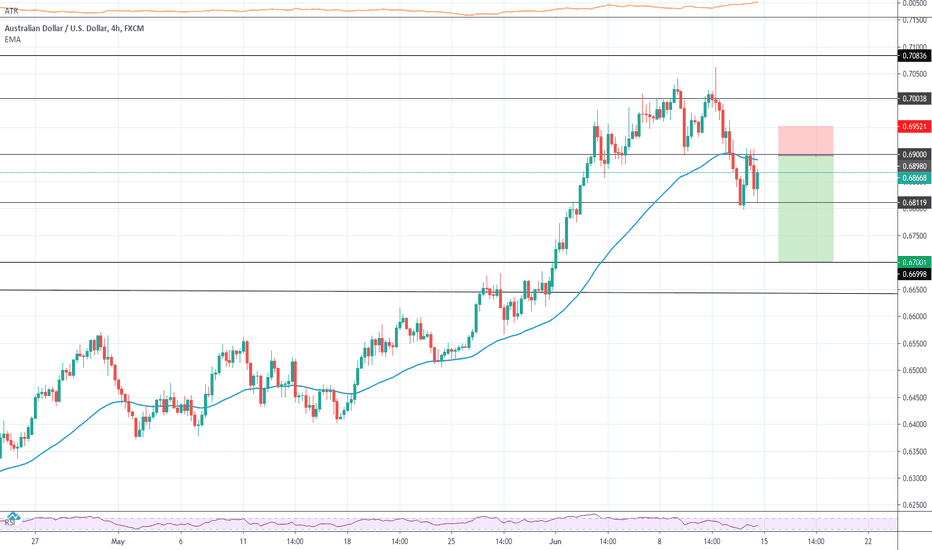

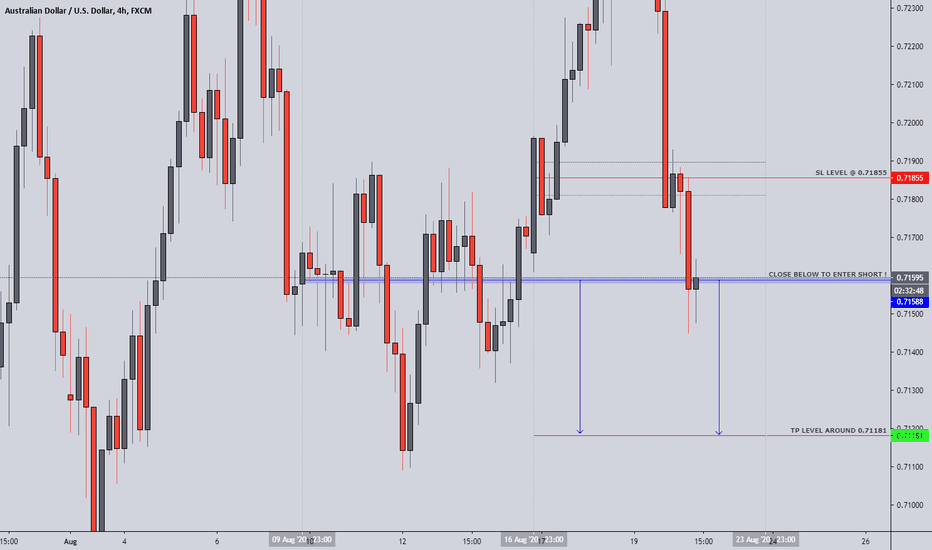

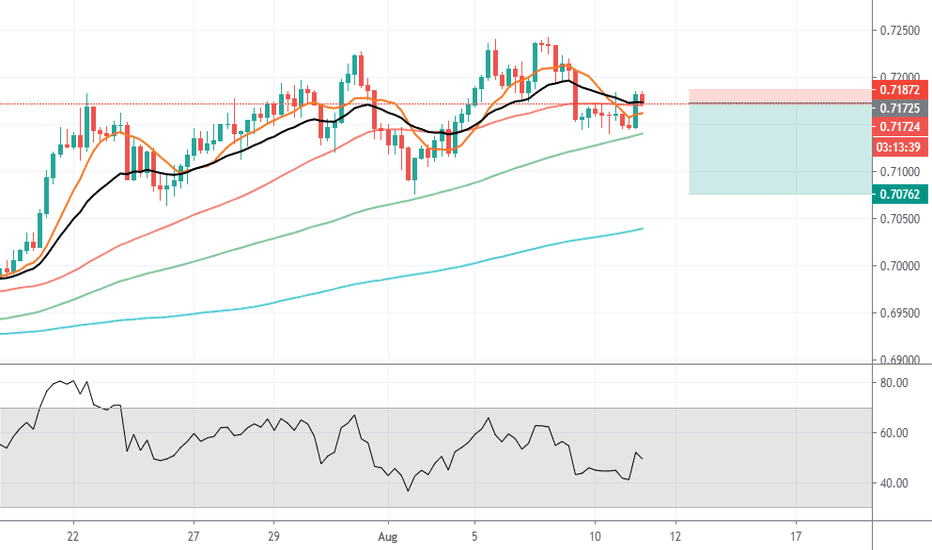

AUD/USD SELL SIGNAL Hey tradomaniacs,

welcome to a new free trading-setup.

Notice: This is meant to be a preparation for you! As always we will have to wait for a confirmation!

AUD/USD: Daytrade-Execution

Market-Sell: 0,71770

Stop-Loss: 0,72180

Target 1: 0,71360

Target 2: 0,71080

Target 3: 0,70845

Stop-Loss: 44,5 pips

Risk: 0,5 % - 1%

Risk-Reward: 2,30

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

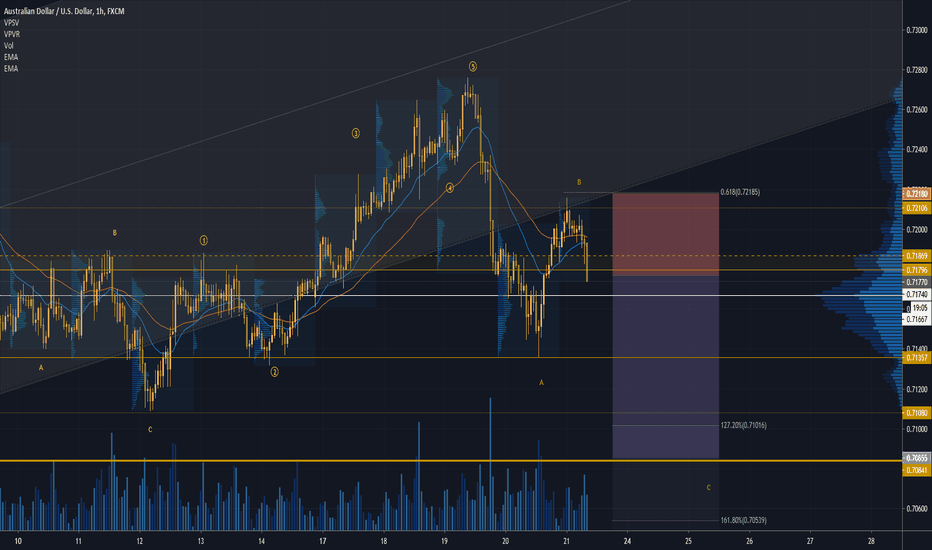

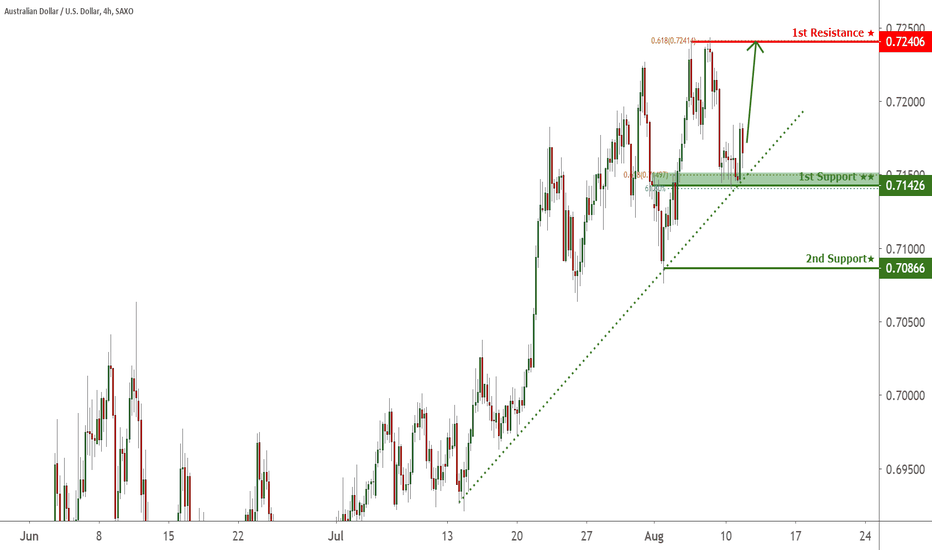

AUDUSD - SWING - 20. AUGU. 2020Welcome to our weekly trade setup ( AUDUSD )!

-

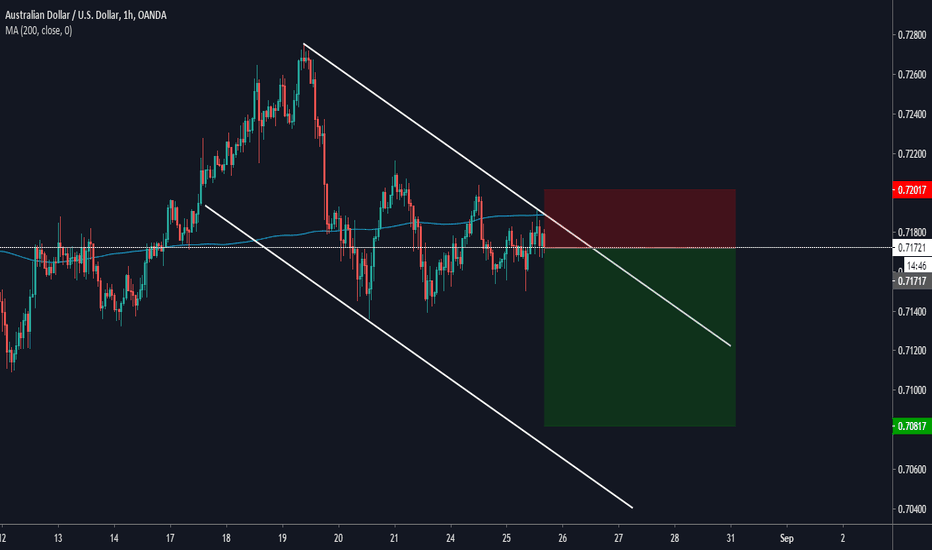

1 HOUR

Very bearish price action and pressure towards previous lows.

4 HOUR

Price broke and closed below main sr level.

DAILY

Expecting prices to drop further!

-

FOREX SWING

SELL AUDUSD

ENTRY LEVEL @ 0.71590

SL @ 0.71860

TP @ 0.71180

Max Risk. 0.5% - 1%!

(Remember to add a few pips to all levels - different Brokers!)

Leave us a comment or like to keep our content for free and alive.

Have a great week everyone!

ALAN

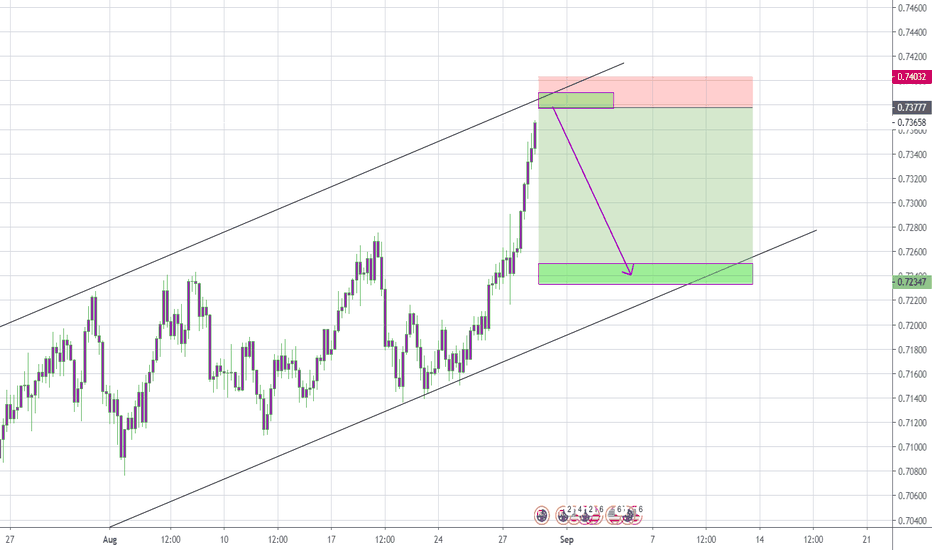

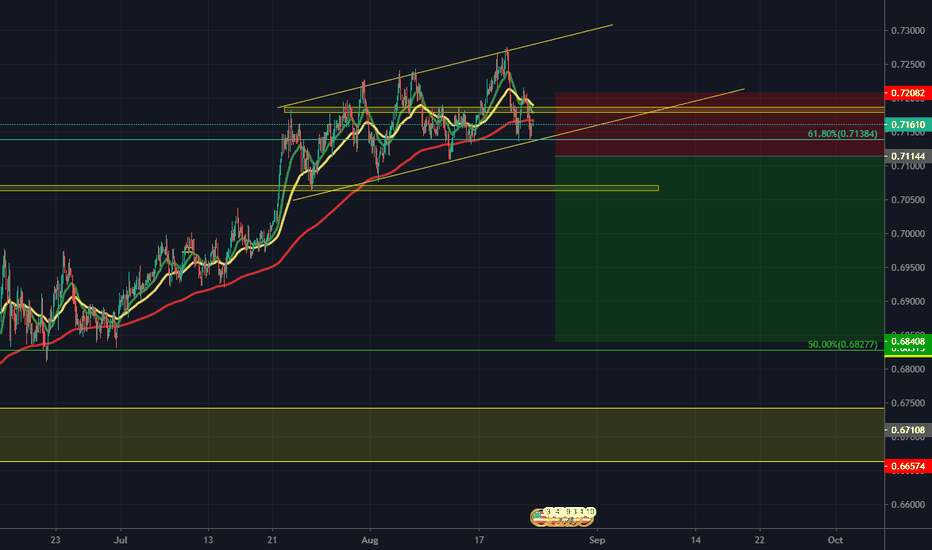

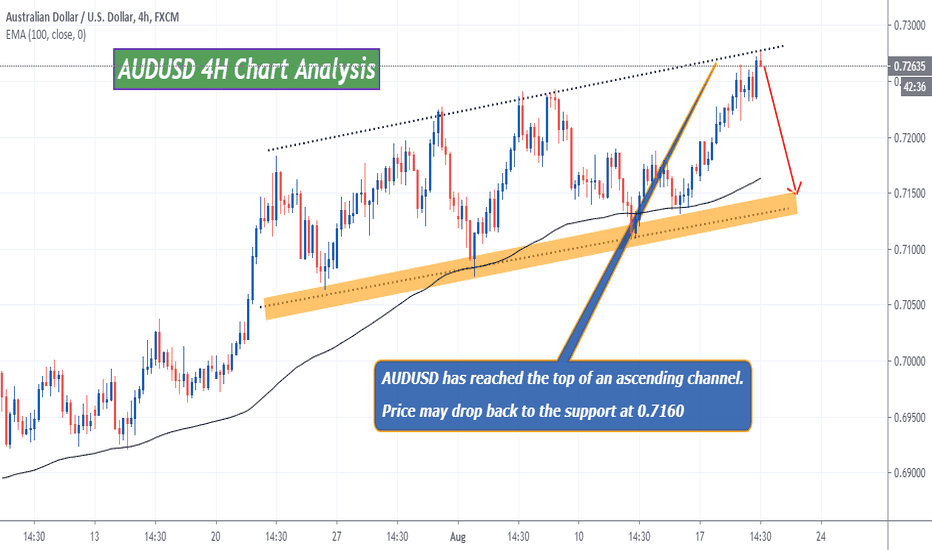

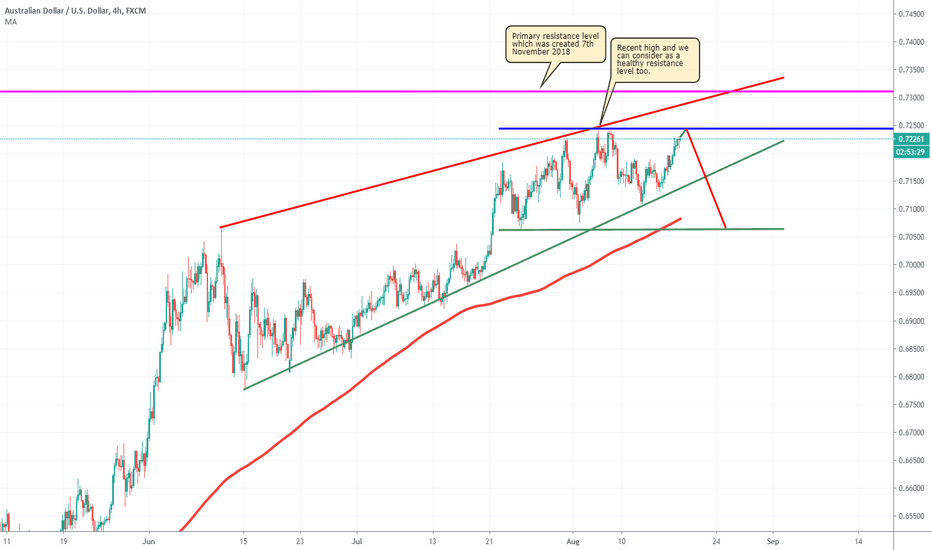

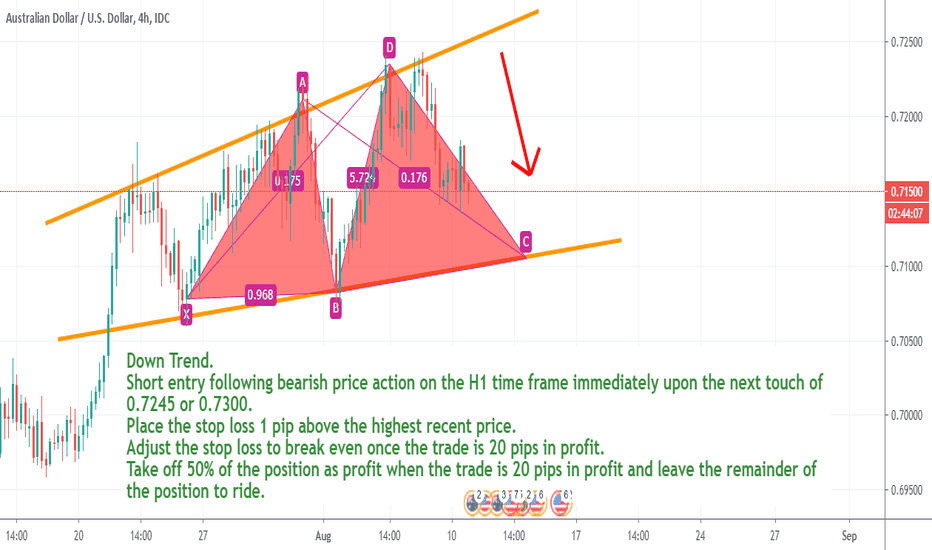

AUDUSD reaches the top of the price channel, time to drop?AUDUSD has reached the top of the ascending price channel. If we see some bearish price action at the top of the channel, it will be a good idea to start looking at some sell trades.

There is a chance that AUDUSD may drop back to the support level at 0.7150.

Traders can look at sell trades between 0.7263-0.7284 with SL above 0.73 and TP at 0.7150

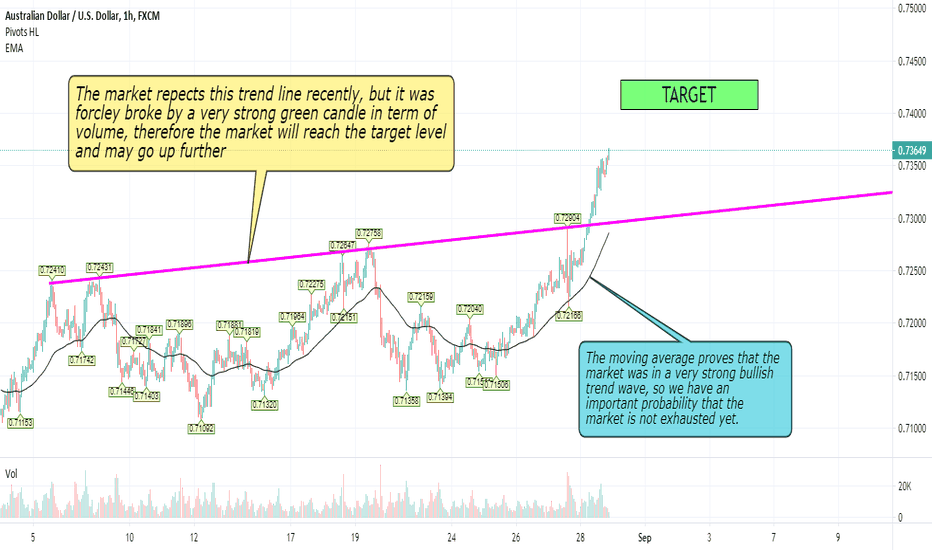

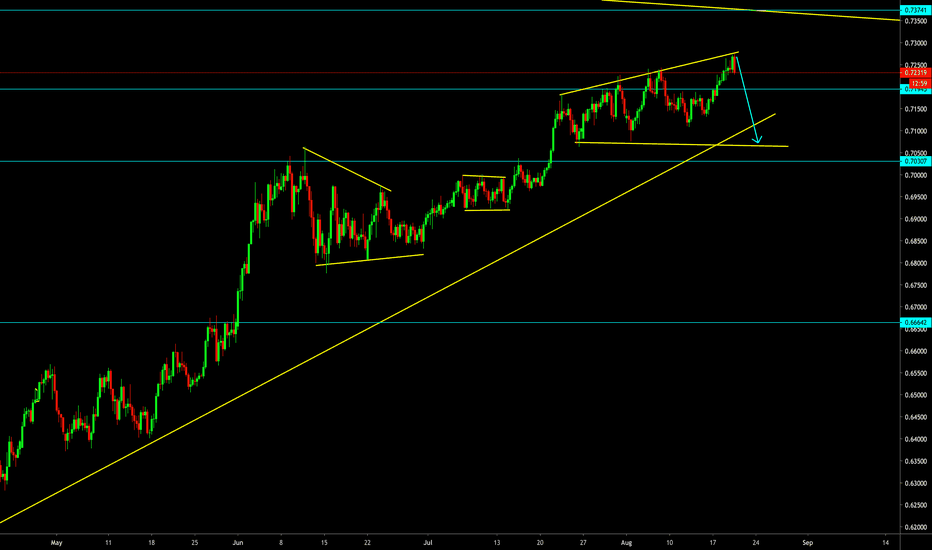

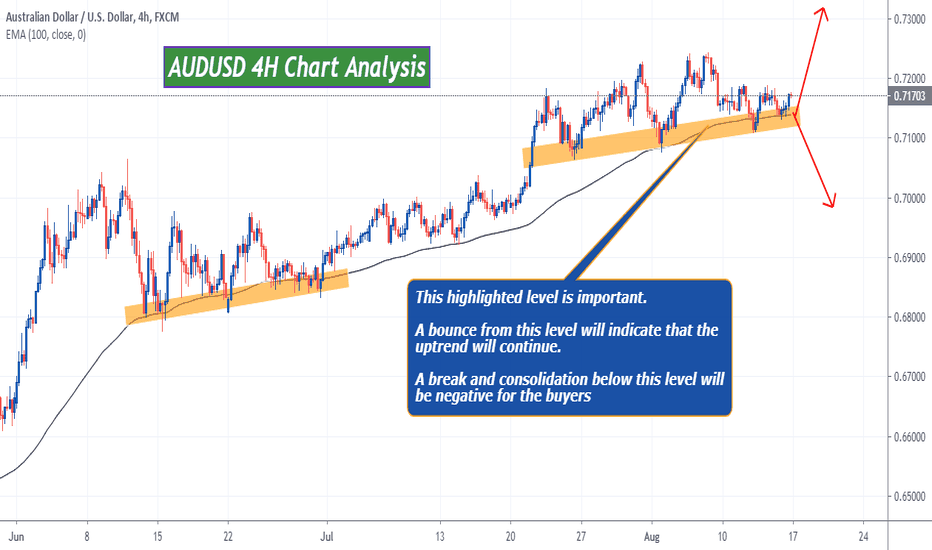

AUDUSD 4-hour chart analysis, uptrend intact but be carefulAUDUSD is still bullish on the 4H Chart. However, the bullish momentum has slowed down considerably. That makes this pair vulnerable to a sharp pullback.

Currently, price is still above the support level and the 100-period EMA. So, the buyers are still running the show here.

However, keep an eye on the level that I have highlighted in my chart. A strong break below this level will be negative for the buyers.

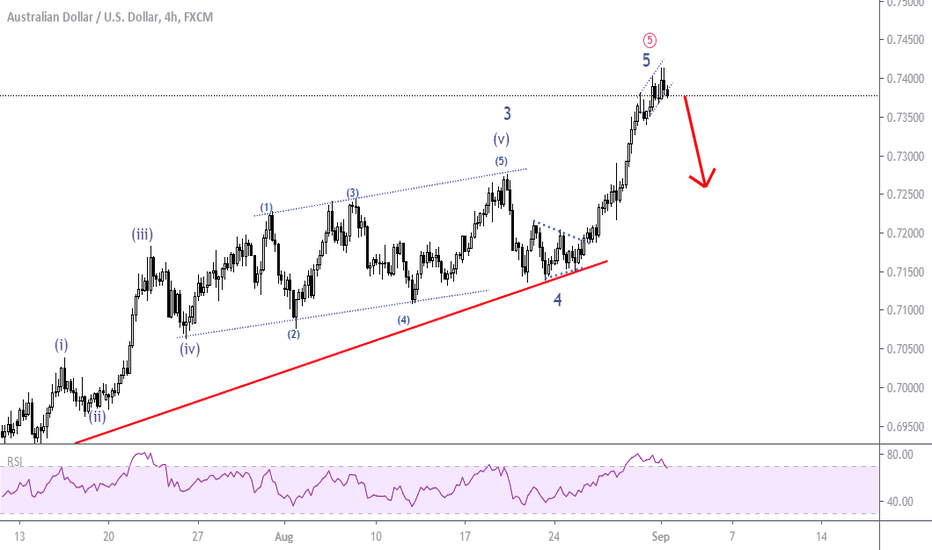

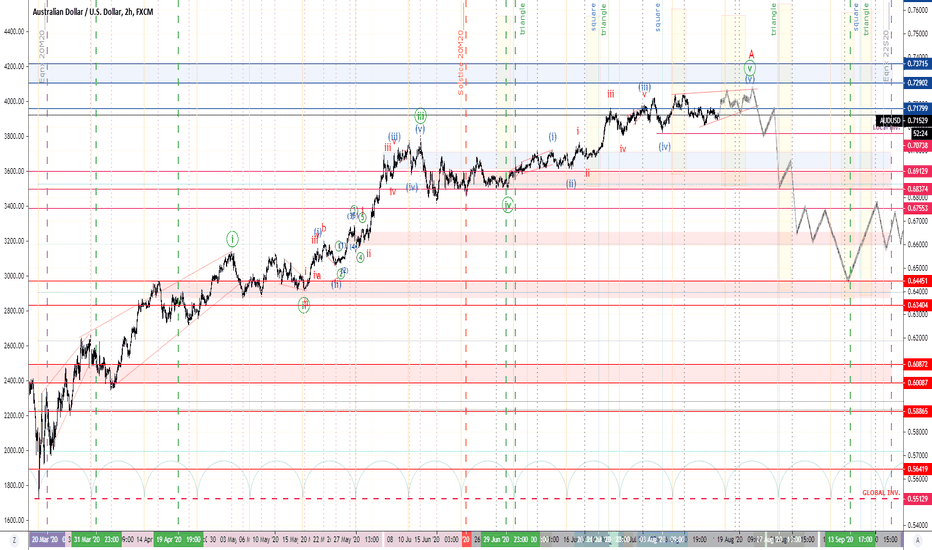

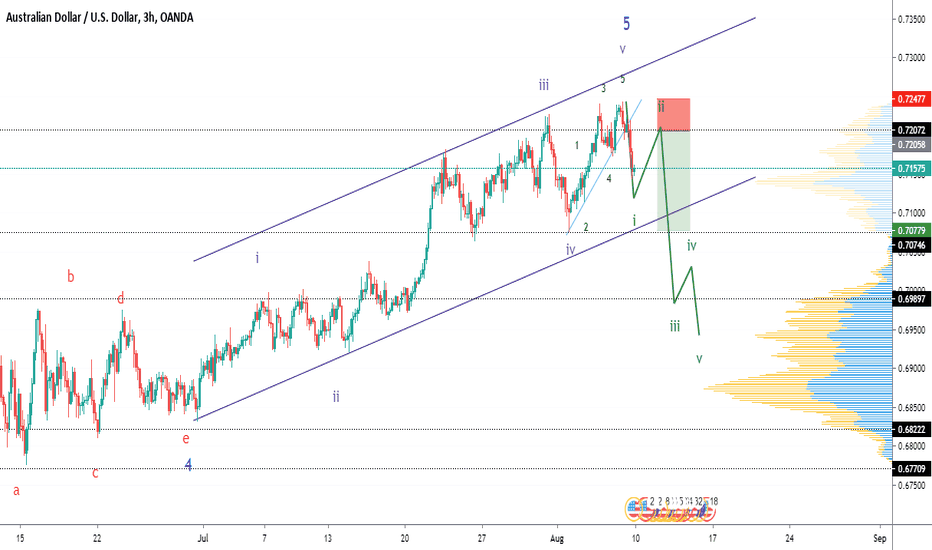

AUDUSD PRICE PREDICTION by POWERFULTRADERSHello Traders.

Glad to present AUDUSD (6A) priceaction forecast near future through Symbiosis of methods and different analysis .

Subscribe to "Powerful Traders"!

Everyday, nine Tengri's traders, creates professional analysis, specializing on Elliotte wave theory, Technichal analysis,

Volume Spread analysis, Market Profile, Depth of Market, Order flow & Footprint.

We trade in all financial markets, there are no boundaries or limitations.

Join us!

«« «« «« «« «« Hold Like! »» »» »» »» »»

(If you have questions, comments, write, reply thoroughly!)

You're welcome!!!

Best regards, Team Traders "Powerful Traders".

AUDUSD SELL OPPORTUNITY Waiting for AUDUSD to decrease down to the point, shown in the post.

..Take it into consideration anything can be possible to happen, if it breaks up the support level this idea would be failed.

You never quite know where the next big wave or gust of wind is coming from, but you know it is out there.

AUD/USD AnalysisA number of Chinese language firms have been listed within the US over the previous two months, and it seems that Chinese language commerce information is just not disturbed by hostile measures and rhetoric between the 2 largest economies on this planet. And that's in defiance of economists' expectations for decrease Chinese language exports, as they rose 7.2% (yr over yr) after June's 0.5% achieve. Imports decreased 1.4%. Economists had anticipated a slight enhance. The web results put a putting commerce surplus of $62.33 billion ($46.Four billion in June).

Of explicit curiosity, exports to the US rose 12.5% (yr over yr), the strongest enhancement in two years. Imports from the US elevated 3.6% (11.3% in June), dropping 3.5% year-on-year, whereas the Part 1 commerce settlement, in fact, known as for a rise not solely throughout 2019 but in addition throughout 2018 as nicely. China's commerce surplus of $32.46 billion with the US was barely lower than the commerce surplus in March and April mixed ($38 billion). Individually, China's oil imports declined 3.6% in the course of the month, whereas imports of commercial minerals (iron ore + 11% month-over-month) and copper ore (+ 13%), and China's metal exports rose 13%.

It seems that the sharp fluctuations within the international change market final month helped enhance the greenback's worth as international central financial institution reserves. South Korea lately introduced a rise of Four billion {dollars} to 416 billion {dollars}. Japan stated its reserves rose by $19.Three billion, the most important enhancement in six years, to $1.402 trillion. China's reserves rose by $42 billion to $3.154 trillion, the most important enhancement in six years.

Short Trade Ideas

>> Brief entry following bearish value motion on the H1 timeframe instantly upon the following contact of 0.7245 or 0.7300.

>> Place the cease loss 1 pip above the best latest value.

>> Modify the cease loss to interrupt even as soon as the commerce is 20 pips in revenue.

>> Take off 50% of the place as revenue when the commerce is 20 pips in revenue and depart the rest of the place to experience.