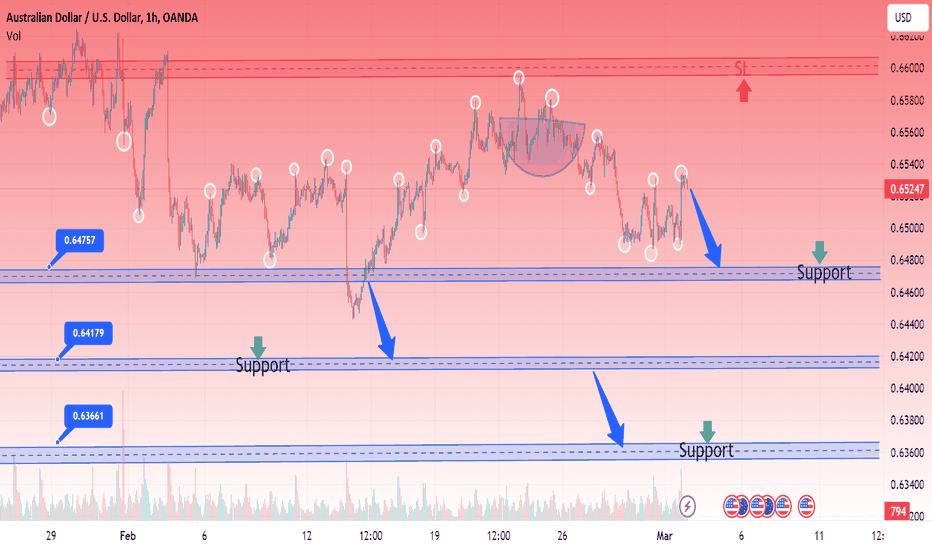

AUDUSD SHORTAUD/USD (Australian Dollar - US Dollar) is one of the most frequently-traded currency pairs in the world. The AUD/USD rate, as shown in the real-time price chart, tells traders how many US Dollars are needed to buy a single Australian Dollar. Follow the AUD/USD live with the interactive chart and read the latest forecast and AUD/USD news to boost your technical and fundamental analysis when trading this pair.

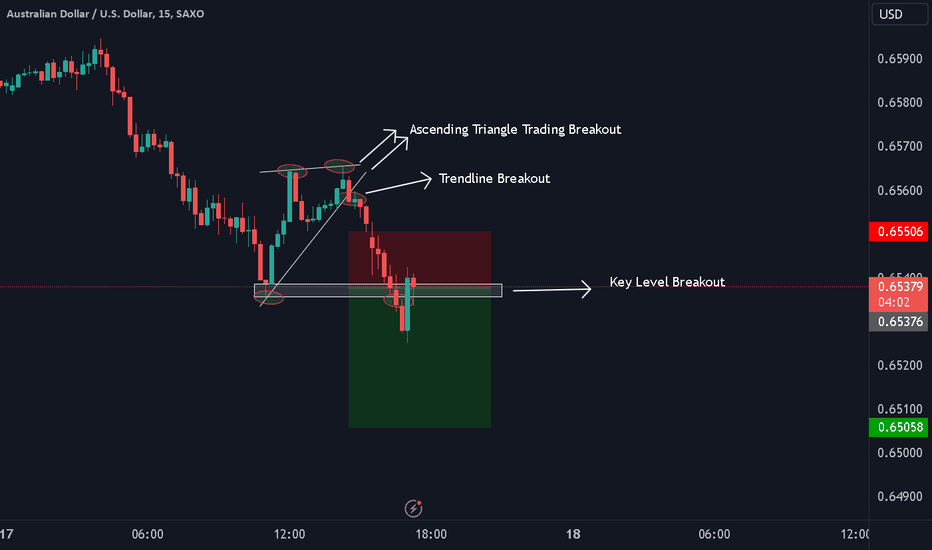

Australian Dollar extends losses amid an improved US Dollar on Friday. The decline in the ASX 200 could have undermined the Australian Dollar. S&P Global Manufacturing PMI rose to 52.5 against the expected 51.7 and 52.2 prior. confirm signal

Audusdsell

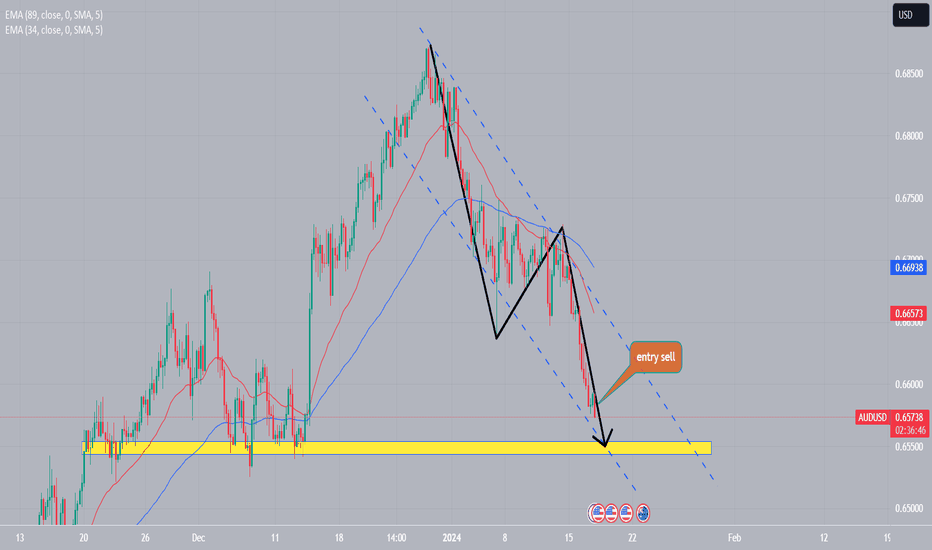

AUDUSD LONGAUD/USD (Australian Dollar - US Dollar) is one of the most frequently-traded currency pairs in the world. The AUD/USD rate, as shown in the real-time price chart, tells traders how many US Dollars are needed to buy a single Australian Dollar. Follow the AUD/USD live with the interactive chart and read the latest forecast and AUD/USD news to boost your technical and fundamental analysis when trading this pair.

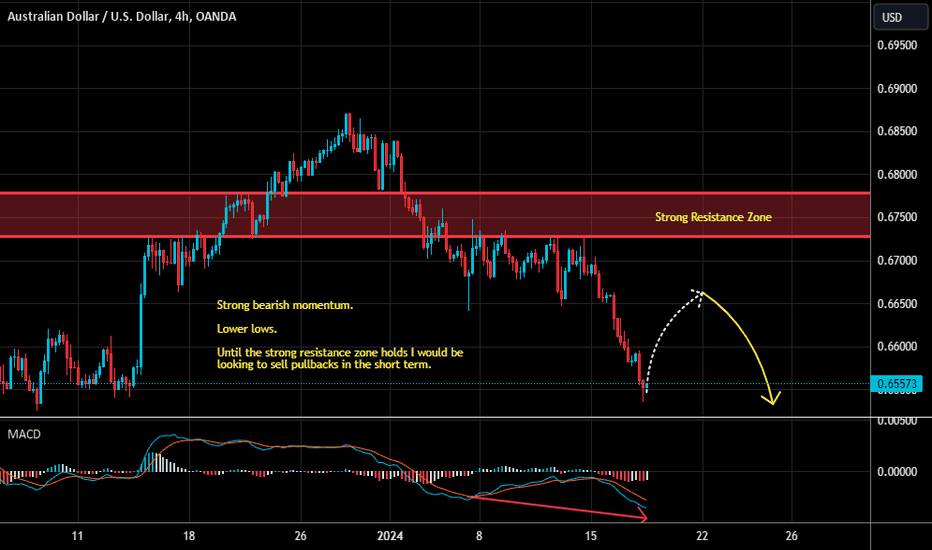

Australian Dollar extends losses after stronger US PPI data. Australia's S&P/ASX 200 Index tracks losses on Wall Street overnight. People's Bank of China has maintained the 1-year MLF rate at 2.5%. US Dollar strengthened as the Fed is expected to prolong its higher interest rates.

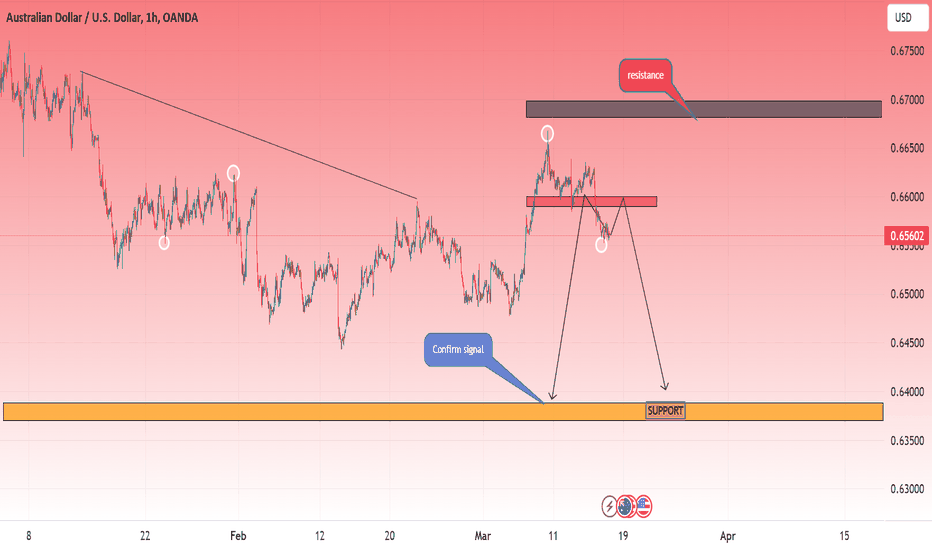

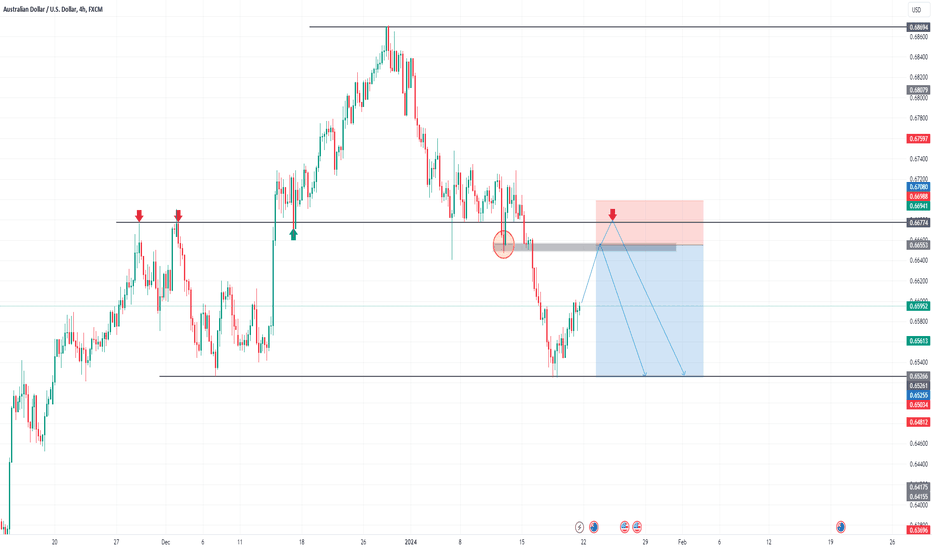

The Australian Dollar traded near 0.6570 on Friday. Immediate support is seen around the 50.0% retracement level of 0.6555, which aligns with the major support at 0.6550. A breach below this level could exert downward pressure on the AUD/USD pair, with potential support at the 61.8% Fibonacci retracement level of 0.6528, followed by the psychological level of 0.6500. On the upside, the AUD/USD pair may encounter a barrier around the nine-day Exponential Moving Average (EMA) at 0.6583, preceding the psychological barrier at 0.6600. A breakthrough above this level could lead the pair to revisit the weekly high of 0.6638, followed by the major level of 0.6650.

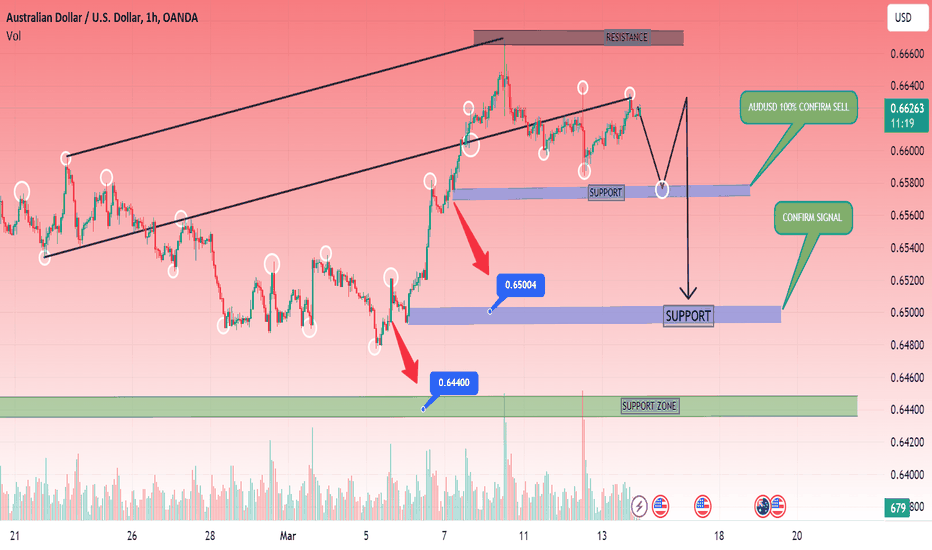

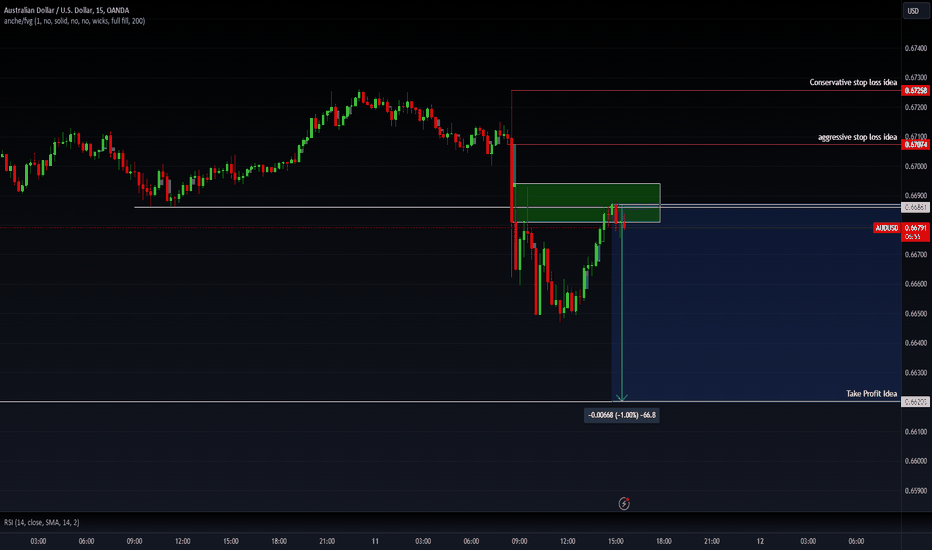

AUDUSD SELL CONFIRM SIGNAL AUD/USD (Australian Dollar - US Dollar) is one of the most frequently-traded currency pairs in the world. The AUD/USD rate, as shown in the real-time price chart, tells traders how many US Dollars are needed to buy a single Australian Dollar. Follow the AUD/USD live with the interactive chart and read the latest forecast and AUD/USD news to boost your technical and fundamental analysis when trading this pair.

AUD/USD managed to regain balance and leave behind two daily pullbacks in a row on the back of the renewed selling pressure in the Greenback and the generalized upbeat tone in the commodity galaxy.

If the AUD/USD breaks through the March peak of 0.6667 (March 8), a challenge to the December 2023 high of 0.6871 (December 28) may be on the horizon, followed by monthly tops of 0.6894 (July 14) and 0.6899 (June 16), all before the important 0.7000 barrier.

On the 4-hour chart, the door now seems open to the resurgence of the upside momentum. Against that, there is immediate hurdle at 0.6667, ahead of 0.6728 and 0.6871. On the other hand, further losses might put the pair on track to retest the 200-SMA at 0.6543, then 06477, and finally 0.6442. Furthermore, the MACD remains in the positive zone, and the RSI has climbed above 62. confirm signal

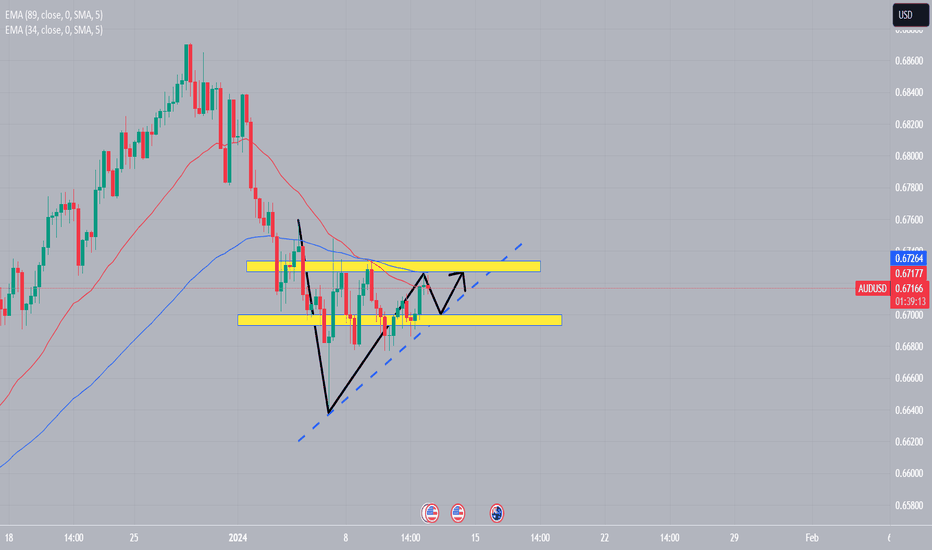

AUD USDAUD/USD (Australian Dollar - US Dollar) is one of the most frequently-traded currency pairs in the world. The AUD/USD rate, as shown in the real-time price chart, tells traders how many US Dollars are needed to buy a single Australian Dollar. Follow the AUD/USD live with the interactive chart and read the latest forecast and AUD/USD news to boost your technical and fundamental analysis when trading this pair.

AUD/USD is trading on the front foot while above 0.6600 in Asian trading on Tuesday. The pair stays supported by a weaker US Dollar and an improvement in risk sentiment even as traders refrain from placing fresh bets on the Aussie ahead of the key US CPI data release confirm chart

AUDUSD: Asia's foreign exchange market is quiet as China's econoMost Asian currencies have been little modified on Tuesday as China`s monetary objectives for 2024 did not buoy markets, even as the greenback steadied in advance of in addition hobby fee alerts later withinside the week .

Anticipation of greater alerts on US hobby prices additionally saved maximum nearby devices buying and selling in tight ranges, specially as remarks from Federal Reserve officers persevered to downgrade expectancies for reduce early.

China's Yuan is quiet because the People's Congress dominates

The Chinese yuan become mildly risky on Tuesday, with the currency's decline tempered with the aid of using a robust midpoint adjustment from the People's Bank of China.

Sentiment closer to the Chinese marketplace advanced little after Beijing set a 5% GDP goal for 2024, similar to 2023. But with a decrease economic deficit goal for the 12 months, traders query asks how possibly this aim is to be accomplished whilst the economic system is not able to reaching it. decrease baseline for assessment with the COVID-19 pandemic.

The Chinese authorities additionally promised greater stimulus measures this 12 months to enhance boom. But the obvious loss of proposed measures has left humans unhappy.

Separately, a personal survey confirmed boom in China's offerings enterprise slowed in February, indicating persevered monetary headwinds for the country.

Asian currencies in trendy are negatively motivated with the aid of using China because of its distinguished economic system withinside the region.

The Australian greenback, which has excessive exchange publicity to China, fell 0.1%, whilst information confirmed an development withinside the country's modern-day account withinside the fourth zone. Article The newspaper study in advance of a capacity development in fourth-zone GDP information, predicted out on Wednesday.

AUDUSD LONGThe AUD/USD pair delivers a V-shape recovery from 0.6490 as investors hope the Federal Reserve (Fed) will start reducing interest rates from the June policy meeting. The Aussie asset recovers sharply as the US Dollar comes under pressure.Meanwhile, the Australian Dollar performs stronger on February's upbeat Caixin Manufacturing PMI. Surprisingly, the economic data rose to 50.9 from expectations of 50.6 and the prior reading of 50.8. The Australian economy is China's leading trading partner, and an improvement in the latter's economic prospects eventually strengthens the confim signal

AUDUSD SELLAUD/USD delivers strong recovery from 0.6500 on subdued US Dollar

AUD/USD recovers vertically from 0.6490 as the US Dollar turns subdued. The market participants hope that the Fed will announce a rate cut in June. Upbeat Caixin Manufacturing PMI improves the appeal of the Australian DollarT.he AUD/USD pair delivers a V-shape recovery from 0.6490 as investors hope the Federal Reserve (Fed) will start reducing interest rates from the June policy meeting. The Aussie asset recovers sharply as the US Dollar comes under pressure. CONFMIR SIGNAL

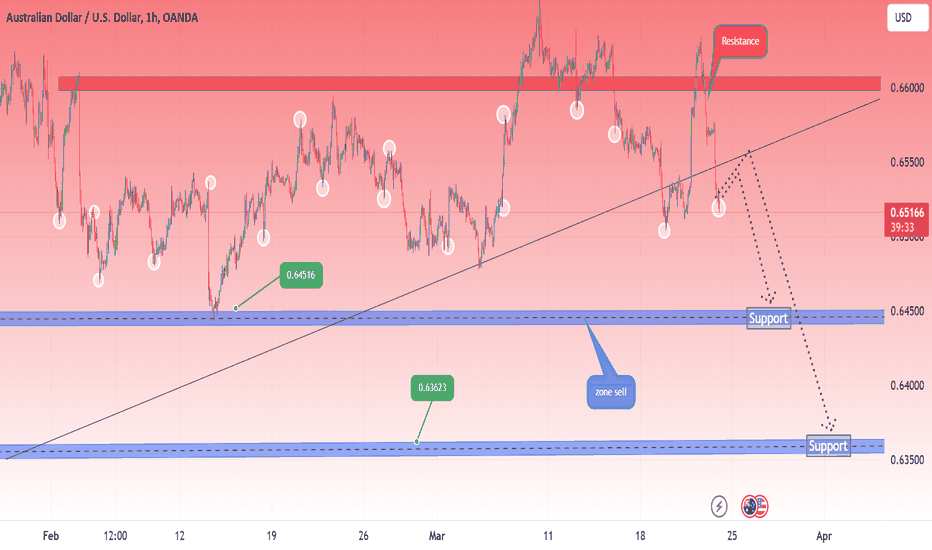

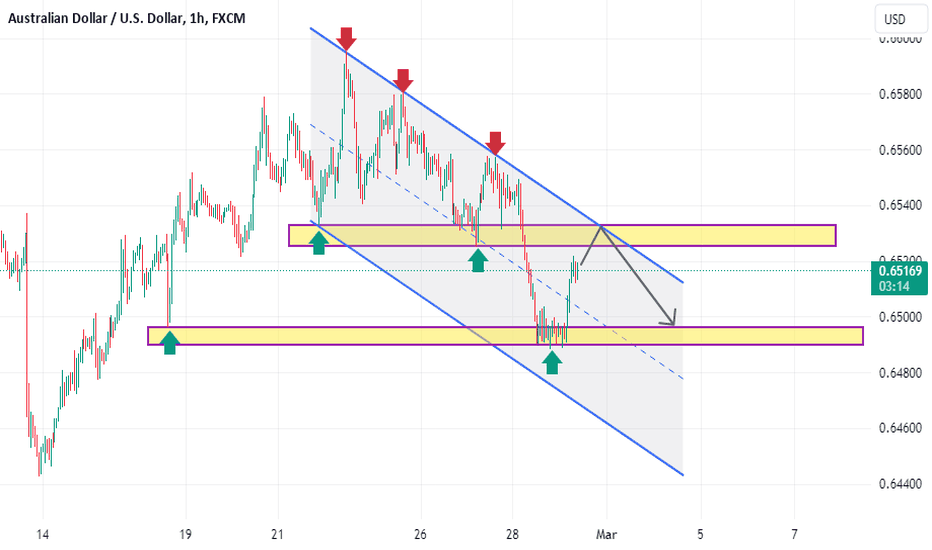

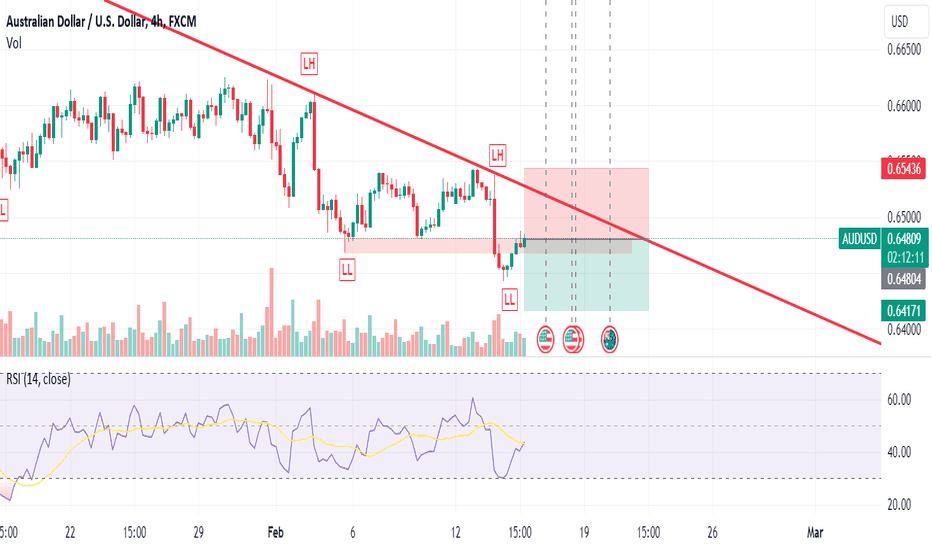

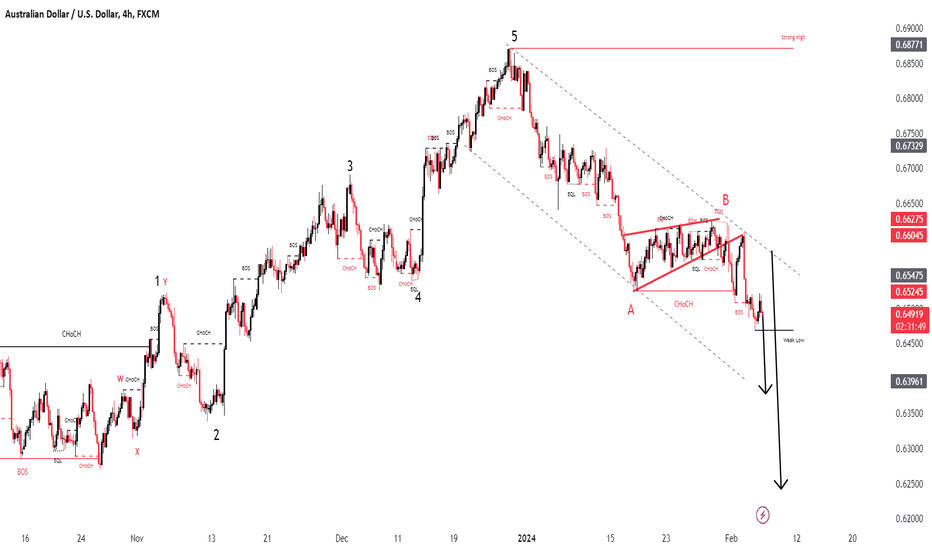

AUDUSD : Short Trade , 1hHello traders, we want to check the AUDUSD chart. The price is moving in a descending channel and is undergoing a correction to a key level. We expect this level to play the role of a resistance level and maintain the downward trend of the price and the price will fall to around 0.64900. Good luck.

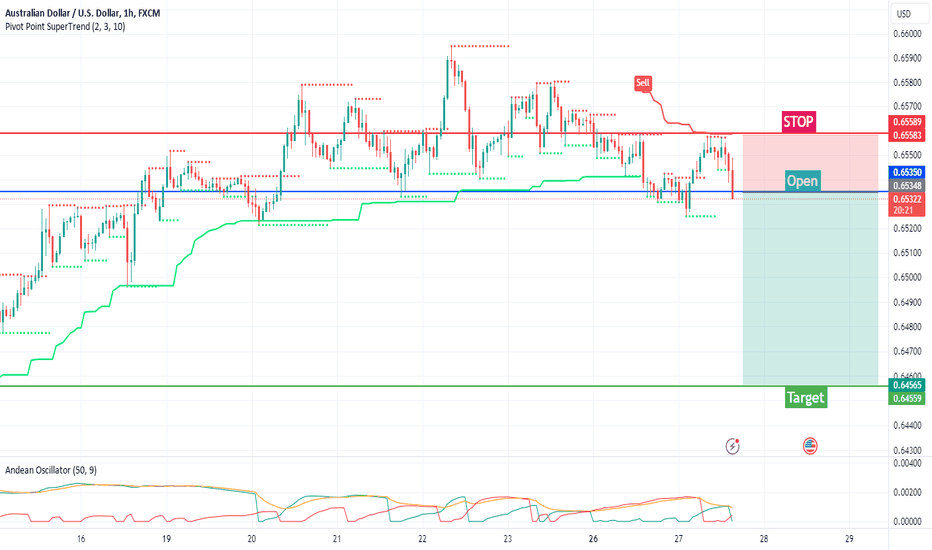

AUD/USD SHORT from .6535AUD/USD has failed to break the 200 EMA on H4 and it looks like the BULLS are in retreat.

On H1 we are below all major EMA levels (25,50,100,200) and the 25 and 50 are now under the 100 EMA. 100, 50 and 25 are gouping together and crossing over each other south.

On the Nadean Oscillator we can see the green buy line is moving south over the signal line and the red SELL line is rising.

The Pivot Point SuperTrend has repelled the price 3 times and AUD/USD BEARS are taking control.

We can get a tight STOP on this trade at .6558 (23 pips) which is today's high.

Target for this trade is open as there's clear daylight between the current price and the next significant support level at .6486 which is the notional target.

It needs to be pointed out that the key WS1 pivot is only 8 pips away and this could support the price but the overall picture looks very BEARISH and I doubt if buyers will come in at WS1 sufficiently enough to deter the BEARS.

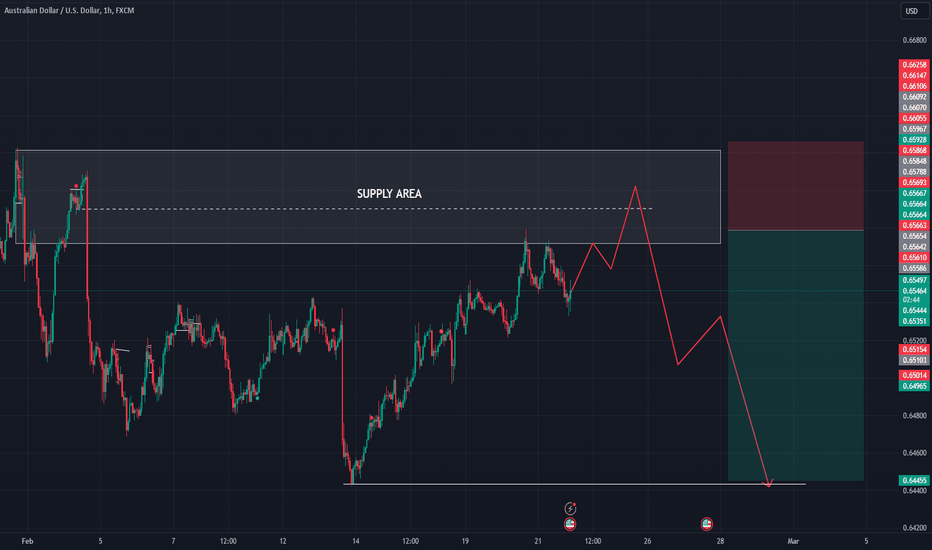

AUDUSD H1 / Looking For a Short Entry in SUPPLY AREA 📉Hello Traders!

This is my idea related to AUDUSD H1/ I will set a pending order in the supply area, where I expect the price to go bearish. I will look for a short trade (if I will see the confirmation) in the supply area as this is my area of interest.

Traders, if you liked my idea or if you have a different vision related to this trade, write in the comments. I will be glad to see your perspective.

____________________________________

Follow, like, and comment to see my content:

tradingview.sweetlogin.com

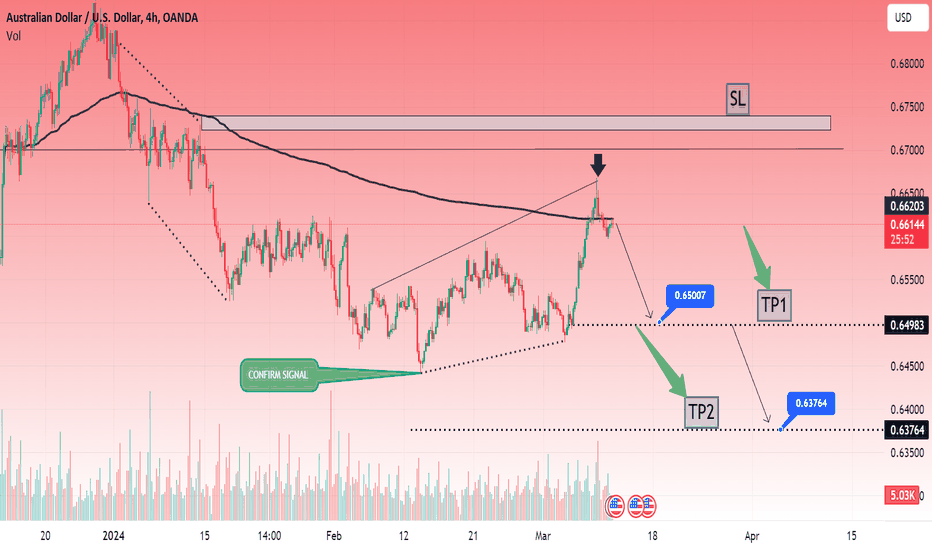

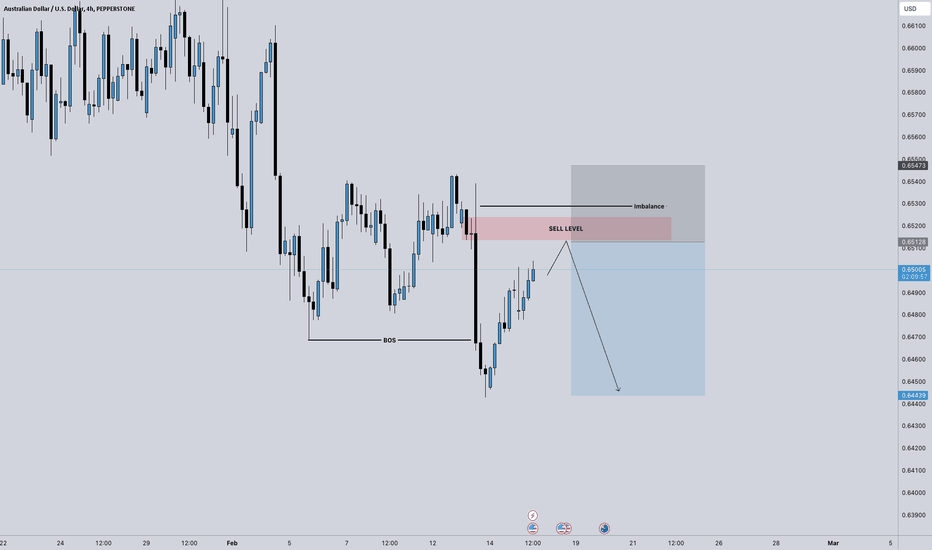

AUD/USD Swing Sell IdeaWe are in downtrend and in this moment we have a strong USD.

On 4H I can see very clear BOS and slowly correction.

I mark my SELL LEVEL area with red rectangle

and imbalance.

Is very possible to see price to go in a lot drawdown because of imbalance but optimal entry is at 0.65128

Set Sell Limit and expect news for USD after 2 hours to open my position.

Good luck to all

AUDUSD: The USD stabilized amid the Fed's speculative cutsThe US greenback remained beneathneath a three-month top on Thursday, as marketplace individuals assessed the timing of capacity hobby fee cuts with the aid of using the Federal Reserve following remarks from Fed officers on inflation statistics. currently released. The yen, even though beneathneath stress this week, did now no longer fall to a three-month low towards the greenback on Tuesday, whilst Japan`s financial system entered recession with an sudden contraction in consecutive quarters because of vulnerable home demand.

Inflation statistics from americaA shifted marketplace expectancies of a Fed fee reduce to mid-yr after the purchaser rate index confirmed a 3.1% upward push in January from a yr earlier, exceeding over the predicted 2.9% increase. Current marketplace valuations factor to no fee reduce in March, a giant alternate from a month in the past while there has been a 77% hazard of a reduce beginning there, in step with CME's FedWatch tool. The chance of hobby fees closing unchanged on the Fed's May assembly is presently at 60%.

Chicago Fed President Austan Goolsbee, talking on Wednesday, stated the Fed ought to now no longer postpone reducing hobby fees for too long, although inflation is barely better than predicted withinside the coming months. Meanwhile, Fed Vice Chairman for Supervision Michael Barr mentioned that the adventure to accomplishing a 2% inflation fee can be challenging, as evidenced with the aid of using January CPI figures.

The senior marketplace analyst from City Index cited that the Fed is taking a long-time period view in their course to 2% inflation, which lets in for a few deviation alongside the way. This sentiment is regular with remarks from Fed officers after the discharge of a better-than-predicted inflation document.

The greenback index, a gauge of the dollar towards a basket of six fundamental currencies, consolidated beneathneath a three-month excessive of 104.ninety seven hit on Wednesday, in advance of americaA retail income document for the month January. It became ultimate recorded at 104.69.

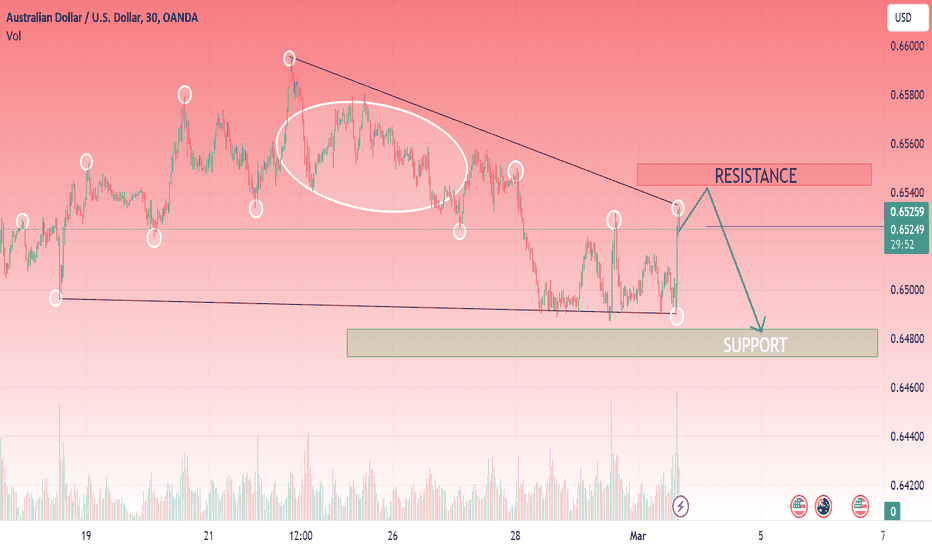

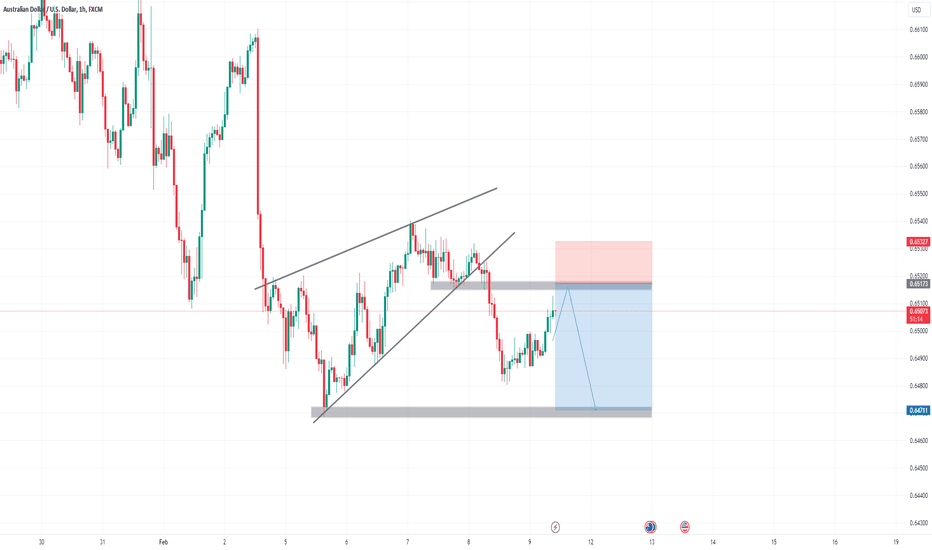

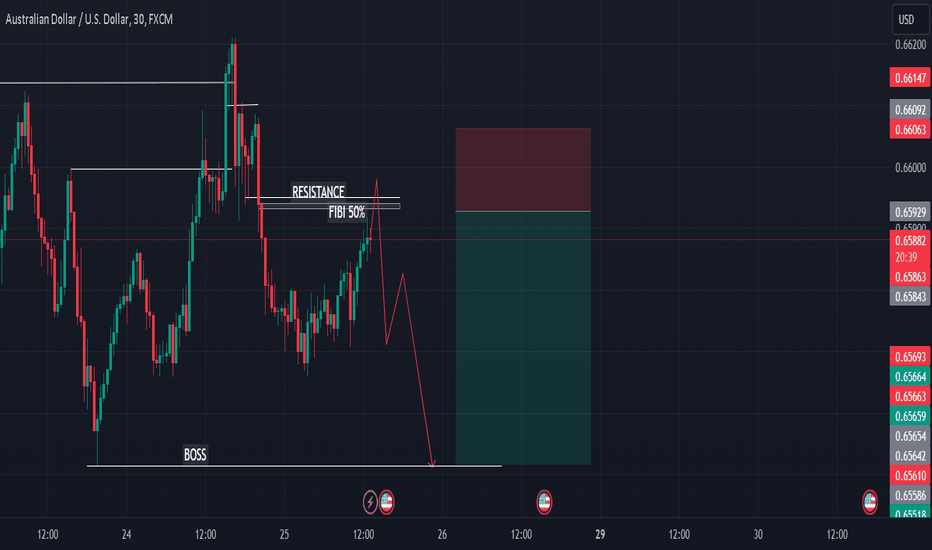

AUDUSD M30 / SHORT TRADE OPPORTUNITY 📉Hello Traders!

This is my idea related to AUDUSD M30. I expect a bearish move after the retracement from the Resistance level, the exact level where we have also fibo 50%.

My target is below the BOSS.

Traders, if you liked my idea or if you have a different vision related to this trade, write in the comments. I will be glad to see your perspective.

____________________________________

Follow, like, and comment to see my content:

tradingview.sweetlogin.com

AUDUSD: The dollar is on track for another weekly gain amid econThe dollar has trended higher for the second consecutive week, supported by a strong domestic economy and the central bank's cautious stance on interest rate cuts. The dollar index, which measures the currency against a basket of six major rivals, rose 0.9% this week to 103.4. The dollar has appreciated about 5% against the yen this year, and the exchange rate currently stands at 148.12 yen.

Risk sentiment-sensitive Australian and New Zealand dollars rose 1.7% and 2%, respectively, and are poised for their biggest weekly gains since November and June. ,beginning%. The probability that the US will cut interest rates in March has decreased, with market odds falling to 57% from 75% the previous week. The change in expectations follows strong U.S. jobs data, with jobless claims at their lowest level in about a year and a half, putting pressure on the market to cut back. Interest fee. The two-year Treasury yield, which reflects expectations for short-term interest rates, rose 22 basis points to 4.35%.

AUDUSD: Asian foreign exchange dropped, USD recovered waiting foMost Asian currencies fell on Tuesday, while the dollar rose as traders largely remained risk-averse ahead of further signals on when the Federal Reserve may begin cutting interest rates.

The dollar index and dollar index futures rose 0.5% and 0.3%, respectively, during the Asian session on Tuesday. The dollar index is also trading at a small premium to futures, suggesting short-term demand for the greenback is growing.

Traders are now awaiting further signals on the Fed and the US economy, with Fed Governor Christopher Waller due to speak later on Tuesday.

On Wednesday, US retail sales and industrial production figures are expected to provide more clues on the world's largest economy, with any signs of cooling allowing for more bets on growth. cut interest rates soon.

However, the market appears to have moderated bets that the Fed will begin cutting interest rates as soon as March 2024, according to Fed policy tracker CME

AUDUSD: Asian foreign exchange markets fall, USD rises ahead of The Australian dollar was among the few exceptions on the day, rising 0.3% as data showed CPI inflation eased in November, but remained well above the Reserve Bank's 3% target of 2%. annual. Core inflation also remains high amid high food and service prices.

The dollar index and dollar index futures were mildly mixed during the Asian session on Wednesday, after seeing a sharp increase in overnight trading.

The main focus remains on the upcoming US CPI data is expected to show a slight increase in inflation in December. But difficult inflation, along with recent signs of strength in the labor market, gives the Fed more room to keep interest rates higher for longer periods of time.

While the central bank is expected to cut interest rates this year, the market is increasingly skeptical about whether a rate cut will come as soon as March 2024.

Fed officials also resisted betting on an early rate cut, as inflation is expected to remain well above the Fed's 2% annual target in the near term.

Divergent Inflation Paths: AUDUSD Set for Bearish MovementAnalysis for AUDUSD: Bearish Outlook

1. U.S. Inflation Trends:

- Recent Data: The U.S. Consumer Price Index (CPI) showed an increase of 3.4% year-over-year in December, the highest in three months. This rise was more than expected, indicating a continued inflationary pressure.

- Core Inflation: Core inflation, which excludes volatile items like food and energy, remains firm. Notable increases were seen in used cars, apparel, housing, and car insurance costs.

- Federal Reserve's Challenge: The Fed faces a difficult path in achieving its 2% inflation target. The recent data suggests that the decline in goods and energy prices is slowing, while inflation in housing and services remains high.

2. Impact on AUDUSD:

- Rising U.S. Inflation: Higher inflation typically leads to expectations of tighter monetary policy from the Fed. This could result in a stronger USD as interest rates may rise to combat inflation.

- Market Response: The release of the inflation data led to a fall in the S&P 500 and fluctuations in Treasuries, reflecting market uncertainty.

3. Comparison with Australian Economy:

- Australian Inflation: The Australian economy is reportedly experiencing a decrease in inflation, moving towards stabilization. This contrasts with the U.S. situation, where inflation remains a concern.

- Economic Stability: Greater stability in the Australian economy, compared to the ongoing inflationary challenges in the U.S., might typically favor the AUD. However, the current global economic environment appears to favor the USD.

4. Global and Political Factors:

- Global Risks: Rising shipping costs and potential escalations in the Middle East could impact global inflation trends, potentially affecting currency markets.

- U.S. Political Climate: Inflation continues to be a significant issue in U.S. politics, affecting public opinion and potentially influencing economic policy.

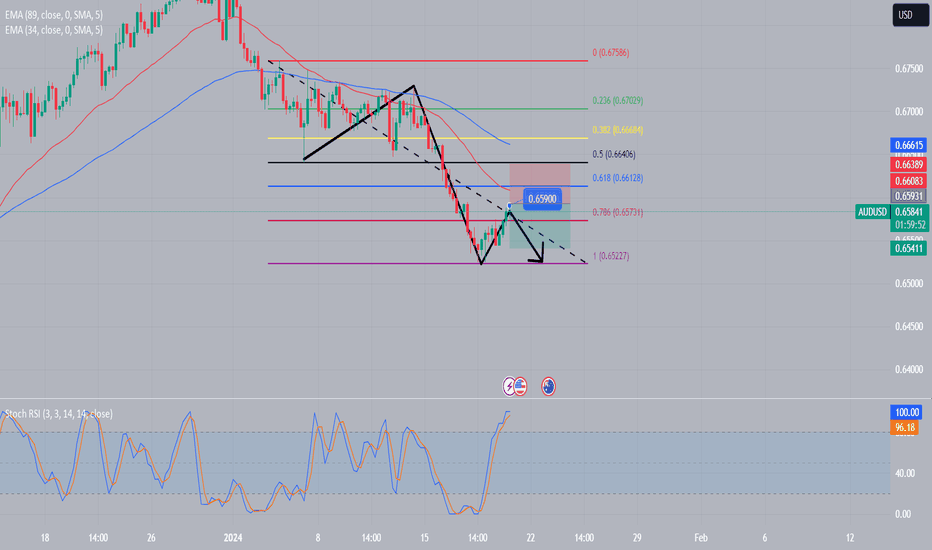

5. Technical Analysis:

- Technical Indicators: Traders should look for technical confirmation of a bearish trend, such as resistance levels, moving averages, and RSI indicators.

- Price Action: Watch for bearish patterns or breaks below key support levels in AUDUSD.

Conclusion:

Given the higher inflation rates in the U.S. and the expectation of continued Fed intervention to control inflation, there is a potential for a stronger USD against the AUD. However, traders should continuously monitor evolving economic data and geopolitical events that could influence market sentiment and currency values. Technical analysis should be used to validate any trading decisions in the context of current market conditions.